|

市场调查报告书

商品编码

1326363

农业测试市场规模和份额分析 - 增长趋势和预测(2023-2028)Agricultural Testing Market Size & Share Analysis - Growth Trends & Forecasts (2023 - 2028) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

农业检验市场规模预计将从2023年的57.1亿美元增长到2028年的75.3亿美元,预测期内(2023-2028年)复合年增长率为5.70%。

主要亮点

- 农业测试可以定义为测量水、土壤和种子等各种样品的质量和污染物含量的测试。 农业检测市场是一个高增长的行业,在世界各地的发达和商业化地区越来越受欢迎。 与环境安全和农业生产力相关的法规和立法是农业检测市场增长的主要驱动力。

- 从中期来看,由于农产品需求增加、产量增加以及定期土壤测试的需要,市场预计将强劲復苏。 同样,消费者对化学残留物方面的食品安全和质量标准的偏好转变,产生了保持土壤特性以实现高质量生产的需求,并将在预测期内继续增长,从而支持市场增长。

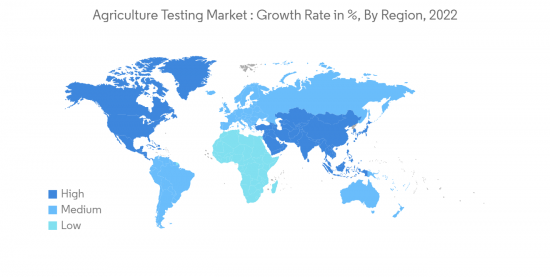

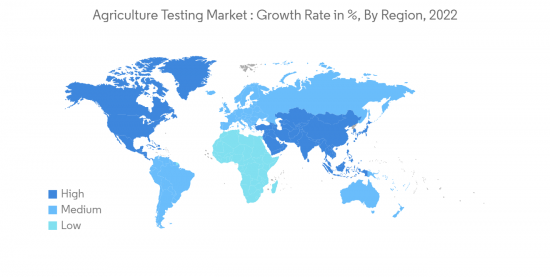

- 北美在农业检验市场上占据主导地位。 该地区的主导份额归因于严格的食品安全、环境、农业法规、营养成分、化学品和标籤法律。 该地区有众多农业检验服务提供商,促进了农业检验服务市场的增长。

农业检验市场趋势

农业和环境安全监管和立法

- 有关环境安全和农业生产力的法规和立法是市场增长的主要驱动力。 随着人们日益关注,各国政府正在积极朝着农业和食品安全方向采取行动,促进市场增长。 例如,美国食品和药物管理局 (FDA) 最近提议对 FDA 食品安全现代化法案 (FSMA) 农产品安全规则 E 子部分进行修订。 拟议的修正案旨在通过确保用于灌溉和其他农业用途的水不含可能导致食物中毒的有害污染物来提高食品安全。Masu。

- 拟议的要求将要求涵盖的农场至少每年以及每当发生增加污染可能性的变化时进行收穫前农业用水评估。 这一监管变化旨在为农民提供更大的灵活性,减轻监管合规负担,同时确保消费者的产品安全。

- 在商业化农业国家,为了维持农产品出口的扩张,样品检测变得越来越流行。

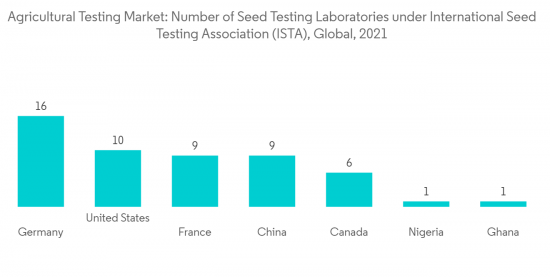

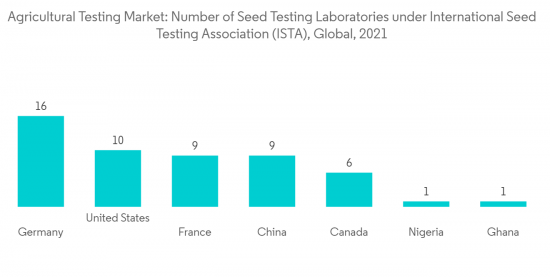

- 近年来,种子测试和土壤测试也很受欢迎。 国际种子测试协会 (ISTA) 是一个国际组织,其宗旨是製定和发布种子测试的标准程序。 国际种子测试协会 (ISTA) 被许多国家视为协调种子测试和种子贸易最新发展的重要工具。 因此,越来越需要解决整个农业供应炼和食品安全的各种问题和挑战,增加农业检测产品的市场潜力。

北美主导市场

- 北美是全球最大的农业检验市场。 其中,美国为玩家提供了极具吸引力的市场潜力。 由于美国种子和谷物需要认证,因此该国仍然需要种子测试。

- 种子监管和测试部门 (SRTD) 测试农业和蔬菜种子,确保种子高效有序的营销,并支持新兴市场的开发和扩张。 这些正在帮助市场增长。 该地区在种子检测中采用电泳和血清学方法的趋势日益明显。

- 电泳用于评估种子储存蛋白。 此外,电泳有时还用于鑑定和测试种子的品种纯度。 相反,血清学方法适用于种子的物种鑑定和混合物的物种组成的测定。 此外,血清学方法可以显示种子蛋白的物种特异性。 随着消费者的偏好转向更高的食品安全和化学残留质量标准,保持土壤特性以实现高质量生产的需求已经出现,预测期内将加强中期市场增长。

农业检验行业概况

全球农业检测市场适度整合,众多政府实验室为世界各地的农民提供各种农业检测服务。 一些领先的公司包括 Eurofins Scientific、R J Hill Laboratories LTD、Agilent Technologies, Inc、SCS Global Services 和 Charm Sciences Inc。 企业在农业检测市场上的竞争以设备质量和推广为主,并着眼于战略举措以抢占更大的市场份额。 新服务、合作伙伴关係和收购是世界领先公司采取的关键战略。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章研究方法

第 3 章执行摘要

第 4 章市场动态

- 市场概览

- 市场驱动因素

- 市场製约因素

- 行业吸引力 - 波特五力分析

- 买家/消费者的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场细分

- 示例

- 水质检测

- 土壤测试

- 种子检验

- 生物固体检查

- 粪便检查

- 其他示例

- 地区

- 北美

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 俄罗斯

- 西班牙

- 欧洲其他地区

- 亚太地区

- 印度

- 中国

- 澳大利亚

- 日本

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 非洲

- 南非

- 其他非洲

- 北美

第6章竞争态势

- 最常采用的策略

- 市场份额分析

- 公司简介

- Eurofins Scientific

- Agilent Technologies Inc.

- SCS Global Services

- Bureau Veritas SA

- ALS Limited

- Element Materials Technology

- TUV Nord Group

- Apal Agricultural Laboratory

- Intertek Group PLC

- EMD Millipore Corporation

- BioMerieux SA

- Aurea Agrosciences

- 3M Company

- Charm Sciences Inc.

- Neogen Corporation

- Biolumix Inc.

第7章 市场机会与今后动向

The Agricultural Testing Market size is expected to grow from USD 5.71 billion in 2023 to USD 7.53 billion by 2028, at a CAGR of 5.70% during the forecast period (2023-2028).

Key Highlights

- Agricultural testing can be defined as the testing of various samples, such as water, soil, seed, etc., to determine their quality and contaminant content. The agricultural testing market is a high-growth sector and is gaining popularity in developed and commercialized regions across the globe. Regulations and legalizations pertaining to environmental safety and agricultural productivity have been the major driving force for the market growth of agricultural testing.

- Over the medium term, the market is anticipated to witness robust recovery with higher demand for agricultural products, resulting in increased production and a need for periodic soil testing. Similarly, the shift in consumer preference to a higher standard of food safety and quality in terms of chemical residues creates the need to maintain the soil properties for quality production, thereby bolstering the market growth during the forecast period.

- North America dominates the agricultural testing market. The dominant share of the region is attributed to the stringency in food safety, environmental and agricultural regulations, and laws pertaining to nutritional content, chemicals, and labeling. The presence of numerous agriculture testing service providers in the region contributes to the growth of the agriculture testing service market.

Agricultural Testing Market Trends

Regulations and Legislations Pertaining to Agriculture and Environmental Safety

- Regulations and legalizations about environmental safety and agricultural productivity have been the major driving factor for the market growth. With the rising concerns, governments are acting proactively in the direction of agriculture and food safety, driving the market growth. For instance, the Food and Drug Administration (FDA) recently proposed revising Subpart E of the FDA Food Safety Modernization Act (FSMA) Produce Safety Rule. The proposed changes aim to enhance food safety by ensuring that the water used for irrigation and other agricultural purposes does not contain harmful contaminants that can lead to foodborne illness.

- Under the proposed requirements, covered farms would be required to conduct pre-harvest agricultural water assessments at least once annually and whenever a change occurs, increasing the likelihood of contamination. This change in the regulation aims to provide greater flexibility to farmers and reduce the burden of compliance with the regulation while also ensuring that the product is safe for consumers.

- Sample testing has become increasingly popular in commercialized agriculture countries to maintain the export growth of agricultural commodities.

- Seed and Soil testing has also gained popularity in recent times. International Seed Testing Association (ISTA) is an international organization that aims to develop and publish standard procedures in seed testing. It has gained recognization in many countries as an important tool to harmonize seed testing and modern trends in the seed trade. Therefore, the growing need to address various issues and challenges across the agricultural supply chain and food safety has increased market potential for agricultural testing products.

North America Dominates the Market

- North America is the largest market for agricultural testing across the globe. The United States, among all the regional countries, provides an attractive market potential for the players. There is an ongoing demand for seed testing in the country due to the requirements of certifications for United States seeds and grains.

- The Seed Regulatory and Testing Division (SRTD) tests agricultural and vegetable seeds to ensure the efficient, orderly marketing of seeds and to assist in developing new or expanding markets. These are aiding the growth of the market. In the region, there is an increase in the trend of following electrophoretic and serological methods in seed testing.

- The electrophoretic method is used for the assessment of seed storage proteins. Furthermore, the electrophoretic method may be used to identify and test the cultivar purity of seeds. In contrast, serological methods are suitable for species identification of seeds and determination of species composition of admixtures. In addition, the serological method allows the display of the species specificity of seed proteins. The shift in consumer preference toward a higher standard of food safety and quality, in terms of chemical residues, creates the need to maintain the soil properties for quality production, thereby bolstering the market growth during the forecast period.

Agricultural Testing Industry Overview

The global agricultural testing market is moderately consolidated, with numerous government-operated laboratories providing various agricultural testing services to farmers worldwide. Eurofins Scientific, R J Hill Laboratories LTD, Agilent Technologies, Inc, SCS Global Services, and Charm Sciences Inc. are some of the major players. Companies compete in the agricultural testing market based on equipment quality and promotion and focus on strategic moves to hold larger market shares. New services, partnerships, and acquisitions are the major strategies adopted by the leading companies in the market globally.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Buyers/Consumers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Sample

- 5.1.1 Water Testing

- 5.1.2 Soil Testing

- 5.1.3 Seed Testing

- 5.1.4 Bio-Solids Testing

- 5.1.5 Manure Testing

- 5.1.6 Other Samples

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Mexico

- 5.2.1.4 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 United Kingdom

- 5.2.2.3 France

- 5.2.2.4 Russia

- 5.2.2.5 Spain

- 5.2.2.6 Rest of Europe

- 5.2.3 Asia Pacific

- 5.2.3.1 India

- 5.2.3.2 China

- 5.2.3.3 Australia

- 5.2.3.4 Japan

- 5.2.3.5 Rest of Asia Pacific

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Africa

- 5.2.5.1 South Africa

- 5.2.5.2 Rest of Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Eurofins Scientific

- 6.3.2 Agilent Technologies Inc.

- 6.3.3 SCS Global Services

- 6.3.4 Bureau Veritas SA

- 6.3.5 ALS Limited

- 6.3.6 Element Materials Technology

- 6.3.7 TUV Nord Group

- 6.3.8 Apal Agricultural Laboratory

- 6.3.9 Intertek Group PLC

- 6.3.10 EMD Millipore Corporation

- 6.3.11 BioMerieux SA

- 6.3.12 Aurea Agrosciences

- 6.3.13 3M Company

- 6.3.14 Charm Sciences Inc.

- 6.3.15 Neogen Corporation

- 6.3.16 Biolumix Inc.

![农业检验市场:趋势、机会与竞争分析 [2023-2028]](/sample/img/cover/42/1341980.png)