|

市场调查报告书

商品编码

1402979

轻度混合:市场占有率分析、产业趋势/统计、成长预测,2024-2029Mild Hybrid Vehicles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

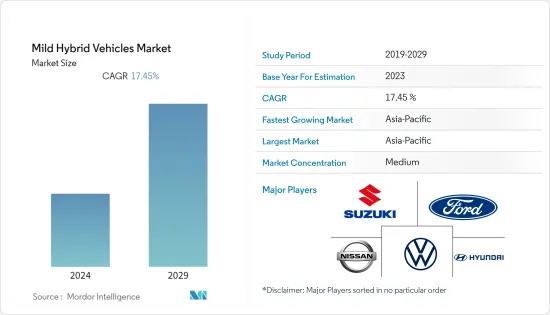

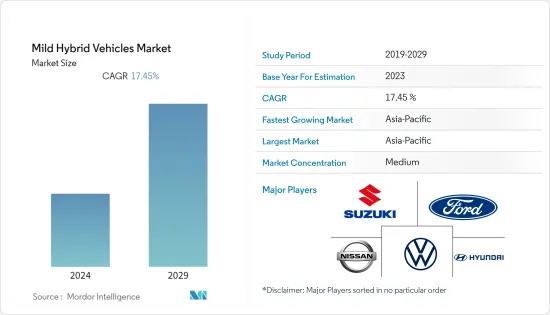

本财年轻混合市场规模预估为1003.5亿美元。

预计未来五年将达2,242.7亿美元,预测期内复合年增长率为17.45%。

严格的排放法规、燃油效率和政府激励措施是推动汽车製造商和购买者从传统汽车转向混合汽车的主要因素。然而,纯电动车的需求正在显着增长,这可能会阻碍轻度混合汽车市场的成长。

预计亚太地区在预测期内将出现加速成长。然而,某些趋势可能会阻碍印度等新兴国家的混合汽车销售成长,印度最近取消了 FAME 计画对轻度混合汽车的补贴。由于北美和欧洲专注于纯电动车和全混合汽车的成长,预计轻度混合汽车将显着成长。

轻度混合动力汽车市场趋势

48V 或更高电压的轻度混合汽车继续获得主要市场占有率

过去三年来,不少汽车製造商开始为新车标配48V轻度混合。世界各国对电压低于 48V 的轻度混合的需求正在稳定成长。

48V 或更高电压的轻度混合的主要优点之一是,它们以较低的成本提供全混合的许多优点,例如再生煞车和引擎启动停止技术。特别是对于SUV和卡车等大型车辆来说,它是提高燃油效率和减少排放气体的经济高效的选择。

包括梅赛德斯-奔驰、奥迪和宝马在内的几家主要汽车製造商都投资了48V轻度混合技术,目前该技术已应用于许多新车。例如,2022 年梅赛德斯-奔驰 S 级车采用 48V 轻度混合系统,可增加 22 马力和高达 184 磅英尺的扭矩,同时提高燃油经济性高达 10%。

世界各地的汽车製造商都在推出配备 48V 以下轻度混合系统的车辆,进一步增加了对 48V 以下细分市场的需求。

SUZUKI汽车公司、马恆达汽车公司和现代汽车公司等主要汽车製造商过去都推出了 12V 轻度混合汽车。由于最终用户的需求不断增加,製造商目前正专注于开发配备48V轻度混合系统的车辆,预计这将在预测期内对市场成长构成挑战。

亚太地区继续占据主要市场占有率

亚太地区由于汽车销量最高,占据了最大的市场份额,主要是在中国。许多车企正计划投资亚太市场,以满足混合的强劲需求。

为了长远发展和实现零排放,中国汽车製造商正在研究强大的混合动力汽车、插电式混合动力汽车、高效引擎等先进技术,同时引入48V轻度混合技术。例如,2022年9月,Volvo在印度推出了最新的汽油轻度混合系列。 2023年的产品阵容包括旗舰SUV XC90、中型SUV XC60、小型SUV XC40和豪华轿车S90的汽油轻度混合版本。

印度政府也实施了多项倡议,促进印度电动车的製造和普及,以减少排放气体,并根据快速都市化的国际惯例发展电动交通。 NEMMP(国家电动车任务计画)和 FAME I/II(印度混合动力和电动车的更快采用和製造)计画有助于提高人们对电动车的初步兴趣和关注。 FAME(印度混合动力车和电动车的更快采用和製造)计划于 2015 年首次实施,并于 2019 年更新,为消费者和国内企业提供各种奖励。例如,在FAME第二阶段,政府宣布2022年支出14亿美元。本阶段重点推动大众交通工具及共享交通电动,津贴7,090辆电动公车、50万辆电动三轮车、55万辆电动小客车、100万辆电动二轮车。

汽车製造商和政府的上述电动车计画预计将在预测期内进一步推动亚太市场轻度混合的销售。

轻度混合汽车产业概况

该市场的主要企业包括日产汽车有限公司、大众汽车集团、SUZUKI汽车公司、现代汽车有限公司、福特汽车公司和丰田汽车公司。各汽车製造商推出的新产品也刺激了对轻度混合的需求。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场驱动因素

- 排放气体消耗和减排

- 政府法规和奖励

- 市场抑制因素

- 竞争替代技术

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 容量类型

- 小于48V

- 48V以上

- 车辆类型

- 小客车

- 商用车

- 地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 其他亚太地区

- 其他地区

- 巴西

- 南非

- 其他的

- 北美洲

第六章竞争形势

- 供应商市场占有率

- 公司简介

- Toyota Motor Corporation

- Nissan Motor Co. Ltd

- Honda Motor Company Ltd

- Hyundai Motor Company

- Kia Motors Corporation

- Suzuki Motor Corporation

- Daimler AG

- Volvo Group

- Volkswagen Group

- BMW AG

- Ford Motor Company

- Audi AG

- Mitsubishi Motors Corporation

- BYD Co. Ltd

第七章 市场机会及未来趋势

- 消费者对混合技术的认知与偏好不断增强

- ADAS(进阶驾驶辅助系统)集成

The Mild Hybrid Vehicles Market size is estimated at USD 100.35 billion in the current year. It is expected to reach USD 224.27 billion within the next five years, registering a CAGR of 17.45% during the forecast period.

Stringent emission standards, fuel efficiency, and government incentives are the major factors driving automakers and buyers to shift toward hybrid vehicles from conventional vehicles. However, demand for battery-electric vehicles is growing significantly, which might hinder the growth of the mild hybrid vehicle market.

Asia-Pacific is expected to grow faster during the forecast period. However, certain trends in emerging countries, like India, may hinder the sales growth of hybrid vehicle types as the country recently removed the subsidy for mild hybrid vehicles under the FAME scheme. North America and Europe are expected to witness considerable growth for mild hybrid vehicles as these regions are focusing more on the growth of pure electric or full hybrid vehicles.

Mild Hybrid Vehicles Market Trends

48V and Above Mild Hybrid Vehicles Continue to Capture the Major Market Share

Over the past three years, many automakers started launching a 48V mild hybrid as a standard feature in their new vehicle models. The demand for mild hybrid vehicles equipped with less than 48V capacity steadily grew in various countries across the globe.

One of the key advantages of 48V and above mild hybrid vehicles is that they can offer many of the benefits of full hybrid vehicles, such as regenerative braking and engine start-stop technology, at a lower cost. It makes them a more cost-effective option for improving fuel efficiency and reducing emissions, especially for larger vehicles such as SUVs and trucks.

Several major automakers, such as Mercedes-Benz, Audi, and BMW, are investing in 48 V mild hybrid technology, and many of their new models now feature this technology. For example, the 2022 Mercedes-Benz S-Class offers a 48 V mild hybrid system that provides an additional 22 horsepower and up to 184 lb-ft of torque while also improving fuel efficiency by up to 10%.

Automobile manufacturers in various countries globally are launching vehicles with a mild hybrid system with less than 48 V capacity, which is further increasing demand for the less than 48 V capacity segment.

Leading vehicle manufacturers such as Suzuki Corporation, Mahindra, Hyundai, etc., launched vehicles with a 12 V mild hybrid in the past. With increasing demand from end users, manufacturers are now focusing on developing vehicles with a 48 V mild hybrid system, which is expected to challenge the growth of the market over the forecast period.

Asia-Pacific Continues to Capture the Major Market Share

Asia-Pacific is capturing the largest share of the market owing to the highest vehicle sales, majorly in China. Many automotive companies planned to invest in the Asia-Pacific market to cater to the strong demand for hybrid vehicles.

With an aim for long-term development and to realize the zero-emission goal, Chinese automakers are working on strong HEV, PHEV, high-efficiency engines, and other advanced technologies while introducing 48V mild hybrid technology. For instance,

- In September 2022, Volvo launched its latest range of petrol mild-hybrid cars in India. The company's 2023 line-up includes the petrol mild-hybrid version of its flagship SUV XC90, mid-size SUV XC60, compact SUV XC40, and its luxury sedan S90.

The Indian government also undertook multiple initiatives to promote the manufacturing and adoption of electric vehicles in India to reduce emissions as per international conventions and develop e-mobility in the wake of rapid urbanization.

The National Electric Mobility Mission Plan (NEMMP) and Faster Adoption and Manufacturing of Hybrid & Electric Vehicles in India (FAME I and II) schemes helped create the initial interest and exposure to electric mobility. The Faster Adoption and Manufacturing of Hybrid & Electric Vehicles in India (FAME) program, first implemented in 2015 and updated in 2019, provides consumers and domestic companies with various incentives. For instance, in phase II of FAME, the government announced an outlay of USD 1.4 billion through 2022. This phase focused on the electrification of public and shared transportation through subsidizing 7090 e-buses, 500,000 electric three-wheelers, 550,000 electric passenger vehicles, and 1,000,000 electric two-wheelers.

The above plans by automakers and governments for electric mobility are anticipated to further boost mild hybrid vehicle sales in the Asia-Pacific market during the forecast period.

Mild Hybrid Vehicles Industry Overview

Some of the major players in the market include Nissan Motor Co. Ltd, Volkswagen Group, Suzuki Motor Corporation, Hyundai Motor Company, Ford Motor Company, and Toyota Motor Corporation, among others. New product launches by various automobile manufacturers are also boosting the demand for mild hybrid cars.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Fuel Efficiency and Emissions Reduction

- 4.1.2 Government Regulations and Incentives

- 4.2 Market Restraints

- 4.2.1 Competing Alternative Technologies

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Capacity Type

- 5.1.1 Less than 48V

- 5.1.2 48V and Above

- 5.2 Vehicle Type

- 5.2.1 Passenger Car

- 5.2.2 Commercial Vehicle

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 US

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 UK

- 5.3.2.3 France

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 Brazil

- 5.3.4.2 South Africa

- 5.3.4.3 Other Countries

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share**

- 6.2 Company Profiles*

- 6.2.1 Toyota Motor Corporation

- 6.2.2 Nissan Motor Co. Ltd

- 6.2.3 Honda Motor Company Ltd

- 6.2.4 Hyundai Motor Company

- 6.2.5 Kia Motors Corporation

- 6.2.6 Suzuki Motor Corporation

- 6.2.7 Daimler AG

- 6.2.8 Volvo Group

- 6.2.9 Volkswagen Group

- 6.2.10 BMW AG

- 6.2.11 Ford Motor Company

- 6.2.12 Audi AG

- 6.2.13 Mitsubishi Motors Corporation

- 6.2.14 BYD Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Consumer Awareness and Preference for Hybrid Technology

- 7.2 Integration of Advanced Driver Assistance Systems (ADAS)