|

市场调查报告书

商品编码

1329860

光电子市场规模和份额分析 - 增长趋势和预测(2023-2028)Optoelectronics Market Size & Share Analysis - Growth Trends & Forecasts (2023 - 2028) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

光电子市场规模预计将从2023年的449.8亿美元增长到2028年的594.6亿美元,在预测期内(2023-2028年)复合年增长率为5.74%。

先进製造和加工技术的日益采用正在推动利用激光和机器视觉系统的工业应用中对光电元件的需求。

主要亮点

- 光电子学的进步极大地促进了通过光纤的有效信息传输(包括处理设备之间和处理设备内的通信)、激光盘中的高容量光存储以及其他一些特定应用。此外,汽车行业不断增长的需求,特别是电动汽车、自动驾驶卡车和自动驾驶汽车的采用,预计将推动光电器件的采用,进一步推动市场发展。

- 激光二极管是用于激光产生的最广泛使用的光电元件。当前光电子市场的趋势是缩小各种器件的尺寸,并实现在同一芯片上集成其他电子元件的系统的更高集成度,例如发光二极管阵列、激光阵列和集成系统。

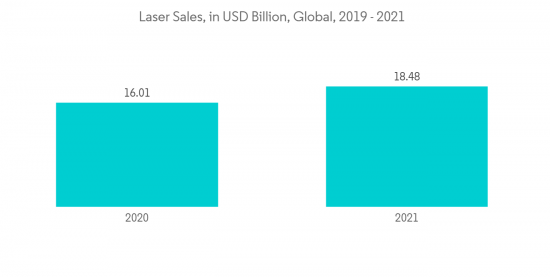

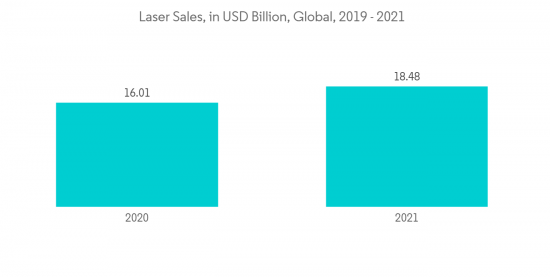

- 激光二极管在多种应用中都有需求,包括光纤通信、条形码读取器、DVD/蓝光播放器、打印和通信技术。相比之下,工业领域对激光器的需求不断增长也推动了市场的增长。

- 光电类产品的价格高于传统产品,这是限制行业增长的因素之一。与 LED 显示器相比,客户可能更喜欢基于光电产品的替代技术,例如 LCD 显示器。另外,与普通商品相比,备件的更换成本更大。自 COVID-19 以来,市场增长势头强劲,生产设施恢復全面生产,以满足各工业领域对光电元件不断增长的需求。

光电市场趋势

激光二极管预计将大幅增长

- 激光二极管是广泛用于产生激光的光电器件,其功能范围从光纤 DVD/蓝光刻录机到打印、网络技术、光通信和条形码读取器。此外,电子设备的高使用率已经建立了标准的显示技术,消费者要求更高的分辨率和效率。

- 高功率激光器在工业领域有着广泛的需求,其应用范围广泛,包括切割、焊接和机械加工。公司正在转向激光技术来利用高性能和可靠性,这推动了对高功率激光二极管的需求。

- 激光二极管应用于多种行业,包括汽车行业。激光二极管在汽车领域用于生产汽车头灯,可提高驾驶因素的可见性并提高道路安全性。此外,汽车车头灯小型化的趋势也增加了对激光二极管的需求。

- 此外,汽车行业的不断发展预计将有助于预测期内该细分市场的增长。例如,2022年11月,京瓷公司宣布将推出一款汽车夜视系统,能够在雨、夜、雪、雾、烟等低能见度驾驶条件下可靠识别潜在碰撞物品。该技术旨在最大限度地减少道路事故并鼓励更安全的驾驶。

- 激光二极管市场开发的增加预计将在预测期内推动市场需求。例如,2022 年 4 月,Lumentum 开发了 FemtoBlade 激光技术,作为该公司高精度、超快工业激光器系列的第二个版本。这种新颖的系统具有灵活的架构和强大的功能。

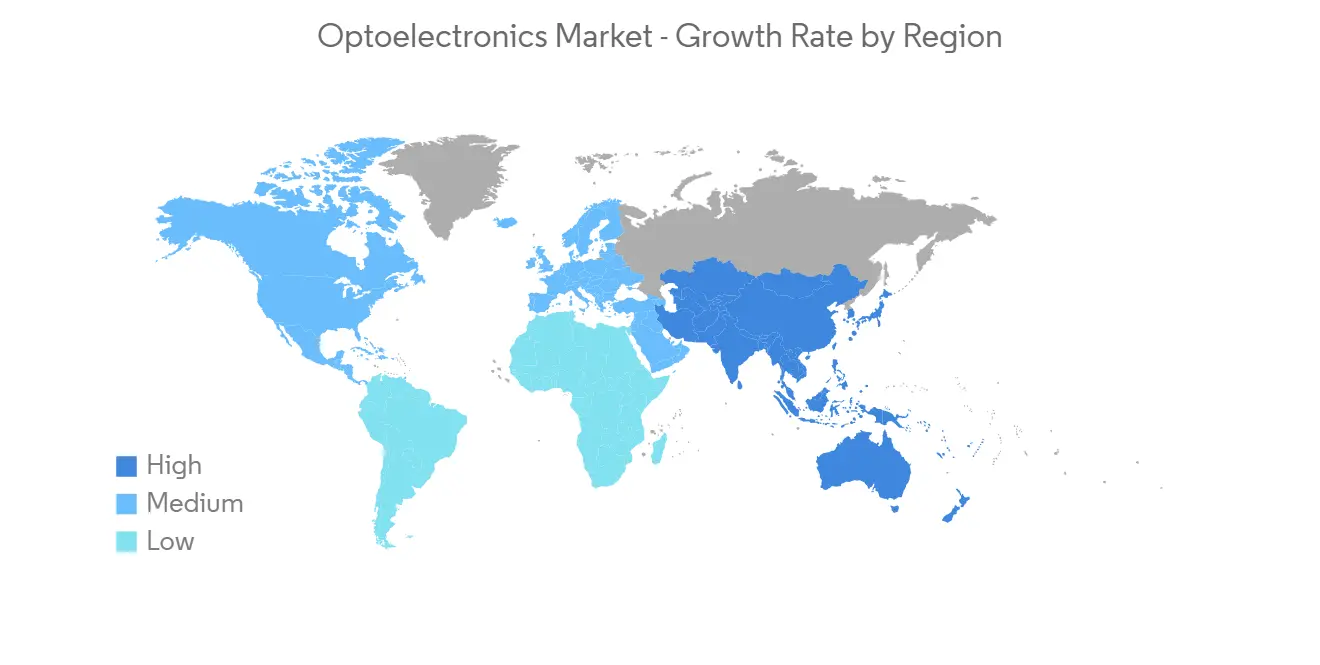

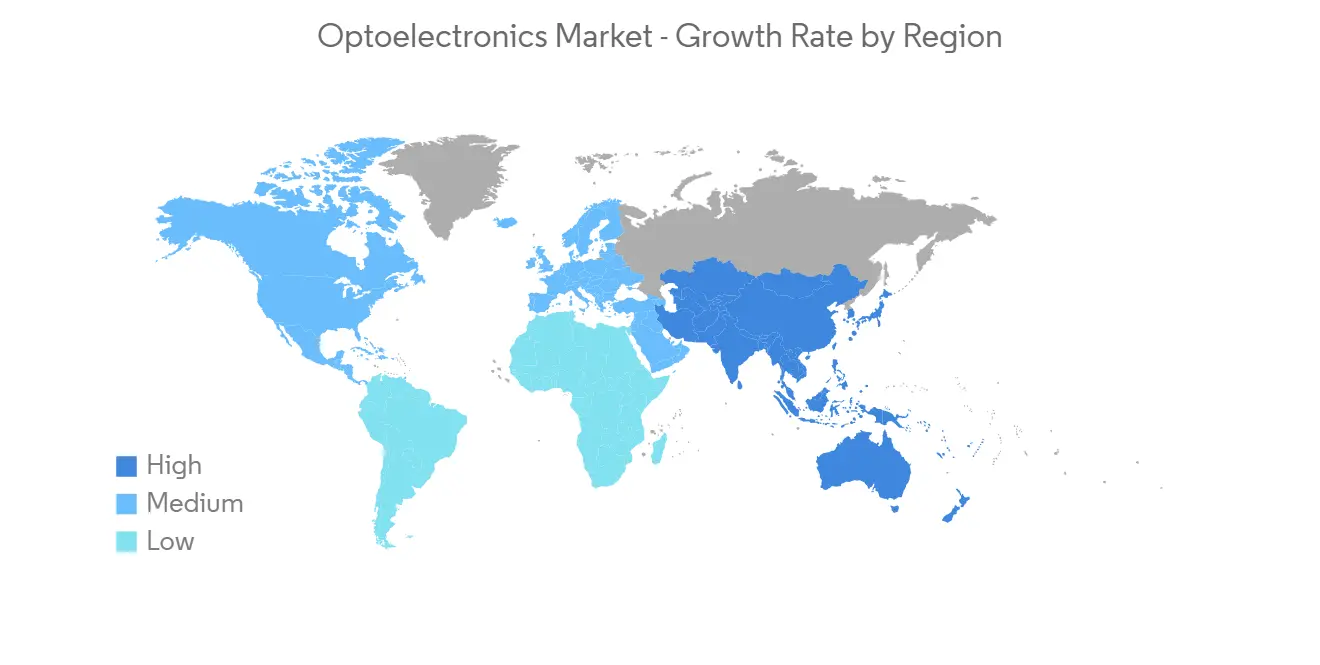

亚太地区预计将占据较大份额

- 亚太地区的快速扩张主要是由该地区最大的消费电子产品和汽车市场推动的。此外,光电器件有望在智慧城市计划、虚拟现实和模拟现实等新创新、大数据、物联网(IoT)和智能工业设备等其他领域得到发展。

- 亚太地区是半导体元件製造的中心。该地区是光电子行业主要企业的集中地,包括ROHM, Sony Corporation, Renesas, Samsung Electronics, Panasonic Corporation, Hamamatsu Photonics K.K., Sharp Corporation,以及一些小型地区公司。

- 印度和中国等新兴经济体政府加大市场开发力度预计将有助于预测期内的市场增长。例如,2022 年 4 月,Navi Mumbai Municipal Corporatio选择将所有路灯转换为 LED 照明。今年将更换 35,000 盏路灯,每年可节省 7 印度卢比(850,000 美元)。该市所有道路,包括高速公路,都将安装LED照明。部分地点将于 2021 年更换,但大部分地点将于 2022 年更换。该项目的招标工作已经开始

- 现代汽车使用光电技术来实现车辆操作的自动化,例如製动信号和前灯。因此,豪华和超豪华汽车的收入不断增加,刺激了光电行业的需求。印度汽车经销商全国组织 FADA(Federation of Automotive Dealers Associations)预计,由于库存增加以及与 OEM 厂商的合作关係,2021 年 12 月豪华车零售额将增长 19.7%。因此,豪华和超豪华汽车销量的增加将在预测期内推动光电业务的发展。

光电产业概况

由于General Electric Company、Panasonic Corporation、Samsung Electronics、Omnivision Technologies Inc.、Sony Corporation等主要参与者的存在,光电子市场上竞争公司之间的竞争非常激烈。他们的产品创新能力,加上在研发方面的大量投资,使他们能够比竞争对手获得竞争优势。战略合作伙伴关係、併购使公司得以发展、获得显着的市场份额并在市场上保持牢固的立足点。

镓芯光电于2022年9月从中国南京大学分拆出来,提供以碳化硅(SiC)和氮化镓(GaN)等宽带隙半导体为核心的紫外(UV)探测器和模块,并正式推出了首款紫外探测器和模块。商用 SiC 基极紫外 (EUV) 光电二极管。

2022年7月,位于中国的国星光电与华为正式签署“合作协议”,生产Mini LED和Micro LED显示技术。此次合作本着优势互补、互惠互利、共同发展的原则。它将聚焦双方公司的基础技术和产业资源。两家公司都打算进行广泛的创新和研究,以扩大潜在的经济影响力。

2022 年 6 月,Synopsys和Juniper出资新成立的独立公司 OpenLight 宣布推出全球首个集成激光器的开放式硅光子架构。这家总部位于加利福尼亚州的公司旨在为芯片製造商提供一种构建光子集成电路(PIC)的方法,以最大限度地发挥其性能潜力。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究结果和市场定义

- 调查范围

第二章研究方法论

第三章执行摘要

第四章市场动态

- 市场概况

- 价值链/供应链分析

- 行业吸引力——波特五力

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 市场驱动力

- 对智能家电和下一代技术的需求不断增长

- 增加技术的工业应用

- 市场製约因素

- 製造加工成本高

第五章市场细分

- 元件类型

- 引领

- 激光二极管

- 传感器

- 光耦

- 太阳能电池

- 其他

- 终端用户行业

- 汽车

- 航空航天与国防

- 消费类电子产品

- 信息技术

- 卫生保健

- 住宅/商业

- 行业

- 其他

- 区域

- 北美

- 美国

- 加拿大

- 欧洲

- 英国

- 法国

- 德国

- 西班牙

- 欧洲其他地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 亚太其他地区

- 拉丁美洲

- 墨西哥

- 巴西

- 其他拉丁美洲

- 中东/非洲

- 北美

第六章 竞争状况

- 公司简介

- General Electric Company

- Panasonic Corporation

- Samsung Electronics

- Omnivision Technologies Inc

- Sony Corporation

- Osram Licht AG

- Koninklijke Philips N.V.

- Vishay Intertechnology, Inc

- Texas Instruments Inc

- Stanley Electric Co

- Rohm Co., Ltd(ROHM SEMICONDUCTOR)

- Mitsubishi Electric

第七章投资分析

第八章市场机会与未来趋势

The Optoelectronics Market size is expected to grow from USD 44.98 billion in 2023 to USD 59.46 billion by 2028, at a CAGR of 5.74% during the forecast period (2023-2028).

The increasing adoption of advanced manufacturing and fabricating technologies is driving the demand for optoelectronic components in the industrial sector using laser and machine vision systems.

Key Highlights

- Advances in optoelectronics have made considerable contributions to the efficient transmission of information via optical fibers (including communication between processing machines and within them), to the high-capacity mass storage of information in laser disks, and several other specific applications. Moreover, the increasing demand in the automotive industry, specifically with the adoption of electric vehicles, self-driven trucks, and autonomous vehicles, is expected to boost optoelectronic devices' adoption, further driving the market.

- Laser diodes are the most widely adopted optoelectronic components deployed in laser generation. The current market trends in optoelectronics are toward scaling down the sizes of different devices and attaining high levels of integration in systems, such as arrays of light-emitting diodes, laser arrays, and integrated systems, with other electronic elements on the same chip.

- Laser diodes are witnessing demand across various applications, including fiber optic communications, barcode readers, DVD/Blu-ray players, printing, and communication technologies. In comparison, growing demand for lasers in the industrial sector has also been identified to boost the market's growth.

- The price of optoelectronics-based goods is higher than that of traditional products, which is among the factors limiting industry growth. Customers may prefer substitute technologies to optoelectronics-based goods, including LCD displays, over LED displays since LCD is a more cost-effective solution. Further, compared to typical goods, the cost of replacing spare components is more significant. Post-COVID-19, the market has gained impetus, with production facilities restarting full-capacity production to fulfill the increased demand for optoelectronic parts throughout various industrial verticals.

Optoelectronics Market Trends

Laser Diodes are Expected to Witness a Significant Growth

- Laser diodes are widely utilized optoelectronic elements in laser generation, with capabilities ranging from fiber DVD/Blu-ray recorders to printing and networking technologies, optic communications, and barcode readers. Furthermore, high usage of electronic equipment has established standard display technology, with consumers wanting better resolution and efficiency, driving the rising demand for electronic devices and increasing the optoelectronics industry.

- High Power lasers are finding extensive demand in industrial sectors for a wide range of applications, including cutting, welding, and fabrication. Companies are moving towards laser technologies to take advantage of high performance and reliability, which is driving the demand for high-power laser diodes.

- Laser diodes are employed in a variety of industries, including automobile industries. Laser diodes are utilized in the automobile sector to produce car headlights that improve driver visibility, leading to better road safety. Furthermore, the tendency to downsize vehicle headlights is increasing demand for laser diodes.

- Moreover, increasing development in the automobile industry is expected to contribute to segment growth over the forecast period. For instance, in November 2022, Kyocera Corporation announced the introduction of an Automotive Night Vision System capable of reliably identifying collision-risk items in low-visibility operating circumstances such as rain, night, snow, fog, or smoke. The technology is designed to minimize traffic accidents and encourage safer driving.

- Increasing development in laser diodes is expected to drive market demand over the forecast period. For instance, in April 2022, The FemtoBlade laser technology was developed by Lumentum as the second version of the company's line of high-precision ultrafast industrial lasers. The novel system has a flexible architecture and a lot of power.

Asia Pacific is Expected to Hold a Significant Share

- The region's rapid expansion is primarily attributable to the region's foremost consumer electronics and automobile markets. Furthermore, development in optoelectronic devices is expected in other areas, including smart city initiatives, emerging innovations including virtual and simulated reality, big data, the Internet of Things (IoT), and intelligent industrial appliances.

- Asia-Pacific is the manufacturing center for semiconductor components. The region is home to the bulk of significant companies in the optoelectronics industry, including Rohm Co., Ltd, Sony Corporation, Renesas, Samsung Electronics Co., Ltd., Panasonic Corporation, Hamamatsu Photonics K.K., and Sharp Corporation, as well as several minor regional businesses which in turn is expected to drive market growth over the forecast period.

- Increasing developments by governments in emerging economies such as India and China are expected to contribute to market growth over the forecast period. For instance, in April 2022, the Navi Mumbai Municipal Corporation chose to convert all streetlights to LED lights; 35,000 streetlights were to be replaced this year, resulting in an INR 7 Crore (USD 0.85 million) yearly savings. All city roadways, including motorways, will have LED illumination installed. While several were changed in the fiscal year 2021, the majority will be changed in the fiscal year 2022. The bidding procedure for the project has begun

- In modern automobiles, optoelectronics automates vehicle operations, including brake signals and headlights. As a result, rising revenues from luxury and ultra-luxurious automobiles boost demand for the optoelectronics sector. As per the Federation of Automotive Dealers Associations (FADA), a nationwide organization comprising automobile sellers in India, retail luxury car sales in December 2021 would increase by 19.7% due to increasing inventory and partnerships with OEMs. As a result, rising sales of premium and ultra-luxury automobiles propel the optoelectronics business over the forecast period.

Optoelectronics Industry Overview

The competitive rivalry in the optoelectronics market is high owing to the presence of major players like General Electric Company, Panasonic Corporation, Samsung Electronics, Omnivision Technologies Inc., and Sony Corporation, among others. Their ability to innovate their products, coupled with hefty investments in research and development, has allowed them to gain a competitive advantage over their competitors. Strategic partnerships, mergers, and acquisitions have allowed the companies to grow and gain a substantial market share and maintain a strong foothold in the market.

In September 2022, GaNo Optoelectronics Inc., a spin-off from Nanjing University in China that provides ultraviolet (UV) detectors and modules centered on wide-bandgap semiconductors like silicon carbide (SiC) and gallium nitride (GaN), officially launched the first commercialized SiC-based extreme ultraviolet (EUV) photodiodes.

In July 2022, Nationstar Optoelectronics, located in China, established a formal "cooperation agreement" with Huawei to manufacture mini-LED and micro-LED display technology. The collaboration is founded on complementary advantages, reciprocal benefits, and joint development principles. It will focus on both parties' fundamental technology and industrial resources. The two firms want to conduct extensive innovation and research to broaden their potential economic coverage.

In June 2022, OpenLight, a newly created independent business funded by Synopsys and Juniper, revealed the world's first open silicon photonics architecture with integrated lasers. The California-based corporation aims to give chip makers a way to construct photonic integrated circuits (PICs) with the greatest potential performance.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Value Chain / Supply Chain Analysis

- 4.3 Industry Attractiveness - Porter Five Forces

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Market Drivers

- 4.4.1 Growing demand for Smart Consumer Electronics and Next Generation Technologies

- 4.4.2 Increasing Industrial Applications of the Technology

- 4.5 Market Restraints

- 4.5.1 High Manufacturing and Fabricating Costs

5 MARKET SEGMENTATION

- 5.1 Component type

- 5.1.1 LED

- 5.1.2 Laser Diode

- 5.1.3 Image Sensors

- 5.1.4 Optocouplers

- 5.1.5 Photovoltaic cells

- 5.1.6 Others

- 5.2 End-User Industry

- 5.2.1 Automotive

- 5.2.2 Aerospace & Defense

- 5.2.3 Consumer Electronics

- 5.2.4 Information Technology

- 5.2.5 Healthcare

- 5.2.6 Residential and Commercial

- 5.2.7 Industrial

- 5.2.8 Others

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 France

- 5.3.2.3 Germany

- 5.3.2.4 Spain

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Latin America

- 5.3.4.1 Mexico

- 5.3.4.2 Brazil

- 5.3.4.3 Rest of Latin America

- 5.3.5 Middle-East & Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 General Electric Company

- 6.1.2 Panasonic Corporation

- 6.1.3 Samsung Electronics

- 6.1.4 Omnivision Technologies Inc

- 6.1.5 Sony Corporation

- 6.1.6 Osram Licht AG

- 6.1.7 Koninklijke Philips N.V.

- 6.1.8 Vishay Intertechnology, Inc

- 6.1.9 Texas Instruments Inc

- 6.1.10 Stanley Electric Co

- 6.1.11 Rohm Co., Ltd (ROHM SEMICONDUCTOR)

- 6.1.12 Mitsubishi Electric