|

市场调查报告书

商品编码

1331340

发泡防火涂料的市场规模和份额分析 - 增长趋势和预测(2023-2028)Intumescent Coatings Market Size & Share Analysis - Growth Trends & Forecasts (2023 - 2028) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

膨胀型防火涂料市场规模预计将从2023年的170.87吨增长到2028年的187.73吨,预测期内(2023-2028年)复合年增长率为1.90%。

COVID-19 大流行对市场产生了负面影响。 然而,市场已达到大流行前的水平,预计在预测期内将稳定增长。

主要亮点

- 亚太地区新兴经济体建筑活动的增加以及石油和天然气勘探活动的增长正在推动所研究市场的增长。

- 原材料价格上涨可能会阻碍市场增长。

- 页岩气产量的增长预计将成为未来的市场机遇。

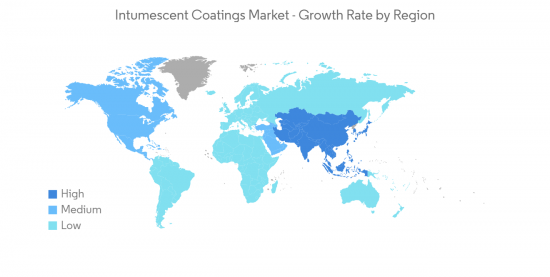

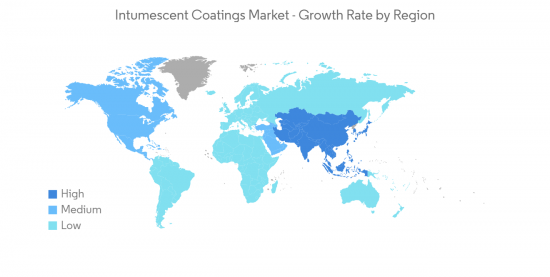

- 预计亚太地区将在预测期内主导市场。

发泡防火涂料市场趋势

石油和天然气行业主导市场

- 石油和天然气行业是膨胀型防火涂料市场的主要最终用户之一。 该行业水平钻井、炼油等业务活动处于高温环境,需要防火、防火涂层。

- 除了防火之外,该产品还可以保护金属和钢结构免受腐蚀和化学物质的侵害,因为它们暴露在潮湿的气候条件下。

- 海上石油和天然气生产涉及一些最恶劣的条件。 因此,生产中使用的涂层系统必须配备适当的设备。

- 在海上,长时间暴露在穿透性紫外线下以及不断接触汹涌的海水,增加了对膨胀型防火涂料的需求。

- 由于对能源和石化产品的需求不断增加,亚太地区的石油和天然气行业正在不断发展。 印度、马来西亚、印度尼西亚、中国、韩国和日本的海上钻探活动正在增加。

- 此外,印度政府还设立了以下三个邦:安得拉邦(Vishakapatnam)、古吉拉特邦(Dahej)、奥里萨邦(Paradip) 和泰米尔纳德邦,以促进这些行业的投资和工业发展。批准了四个石油、化学品和石化投资区 (PCPIR)(Cuddalore 和 Nagapattinam)。

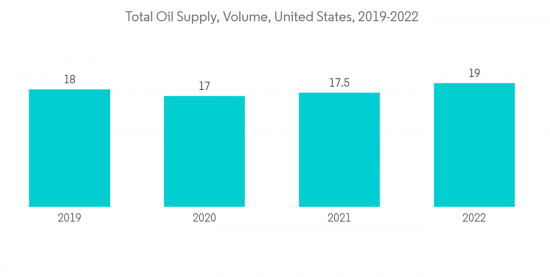

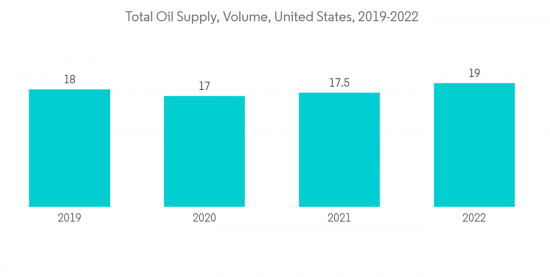

- 根据 IEA 的数据,美国引领全球供应增长,与加拿大、巴西和圭亚那一道,到 2022 年连续第二年打破年度产量记录。 12月份全球炼油产能保持稳定,其中美国因天气不利而减少910kb/d。 继 2022 年增加 2.1 mb/d 后,炼油厂产能预计将在 2023 年增加 150 mb/d,第四季度至 2023 年底期间产能将增加 220 mb/d。

- 此外,印度尼西亚的 Bison、Iguana 和 Gajah Puteri (BIGP) 项目等项目涉及 Iguana、Bison 和 Gajah Puteri 地区三个油气田的开发,将有助于膨胀型防火材料的增长亚太地区的涂料需求预计将增加。

- 因此,由于上述因素,石油和天然气行业预计将主导市场。

印度主导亚太市场

- 由于政府投资增加,印度建筑业正在快速增长。 商业房地产的增长主要由服务业,尤其是 IT 部门推动。

- 此外,信实工业有限公司 (Reliance Industries Limited) 和印度石油公司 (Indian Oil Corporation) 等公司正计划在未来五年内扩建炼油厂。

- 根据国际航空运输协会 (IATA) 的数据,印度是全球增长最快的国内市场之一,近年来旅客吞吐量达 1.9 亿人次。 到 2030 年,预计将有约 3.37 亿国内乘客和约 8400 万国际乘客使用该服务。

- 此外,根据 OICA 的数据,2022 年将生产约 5,456,857 辆汽车,比 2021 年生产的 4,399,112 辆汽车增加 24%。 预计汽车行业的增长将在预测期内扩大市场。 此外,“Aatma Nirbhar Bharat”和“印度製造”计划等政府改革预计将提振汽车行业,进一步提振高端汽车应用的PFA需求。

- 到 2022 年,印度电动汽车销量将超过 100 万辆,比 2021 年增长 206%。 印度电动汽车销量创历史新高,总销量约为 10,54,938 辆,约占所有汽车细分市场总销量的 4.7%。

- 不断增长的汽车工业,加上炼油厂的增加,预计将在预测期内显着推动印度膨胀型涂料市场的发展。

- 鑑于上述情况,印度预计将主导亚太市场。

膨胀型涂料行业概述

膨胀型涂料市场整合,主要厂商占据较大份额。 主要公司(排名不分先后)包括 Jotun、AkzoNobel NV、PPG Industries、The Sherwin-Williams Company 和 Hempel AS。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章简介

- 调查的先决条件

- 调查范围

第 2 章研究方法

第 3 章执行摘要

第 4 章市场动态

- 促进因素

- 亚太新兴国家的建筑活动有所增加

- 石油和天然气勘探活动的增长

- 其他司机

- 抑制因素

- 原材料价格上涨

- 其他抑制因素

- 工业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第 5 章市场细分(基于价值的市场规模)

- 应用

- 纤维素

- 碳氢化合物

- 最终用户行业

- 建筑

- 汽车和其他运输

- 石油和天然气

- 其他最终用户行业

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 意大利

- 法国

- 俄罗斯

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙特阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第 6 章竞争态势

- 併购、合资企业、联盟、协议

- 市场份额 (%)**/排名分析

- 各大公司的战略

- 公司简介

- 3M

- AkzoNobel NV

- Albi Protective Coating

- BASF SE

- Carboline

- Contego International Inc.

- Hempel AS

- Jotun

- Isolatek International

- No-Burn Inc.

- PPG Industries

- RPM International Inc.

- Tremco Illbruck

- The Sherwin-Williams Company

第 7 章市场机会和未来趋势

- 页岩气生产活跃

- 其他机会

The Intumescent Coatings Market size is expected to grow from 170.87 kilotons in 2023 to 187.73 kilotons by 2028, at a CAGR of 1.90% during the forecast period (2023-2028).

The COVID-19 pandemic negatively impacted the market. However, the market is reaching pre-pandemic levels and is expected to grow steadily during the forecast period.

Key Highlights

- Increasing construction activities in emerging economies of Asia-Pacific and growth in oil and gas exploration activities are augmenting the growth of the market studied.

- Rising prices of raw materials are likely to hinder the market's growth.

- Growing shale gas production is projected to act as an opportunity for the market in the future.

- Asia Pacific region is expected to dominate the market in the forecast period.

Intumescent Coatings Market Trends

Oil and Gas Industry to Dominate the Market

- The oil and gas sector is one of the major end-users of the intumescent coatings market. The sector requires fire protection and fireproofing due to the high-temperature environment in its business operations, including horizontal drilling and refining.

- Apart from fire protection, the product protects metal and steel structures from corrosion and chemicals as they are exposed to moist and damp climatic conditions.

- Offshore oil and gas production has some of the most demanding conditions. Therefore, coating systems used in production are required to be equipped appropriately.

- Offshore, prolonged exposure to penetrating UV rays and constant contact with rough seawater increases the need for intumescent coatings.

- The Asia-Pacific oil and gas industry is growing due to the rising demand for energy and petrochemicals. India, Malaysia, Indonesia, China, South Korea, and Japan are experiencing increased offshore drilling activities.

- Also, the Government of India has approved four petroleum, chemical, and petrochemical investment regions (PCPIRs) in the states of Andhra Pradesh (Vishakhapatnam), Gujarat (Dahej), Odisha (Paradeep), and Tamil Nadu (Cuddalore and Naghapattinam) to promote investment and industrial development in these sectors.

- According to the IEA, the United States led the global supply growth and, along with Canada, Brazil, and Guyana, set an annual production record for the second year until 2022. In December, global refinery activity remained stable as US runs fell 910 kb/d owing to weather-related disruptions; stronger runs in Europe and Asia compensated for the dip. Following a 2.1 mb/d increase in 2022, refinery throughputs were expected to climb by 1.5 mb/d in 2023, aided by 2.2 mb/d capacity expansions between 4Q22 and end-2023.

- Furthermore, projects such as the Bison, Iguana, and Gajah Puteri (BIGP) Project in Indonesia, involving the development of three oil and gas fields in the Iguana, Bison, and Gajah Puteri regions, are expected to increase the demand for intumescent coatings in Asia-Pacific.

- Thus, based on the abovementioned factors, the oil and gas industry is expected to dominate the market.

India to Dominate the Asia-Pacific Market

- India's construction sector has been growing rapidly, with increased investments by the government. Commercial real estate growth has been driven largely by service sectors, especially IT.

- In addition, companies like Reliance Industries Limited and Indian Oil Corporation have planned for expansion in oil refineries over the next five years.

- According to the International Air Transport Association (IATA), India is one of the fastest-growing domestic markets worldwide, with 190 million passengers traveling in recent years. About 337 million domestic and 84 million international passengers are expected to travel by 2030.

- Furthermore, according to the OICA, around 5,456,857 vehicles were produced in 2022, which increased by 24% compared to 4,399,112 units manufactured in 2021. The increasing automotive sector is expected to augment the market during the forecast period. Moreover, the government's reforms, such as "Aatma Nirbhar Bharat" and "Make in India" programs, are expected to likely boost the automotive industry, further supporting the demand for PFA in high-end automotive applications.

- In 2022, India's EV sales crossed a million units and recorded a 206% year-on-year hike over 2021 sales. With a total sales of about 10,54,938, India's EV record sales year across all vehicle segments accounted for about 4.7% of overall automotive sales.

- The growing automotive industry, coupled with the increasing number of petroleum refineries, is expected to majorly boost the Indian intumescent coatings market over the forecast period.

- Thus, based on the above factors, India is expected to dominate the Asia-Pacific market.

Intumescent Coatings Industry Overview

The intumescent coatings market is consolidated, with the top players accounting for major share of the market. Major players (in no particular order) include Jotun, AkzoNobel NV, PPG Industries, The Sherwin-Williams Company, and Hempel AS.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Construction Activities in Emerging Economies of Asia-Pacific

- 4.1.2 Growth in the Oil and Gas Exploration Activities

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Rise in Prices of Raw Materials

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Application

- 5.1.1 Cellulosic

- 5.1.2 Hydrocarbon

- 5.2 End-user Industry

- 5.2.1 Construction

- 5.2.2 Automotive and Other Transportation

- 5.2.3 Oil and Gas

- 5.2.4 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Russia

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 AkzoNobel NV

- 6.4.3 Albi Protective Coating

- 6.4.4 BASF SE

- 6.4.5 Carboline

- 6.4.6 Contego International Inc.

- 6.4.7 Hempel AS

- 6.4.8 Jotun

- 6.4.9 Isolatek International

- 6.4.10 No-Burn Inc.

- 6.4.11 PPG Industries

- 6.4.12 RPM International Inc.

- 6.4.13 Tremco Illbruck

- 6.4.14 The Sherwin-Williams Company

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Strong Shale Gas Production

- 7.2 Other Opportunities