|

市场调查报告书

商品编码

1332534

支付安全的市场规模和份额分析 - 增长趋势和预测(2023-2028)Payment Security Market Size & Share Analysis - Growth Trends & Forecasts (2023 - 2028) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

支付安全市场规模预计将从 2023 年的 234.8 亿美元增长到 2028 年的 481.4 亿美元,预测期内(2023-2028 年)复合年增长率为 15.44%。

安全的支付处理有助于在线支付、客户数据和其他敏感信息的高效传输。 它还可以保护支付数据免受欺诈和其他安全问题的影响。

主要亮点

- 由于在线购物和交易的快速转变、复杂的数据盗窃和支付欺诈的增加以及人们对支付安全和PCI DSS(支付卡行业数据安全标准)合规计划的认识不断增强,支付安全解决方案变得越来越重要. 由于几个重要因素,它的需求量很大。

- 此外,由于信用卡/借记卡支付、移动钱包和互联网支付等数字支付的增长,预计支付安全市场在预测期内将在全球范围内扩张。

- TPP 增加了网上商店支付欺诈的风险,因此对支付服务的需求不断增加。 安全措施另一个因素是安全技术的引入,例如安全套接字层(SSL)协议,它使用加密算法来确保传输数据的机密性。

- 此外,支付安全模型中日益增多的缺陷为蠕虫、木马、网络钓鱼、病毒、拒绝服务攻击、交易中毒、垃圾邮件发送者、未经授权的访问、盗窃和欺诈提供了新的攻击平台。风险正在增加。

- 随着全球越来越多的人使用在线支付服务以及更多行业需要高安全性交易处理系统,COVID-19 疫情将对支付安全市场的增长率产生积极影响。

支付安全市场趋势

零售业实现高增长

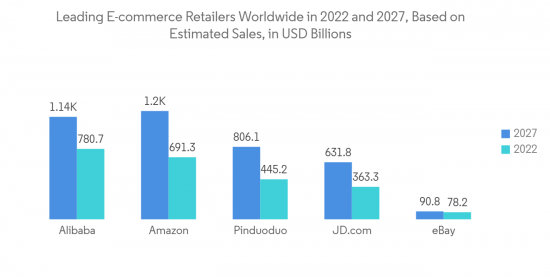

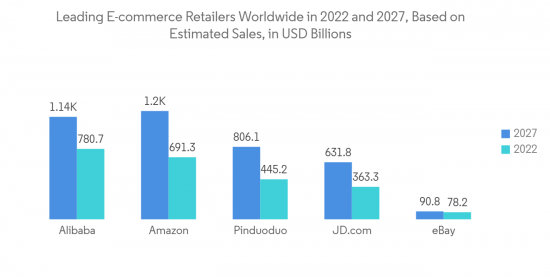

- 移动支付在零售行业尤其是电子商务领域的使用不断增加,支付安全市场也在不断扩大。 手机银行和移动支付安全已成为消费者和金融服务提供商关注的重点,为移动支付安全软件市场带来了增长空间。 美国和中国等主要国家的零售电子商务销售正在经历显着增长。

- 政府的支持、智能手机普及率的提高以及应用程序的使用都促进了零售电子商务销售额的快速增长。 随着购物体验的改善,这一趋势可能会进一步加速。

- 电子商务给零售业带来了新的机遇。 在线渠道现在已成为零售商客户体验的重要组成部分,因为它们可以显着降低实体店的运营成本和销售波动性。

- 由于零售行业经常成为网络攻击的目标,因此对强大的支付安全解决方案的需求不断增加,预计将支持该行业未来的收入增长。

- 由于移动技术的持续增长,以及云、分析、社交和移动支付等补充技术的支持,预计该市场将继续扩大。

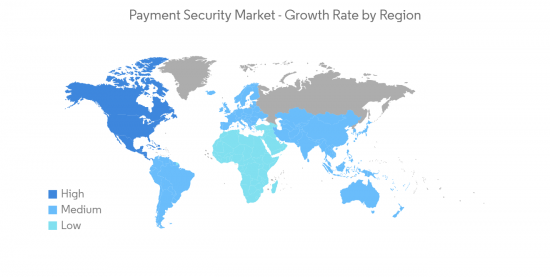

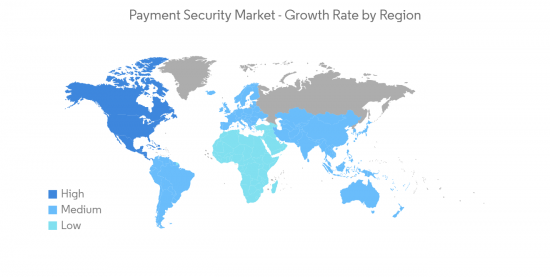

北美市场份额最大

- 北美强大的财务基础使公司能够大力投资尖端产品和技术,从而为在北美运营的公司提供市场竞争优势。

- 此外,该地区存在多家支付安全供应商,例如 Cyber□□Source Corporation、Elavon Inc.、Geobridge Corporation 和 TNS Inc.,也是影响该地区行业的另一个因素。

- 越来越多的企业使用在线支付处理器的新兴市场、端到端加密支付安全技术的快速采用以及具有自动欺诈检测和用户友好型支付界面开发功能的可靠平台,这些都是促成这一趋势的因素。该地区的市场收入增长。

- 此外,该地区不断变化的零售市场和不断增长的电子商务销售额是快速支付解决方案需求不断增长的主要原因,这反过来又推动了对支付安全行业的需求。

- 普通客户会同时使用多张卡,在线支付的增长速度是零售支付的四倍。 这些因素,加上信用卡市场的蓬勃发展,为支付安全创造了市场机会。

- 随着消费者接受移动支付,该地区数字支付的使用不断增加。 当地经济增长的主要推动力之一是蓬勃发展的零售业。

支付安全行业概述

由于国内外运营商众多,支付安全市场竞争非常激烈。 技术进步和併购是行业主要竞争对手的主要策略,行业集中度中等。 市场参与者的主要例子包括 Cyber□□Source Corporation、Braintree Payment Solutions, LLC、Ingenico Group 和 Elavon Inc.。

- 2022 年 11 月 - Bluefin Payment Systems LLC 宣布收购 TECS Payment Systems,Bluefin 和 TECS 携手合作,为 55 个国家/地区的 34,000 家关联商户和近 300 个国际合作伙伴提供支持。 这一战略伙伴关係将扩大两个组织的全球影响力。 TECS 现有的支付和数据安全套件将与 Bluefin 及其为其客户提供的全渠道支付和 smartPOS 功能集成。

- 2022 年 9 月 - Elavon Inc. 为北美小企业主推出了 talech Register。 talech Register 是下一代一体化支付和业务分析平台,使小企业主能够更好地管理其运营,使他们能够通过註册公司 AMI 解决其业务中所有復杂的支付、银行业务和运营需求..

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第1章简介

- 研究假设和市场定义

- 调查范围

第2章研究方法

第 3 章执行摘要

第 4 章市场洞察

- 市场概览

- 行业吸引力 - 波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的对抗关係

- 工业价值链分析

第5章市场动态

- 市场驱动因素

- 扩大数字支付的引入范围

- 电子商务欺诈行为增加

- 市场製约因素

- 对在线支付缺乏信任

- 新冠肺炎 (COVID-19) 对行业的影响

第6章市场细分

- 平台

- 移动基地

- 基于网络

- 其他平台

- 最终用户行业

- 移动基地

- 零售

- 医疗保健

- IT/通信

- 旅游/酒店业

- 其他最终用户行业

- 地区

- 北美

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第7章竞争态势

- 公司简介

- CyberSource Corporation(Visa Inc.)

- Bluefin Payment Systems LLC

- Braintree Payment Solutions LLC

- Elavon Inc.

- SecurionPay

- Broadcom Inc.

- Signified Inc.

- TokenEx Inc.

- TNS Inc.

- Shift4 Corporation

第8章 投资分析

第9章 市场机会与将来动向

The Payment Security Market size is expected to grow from USD 23.48 billion in 2023 to USD 48.14 billion by 2028, at a CAGR of 15.44% during the forecast period (2023-2028).

Secure payment processing facilitates the efficient transfer of online payments, client data, and other sensitive information. It protects payment data against fraud and other security issues.

Key Highlights

- Payment security solutions are in high demand due to several important factors, including the quick shift to online shopping and transactions, the rise in sophisticated data thefts and payment frauds, and the rising awareness of payment security and Payment Card Industry Data Security Standard (PCI DSS) compliance programs.

- Due to the rise in digital payments, such as credit/debit payments, mobile wallets, and internet payments, it is also projected that the market for payment security would expand globally over the course of the projection period.

- Demand for payment services is increasing due to the TPP's increased risk of payment fraud for online shops. Security measures Another factor is implementing security technologies, such as the Secure Sockets Layer (SSL) protocol, which ensures the confidentiality of transmitted data due to the encryption algorithm.

- Moreover, growing flaws in payment security models provide worms, Trojan horses, phishing, viruses, denial of service attacks, transaction poisoning, and spammers with new attack platforms, increasing the risk of unauthorized access, theft, and fraud.

- The COVID-19 pandemic is anticipated to favorably affect the growth rate of the payment security market since more people are using online payment services globally, and more industries need high-security transaction processing systems.

Payment Security Market Trends

Retail Sector to Witness High Growth

- The market for payment security is growing as mobile payments are increasingly used in retail, particularly in the e-commerce sector. The security of mobile banking and payments has become a significant area of concern for consumers and financial service providers, giving the market for mobile payment security software room to grow. Major economies like the United States and China have significantly increased retail e-commerce sales.

- Government support, rising smartphone penetration, and application usage all contribute to the rapid expansion of retail e-commerce sales. The prospect of an improved shopping experience is likely to accelerate this trend.

- E-commerce has created new opportunities for the retail industry. Online channels are now an essential element of the customer experience for retailers as they help significantly lower operational expenses and sales fluctuations in physical locations.

- Since the retail industry is a frequent target of cyberattacks, there is an increasing need for solid payment security solutions, which are anticipated to support segment revenue growth in the future.

- The market is predicted to continue to expand due to the continued growth of mobile technologies, which are supported by the complementary technologies of cloud, analytics, and social, mobile payments.

North America occupies the Largest Market Share

- The robust financial standing of North America allows it to make significant investments in cutting-edge products and technologies, giving the businesses operating here a competitive edge in the market.

- Also, the existence of multiple payment security vendors in the region among them CyberSource Corporation, Elavon Inc., Geobridge Corporation, and TNS Inc. is one of the factors influencing the industry in this area.

- The rise in businesses using online payment processors, the quick adoption of end-to-end encrypted payment security technologies, and the development of reliable platforms with automated fraud detection and user-friendly payment interfaces are all factors that have contributed to the region's market's revenue growth.

- Moreover, The key reason for the increase in demand for a quick payment solution, which in turn fuels the need for the payment security industry, is the changing retail market and rising E-commerce sales in this region.

- The average customer uses multiple cards concurrently, and online payments are growing four times faster than retail payments. These factors, combined with the booming credit card market, present a market opportunity for payment security.

- The region is seeing a rise in the use of digital payments due to consumer acceptance of mobile payments. One of the main factors for the growth drivers for the local economy is the thriving retail sector.

Payment Security Industry Overview

The payment security market is highly competitive due to the presence of numerous players conducting business both domestically and internationally. Technology advancements and mergers & acquisitions are the main methods used by the leading competitors in the industry, which appears to be moderately concentrated. CyberSource Corporation, Braintree Payment Solutions, LLC, Ingenico Group, and Elavon Inc. are a few of the market's key participants.

- November 2022 - Bluefin Payment Systems LLC announced the acquisition of TECS Payment Systems, Bluefin and TECS will work together to support 34,000 linked merchants and around 300 international partners across 55 countries. The strategic alliance broadens both organizations' global reach. The company's existing payment and data security suite will be integrated with omnichannel payments and smartPOS capabilities for Bluefin and its clients.

- September 2022 - Elavon Inc has launched talech Register for North American small business owners, where talech Register is the next-generation, all-in-one payments and business analytics platform that empowers small business owners to better manage their operations, through register company amis to tackle all the complex payments, banking and operational needs of bussiness.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Force Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Adoption of Digital Payment Modes

- 5.1.2 Increase in Fraudulent Activities in E-commerce

- 5.2 Market Restraints

- 5.2.1 Lack of Trust in Online Payment Modes

- 5.3 Impact of COVID-19 on the industry

6 MARKET SEGMENTATION

- 6.1 Platform

- 6.1.1 Mobile Based

- 6.1.2 Web Based

- 6.1.3 Other Platforms

- 6.2 End-user Industry

- 6.2.1 Mobile Based

- 6.2.2 Retail

- 6.2.3 Healthcare

- 6.2.4 IT and Telecom

- 6.2.5 Travel and Hospitality

- 6.2.6 Other End-user Industry

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle-East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 CyberSource Corporation (Visa Inc.)

- 7.1.2 Bluefin Payment Systems LLC

- 7.1.3 Braintree Payment Solutions LLC

- 7.1.4 Elavon Inc.

- 7.1.5 SecurionPay

- 7.1.6 Broadcom Inc.

- 7.1.7 Signified Inc.

- 7.1.8 TokenEx Inc.

- 7.1.9 TNS Inc.

- 7.1.10 Shift4 Corporation

![支付安全市场 - 按组件(解决方案 [加密令牌化、诈欺检测和预防、生物识别认证]、服务)、按组织规模(中小企业、大型组织)、按最终用户和预测,2023 - 2032 年](/sample/img/cover/42/1395086.png)