|

市场调查报告书

商品编码

1333802

干混砂浆添加剂和化学品的市场规模和份额分析 - 增长趋势和预测(2023-2028)Dry-Mix Mortar Additives And Chemicals Market Size & Share Analysis - Growth Trends & Forecasts (2023 - 2028) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

干混砂浆添加剂和化学品市场规模预计将从 2023 年的 449 万吨增长到 2028 年的 560 万吨,预测期内(2023-2028 年)复合年增长率为 4.52%。

干混砂浆添加剂和化学品市场在 2020 年受到了 COVID-19 的负面影响。 然而,COVID-19 爆发后的情况于 2021 年开始復苏,恢復了预测期内市场的增长轨迹。

主要亮点

- 短期内,亚太地区建筑活动的增加以及建筑行业的长期成本效益是推动市场的主要因素。

- 相反,美国和欧洲建筑活动的放缓预计将阻碍市场增长。

- 对环保建筑的需求不断增长可能会给预测期内接受调查的市场带来机遇。

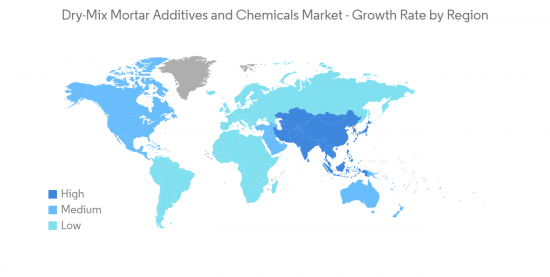

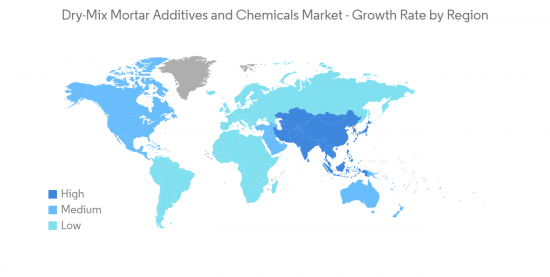

- 亚太地区是最大的市场,由于中国、印度和东盟国家等国家的消费不断增加,预计亚太地区将成为预测期内增长最快的市场。

干混砂浆添加剂及化学品市场趋势

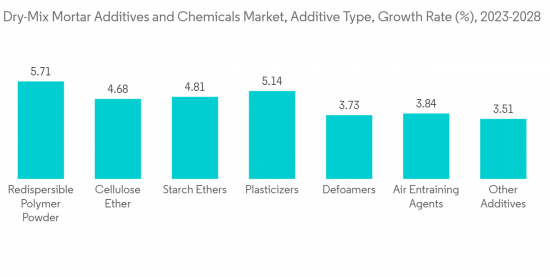

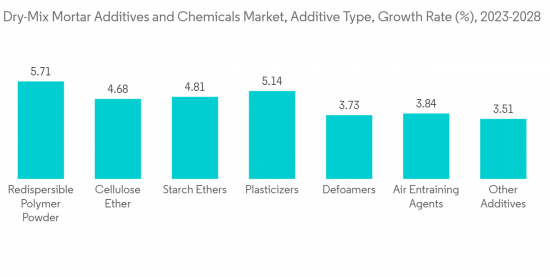

可再分散聚合物粉末可能在添加剂领域占据主导地位

- 可再分散粉末通过喷雾干燥含有再分散剂的相应水性聚合物分散体而获得。 聚合物粉末的再分散性是实现砂浆性能(例如对基材的附着力和耐磨性)的最重要参数。

- 可再分散聚合物粉末是水泥和石膏基干粉材料中最重要的粘合剂。 可再分散聚合物粉末是聚合物乳液的喷雾干燥粉末。 它可以与水重新乳化,具有与原乳液相同的性质,即水蒸发后形成薄膜。 该薄膜具有高韧性、耐候性和对基材的附着力。 另外,具有疏水性能的乳胶粉可以提高防水砂浆的防水性能。

- 可再分散乳胶粉在干砂浆中的性能:

- 提高干砂浆对各种基材的附着力,保证各种使用条件下砂浆粘结强度的耐候性。 例如,可用于保温砂浆中,提高砂浆与EPS板、EPS颗粒、混凝土墙、砖墙之间的粘结强度。

- 可再分散乳胶粉可以降低材料的吸水率,特殊疏水性乳胶粉效果更明显。 减少水和水对成型砂浆的损害。

- 一些可再分散聚合物粉末可以改善砂浆的抗流挂性和流动性,改善砂浆的施工性能。

- 因此,所研究市场对可再分散聚合物粉末领域的需求可能会增加。

亚太地区主导市场

- 预计在预测期内,亚太地区将占据整个干混砂浆添加剂和化学品市场的最大份额。

- 目前,中国、印度和东盟国家是该地区最大的干混砂浆生产国和消费国,也是干混砂浆消费增长最快的国家。

- 中国在亚太地区干混砂浆添加剂和化学品市场中占有最大份额。

- 2021 年,西卡股份公司在中国东部浙江省嘉兴市开设了新的砂浆生产工厂,以满足该地区的高需求。

- 2022 年,西卡股份公司将在中国西南地区重庆开设一家新的液膜和砂浆生产工厂。 成渝地区拥有丰富的汽车、金融和物流行业,建筑业受益于这些企业和公司实现更可持续生产的努力。

- 由于该国投资和建设活动增加,预计干混砂浆添加剂和化学品市场的需求将在预测期内增加。 近年来,中国一直是世界基础设施建设的主要投资者之一,做出了重大贡献。 例如,根据国家统计局(NBS)的数据,2022年中国建筑业产值达到27.63万亿元人民币(41085.81亿美元),比2021年增长6.6%。

- 此外,据中国住房和城乡建设部称,到 2025 年,建筑业占国内生产总值的比重将保持在 6%。 全国装配式建筑趋势不断增强,预计新建建筑中将有超过30%为装配式建筑。

- 据国家发展和改革委员会称,中国政府已批准 26 个基础设施项目,预计投资约 1,420 亿美元,预计将于 2023 年完工。 住房需求的增长预计将推动公共和私营部门的住房建设。

- 此外,印度正在大力投资基础设施项目,预计将为市场创造大量需求。 这样,印度基础设施建设不断取得进展,干混砂浆添加剂和化学品的需求有望扩大。

- 据 IBEF 称,在 2022-2023 年联邦预算中,政府已拨款 100 万印度卢比(1,305.7 亿美元)用于加强基础设施部门。 此外,印度计划在未来五年通过国家基础设施管道投资 1.4 万亿美元用于基础设施建设。

- 据印度海水淡化协会称,印度有 1000 多个海水淡化厂,处理能力从 20 立方米/天到 10,000 立方米/天不等。 印度的大型海水淡化厂大部分位于市政部门。 NITI Aayog(政府的中央规划委员会)计划在金奈、孟买、加尔各答、苏拉特和维扎格等缺水城市建立更多工厂。 因此,它有望成为聚合物改性干混砂浆防水浆料市场的推动力。 防水浆料用于容易风化、应力和开裂的管道和储罐。 因此,对印度干混砂浆添加剂和化学品的需求预计将增加。

- 因此,由于上述因素,预计预测期内亚太地区对干混砂浆添加剂和化学品的需求将快速增长。

干混砂浆添加剂及化学工业概述

干混砂浆添加剂和化学品市场得到部分整□□合。 研究市场的主要参与者包括Wacker Chemie AG、The Dow Chemical Company、BASF AG、Evonik Industries AG、Sika AG等。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查的先决条件

- 调查范围

第二章研究方法

第 3 章执行摘要

第 4 章市场动态

- 促进因素

- 亚太地区建筑活动增加

- 建筑行业的长期成本效益

- 其他司机

- 抑制因素

- 美国和欧洲的建筑活动放缓

- 投资成本高

- 行业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场细分

- 类型

- 添加剂

- 可再分散聚合物粉末

- 增塑剂

- 消泡剂

- 纤维素醚

- AE 代理

- 其他添加剂

- 化学品

- 收缩剂(无水石英)

- 阻燃剂

- 柠檬酸钠

- 酒石酸钠

- 石膏

- 膦酸阻燃剂

- 加速器

- 甲酸钙

- 碳酸钙

- 硝酸钙

- 碳酸锂

- CSH 和 CSA 加速器

- 添加剂

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 意大利

- 法国

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙特阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章竞争态势

- 併购、合资企业、联盟、协议

- 市场份额 (%)**/排名分析

- 各大公司的战略

- 公司简介

- AGRANA Beteiligungs AG

- Ashland

- Avebe

- BASF SE

- Celanese Corporation

- CEMEX S.A.B. de CV

- Chemstar Products Company

- DCC

- Don Construction Products Ltd

- Dow

- Emsland Group

- Evonik Industries AG

- Innospec

- Kima Chemical Co. Ltd

- LOTTE Fine Chemical

- Mapei SpA

- Nouryon

- Rudolf GmbH

- SE Tylose GmbH & Co. KG(ShinEtsu)

- Shandong Head Co. Ltd

- SIDLEY CHEMICAL CO. LTD

- Sika AG

- SMScor

- The Euclid Chemical Company

- Wacker Chemie AG

- Berolan GmbH

第七章市场机会和未来趋势

- 对绿色建筑的需求不断增加

The Dry-mix Mortar Additives And Chemicals Market size is expected to grow from 4.49 million tons in 2023 to 5.6 million tons by 2028, at a CAGR of 4.52% during the forecast period (2023-2028).

The dry-mix mortar additives and chemicals market was adversely impacted by COVID-19 in 2020. However, post-COVID-19 pandemic, the conditions started recovering in 2021, restoring the market's growth trajectory during the forecast period.

Key Highlights

- Over the short term, increasing construction activities in the Asia-Pacific and long-term cost-effectiveness in the construction industry are the major factors driving the market.

- Conversely, a slowdown of construction activities in the United States and Europe is expected to hinder market growth.

- The increase in demand for eco-friendly construction is likely to act as an opportunity for the market studied over the forecast period.

- Asia-Pacific represents the largest market and is expected to be the fastest-growing market over the forecast period, owing to the increasing consumption from countries such as China, India, and ASEAN Countries.

Dry-mix Mortar Additives And Chemicals Market Trends

Re-dispersible Polymer Powder Likely to Dominate the Additives Segment

- Re-dispersible powders are obtained by spray drying the corresponding aqueous polymer dispersions containing a redispersing agent while adding finely ground inorganic materials as anticaking agents. The re-dispersibility of the polymer powder is the most critical parameter to achieving mortar performances, like adhesion onto the substrate and abrasion resistance.

- Re-dispersible polymer powder is the most important binder in cement- and gypsum-based dry powder material. Re-dispersible polymer powder is a spray-dried powder of polymer emulsion. It is re-emulsified with water and has the same properties as the original emulsion, i.e., a film can be formed after water evaporation. This film has high toughness, weather resistance, and adhesion to a substrate. In addition, the latex powder with hydrophobic properties can improve the waterproof performance of the waterproof mortar.

- Performance of re-dispersible polymer powder in a dry mortar:

- Improves the adhesion of dry mortar to various substrates and ensures the weather resistance of mortar bond strength under different conditions of use. For example, it may be used to improve the bond strength between mortar and EPS board, EPS particles, concrete walls, and brick walls in the thermal mortar.

- Re-dispersible polymer powder can reduce the water absorption of the material, and the special hydrophobic latex powder effect is more pronounced. It reduces water and damage caused by water to the molded mortar.

- Some re-dispersible polymer powders can improve sag resistance and fluidity of the mortar to improve the construction performance of the mortar.

- Thus, the demand for the re-dispersible polymer powder segment is likely to increase in the market studied.

Asia-Pacific to Dominate the Market

- Asia-Pacific is expected to account for the largest share of the overall dry-mix mortar additives and chemicals market during the forecast period.

- Currently, China, India, and ASEAN Countries are among the largest producer and consumers of dry mix mortar in the region and the fastest-growing countries in terms of consumption of dry mix mortar.

- China holds the largest Asia-Pacific market share for the dry-mix mortar additives and chemicals market.

- In 2021, Sika AG opened a new production facility of mortar in Jiaxing City, in the province of Zhejiang in Eastern China, in response to high demand from the region.

- In 2022, Sika AG opened a new plant for liquid membranes and mortar production in Chongqing, a city in southwestern China. The automotive, finance, and logistics sectors are well represented in the Chengdu-Chongqingregion and the construction industry benefits from these operations and companies' efforts to achieve more sustainable production.

- The demand for the dry-mix mortar additives and chemicals market is expected to rise throughout the forecast period due to rising investments and construction activity in the country. China is a huge contributor, as it has been one of the leading investors in infrastructure worldwide over the past few years. For instance, according to the National Bureau of Statistics (NBS) of China, in 2022, the output value of construction works in China amounted to CNY 27.63 trillion (USD 4,108.581 billion), an increase of 6.6% compared with 2021.

- Moreover, according to the country's Ministry of Housing and Urban-Rural Development, the construction industry will maintain a 6% share of the country's GDP by 2025. There is a growing trend in the country for prefabricated buildings, which is expected to account for more than 30% of the country's new construction.

- According to the National Development and Reform Commission, the Chinese government approved 26 infrastructure projects at an estimated investment of about USD 142 billion, which are estimated to be completed by 2023. The growing demand for housing is expected to drive residential construction in the public and private sectors.

- Furthermore, India is also witnessing considerable investments in infrastructure projects, likely to provide massive demand for the market studied. Thus, growing infrastructural development in India is expected to augment the demand for dry-mix mortar additives and chemicals.

- According to IBEF, in Union Budget 2022-2023, the government allocated INR 10,00,000 crore (USD 130.57 billion) to enhance the infrastructure sector. Moreover, India plans to spend USD 1.4 trillion on infrastructure through the 'National Infrastructure Pipeline' in the next five years.

- According to the Desalination Association of India, there are more than 1000 desalination plants of various capacities ranging from 20 m3/day to 10,000 m3 /day. Most of the large desalination plants in India are in the municipal sector. NITI Aayog (Government Central Planning Commission) plans to set up more plants in water scare cities like Chennai, Mumbai, Kolkata, Surat, and Vizag. This is expected to drive the market of polymer-modified dry-mix mortar waterproofing slurries. Waterproofing slurries are used in pipes and tanks, which might be prone to weathering, stress, and crack formation. Thus, this is expected to bolster India's demand for dry-mix mortar additives and chemicals.

- Hence, owing to the aforementioned factors, the demand for dry-mix mortar additives and chemicals is expected to increase in Asia-Pacific over the forecast period rapidly.

Dry-mix Mortar Additives And Chemicals Industry Overview

The dry-mix mortar additives and chemicals market is partly consolidated. The major companies in the market studied include Wacker Chemie AG, Dow, BASF SE, Evonik Industries AG, and Sika AG, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Construction Activities in Asia-Pacific

- 4.1.2 Long-term Cost-effectiveness in the Construction Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Slowdown of Construction Activities in the United States and Europe

- 4.2.2 High Cost of Investments

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Additives

- 5.1.1.1 Redispersible Polymer Powder

- 5.1.1.2 Plasticizers

- 5.1.1.3 Defoamers

- 5.1.1.4 Cellulose Ether

- 5.1.1.5 Air Entraining Agents

- 5.1.1.6 Other Additives

- 5.1.2 Chemicals

- 5.1.2.1 Shrinkage (Anhydrites)

- 5.1.2.2 Retarders

- 5.1.2.2.1 Na-citrate

- 5.1.2.2.2 Na-tartrate

- 5.1.2.2.3 Gypsum

- 5.1.2.2.4 Phosphonate-based Retarders

- 5.1.2.3 Accelerators

- 5.1.2.3.1 Ca-Formate

- 5.1.2.3.2 Ca-carbonate

- 5.1.2.3.3 Ca-nitrate

- 5.1.2.3.4 Li-Carbonate

- 5.1.2.3.5 CSH and CSA Accelerators

- 5.1.1 Additives

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 Italy

- 5.2.3.4 France

- 5.2.3.5 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle East & Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 South Africa

- 5.2.5.3 Rest of Middle East &Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AGRANA Beteiligungs AG

- 6.4.2 Ashland

- 6.4.3 Avebe

- 6.4.4 BASF SE

- 6.4.5 Celanese Corporation

- 6.4.6 CEMEX S.A.B. de CV

- 6.4.7 Chemstar Products Company

- 6.4.8 DCC

- 6.4.9 Don Construction Products Ltd

- 6.4.10 Dow

- 6.4.11 Emsland Group

- 6.4.12 Evonik Industries AG

- 6.4.13 Innospec

- 6.4.14 Kima Chemical Co. Ltd

- 6.4.15 LOTTE Fine Chemical

- 6.4.16 Mapei SpA

- 6.4.17 Nouryon

- 6.4.18 Rudolf GmbH

- 6.4.19 SE Tylose GmbH & Co. KG (ShinEtsu)

- 6.4.20 Shandong Head Co. Ltd

- 6.4.21 SIDLEY CHEMICAL CO. LTD

- 6.4.22 Sika AG

- 6.4.23 SMScor

- 6.4.24 The Euclid Chemical Company

- 6.4.25 Wacker Chemie AG

- 6.4.26 Berolan GmbH

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increase in demand for Eco Friendly Construction