|

市场调查报告书

商品编码

1637809

实验室机械臂-市场占有率分析、产业趋势/统计、成长预测(2025-2030)Robotic Arms In Laboratories - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

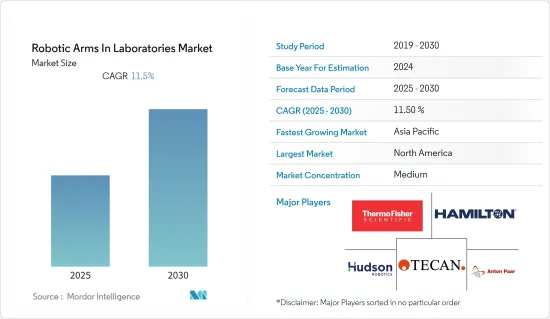

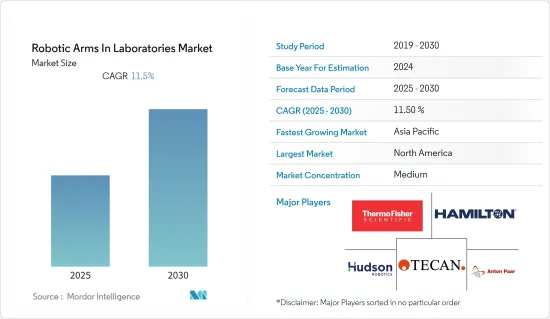

实验室机械臂市场预计在预测期内复合年增长率为 11.5%。

机械臂正在迅速应用于研究实验室,用于需要灵活性、有效空间利用和周边设备无缝整合的应用。这款手臂易于编程,因此得到越来越多的采用。样品製备、分析仪器操作和样品处理是这些机器人执行的典型业务。因此,实验室自动化已成为实验室机械臂使用的主要驱动力。

主要亮点

- 机械臂广泛应用于检测开发、细胞生物学、生物检测验证、DNA 定量、PCR 设定、净化等。它们针对处理标准实验室设备(例如微孔盘、储液槽和一次性吸头架)进行了最佳化。它们还可用于装载和卸载基于微孔盘的实验室设备,例如读取器、清洗和试剂分配器。

- 此外,在生物医学研究中,机械臂主要用于样本处理。机器人在药物发现过程中的影响力有限,这就是为什么开发、测试和商业化过程平均需要15至20年的时间。实验室自动化和机器人技术(尤其是人工智慧和机器学习)的最新改进为生命科学和製药领域创造了新的前沿。我们现在可以以超出人类能力的速度和准确性完成任务。

- 例如,FDA 药物评估与研究中心 (CDER) 最近核准了50 种全新药物和生技药品。在核准的50种新药和生技药品中,有33种是小分子,17种是单株抗体等大分子药物。然而,近年来生技药品的核准数量一直在稳步增加。如此庞大的药物核准数量可能是研究目标市场背后的驱动力。

- 此外,由于协作机械臂具有稳定性、高精度、重复性、多自由度、移动性、远端控制等明显优势,在医学影像和手术中的应用已经有一段时间了。机器人手术现在已成为许多外科手术的现实。根据英国国家卫生服务局的数据,2021 年 4 月至 2022 年 3 月期间,英国报告了 4,330 万次影像检查。预计 2022 年 3 月进行了 367 万次影像检查。 2022 年 3 月,最常见的诊断影像类型是平片(X 光),有 182 万例,其次是诊断超音波(85 万例)、电脑断层扫描(电脑断层扫描)和磁振造影(56 万例) 。

- 此外,由于患者数量的增加以及可检测的检测项目的增加,送往实验室的检测项目的数量也在增加。然而,需要更多的人员来处理这些样本,医疗设施也需要人力。根据劳工统计局的数据,对实验室技术人员的需求正在增加。例如,美国医学院协会 (AAMC) 预测,到 2030 年,临床医生短缺 42,600 名,到年终,临床医生短缺 121,300 名。预计这将推动研究市场的需求。

- 此外,俄罗斯和乌克兰之间的战争正在影响电子元件供应链。衝突可能会扰乱供应链,导致原材料短缺和价格上涨,影响机械臂製造商并导致最终用户的成本更高。

实验室机械臂市场趋势

基因组学和蛋白质组学应用预计将占据主要市场占有率

- 基因组学是指生物体整个基因组的研究,同时结合遗传学的元素。科学家不断寻求提高先进基因序列测定的准确性、增加通量并降低成本。自动化通常使这一切成为可能,而这是大多数实验室无法实现的。

- 近年来技术的进步、临床研究投资的增加以及计算能力的提高导致了资料分析的进步,揭示了以前未知的相关性、隐藏的模式和其他见解,特别是在测试大型资料集时。显着提高。此外,新的医学进步正在迅速发生,这主要归功于基因组分析的最新趋势。 DNA 序列分析可以让我们更清楚地了解遗传变异如何导致疾病,进而带来新的治疗方法。据 NIH 称,美国国立卫生研究院的临床研究经费为 180 亿美元。

- 此外,实验室自动化为更大的灵活性、更高的通量和经济实惠的解决方案创造了空间。它提供更快的处理速度,让您可以加快流程,而不必担心缺乏可靠性和准确性。基因型鉴定和 DNA定序已经变得负担得起,而且增长速度稳定。自动化大规模定序过程中的几乎每一步,包括分离 DNA、克隆或扩增 DNA、准备酶促定序反应、精製DNA,以及透过分离 DNA 片段并用萤光标记检测来获得 DNA 序列。

- 基因组学具有提高医疗效果和加速精准医疗的潜力,但最有前景的领域之一是将基因检测引入临床检测。随着科学的突飞猛进以及人们对基因组学影响的认识不断增强,有必要也有机会最大限度地发挥所收集样本及其生成的资料的价值。因此,临床开发和研究的各个阶段都广泛需要基因样本收集。

- 2022 年 4 月,由印度 38 个基因组序列测定机构组成的 INSACOG(印度 SARS-CoV-2 基因组学联盟)报告称,估计 1 月至 4 月印度已对 89,860 个样本进行了序列测定。目前总合240,570 个样本已完成定序。印度所有病例中只有 0.397% 得到了定序。这是根据全球最广泛的新型冠状病毒基因组序列资料库GISAID(全球禽流感资料共享倡议)的最新资料得出的。基因组学可用于识别病毒模式并预防未来的突变。对基因组学和蛋白质组学不断增长的需求预计将为所研究市场的成长提供有利可图的机会。

- 此外,核酸分离、RNAi筛检、CRISPR 分析、PCR 和基因表现分析只是使用自动化的基因组学应用的一部分。实验室自动化参与企业/供应商正在开发工具来满足这些应用要求。例如,Tecan集团最近宣布推出新的「Fluent自动化工作站」平台。该平台包含多种功能,可简化日常实验室自动化并提高工作流程生产力。该技术在执行过程中动态反应,根据实际时间进行调整,以持续保持最佳吞吐量,透过易于理解的甘特图即时可见。

预计北美将占据主要市场占有率

- 美国长期以来一直是临床研究的先驱。该国是辉瑞、葛兰素史克、强生和诺华等主要製药公司的所在地。政府也拥有最集中的委外研发机构(CRO)。该国重要的 CRO 包括 Laboratory Corp. of America Holdings、IQVIA、SyneosHealth 和 Parexel International Corp.。

- 由于主要行业参与者的存在和严格的 FDA 法规,该国的市场竞争非常激烈。国内公司越来越多地在实验室中实施机器人和自动化技术,以获得相对于竞争对手的优势。

- 2022 年 2 月,Auris Health 和 Kinova 同意续约五年合约。透过这项协议,Kinova 将继续支援 Auris 发展机器人辅助手术的 Monarch 平台。该协议还包括将合作关係再延长三年的选项。 Auris 团队与加拿大机械臂专家 Kinova 合作开发了机械臂,将支援外科手术的重大进步。 Monarch 平台适用于治疗性和诊断性支气管镜手术。

- 此外,杜克大学的工程师和眼科医生最近开发了一种机器人成像设备,可以自动识别患者的眼睛并扫描其是否有各种眼部疾病的征兆。新设备结合了机械臂和影像扫描仪,可以在不到一分钟的时间内自动追踪患者的眼睛并对其进行成像,从而产生与专业眼科诊所使用的传统扫描仪相当的清晰影像。此类创新产品在该国的扩张可能会进一步推动所研究市场的成长。

- 此外,该国拥有数量最多的合约研究组织(CRO)。 Syneos Health、IQVIA、Laboratory Corp. of America Holdings 和 Parexel International Corp. 是美国最大的 CRO。由于所有主要竞争对手的存在以及 FDA 的严格监管,该国的市场竞争非常激烈。这里的公司正在实验室中迅速利用机器人和自动化,以获得相对于竞争对手的竞争优势。

- 据 ClinicalTrials.gov 称,机器人和自动化的实施是支持临床研究领域发展的关键因素,美国最近提交了超过 129,005 份临床试验申请。此外,由于机器人和自动化的采用增加,近年来 FDA 的核准显着增加。

实验室机械臂行业概况

Thermo Fisher Scientific、Hamilton、 Hudson Robotics、Tecan Group 和 Anton Paar 等主要企业已製造出半固体实验室机械臂。市场参与企业正在采取联盟和收购等策略来加强其产品供应并获得可持续的竞争优势。

- 2024 年 1 月,SRI 的 XRGo 机器人平台将透过确保无尘室无菌并在大批量生产线和其他危险环境的维护期间保护工人来彻底改变製药业。直觉的远端操作软体使操作员能够对机械臂进行精细控制,并在不干扰环境的情况下促进远端干预。

- 2023年12月,ABB机器人与晶泰科技将达成策略伙伴关係关係,在中国开发一系列自动化实验室工作站。这些最先进的实验室显着提高了生物製药、化学工程、化学和新能源材料研发过程的生产力。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 评估宏观经济趋势对市场的影响

第五章市场动态

- 市场驱动因素

- 实验室自动化的上升趋势

- 人们对实验室工作安全的兴趣日益浓厚

- 市场限制因素

- 昂贵的初始设置

第六章 市场细分

- 按类型

- 多关节臂

- 双臂

- 平行连桿臂

- 其他的

- 按用途

- 药物发现

- 数位影像

- 基因组学和蛋白质组学

- 临床诊断

- 系统生物学

- 其他的

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲/纽西兰

- 拉丁美洲

- 中东/非洲

第七章 竞争格局

- 公司简介

- Thermo Fisher Scientific Inc.

- Hamilton Company

- Hudson Robotics, Inc.

- Tecan Group

- Anton Paar GmbH

- Biomrieux SA

- Siemens Healthineers AG

- Beckman Coulter Inc.

- Perkinelmer Inc.

- QIAGEN NV

- Abbott Laboratories

第八章投资分析

第9章市场的未来

The Robotic Arms In Laboratories Market is expected to register a CAGR of 11.5% during the forecast period.

Robotic arms are rapidly being used in research laboratories for applications that need flexibility, effective space use, and seamless integration of lab peripherals. With the simplicity with which the arms may be programmed, the adoption has expanded over time. Preparing samples, running analytical equipment, and handling sample material are typical duties these robots do. As a result, lab automation is the primary driver of laboratory robotic arm use.

Key Highlights

- Robotic arms are widely used in assay development, cell biology, bioassay validation, DNA quantification, PCR setup, and cleanup. These are optimized for handling standard labware, like microplates, reservoirs, and disposable tip racks. These are also helpful for loading and unloading microplate-based lab instruments, such as readers, washers, and reagent dispensers.

- Further, biomedical research has employed robotic arms primarily to process samples. Their influence in the drug discovery process remained limited, which explains why the development, testing, and commercialization process takes 15 to 20 years on average. Recent improvements in laboratory automation and robotics, particularly in AI and ML, have created a new frontier in life science and pharmaceutical. Tasks can now be completed at rates and precision that exceed human competence.

- For instance, the FDA's Center for Drug Evaluation and Research (CDER) recently approved 50 brand-new pharmaceutical and biological products. 33 of the 50 novel medications and biological products approved for usage had tiny molecules, while 17 were monoclonal antibodies and other large molecules. However, the number of biological approvals has constantly risen during the past few years. Such huge approvals for drugs will drive the studied market.

- Furthermore, due to its apparent benefits, including stability, high precision, repeatability, many degrees of freedom, mobility, and remote control, collaborative robotic arms have been used with medical imaging and operations for a while. In many surgical procedures, robotic surgery is now a reality. According to National Health Service (United Kingdom), 43.3 million imaging tests were reported between April 2021 and March 2022 in England. 3.67 million imaging tests were said to have been performed in March 2022. The most prevalent type of imaging in March 2022 was plain radiography (X-rays), with 1.82 million cases, followed by diagnostic ultrasound (0.85 million), computerized axial tomography (CT-scan), and magnetic resonance imaging (0.56 million).

- Moreover, more tests are being sent to the lab due to a higher number of patients and an increasing number of tests available. However, the need for more staff to process these samples leaves medical facilities needing help. According to the Bureau of Labor Statistics, the demand for lab workers is growing. For instance, the American Association of Medical Colleges (AAMC) predicted that by 2030 there would be a shortage of 42,600 and 121,300 clinicians by the end of the following decade. This would drive the demand for the studied market.

- Furthermore, the Russia-Ukraine war is impacting the supply chain of electronic components. The dispute has disrupted the supply chain, causing shortages and price increases for raw materials, affecting robotic arms manufacturers and potentially leading to higher costs for end-users.

Laboratory Robotic Arm Market Trends

Genomics and Proteomics Application is Expected to Hold Significant Market Share

- Genomics refers to the study of whole genomes of organisms while incorporating elements from genetics. Scientists always look for improved accuracy, higher throughput, and reduced cost during advanced gene sequencing. Though most labs lack access, automation has often delivered all these.

- With the technological advancements, increasing investments in clinical research, and computational capacities over the past few years, there has been significant improvement in knowledge of genome sequencing in terms of data analytics advances that show unknown correlations, hidden patterns, and other insights, specifically when testing data sets on a large scale. Moreover, novel medical advances are being made rapidly, mainly due to recent developments in genome analysis. DNA sequence analysis provides a clearer understanding of how genetic variation leads to disease and, thus, will lead to new cures. According to NIH, clinical research funding by the National Institute of Health was USD 18 billion.

- Furthermore, laboratory automation has made room for great flexibility, higher throughputs, and affordable solutions. It offers faster handling, and the process can be expedited without worrying about a lack of reliability and precision. Genotyping and DNA sequencing have been affordable, and the growth rate is robust. Some instruments can automate nearly every step of the large-scale sequencing process: isolating DNA, cloning or amplifying DNA, preparing enzymatic sequencing reactions, purifying DNA, and separating and detecting DNA fragments with fluorescent labels to obtain DNA sequences.

- Although genomics has the potential to increase medicine efficacy and speed up precision healthcare, one of the most promising areas is the introduction of genetic testing into clinical trials. With breakthroughs in science and growing awareness of the effect of genomics, there is a need and an opportunity to maximize the value of the gathered samples and the data generated from them. As a result, obtaining genetic samples is extensively urged at all phases and studies of clinical development.

- In April 2022, INSACOG (Indian SARS-CoV-2 Consortium on Genomics), a group of 38 genome sequencing institutes in India, published a report in which it was estimated that India sequenced 89,860 samples between January and April. There are now 240,570 sequenced samples in total. Only 0.397 percent of India's total cases have been sequenced. According to the most recent data from the Global Initiative on Sharing Avian Influenza Data (GISAID), the world's most extensive database of new coronavirus genome sequences, this is the case. Using genomics will enable the identification of the pattern of the virus and prevent future mutation spread. The increasing need for Genomics & Proteomics is anticipated to be a lucrative opportunity for the studied market's growth.

- Furthermore, nucleic acid isolation, RNAi screening, CRISPR analysis, PCR, and gene expression analysis are just a few of the genomics applications that use automation. Laboratory automation players/vendors are developing tools to meet these application requirements. Tecan Group, for example, recently introduced their new "Fluent Automation Workstation" platform, which incorporates various capabilities to simplify day-to-day laboratory automation and increase workflow productivity. The technique reacts dynamically during a run, making adjustments based on actual times to maintain continuous optimal throughput, visible in real time via an easy-to-understand Gantt chart.

North America is Expected to Hold the Significant Market Share

- The United States has been a pioneer in clinical research for years. This country is home to major pharmaceutical companies, like Pfizer, Novartis, GlaxoSmithKline, J&J, and Novartis. The government also has the highest concentration of contract research organizations (CROs). Some of the significant CROs in the country are Laboratory Corp. of America Holdings, IQVIA, SyneosHealth, and Parexel International Corp.

- Owing to the presence of all the major players in the industry and stringent FDA regulations, the market is very competitive in the country. Companies in the country are increasingly adopting robotics and automation in labs to gain an advantage over competitors.

- In February 2022, Auris Health and Kinova agreed to a five-year contract extension. In accordance with the deal, Kinovawould keep assisting Auris in growing its Monarch Platform, which is intended for robotic-assisted surgery. An option to prolong the relationship for a further three years is part of the agreement. To define and create a purpose-built robotic arm to support substantial advancement in surgery, the team at Auris collaborated with Kinova, a Canadian business specializing in robotic arms. The Monarch Platform is intended for therapeutic and diagnostic bronchoscopic operations.

- In addition, Duke University engineers and ophthalmologists recently created robotic imaging equipment that can automatically identify and scan a patient's eyes for signs of various eye illnesses. The new device, which combines a robotic arm and an imaging scanner, can automatically track and picture a patient's eyes in less than a minute and generate images as clear as those from conventional scanners used in specialized eye clinics. Such expansion of innovative products in the country may further drive the studied market growth.

- In addition, the country has the most significant number of contract research organizations (CROs). Syneos Health, IQVIA, Laboratory Corp. of America Holdings, and Parexel International Corp. are among the country's largest CROs. The market in the nation is exceptionally competitive, thanks to the presence of all of the main competitors in the business and strict FDA rules. Companies in the country are rapidly using robots and automation in labs to get a competitive advantage over competitors.

- According to ClinicalTrials.gov, incorporating robots and automation has been a critical component assisting the development of the clinical research sector, with more than 129,005 clinical trials filed in the United States recently. Furthermore, due to the growing adoption of robots and automation, there has been a considerable increase in FDA approvals in recent years.

Laboratory Robotic Arm Industry Overview

The Robotic Arms in Laboratories is semi-consolidated with the presence of major players like Thermo Fisher Scientific Inc., Hamilton Company, Hudson Robotics, Inc., Tecan Group, and Anton Paar GmbH. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- January 2024: SRI's XRGo robotic platform is set to revolutionize the pharmaceutical industry by ensuring cleanrooms remain sterile and safeguarding workers during maintenance on high-volume production lines and in other hazardous environments. With its intuitive telemanipulation software, operators can exert fine control over a robotic arm, facilitating remote interventions without disturbing the environment.

- December 2023: ABB Robotics and XtalPi have established a strategic partnership to develop a series of automated laboratory workstations in China. These cutting-edge laboratories will significantly enhance the productivity of R&D processes in biopharmaceuticals, chemical engineering, chemistry, and new energy materials.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of Impact of Macroeconomic Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Trend of Lab automation

- 5.1.2 Increasing Focus Towards Work-safety in Laboratories

- 5.2 Market Restraints

- 5.2.1 Expensive Initial Setup

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Articulated Arm

- 6.1.2 Dual Arm

- 6.1.3 Parallel Link Arm

- 6.1.4 Others

- 6.2 By Application

- 6.2.1 Drug Discovery

- 6.2.2 Digital Imaging

- 6.2.3 Genomics & Proteomics

- 6.2.4 Clinical Diagnostics,

- 6.2.5 System Biology

- 6.2.6 Others

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Thermo Fisher Scientific Inc.

- 7.1.2 Hamilton Company

- 7.1.3 Hudson Robotics, Inc.

- 7.1.4 Tecan Group

- 7.1.5 Anton Paar GmbH

- 7.1.6 Biomrieux SA

- 7.1.7 Siemens Healthineers AG

- 7.1.8 Beckman Coulter Inc.

- 7.1.9 Perkinelmer Inc.

- 7.1.10 QIAGEN NV

- 7.1.11 Abbott Laboratories