|

市场调查报告书

商品编码

1402976

货运管理 -市场占有率分析、产业趋势/统计、2024-2029 年成长预测Freight Transport Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

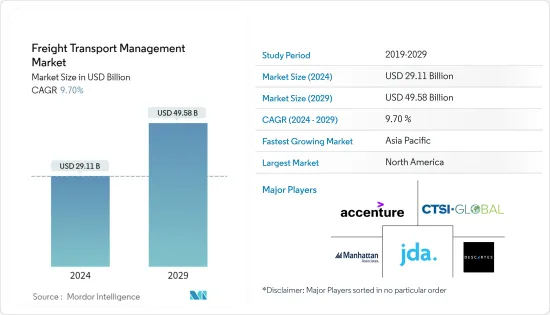

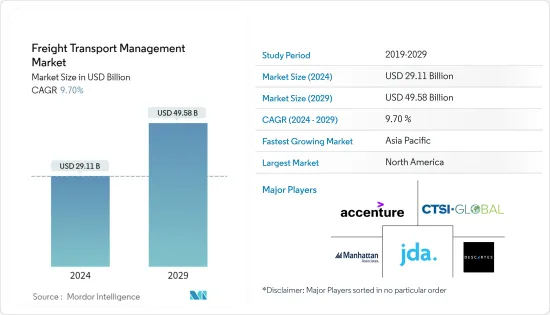

货运管理市场规模预计到 2024 年为 291.1 亿美元,预计到 2029 年将达到 495.8 亿美元,在预测期内(2024-2029 年)复合年增长率为 9.70%。

主要亮点

- 该市场对货运管理解决方案不断增长的需求是由多种因素推动的,包括货运管理提供的高利润水平,以及日益增长的全球化,这有助于运输量的增加。

- 每个国家的经济都取决于货运业务效率的提升。随着人口成长和全球化,对商品和服务的需求不断增加。许多航运公司正在选择货运管理解决方案来解决其业务运作中的各种环境和安全问题。

- 技术的进步使得以新颖的方式设想流程并创造新的效率成为可能。资讯网路的出现预计将推动货运市场的成长,资讯网路使新兴产业能够实现更快的通讯、交易时间和更安全的运输。

- 在印度等新兴国家,最终用户和製造商需要解决可以透过多种货运管理解决方案解决的物流问题,包括车辆追踪和维护、安全和安保监控系统、仓库管理系统和第三方物流服务。我们没有适当的管理体系。这一因素支持了目标市场的整体成长。

- 海运的高度复杂性和低效率以及必要的成本控制是货运市场成长的挑战。此外,跨境运输相关的风险预计将阻碍货运市场的开拓。然而,运输管理系统的开发是为了满足物流部门的需求并考虑现有的问题。

- 作为 COVID-19 的一部分,旨在促进全球贸易的政府政策的增加导致了货运管理市场的成长。此外,由于成本最佳化和路线选择等优势,市场对货运管理服务的需求不断增加。

货运管理市场趋势

铁路货运是货运管理解决方案的主要需求

- 铁路货运利用铁路作为陆上货物运输的手段。铁路运输用于运输多种类型的货物,包括化学品、土木工程材料、农产品、汽车、能源原料、石油、风力发电机和林业产品。

- 此外,铁路运输是最常用的运输方式之一,在世界各地拥有广泛的基础设施。随着铁路在运输中使用的增加,管理铁路货运的货运管理也在成长。

- 铁路货运在环境、用地、能耗、安全性能等方面较其他运输方式具有竞争优势。结果,铁路物流环境变得复杂且充满挑战,企业越来越偏好依赖铁路货运经验和IT系统。

- 这导致了各种铁路货运管理解决方案的出现。这些解决方案针对小型货运列车、联运铁路和私人铁路,这些领域的营运复杂性不断增加,对流程简化的需求也不断增加。因此,DXC Technologies 和 Goal Systems 等公司开发的产品系列都专注于满足这些需求。

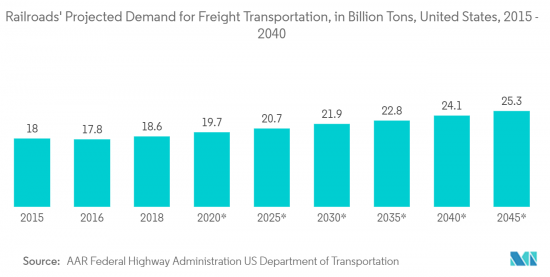

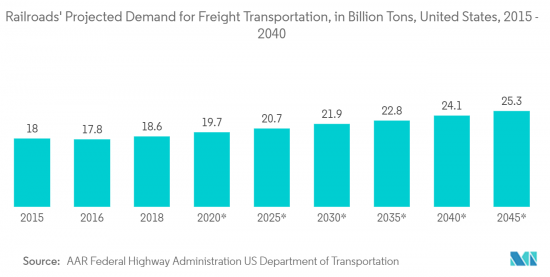

- 此外,该市场的一个关键成长要素是对铁路货运服务的需求不断增长,特别是在经济合作暨发展组织(OECD)国家。考虑到这一点,铁路货运管理解决方案预计在预测期内将大幅成长。

预计北美将占据很大的市场份额

- 据估计,美国将在该地区发挥重要作用。这一份额归因于随着越来越多的公司扩展到网路管道,零售商的销售额增加。由于IT和云端处理领域的技术进步,美国的货运业持续成长。

- 北美货运管理解决方案市场成长势头强劲,尤其是在美国,这是由于数位化程度的提高和物联网在各个领域的使用增加而导致的全球化。北美公路货运市场是世界上最成熟的市场之一。

- 线上零售业的快速成长迫使企业提高供应链效率,减少运输时间,并儘快将产品送到客户手中。因此,国内道路交通流量增加,为此调动了大量卡车。道路技术的不断发展正在推动全球各地区货运管理市场的发展。

- 根据美国运输部统计,卡车运输占美国货运量的近70%。预计未来几十年将增加 45%,需要更多的高速公路、铁路、港口、管道,甚至改善多式联运连接以有效地运输货物。特别是,由于该国电子商务的繁荣,对卡车运输的需求增加,预计将导致该地区对货运管理解决方案的需求增加。

货运管理产业概况

货运管理行业的特点是高度分散,存在大量竞争和本地参与企业。该行业也见证了向资讯和通讯领域的转变,特别是云端处理。多式联运承运商采用包括水平和垂直整合在内的商业实践是出于降低营运成本和增加报酬率的愿望,从而导致市场竞争加剧。该行业的着名参与企业包括 JDA Software、Accenture PLC、DSV A/S、Manhattan Associates 和 Ceva Logistics。

2023 年 5 月,Manhattan Associates 宣布推出新的曼哈顿主动庭院管理解决方案。此举符合公司实现统一供应链的更广泛愿景。新的堆场管理解决方案旨在与曼哈顿联合公司领先的仓库和运输管理解决方案无缝集成,所有解决方案都在单一云端原生平台上运行。

2023 年 2 月,IBS Software 完成了 Accenture Freight and Logistics Software (AFLS) 的收购。这项策略性收购进一步巩固了 IBS Software 作为航空货运业杰出技术供应商的地位。此次收购将使 IBS Software 透过整合更多解决方案并共用创新和业务模式转型的通用愿景,加强其在货运和物流领域的服务。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第 4 章行销洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 国际贸易增加导致货物运输量增加

- 成长向资讯科技倾斜

- 市场抑制因素

- 引进新技术导致高资本投资

- 与贸易路线相关的风险和拥堵

第六章市场区隔

- 按解决方案(仅定性分析,包括解决方案提供的关键服务、关键市场趋势、主要企业和产品)

- 货运成本管理

- 货物安全监控系统

- 货物流动解决方案

- 仓库管理系统

- 货运 3PL 解决方案

- 其他解决方案

- 按发展(2020-2027年市场预测、主要趋势、新兴市场开拓、产业前景等)

- 云

- 本地

- 依运输型态划分(2020-2027年市场预测、主要趋势、市场开拓、产业前景等)

- 铁路货运

- 公路货运

- 水运货物

- 空运货物

- 按最终用户(2020-2027年市场预测、主要趋势、市场开拓、产业前景等)

- 航太/国防

- 车

- 油和气

- 消费品/零售

- 能源/电力

- 其他最终用户

- 按地区划分(2020-2027年市场预测、主要趋势、新兴国家发展、市场前景等)

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章竞争形势

- 公司简介

- JDA Software

- Manhattan Associates

- CTSI-Global

- Accenture PLC

- Descartes Systems Group Inc.

- DSV A/S

- HighJump

- CEVA Logistics

- DB Schenker

- Geodis

第八章投资分析

第九章 市场机会及未来趋势

The Freight Transport Management Market size is estimated at USD 29.11 billion in 2024, and is expected to reach USD 49.58 billion by 2029, growing at a CAGR of 9.70% during the forecast period (2024-2029).

Key Highlights

- The growing demand for freight management solutions in the market is being driven by the high levels of benefits that freight management offers, as well as a combination of factors such as increased globalization contributing to rising transport volumes.

- The economy of all countries depends on better operational efficiency in freight transport. With the growth of population and globalization, there is an increase in demand for goods and services. In order to address the different environmental and safety concerns of their operations, a number of shipping undertakings are choosing freight transport management solutions.

- Technological progress has made it possible to conceive the process in novel ways and generate new efficiencies. The freight transport market growth is foreseen to be driven by the emergence of information networks with rapid contacts, transaction times, and more secure shipments within emerging sectors.

- In emerging countries, e.g., India, end users, and manufacturers do not have the controls necessary to solve logistics problems that can be solved through a range of freight management solutions like fleet tracking& maintenance, safety and security monitoring systems, warehouse management systems, or third-party logistics services. This factor is underpinning the growth of the entire target market.

- The high complexity and inefficiency of maritime transport, as well as the cost control required, are a challenge for market growth in freight transport. In addition, it is expected that the development of the freight market will be hindered by the risk associated with cross-border transport. Nevertheless, in order to be able to meet the needs of the logistics sector and take into account existing problems, transport management systems are being developed.

- The increase in government policies aimed at promoting global trade as part of COVID-19 is leading to a growth in the market for freight management. In addition, there is increasing demand for freight transport management services in the market due to its benefits of cost optimization and routing.

Freight Transport Management Market Trends

Rail Freight to Account for a Significant Demand for Freight Management Solutions

- Freight railway transport uses railways as a means of shipping cargo on land. It is employed for the transportation of many types of cargo, e.g., chemicals, earth-building materials, agricultural products, automobiles, energy feedstocks, oils, and wind turbines, as well as forestry production.

- Furthermore, rail transport is one of the most frequent modes of transport and has a large infrastructure in place all over the world. The increasing use of railways for transportation increases the growth of freight transportation management for managing rail freight transportation.

- In terms of performance in the environment, land use, energy consumption, and safety, rail freight transport has a competitive edge over other modes. As a result, the railway logistics environment is complex and difficult to navigate due to an increased preference with companies having to rely on rail cargo experience and IT systems for their management.

- This has led to the emergence of a range of management solutions for rail freight traffic, which are geared towards small cargo trains, intermodal railroads, and private railway lines that have been confronted with an increased level of operating complexity and increasingly pressing demands for process simplification. As a result, the portfolio of products developed by companies like DXC Technology and Goal Systems is being concentrated on these needs.

- Furthermore, the main growth driver for this market will be a higher demand for rail freight services, particularly in Organization for Economic Co-operation and Development (OECD) countries. With that in mind, rail freight management solutions are expected to grow significantly over the forecast period.

North America is Expected to Hold a Major Share in Market

- It is estimated that the United States will play a major role in this region. As a result of the increasing number of companies moving into the Internet channel, this share is attributed to an increase in retailers' sales. The US has continued to grow its freight transport sector, thanks to technological progress in the IT and Cloud computing sectors.

- The North American market for freight transport management solutions picked up momentum, particularly in the US, because of globalization as a result of growing digitalization and increased use of the Internet of Things by various sectors. North America's road freight market is one of the most mature markets in the world.

- The rapid growth of the online sales sector has led to a need for companies to improve their supply chain's efficiency, decrease transit time, and provide the products at customers' disposal as soon as possible. This has resulted in the increased movement of domestic traffic via roads, with a high volume of trucks being mobilized to do so. The increasing development of road technology is driving the global freight transport management market in all regions.

- According to the US Department of Transport, truck traffic in the United States accounts for nearly 70% of freight movements. It is expected to rise by 45% over the coming decades, requiring more highways, railroads, ports, or pipelines, as well as improved intermodal connections that move cargo efficiently. The increased demand for trucking, especially due to the boom in e-commerce in the country, is expected to lead to an increased demand for freight transport management solutions in the region.

Freight Transport Management Industry Overview

The freight transport management industry is characterized by significant fragmentation, with numerous competitors and local players. This sector is also witnessing a shift towards the information communication domain, particularly in cloud computing. The adoption of business practices involving both horizontal and vertical integration by intermodal freight transport operators has been driven by the desire to reduce operational costs and enhance profit margins, resulting in intensified competition within the market. Prominent players in this industry include JDA Software, Accenture PLC, DSV A/S, Manhattan Associates, and Ceva Logistics.

In May 2023, Manhattan Associates announced the launch of its reimagined Manhattan Active Yard Management solution. This move is aligned with the company's broader vision of achieving a unified supply chain. The new yard management solution has been designed to seamlessly integrate with Manhattan Associates' leading warehouse and transportation management solutions, all operating on a single, cloud-native platform.

In February 2023, IBS Software completed the acquisition of Accenture Freight and Logistics Software (AFLS). This strategic acquisition further solidifies IBS Software's position as a prominent technology provider in the air freight industry. By incorporating additional solutions and sharing a common vision for innovation and business model transformation, this acquisition will enable IBS Software to enhance its offerings in the freight and logistics sector.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Freight Transportation due to Increasing International Trade

- 5.1.2 Inclination of Growth toward Information Technology

- 5.2 Market Restraints

- 5.2.1 High Capital Investment due to Implementation of New Technologies

- 5.2.2 Risk and Congestion Associated with Trade Routes

6 MARKET SEGMENTATION

- 6.1 By Solution (Qualitative Analysis only Major services offered by the solution, key trends in the market, major players and products etc.)

- 6.1.1 Freight Transportation Cost Management

- 6.1.2 Freight Security and Monitoring System

- 6.1.3 Freight Mobility Solution

- 6.1.4 Warehouse Management System

- 6.1.5 Freight 3PL Solutions

- 6.1.6 Other Solutions

- 6.2 By Deployment (Market forecasts form 2020-2027, Key Trends, Recent Developments, Section Outlook etc.)

- 6.2.1 Cloud

- 6.2.2 On-premise

- 6.3 By Mode of Transport (Market forecasts form 2020-2027, Key Trends, Recent Developments, Section Outlook etc.)

- 6.3.1 Rail Freight

- 6.3.2 Road Freight

- 6.3.3 Waterborne Freight

- 6.3.4 Air Freight

- 6.4 By End -ser (Market forecasts form 2020-2027, Key Trends, Recent Developments, Section Outlook etc.)

- 6.4.1 Aerospace and Defense

- 6.4.2 Automotive

- 6.4.3 Oil and Gas

- 6.4.4 Consumer and Retail

- 6.4.5 Energy and Power

- 6.4.6 Other End-Users

- 6.5 By Geography (Market forecasts form 2020-2027, Key Trends, Recent Developments, Section Outlook etc.)

- 6.5.1 North America

- 6.5.2 Europe

- 6.5.3 Asia Pacific

- 6.5.4 Latin America

- 6.5.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 JDA Software

- 7.1.2 Manhattan Associates

- 7.1.3 CTSI-Global

- 7.1.4 Accenture PLC

- 7.1.5 Descartes Systems Group Inc.

- 7.1.6 DSV A/S

- 7.1.7 HighJump

- 7.1.8 CEVA Logistics

- 7.1.9 DB Schenker

- 7.1.10 Geodis