|

市场调查报告书

商品编码

1332599

氧化钙市场规模和份额分析-增长趋势和预测(2023-2028)Calcium Oxide Market Size & Share Analysis - Growth Trends & Forecasts (2023 - 2028) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

氧化钙市场规模预计将从2023年的5189万吨增长到2028年的6578万吨,预测期内(2023-2028年)复合年增长率为4.86%。

所研究的市场受到 2020 年 COVID-19 爆发的负面影响。 然而,2021年和2022年市场出现復苏迹象。

主要亮点

- 钢铁行业的需求正在拉动市场对石灰的需求。 石灰在电弧炉、AOD 转炉和冶炼钢包中的新用途正在推动炼钢中氧化钙的需求。 在炼铁中用作精炼剂,去除杂质,去除硫、磷。

- 氧化钙对健康有害。 它与水发生剧烈反应,如果吸入或接触皮肤或眼睛,会引起严重刺激。 在更极端的情况下,接触生石灰会导致腹痛、呕吐和噁心。 当它与水反应时,可以释放足够的热量来点燃可燃材料。 因此,生石灰生产需要仔细观察并遵守各种环境法规,这可能是市场的製约因素。

- 生物燃料行业不断增长的需求预计将为氧化钙市场创造机会。 预计这将影响氧化钙作为固体多相催化剂用于从棕榈油製备生物柴油的日益增长的使用。

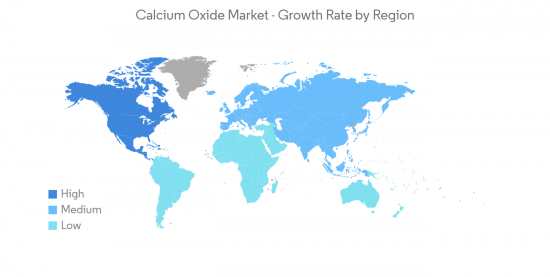

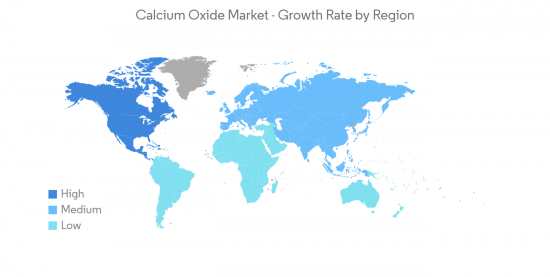

- 亚太地区在全球市场中占据主导地位,最大的消费来自中国和印度等国家。

氧化钙市场趋势

冶金行业需求不断增加

- 氧化钙由于能够与硅酸盐和其他材料反应形成溶液,因此在许多工艺中都有应用。 钢铁和冶金行业的製造商是氧化钙的主要消费者,因为他们将氧化钙用于其他金属的熔化和精炼。

- 在钢铁製造中,氧化钙用作熟料剂,以去除金属部件中的杂质。 电弧炉、AOD 转炉和冶炼钢包需要添加氧化钙。 其他用途包括冶金工业作为腐蚀抑製剂和酸中和剂。 此外,氧化钙还用于生产铜、铅、锌、银、镍、金、铀等,并利用各种金属盐的悬浮液来分离杂质。

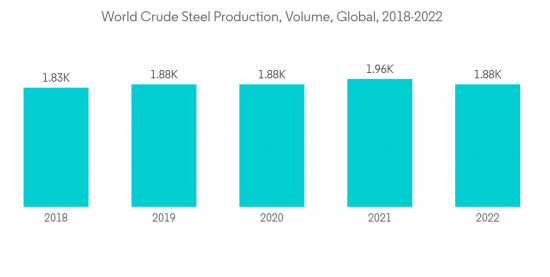

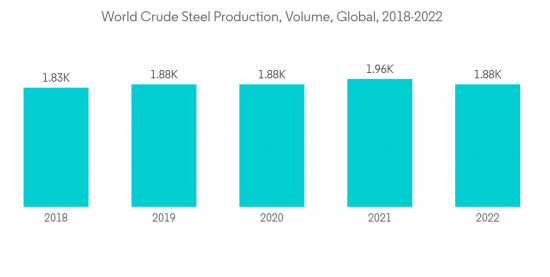

- 钢铁工业是现代工业增长的引擎之一,过去十年钢铁产量一直稳定增长。 据世界钢铁协会预测,2022年12月全球粗钢产量将为1.407亿吨。 然而,预计 2023 年将出现进一步的正增长率,从而推动当前的研究市场。

- 亚太地区是氧化钙的主要消费国之一,其中以中国为主。 以美国为主的北美地区也占有重要地位。 在美国,冶金工业被认为是氧化钙市场的主要应用,它被用作炼钢炉的助熔剂。 美国生产的氧化钙大约有 35% 用于冶金应用。

- 预计上述因素将在预测期内推动全球市场的发展。

北美主导市场

- 预计在预测期内,北美将主导全球氧化钙市场。

- 美国是世界第四大粗钢生产国,全国拥有 100 多家生产厂。

- 氧化钙是建筑施工中的一种多功能材料。 氧化钙可作为砂浆的成分用于砌筑系统的施工。 氧化钙还可用于外部(灰泥)和内部灰泥系统。 作为沥青中的添加剂,氧化钙可以提高沥青的粘结强度,减少剥落,并减缓老化过程。

- 美国拥有庞大的建筑业,拥有超过 760 万名员工。 根据美国人口普查局的数据,2022 年建筑业价值为 1.79 万亿美元,比 2021 年的 1.63 万亿美元增长 10.2%(0.8%)。

- 此外,美国人口普查局进一步统计显示,2022 年美国新建建筑年价值将为 1.66 万亿美元,而 2021 年为 1.49 万亿美元。 此外,2022 年美国住宅建设金额将为 8491.6 亿美元,而 2021 年为 7406.4 亿美元。 2022年该国非住宅建筑年价值为8084.2亿美元,而2021年为7591.7亿美元,从而短期内减少了调查市场的消费。

- 由于消费者支出增加以及政府对旅游业、办公楼和零售空间的投资增加,商业建筑预计也会增加。

- 建筑业是墨西哥经济的支柱。 过去 50 年来,墨西哥的城市化速度超过了经济合作与发展组织 (OECD) 的大多数国家。 城市化进程的加快和收入水平的提高正在推动该国的建筑需求。

- 向墨西哥住房部门提供的大部分资金(约 68%)来自政府机构。 CONAVI(国家住房委员会)、INFONAVIT、FOVISSSTE 和 CFE 等政府机构支持国家住房建设行业的发展。

- 由于上述因素,预计在预测期内对氧化钙等聚烯烃催化剂的需求将会增加。

氧化钙行业概述

氧化钙市场大多分散。 氧化钙市场的主要参与者包括 Carmeuse、Graymont、Lhoist、Mississippi Lime、Minerals Technologies 等。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章简介

- 调查结果

- 调查的先决条件

- 调查范围

第 2 章研究方法

第 3 章执行摘要

第 4 章市场动态

- 促进因素

- 全球钢铁产量增加

- 扩大建设和基础设施发展

- 抑制因素

- 严格的环境法规阻碍氧化钙的生产

- 工业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第 5 章市场细分(市场规模:基于数量)

- 最终用户行业

- 冶金

- 建筑

- 肥料/化学

- 纸浆和造纸製造

- 耐火材料

- 其他最终用户行业(橡胶、食品和饮料等)

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美

- 美国

- 墨西哥

- 加拿大

- 欧洲

- 德国

- 英国

- 意大利

- 法国

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙特阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第 6 章竞争态势

- 併购、合资企业、联盟、协议

- 市场份额 (%)/排名分析

- 各大公司的战略

- 公司简介

- Carmeuse

- Graymont Limited

- Lhoist

- Mississippi Lime

- Minerals Technologies Inc.

- CAO Industries Sdn Bhd

- AKJ Minchem Private Limited

- Sigma Minerals Ltd

- Astrra Chemicals

- Kemipex

- Sibelco

- American Elements

- Graymont Limited

- American Elements

- CAO Industries Sdn Bhd

- Mississippi Lime

第 7 章市场机会和未来趋势

The Calcium Oxide Market size is expected to grow from 51.89 million metric tons in 2023 to 65.78 million metric tons by 2028, at a CAGR of 4.86% during the forecast period (2023-2028).

The studied market was negatively impacted by the outbreak of COVID-19 in the year 2020. However, in 2021 and 2022, the market showed signs of recovery.

Key Highlights

- Demand from the steel industry is empowering the demand for lime in the market. Emerging use for lime in electric arc furnaces, AOD converters, and refining ladles is driving the demand for calcium oxide in steel-making. Steel-making uses it as a purifying agent to eliminate impurities and remove sulfur and phosphorus.

- Calcium Oxide includes a hazardous impact on health. It reacts vigorously with water, leading to severe irritation when inhaled or in contact with the skin and eyes. Moreover, in extreme cases, quicklime exposure can cause abdominal pain, vomiting, and nausea. When reacted with water, it can release enough heat to ignite combustible materials. Hence, their production needs to be carefully observed and conform to various environmental regulations, which may act as a restraining factor in the market.

- Growing demand for the biofuel industry is expected to provide an opportunity for the market for calcium oxide. It is expected to impact the increase in the usage of calcium oxide as a solid heterogeneous catalyst for the preparation of biodiesel from palm oil.

- Asia-Pacific dominated the market across the world, with the most significant consumption from countries such as China and India.

Calcium Oxide Market Trends

Increasing Demand from the Metallurgical Industry

- The ability of calcium oxide to react with silicates and other materials to form solutions makes it applicable to numerous processes. Manufacturers in the steel and metallurgical industries are the leading consumers of calcium oxide, as they use it to melt and purify other metals.

- In steel manufacturing, calcium oxide is used as a clinker agent to eliminate impurities in metal parts. Calcium oxide addition is necessary for electric arc furnaces, AOD converters, and refining ladles. It includes other utilities in the metallurgical industry as a corrosion protector and as a neutralizer of acids. Further, calcium oxide is also used to produce copper, lead, zinc, silver, nickel, gold, uranium, etc., to segregate impurities using floatation of different metallic salts.

- The iron and steel industry is one of the drivers of modern industrial growth, and steel production is growing steadily over the past decade. According to the World Steel Association, the global crude steel production was 140.7 million tonnes (Mt) in December 2022. However, in 2023, it is further expected to register a positive growth rate, thereby driving the current studied market.

- Asia-Pacific is one of the major consumers of calcium oxide, dominated by China. North America, dominated by the United States, also includes a significant market position. In the United States, the metallurgical industry is considered the leading application for the calcium oxide market, where it is used as fluxes in iron and steel furnaces. Around 35% of calcium oxide produced in the United States is used for metallurgical applications.

- All the factors above are expected to drive the global market during the forecast period.

North America region to Dominate the Market

- North America is expected to dominate the global calcium oxide market during the forecast period.

- The United States is the world's fourth-largest producer of crude steel, with more than 100 production plants in the country.

- Calcium oxide is a versatile material in the construction of buildings. It can be used in constructing masonry systems as a mortar component. Exterior (stucco) and interior plaster systems can also contain calcium oxide. As an additive in asphalt, calcium oxide improves the cohesion of asphalt, reduces stripping, and retards the aging process.

- The United States boasts a colossal construction sector with over 7.6 million employees. According to US Census Bureau, in 2022, the value of construction was USD 1.79 trillion billion, a 10.2% (0.8%) increase over the USD 1.63 trillion spent in 2021.

- Further, as per further statistics generated by the US Census Bureau, the annual value for new construction in the United States accounted for USD 1.66 trillion in 2022, compared to USD 1.49 trillion in 2021. Moreover, the annual residential construction in the United States was valued at USD 849.16 billion in 2022, compared to USD 740.64 billion in 2021. The annual value of non-residential construction put in place in the country was valued at USD 808.42 billion in 2022, compared to USD 759.17 billion in 2021, thereby decreasing the consumption of the market studied in the short term.

- Commercial construction is also expected to increase, with more consumer expenditure and governmental investments in tourism, office buildings, and retail spaces.

- The construction sector is the backbone of the Mexican economy. Over the last five decades, Mexico urbanized faster than most OECD (Organization for Economic Co-operation and Development) countries. The increasing urbanization and public income levels are fueling the country's construction demand.

- The government bodies are responsible for most of the funds (around 68%) provided to the housing sector in Mexico. The government agencies, such as CONAVI (National Housing Commission), INFONAVIT, FOVISSSTE, and CFE, are supporting the growth of the housing construction sector in the country.

- All the factors above are expected to boost the demand for polyolefin catalysts, like calcium oxide, during the forecast period.

Calcium Oxide Industry Overview

The calcium oxide market is mostly fragmented. The calcium oxide market key players include Carmeuse, Graymont, Lhoist, Mississippi Lime, and Minerals Technologies.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Steel Production Across the World

- 4.1.2 Growing Construction and Infrastructural Developments

- 4.2 Restraints

- 4.2.1 Stringent Environmental Production Hampering the Production of Calcium Oxide

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 End-user Industry

- 5.1.1 Metallurgical

- 5.1.2 Construction

- 5.1.3 Fertilizer and Chemicals

- 5.1.4 Pulp and Paper

- 5.1.5 Refractory

- 5.1.6 Other End-user Industries (Rubber, Food and Beverages, etc.)

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Mexico

- 5.2.2.3 Canada

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 Italy

- 5.2.3.4 France

- 5.2.3.5 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 South Africa

- 5.2.5.3 Rest of Middle-East and Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Carmeuse

- 6.4.2 Graymont Limited

- 6.4.3 Lhoist

- 6.4.4 Mississippi Lime

- 6.4.5 Minerals Technologies Inc.

- 6.4.6 CAO Industries Sdn Bhd

- 6.4.7 AKJ Minchem Private Limited

- 6.4.8 Sigma Minerals Ltd

- 6.4.9 Astrra Chemicals

- 6.4.10 Kemipex

- 6.4.11 Sibelco

- 6.4.12 American Elements

- 6.4.13 Graymont Limited

- 6.4.14 American Elements

- 6.4.15 CAO Industries Sdn Bhd

- 6.4.16 Mississippi Lime

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Emerging use of Calcium Oxide as a Catalyst for Biodiesel Production from Palm Oil

- 7.2 Augmenting Usage of Calcium Oxide in Animal Waste Treatment