|

市场调查报告书

商品编码

1644395

区块链供应链 -市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Blockchain Supply Chain - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

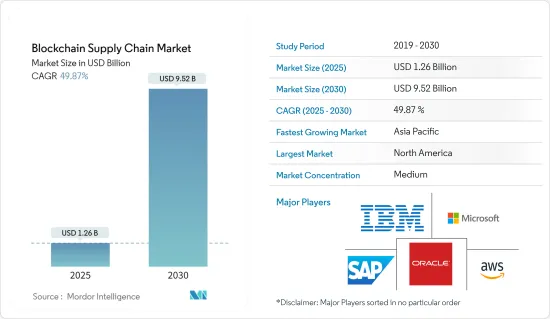

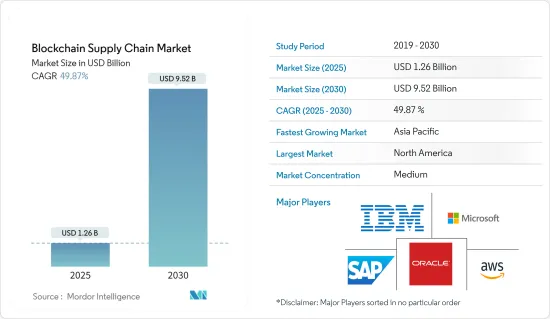

区块链供应链市场规模在 2025 年估计为 12.6 亿美元,预计到 2030 年将达到 95.2 亿美元,预测期内(2025-2030 年)的复合年增长率为 49.87%。

对供应链透明度的需求不断增加以及对供应链交易安全性提高的需求激增是市场成长要素。透过区块链提高供应链管理的自动化和非中介化可能为市场成长创造潜力。

关键亮点

- 整个区块链供应链市场由平台组件部分主导,由于越来越多地采用区块链平台来简化供应链流程,预计将继续呈现积极发展。由于市场参与企业提供价格实惠且多样化的定价计划,预计未来几年该领域将大幅成长。

- 随着区块链变得越来越普及,开发人员应该继续监控开始尝试区块链的市场参与企业。区块链极大地受益于网路效应。一旦供应链达到临界规模,新参与者就可以更轻鬆地加入并获得利益。开发人员可以透过观察竞争对手和其他供应链参与者来获得何时开发区块链原型的线索。

- 一旦区块链能够创造价值,有远见的公司就会计划对其进行投资。然而,区块链除了在食品和医药领域的应用外,尚未提供其他重大价值。因此,根据 Kenco Group 的调查,只有 6% 的供应链领导者将区块链视为高度优先事项。智慧型手机和平板电脑用户的增加推动了电子商务领域的快速成长。例如,根据 Experian Plc. 的调查显示,97% 的平板电脑用户会购买该设备,83% 的用户会在访问商店之前、期间或之后进行购物相关行为。这是推动供应链管理区块链市场机会的关键因素。

- 此外,医疗服务供应商正在采用区块链技术来持续管理和追踪医疗产品从生产到交付的整个流程。此外,区块链供应链的提供将使製药公司减少非法活动,例如非法生产假冒或有害药品以及不当的库存管理。

- 每个行业都受到了冠状病毒大流行造成的特殊情况的影响。新冠肺炎危机影响了人们、社会、企业和全球经济。值得注意的是,在疫情期间,供应链对区块链的需求受到了不利影响。根据 Supply Chain Media 的一项调查,COVID-19 疫情对几乎每个製造商、经销商和零售商都产生了重大影响。同时,新冠疫情导致电子商务需求增加。作为疫情的一部分,企业创新计画受到人工智慧(AI)和机器学习(ML)的推动,加速了中小企业对区块链供应链解决方案的采用。

区块链供应链市场趋势

零售和消费品占据市场主导地位

- 零售业占据区块链供应链市场的最大份额。由于零售商迅速采用简化其供应链流程的方法,预计未来它将保持主导地位。此外,区块链可以确保品质、产品安全、真实性和可靠性,同时让供应链合作伙伴知道产品的下落。这些决定因素正在推动区块链在零售业的市场成长。

- 仿冒运动鞋约占全球假冒时尚产业的 40%,估计价值为 6000 亿美元。製造商用来确保真实性的传统方法(例如印章和证书)本身也可能被伪造。然而,零售商开始采用区块链技术来解决假冒问题。

- 对透明交易和智慧合约的不断增长的需求是推动零售业区块链市场成长的关键因素。智慧付款有助于实现线上和线下交易的付款流程自动化。透过消除对交易验证收取额外费用的商家(中间商),它可以为企业节省时间和金钱。

- 由于零售商越来越多地采用区块链来简化其供应链流程,预计零售业将主导区块链供应链市场。例如,在Eyefortransport Ltd.的一项调查中(如左图所示),区块链占据了最大的份额。调查(如左图所示)发现,最大一部分支出用于了解技术,38.2% 的零售商、品牌和製造商以及 55.3% 的物流服务供应商表示他们在供应链领域的区块链上花费了钱。

- 区块链技术不仅增强了供应链自动化并最大限度地减少了人为干预,而且还提供了高度的可追溯性,使得在供应链的所有阶段即时追踪货物并将所有必要的资料储存在分散式帐本上成为可能。由于区块链的高可追溯性,零售公司中最常见的供应商纠纷可以快速解决,因为与纠纷来源相关的所有资讯都可以轻鬆被所有人取得。

- 近期,沃尔玛在印度安得拉邦采用区块链技术追踪水产品,并计画利用这项策略来增强全球食品的可追溯性。亚马逊在亚马逊网路服务(AWS)上推出了区块链解决方案,提供完全託管的服务,使用开放原始码框架轻鬆创建和管理面向零售的可扩展区块链网路。

- 此外,国际劳工组织(ILO)估计,全球约有2,500万人在供应链内外从事强迫劳动,其中47%发生在亚太地区。为了维护其供应链中的劳工权利,可口可乐与美国国务院合作,选择使用区块链技术来确保其产品供应链中的工作条件符合道德规范。

- 然而,预计预测期内熟练专业人员的短缺将阻碍区块链在零售市场的成长。此外,由于技术进步和全球贸易推动的零售业变化加速,预计在未来几年为区块链零售市场提供巨大的成长机会。

预计北美将占据较大的市场占有率

- 北美被公认为技术采用和基础设施最先进的地区。该地区主要行业参与企业对区块链技术解决方案的更广泛活动是关键驱动因素。製造业、医疗保健、零售/消费品和物流等垂直行业为供应商提供了重要的成长机会。

- 北美引领全球市场,预计由于主要市场参与企业的存在和区块链技术的持续开拓,在预测期内将继续见证活跃的发展。此外,零售商对资料安全的日益担忧也是未来几年推动该领域市场成长的主要因素。

- 例如,根据美国美国课责局的数据,从陆军到国税局等美国政府机构每天都会遭遇 70 多起资料外洩事件。该地区的零售商每年花费数百万美元用于资料安全,建造广泛的防火墙并聘请世界一流的网路安全专家。

- 在预测期内,IBM、微软、甲骨文、AWS 和 Digital Asset Holdings 等主要产业参与者预计将对北美市场产生重大影响。研究指出,疫情加速了对云端基础的服务和软体的需求,为区块链创新创造了成熟的市场。随着越来越多的企业希望建立虚拟工作平台,安全和开放的资料管理比以往任何时候都更加必要。

区块链供应链产业概览

区块链供应链市场半固体,生态系统由 IBM 公司、微软公司、甲骨文公司、SAP SE 和 AWS 公司等主要供应商组成。市场上的知名参与企业正在采用合作、併购和伙伴关係等先进策略来抢占全球市场的更大份额。随着市场有望实现盈利成长,许多公司预计很快就会进入该市场。

2023 年 5 月,埃森哲透过控制塔解决方案帮助微软改造了 Azure 供应链,改善了整个网路的库存管理,创造了额外的云端收益并提高了劳动力效率。

2022年8月,全球最知名的企业区块链VeChain与已建立强大SaaS平台并向供应链市场提供一流技术的全球供应链技术解决方案供应商OrionOne Inc.宣布进行技术整合,以加速区块链在物流企业中的应用。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力波特五力分析

- 购买者/消费者的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场动态

- 市场驱动因素

- 对供应链交易安全性提高的需求日益增加

- 对供应链透明度的需求日益增加

- 零售和消费品领域的区块链采用率提高

- 市场限制

- 区块链技术认知度较低

- 评估新冠肺炎对各行业的影响

第六章 市场细分

- 按应用

- 付款

- 产品可追溯性

- 仿冒品商品检测

- 智能合约

- 风险与合规管理

- 其他的

- 按行业

- 零售和消费品

- 医疗与生命科学

- 製造业

- 物流、石油和天然气

- 其他行业

- 按组件

- 平台

- 按服务

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 亚洲

- 中国

- 日本

- 印度

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 北美洲

第七章 竞争格局

- 公司简介

- IBM Corporation

- Oracle Corporation

- Microsoft Corporation

- SAP SE

- Amazon Web Services Inc.

- Huawei Technologies Co., Ltd.

- TIBCO Software Inc.

- Auxesis Group

- Guardtime Inc.

- BTL Group

- Bitfury Group Limited.

- Omnichain Inc.

- VeChain Foundation

- Accenture PLC

- Digital Treasury Corporation

第八章投资分析

第九章 市场机会与未来趋势

The Blockchain Supply Chain Market size is estimated at USD 1.26 billion in 2025, and is expected to reach USD 9.52 billion by 2030, at a CAGR of 49.87% during the forecast period (2025-2030).

A growing requirement for supply chain transparency and surging demand for heightened security of supply chain transactions are significant growth factors for the market. Increased automation and removal of intermediaries with blockchain in supply chain management would generate possibilities for market growth.

Key Highlights

- The platform component part dominated the overall blockchain supply chain market and is anticipated to remain aggressive due to an increase in the adoption of blockchain platforms to streamline the supply chain processes. The segment is anticipated to observe significant growth in the upcoming years due to the advent of affordable and diverse pricing plans offered by market players.

- Companies should continue to monitor the players in their market that have started experimenting with blockchain as it develops traction. Blockchain greatly benefits from the network effect; once a critical mass forms in a supply chain, it is simpler for new participants to join and reap the benefits. Companies could observe competitors and other supply chain participants for clues on when to develop a blockchain prototype.

- Forward-thinking companies are planning to invest when blockchain gets to the point where it can deliver value. However, blockchain has yet to provide full value beyond food or pharmaceutical applications. As a result, only 6% of supply chain leaders consider blockchain to be a high priority, according to Kenco Group. The increasing number of smartphone and tablet subscribers has resulted in the rapid growth of the E-Commerce sector. For example, according to Experian Plc., 97% of tablet owners have purchased their device, and 83% have engaged in shopping-related activities immediately before, during, or after visiting a store. This is a significant factor leading to opportunities for the blockchain market in supply chain management.

- Further, healthcare service providers are performing blockchain technology to control and track healthcare products from production to delivery continually. Also, blockchain supply chain offerings enable pharmaceutical companies to decrease illegal activities, such as counterfeit drugs and, unlawful production of harmful medicines, improper stock control.

- Every industry was affected by the exceptional occurrences caused by the coronavirus epidemic. The COVID-19 crisis influenced people, society, businesses, and the global economy. It has been noted that the need for blockchain in supply chains had a negative impact during the pandemic. According to a survey done by Supply Chain Media, the COVID-19 epidemic significantly impacted almost all manufacturers, distributors, and the retail business. On the other hand, the COVID-19 outbreak led to a rise in eCommerce demand. As part of a pandemic, corporate innovation plans were driven by artificial intelligence (AI) and machine learning (ML), which accelerated SMEs' adoption of blockchain supply chain solutions.

Blockchain Supply Chain Market Trends

Retail & Consumer Goods to Dominate the Market

- The retail industry controls the blockchain supply chain market share. It is supposed to remain dominant due to a surge in adoption by retail players to streamline their supply chain processes. Moreover, blockchain assures quality, product safety, reliability, and authenticity, along with enabling supply chain partners to know about their product location. These determinants drive market growth for blockchain in the retail industry.

- Counterfeit sneakers make up about 40% of the estimated USD 600 billion global fake fashion industry. The traditional methods manufacturers have used to assure authenticities, such as seals and certificates, can themselves be counterfeited. But retailers are beginning to implement blockchain technology to solve the counterfeiting problem.

- An increase in demand for transparent transactions and smart contracts is the key factor driving the market growth for blockchain in the retail industry. Smart Contracts can help in automating payment processes for online as well as offline transactions. It can save time and cost for companies by removing the merchant (middleman), who charges extra for authenticating the transaction.

- The retail industry, owing to the rise in adoption by retail players to streamline their supply chain processes, is anticipated to dominate the blockchain supply chain market. For instance, in a survey by Eyefortransport Ltd. (left), the most significant share of spending was directed toward understanding the technology, with 38.2% of retailers, brands & manufacturers, and 55.3% of logistics service providers stating that they spent money on blockchain in the supply chain area.

- Blockchain technologies not only enhance supply chain automation and minimize human intervention but also provide high traceability, allowing one to track goods in real time through all supply chain stages and store all necessary data on a decentralized ledger. With blockchain's high traceability characteristic, vendor conflicts, which are most frequent in retail enterprises, can be quickly resolved because all information linked to the source of disputes will be readily accessible to all.

- Recently, Walmart employed blockchain technology to track seafood in Andhra Pradesh, India, and is planning to intensify its global food traceability with this strategy. Amazon launched its blockchain solutions on Amazon Web Services (AWS), offering a fully-managed service that makes it easy to create and manage scalable blockchain networks in retail using open-source frameworks.

- Besides, the International Labor Organization estimates that nearly 25 million people work in forced-labor conditions in and out of supply chains around the globe, with 47% in the Asia-Pacific region alone. To enforce labor rights along the supply chain, Coca-Cola, together with the U.S. Department of State, has opted to use blockchain technology to ensure that labor conditions along their product supply chain are ethical.

- However, the lack of skilled experts is anticipated to hinder blockchain in retail market growth during the forecast period. Furthermore, accelerated changes in the retail industry due to technological advancements and global trade are anticipated to give the blockchain retail market essential growth opportunities in the upcoming years.

North America is Expected to Hold Significant Market Share

- North America is recognized as the most advanced region in terms of technology appropriation and infrastructure. The broad behavior of principal industry players of blockchain technology solutions in this region is the primary driving determinant. Organizations across industry verticals, such as manufacturing, healthcare, retail and consumer goods, and logistics, provide essential growth opportunities for vendors.

- North America commanded the global market and is anticipated to remain aggressive during the blockchain in the retail market forecast period due to the presence of major market players and ongoing developments in blockchain technology. The growth in data security concerns amongst retailers is also the principal factor that is supposed to feed the market growth in this area in the coming years.

- For instance, the U.S. government agencies ranging from the Army to the IRS see more than 70 breach incidents a day, according to the Government Accountability Office. Retailers in the region spend millions of dollars a year on data security, establishing extensive firewalls, hiring world-class cybersecurity experts, and taking other steps.

- During the forecast period, major industry players like IBM, Microsoft, Oracle, AWS, Digital Asset Holdings, and others in the North American market would have a significant impact. The study finds that the pandemic has accelerated demand for cloud-based services and software, creating a market ready for blockchain innovation. As more companies look to create virtual work platforms, there is a greater need than ever for safe and open data management.

Blockchain Supply Chain Industry Overview

The Blockchain Supply Chain Market is semi-consolidated, and the ecosystem comprises some major vendors, such as IBM Corporation, Microsoft Corporation, Oracle Corporation, SAP SE, and AWS Inc., among others. Notable players in the market adopt advanced strategies such as collaboration, mergers and acquisitions, and partnerships that help them get a larger share of the global market. Many businesses are anticipated to enter the market shortly with the expected profitable growth of the market.

In May 2023, Accenture assisted Microsoft in transforming its Azure supply chain with a control tower solution that better manages network-wide inventory, generates additional cloud revenue, and enhances employee efficiency.

In August 2022, VeChain, the most well-known enterprise blockchain in the world, and OrionOne Inc., a global supply chain technology solutions provider that has built a robust SaaS platform to deliver best-in-class technology to the supply chain market, announced the integration of their technologies to speed up blockchain adoption among logistics companies.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers/Consumers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Augmented Demand for Improved Security of Supply Chain Transactions

- 5.1.2 Growing Requirement for Supply Chain Transparency

- 5.1.3 Rising use of Blockchain in Retail & Consumer Goods sector

- 5.2 Market Restraints

- 5.2.1 Absence of Awareness of the Blockchain Technology

- 5.3 Assessment of Impact of COVID-19 on the Industry

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Payment & Settlement

- 6.1.2 Product Traceability

- 6.1.3 Counterfeit Detection

- 6.1.4 Smart Contracts

- 6.1.5 Risk & Compliance Management

- 6.1.6 Other Applications

- 6.2 By Industry Vertical

- 6.2.1 Retail & Consumer Goods

- 6.2.2 Healthcare & Life Sciences

- 6.2.3 Manufacturing

- 6.2.4 Logistics, Oil & Gas

- 6.2.5 Other Industry Verticals

- 6.3 By Component

- 6.3.1 Platform

- 6.3.2 Services

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 Germany

- 6.4.2.2 United Kingdom

- 6.4.2.3 France

- 6.4.2.4 Spain

- 6.4.3 Asia

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.3.4 Australia

- 6.4.4 Latin America

- 6.4.4.1 Brazil

- 6.4.4.2 Mexico

- 6.4.4.3 Argentina

- 6.4.5 Middle East and Africa

- 6.4.5.1 United Arab Emirates

- 6.4.5.2 Saudi Arabia

- 6.4.5.3 South Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 Oracle Corporation

- 7.1.3 Microsoft Corporation

- 7.1.4 SAP SE

- 7.1.5 Amazon Web Services Inc.

- 7.1.6 Huawei Technologies Co., Ltd.

- 7.1.7 TIBCO Software Inc.

- 7.1.8 Auxesis Group

- 7.1.9 Guardtime Inc.

- 7.1.10 BTL Group

- 7.1.11 Bitfury Group Limited.

- 7.1.12 Omnichain Inc.

- 7.1.13 VeChain Foundation

- 7.1.14 Accenture PLC

- 7.1.15 Digital Treasury Corporation