|

市场调查报告书

商品编码

1643235

企业 WLAN -市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Enterprise WLAN - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

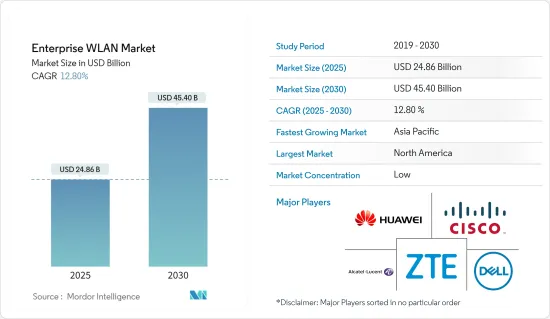

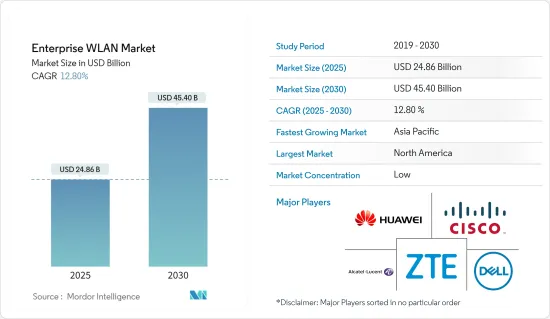

预计 2025 年企业 WLAN 市场规模为 248.6 亿美元,到 2030 年将达到 454 亿美元,预测期内(2025-2030 年)的复合年增长率为 12.8%。

企业 WLAN 市场持续快速成长,凸显了无线技术对全球组织的网路和数位转型目标的重要性。

关键亮点

- 企业 WLAN 市场的成长源于对可靠、高速和安全的无线网路日益增长的需求,这些网路可以支援职场中日益增多的连接设备。

- 随着越来越多的组织将应用程式和资料迁移到云端,对能够满足不断增长的流量和频宽需求的强大无线网路的需求也随之增加。此外,随着连接到无线网路的装置数量的增加,安全漏洞的风险也在增加,可以使用企业 WLAN 解决方案提供的进阶安全功能来防范安全漏洞的风险。

- 网路基础设施的持续成长、对高速网路的需求不断增长以及新无线标准 WIFI6(也称为 802.11ax)的采用预计将对市场产生积极影响。此外,定期更新标准可提高网路吞吐量,例如最大速度和传输容量。

- 中小型企业部署和维护企业WLAN的高成本对企业WLAN市场的成长构成了挑战。

- COVID-19 影响了企业 WLAN 的使用和部署。疫情加速了企业采用支援远距工作并提供更大灵活性和可扩展性的 WLAN 解决方案。它还强调了 WLAN 安全性以及组织能够适应不断变化的流量模式的必要性。然而,疫情也导致WLAN部署计划的延迟和挑战,对WLAN的采用和使用产生长期影响。

企业 WLAN 市场趋势

资料流量的增加和对高速资料连接的需求正在推动市场成长

- 云端基础的应用程式的日益普及导致资料流量需求大幅增加。随着越来越多的企业将其应用程式迁移到云端,他们需要可靠、高速的网路连线来确保业务顺利进行。企业 WLAN 解决方案透过提供高资料传输速率来实现这种连接,从而实现快速、高效的资料传输。

- 随着越来越多的企业在业务中采用数位技术,商业互联网资料流量正在成长。 2022 年,美国商业网路资料流量达到 1,782.1 亿千兆字节,高于 2021 年的 1,417.3 亿千兆位元组。

- 此外,由于近年来连接到企业网路的设备数量不断增加,对高速资料的需求显着增加。员工现在使用多种设备存取公司资料和应用程序,需要企业 WLAN 解决方案能够提供强大、高速的资料传输能力。

- 此外,越来越重视在企业行动领域创造数位化和无线职场也是市场成长的主要动力。此外,BYOD和数位转型的兴起趋势迫使企业考虑更大的企业园区,这可能会在明年推动市场成长。

- 不断增长的需求促使一些媒体和通讯公司投资高速资讯服务。例如,2022年12月,社群媒体巨头Meta和Bharti Airtel联手投资通讯基础设施,以满足印度日益增长的高速资料和数位服务需求,支援客户和企业的新需求。

预计北美将占据最大市场占有率

- 北美的智慧型手机、平板电脑和笔记型电脑等行动装置普及率很高,对无线连线的需求日益增长。因此,企业希望为其员工和客户提供可靠、高速的无线连接,从而推动企业 WLAN 市场的成长。此外,互联网的高普及率和大部分人口的可近性刺激了对无线连接的需求,从而支持了市场的成长。

- 由于智慧型手机消费量的持续成长,该地区的组织正在大规模采用 BYOD。这为室内办公场所提供者提供了潜在的机会,有助于在预测期内推动市场成长。

- 5G 部署正在北美扩大,由于网路容量增加、速度更快、可靠性提高、安全性增强和物联网功能增强,推动企业 WLAN 市场的成长。这为企业 WLAN 供应商创造了新的机会,并推动了对其产品和服务的需求。

- 根据 CTIA 的 2022 年无线产业年度研究,美国无线产业在 2021 年投资了约 350 亿美元用于发展、改进和营运网路。这项投资带来了无与伦比的成果:5G 网路覆盖超过 3.15 亿美国。研究也发现,无线资本投资正在加速5G部署。

- 此外,北美正在经历云端运算应用的激增。企业依赖基于云端基础的应用程式和服务,并需要可靠、高速的无线连接,从而推动了对支援云端基础的应用程式的 WLAN 解决方案的需求。

企业 WLAN 产业概览

企业 WLAN 市场竞争激烈,由多家大型企业组成。从市场占有率来看,目前市场主要被少数几家大公司占据。这些拥有突出市场份额的领先公司正致力于扩大其全球基本客群。

2023年9月,华为针对新兴市场推出了三大产品组合,包括华为零漫游分散式Wi-Fi解决方案,建立高品质连接,华为高品质极简资料中心网路解决方案,以及高品质中小企业办公,因为新兴市场中有很多对经济发展至关重要的产品系列。华为将开发更多适合市场的产品和组合,帮助我们的合作伙伴赢得更多客户并在商业市场取得成功。

2022年10月,IO by HFCL宣布推出其Wi-Fi 7企业级Wi-Fi网路基地台,并在印度移动大会上推出了两款新设备(室内和室外版本)。新的网路基地台专为开放原始码网路而设计,支援 OpenWiFi 并由 Qualcomm 的 Networking Pro 平台提供支援。

2022 年 8 月,云端网路领导者之一 Extreme Networks Inc. 推出了 Extreme AP5050。它是业界首个室外 Wi-Fi 6E网路基地台(AP),针对户外场馆、会议中心、医院和大学校园、大型体育场等部署进行了最佳化。它提供更好的无线体验、更快的通讯和更少的干扰。在大型户外场所,与前几代 Wi-Fi 相比,可以使用高达三倍的频段进行运作。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 工业影响评估

第五章 市场动态

- 市场驱动因素

- BYOD快速普及

- 资料流量不断增加,对高速资料连线的需求不断增加

- 市场限制

- 企业 WLAN 技术缺乏标准化

第六章 市场细分

- 按组件

- 透过硬体

- 网路基地台

- WLAN 控制器

- 无线热点网关

- 按软体

- WLAN 安全

- 无线网路管理

- WLAN分析

- 其他软体

- 按服务

- 专业服务

- 透过硬体

- 按组织规模

- 大型企业

- 中小型企业

- 按最终用户产业

- 银行、金融服务和保险

- 医疗

- 零售

- 资讯科技/通讯

- 其他行业

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- Cisco Systems Inc.

- Juniper Networks Inc.

- Huawei Technologies Co. Ltd.

- Alcatel Lucent Enterprises(ALE International)

- Aruba Networks(Hewlett Packard Enterprise Development LP)

- Ruckus Wireless, Inc.

- Aerohive Networks Ltd.

- Dell Inc.

- Extreme Networks Inc.

- ZTE Corporation

- Fortinet Inc.

第八章投资分析

第九章:市场的未来

The Enterprise WLAN Market size is estimated at USD 24.86 billion in 2025, and is expected to reach USD 45.40 billion by 2030, at a CAGR of 12.8% during the forecast period (2025-2030).

The Enterprise WLAN market continues to grow rapidly, emphasizing the importance of wireless technology in the network and digital transformation goals of organizations across the globe.

Key Highlights

- The growth of the Enterprise WLAN market is attributed to the increasing demand for reliable, high-speed, and secure wireless networks that can support the growing number of connected devices in the workplace.

- As many organizations are moving their applications and data to the cloud, the requirement for a robust wireless network that can handle the increased traffic and bandwidth demands is increased. Also, as the number of devices connected to a wireless network increases, so does the risk of security breaches that can be protected using advanced security features provided by Enterprises' WLAN solutions.

- The continuous growth of network infrastructure, increased demand for high-speed internet, and introduction of new wireless standards named WIFI6, also known as 802.11ax, is expected to impact the market positively. Also, regularly updating standards improves network throughput in terms of maximum speeds and transmission capabilities.

- The high cost associated with the deployment and maintaining Enterprise WLAN for small and medium-sized businesses is challenging for the growth of the Enterprise WLAN market.

- COVID-19 impacted Enterprise WLAN usage and deployment. The pandemic accelerated the adoption of enterprise WLAN solutions that support remote work and provide greater flexibility and scalability. It also highlighted WLAN security and the need for organizations to be able to adapt to changing traffic patterns. However, the pandemic also caused delays and challenges for WLAN deployment projects, which long-term impacted WLAN adoption and usage.

Enterprise WLAN Market Trends

Increasing Data Traffic and Demand for High Speed Data Connectivity to Drive the Growth of the Market

- With the growing adoption of cloud-based applications, the demand for data traffic has increased tremendously. As more and more businesses move their applications to the cloud, they require reliable and fast internet connectivity to ensure their operation runs smoothly. Enterprise WLAN solutions provide this connectivity by offering high-speed data transmission rates, which allow businesses to transfer data quickly and efficiently.

- Business internet data traffic is growing as more businesses adopt digital technologies in their operations. In 2022, the business internet data traffic in the United States reached 178.21 billion gigabytes from 141.73 billion gigabytes in 2021.

- In addition, the demand for high-speed data has increased substantially in recent years due to the growing number of devices connected to enterprise networks. Employees now use multiple devices to access company data and applications, which requires robust and high-speed data transmission capabilities that can be achieved with enterprise WLAN solutions.

- Moreover, the increased emphasis of organizations on creating a digital and wireless workplace within premise mobility has become a major driving factor for the market's growth. Also, the increasing trend of BYOD and digital transformation is making enterprises consider broader enterprise campuses, which will fuel the market's growth in the coming year.

- Due to increased demand, several media and telecom companies are investing in high-speed data services. For instance, in December 2022, Social media giant Meta and Bharti Airtel collaborated to invest in telecom infrastructure to cater to the rising demand for high-speed data and digital services in India to support the emerging requirements of customers and enterprises.

North America is Expected to Hold the Largest Market Share

- North America has a high adoption rate of mobile devices such as smartphones, tablets, and laptops, which has led to an increased demand for wireless connectivity. This has driven the growth of the enterprise WLAN market as businesses seek to provide reliable, high-speed wireless connectivity to their employees and customers. Also, the high level of internet penetration, with a large percentage of the population having access to the internet, led to higher demand for wireless connectivity, supporting the market's growth.

- The continuously increasing consumption of smartphones has led organizations in the region to adopt BYOD on a large scale; therefore, good coverage inside office spaces becomes essential. This represents a potential opportunity for the in-building office providers, fueling the market's growth over the forecast period.

- The growing deployment of 5G in North America is helping to drive the growth of the Enterprise WLAN market by providing increased network capacity, faster speed, improved reliability, enhanced security, and improved IoT capabilities. This creates new opportunities for Enterprise WLAN vendors and drives demand for their products and services.

- According to CTIA's 2022 Annual Wireless Industry Survey, The United States wireless industry invested nearly USD 35 billion to grow, improve and run their networks in 2021. This investment drives unparalleled results of 5G networks covering over 315 million Americans. Also, the survey states that wireless capital investment is speeding up 5G deployment.

- Moreover, the growing adoption of cloud computing in North America is increasing rapidly. Businesses rely on cloud-based applications and services, which need reliable and high-speed wireless connectivity, leading to increased demand for WLAN solutions to support cloud-based applications.

Enterprise WLAN Industry Overview

The enterprise WLAN market is highly competitive and consists of several major players. In terms of market share, few of the major players currently dominate the market. These major players with prominent shares in the market are focusing on expanding their customer base worldwide.

In September 2023 - Huawei announced to launch of three Product Portfolios for the Commercial Market to Build High-Quality Connections, including Huawei Zero-Roaming Distributed Wi-Fi solution, Huawei High-Quality Simplified Data Center Network Solution, High-Quality SME Office as there are a large number of SMEs, which are critical to economic development. Huawei will develop more marketable products and portfolios to help partners win more customers and succeed in the commercial market.

In October 2022, IO by HFCL launched the Wi-Fi 7 enterprise-grade Wi-Fi access points revealing the two new devices (indoor and outdoor versions) at the India Mobile Congress. The new access points are designed for open-source networking, are OpenWiFi-ready, and are powered by Qualcomm's Networking Pro platform.

In August 2022, Extreme Networks Inc., one of the leaders in cloud networking, introduced the Extreme AP5050: the industry's first outdoor Wi-Fi 6E Outdoor Access Point (AP) optimized for installation at outdoor venues, convention centers, hospital and university campuses, and large stadiums, among others. It delivers enhanced wireless experiences, faster speeds, and reduced interference. It enables large outdoor venues to operate across up to three times as much spectrum as previous generations of Wi-Fi.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rapid Adoption of BYOD

- 5.1.2 Increasing Data Traffic and Demand for High Speed Data Connectivity

- 5.2 Market Restraints

- 5.2.1 Lack of Standardization in Enterprise WLAN Technology

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 By Hardware

- 6.1.1.1 Access points

- 6.1.1.2 WLAN Controllers

- 6.1.1.3 Wireless Hotspot Gateways

- 6.1.2 By Software

- 6.1.2.1 WLAN Security

- 6.1.2.2 WLAN Management

- 6.1.2.3 WLAN Analytics

- 6.1.2.4 Other Softwares

- 6.1.3 By Services

- 6.1.3.1 Professional Services

- 6.1.1 By Hardware

- 6.2 By Organization Size

- 6.2.1 Large Enterprises

- 6.2.2 Small and Medium-Sized Enterprises

- 6.3 By End-user Verticals

- 6.3.1 Banking, Financial Services and Insurance

- 6.3.2 Healthcare

- 6.3.3 Retail

- 6.3.4 IT and Telecommunications

- 6.3.5 Other End-user Verticals

- 6.4 Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Cisco Systems Inc.

- 7.1.2 Juniper Networks Inc.

- 7.1.3 Huawei Technologies Co. Ltd.

- 7.1.4 Alcatel Lucent Enterprises (ALE International)

- 7.1.5 Aruba Networks (Hewlett Packard Enterprise Development LP)

- 7.1.6 Ruckus Wireless, Inc.

- 7.1.7 Aerohive Networks Ltd.

- 7.1.8 Dell Inc.

- 7.1.9 Extreme Networks Inc.

- 7.1.10 ZTE Corporation

- 7.1.11 Fortinet Inc.