|

市场调查报告书

商品编码

1402968

天线:市场占有率分析、产业趋势/统计、成长预测,2024-2029Antenna - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

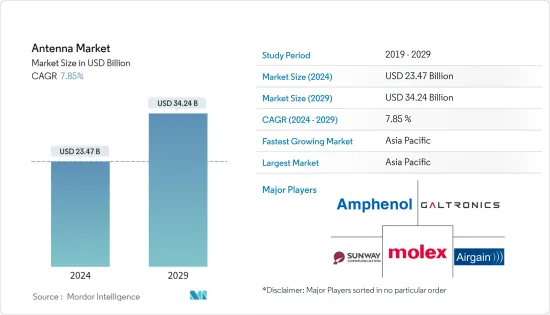

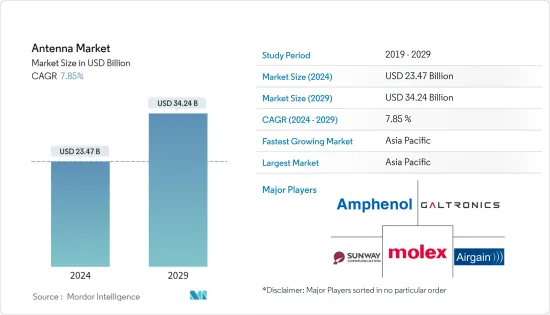

预计2024年天线市场规模为234.7亿美元,预计2029年将达到342.4亿美元,在预测期间(2024-2029年)复合年增长率为7.85%。

主要亮点

- 由于无线通讯的增加、互联网使用量的增加、智慧城市、ADAS(高级驾驶辅助系统)车辆等的市场开拓,预计该市场将在预测期内显着增长。为了满足这些需求,新兴市场的参与者正在开发新产品以赢得市场占有率。

- 由于数位转型导致无线连接解决方案的使用增加,天线市场呈现向上成长的趋势。在预测期内,天线市场预计将受到无线系统、无线通讯以及笔记型电脑、平板电脑、穿戴式装置、智慧型手机和其他设备等消费性电子产品中天线使用量不断增加的推动。

- 卫星通讯的日益普及预计也将推动天线市场的发展。推动天线市场成长的关键方面之一是空间领域的扩张。由于太空探勘任务的增加、卫星发射操作的成本效益、卫星支援的作战需求的增加以及小型卫星部署的增加,该市场正在扩大。美国太空军(USSF) 为军事作战人员运作价值68 亿美元的卫星控制网路(SCN),其中包括七个固定天线位置,用于指挥190 多颗军事和政府卫星。它由一个国际地面网路组成,其中包括:

- 天线对于在智慧城市中提供无线连线至关重要。天线可以在设备和基础设施组件(例如感测器、摄影机、路灯和车辆)之间实现高效、可靠的通讯。天线用于建立无线网路并实现资料传输,以便于对各种系统进行即时监控和控制。智慧城市的兴起预计将推动所研究的市场。

- 另一方面,天线需要复杂的设计,这在开发高效能、多频段天线时尤其重要。在冲压製程的限制内实现所需的性能特征是一项挑战。此外,冲压材料的选择对天线性能也有重大影响。要找到平衡导电性、机械强度和成本的合适材料很困难。

- 大流行后,由于客户需求的增加,市场参与者正在开发新的永续产品。例如,2023年1月,凸版设计了一款环保的近场通讯(NFC)标籤,该标籤使用纸质材料作为天线基材,而不是传统的聚对苯二甲酸Terephthalate(PET)薄膜。这种新标籤的销售已经开始,环保意识较高的欧洲预计将是一个有利的市场。除了透过改用纸张将塑胶消费量降至零之外,新的电路形成技术还确保了作为 NFC 设备的足够的通讯性能。

天线市场趋势

电话是受访市场中最大的产品领域。

- 根据GSM协会预测,2022年全球行动网路用户将达到44亿人。随着全球电话网路基础设施投资的增加,行动宽频网路的差距在过去十年中显着缩小。

- 行动电话天线性能对于确保讯号弱区域的足够通讯至关重要。 5G技术的成熟使得5G即使在中等收入市场也能大规模部署和商用。这可能会进一步推动行动用户的成长。

- GSM 协会表示,到 2025 年,全球将有超过五分之二的人生活在 5G 网路覆盖范围内。 5G 的引进扩大了主动天线系统的使用范围。随着行动电话的出现,工程师们正在开发天线解决方案,透过将多个天线整合到小型设备中来应对多无线电环境的挑战。

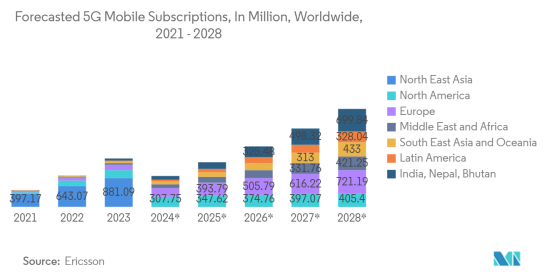

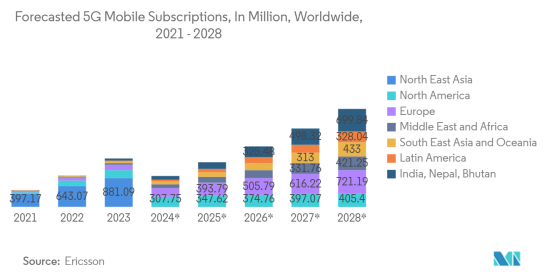

- 5G 订阅的开拓和采用可能会为该地区的市场参与者创造机会开发新产品,以增强其服务的顺利运作。爱立信预计,2021年至2028年,全球5G用户数预计将大幅成长,从超过5.0962亿增加到超过46.2亿。按地区划分,预计新增数量最多的是东南亚、东北亚、尼泊尔、印度和不丹。

- 模拟软体比传统测量工具在技术上更加先进,其优势将使行动电话製造商能够更有效率地製造5G行动电话,从而增强客户的竞争优势。此外,5G技术的出现正促使行动电话製造商和行动网路营运商采用5G天线技术来满足消费者的即时需求。

亚太地区预计将出现显着成长

- 资讯共用、车载娱乐和物联网 (IoT) 的扩张推动了亚太地区的市场成长。天线对于高速通讯系统中的无缝无线连接变得非常重要。因此,亚太地区最大、最值得信赖的天线创新者拥有广泛的天线解决方案,我们致力于为客户提供协助。

- 有线外部天线越来越多地被采用,在坚固的热塑性机壳中提供一流的射频 (RF) 性能。外部天线正在推动亚太地区的市场需求,因为它们能够抵抗潮湿、极端温度条件、震动,并且方便在不同地点安装。

- 这家亚太天线製造商利用业界领先的专业知识和能力,专注于紧凑型多频段和互补天线,并使用雷射直接成型 (LDS)、柔性、冲压和陶瓷技术自订,设计和製造解决方案。

- 小型化正在增强其主导地位,同时在无线和消费性电子产品等先进应用中实现更小、更轻的天线基础设施。设计人员必须应对更高的功能密度才能满足使用者的期望。小型化允许将更多的功能装入更小的空间。协作和伙伴关係促进了产品设计和新兴技术的进步,以在生产前解决潜在问题。云端协作还可以帮助製造专业人员避免成本高昂的返工週期。借助最先进的模拟工具,製造商可以做出准确的性能和可靠性预测。

- 立讯精密是中国电子元件製造商,在中国提供资料通讯设备和企业级5G相关产品。该公司的核心产品系列包括天线、连接器、电缆、光学模组和互连产品。

- 2023 年 2 月,该公司与 POET Technologies Inc. 合作,为资料中心开发节能且经济高效的 400G 和 800G 收发器解决方案组合。该公司专注于透过智慧型製造技术将电子元件无缝整合到单一多晶片模组中。

- 日本製造商村田製作所 (Murata Manufacturing Co., Ltd.) 提供用于基于磁场的通讯的低频射频识别 (LF RFID) 天线。该公司的产品专为汽车和智慧型家庭关键应用而设计。 LF RFID天线符合汽车标准,用于汽车智慧钥匙。汽车智慧型钥匙高阶天线线圈的需求不断增长可能会推动该地区的产品需求。汽车、智慧城市和施工机械中物联网的进步也推动了该地区天线市场的需求。

天线产业概况

天线市场的特点是高度分散,主要参与者包括 Molex LLC、Ampheno Corporation、Airgain Inc.、Galtronics USA Inc. 和 Sunway Communications。这些市场参与企业正在采取联盟和收购等各种策略来加强产品系列获得永续的竞争优势。

2023 年 4 月,安费诺子公司安费诺无线通讯电子公司宣布与全球无线充电系统领导者 NuCurrent 建立策略合作伙伴关係。此次合作旨在满足全行业向新 Qi2 标准(发音为“chee-two”)过渡的迫切需求。该合作伙伴关係利用了 NuCurrent 的无线电源知识产权、系统技术和设计专业知识以及 Amphenanol 的天线技术、设计和製造能力。

2023 年 3 月,Lynx Technologies(现已隶属于 TE Connectivity (TE),以其连接器和感测器而闻名)宣布推出一系列新的蜂窝粘胶柔性印刷电路 (FPC) 天线。这些天线专为需要经济高效且多功能的天线解决方案的 5G 新无线电、LTE 和蜂巢式物联网(LTE-M、NB-IoT)应用而设计。 ANT-5GW-FPC 天线提供灵活的接地平面独立偶极子整合/嵌入式天线解决方案。其弹性和黏合特性便于安装到射频透明机壳(例如塑胶)中,提供环境密封并防止天线损坏。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 消费者议价能力

- 供应商的议价能力

- 新进入者的威胁

- 竞争公司之间的敌对关係

- 替代品的威胁

- COVID-19 对天线市场的影响

第五章市场动态

- 市场驱动因素

- 发展中国家各产业自动化程度快速提高

- 网路的普及和物联网的到来

- 市场抑制因素

- 对效率和改进频宽的需求

第六章市场区隔

- 按类型

- 冲压天线

- FPC天线

- LDS天线

- LCP天线

- MPI天线

- 按申请

- 主天线

- 蓝牙天线

- 无线网路天线

- GPS天线

- NFC天线

- 副产品

- 电话

- 笔记型电脑

- 药片

- 穿戴式的

- 其他的

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 其他地区

第七章全球天线市场最终用户产业分析

- 消费性电子产品

- 军事/国防

- 卫生保健

- 车

- 其他最终用户产业

第 8 章技术颠覆

- 片上天线和封装天线改变了天线市场

- 干扰者简介

- MediaTek Inc.

- Qualcomm Technologies Inc.

- TDK Corporation

- Nordic Semiconductor ASA

- Johanson Technology Inc.

- Vishay Intertechnology Inc.

- Microchip Technology Inc.

- Intel Corporation

- 5G天线市场

- 电缆天线

- RFID/超高频天线

第9章竞争形势

- 公司简介

- Molex LLC

- Amphenol Corporation

- Airgain Inc.

- Galtronics USA Inc

- Sunway Communication

- Luxshare Precision

- Murata Manufacturing Co. Ltd.

- Huizhou SPEED Wireless Technology Co. Ltd

- Fujikura Electronics

- Xinwei Communication

- HOLITECH Technology Co. Ltd

- AAC Technologies

- TE Connectivit Ltd

- Qualcomm Technologies Inc

- Texas Instruments Incorporated

- Linx Technologies

第10章供应商定位分析

第十一章投资分析

第十二章 未来趋势

The Antenna Market size is estimated at USD 23.47 billion in 2024, and is expected to reach USD 34.24 billion by 2029, growing at a CAGR of 7.85% during the forecast period (2024-2029).

Key Highlights

- The market is expected to observe significant growth over the forecasted period due to the rise in wireless communication, the rise in internet usage, the development of smart cities, advanced driver assistance systems (ADAS) vehicles, and many more. To cater to those needs, the players in the market are developing new products to capture the market share.

- The antenna market is showing upward growth due to the increasing usage of wireless connectivity solutions due to digital transformation. During the forecast period, the antenna market is expected to be driven by the growing use of wireless systems, wireless communications, and the increased use of antennas in consumer electronic products, such as laptops, tablets, wearables, smartphones, and other devices.

- The rise in the adoption of satellite communications is expected to drive the antenna market. One of the key aspects driving the growth of the Antenna market is the expansion of the space sector. The market is expanding as a result of an increase in space exploration missions, cost-effective satellite launch operations, increased demand for satellite-assisted combat, and enhanced small satellite deployment. The United States Space Force (USSF) operates the USD 6.8 billion satellite control network (SCN) for military warfighters, which consists of an international ground network of fixed antennas at seven locations to command more than 190 military and government satellites.

- Antennas are essential for providing wireless connectivity in smart cities. They enable efficient and reliable communication between devices and infrastructure components such as sensors, cameras, streetlights, and vehicles. Antennas are used to establish wireless networks and enable data transfer, facilitating real-time monitoring and control of different systems. The rise in smart cities is expected to drive the studied market.

- On the contrary, antennas require intricate designs, especially when developing high-performance and multi-band antennas. Achieving the desired performance characteristics within the constraints of the stamping process can be challenging. Further, the choice of stamping material can significantly impact antenna performance. Finding the right material that balances electrical conductivity, mechanical strength, and cost can be challenging.

- Post-pandemic, the players in the market are developing new sustainable products due to the rise in the demand from customers. For instance, in January 2023, Toppan designed an eco-friendly near-field communication (NFC) tag label that utilizes paper material as the substrate for the antenna rather than conventional polyethylene terephthalate (PET) film. The sales of the new tag label have been launched, with Europe anticipated to be a favorable market due to the high level of environmental consciousness. In addition to reducing plastic consumption to zero by switching to paper, a new circuit fabrication technology ensures sufficient communication performance as an NFC device.

Antenna Market Trends

Phone to be the Largest Product Segment in the Studied Market

- According to the GSM Association, global mobile internet subscribers reached 4.4 billion in 2022. Growing investments in phone network infrastructure across the globe have narrowed down the mobile broadband network gap significantly over the last decade.

- The antenna performance of a phone is vital to ensure adequate communication coverage in low-signal areas. With the maturity of 5G technology, large-scale deployments and commercialization of 5G have become possible in modest-income markets. This could further bolster the mobile subscriber growth.

- The GSM Association states that more than two in five people across the world will live within the 5G network reach by 2025. The introduction of 5G has expanded the use of active antenna systems. With the advent of phones, engineers are developing antenna solutions by integrating multiple antennas into small form-factor devices to address the challenges in multi-radio environments.

- The developments and adoption of 5G subscriptions would create an opportunity for the market players in the region to develop new products to enhance the smooth functioning of services. According to Ericsson, 5G subscriptions are forecast to increase drastically worldwide from 2021 to 2028, from over 509.62 million to over 4.62 billion subscriptions. Southeast Asia, Northeast Asia, Nepal, India, and Bhutan are expected to have the most subscriptions by region.

- The advantages of technologically advanced simulation software over traditional measurement tools enable mobile phone manufacturers to produce 5G phones more efficiently and reinforce customers' competitive advantages. Further, the advent of 5G technologies is encouraging phone manufacturers and mobile network operators to adopt 5G antenna technology to meet the real-time demands of consumers.

Asia Pacific is Expected to Register Major Growth

- Asia-Pacific is witnessing a growing market for advancing information sharing, in-car entertainment, and Internet of Things (IoT) expansion. Antennas have become incredibly important for seamless wireless connectivity for high-speed communication systems. As a result, Asia-Pacific's largest and most trusted antenna innovators strive to empower customers with an extensive range of antenna solutions for applications, including industrial, cellular, 5G, automotive, global navigation satellite system/global positioning system (GNSS/GPS), healthcare, etc.

- A rise in the adoption of cabled external antennas has been observed that offer best-in-class radio frequency (RF) performance in ruggedized thermoplastic enclosures. External antennas are resistant to moisture, extreme thermal conditions, and vibration for convenient mounting in various locations, driving the market demand in the Asia-Pacific region.

- Antenna manufacturers across the Asia-Pacific region utilize their industry-leading expertise and capabilities to design and manufacture custom solutions emphasizing small multiband and complementary antennas and employing laser direct structuring (LDS), flex, stamped, and ceramic technologies.

- Miniaturization strengthens its hold in advanced applications such as wireless and consumer electronics while enabling small, lighter antenna infrastructures. Designers must contend with greater feature density to meet user expectations. Miniaturizations enable packing greater functionality into smaller spaces. Collaboration and partnerships enabled advances in product design and solutions to potential issues before production through emerging technologies. Cloud collaboration also brings manufacturing experts to avoid costly rework cycles. With the help of state-of-the-art simulation tools, manufacturers can make accurate performance and reliability predictions.

- Luxshare Technology Co. Ltd., a Chinese electronic components manufacturer, provides data-communication facilities and enterprise-level 5G-related products in China. The company's core product portfolio includes antennas, connectors, cables, optical modules, and interconnection products.

- In February 2023, the company partnered with POET Technologies Inc. to develop a power-efficient and cost-effective portfolio of 400G and 800G transceiver solutions for data centers. The company focuses on offering seamless electronic component integration into a single multi-chip module through intelligent manufacturing techniques.

- Murata, a Japanese manufacturing company, offers a low-frequency radio frequency identification (LF RFID) antenna for magnetic field-based communication. The company products are designed for automotive and intelligent home key applications. An LF RFID antenna complies with vehicle-mounting standards and is used in vehicle smart keys. Rising demand for high-end antenna coils for intelligent keys for automobiles is likely to boost product demand in the region. The advancement of IoT in automotive, smart cities, and construction machinery also propels the market demand for antennas in the region.

Antenna Industry Overview

The Antenna Market is characterized by significant fragmentation, featuring key players such as Molex LLC, Amphenol Corporation, Airgain Inc., Galtronics USA Inc., and Sunway Communication. These market participants employ various strategies, including partnerships and acquisitions, to bolster their product portfolios and attain a sustainable competitive advantage.

In April 2023, Amphenol Airwave Communication Electronics Co. Ltd., a subsidiary of Amphenol Corporation, announced a strategic partnership with NuCurrent, a global leader in wireless power systems. This collaboration aims to address the pressing industry-wide demand for a transition to the new Qi2 standard (pronounced "chee tu"). It will leverage NuCurrent's expertise in wireless power intellectual property, systems technology, and design capabilities, along with Amphenol's proficiency in antenna technology, design, and manufacturing.

In March 2023, Linx Technologies, now a part of TE Connectivity (TE), a renowned leader in connectors and sensors, introduced a new series of cellular adhesive flexible printed circuit (FPC) antennas. These antennas are designed for 5G New Radio, LTE, and cellular IoT (LTE-M, NB-IoT) applications that require a cost-effective and versatile antenna solution. The ANT-5GW-FPC antennas offer a flexible ground plane-independent dipole internal/embedded antenna solution. Their flexibility and adhesive backing facilitates easy mounting within RF transparent enclosures (e.g., plastic), enabling environmental sealing and protection against antenna damage.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Consumers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Impact of COVID -19 on the Antenna Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Automation in Developing Countries Across Various Verticals

- 5.1.2 Penetration of the Internet and the Advent of IoT

- 5.2 Market Restraints

- 5.2.1 Need for Efficiency and Bandwidth Improvements

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Stamping Antenna

- 6.1.2 FPC Antenna

- 6.1.3 LDS Antenna

- 6.1.4 LCP Antenna

- 6.1.5 MPI Antenna

- 6.2 By Application

- 6.2.1 Main Antenna

- 6.2.2 Bluetooth Antenna

- 6.2.3 WiFi Antenna

- 6.2.4 GPS Antenna

- 6.2.5 NFC Antenna

- 6.3 By Product

- 6.3.1 Phone

- 6.3.2 Laptop

- 6.3.3 Tablet

- 6.3.4 Wearables

- 6.3.5 Other Products

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Rest of the World

7 GLOBAL ANTENNA MARKET END-USER INDUSTRY ANALYSIS

- 7.1 Consumer Electronics

- 7.2 Military and Defense

- 7.3 Healthcare

- 7.4 Automotive

- 7.5 Other End-user Industries

8 TECHNOLOGY DISRUPTION

- 8.1 Antenna on Chip and Antenna in Package to Disrupt the Antenna Market

- 8.2 Disruptors Profiles

- 8.2.1 MediaTek Inc.

- 8.2.2 Qualcomm Technologies Inc.

- 8.2.3 TDK Corporation

- 8.2.4 Nordic Semiconductor ASA

- 8.2.5 Johanson Technology Inc.

- 8.2.6 Vishay Intertechnology Inc.

- 8.2.7 Microchip Technology Inc.

- 8.2.8 Intel Corporation

- 8.3 5G Antenna Market

- 8.4 Cable Antenna

- 8.5 RFID/UHF Antenna

9 COMPETITIVE LANDSCAPE

- 9.1 Company Profiles*

- 9.1.1 Molex LLC

- 9.1.2 Amphenol Corporation

- 9.1.3 Airgain Inc.

- 9.1.4 Galtronics USA Inc

- 9.1.5 Sunway Communication

- 9.1.6 Luxshare Precision

- 9.1.7 Murata Manufacturing Co. Ltd.

- 9.1.8 Huizhou SPEED Wireless Technology Co. Ltd

- 9.1.9 Fujikura Electronics

- 9.1.10 Xinwei Communication

- 9.1.11 HOLITECH Technology Co. Ltd

- 9.1.12 AAC Technologies

- 9.1.13 TE Connectivit Ltd

- 9.1.14 Qualcomm Technologies Inc

- 9.1.15 Texas Instruments Incorporated

- 9.1.16 Linx Technologies