|

市场调查报告书

商品编码

1332444

云端无线接入网路 (C-RAN) 市场规模和份额分析 - 增长趋势和预测(2023-2028)Cloud Radio Access Network (C-RAN) Market Size & Share Analysis - Growth Trends & Forecasts (2023 - 2028) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

云端无线接入网路 (C-RAN) 市场规模将从 2023 年的 96 亿美元增长到 2028 年的 251 亿美元,预测期内(2023-2028 年)复合年增长率为 21.19%。

由于确保遵守企业和政府法规的需求不断增加,云端 RAN 市场有望增长。

与资本支出 (CAPEX) 和运营支出 (OPEX) 相关的成本降低、4G 和 5G 的便捷接入预计将推动市场增长。

对节能和经济高效的网路解决方案的需求不断增长以及 5G 网路技术的市场开发正在推动市场扩张。 此外,不断增长的带宽需求正在推动 C-RAN 行业向前发展。 然而,高容量前传需求限制了市场扩张。 相反,全球互联网用户数量的不断增长以及采用物联网的网路连接的激增预计将为整个预测期内的市场扩张带来多种前景。

由于智能无线设备的激增和 LTE 市场的增长,预计该市场将大幅增长。 未来两三年,移动网路运营商最紧迫的问题将是移动网路价值最大化、建设面向未来的移动接入网路和未来业务创新。

COVID-19 大流行增加了对云端无线接入网路 (C-RAN) 的需求。 自新型冠状病毒爆发以来,在线服务和渠道的使用有所增加。 劳动力推动了对视频会议的需求,在线医疗咨询等产生了海量数据流。 预计对无缝、低延迟云端无线接入网路的需求将会增加。

云端无线接入网路 (C-RAN) 市场趋势

各个最终用户细分市场对 5G 的需求不断增长,推动了市场发展

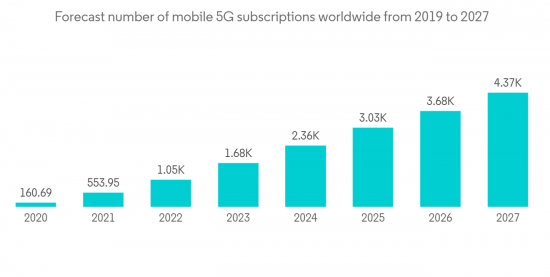

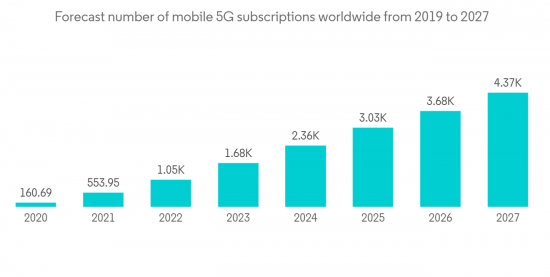

随着互联网数据流量的增加,容量需求不断增加,5G 的目标是使数据通信速度比 4G/LTE 快三倍。 推动5G发展的主要用例是移动宽带服务的增强。

借助CloudRAN,您可以通过虚拟化容器更轻鬆地释放无线基站的网路容量。 CloudRAN的容量解锁能力将不断从简单的API向复杂的场景化、互联网化的API演进。

移动数据传输架构的评估标准包括敏捷性、上市时间、成本效益、操作和架构简单性、可扩展性和灵活性。

随着每个无线网路节点人口密度较高的办公室、体育场、城镇广场和通勤区越来越多地使用集中式基带技术来提高网路性能,市场正在不断扩大。我来了。

能源消耗和物理尺寸也是开发新网路架构、功率和空间的重要因素,这需要基站站点昂贵且稀缺的资源。

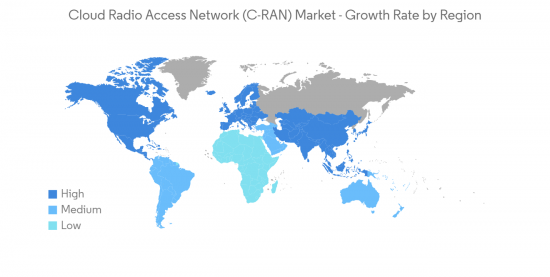

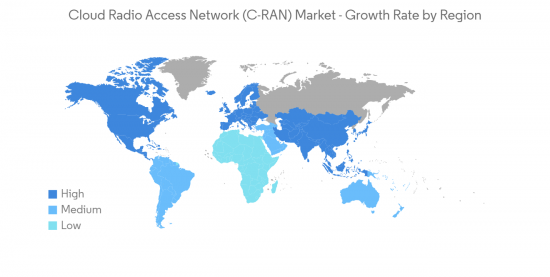

预计欧洲地区将出现显着增长

沃达丰将使用德国三星的 2G/4G vRAN 和 O-RAN 兼容无线电解决方案开展广泛的 Open RAN 试点项目。 沃达丰计划在这些计划于 2022 年 10 月开始的商业试点中使用三星成熟的密钥,以展示其卓越的性能、稳定性和可靠性。 在欧洲,该地区可供託管的塔楼数量预计将大幅增加。

LTE正在顺利进行,5G也逐渐普及,预计2022年上半年商用。 因此,未来几年的网路增长预计将集中在城市填充容量和室内解决方案上。

通过与诺基亚的合作,Plauen 将成为第一家在该市场测试兼容软件的欧洲供应商,并成为新 Open RAN 技术的创新现场测试场。 此外,Mavenir 还将对其一些新的 Open RAN 设备进行现场测试。

2018年,4G网路覆盖率达到欧洲人口的90%,预计2020年将达到93%。 覆盖范围的扩大、价格范围更广的更多设备以及音乐和视频流服务使用的增加是推动 4G 服务采用的一些因素。 对更好数据的需求增加可能会导致该地区更多地部署 Cloud RAN。

云端无线接入网路 (C-RAN) 行业概览

云端无线接入网路(C-RAN)市场的竞争温和,只有少数主要参与者。 从市场份额来看,目前少数参与者占据市场主导地位。 然而,随着4G和5G服务的进步,新的参与者正在增加他们在市场上的存在,并扩大他们在新兴国家的业务。 该市场的主要参与者包括诺基亚、思科、爱立信和英特尔。

2022 年 12 月,Verizon 的 vRAN 网路扩展得到了英特尔关键技术的支持。 爱立信的 Cloud RAN 蜂窝站点是 Verizon 扩大其 vRAN 领导地位的努力的一部分。

2022年11月——高通和沃达丰最近宣布将基于高通的Open RAN(O-RAN)设备、QRU100 5G RAN平台以及X100 5G RAN加速卡,据说高性能和节能effective. 宣布他们将合作为世界测试和创建基础设施解决方案。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章简介

- 调查结果

- 调查假设

- 调查范围

第 2 章研究方法

第 3 章执行摘要

第 4 章市场动态

- 市场概览

- 市场促进因素和市场抑制因素介绍

- 市场促进因素

- 各个最终用户细分市场对 5G 趋势的需求不断增长

- 需要降低4G-5G网路中使用的硬件设备成本

- 市场抑制因素

- 缺乏网路扩展所需的频谱以及监管限制

- 行业吸引力 - 波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的对抗关係

- 技术快照

- 云端 - 虚拟化

- 集中式 RAN

第 5 章市场细分

- 按服务

- 专业

- 託管

- 按网路类型

- 5G

- 4G

- LTE

- 3G(边缘)

- 按地区

- 北美

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 欧洲其他地区

- 亚太地区

- 中国

- 日本

- 其他亚太地区

- 拉丁美洲

- 中东/非洲

- 北美

第 6 章竞争态势

- 公司简介

- Cisco System Inc.

- Nokia Corporation

- Huawei Technologies Co. Ltd.

- Telefonaktiebolaget LM Ericsson

- Intel Corporation

- Fujitsu Limited

- Mavenir Systems Inc.

- Artiza Networks Inc.

第 7 章投资分析

第 8 章市场机会和未来趋势

The C-RAN Market size is expected to grow from USD 9.60 billion in 2023 to USD 25.10 billion by 2028, at a CAGR of 21.19% during the forecast period (2023-2028).

The Cloud RAN market is expected to hold potential growth due to the growing industry's need to ensure compliance with corporate and government regulations.

Reduction in charges related to Capital Expenditure (CAPEX) and Operational Expenditure (OPEX) and convenient 4G and 5G accessibility are expected to drive the market's growth.

The growing need for energy-efficient and cost-effective networking solutions and the development of 5G network technologies are driving market expansion. Furthermore, the increasing bandwidth demand is propelling the C-RAN industry forward. Nevertheless, the requirement for a high-capacity fronthaul constrains the market's expansion. Conversely, expanding worldwide internet users and a spike in network connectivity to adopt IoT is expected to give multiple prospects for market expansion throughout the projection period.

The market is expected to grow considerably with the proliferation of intelligent wireless devices and the LTE market's growth. Over the next two to three years, mobile network operators' most pressing issues will be maximizing the value of mobile networks, constructing future-facing mobile access networks, and future service innovation.

The COVID-19 pandemic increased the demand for a cloud radio access network (C-RAN). The use of online services and channels increased due to the introduction of novel coronaviruses. The workforce was driving the demand for video-based conferences, and among other things, online medical consultations have generated a tonne of data flow. The need for seamless, low-latency cloud radio access networks was projected to increase.

Cloud Radio Access Network Market Trends

Rising Demand of 5G Trend Across Various End-user Segment is Driving the Market

As capacity demands driven by growing internet data traffic increase, 5G aims to speed up data communication up to three times as compared to 4G/LTE. The key use case driving the development of 5G is the enhancement of mobile broadband services.

With CloudRAN, the network capabilities of wireless base stations can be more easily opened through virtualized containers. CloudRAN's capability opening function will continue to evolve from simple APIs to complex APIs which are scenario-based and Internetized.

Mobile data transport architectures are evaluated based on agility, time to market, cost-effectiveness, operational & architectural simplicity, expandability, and flexibility.

The market is growing as more offices, stadiums, city squares, and commuter areas with high people density per wireless network node use centralized baseband technology to enhance network performance.

Energy consumption and physical size are also key factors in developing new network architecture, power, and space, as are expensive and scarce resources at base station sites.

Europe Region is Expected to Grow at a Significant Rate

Vodafone will use Samsung's 2G/4G vRAN and O-RAN compliant radio solutions from Germany to conduct extensive Open RAN pilot projects. Vodafone will use Samsung's mature keys in these commercial pilots, which are scheduled to launch in October 2022, to show their superior performance, stability, and dependability. in Europe, the region is expected to experience a significant increase in the number of towers available for co-location.

LTE is well underway, and 5G has slowly begun to roll out which is expected to commercialize by the first half of 2022. As a result, network growth in the next years is poised to center around urban infill capacity and indoor solutions.

With Nokia's help, Plauen will host the first European vendor to try out compatible software in this market and serve as the site for innovative field tests of new Open RAN technology. Additionally, Mavenir will perform live tests on some of its new Open RAN equipment.

In 2018, 4G network coverage was used by 90% of the European population, and is anticipated to reach 93% by 2020. Improved coverage, greater number of available devices at a wider range of price points, and increasing use of music and video streaming services are a few factors driving the adoption of 4G services. This increased demand for better data is likely to augment the deployment of cloud RAN in the region.

Cloud Radio Access Network Industry Overview

The cloud radio access network market is moderately competitive and has a few major players. In terms of market share, some of the players currently dominate the market. However, with the advancement in the 4G & 5G services, new players are increasing their market presence, expanding their business footprint across emerging economies. Some of the key players in the market are Nokia, Cisco, Ericsson, and Intel, among others.

In December 2022, Verizon's vRAN network expansion was supported by critical technologies from Intel. Ericsson Cloud RAN cell site is part of Verizon's efforts to extend its vRAN leadership position.

In November 2022 - Recently, Qualcomm and Vodafone announced that they would work together to test and create infrastructure solutions based on Qualcomm's Open RAN (O-RAN) devices, the QRU100 5G RAN Platform and the X100 5G RAN Accelerator Card, which is said to be high performing and energy efficient.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Rising Demand of 5G Trend Across Various End-user Segment

- 4.3.2 Need to Eliminate the Cost of Hardware Equipment Used in 4G-5G Network

- 4.4 Market Restraints

- 4.4.1 Scarce Spectrum Availability for Network Expansion When Combined With Regulatory Limits

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Technology Snapshot

- 4.6.1 Cloud-Virtualization

- 4.6.2 Centralized-RAN

5 MARKET SEGMENTATION

- 5.1 By Service

- 5.1.1 Professional

- 5.1.2 Managed

- 5.2 By Network Type

- 5.2.1 5G

- 5.2.2 4G

- 5.2.3 LTE

- 5.2.4 3G (EDGE)

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 Rest of Asia-Pacific

- 5.3.4 Latin America

- 5.3.5 Middle-East & Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Cisco System Inc.

- 6.1.2 Nokia Corporation

- 6.1.3 Huawei Technologies Co. Ltd.

- 6.1.4 Telefonaktiebolaget LM Ericsson

- 6.1.5 Intel Corporation

- 6.1.6 Fujitsu Limited

- 6.1.7 Mavenir Systems Inc.

- 6.1.8 Artiza Networks Inc.