|

市场调查报告书

商品编码

1333760

无水氯化铝市场规模和份额分析 - 增长趋势和预测(2023-2028)Anhydrous Aluminum Chloride Market Size & Share Analysis - Growth Trends & Forecasts (2023 - 2028) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

全球无水氯化铝市场规模预计将从2023年的140万吨扩大到2028年的186万吨,预测期内(2023-2028年)复合年增长率为5.81%。

推动市场的主要因素是农业农药製造中使用量的增加以及化学品製造中作为催化剂的需求的增加。 原材料价格和有害废水的波动预计将阻碍市场增长。

主要亮点

- 由于无水氯化铝在化学品製造(包括药品、农用化学品、聚合物、香料和香料)中越来越多地用作催化剂,无水氯化铝市场正在扩大。

- 化学品製造和化妆品行业的增长为无水氯化铝市场在预测期内的增长提供了充足的机会。

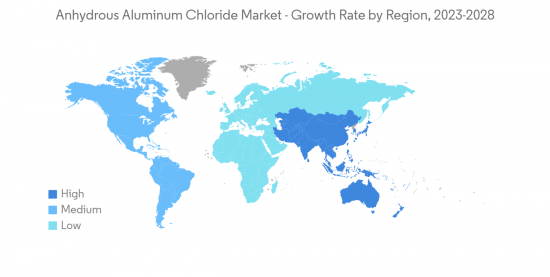

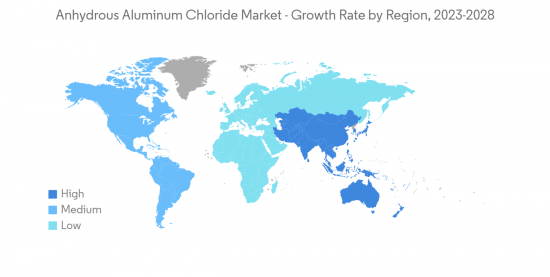

- 亚太地区在全球市场中占据主导地位,其中中国和印度等国家的消费量最高。

无水氯化铝市场趋势

化学品製造行业的需求不断增加

- 由于越来越多地使用无水氯化铝作为催化剂生产染料、□□、乙苯和间苯氧基苯甲醛等化学中间体,无水氯化铝市场预计将扩大。

- 由于无水氯化铝充当路易斯酸,因此在製药行业中被积极用作催化剂来生产布洛芬和其他药品,从而推动了对无水氯化铝市场的需求。

- 使用无水氯化铝作为烃类烷基化、□化、聚合和异构化等傅克反应的主要催化剂正在刺激市场需求。

- 它在石化工业中用于生产烃树脂以及生产二氧化钛和气相氧化铝等无机化学品,从而推动市场增长。

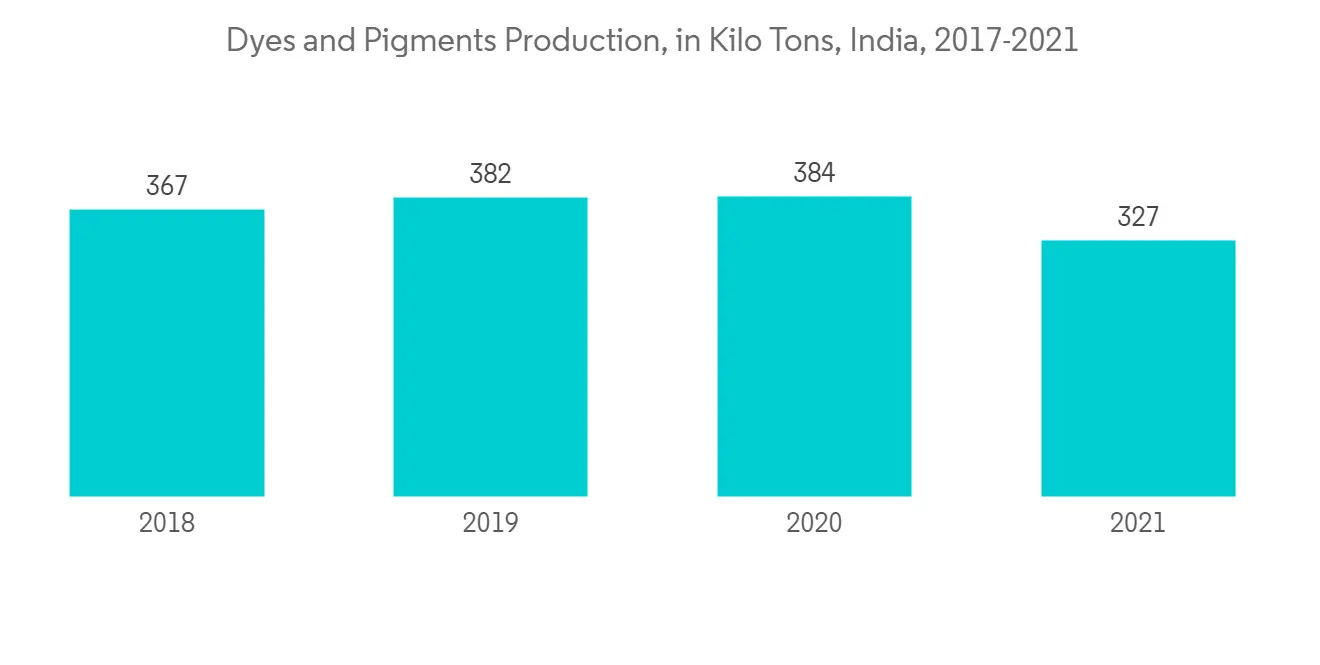

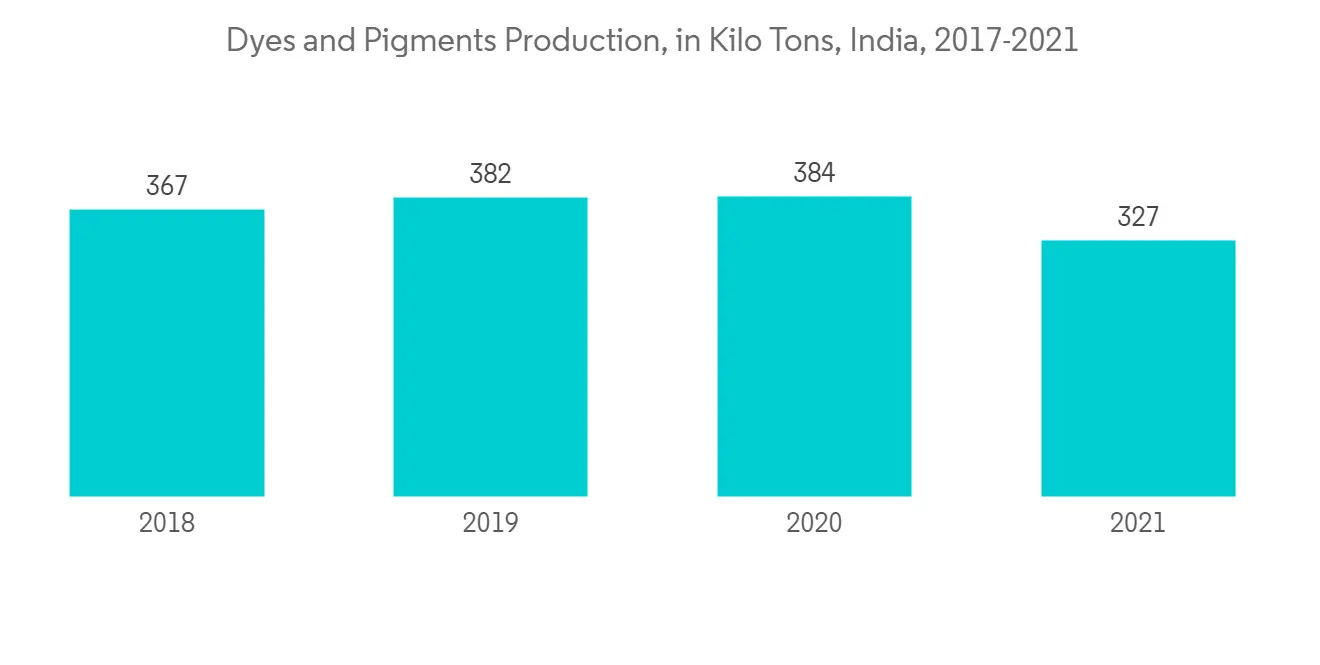

- 在印度,染料和颜料是化学领域唯一的行业,约占全球市场的 17%。 据化学肥料部统计,2021年染料和颜料产量达到327吨。

- 染料和颜料的最大消费者是纺织工业。 了解纺织行业的要求将对产品开发参与者大有裨益。

- 此外,根据国家纺织组织委员会 (NCTO) 的数据,到 2022 年,纺织品和服装总出货量将达到 658 亿美元。 2021年纺织品、纺织品和服装出口总额将达到340亿美元,成为全球第三大纺织相关产品出口国。

- 北美、欧洲和其他地区对颜料的需求也很高。 为了满足客户需求,厂商正在扩大产能。 例如,DCL公司已经在北美拥有五个製造工厂。 2022年6月,该公司将荷兰马斯特里赫特钒酸铋产能扩大20%。

- 由于上述因素,无水氯化铝市场预计在预测期内将快速增长。

亚太地区主导市场

- 亚太地区在全球市场份额中占据主导地位。 中国、日本和印度等国家的应用正在扩大,无水氯化铝在该地区的使用量正在增加。

- 中国目前是全球最大的染料和颜料市场,约占全球消费量的30%。 该国纺织工业的增长以及对油漆和涂料的需求不断增加是这一增长的主要驱动力。 此外,人口增长和消费者可支配收入的增加预计将在未来几年推动中国对染料和颜料的需求。

- 由于工业化的快速发展,中国预计将成为该地区增长最快的国家,并且各个製造业对用作原材料和催化剂的无水氯化铝的需求正在不断增加。

- 中国和印度等国家为发展化学製造、製药和化妆品等行业而增加的政府支出预计将在预测期内刺激市场需求。

- 中国拥有全球第二大医药市场,也是该领域增长最快的市场。 中国国家统计局的报告显示,2021年中国医药行业收入超过3.3万亿元人民币(5100亿美元),同比增长率约为20%。 2020年,中国医药行业总收入将超过2.7万亿元人民币(3900亿美元)。

- 此外,印度是少数几个严重依赖农业的经济体之一。 超过55%的人口仍然依赖农业作为主要生计来源。 根据印度品牌资产基金会的数据,2021 财年农业及相关部门的总增加值为 2,719 亿美元。

- 因此,这些因素预计将加速无水氯化铝在各种最终用途中的应用,并在预测期内推动行业增长。

无水氯化铝行业概况

无水氯化铝市场较为分散,市场份额较小。 主要市场参与者包括(排名不分先后)Aditya Birla Chemicals、BASF SE、DCM Shriram、Gujarat Alkali and Chemicals Ltd. 和 Kanto Denka Kogyo。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章简介

- 调查的先决条件

- 调查范围

第 2 章研究方法

第 3 章执行摘要

第 4 章市场动态

- 促进因素

- 化学品製造和颜料行业的需求不断扩大

- 製药行业的需求增加

- 抑制因素

- 无水氯化铝难以储存

- 行业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第 5 章市场细分(市场规模:基于数量)

- 形态

- 粉末

- 颗粒

- 结晶

- 应用

- 医学

- 杀虫剂

- 化学製造

- 颜料

- 其他用途

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 意大利

- 法国

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙特阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第 6 章竞争态势

- 併购、合资企业、联盟、协议

- 市场排名分析

- 各大公司的战略

- 公司简介

- Aditya Birla Chemicals

- Anmol Chloro Chem

- Base Metal Group

- BASF SE

- DCM Shriram

- Gujarat Alkali & Chemicals Ltd.

- Gulbrandsen Manufacturing Inc.

- Kanto Denka Kogyo Co. Ltd.

- Nippon Light Metal Company Ltd.

- Shandong Kunbao New Materials Group Co. Ltd.

- Upra Chem Pvt. Ltd

第 7 章市场机会和未来趋势

- 香水和口腔护理行业的增长

The Global Anhydrous Aluminum Chloride Market size is expected to grow from 1.40 million tons in 2023 to 1.86 million tons by 2028, at a CAGR of 5.81% during the forecast period (2023-2028).

Major factors driving the market studied are the increasing usage in manufacturing pesticides for agriculture sector and growing demand as catalyst in chemical manufacturing. Volatility in raw materials prices and harmful waste effluents are expected to hinder the growth of the market studied.

Key Highlights

- The anhydrous aluminum chloride market is blooming owing to the increasing application of anhydrous aluminum chloride as a catalyst in pharmaceuticals and chemical manufacturing including agriculture chemicals, polymers, flavors, and fragrances.

- The growth in chemical manufacturing industry and cosmetics industry will provide ample opportunities for the anhydrous aluminum chloride market to grow over the forecast period.

- Asia-Pacific dominated the market across the globe with the largest consumption from countries such as China, India.

Anhydrous Aluminum Chloride Market Trends

Increasing Demand from Chemicals Manufacturing Sector

- The anhydrous aluminum chloride market is expected to bloom due to the increased use of anhydrous aluminum chloride as a catalyst in producing chemical intermediates such as dyes, namely anthraquinone, ethylbenzene, and meta phenoxy benzaldehyde.

- Anhydrous aluminum chloride acts as a Lewis acid, owing to which it is actively used as a catalyst in the pharmaceutical industry to manufacture ibuprofen and other drugs, which is propelling the demand for the anhydrous aluminum chloride market.

- The usage of anhydrous aluminum chloride as the primary catalyst in Friedel-Crafts reactions, both alkylation and acylation, as well as polymerization and isomerization of hydrocarbons, is stimulating market demand.

- It is used in the petrochemical industry in the production of hydrocarbon resins and in the production of inorganic chemicals like titanium dioxide and fumed alumina, which are enhancing market growth.

- In India, dyestuff and pigments are the only industries in the chemical sector that hold about 17% of the global market. According to the Ministry of Chemicals and Fertilizers, the production of dyes and pigments reached 327 kilotons in 2021.

- The textile industry is the biggest consumer of dye and pigment. Understanding the requirements of the textile industry gives tremendous benefits to the players in developing the products.

- Additionally, according to the National Council of Textile Organizations (NCTO), the total shipments of textiles and apparel reached USD 65.8 billion in 2022. The country became the third-largest exporter of textile-related products across the world, with combined exports of textile, fiber, and apparel reaching USD 34 billion in 2021.

- Even in North America, Europe, and other regions, the demand for pigments is high. To fulfill customer demand, players are expanding their production capacity. For instance, DCL Corporation already has five manufacturing plants in North America. In June 2022, the company started the expansion of Bismuth Vanadate manufacturing capacity at its Maastricht, Netherlands, location by 20%.

- Owing to all the above-mentioned factors, the market for anhydrous aluminum chloride is expected to grow rapidly over the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region dominated the global market share. With growing applications in countries such as China, Japan, and India, the utilization of anhydrous aluminum chloride is increasing in the region.

- China is currently the largest market for dyes and pigments in the world, accounting for approximately 30% of global consumption. The growing textile industry and the increasing demand for paints and coatings in the country are the main drivers of this growth. Moreover, the growing population and increasing disposable income of consumers are expected to drive the demand for dyes and pigments in China in the coming years.

- China is expected to grow fastest in the region due to rapid industrialization, and the demand for anhydrous aluminum chloride to be used as a raw material and catalyst is increasing in various manufacturing industries.

- Increased government spending on industrial development, namely chemical manufacturing, pharmaceuticals, and cosmetics, in countries like China and India is expected to stimulate market demand over the forecast period.

- China has the world's second-largest market for pharmaceutical products and is the fastest-emerging market for the sector. As per the report of the National Bureau of Statistics of China, the pharmaceutical industry in China generated revenues of more than CNY 3.3 trillion (USD 0.51 trillion) in 2021, representing year-on-year growth of around 20%. The Chinese pharmaceutical industry generated total revenue of over CNY 2.7 trillion (USD 0.39 trillion) in 2020.

- Furthermore, India is one of the few economies that is largely dependent on agriculture. Agriculture is still the primary source of livelihood for more than 55% of the population. According to the India Brand Equity Foundation, in FY21, the total gross value added by agriculture and allied sectors stood at USD 271.90 billion.

- Therefore, these aforementioned factors are expected to accelerate the applications of anhydrous aluminum chloride in various end-use applications, thereby propelling industry growth during the forecast period.

Anhydrous Aluminum Chloride Industry Overview

The anhydrous aluminum chloride market is fragmented with players accounting for a marginal share of the market. The key market players include Aditya Birla Chemicals, BASF SE, DCM Shriram, Gujarat Alkali and Chemicals Ltd., and Kanto Denka Kogyo among others (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand from the Chemical Manufacturing and Pigment Industry

- 4.1.2 Rising Demand from the Pharmaceutical Sector

- 4.2 Restraints

- 4.2.1 Difficult to Store Anhydrous Aluminum Chloride

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Form

- 5.1.1 Powder

- 5.1.2 Granules

- 5.1.3 Crystals

- 5.2 Application

- 5.2.1 Pharmaceuticals

- 5.2.2 Pesticides

- 5.2.3 Chemical Manufacturing

- 5.2.4 Pigments

- 5.2.5 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Aditya Birla Chemicals

- 6.4.2 Anmol Chloro Chem

- 6.4.3 Base Metal Group

- 6.4.4 BASF SE

- 6.4.5 DCM Shriram

- 6.4.6 Gujarat Alkali & Chemicals Ltd.

- 6.4.7 Gulbrandsen Manufacturing Inc.

- 6.4.8 Kanto Denka Kogyo Co. Ltd.

- 6.4.9 Nippon Light Metal Company Ltd.

- 6.4.10 Shandong Kunbao New Materials Group Co. Ltd.

- 6.4.11 Upra Chem Pvt. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growth in Flavors and Fragrances and Oral Care Industries