|

市场调查报告书

商品编码

1403035

永磁马达:市场占有率分析、产业趋势/统计、成长预测,2024-2029Permanent Magnet Motor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

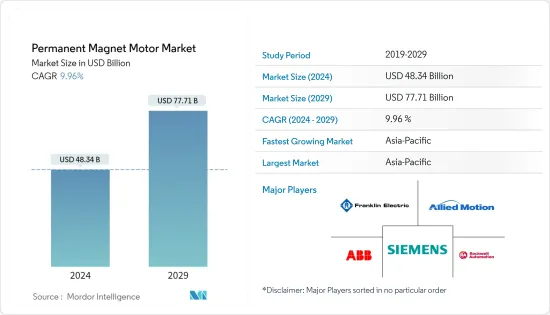

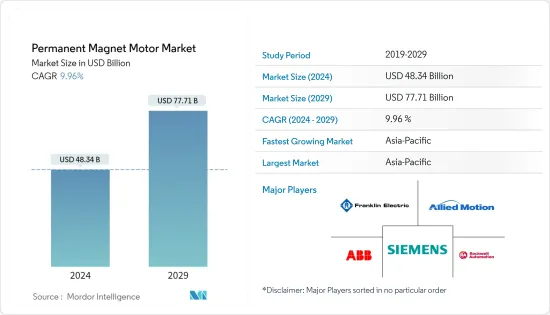

预计2024年永磁马达市场规模为483.4亿美元,预计2029年将达777.1亿美元,预测期内(2024-2029年)复合年增长率为9.96%。

市场成长背后的驱动力是对电动车的需求不断增长及其在工业领域的日益采用。提高马达效率进一步推动永磁马达在最终用户领域的采用。

主要亮点

- 永磁马达 (PMM) 由于其高效率和吞吐量,其需求正在显着增加。这些马达涵盖广泛的应用,从用于手錶的步进马达和用于工具机的工业驱动器,到用于船舶推进的大型永磁同步马达。

- 预计电动车将在预测期内推动受调查市场的成长。在全球范围内,2021 年电动车新註册量将创下前所未有的市场占有率,新兴市场也支持了这一趋势。由于主要汽车製造商越来越多地在其电动车中采用永磁电机,预计全球需求将会增加,从而推动预测期内的市场成长。

- 钕的高剩余磁通密度及其高能量性质使其成为工业应用材料的有力选择。钕有高阶和低檔版本,其采用率正在不断增加,因为与传统马达相比,它可以提供卓越的性能和扭力。然而,高价格和稀缺性可能会对这种材料的成长带来挑战。

- 对暖通空调设备的需求不断增长预计也会影响市场研究。这主要是由几个主要经济体的新家庭数量增加、平均建筑支出增加、快速都市化以及可支配收入增加所推动的。提高电器和设备的最低能源效率标准也推动了 HVAC 设备中 PMM 的成长。

- 由于地缘政治担忧和矿产资源稀缺而导致的原材料价格上涨将导致电机价格上涨,预计这将限制市场成长。稀土元素的可得性有限也给电机製造商带来了额外的挑战并增加了生产成本。

- COVID-19 的爆发迫使全球多个行业暂停几乎所有工业活动。原材料过去并且仍然来自中国,因此采购受到美国关税的影响。此外,随着COVID-19大流行的蔓延,在工业(例如製造业)中具有重要应用并在工业中广泛采用的PMM市场也受到了重大影响。

永磁马达市场趋势

直流马达占有很大份额

- 自从工业开始从感应马达马达一直在工业中流行。直流马达具有多种优点,包括易于操作、尺寸紧凑和无需进一步控制即可实现性能。

- PMDC 马达效率很高,能够以较小的外形尺寸提供相当大的功率和扭力。而且,它广泛应用于各种应用,并且可以轻鬆与电池整合。它们的小尺寸和与电池配合使用的能力使其可用于许多新行业和应用,包括无人机、再生煞车和电动工具。

- PMDC 马达用于多种应用,包括汽车零件(包括空调和加热器中使用的窗户和鼓风机)、电脑磁碟和驱动器,以及玩具和小型机器人等小额定功率功率设备。

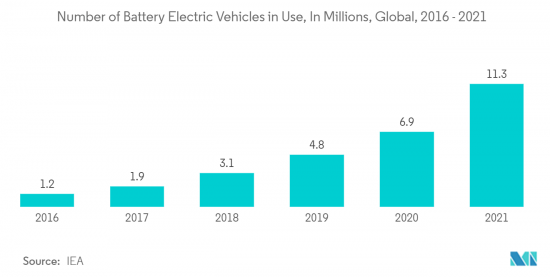

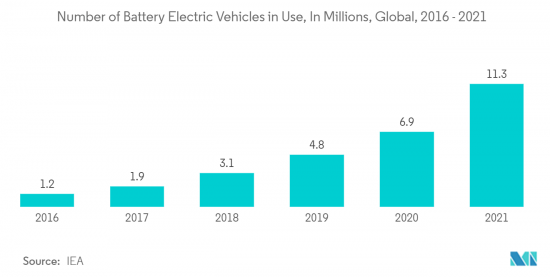

- 近年来,世界见证了电动车的出现。电动车通常被认为是汽车市场的未来。电动车中 PMDC 马达的采用增加以及特斯拉汽车等大公司的投资增加预计将提振市场。 IEA 预计,全球纯电动车销量将从 2021 年的约 46 亿辆增至 2022 年的约 730 万辆。

- 此外,随着各国寻求快速采用电动车以实现永续的未来,市场正在见证许多开拓。例如,2022 年 7 月,印度理工学院 Kharagpur 开发了一种本土生产、高效且廉价的电动人力车智慧控制器,作为电子和资讯技术部 (MeitY)电动车子系统本土化计画的一部分。此智慧型控制器采用直流电压供电的无刷DC马达(BLDC)。

北美占据主要市场占有率

- 由于市场相关人员和其他组织的投资不断增加,加上政府为创造节能和永续环境所采取的倡议,北美地区预计将在全球占据重要份额。在预测期内,强劲的风力发电产业将在该地区成长,并推动永磁体市场的成长。

- 随着对节能解决方案的日益关注,该地区各行业正在各个工厂营运部门实施 PMM,从而扩大了 PMM 市场。加拿大透过 CIPEC(加拿大节能产业计画)等计画重点关注能源消耗。

- Geomega Resources Inc. 是一家用于采矿和回收的稀土清洁技术开发商,正在与美国稀土公司(西德克萨斯州圆顶重稀土和关键矿物项目的资金筹措和开发合作伙伴)合作,以提高稀土产量-含有材料。我们也致力于废弃物废弃物。这些废弃物是美国稀土公司在美国生产烧结钕铁硼永磁体(烧结磁铁)时产生的。希望这些努力能够鼓励该地区采用 PMM,特别是在该地区的主要行业这一领域。

- 此外,匹兹堡大学的研究人员与俄亥俄州先进材料研发公司 Powdermet Inc. 合作,开发了一种不含稀土矿物的电动马达。该计划将製造电子机械。

永磁马达产业概况

永磁马达市场竞争激烈。市场上的现有公司可以透过投资创新和研发来获得优势并占领更大的市场占有率。由于市场渗透率的提高和市场参与者制定强有力的竞争策略,竞争公司之间的敌意预计将进一步加剧。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 对市场的影响

- 技术简介

第五章市场动态

- 市场驱动因素

- 利用永磁体提高马达效率

- 电动车需求增加

- 工业领域对永磁马达(PMM)的需求增加

- 市场挑战

- 稀土金属可得性减少

第六章市场区隔

- 马达类型

- 直流 (DC) 电机

- 交流 (AC) 电机

- 磁性材料材料类型

- 铁氧体

- 钕

- 钐钴

- 其他磁性材料材料类型

- 最终用户产业

- 车

- 一般工业

- 活力

- 用水和污水管理

- 采矿、石油和天然气

- 航太/国防

- 其他最终用户产业

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章竞争形势

- 公司简介

- Siemens AG

- Rockwell Automation

- ABB Limited

- Franklin Electric Company Inc.

- Allied Motion Technologies Inc.

- Toshiba Corporation

- Ametek Inc.

- Johnson Electric Holdings Ltd

- GIC Manufacturing, LLC(Autotrol Corporation)

- Robert Bosch GmbH

- Danaher Corporation

- Bonfiglioli Group

- Aerotech Corporation

- Crouzet Automatismes

- Buhler Motors GmbH

- Nidec Corporation

第八章投资分析

第9章市场的未来

The Permanent Magnet Motor Market size is estimated at USD 48.34 billion in 2024, and is expected to reach USD 77.71 billion by 2029, growing at a CAGR of 9.96% during the forecast period (2024-2029).

The market growth is driven by growing demand for electric vehicles and increased adoption in the industrial sector. Advancement in motor efficiency further fuels the adoption of permanent magnetic motors in end-user verticals.

Key Highlights

- Permanent magnet motors (PMM) are witnessing a significant increase in demand due to their high efficiency and throughput. These motors cover a wide range of applications, from stepping motors for wristwatches and industrial drives for machine tools to large PM synchronous motors for ship propulsion.

- Electric vehicles are expected to boost the growth of the market studied over the forecast period. The number of new electric cars registered globally hit an unprecedented market share in 2021, with the developed markets supporting this trend. With leading automakers increasingly incorporating permanent magnet motors into EVs, global demand is expected to rise, driving the market's growth over the forecast period.

- The high energy product, along with the high residual flux density of neodymium, make it a compulsive choice of material for industrial applications. Neodymium offers both high- and low-grade variants, enabling it to deliver superior performance and torque as compared to a conventional motor, thereby increasing its adoption. However, high prices and scarcity are likely to pose challenges to the growth of this material.

- The increasing demand for HVAC equipment is also expected to influence the market studied. It is majorly driven by the increase in the number of new households, rising average construction spending, rapid urbanization, and growth in disposable income across several major economies. The increasing standards on minimum energy efficiency for appliances and equipment are also driving the growth of PMMs in HVAC equipment.

- The increasing price of raw materials due to geopolitical concerns and scarcity of minerals sources results in increasing price of motors, which is expected to restrict market growth. Also, the limited availability of rare-earth metals further create challanges for the motor manufacturers and increase the production cost.

- The COVID-19 outbreak forced several industries to halt almost every industrial operation globally. Since the raw materials were and still are bought in from China, the sourcing was affected by the United States' tariffs. Further, amidst the pandemic spread of COVID-19, the market for PMMs, which has a significant application in industries (such as the manufacturing sector) and sees substantial adoption on the industrial front, was highly impacted.

Permanent Magnet Motor Market Trends

Direct Current Motor Holds Significant Share

- Permanent DC motors have been popular in the industry since the industry started shifting from induction motors. DC motors offer a few advantages, such as ease of operation, compact size, and the ability to perform without further control.

- PMDC motors are highly efficient and can provide considerable power and torque in a tiny form factor. Additionally, they can be easily interfaced with batteries because they have been widely used in various applications. Their small size and ability to work with batteries make them useful in many new industries and applications, such as drones, regenerative braking, power tools, etc.

- PMDC motors have various applications in automobile components, which include windows and blowers used in AC and heaters, in personal computer disks and drives, as well as small power ratings equipment like toys and small robots.

- In recent years, the world has witnessed the advent of electric vehicles. Electric cars are often considered the future of the automotive market. Increasing adoption of PMDC motors in electric cars and increasing investments by leading players, like Tesla Motors, are expected to boost the market. The number of battery electric vehicles sold worldwide was approximately 7.3 million units in 2022, increase from around 4.6 billion in 2021, as per the IEA.

- Moreover, the market is witnessing a lot of developments as countries look for faster deployment of electric vehicles with an aim to move towards a sustainable future. For instance, in July 2022, IIT Kharagpur developed an indigenous, efficient, and affordable smart controller for e-rickshaws as a part of the Ministry of Electronics and Information Technology's (MeitY) program for indigenous development of electric vehicle subsystems. The smart controller uses a brushless DC motor (BLDC) powered by a direct current voltage supply.

North America Holds Significant Market Share

- The North American region is expected to hold a significant share globally due to the increasing investments by market players and other organizations, coupled with government initiatives toward building an energy-efficient and sustainable environment. The strong wind energy sector is set to grow in the region and boost the growth of the permanent magnet market during the forecast period.

- With the focus on energy-efficient solutions rising, industries across the region are deploying PMM across various factory operation segments, thereby augmenting the market for PMM. Canada is focusing heavily on energy consumption with programs like CIPEC (Canada Industry Program for Energy Conservation).

- Geomega Resources Inc., a rare earth cleantech developer for mining and recycling, also worked with USA Rare Earth, a funding and development partner of the Round Top-Heavy Rare Earth and Critical Minerals Project West Texas, to recycle rare earth-containing production waste. This waste comes from USA Rare Earths production of sintered neodymium iron boron permanent magnets (sintered neo magnets) in the United States. Such initiatives are expected to boost the adoption of PMMs in the region, especially in this sector, which is a major industry in the region.

- Furthermore, researchers at the University of Pittsburgh partnered with Powdermet Inc., an advanced materials research and development company in Ohio, to develop a rare-earth mineral-free electric motor. The project will create an electric machine that uses permanent magnets made of more abundant metals instead of rare-earth metals.

Permanent Magnet Motor Industry Overview

The Permanent Magnet Motor Market is highly competitive. Market incumbents can gain an advantage and garner a larger market share with innovations and investments in R&D. The intensity of competitive rivalry is expected to increase further, owing to increasing market penetration and the deployment of powerful competitive strategies by market players.

- July 2023 - Delta Line announced a new range of brushed permanent magnet DC motors in three sizes 52DI, 42DI, and 63DI. These new motors feature nominal torque up to 0.22Nm in 52mm, 0.06Nm in 42mm, and 0.27Nm in 63mm.

- July 2022, Collins Aerospace announced the development of the first working prototype of its 500-kilowatt electric motor for Airlander 10 aircraft in partnership with Hybrid Air Vehicles and the University of Nottingham. Collins wants the 2,000 rpm permanent magnet electric motor to have a power density of 9 kW/kg and an efficiency of 98%. He does this by using a new motor topology and a composite construction.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 on the Market

- 4.5 Technology Snapshot

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Motor Efficiency due to Permanent Magnets

- 5.1.2 Rising Demand for Electric Vehicles

- 5.1.3 Rising Demand for Permanent Magnet Motor (PMM) in the Industrial Sector

- 5.2 Market Challenges

- 5.2.1 Diminishing Availability of Rare-earth Metals

6 MARKET SEGMENTATION

- 6.1 Motor Type

- 6.1.1 Direct Current (DC) Motor

- 6.1.2 Alternating Current (AC) Motor

- 6.2 Magnetic Material Type

- 6.2.1 Ferrite

- 6.2.2 Neodymium

- 6.2.3 Samarium Cobalt

- 6.2.4 Other Magnetic Material Types

- 6.3 End-user Vertical

- 6.3.1 Automotive

- 6.3.2 General Industrial

- 6.3.3 Energy

- 6.3.4 Water and Wastewater Management

- 6.3.5 Mining, Oil, and Gas

- 6.3.6 Aerospace and Defense

- 6.3.7 Other End-user Verticals

- 6.4 Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Siemens AG

- 7.1.2 Rockwell Automation

- 7.1.3 ABB Limited

- 7.1.4 Franklin Electric Company Inc.

- 7.1.5 Allied Motion Technologies Inc.

- 7.1.6 Toshiba Corporation

- 7.1.7 Ametek Inc.

- 7.1.8 Johnson Electric Holdings Ltd

- 7.1.9 GIC Manufacturing, LLC (Autotrol Corporation)

- 7.1.10 Robert Bosch GmbH

- 7.1.11 Danaher Corporation

- 7.1.12 Bonfiglioli Group

- 7.1.13 Aerotech Corporation

- 7.1.14 Crouzet Automatismes

- 7.1.15 Buhler Motors GmbH

- 7.1.16 Nidec Corporation