|

市场调查报告书

商品编码

1403032

汽车火星塞和电热塞:市场占有率分析、行业趋势和统计、2024-2029 年成长预测Automotive Spark Plugs And Glow Plugs - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

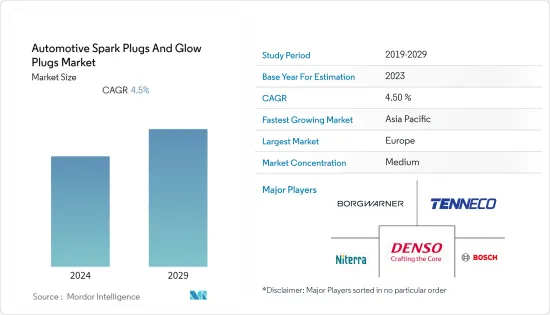

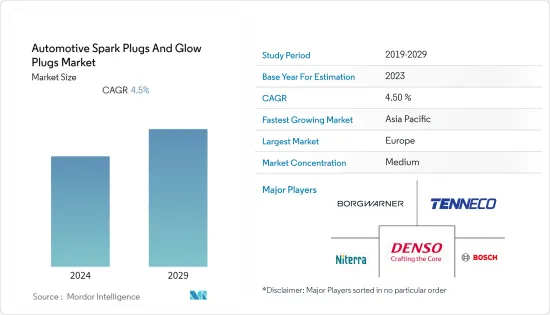

目前汽车火星塞和电热塞市场规模为75亿美元。

预计未来五年将成长至 97.7 亿美元,预测期内收益复合年增率为 4.5%。

从中期来看,随着个人和个人出行需求的增加,新车销售和售后市场销售都将大幅改善,从而改善疫情后的市场经济状况。由于重型货物运输的需求预计将增加,火星塞和电热塞的新销量和售后市场销售应该会有所改善。

推动所研究市场成长的关键因素之一是商用车需求和销售的成长(物流业和建筑业由于电子商务产业的成长而成长)。然而,电动车的普及、需求的增加和功能问题等因素可能会阻碍所研究市场的成长。

根据欧盟统计局的数据,欧盟 (EU) 内约 75% 的内陆货运(即约 1.75 兆吨公里)是透过公路进行的。在一些欧洲国家,这一比例达到90%以上。因此,该地区对商用车以及来自OEM和售后市场管道的电热塞的需求持续成长。这是由于物流业的成长以及货车(用于叫车服务服务)等轻型商用车的使用增加。

铂基和铱基火星塞应用广泛,铱基冷型火星塞主要用于高性能引擎。另一方面,由于从传统柴油发动机转向小型汽油发动机,轿车销售中对工厂安装的电热塞的需求正在下降。

汽车火星塞和电热塞市场趋势

商用车销售量增加

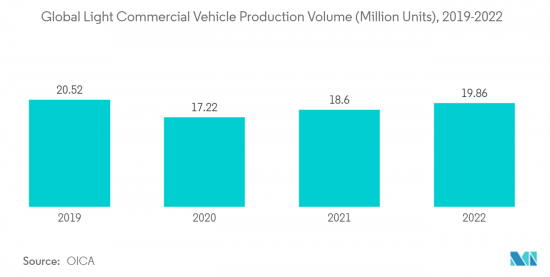

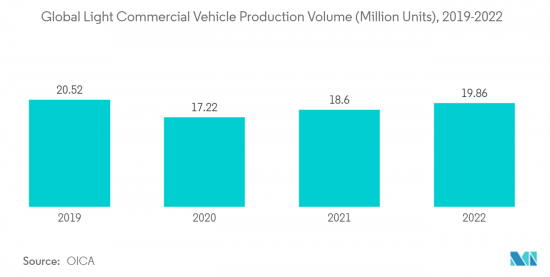

商用车在世界各地的需求量很大,其高运转率和盈利推动了车队更新和扩张活动的势头。全球强劲且持续的货运需求以及电子商务行业的成长正在推动营运商购买新的商用车辆。

整体宏观经济环境有利,各业者的运转率和盈利稳健,加速机队更新扩张。

成长的主要推动因素是全球整体(特别是欧洲、亚太地区、中东和非洲)对商用车的需求不断增长,以及与汽油引擎相比柴油引擎在商用车中的普及更高。

- 随着供应链问题的缓解,2023年上半年欧盟新货车销量将比2022年第一季成长11.2%,新卡车销售将成长20%,新卡车销售将成长15%巴士销售。

商用车在过去五年中出现了显着增长,预计这一趋势在预测期内将持续下去。商用车广泛应用于多种行业,包括建筑、物料运输和製造。

因此,这些最终用户产业的成长预计将推动商用车的需求。因此,在预测期内,火星塞和电热塞的需求可能会增加。

新兴国家和已开发国家之间的采矿和建筑业活动正在增加,预计将对市场成长做出重大贡献。此外,运输和物流业的快速成长、基础设施的进步以及全球贸易中休閒的增加预计将为市场参与企业提供新的机会。

随着上述全球发展,未来几年商用车的需求可能会扩大。

亚太地区和欧洲将在预测期内占据主要份额

商用车产销售量的成长预计将成为预测期内市场的主要驱动因素。然而,由于中国销售的大部分新小客车都配备汽油发动机,预计在预测期内小客车对电热塞的需求仍将疲软。

因此,由于物流业的成长以及货车等轻型叫车服务)的使用增加,该地区商用车以及OEM和售后市场渠道对电热塞的需求持续增加- 叫车服务)。因此,预计在预测期内,轻型商用车对轻量化汽车零件的需求将大幅增加。

法规要求轻型商用车保持在规定的重量限制内,这使得OEM必须专注于使用轻量材料製造轻型商用车。随着欧洲电子商务产业的持续成长,对更复杂的分销网路的需求不断增长。

除欧洲之外,由于电子商务的扩张,亚太地区的商用车销售也激增,导致物流、建筑和采矿业的成长。

鑑于上述趋势,预计未来对电热塞的需求将会增加。

汽车火星塞和电热塞产业概述

几家主要企业主导火星塞市场,包括 DENSO Corporation、Niterra Robert Bosch GmbH、Tenneco Inc. 和 BorgWarner Inc.。製造设施的扩建和轻量化发动机的持续引入导致该市场在未来可能会出现显着增长年。例如

- 2023年7月,电装公司与NGK火星塞开始讨论将Denso的火星塞、O2感测器、空燃比感测器等陶瓷产品转移到NGK SPARK PLUG。

- 2023年6月,Stellantis集团成员VM Motori宣布将发表其2.2升引擎的H2(氢)版本。输出:62kW,最大扭力:270Nm,共轨、活塞、火星塞、点火器线圈、调压稳压器已更新。

- 2022年6月,NGK火星塞与International Metalworking Companies BV (IMC)签署了基本协议,并开始讨论工具机业务的资本和业务联盟。透过这项协议,该公司扩大了在欧洲各地的设施。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场驱动因素

- 商用车销售量增加

- 市场抑制因素

- 电动车销售需求的增加阻碍了市场成长

- 波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔(市场规模(美元))

- 依产品类型

- 热火星塞

- 冷火星塞

- 金属电热塞

- 陶瓷电热塞

- 按车型

- 小客车

- 商用车

- 按销售管道

- 目的地设备製造商(OEM)

- 售后市场

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 世界其他地区 中东/非洲

- 南美洲

- 中东/非洲

- 北美洲

第六章竞争形势

- 供应商市场占有率

- 公司简介

- DENSO Corporation

- NGK Spark Plug Co. Ltd

- Robert Bosch GmbH

- BorgWarner Inc.

- Autolite(Fram Group LLC)

- Tenneco Inc.

- ACDelco Corporation

- Niterra Co., Ltd.

- Wellman glow plugs Co.

第七章 市场机会及未来趋势

The Automotive Spark Plugs and Glow Plugs market is valued at USD 7.50 billion in the current year. It is anticipated to grow to USD 9.77 billion by the next five years, registering a CAGR of 4.5% in terms of revenue during the forecast period.

Over the medium term, with the increased need for personal and individual mobility, both new and aftermarket sales are set to improve drastically, consequently improving the market economics after the pandemic. The expected increase in demand for heavy materials transport is bound to improve new and aftermarket sales of spark plugs and glow plugs.

One of the major factors driving the growth of the market studied is the increasing demand and sales of commercial vehicles (owing to the rise in the e-commerce sector, resulting in growth in the logistics industry and construction sector). However, factors such as growing penetration and demand for electric vehicles, as well as functional issues, may hinder the growth of the market studied.

According to the Eurostat, about 75% of inland cargo transports within the European Union, which translates to about 1,750 billion metric ton-kilometers (t km), takes place by road. In some European countries, this percentage goes as high as 90% or more. As a result, the demand for commercial vehicles and, subsequently, the glow plugs from OEM and aftermarket channels is continually increasing in the region. It is owing to the growing logistics industry, as well as the increasing usage of light commercial vehicles, such as vans (for ride-hailing services).

Platinum and Iridium-based spark plugs are the widely used varieties of which iridium-based cold-type spark plugs are majorly used in high-performance engines. On the other hand, the demand for factory-fitted glow plugs is observing a decline in the sales of sedans, owing to the transformation to down-sized gasoline engines from conventional diesel engines.

Automotive Spark Plugs And Glow Plugs Market Trends

Rise in Commercial Vehicle Sales

Commercial vehicles are witnessing high demand across the world, with high-capacity utilization and profitability driving the momentum for fleet renewal and expansion activities. Strong and sustained freight demand across the world and the growth of the e-commerce industry are propelling operators to purchase new commercial vehicles.

The overall macroeconomic environment is favorable, with robust utilization and profitability across operators boosting fleet renewals and expansions at an accelerated pace.

Increasing demand for commercial vehicles across the world, especially across Europe, Asia-Pacific, and Middle East & Africa, and higher penetration of diesel-powered engines in commercial vehicles when compared to gasoline-powered engines, is primarily driving the growth.For instance,

- In the first half of 2023, the European Union recorded an increase of 11.2% in new van sales, a 20% increase in new truck sales, and a 15% increase in new bus sales compared to Q1 2022 with the relaxation in supply chain issues.

Commercial vehicles witnessed significant growth in the last five years, and the trend is expected to continue during the forecast period. Commercial vehicles include applications in various industries, like construction, goods transportation, manufacturing industry, and various others.

Therefore, the growth of these end-user industries is anticipated to drive the demand for commercial vehicles. It, in turn, is likely to enhance the demand for spark plugs and glow plugs during the forecast period.

Growing mining and construction sector activities among developing and developed nations are expected to contribute significantly to market growth. Further, rapid growth in the transportation and logistics industry, advancements in infrastructure, and increased recreational activities in global trade are anticipated to offer new opportunities for players in the market.

With the development mentioned above across the globe, the demand for commercial vehicles is likely to grow in the coming years.

Asia-Pacific and Europe to Witness Significant share during the Forecast Period

The increasing production and sales of commercial vehicles is anticipated to be the major driving factor for the market during the forecast period. However, the majority of the new passenger cars sold in China are gasoline-powered, owing to which the demand for glow plugs from passenger cars is anticipated to remain slow during the forecast period.

As a result, the demand for commercial vehicles and, subsequently, the glow plugs from OEM and aftermarket channels is continually increasing in the region, owing to the growing logistics industry, as well as the increasing usage of light commercial vehicles, such as vans (for ride-hailing services). Thus, the demand for lightweight vehicle components to integrate into light commercial vehicles is expected to rise significantly during the forecast period.

With the regulations mandating the LCVs to stay within the stipulated weight limit, it became critical for OEMs to focus on making LCVs with lighter materials. As the e-commerce industry continues to witness growth across Europe, the demand for a more advanced distribution network is increasing.

Apart from Europe, the Asia-Pacific region is also experiencing a boom in the sales of commercial vehicles, owing to the growing e-commerce, resulting in the growth of the logistics, construction, and mining industries.

Thus, based on the developments above, the demand for glow plugs is expected to increase in the future.

Automotive Spark Plugs And Glow Plugs Industry Overview

The spark plugs and several key players, such as DENSO Corporation, Niterra Co., Ltd. Robert Bosch GmbH, Tenneco Inc., BorgWarner Inc., and others dominate the Glow plugs market. The growing expansion of manufacturing facilities and introduction of lightweight engines is likely to witness major growth for the market in the coming years. For instance,

- In July 2023, Denso Corporation and NGK Spark Plug Co., Ltd. began a discussion regarding the transfer of Denso ceramic products, such as spark plugs, O2 sensors, and air-fuel ratio sensors, to NGK Spark Plug Co., Ltd.

- In June 2023, VM Motori, a Stellantis Group company, announced to launch of an H2 (hydrogen) version of its 2.2 l engine. The engine is equipped with 62 kW output and 270 Nm peak torque, an updated common rail, pistons, spark plugs, ignition coil, and pressure regulator.

- In June 2022, NGK Spark Plug Co., Ltd. signed a basic agreement with International Metalworking Companies BV (IMC) to start discussions on a capital and business alliance in the machine tools business. Through this agreement, the company expanded its facilities across the European region,

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Rise in Commercial Vehicle Sales

- 4.2 Market Restraints

- 4.2.1 The Rise in demand for Electric Vehicle Sale Will Hinder the Market Growth

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value (USD))

- 5.1 By Product Type

- 5.1.1 Hot Spark Plug

- 5.1.2 Cold Spark Plug

- 5.1.3 Metal Glow Plug

- 5.1.4 Ceramic Glow Plug

- 5.2 By Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Commercial Vehicles

- 5.3 By Sales Channel

- 5.3.1 Original Equipment Manufacturers (OEM)

- 5.3.2 Aftermarket

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 South America

- 5.4.4.2 Middle-East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 DENSO Corporation

- 6.2.2 NGK Spark Plug Co. Ltd

- 6.2.3 Robert Bosch GmbH

- 6.2.4 BorgWarner Inc.

- 6.2.5 Autolite (Fram Group LLC)

- 6.2.6 Tenneco Inc.

- 6.2.7 ACDelco Corporation

- 6.2.8 Niterra Co., Ltd.

- 6.2.9 Wellman glow plugs Co.