|

市场调查报告书

商品编码

1690718

日本 CEP(快递包裹):市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Japan Courier, Express, and Parcel (CEP) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

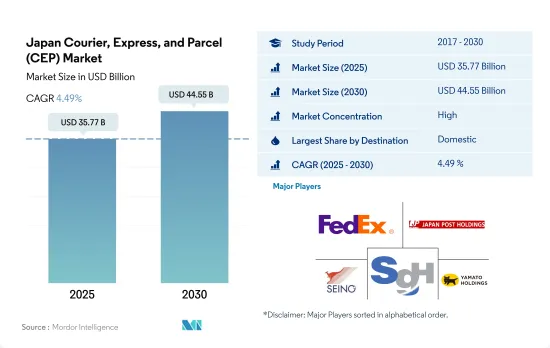

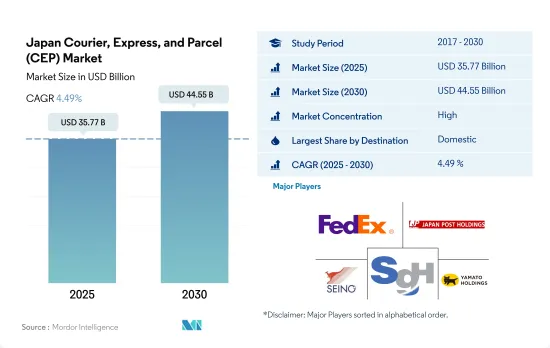

日本快递包裹 (CEP) 市场规模预计在 2025 年为 357.7 亿美元,预计到 2030 年将达到 445.5 亿美元,预测期内(2025-2030 年)的复合年增长率为 4.49%。

电子商务产业将推动日本细分市场需求

- 国内和跨境电子商务正在推动日本对宅配、快递和小包裹服务的需求。 2022 年电子商务市场价值将达到 1,450 亿美元,进而带动 CEP 数量成长。经济重新开放后,国内CEP需求整体增加。儘管该国劳动力老化且劳动力短缺,但 2022 年国内和国际 CEP 数量仍有所增加。小包裹重新投递对 CEP 市场的成长做出了巨大贡献。例如,2022 年 10 月,日本主要送货上门宅配服务发送的小包裹中约有 11.8% 需要重新投递,高于 2022 年 4 月的 11.7%。到 2024 年,在网路用户普及率高的推动下,电子商务产业销售额预计将达到 1,760 亿美元。

- 2020 年,由于新冠疫情,电子商务为 CEP 市场做出了贡献,其中时尚类别收益了25%,电子类别收益了19%。政府为遏制病毒传播和在家工作而实施的限制措施导致了网上配送方式的流行。预计到 2027 年,电子商务规模将达到 2,250 亿美元,这将大大增加 CEP 市场的需求。

日本CEP(快递包裹)市场的趋势

由于宅配需求不断增长和劳动力短缺,MILT 将重点建造自动化货运道路和物流隧道

- 2024 年 5 月 17 日,在东京车站举行的展览会上,重点强调了使用高速旅客列车的轻型货运的扩张。这一转变是由于商务用司机短缺和新的加班法导致公路运输成本增加高达 20%。从 2023 年 8 月开始,JR 东日本将使用 12 辆车的 E 系列专用列车实施从新舄到东京的当日送货服务。运送的物品包括生鲜食品、糖果零食、饮料、鲜花、精密零件、医疗用品等。 2023 年 9 月,JR 东日本在东北新干线推出货运专用服务,目前在其高速和特快网路中提供「Hako Bun」品牌货运服务。

- 2024年3月,由于静冈县持续反对环保问题,JR东海放弃了2027年前在东京和名古屋之间引入高速磁浮列车的计划,该计划可能会被推迟到2034年或更晚。中央新干线的目标是以每小时 500 公里的速度连接东京和大阪,但静冈境内的一小段路程却构成了重大障碍。

儘管政府提供补贴,2024 年 7 月燃油价格仍将上涨至 2023 年 10 月以来的最高水平

- 自然资源与能源署于2024年7月宣布,普通汽油零售价格已达每公升1.33美元。这一价格是自2023年10月以来约九个月以来的最高价格,零售价格的上涨是由于批发价格上涨。为了解决这个问题,各国政府正在向炼油精製提供补贴,以降低批发价格。此外,补贴金额也有所增加,6月27日至7月3日期间补贴金额为0.19美元,较前一週增加0.01美元。

- 日本天然气公司预测,由于 2023-24 年天气异常温暖,城市天然气使用量将下降,因此 2024 年 4 月至 2025 年 3 月的财年,城市天然气需求将会增加。日本最大的瓦斯零售商东京瓦斯公司预测,到2025年,其城市瓦斯销售量将增加1.1%至114.22亿立方公尺。其中,居民用气预计增加3.4%至28亿立方米,工业和商务用预计增加0.3%至86亿立方米。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章执行摘要和主要发现

第二章 报告要约

第 3 章 简介

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 人口统计

- 按经济活动分類的 GDP 分布

- 经济活动带来的 GDP 成长

- 通货膨胀率

- 经济表现及概况

- 电子商务产业趋势

- 製造业趋势

- 交通运输仓储业生产毛额

- 出口趋势

- 进口趋势

- 燃油价格

- 物流绩效

- 基础设施

- 法律规范

- 日本

- 价值链与通路分析

第五章 市场区隔

- 目的地

- 国内的

- 国际的

- 送货速度

- 表达

- 非快递

- 模型

- 企业对企业 (B2B)

- 企业对消费者 (B2C)

- 消费者对消费者(C2C)

- 运输重量

- 重型货物

- 轻型货物

- 中等重量货物

- 运输方式

- 航空邮件

- 路

- 其他的

- 最终用户

- 电子商务

- 金融服务(BFSI)

- 卫生保健

- 製造业

- 一级产业

- 批发零售(线下)

- 其他的

第六章 竞争格局

- 主要策略趋势

- 市场占有率分析

- 业务状况

- 公司简介

- DHL Group

- Ecohai

- FedEx

- Japan Post Holdings Co., Ltd.

- Nippon Express Holdings

- Seino Holdings Co., Ltd.

- SG Holdings Co., Ltd.

- United Parcel Service of America, Inc.(UPS)

- Yamato Holdings Co., Ltd.

第七章:执行长的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 技术进步

- 资讯来源和进一步阅读

- 图表清单

- 关键见解

- 资料包

- 词彙表

简介目录

Product Code: 71123

The Japan Courier, Express, and Parcel (CEP) Market size is estimated at 35.77 billion USD in 2025, and is expected to reach 44.55 billion USD by 2030, growing at a CAGR of 4.49% during the forecast period (2025-2030).

The e-commerce industry is driving the segmental demand in Japan

- Domestic and cross-border e-commerce is a major driver of the demand for courier, express, and parcel in the country. The e-commerce market was valued at USD 145 billion in 2022, leading to growth in CEP volume. Post re-opening of the economy, overall CEP demand in the country increased. The domestic and international CEP volume grew in 2022 despite the presence of an aging workforce in the country, along with labor shortages. The redelivery of parcels significantly contributed to the growth of the CEP market. For instance, approximately 11.8% of parcels shipped by major door-to-door delivery services in Japan had to be redelivered in October 2022, increasing from 11.7% in April 2022. By 2024, the revenue in the e-commerce industry is expected to reach USD 176 billion, driven by high internet user penetration.

- E-commerce, led by the fashion category with a 25% revenue contribution and the electronics category with a 19% revenue, contributed to the CEP market in 2020, owing to the COVID-19 pandemic. Government-imposed restrictions to curtail the spread of the virus and the work-from-home scenario led to the popularity of the online delivery method. E-commerce is projected to reach USD 225 billion by 2027, significantly increasing demand for the CEP market.

Japan Courier, Express, and Parcel (CEP) Market Trends

With growing demand for home deliveries & labour shortages, the MILT is focusing on construction of automatic cargo transport roads and logistics tunnels

- On May 17, 2024, a fair at Tokyo Station highlighted the growing use of high-speed passenger trains for light freight. This shift, driven by a shortage of commercial drivers and new overtime laws, has increased road delivery costs by up to 20%. Since August 2023, JR East has been running a same-day delivery service from Niigata to Tokyo using a dedicated 12-car Series E trainset. Items transported include fresh food, confectionery, drinks, flowers, precision components, and medical supplies. In September 2023, JR East launched a freight-only service on the Tohoku Shinkansen and now offers Hakobyun-branded freight services across its high-speed and Limited Express networks.

- In March 2024, Central Japan Railway Co. abandoned its plan to launch a high-speed maglev train between Tokyo and Nagoya by 2027 due to ongoing environmental opposition in Shizuoka Prefecture, possibly delaying the project until 2034 or later. The Linear Chuo Shinkansen aims to connect Tokyo and Osaka with trains reaching speeds of 500 kilometers per hour, but a small section in Shizuoka has been a major obstacle.

Rising prices of fuel in Japan witnessed in July 2024, highest since October 2023, despite government subsidies

- In July 2024, the Agency for Natural Resources and Energy announced that the retail price of regular gasoline reached USD 1.33 per liter, marking an increase of USD 0.006 from June 2024. This price point is the highest observed in nearly nine months, dating back to October 2023. The uptick in retail prices is attributed to surging wholesale prices. To counteract this, the government has been subsidizing oil refiners, ensuring that wholesale prices remain subdued. Moreover, the subsidy amount saw an uptick, rising to USD 0.19 between June 27 and July 3, which is an increase of USD 0.01 from the week prior.

- Japanese gas utilities expect city gas demand to rise in the fiscal year April 2024 to March 2025, following reduced usage in 2023-24 due to unusually warm weather. Tokyo Gas, Japan's largest gas retailer, forecasts city gas sales will increase by 1.1% to 11.422 billion cubic meters by 2025. Household sales are expected to grow by 3.4% to 2.8 billion cubic meters, while supplies to industry and commercial users are projected to rise by 0.3% to 8.6 billion cubic meters.

Japan Courier, Express, and Parcel (CEP) Industry Overview

The Japan Courier, Express, and Parcel (CEP) Market is fairly consolidated, with the major five players in this market being FedEx, Japan Post Holdings Co., Ltd., Seino Holdings Co., Ltd., SG Holdings Co., Ltd. and Yamato Holdings Co., Ltd. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Demographics

- 4.2 GDP Distribution By Economic Activity

- 4.3 GDP Growth By Economic Activity

- 4.4 Inflation

- 4.5 Economic Performance And Profile

- 4.5.1 Trends in E-Commerce Industry

- 4.5.2 Trends in Manufacturing Industry

- 4.6 Transport And Storage Sector GDP

- 4.7 Export Trends

- 4.8 Import Trends

- 4.9 Fuel Price

- 4.10 Logistics Performance

- 4.11 Infrastructure

- 4.12 Regulatory Framework

- 4.12.1 Japan

- 4.13 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes Market Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Destination

- 5.1.1 Domestic

- 5.1.2 International

- 5.2 Speed Of Delivery

- 5.2.1 Express

- 5.2.2 Non-Express

- 5.3 Model

- 5.3.1 Business-to-Business (B2B)

- 5.3.2 Business-to-Consumer (B2C)

- 5.3.3 Consumer-to-Consumer (C2C)

- 5.4 Shipment Weight

- 5.4.1 Heavy Weight Shipments

- 5.4.2 Light Weight Shipments

- 5.4.3 Medium Weight Shipments

- 5.5 Mode Of Transport

- 5.5.1 Air

- 5.5.2 Road

- 5.5.3 Others

- 5.6 End User Industry

- 5.6.1 E-Commerce

- 5.6.2 Financial Services (BFSI)

- 5.6.3 Healthcare

- 5.6.4 Manufacturing

- 5.6.5 Primary Industry

- 5.6.6 Wholesale and Retail Trade (Offline)

- 5.6.7 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 DHL Group

- 6.4.2 Ecohai

- 6.4.3 FedEx

- 6.4.4 Japan Post Holdings Co., Ltd.

- 6.4.5 Nippon Express Holdings

- 6.4.6 Seino Holdings Co., Ltd.

- 6.4.7 SG Holdings Co., Ltd.

- 6.4.8 United Parcel Service of America, Inc. (UPS)

- 6.4.9 Yamato Holdings Co., Ltd.

7 KEY STRATEGIC QUESTIONS FOR CEP CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.1.5 Technological Advancements

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219