|

市场调查报告书

商品编码

1640512

机器对机器 (M2M) 服务 -市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Machine To Machine (M2M) Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

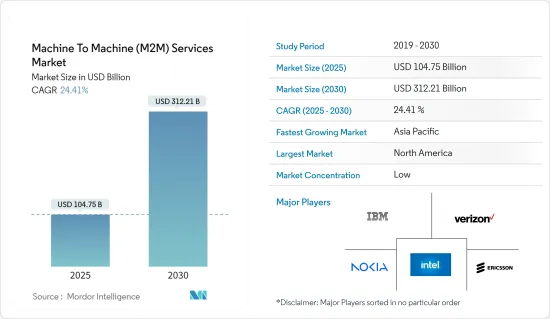

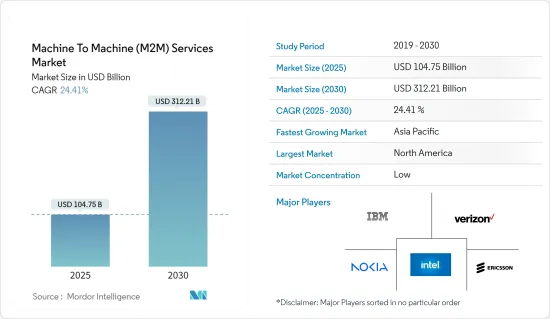

机器对机器服务市场规模在 2025 年预计为 1,047.5 亿美元,预计到 2030 年将达到 3,122.1 亿美元,预测期内(2025-2030 年)的复合年增长率为 24.41%。

世界正在走向工业 4.0,其中分析、人工智慧 (AI) 和物联网 (IoT) 有望推动智慧、决策和生产力。反过来,这为机器对机器服务市场创造了巨大的机会。

关键亮点

- 机器对机器 (M2M)通讯,也称为基于机器的通讯(MTC),是指一组协作的机器交换感测资料或资讯并进行决策,通常不需要人工参与。 M2M技术近年来发展迅速,使大量设备能够透过网路互联互通。这可能是许多领域的关键推动因素,特别是物联网(IoT)和第五代(5G)网路。

- 随后,各行业采用有线或无线连接也推动了市场的发展。此外,高速网路连线的广泛普及以及 4G/LTE 和 5G 等新连接技术的日益普及进一步推动了 M2M 连接市场的成长。

- 除了连接性之外,为增强产品而不断增加的软体应用程式整合以及为提高成本效益和满足安全法规而在产品製造中采用各种技术预计也将成为支援成长的因素。在预计预测期内,收购和合作等不断增加的策略发展将推动市场成长率。

- 例如,2022年2月,森萨塔科技完成了对私人控股的Elastic M2M Inc.的收购,后者是重型运输、仓储、供应炼和物流、工业、轻型车辆和许多其他业务部门的营运资产互联智慧创新者。 Elastic M2M 的云端平台和分析功能使远端资讯处理服务供应商(「TSP」)和经销商能够向最终用户提供基于感测器的营运资料。

- 此外,2022 年 5 月,M2M通讯品牌 Sensorise Digital Services 被 Rosmerta Group 收购。结合 Rosmerta 集团在 M2M 和 IoT 领域的财务实力和技术力,Sensorise 有望进入下一阶段的扩张阶段。

- 然而,实施和维护这项技术的高成本是限制市场成长的一个问题。

机器对机器服务市场趋势

预计通讯产业将在其他终端用户产业中见证显着的成长。

- M2M 系统透过无线或有线网路在硬体、感测器和机器之间采用点对点通讯。基于蜂巢的 M2M 增加了不同 SIM 卡机器之间的连接过程,以提供透过多个无线网路的连接。许多企业正在采用蜂窝M2M附加价值服务,以确保营运效率并最大限度地减少与营运违规相关的损失。

- 由于政府采取倡议,预计基于蜂窝的 M2M 将在预测期内实现更广泛地部署,这些倡议将推动蜂窝 M2M 在公共、智慧城市、汽车和医疗保健等关键领域的发展。

- 2022 年 9 月,印度理工学院德里分校 (IITD) 和该国着名的通讯研发机构新兴国家远端资讯处理发展中心 (C-DOT) 将在物联网/M2M、人工智慧/机器学习、网路安全、 5G及其两家公司签署了一份谅解备忘录,将在包括上述技术在内的多个通讯相关领域开展合作。 C-DOT 已进行先进的研究和开发计划,开发涵盖多种技术的广泛产品,包括光学、交换、无线、安全、网路管理和先进的通讯软体应用。 C-DOT 与当地企业、学术界和新兴企业伙伴关係,在建立该国 4G 和 5G 系统方面发挥了关键作用。

- 该谅解备忘录旨在创建一个互惠互利的研发和学术合作框架,以鼓励设计和开发完整的本土通讯解决方案。该平台可望成为催化剂,加速创新概念发展成为市场化产品。

亚太地区将经历最快成长

- 由于中国和印度等国家采用了数位技术,预测期内亚太地区将以最高速度成长。物联网、人工智慧和云端运算等技术进步正在促进市场成长。

- 根据2021年7月10个政府部门联合发布的三年规划,中国的目标是到2023年终发展5.6亿5G行动客户,并将大型企业的高速无线技术普及率提高35%。 %。到2023年终,中国预计5G在个人消费者中的普及率将达到40%,5G资料将占所有线上流量的一半以上。

- 此外,印度采用 5G 连接将带来许多新机会,提高线上和 M2M(机器对机器)交易的效率和安全性。事实上,物联网 (IoT) 的主要目标之一是使公司能够开发使用人工智慧 (AI) 的自动化系统,从管理家用电子电器到智慧电錶和交通灯。业界还必须确定有关设备、连接、安全部署和实体安全的连接技术的安全参数。

- 此外,政府倡议,例如推动广泛部署智慧城市、智慧电錶和蜂窝 M2M倡议的措施,将促进 M2M 服务市场的成长。

- 例如,2022 年 2 月,电讯部要求所有机器对机器服务供应商向该部註册,以解决安全问题、与电讯公司对接等。随着 5G 的出现以及 M2M/IoT 领域重大开发计划的开展,这些法规可能会促进通讯领域的成长。此外,这将鼓励企业创造更广泛的创新应用和解决方案,造福公民。

机器对机器服务产业概览

由于有多家领导企业,机器对机器(M2M)服务市场的竞争格局十分激烈且细分化。这个市场的参与企业俱有很强的创新能力。产品研究、高额研发支出、合作和收购是公司为维持激烈竞争而采取的主要成长策略。全球市场的主要企业包括华为科技公司、思科系统、Google、英特尔和 IBM。

2023 年 12 月:Zebra Technologies 宣布推出 Zebra 行动装置和软体封装解决方案,旨在帮助 Verizon Private 5G 客户更快开始享受网路优势。 Zebra 坚固耐用的企业平板电脑和行动数据终端旨在简化运输和物流、零售、製造和其他行业第一线员工的工作流程。

2023 年 11 月:Telenor 与爱立信合作,率先利用人工智慧和机器学习研究实现永续的智慧未来。挪威电信和爱立信在此次合作下的合作凸显了他们通用致力于以负责任的方式利用人工智慧和机器学习的潜力来释放客户潜力。

2022年10月,印度领先的通讯服务供应商Bharti Airtel(「Airtel」)宣布在该国推出其「Always On」物联网连接解决方案。作为 Airtel「始终连接」服务的一部分,双重配置 M2M eSIM 使物联网设备能够在 eSIM 内维持来自多个行动通讯业者(MNO) 的行动网路连线。 Airtel 符合 GSMA 标准的技术、功能丰富的 Airtel IoT Hub 中基于 API 的灵活 eSim 生命週期管理以及对电讯部 (DoT) M2M 要求的完全符合性都有助于确保面向未来。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查结果

- 调查前提

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 购买者/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 市场影响评估

第五章 市场动态

- 市场驱动因素

- 科技快速进步

- 连网设备数量不断增加

- 市场限制

- 缺乏标准化

- 庞大的运输成本

第六章 市场细分

- 按类型

- 託管服务

- 专业服务

- 按最终用户

- 零售

- 银行和金融机构

- 通讯及IT业

- 医疗

- 车

- 石油和天然气

- 运输

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- International Business Machine Corporation

- Rogers Communications Inc.

- Cstar Technologies Inc

- Nokia Corp(Alcatel-Lucent SA)

- Comarch Inc

- Cisco System Inc

- Huawei Technologies Co. Ltd

- Intel Corporation

- Thales Group(Gemalto NV)

- Amdocs Inc

- EE Ltd

- Verizon Communications Inc

第八章投资分析

第九章 市场机会与未来趋势

The Machine To Machine Services Market size is estimated at USD 104.75 billion in 2025, and is expected to reach USD 312.21 billion by 2030, at a CAGR of 24.41% during the forecast period (2025-2030).

The world is moving toward industry 4.0, where analytics, artificial intelligence (AI), and the internet of things (IoT) are expected to drive intelligence, decision-making, and productivity. In return, this creates a huge opportunity for the machine-to-machine services market.

Key Highlights

- Machine-to-machine (M2M) communications, also known as a machine-type communication (MTC), typically refer to the exchange of sensed data or information and decision-making by a group of collaborating machines without human involvement. M2M technology enables a sizable number of devices to be interconnected through the internet, which has resulted in recent rapid development. It can be a favorable enabling key for many fields, particularly the internet of things (IoT) and fifth-generation (5G) networks.

- Following this, the adoption of wired or wireless connectivity across different industries is also fueling the market. In addition, the penetration of high-speed internet connectivity and the growing adoption of new connectivity technologies, such as 4G/LTE and 5G, is further driving the growth of the M2M connections market.

- Apart from connectivity, increasing software application integration for product enhancements and adoption of various technologies in manufacturing products for cost-effectiveness and to meet safety regulations are the factors that are expected to support the growth. The growing strategic developments, such as acquisitions and partnerships, are analyzed to boost the market growth rate during the forecast period.

- For instance, in February 2022, Sensata Technologies announced the acquisition of Elastic M2M Inc., a privately held innovator of connected intelligence for operational assets in the heavy-duty transport, warehousing, supply chain and logistics, industrial, light-duty passenger car, and numerous other business segments. With the help of Elastic M2M's cloud platform and analytics capabilities, telematics service providers ("TSPs") and resellers can employ sensor-based operational data to inform their end users.

- Further, in May 2022, Sensorise Digital Services, an M2M communication brand, was acquired by Rosmerta Group. By integrating the financial and technological strength of Rosmerta Group in the M2M and IoT arena, Sensorise is therefore prepared for the next expansion stage.

- However, on the contrary, the high cost of installation of this technology and its maintenance are some of the challenges the market faces, restraining its growth.

Machine-to-Machine Services Market Trends

Telecom Industry to Witness Significant Growth Among Other End-user Verticals

- M2M systems employ point-to-point communications between hardware, sensors, and machines across wireless or wired networks. Cellular-based M2M is added connectivity process among different sim-enabled machines to provide connectivity over multiple wireless networks. Cellular M2M value-added services are being incorporated in many enterprises to ensure operational efficiency and minimize losses associated with operational breaches.

- The cellular-based (M2M) is expected to grow during the forecast period because of the introduction of government policies, which enable wider deployment of cellular M2M in key sectors, such as utilities, smart cities, automotive, and healthcare.

- In September 2022, The Indian Institute of Technology, Delhi (IITD) and the Centre for Development of Telematics (C-DOT), the country's prominent telecom R&D facility, signed a Memorandum of Understanding (MoU) for collaboration in several telecom-related fields, including IoT/M2M, AI/ML, cyber security, and 5G and beyond technologies. C-DOT has engaged in several advanced R&D projects that have resulted in the development of a wide range of products that encompass a variety of technologies in the areas of optical, switching, wireless, security, network management, and cutting-edge telecom software applications. In partnership with local businesses, academics, and startups, C-DOT has played a key role in creating domestic 4G & 5G systems.

- This MoU attempts to build a mutually beneficial framework for R&D and academic cooperation on encouraging the design and development of entirely indigenous telecom solutions. The platform would catalyze to accelerate the development of innovative concepts into products ready for market.

Asia-Pacific to Witness the Fastest Growth

- Asia-pacific is analyzed to grow at the highest growth rate during the forecast period owing to the adoption of digital technologies in countries such as China, India, etc. Technological advancements like IoT, AI, and Cloud contribute to market growth.

- According to a three-year plan jointly released by ten government entities in July 2021, China plans to develop 560 million 5G mobile customers by the end of 2023 and increase the penetration rate of fast wireless technology among large industrial firms to 35%. By the end of 2023, China hopes to have reached a 40 percent penetration rate of 5G among individual consumers, with 5G data making up more than half of all online traffic.

- Further, with the introduction of 5G connectivity in India, various new opportunities are developed to boost the efficiency and security of online transactions and Machine-to-Machine (M2M) transactions. Indeed, one of the primary goals of the Internet of Things (IoT) is to enable businesses to develop automated systems employing Artificial Intelligence (AI) for applications ranging from home appliance management to smart meters and traffic lights. The industry must also specify the parameters of connected technology security regarding devices, connection, secure deployment, and physical security.

- Further, government initiatives, like smart cities, smart meters, and policies, enabling a wider deployment of cellular M2M initiatives will help the M2M services market to grow.

- For instance, in February 2022, The Department of Telecom mandated all machine-to-machine service providers to register with the department to address security concerns and interface with telecom companies, among other things. With 5G on the horizon and massive development projects in the M2M/IoT sector, these rules will boost the growth of the communication sector. Additionally, this will encourage companies to create a wide range of innovative applications and solutions for the benefit of citizens.

Machine-to-Machine Services Industry Overview

The competitive landscape for the Machine to Machine (M2M) services market is highly competitive and fragmented because of the presence of many major players. The players in this market are highly innovative. Product launches, high expenses on research and development, partnerships and acquisitions, etc., are the prime growth strategies these companies adopt to sustain the intense competition. Key market players in the global market are Huawei Technologies Co. Ltd, Cisco Systems Inc., Google Inc., Intel Corporation, IBM, and other prominent players.

In Decmber 2023 : Zebra Technologies has announced the launch of Zebra mobile device and software packaged solutions designed to help Verizon Private 5G customers reap the benefits of their networks even faster. Zebra rugged enterprise tablets and mobile computers are purpose-built to simplify processes for frontline workers in transportation and logistics, retail, manufacturing, and other industries

In November 2023 : Telenor and Ericsson join forces to pioneer the usage of AI and Machine Learning Research for a Sustainable and Smarter Future, The collaboration between Telenor and Ericsson under this collobration underscores the shared commitment of both companies to harnessing the potential of AI and ML in a responsible manner to unlock the potential for the customer.

In October 2022, Bharti Airtel ("Airtel"), India's major telecommunications services provider, announced the implementation of the "Always On" IoT connectivity solution in the country. Dual profile M2M eSIM, part of Airtel's "Always On" service, enables an IOT device to maintain a mobile network connection from several Mobile Network Operators (MNOs) in the eSIM. GSMA-compliant technology from Airtel, flexible API-based eSim lifecycle management on the feature-rich Airtel IoT Hub, and full compliance with Department of Telecom (DoT) M2M requirements all contribute to the company's ability to meet future needs.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Force Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of Impact of COVID-19 on the market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rapid Technological Advancements

- 5.1.2 Increasing Number of Connected Devices

- 5.2 Market Restraints

- 5.2.1 Lack of Standardization

- 5.2.2 Huge Delivery Cost

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Managed Service

- 6.1.2 Professional Service

- 6.2 By End User

- 6.2.1 Retail

- 6.2.2 Banking and Financial Institution

- 6.2.3 Telecom and IT Industry

- 6.2.4 Healthcare

- 6.2.5 Automotive

- 6.2.6 Oil and Gas

- 6.2.7 Transportation

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 International Business Machine Corporation

- 7.1.2 Rogers Communications Inc.

- 7.1.3 Cstar Technologies Inc

- 7.1.4 Nokia Corp (Alcatel-Lucent S.A.)

- 7.1.5 Comarch Inc

- 7.1.6 Cisco System Inc

- 7.1.7 Huawei Technologies Co. Ltd

- 7.1.8 Intel Corporation

- 7.1.9 Thales Group (Gemalto NV)

- 7.1.10 Amdocs Inc

- 7.1.11 EE Ltd

- 7.1.12 Verizon Communications Inc