|

市场调查报告书

商品编码

1403078

表面计算:市场占有率分析、产业趋势/统计、成长预测,2024-2029 年Surface Computing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

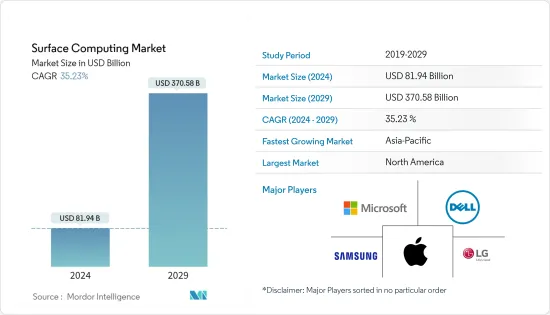

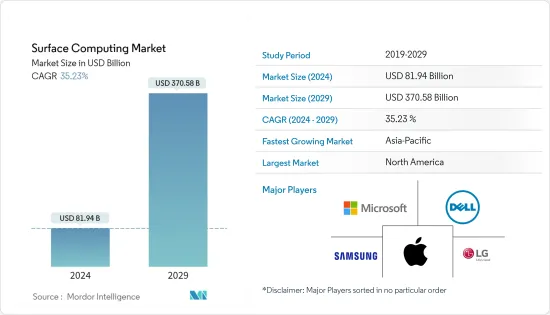

表面计算市场规模预计到 2024 年为 819.4 亿美元,预计到 2029 年将达到 3705.8 亿美元,在预测期内(2024-2029 年)复合年增长率为 35.23%。

主要亮点

- 表面计算是一种新的计算型态,可让您将桌面表面作为电脑介面进行工作。表面计算使用专用的电脑 GUI,因为传统的 GUI 被直觉的物件所取代。表面运算开启了使用者可以互动的全新产品类别。

- 微软是第一家引进表面运算概念的公司。 Microsoft Surface 技术允许将非数位物件用作输入装置。 Microsoft Surface 是 Microsoft 推出的首款商用表面计算机,它是一个革命性的表面计算平台,可响应自然手势以及现实世界物件在显示器上的放置。 Microsoft Surface 使用大型 360 度水平使用者介面来创建一个独特的聚集场所,多个使用者可以同时协作并与资讯和内容互动。使用者还可以透过在萤幕上触摸和拖曳指尖或画笔等对象,以及定位和移动放置的对象来与机器互动。

- 此外,商用多点触控技术(例如 Microsoft 和 SMART Technologies 的技术)使表面运算能够在实验室以外的场所使用,例如企业、零售店、酒店、学校、餐厅甚至医院。预计将成为预测期内市场成长的驱动力。此外,微软Surface具有独特的功能,可让企业设计创新宣传活动来获取和转化新客户、交叉销售产品和服务、提高客户忠诚度并提高业务效率。

- COVID-19大流行的一个积极方面是技术的使用增加。 PC市场是少数几个需求大幅成长的市场之一,因为由于各种限制以及大多数企业组织采用的远距工作模式,人们大多被限制在家中。由于混合工作模式预计将在 COVID-19 后持续存在,个人电脑及相关行业可能会出现持续的需求。

- 介面设计的复杂性和多向媒体是重要的市场议题。由于可用功能较少且普及较高,预计 Surface 计算机的采用将受到限制。由于行业内的激烈竞争,表面计算市场遇到了重大障碍,导致参与者采用多用户和表面计算技术。

表面计算市场趋势

零售业预计将占据主要市场占有率

- 零售业对錶面计算市场的成长具有巨大潜力。表面运算不仅使交易变得更快、更轻鬆,还为企业主提供了个人化的运算环境。表面运算还可以帮助公司透过减少纸张、墨水和其他办公用品的浪费来促进绿色措施。

- 透过将实体店与数位体验连接起来,零售商可以更好地服务客户,并创建从销售楼层和商店到最高管理层的更互联的组织。线下商家正在拥抱新的商业模式,例如非接触式购物和路边取货。这是一个巨大的转变,将帮助消费者找到他们想要的东西,预测需求,并为零售商在竞争的市场中创造新的机会。

- 同样,根据印度零售商协会(RAI) 的数据,2021 年2 月,零售业实现了COVID-19 之前销售额的93%,而耐用消费品和快餐店(QSR) 分别实现了15% 和18% 的增长。

- 此外,2023年5月,中国超级市场麦德龙推出了名为「Telpo」的自助服务终端。 K7 Telpo Kiosk 有多种付款方式,包括电子转帐、二维码和脸部认证。热敏印表机纸张宽度为80毫米,列印速度为每秒150毫米,并配有自动切割机。

- 此外,零售业的数位化正在突飞猛进。表面运算技术可以透过多种方式进一步支援零售业的转型,包括高效的库存管理、改善的用户体验、增强的盈利以及扩大的广告机会。

预计北美将占据最大的市场占有率

- 北美是一个已开发地区,其购买力和可支配收入高于发展中地区。在北美,市场以美国为主导,表面计算厂商集中。

- 由于该地区对技术先进产品的需求,北美表面计算市场正在快速发展。消费者的高认知度和产品的便利性正在增加该行业的成长机会。美国是多家重要的表面运算技术製造商的所在地,产品认知度和需求不断增加。

表面计算行业概述

由于微软、戴尔、苹果和三星等现有参与者的存在,表面运算市场竞争适中。然而,随着表面计算变得越来越普及,参与者之间的竞争预计将加剧。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 更先进和用户友好的介面 - 自然用户介面(NUI)

- 透过采用多用户平板电脑增加业务收益

- 市场抑制因素

- 可用功能有限

- 表面计算机高成本

第六章市场区隔

- 类型

- 平面显示器

- 曲面显示器

- 成分

- 萤幕

- 相机

- 感应器

- 处理器

- 软体

- 投影仪

- 其他的

- 触碰

- 单点触摸

- 多点触摸

- 多用户

- 其他的

- 想像

- QR 图

- 三维

- 应用

- 娱乐

- 零售

- 款待

- 卫生保健

- 商业的

- 广告

- 车

- 教育

- 其他的

- 地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 其他亚太地区

- 拉丁美洲

- 墨西哥

- 巴西

- 阿根廷

- 其他拉丁美洲

- 中东/非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 其他中东/非洲

- 北美洲

第七章竞争形势

- 公司简介

- Microsoft Corporation

- 3M Co.

- Dell Inc.

- Samsung Electronic Co. Ltd

- Planar Systems Inc.

- Lenovo Group Ltd

- Apple Inc.

- Viewsonic Corporation

- Toshiba Corporation

- Hewlett-Packard Ltd

- Sony Corporation

- LG Electronics Inc.

- Fujitsu Ltd

- IBM Corporation

- Intel Corporation

- Panasonic Corporation

- Qualcomm Technologies Inc.

- Acer Inc.

第八章投资分析

第9章市场的未来

The Surface Computing Market size is estimated at USD 81.94 billion in 2024, and is expected to reach USD 370.58 billion by 2029, growing at a CAGR of 35.23% during the forecast period (2024-2029).

Key Highlights

- Surface computing is a new form of computing that allows users to work on a tabletop surface as a computer interface. Surface computing uses a specialized computer GUI as the traditional GUI is replaced by intuitive objects. Surface computing opens up a whole new category of products for users to interact with.

- Microsoft was the first company to unveil the concept of surface computing. The technology of Microsoft Surface allows non-digital objects to be used as input devices. Microsoft Surface, the first commercially available surface computer from Microsoft, is a revolutionary surface computing platform that responds to natural hand gestures and the placement of real-world objects on display. Using its large, 360-degree, horizontal user interface, Microsoft Surface creates a unique gathering place where multiple users can collaboratively and simultaneously interact with information and content. Furthermore, users can also interact with the machine by touching or dragging their fingertips and objects, such as paintbrushes, across the screen or by placing and moving placed objects.

- Furthermore, commercially available multitouch technology (e.g., Microsoft and SMART Technologies) enables exploration of surface computing in settings outside of the lab, such as of?ces, retail stores, hotels, schools, restaurants, and even hospitals, which is expected to drive the market growth during the forecast period. In addition, Microsoft Surface, with its unique set of features, enables companies to design innovative campaigns to attract and convert new customers as well as cross-sell products and services, drive customer loyalty, and achieve operating efficiencies.

- One of the positive aspects of the COVID-19 pandemic was the increased use of technology. The PC market has been among the few markets wherein the demand has increased significantly as people are mostly staying in due to various restrictions and the remote working model adopted by most corporate organizations. As the hybrid working model is expected to be sustained in the post-COVID-19 period, the PC and related industries are expected to witness a sustainable demand.

- Interface design complexity and Multi-directional media are significant market problems. The low availability of features and the high cost of surface computers are expected to limit their adoption rate. The surface computing market has encountered a significant barrier due to the intense competition in the industry, resulting in players adopting multi-user and surface computer technology.

Surface Computing Market Trends

The Retail Sector is Expected to Hold a Significant Market Share

- The retail segment possesses a huge potential for the growth of the Surface Computing Market. Surface computing not only makes transactions faster and easier but also provides a personalized computing environment to business owners. Surface computing also facilitates businesses in their green initiatives, allowing them to cut back on paper, ink, and other office supply wastes.

- Retailers connect their physical locations with digital experiences to better serve customers and build a more connected organization from the sales/shop floor to the C-suite. Offline merchants are embracing new business models, like contactless shopping and curbside pickup. It's an upheaval that brings new opportunities for retailers in an ever-competitive market, helping consumers find what they're looking for and anticipating demand.

- Similarly, according to the Retailers Association of India (RAI), the retail industry achieved 93% of pre-COVID-19 sales in February 2021; consumer durables and quick service restaurants (QSR) increased by 15% and 18%, respectively.

- Further, in May 2023, Metro, a China-based supermarket, introduced Telpo self-service kiosks. The K7 Telpo kiosks feature multiple payment methods, including EFT, QR code, and facial recognition. The thermal printer features an 80-millimeter paper width, 150-millimeters per second printing speed, and an automated cutter.

- Furthermore, the digitization of the retail sector has increased manifold. Surface computing technology can further support the transformation of the retail sector in multiple ways, including efficient inventory management, better user experience, enhanced profitability, and better advertising opportunities.

North America is Expected to Hold the Largest Market Share

- North America is a developed region, and people have more purchasing power and disposable income than those in growing areas. In North America, this market is driven by the United States, owing to the concentration of surface computing manufacturers.

- The North America surface computing market is developing rapidly due to the region's demand for technically advanced products. High consumer awareness and easy product availability increase the industry's growth opportunities. The existence of several significant surface computing technology manufacturers in the U.S. creates heightened product awareness and demand.

- According to Select USA, the U.S. media and entertainment industry is the largest in the world. At USD 717 billion, it represents a third of the global media and entertainment industry, and it includes motion pictures, television programs and commercials, streaming content, music and audio recordings, broadcast, radio, book publishing, video games, and ancillary services and products.

- Furthermore, the country's retail sector is among the largest, owing to the presence of retail giants such as Amazon and Walmart. According to the U.S. Census Bureau, total retail sales for the 12 months of 2021 were up by 19.3% from 2020, while total sales for October 2021 through December 2021 were up by 17.1% from the same period a year ago.

- The growth of these sectors, along with the growing adoption of innovative technological solutions across various sectors, is expected to drive the development of the surface computing market in the region during the forecast period.

Surface Computing Industry Overview

The surface computing market is moderately competitive due to the presence of established players such as Microsoft, Dell, Apple Inc., and Samsung. However, competition among the players is expected to grow as the penetration of surface computers increases.

In April 2023, Zalando introduced a virtual fitting room pilot to millions of customers. This pilot brings the virtual fitting room to customers in all 25 Zalando markets for the first time. The company has already successfully run two pilots with selected clothing items from Zalando's and Puma private label Anna Field, where more than 30,000 customers have tried this innovative technology.

In August 2022, Hugo Boss ventured into a virtual reality dressing room, letting online shoppers try on apparel using personalized avatars. The exclusive German brand has partnered with virtual try-on (VTO) provider Reactive Reality for the ambition, initially available for UK, German, and France customers. Customers can check on thousands of products via personalized dummies created through Reactive Reality's PITCTOFiT platform.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 More Advanced and User-friendly Interface - Natural User Interface (NUI)

- 5.1.2 Increasing Business Revenue Due to Adoption of Multi-user Tabletops

- 5.2 Market Restraints

- 5.2.1 Limited Availability of Features

- 5.2.2 High Cost of Surface Computers

6 MARKET SEGMENTATION

- 6.1 Type

- 6.1.1 Flat Display

- 6.1.2 Curved Display

- 6.1.3 Components

- 6.1.3.1 Screen

- 6.1.3.2 Camera

- 6.1.3.3 Sensor

- 6.1.3.4 Processor

- 6.1.3.5 Software

- 6.1.3.6 Projector

- 6.1.3.7 Other Components

- 6.2 Touch

- 6.2.1 Single Touch

- 6.2.2 Multi-touch

- 6.2.3 Multi-user

- 6.2.4 Other Touches

- 6.3 Vision

- 6.3.1 Two Dimensional

- 6.3.2 Three Dimensional

- 6.4 Application

- 6.4.1 Entertainment

- 6.4.2 Retail

- 6.4.3 Hospitality

- 6.4.4 Healthcare

- 6.4.5 Commercial

- 6.4.6 Advertisement

- 6.4.7 Automotive

- 6.4.8 Education

- 6.4.9 Other Applications

- 6.5 Geography

- 6.5.1 North America

- 6.5.1.1 United States

- 6.5.1.2 Canada

- 6.5.2 Europe

- 6.5.2.1 United Kingdom

- 6.5.2.2 Germany

- 6.5.2.3 France

- 6.5.2.4 Rest of Europe

- 6.5.3 Asia-Pacific

- 6.5.3.1 China

- 6.5.3.2 Japan

- 6.5.3.3 India

- 6.5.3.4 Rest of Asia-Pacific

- 6.5.4 Latin America

- 6.5.4.1 Mexico

- 6.5.4.2 Brazil

- 6.5.4.3 Argentina

- 6.5.4.4 Rest of Latin America

- 6.5.5 Middle-East and Africa

- 6.5.5.1 Saudi Arabia

- 6.5.5.2 United Arab Emirates

- 6.5.5.3 South Africa

- 6.5.5.4 Rest of Middle-East and Africa

- 6.5.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Microsoft Corporation

- 7.1.2 3M Co.

- 7.1.3 Dell Inc.

- 7.1.4 Samsung Electronic Co. Ltd

- 7.1.5 Planar Systems Inc.

- 7.1.6 Lenovo Group Ltd

- 7.1.7 Apple Inc.

- 7.1.8 Viewsonic Corporation

- 7.1.9 Toshiba Corporation

- 7.1.10 Hewlett-Packard Ltd

- 7.1.11 Sony Corporation

- 7.1.12 LG Electronics Inc.

- 7.1.13 Fujitsu Ltd

- 7.1.14 IBM Corporation

- 7.1.15 Intel Corporation

- 7.1.16 Panasonic Corporation

- 7.1.17 Qualcomm Technologies Inc.

- 7.1.18 Acer Inc.