|

市场调查报告书

商品编码

1334493

数据中心发电机的市场规模和份额分析 - 增长趋势和预测(2023-2028)Data Center Generator Market Size & Share Analysis - Growth Trends & Forecasts (2023 - 2028) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

数据中心发电机的市场规模预计将从 2023 年的 49.8 亿美元扩大到 2028 年的 64.6 亿美元,预测期内(2023-2028 年)复合年增长率为 5.35%。

由于电网故障、轮流停电、恶劣天气、自然灾害、人为灾害、电力系统故障等造成停电,数据中心面临着巨大的运营损失风险。 数据中心使用的系统和组件预计将不间断运行。 因此,数据中心发电机市场需要每週 7 天可靠、不间断的电源。

主要亮点

- 发电机技术的进步使天然气发电机成为提供持续电力并使公司更接近其可持续发展目标的理想解决方案。 此外,这些燃料来源丰富且比柴油更经济。 可再生天然气是更环保、低排放的天然气选择之一,因为它可以从废物、牲畜和废水处理设施中持续获得,并且有望在未来推动燃气发电机的采用。

- 大多数数据中心运营商要求其应急电源系统 (EPSS) 运行超过 120 分钟(通常需要现场燃料储存),使其成为关键系统主要且最重要的备用能源来源。柴油发电机作为广泛使用的选项,这正在创造全球数据中心发电机市场的需求。

- 许多託管服务提供商正在提高数据中心容量,以满足全球对边缘数据中心不断增长的需求。 例如,去年 10 月,亚马逊向爱尔兰环境保护局申请了排放许可证,在其位于都柏林的新数据中心设施中建造了 105 台柴油发电机。

- 预计电力成本上涨将衝击市场。 此外,由于发电机成本高昂,越来越多地使用燃料电池作为备用电源也可能成为市场增长的製约因素。 此外,未来柴油机作为数据中心备用电源预计将包括更严格的使用法规、更严格的税收、许可、更低的排放目标、改善的空气质量要求、噪声法规等等,使得柴油发电机拥有较大的市场份额,这可能会给市场增长带来挑战。

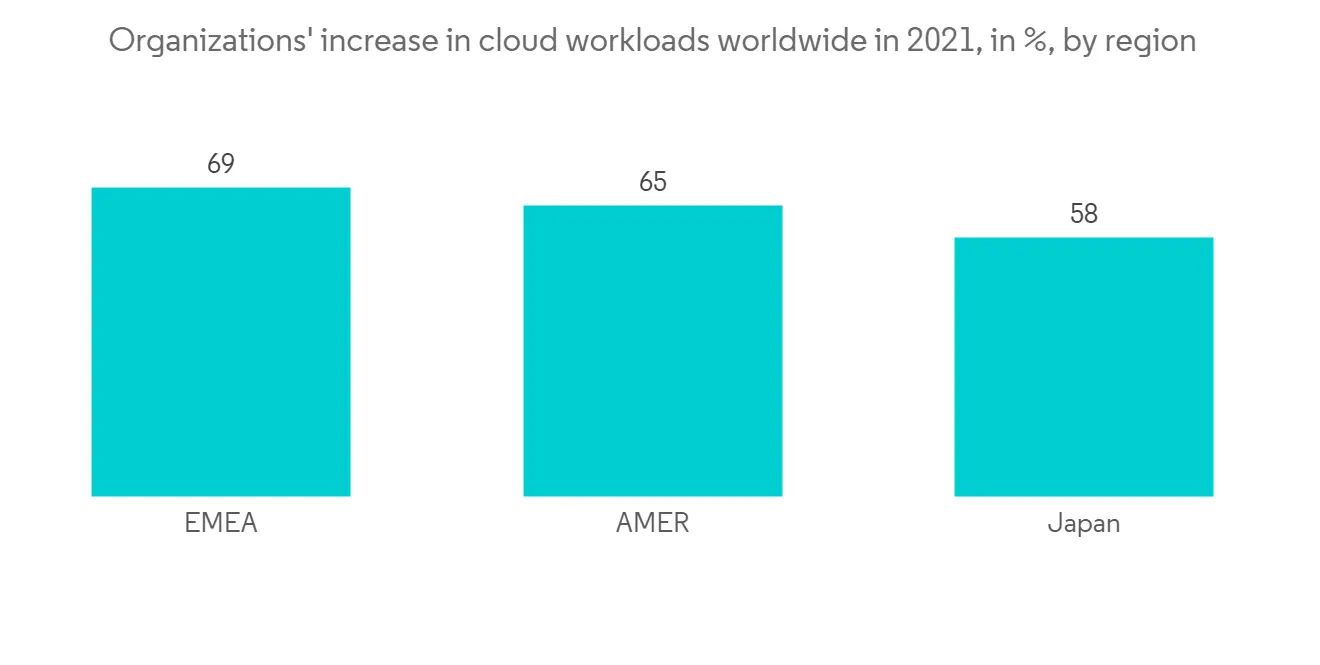

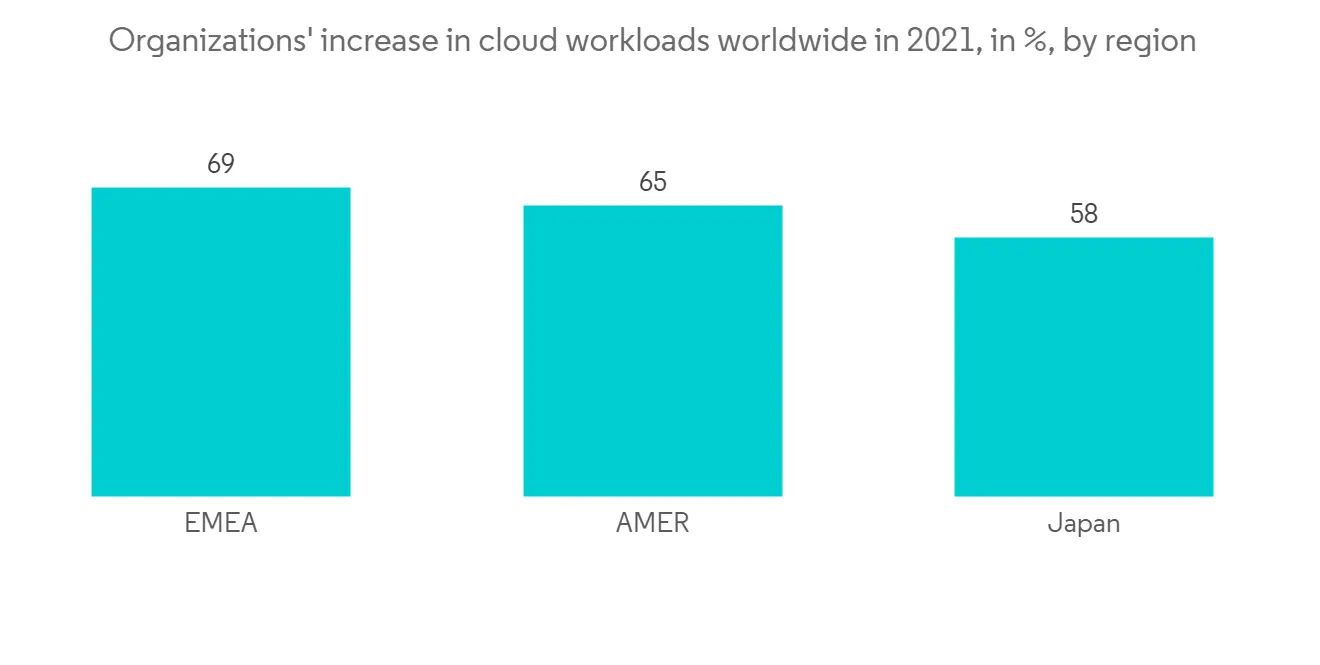

- 新冠肺炎 (COVID-19) 疫情凸显了数据中心和云计算的重要性。 在危机的早期阶段,数据中心行业充当了全球经济的安全网,显着增加了企业对在线服务的采用。 因此,随着数据中心的增加,由于直流持续供电的重要性,对直流发电机的需求也在增加。

数据中心发电机市场趋势

柴油发电机主导市场

- 柴油发电机是数据中心最常见的备用电源类型。 柴油发电机广泛应用于数据中心和其他关键设施,因为它们具有良好的维护记录,并且很容易找到维修专家。 数据中心的客户满意度相对较高,因为该公司的柴油发电机能够以出色的控制实现100%的负载接受,这种能力已经得到了时间的证明。

- 世界各地的 IT 服务公司都在为其业务采用云战略,并将其服务转变为云託管服务。 这一转变正在推动数据中心市场的发展,并间接推动直流柴油发电机的发展。 柴油直流发电机适用于 Tier 4 DC,这是拥有需要持续运行的关键任务服务器的大型企业所需要的。

- 世界上许多国家都在开发数据中心以增强其云基础设施。 例如,泰国的移动数据服务行业近年来经历了快速增长。 该行业的核心是高级信息服务 (AIS),一家着名的泰国移动电话运营商。 该国的移动运营商 AIS 致力于即使在公用事业停电期间也为其客户提供不间断的服务。 Fax Lite 是 AIS 的子公司,拥有 Tellus 数据中心,该数据中心设有 AIS 的移动交换设施。 该数据中心的设计符合 Tier 3 要求,以最大程度地减少计划内和计划外停机时间。

- 为了满足高可用性要求,Fax Lite 需要实现可靠的备用电源,以确保关键负载在断电期间保持不间断。 Fax Lite 根据成本竞争力、产品可靠性和出色的客户支持考虑了不同的供应商。

- 康明斯因其设计、集成和调试可靠电力系统的能力而被选为供应商。 AIS 为其移动交换设施购买了一台 12 台康明斯发电机组。 康明斯通过八组柴油发电机组 C1675 D5A 提供 12 MW 备用电力,该发电机组集成了 PowerCommand 3.3 控制系统和两台 PowerCommand 数字主控制 (DMC) 1000 装置。

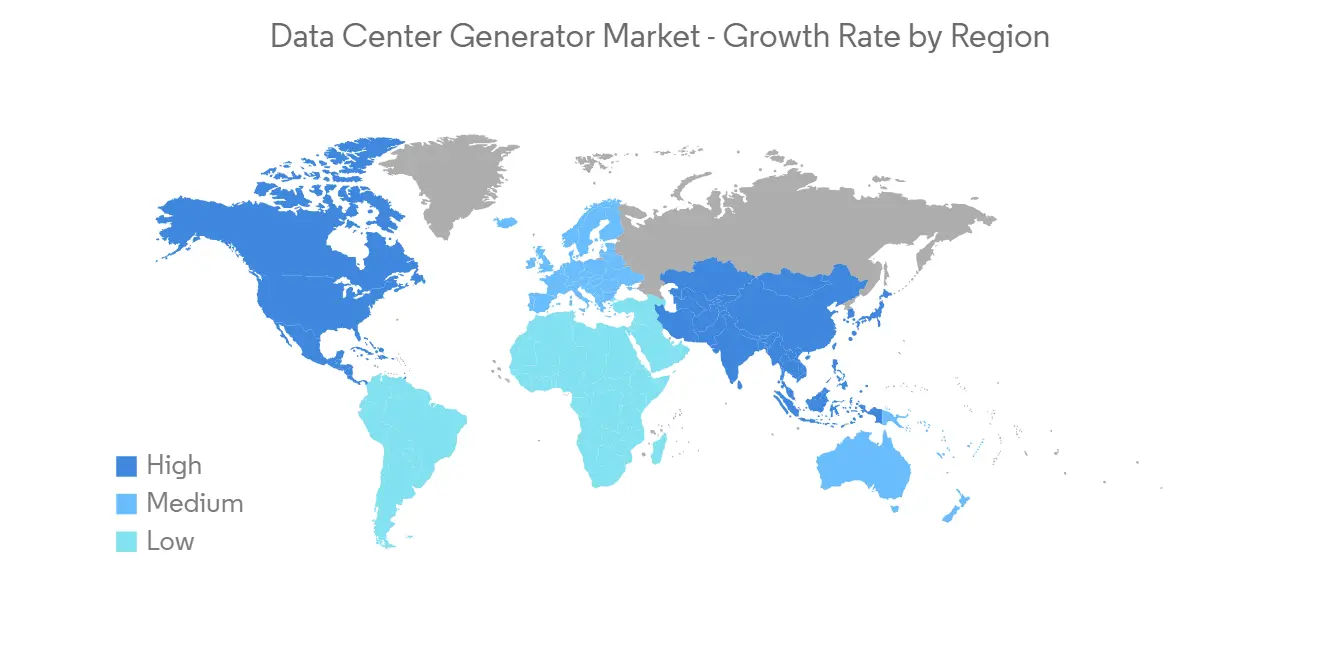

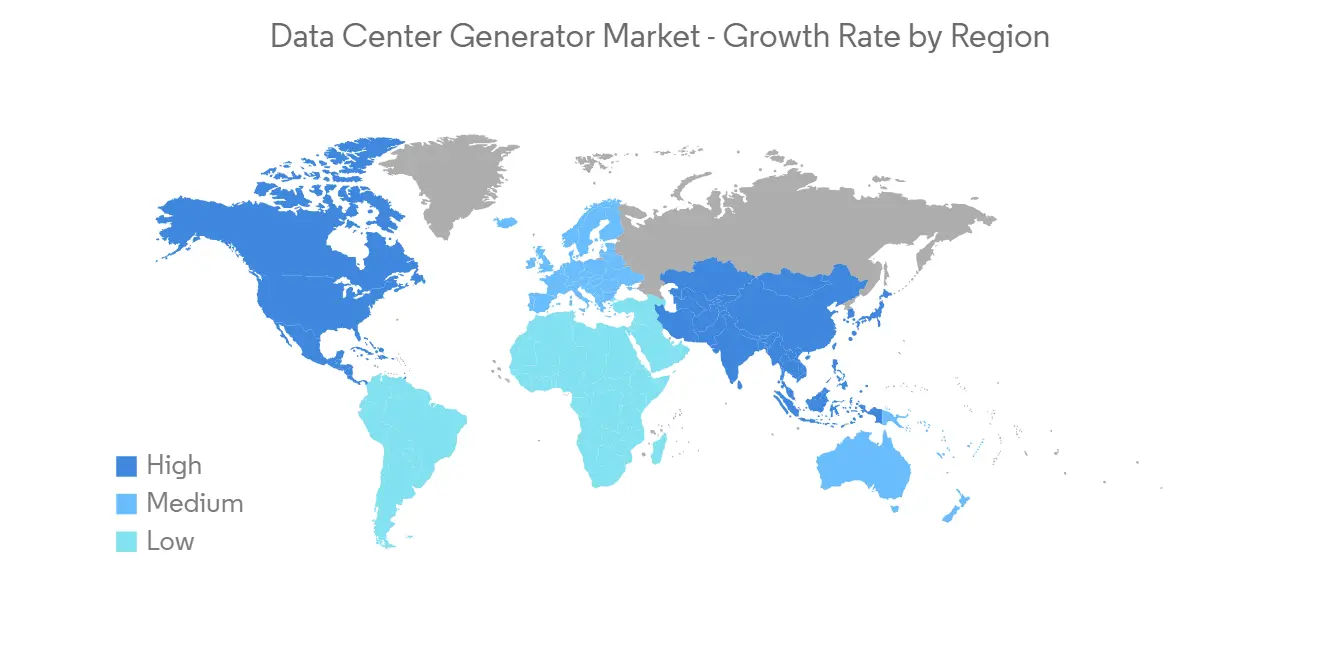

亚太地区市场出现显着增长

- 亚太地区数据中心发电机市场增长的主要因素是全球和区域设施运营商增加投资、增加公有云和混合云服务的采用。

- AWS、谷歌、百度、阿里巴巴、微软和苹果是亚太市场最大的投资者。 许多国家(尤其是印度和中国)部署边缘计算中心可能会支持亚太地区在预测期内的增长。

- 卡特彼勒公司 (Caterpillar Inc.) 和康明斯公司 (Cummins, Inc.) 等领先公司的入驻对该地区的市场增长产生了积极影响。 此外,先进技术的进步和相关信息等决定因素预计将对市场产生积极影响。

- 在该地区,建设环保数据中心的投资清单正在取得进展,我们相信该地区数据中心的氢燃料发电机等可再生能源发电机的需求将会分裂。 例如,去年8月,亚洲首家绿色数据中心建设商Empyrion DC宣布将在韩国首尔江南区建设一座40兆瓦的绿色数据中心。 Empyrion DC 已与当地发起人签订了具有□□法律约束力的协议,购买 100% 的开发权,拟在该地区投资高达 4 亿美元。

- 此外,直流基础设施公司 Equinix 正在考虑在其新加坡数据中心使用氢气作为绿色燃料。 公司与能源研究与技术中心合作,开发了质子交换膜燃料电池和燃料灵活的线性发电机技术。我们计划为我们使用的发电机建立可持续的动力来源,并在发生紧急情况时提供应急电力电力公司停电。

数据中心发电机行业概览

数据中心发电机市场高度整合,由少数大型企业主导。 公司正在改变其产品线,以反映质量的提高和技术的进步,例如发电机的智能数字控制和双燃料技术。 Caterpillar Inc.、Cummins Inc.、Generac Holdings Inc.、Kinolt (Euro-Diesel SA) 和 Hitec Power Protection BV 是该领域的一些顶尖公司。 这些占据相当大市场份额的大公司专注于扩大海外客户群。 这些公司正在进行战略合作,以提高市场份额和盈利能力。

- 2022 年 11 月 - 科勒电力系统公司已正式开始在其位于美国威斯康星州的北美髮电机製造基地进行先进的生产扩建。 此次产量增加将有助于科勒扩大其在数据中心等关键战略行业的业务。

- 2022 年 10 月 - 比利时数据中心公司 LCL 使用加氢处理植物油替代其备用发电机中的柴油。 该公司宣布,位于阿尔斯特的 LCL 布鲁塞尔西站刚刚投资了六台新的 2.25 MVA 发电机,将成为第一个使用生物柴油的站点。 该电厂拥有八台备用发电机,其中包括两台 1MW 旧发电机和六台新 HVO 发电机。 从柴油到其他可再生能源的燃料转换使直流发电机製造商能够开发先进的产品。

- 2022 年 6 月 - 微软将把微电网集成到加利福尼亚州圣何塞的新数据中心,并使用可再生天然气而不是柴油运行紧急备用发电机。 该项目将使微软能够在 2030 年之前从其数据中心运营中消除柴油燃料。 这项工作将提高数据中心的弹性,使微软更接近消除对石油柴油的依赖,并为天然气发电机进入市场创造机会。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章研究方法

第 3 章执行摘要

第 4 章市场动态

- 市场概览

- 市场驱动因素

- 託管服务提供商增加数据中心建设

- 增加超大规模数据中心的建设

- 市场製约因素

- 数据中心的碳足迹增加

- 行业吸引力 - 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的对抗关係

- 评估新冠肺炎 (COVID-19) 对行业的影响

- 行业价值链分析

- 柴油、天然气和其他替代燃料对环境的影响

第五章市场细分

- 产品类型

- 柴油机

- 天然气

- 其他产品类型

- 发电能力

- 小于1MW

- 1-2MW

- 2MW或以上

- 等级

- 一级和二级

- 第三级

- 第四级

- 地区

- 北美

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第 6 章竞争格局

- 公司简介

- Caterpillar Inc.

- Atlas Copco

- Cummins Inc.

- Hitec Power Protection

- Himoinsa SL

- KOHLER Group

- Mitsubishi Motor Corporation

- Generac Power Systems Inc.

- Rolls Royce Power Systems AG

- Piller

第7章 投资分析

第8章 市场展望

The Data Center Generator Market size is expected to grow from USD 4.98 billion in 2023 to USD 6.46 billion by 2028, at a CAGR of 5.35% during the forecast period (2023-2028).

Data centers are at significant risk of experiencing operational losses owing to power outages caused by utility grid failures, rolling blackouts, bad weather, natural or artificial calamities, or electrical breakdown. Systems and components used in data centers are expected to operate nonstop. They require dependable, uninterrupted power seven days a week, creating a demand for the Data Center Generator Market.

Key Highlights

- Due to developments in generator technology, natural gas generators are a desired solution to supply continuous power and get closer to corporate sustainability targets. Additionally, these fuels are abundantly available and more economical than diesel. Renewable natural gas is still another low-emission option that is more environmentally responsible because it may be continuously obtained from waste, livestock operations, and wastewater treatment facilities, which will drive the adoption of gas generators in the future.

- The majority of data center operators prefer diesel generators as the primary and most widely used option for backup energy for critical systems due to the requirement that an emergency power supply system (EPSS) operate for 120 minutes or longer (typically requiring onsite fuel storage), which is creating a demand for the Data Center generator market worldwide.

- Many colocation service providers have raised data center production due to the growing demand for edge data centers worldwide. For example, in October last year, Amazon applied for an emission license with Ireland's Environmental Protection Agency to build 105 diesel generators at its new Dublin data center facility.

- The rising power cost is predicted to hurt the market. Accelerating the trend of utilizing fuel cells as a power backup due to the enormous costs of generators might also cause restraint in the market growth. Additionally, the future of diesel as a backup power source for data centers appears to be one of tighter usage restrictions, more stringent tax policies, permitting, lower emissions targets, better air quality requirements, and noise laws, which could be a challenge for the market growth due to the significant market share of diesel-based generators.

- The COVID-19 pandemic has spotted the importance of data centers and cloud computing. During the early phases of the crisis, the data center industry served as the safety net for the global economy, which significantly increased the adoption of online services by businesses. Thus, with an increase of Data Centers, the demand for DC generators has increased due to their importance in continuous power supply to the DCs.

Data Center Generator Market Trends

Diesel type of Generators is Dominating the Market

- Diesel generators are the data centers' most common type of backup power. The use of diesel generators is widespread in data centers and other critical facilities as they have a well-understood maintenance record, and it is easy to find repair experts. Customer satisfaction for data center customers is relatively high because of the company's diesel generators' time-tested capacity to achieve 100% load acceptance with superior controls.

- IT service companies around the globe are adopting cloud strategy in their business and transforming their services to be hosted in the cloud. This transformation is driving the Datacentre market and indirectly fuelling the diesel generator for DCs, because of its suitability in Tier 4 DCs, which are required by large enterprises with mission-critical servers that must be operated continuously.

- Many countries worldwide are developing DCs to increase their cloud infrastructures. For instance, Thailand's mobile data service sector has witnessed rapid growth in recent years. At the core of this industry is Advanced Info Service (AIS), the prominent mobile operator in Thailand. As the country's mobile operator, AIS is committed to providing uninterrupted service to its customers, even during a utility outage. An AIS subsidiary, Fax Lite Co. Ltd. owns the Tellus Data Center, which houses AIS' mobile switching facilities. This data center was designed to comply with Tier 3 requirements to ensure minimal planned and unplanned downtime.

- To support the high availability requirements, Fax Lite Co. Ltd needed to implement reliable standby power to ensure uninterrupted critical load during an outage. Fax Lite Co. Ltd. considered various vendors based on the following criteria: cost competitiveness, product reliability, and excellent customer support.

- Cummins was selected as the vendor of choice based on its capabilities in designing, integrating, and commissioning dependable power systems. AIS purchased 12 units of Cummins generator sets for mobile-switching facilities. Cummins supplied 12 MW of standby power with eight teams of diesel-powered generator sets C1675 D5A, integrated with a PowerCommand 3.3 control system and two units of PowerCommand Digital Master Control (DMC) 1000.

Asia Pacific is Registering a Significant Market Growth

- The increasing investments by global and regional facility operators and the rising adoption of public cloud and hybrid cloud services are the primary factors attributing to the growth of the Data Center Generator Market in the APAC region.

- AWS, Google, Baidu, Alibaba, Microsoft, and Apple are the largest investors in the APAC market. The deployment of edge computing locations across many nations, particularly India and China, will support APAC's growth during the forecast period.

- The presence of influential companies, such as Caterpillar Inc. and Cummins, Inc., has positively influenced the regional market's growth. Determinants, such as advanced technology advancement and information about the same, are also anticipated to influence the market positively.

- The region is witnessing progress in the investment menus in building green DCs in the region, which would create a demand for renewable source generators such as hydrogen fuel generators for Data centers in the region. For instance, in August last year, the first green data center builder in Asia, Empyrion DC, announced the construction of a 40MW green data center in Gangnam, Seoul, South Korea. Intending to invest up to USD 400 million in the region, Empyrion DC and a local promoter entered into a legally binding agreement to buy 100% of the development rights.

- Additionally, Equinix, a DC infra company, is considering using hydrogen as a green fuel source in the company's data centers in Singapore. The company would use Proton-exchange membrane fuel cells and fuel-flexible linear generator technologies with the collaboration of the Centre for Energy Research & Technology to create sustainable electricity sources for the generators that supply emergency power during utility outages is a crucial component of that transformation in Singapore, which would drive the DC generator market in the region.

Data Center Generator Industry Overview

Data Center Generator Market is dominated by a small number of major players and is highly consolidated. Companies make an effort to modify their product lines to reflect improvements in quality and technological advancements, such as intelligent digital controls and bi-fuel technology in generators. Caterpillar Inc., Cummins Inc., Generac Holdings Inc., Kinolt (Euro-Diesel SA), and Hitec Power Protection BV are some of the top businesses in the sector. These large companies, which account for a sizeable portion of the market, are focusing on expanding their clientele abroad. To enhance their market share and profitability, these companies are collaborating strategically.

- November 2022 - Kohler Power Systems officially opened an advanced production expansion to its present North American generator manufacturing location in Wisconsin, United States. The manufacturing increase would help Kohler expand in critical strategic industries like data centers.

- October 2022 - Belgian data center company LCL has used hydrotreated vegetable oil to replace diesel in its backup generators. The business announced that LCL Brussels-West in Aalst, where it just invested in 6 new 2.25 MVA generators, would be the first location to use biodiesel. The plant has eight backup generators, including two 1MW older types and six new HVO generators. This fuel transformation from diesel to other renewable sources allows DC generator manufacturers to develop advanced products.

- June 2022 - Microsoft would integrate a microgrid at a new data center in San Jose, California, which would run its emergency backup generators on renewable natural gas rather than diesel fuel. The project would enable Microsoft to eliminate diesel fuel from its data center operations by 2030. This initiative improves the resilience of its data center, moves Microsoft closer to ending its reliance on petroleum-based diesel, and creates an opportunity for natural gas-based generators in the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Construction of Data Centers by Colocation Service Providers

- 4.2.2 Growing Construction of Hyperscale Data Centers

- 4.3 Market Restraints

- 4.3.1 Growing Carbon Emissions from Data Centers

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitutes

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Assessment of Impact of Covid-19 on the Industry

- 4.6 Industry Value Chain Analysis

- 4.7 Environmental Impact of Diesel vs Natural Gas and Other Alternatives

5 MARKET SEGMENTATION

- 5.1 Product Type

- 5.1.1 Diesel

- 5.1.2 Natural Gas

- 5.1.3 Other Product Types

- 5.2 Capacity

- 5.2.1 Less than 1MW

- 5.2.2 1-2MW

- 5.2.3 Greater than 2MW

- 5.3 Tier

- 5.3.1 Tier I and II

- 5.3.2 Tier III

- 5.3.3 Tier IV

- 5.4 Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia Pacific

- 5.4.4 Latin America

- 5.4.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Caterpillar Inc.

- 6.1.2 Atlas Copco

- 6.1.3 Cummins Inc.

- 6.1.4 Hitec Power Protection

- 6.1.5 Himoinsa SL

- 6.1.6 KOHLER Group

- 6.1.7 Mitsubishi Motor Corporation

- 6.1.8 Generac Power Systems Inc.

- 6.1.9 Rolls Royce Power Systems AG

- 6.1.10 Piller