|

市场调查报告书

商品编码

1403106

低 VOC 涂料 -市场占有率分析、产业趋势/统计、2024-2029 年成长预测Low VOC Paint - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

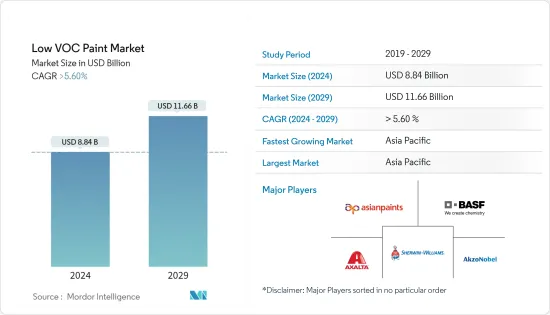

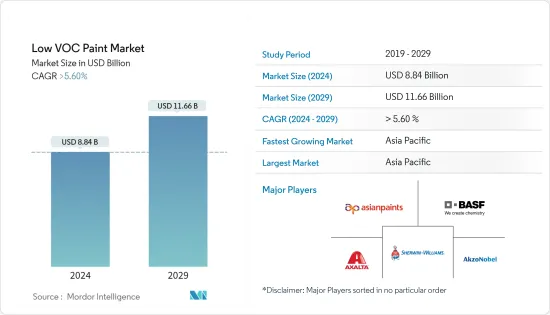

低VOC涂料市场规模预计到2024年为88.4亿美元,预计到2029年将达到116.6亿美元,在预测期内(2024-2029年)复合年增长率将超过5.60%,预计会增长。

COVID-19大流行影响了 2020 年和 2021 年的低 VOC 涂料市场,导致经济和商业活动收缩,以及建筑和工业产出下降。然而,市场近年来已经復苏,预计在此期间将会成长。

人们对传统涂料相对于环保且使用安全的低挥发性有机化合物涂料的危害性的认识不断提高,预计将在预测期内推动市场成长。

另一方面,与传统涂料相比,低挥发性有机化合物涂料的成本较高,预计将阻碍市场成长。

在预测期内,增加生态建筑的建设、转向使用环境友善化学品以及回收低挥发性有机化合物涂料可能会为受调查的市场提供机会。

由于建筑业低挥发性有机化合物涂料的大量消费量,亚太地区在全球市场占据主导地位。

低VOC涂料市场趋势

架构及装饰业需求增加

- 装饰涂料可以保护表面免受天气影响,增强防水性,保护表面免受白蚁侵袭,增加表面的耐用性并赋予建筑物美观的吸引力。

- 此外,它还可以防止腐蚀、细菌、紫外线、霉菌、进水和藻类,延长结构的使用寿命。

- 对低挥发性有机化合物涂料的需求主要是由全球住宅和商业建筑的成长所推动的,其中建筑和装饰行业占大多数。

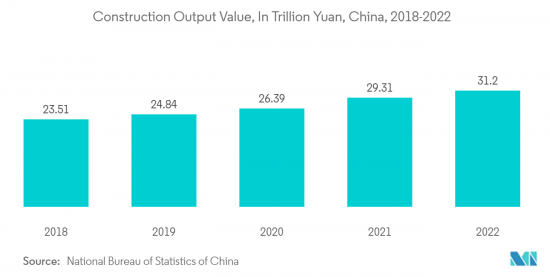

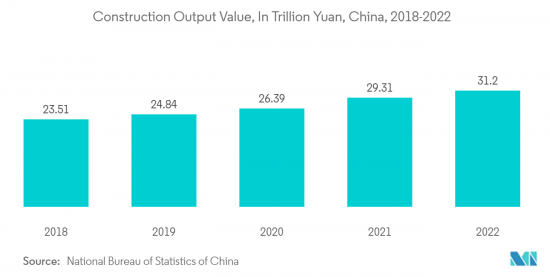

- 中国经济成长的驱动力主要是住宅和商业设施的快速扩张。该国建筑产值于2022年达到峰值,达到约4.64兆美元(31.2兆元)。因此,这些因素往往会增加预测期内的市场需求。

- 根据美国人口普查局的数据,商业竣工面积将反弹至景气衰退的水平,并于 2022 年达到 1,150 亿美元。在美国最受欢迎的商业开发类型是仓库和私人办公室。此外,2023年1-8月建筑支出达12,847亿美元,比2022年同期的12,334亿美元成长4.2%。

- 此外,根据欧盟统计局的数据,由于欧盟復苏基金的新投资,欧洲建筑业在 2022 年成长了 2.5%。 2022年的主要建设计划将是非住宅(办公室、医院、饭店、学校、工业建筑),占总活动的31.3%。

- 预计此类建设活动将在预测期内增加对低挥发性有机化合物涂料等的需求。

亚太地区主导市场

- 亚太地区主导全球市场。随着印度、中国、菲律宾、越南和印尼等国家增加对住宅和商业建筑的投资,低挥发性有机化合物涂料市场预计在未来几年将扩大。

- 低VOC涂料因其比普通涂料更环保而广泛应用于建设产业。低挥发性有机化合物涂料用于多种应用,包括内外墙、天花板、装饰、混凝土地板、金属表面、家具和橱柜的涂漆。

- 在「十四五」规划(2021-2025 财年)基础设施投资的支持下,预计 2024 年至 2027 年建设产业的复合年增长率将达到 4.3%。此外,到 2030 年,政府为基础建设计划提供 6.8 兆元人民币(1.1 兆美元)资金也将支持产业成长。 2022年,国家发展与改革委员会(NDRC)核准了109个固定资产投资计划,价值1.5兆元(2,223亿美元)。

- 据中国政府称,新的信贷政策将于2023年1月宣布,旨在促进中国都市区的住宅销售。为了鼓励中国的住宅销售,许多地方当局宣布了优惠券计划。此外,2022年初,政府宣布提供290亿美元的专案贷款,帮助建设公司完成停滞的计划。

- 此外,印度政府计划在未来七年内投资约 1.3 兆美元用于住宅建设。预计这将导致建造 6000 万套新住宅。这些计划正在推动建设产业低挥发性有机化合物涂料市场的发展。

- 此外,印尼政府还启动了一项在印尼各地建造约100万套住宅的计划,并为此累计约10亿美元。因此,它极大地促进了市场的成长。

- 低 VOC 涂料的 VOC 含量明显低于传统涂料,使其成为更环保、更健康的选择。在汽车行业,低VOC涂料用于汽车外装和内装、汽车轮胎部件的涂装以及受损汽车的重新涂装。

- 根据中国工业协会统计,中国是全球最重要的汽车生产基地,预计2022年汽车产量将达到约2,702万辆,比去年的2,612万辆成长3.4%。因此,低VOC涂料在汽车领域有着庞大的市场。

- 因此,预计上述因素将在预测期内推动该地区对低挥发性有机化合物涂料的需求。

低VOC涂料产业概况

低挥发性有机化合物涂料市场因其性质而部分分散。主要参与企业(排名不分先后)包括 Akzo Nobel NV、Asian Paints、 BASF SE、Axalta Coating Systems, LLC 和 The Sherwin-Williams Company。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究成果

- 研究场所

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 人们越来越认识到传统涂料的毒性

- 建筑装饰产业需求不断成长

- 其他司机

- 抑制因素

- 成本比传统涂料高

- 其他阻碍因素

- 价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(以金额为准的市场规模)

- 类型

- 低挥发性有机化合物

- 无或零 VOC

- 自然的

- 复合型

- 水性的

- 溶剂型

- 粉末

- 目的

- 架构与装饰

- 一般工业

- 汽车OEM

- 自动修理

- 海洋

- 耐久性消费品

- 其他应用(製药、电子等)

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 中东和非洲其他地区

- 亚太地区

第六章竞争形势

- 併购、合资、联盟、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- Akzo Nobel NV

- American Formulating & Manufacturing

- Arkema

- Asian Paints

- AURO

- Axalta Coating Systems, LLC

- BASF SE

- Benjamin Moore & Co.

- Berger Paints India Limited

- BioShield Paint Company

- Cloverdale Paint Inc.

- Crown Trade

- Fine Paints of Europe

- Jotun

- Kalekim

- Kansai Paint Co.,Ltd.

- Nippon Paint Holdings Co., Ltd.

- PPG Industries, Inc.

- The Sherwin-Williams Company

第七章 市场机会及未来趋势

- 加大生态建筑建设力度

- 转向环保化学品

The Low VOC Paint Market size is estimated at USD 8.84 billion in 2024, and is expected to reach USD 11.66 billion by 2029, growing at a CAGR of greater than 5.60% during the forecast period (2024-2029).

The COVID-19 pandemic impacted the low VOC paint market in 2020 and 2021, driven by reduced economic and commercial activities coupled with declines in construction and industrial output. But the market recovered in recent years and is anticipated to grow over the period.

The increasing awareness about the harmful effects of conventional paints, which is contrary to low VOC paints as they are eco-friendly and safe to use, is expected to drive the market's growth during the forecast period.

On the other hand, the high cost of low VOC paint compared to conventional paint is expected to hinder the market's growth.

The increasing construction of green buildings, shift toward eco-friendly chemicals, and recycling of low VOC paint will likely provide opportunities for the market studied during the forecast period.

Asia-Pacific dominated the global market due to the high consumption of low-VOC paints from the architectural industry.

Low VOC Paint Market Trends

Increasing Demand from Architectural and Decorative Segment

- Decorative paints help protect the surface from the impact of weather, make the surface waterproof, protect the surface from termite attacks, and increase surface durability, providing an aesthetic appeal to the building.

- In addition, they offer protection from corrosion, bacteria, UV radiation, fungus, water seepage, and algae and enhance the structure's life.

- The demand for Low VOC paints is dominated by the architectural and decorative industry, driven by the growing residential and commercial construction activities worldwide.

- China's growth is fueled mainly by rapid residential and commercial building expansion. The country's construction output peaked in 2022 at about USD 4.64 trillion (31.2 trillion yuan). As a result, these factors tend to increase the market demand during the forecast period.

- According to the US Census Bureau, the value of completed commercial construction has rebounded to pre-recession levels, reaching USD 115 billion in 2022. The most popular types of commercial development started in the United States were warehouses and private offices. Additionally, during the first eight months of 2023, construction spending amounted to USD 1,284.7 billion, which increased by 4.2% to USD 1,233.4 billion for the same period in 2022.

- Furthermore, according to Eurostat, the European construction sector grew by 2.5% in 2022 due to new investments from the EU Recovery Fund. The major construction projects in 2022 accounted for non-residential construction (offices, hospitals, hotels, schools, and industrial buildings), accounting for 31.3% of total activity.

- Such construction activities are expected to increase the demand During the forecast period such as low-VOC paints.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific region dominated the global market share. With growing investment in residential and commercial construction in countries such as India, China, the Philippines, Vietnam, and Indonesia, the market for low-VOC paints is expected to increase in the coming years.

- Low-VOC paints are widely used in the construction industry as it is eco-friendly compared to regular paints. Low VOC paints are used for various applications, including painting interior and exterior walls, ceilings, trim, concrete floors, metal surfaces, furniture, and cabinets.

- The construction industry is expected to record an average annual growth rate of 4.3% between 2024 and 2027, supported by investment in infrastructure as part of the 14th Five-Year Plan (FYP 2021-2025). Additionally, growth in the industry will also be aided by CNY 6.8 trillion (USD 1.1 trillion) of government funds for infrastructure construction projects by 2030. In 2022, the National Development and Reform Commission (NDRC) approved 109 fixed asset investment projects worth CNY 1.5 trillion (USD 222.3 billion).

- According to the Government of China, in January 2023, announced the new credit policy aims to drive urban housing sales in the country. To drive housing sales in China, many local authorities announced voucher schemes. Earlier in 2022, the government also announced a pledge of USD 29 billion in special loans, thereby allowing construction firms to finish stalled projects.

- Furthermore, the Indian government is likely to invest around USD 1.3 trillion in housing over the next seven years. It is expected to see the construction of 60 million new homes. Such projects are driving the low VOC paints market in the construction industry.

- Moreover, the Indonesian government has started a program to build about one million housing units across Indonesia, for which the government has allocated about USD 1 billion in the budget. Thus boosting the market growth significantly.

- Low VOC paints contain significantly less VOCs than traditional paints, making them a more environmentally friendly and healthier option. In the automotive industry, low VOC paints are used for painting exteriors and interior surfaces of the vehicle, automotive tire parts and refinishing damaged vehicles.

- According to the China Association of Automobile Manufacturers (CAAM), China has the most significant automotive production base in the world, with a total vehicle production of around 27.02 million units in 2022, registering an increase of 3.4 % compared to 26.12 million units produced last year. Thus providing a massive market for low-VOC paint in the automotive sector.

- Thus, the factors above are expected to drive the demand for low-VOC paints in the region during the forecast period.

Low VOC Paint Industry Overview

The low VOC paint market is partially fragmented in nature. The major players (not in any particular order) include Akzo Nobel N.V., Asian Paints, BASF SE, Axalta Coating Systems, LLC, and The Sherwin-Williams Company, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Awareness about Harmful Effects of Conventional Paint

- 4.1.2 increasing Demand in Architectural and Decorative Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 High Cost in Comparison to Conventional Paint

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Low-VOC

- 5.1.2 No or Zero VOC

- 5.1.3 Natural

- 5.2 Formulation Type

- 5.2.1 Water-borne

- 5.2.2 Solvent-borne

- 5.2.3 Powder

- 5.3 Application

- 5.3.1 Architecture and Decorative

- 5.3.2 General Industrial

- 5.3.3 Automotive OEM

- 5.3.4 Automotive Refinish

- 5.3.5 Marine

- 5.3.6 Consumer Durables

- 5.3.7 Other Applications (Pharmaceuticals, Electronics, etc.)

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Akzo Nobel N.V.

- 6.4.2 American Formulating & Manufacturing

- 6.4.3 Arkema

- 6.4.4 Asian Paints

- 6.4.5 AURO

- 6.4.6 Axalta Coating Systems, LLC

- 6.4.7 BASF SE

- 6.4.8 Benjamin Moore & Co.

- 6.4.9 Berger Paints India Limited

- 6.4.10 BioShield Paint Company

- 6.4.11 Cloverdale Paint Inc.

- 6.4.12 Crown Trade

- 6.4.13 Fine Paints of Europe

- 6.4.14 Jotun

- 6.4.15 Kalekim

- 6.4.16 Kansai Paint Co.,Ltd.

- 6.4.17 Nippon Paint Holdings Co., Ltd.

- 6.4.18 PPG Industries, Inc.

- 6.4.19 The Sherwin-Williams Company

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Construction of Green Buildings

- 7.2 Shift toward Eco-friendly Chemicals