|

市场调查报告书

商品编码

1402967

农业螯合化合物市场占有率分析、产业趋势与统计、2024 年至 2029 年成长预测Agricultural Chelates - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

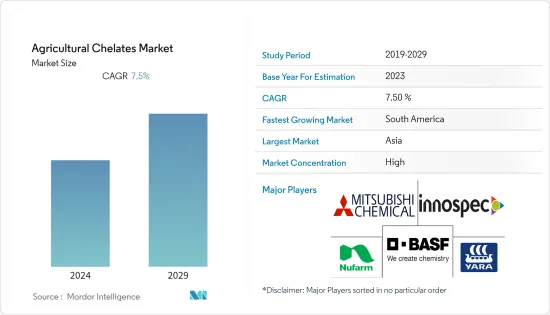

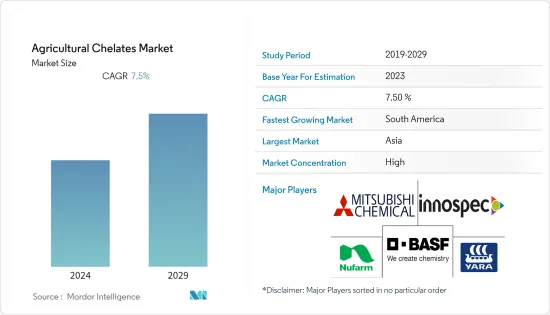

预计到 2024 年,农业螯合物市值将达到 11 亿美元,预测期内复合年增长率为 7.5%。

主要亮点

- 不断变化的气候条件、减少的耕地和不断增加的全球人口正在增加人们对粮食安全的担忧。因此,螯合物在农业领域的使用显着增加,以提高作物产量并满足全球粮食需求。螯合透过提供某些营养物质来帮助改善植物的营养吸收。这个过程改善了植物的生长和发育,并提高了作物的产量和品质。

- 由于土壤的异质性和复杂性,传统的微量营养素很容易被氧化或沉淀。螯合可防止微量营养素在溶液和土壤中发生不良反应。螯合肥料可提高铁、铜、锰和锌等微量营养素的生物利用度,有助于提高经济作物生产的生产力和盈利。当作物生长在微量营养素压力较低或 pH 值高于 6.5 的土壤中时,螯合肥料可以比常规微量营养素提高商业性产量。

- 随着永续农业的兴起以及人们日益认识到合成螯合物对环境的负面影响,对生物分解性螯合物的需求不断增加。因此,每家公司都充分利用客户需求并保持市场主导地位。

- 例如,美国特殊化学品製造商 Innospec 于 2022 年推出了生物分解性螯合物 ENVIOMET® C。 ENVIOMET(R) C生物分解释放到环境中后会迅速生物降解,进而降低与铅(Pb) 等重金属形成持久性有机螯合物的可能性。因此,土壤堆积和地下水污染的风险较小。

- 因此,上述因素预计将在研究期间刺激市场成长。

农业螯合物市场趋势

农业领域越来越青睐 EDTA

- 乙二胺四乙酸 (EDTA) 是农业中使用最广泛的合成螯合物之一,应用于土壤和叶面喷布营养剂。 EDTA 也可用于 pH 值为 6.0 的土壤中进行露地施肥。 EDTA由于其广泛的应用而拥有最大的市场占有率。

- EDTA 螯合物比其他无机来源更受青睐,因为它能有效地将微量元素(如铁(Fe)、锰(Mn)、铜(Cu) 和锌(Zn))从土壤吸收到植物根部。这种情况很少见。

- 锌是一种微量营养素,对于植物激素平衡和生长素活性很重要,对于植物生长至关重要。有机螯合锌源如 Zn-EDTA (12% Zn) 通常被认为优于无机锌源。对于玉米和豆类,使用 Zn-EDTA 螯合肥料代替硫酸锌 (ZnSO4) 需要总量的一半。 EDTA 螯合物比其他市售农业螯合物相对便宜且更容易取得。

- 市场领先公司拥有用于农业投入品的全面的 EDTA产品系列。例如,Corteva 提供各种 EDTA 螯合物,例如 Versenol 和 Crop Max,这些产品在农业领域的需求量很大。与其他市售农业螯合物相比,EDTA 螯合物相对便宜且容易取得。处理土壤中汞、镉和铅毒素的能力将在预测期内促进 EDTA 螯合物的成长。

亚太地区主导市场

- 亚太地区拥有最大的农业螯合物市场规模,主要由中国、印度和日本推动。中国是人口最多的国家,拥有世界上一些最大的农业设施。人口的快速增长和对粮食需求的增加迫使农民种植产量作物。因此,国内需要农业螯合物。

- 据澳洲政府称,碱性土壤约占澳洲国土面积的23.8%,西澳土壤pH值在4至8.5之间。因此,由于微量元素效率限制了农业生产力的成长,澳洲对 EDTA 螯合物的需求正在增加。

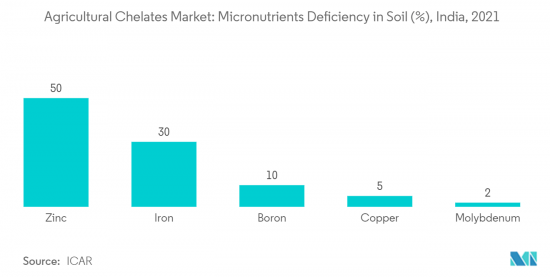

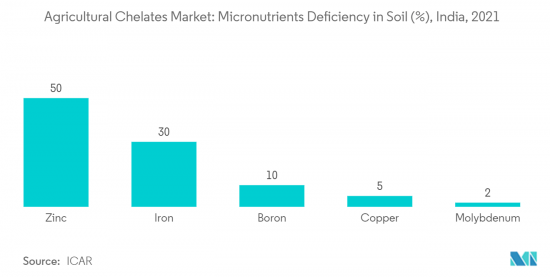

- 印度存在微量营养素缺乏:锌 36.5%、溴 24.2%、铁 12.8%、锰 7.1%、铜 4.2%。结果是,农产品的产量和营养品质显着降低。由于土壤养分缺乏以及螯合物的有效性,该国对螯合物的需求正在增加。印度市场的成长速度预期温和。

农业螯合物产业概况

全球农业螯合物市场集中。该市场的主要企业包括 Yara International ASA、 BASF SE、Nufarm、Mitsubishi Chemical Corporation 和 Innospec Inc.。这些参与企业的巨大市场占有率归因于其高度多元化的产品系列以及回顾期间的收购和合作伙伴关係。这些公司也专注于研发和产品创新,以扩大其地理影响力。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 对农作物产量的需求

- 螯合剂在微量营养素中毒的应用

- 土壤微量营养素缺乏

- 市场抑制因素

- 螯合物的非生物分解

- 有机农业的兴起与合成螯合物使用的限制

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 类型

- 合成

- EDTA

- EDDHA

- DTPA

- IDHA

- 其他组合类型

- 有机的

- 苹果硫酸盐

- 胺基酸

- 七葡萄糖酸盐

- 其他有机类型

- 合成

- 目的

- 土壤

- 叶面喷布

- 施肥

- 其他用途

- 作物类型

- 粮食

- 豆类和油籽

- 经济作物

- 水果和蔬菜

- 草坪/观叶植物

- 地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 其他北美地区

- 欧洲

- 西班牙

- 英国

- 法国

- 德国

- 俄罗斯

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 非洲

- 南非

- 其他非洲

- 北美洲

第六章竞争形势

- 最采用的策略

- 市场占有率分析

- 公司简介

- Yara International ASA

- Nouryon

- BASF SE

- Shandong Iro Chelating Chemical Co. Ltd

- Haifa Negev technologies Ltd

- Ava Chemicals Private Limited

- Protex International

- Mitsubishi Chemical Corporation

- Deretil Agronutritional

- Innospec Inc.

第七章 市场机会及未来趋势

The agricultural chelates market is valued at USD 1.1 billion in 2024 and is projected to register a CAGR of 7.5% during the forecast period.

Key Highlights

- Changing climatic conditions, decreasing availability of arable land, and increasing global population are raising food security concerns. As a result, there has been a significant rise in the use of chelating agents in the agriculture sector to improve crop yield and meet global food demand. Chelating agents help improve plant nutrient uptake by making certain nutrients available. This process can improve plant growth and development and increase crop yield and quality.

- Since soil is heterogeneous and complex, traditional micronutrients are readily oxidized or precipitated. Chelation keeps a micronutrient from undesirable reactions in solution and soil. Chelated fertilizers improve the bioavailability of micronutrients, such as Fe, Cu, Mn, and Zn, and, in turn, contribute to the productivity and profitability of commercial crop production. Chelated fertilizers have more potential to increase commercial yield than regular micronutrients when the crop is grown in low-micronutrient stress or soils with a pH greater than 6.5.

- With the rise of sustainable farming and the increasing awareness of the adverse environmental impact of synthetic chelating agents, there has been a rise in the demand for biodegradable chelating agents. Therefore, companies are capitalizing on customers' needs to uphold a leading position in the market.

- For instance, in 2022, Innospec, a US-based specialty chemical company, launched ENVIOMET® C biodegradable chelating agents. When released into the environment, ENVIOMET® C chelating agents rapidly biodegrade, reducing the possibility of forming persistent organic chelates with heavy metals, such as lead (Pb). This results in less risk of soil accumulation and underground water pollution.

- Therefore, the abovementioned factors are anticipated to stimulate market growth during the study period.

Agricultural Chelates Market Trends

Increasing Preference for EDTA in Agriculture

- Ethylenediaminetetraacetic acid (EDTA) is one of the most extensively used synthetic chelating agents in agriculture and finds applications in soil and foliar-applied nutrients. EDTA can also be used for open-field fertigation in the case of soil with a pH range of 6.0. Its wide application is a significant reason behind its holding the largest market share.

- EDTA chelates are widely preferred over other inorganic sources, as they are effective in the uptake of trace elements, such as iron (Fe), manganese (Mn), copper (Cu), and zinc (Zn), from the soil to the roots of the plant.

- As a micronutrient, zinc is crucial for plant hormone balance and auxin activity and is vital for the growth of plants. Organic chelated zinc sources, such as Zn-EDTA (12% of Zn), are generally considered superior to inorganic zinc sources. In the case of corn and bean crops, only half the total is required if Zn-EDTA chelate fertilizer is the source rather than zinc sulfate (ZnSO4). EDTA chelates are comparatively less expensive and readily available than other commercial agriculture chelates available in the market.

- The major players in the market have a comprehensive product portfolio for EDTA being used in agriculture inputs. For instance, Corteva has a wide range of EDTA chelating agents under Versenol and Crop Max, which are highly demanded in agriculture. EDTA chelates are comparatively less expensive and readily available than other commercial agriculture chelates available in the market. Its ability to treat toxins such as mercury, cadmium, and lead in the soil drives the growth of EDTA chelates during the forecast period.

Asia-Pacific Dominates the Market

- The Asia-Pacific region has the highest market value for agricultural chelates, majorly led by China, India, and Japan. As the country with the largest population, China has one of the most extensive agricultural facilities globally. With a rapid increase in population and the increasing demand for food, farmers are compelled to grow crops with high yields. This creates the need for agricultural chelates in the country.

- According to the Government of Australia, alkaline soils occupy about 23.8% of the total land area in Australia, and soils in western Australia have a pH range between 4 and 8.5. Therefore, the demand for EDTA chelating agents is increasing in Australia due to trace element efficiencies, which limit agricultural productivity growth.

- India is witnessing an incidence of micronutrient deficiencies, such as Zn 36.5%, Boron 24.2%, Fe 12.8%, Mn 7.1%, and Cu 4.2%. This has led to severe losses in produce yield and nutritional quality. In line with the nutrient deficiency in the soil and the effectiveness of chelates in combatting it, the demand for chelates is increasing in the country. The Indian market is estimated to grow at a moderate rate.

Agricultural Chelates Industry Overview

The global agricultural chelates market is concentrated. The major players in the market are Yara International ASA, BASF SE, Nufarm, Mitsubishi Chemical Corporation, and Innospec Inc, among others. The significant market share of these players can be attributed to a highly diversified product portfolio and acquisitions and partnerships during the review period. These players also focus on R&D and product innovations to widen their geographical presence.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Demand For Higher Crop Yields

- 4.2.2 Application of Chelates in Micronutrient Intoxication

- 4.2.3 Micronutrient Deficiency In Soil

- 4.3 Market Restraints

- 4.3.1 Non-biodegradable Nature of Chelates

- 4.3.2 Rise of Organic Farming and Restriction on the Use of Synthetic Chelating Agents

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitutes

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Synthetic

- 5.1.1.1 EDTA

- 5.1.1.2 EDDHA

- 5.1.1.3 DTPA

- 5.1.1.4 IDHA

- 5.1.1.5 Other Synthetic Types

- 5.1.2 Organic

- 5.1.2.1 LingoSulphates

- 5.1.2.2 Aminoacids

- 5.1.2.3 Heptagluconates

- 5.1.2.4 Other Organic Types

- 5.1.1 Synthetic

- 5.2 Application

- 5.2.1 Soil

- 5.2.2 Foliar

- 5.2.3 Fertigation

- 5.2.4 Other Applications

- 5.3 Crop Type

- 5.3.1 Grains and Cereals

- 5.3.2 Pulses and Oilseeds

- 5.3.3 Commercial Crops

- 5.3.4 Fruits and Vegetables

- 5.3.5 Turf and Ornamentals

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Spain

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Germany

- 5.4.2.5 Russia

- 5.4.2.6 Italy

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Rest of Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Yara International ASA

- 6.3.2 Nouryon

- 6.3.3 BASF SE

- 6.3.4 Shandong Iro Chelating Chemical Co. Ltd

- 6.3.5 Haifa Negev technologies Ltd

- 6.3.6 Ava Chemicals Private Limited

- 6.3.7 Protex International

- 6.3.8 Mitsubishi Chemical Corporation

- 6.3.9 Deretil Agronutritional

- 6.3.10 Innospec Inc.