|

市场调查报告书

商品编码

1403113

云端服务中介:市场占有率分析、产业趋势/统计、2024-2029 年成长预测Cloud Services Brokerage - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

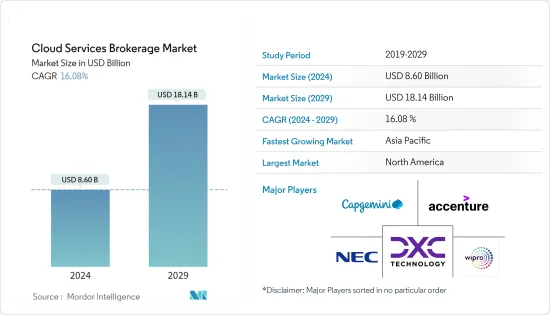

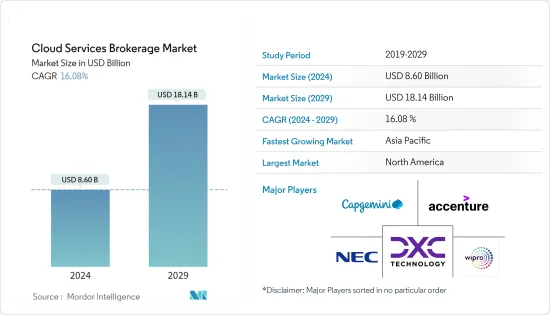

云端服务中介市场规模预计到 2024 年为 86 亿美元,预计到 2029 年将达到 181.4 亿美元,在预测期内(2024-2029 年)复合年增长率为 16.08%。

主要亮点

- 不断上升的资料安全担忧和对云端服务中介机构的认识不足是阻碍市场成长的主要因素。云端服务代理是一种商业概念,可作为云端提供者和云端客户之间的中介,帮助公司选择最能满足其目标市场需求的服务和产品。

- 它还使消费者能够从目录中的各种竞争服务中进行选择,并有可能降低成本。它有助于跨多个云端部署和整合应用程式。这意味着您可以节省搜寻不同供应商的服务的时间,并向您的客户提供有关如何使用云端处理来实现其企业目标的资讯。

- 此外,由于领先企业对混合IT解决方案的需求迅速增长,以及对大量企业资料的储存和高效管理的需求不断增长,预计该市场在预测期内将大幅增长。

- 企业还可以选择从单一网路基地台向合作伙伴和客户提供各种云端服务,包括管理、申请和支援。为满足各种客户、服务供应商和技术合作伙伴的需求,多重云端平台的快速采用预计仍将是预测期内扩大全球云端服务中介市场的主要因素。

- 然而,缺乏对云端服务中介解决方案优势的了解,以及消费者对网路安全的日益担忧,可能会阻碍其在预测期内的扩张。您需要详细了解云端运算和储存服务及解决方案的各种优势。理解的需要也拉大了客户和供应商之间的距离。

- 此外,为了在疫情期间保护员工社会福利并维持业务效率,全球许多公司都在接受允许员工在家工作的概念,这增加了对云端基础的解决方案的需求。我是。随着越来越多的公司考虑利用云端基础的解决方案来升级IT基础设施,对云端服务中介和解决方案的需求在不久的将来可能会增加。

云端服务中介市场趋势

内部云端服务中介预计将占据主要份额

- 内部云端服务中介是指组织内用于管理和分发来自不同提供者的云端服务到不同部门和团队的集中平台。云端服务中介充当中介,帮助团队选择和使用正确的云端服务,同时保持控制、管治和成本优化。

- 云端服务中介可以将您所有的云端服务整合到一张申请中。透过使用云端服务中介,客户可以从各种IaaS(基础设施即服务)、PaaS(平台即服务)和SaaS(软体即服务)平台存取云端服务。・可以管理服务提供者的申请。此方法简化了云端资源的配置、管理和最佳化流程,使组织的不同部分能够更有效率地根据需要存取和利用云端服务。

- 内部云端服务经纪为员工提供统一的多重云端/SaaS管治、安全性、合规性、授权管理、支援、支出管理和整体使用者体验。为公有云和私有云服务使用者提供集中的资源。

- 2022 年 4 月,云端服务供应商OVHcloud 将向与 ESA Φ-lab、ESA InCubed 商业计画、ESA 商业孵化中心(ESA BIC)和 ESA 技术经纪人合併的创新新Start-Ups提供免费的云端服务包。我决定这么做。

- 为了获得最佳结果,云端服务中介必须成为企业云端方程式的一部分。否则,将服务转移到公司外部的好处可能会因内部混乱而受到阻碍。它支援跨不同云端服务安装的云端工作负载:IaaS、PaaS 和 SaaS。

亚太地区预计成长率最高

- 由于中国、印度、新加坡、澳洲和纽西兰广泛采用云端服务中介,预计亚太市场将在未来几年以最快的速度扩张。

- 该地区的成长得益于多种因素,包括都市化的加速、技术进步以及政府对数位经济的支持。通讯、云端处理和物联网的快速发展促使该地区多家公司采用云端基础的技术。

- 云端服务中介市场的推动因素包括企业越来越多地采用多重云端策略、管理多样化云端环境的专业知识、云端服务无缝整合的需求、成本优化以及提高整体效率的愿望等。此外,随着云端处理的发展,企业正在寻求协助来驾驭复杂的云端生态系统,这进一步推动了对云端服务中介的需求。

- 例如,2022 年 11 月,全球网路安全供应商 Palo Alto Networks 收购了应用程式安全 (AppSec) 和软体供应链安全供应商 Cider Security。此次收购支援 Palo Alto Networks 的 Prisma Cloud 平台方法,以确保从程式码到云端的全面应用程式安全生命週期。 Prisma Cloud 与软体构成分析功能结合,将提供全面的供应链安全解决方案,作为程式码到云端安全平台的一部分。

- 该地区的资料中心市场是全球成长最快的。因此,预计该地区将在预测期内实现快速成长。因此,它为全球工业的扩张做出了巨大贡献。

云端服务中介产业概况

云端服务中介市场竞争温和,有多家主要企业。目前,几个主要的市场领导占据着重要的市场占有率。然而,随着云端领域技术创新的不断推进,大多数公司都在积极扩大市场影响并进入新市场。

2022 年 8 月,託管基础设施解决方案提供商 11:11 Systems 透过收购 Sungard Availability Services (Sungard AS) 的云端託管服务业务进行了重大收购。云端管理服务领域是云端管理的一个成熟且成熟的领域。它针对依赖混合云端和多重云端环境来支援业务的蓝筹企业客户,提供透明度、控制力和合规性。

2022 年 3 月,Persistent Systems 宣布达成协议,收购总部位于新泽西州普林斯顿的 MediaAgility。 MediaAgility 是 Google 云端合作伙伴,专门提供全面的云端转型服务,在开发可扩展的云端基础的系统方面拥有丰富的经验。该公司为全球超过 35 家企业服务客户提供云端原生应用程式开发和现代化、分析和人工智慧解决方案、云端工程、迁移服务和託管服务等服务。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究成果

- 研究场所

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场促进因素与市场抑制因素介绍

- 市场驱动因素

- 混合和多重云端环境的采用率有所提高

- 云端运算服务的采用率不断提高

- 市场抑制因素

- 缺乏意识和安全担忧

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 按平台

- 内部云端服务中介

- 外部云端服务中介

- 按部署模型

- 民众

- 私人的

- 混合

- 按公司

- 中小企业 (SME)

- 大公司

- 按最终用户产业

- 资讯科技/通讯

- BFSI

- 零售

- 卫生保健

- 政府机关

- 製造业

- 其他最终用户产业

- 地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 其他亚太地区

- 拉丁美洲

- 墨西哥

- 巴西

- 阿根廷

- 其他拉丁美洲

- 中东/非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 其他中东和非洲

- 北美洲

第六章竞争形势

- 公司简介

- Accenture PLC

- Capgemini SE

- NEC Corporation

- DXC Technology Company

- Rightscale Inc.

- Wipro Limited

- IBM Corporation

- NTT Data Inc.

- Cognizant Technology Solutions Corp.

第七章 投资分析

第八章 市场机会及未来趋势

The Cloud Services Brokerage Market size is estimated at USD 8.60 billion in 2024, and is expected to reach USD 18.14 billion by 2029, growing at a CAGR of 16.08% during the forecast period (2024-2029).

Key Highlights

- The increasing security concerns regarding the data and the lack of awareness about cloud brokerage services are some of the primary factors hindering market growth. Cloud service brokerage is a business concept that serves as a middleman between cloud providers and cloud customers and helps businesses select services and offers that best meet the demands of the target market.

- Also, it offers consumers a choice and potential cost-saving function, which includes a variety of competing services from a catalog. It helps them deploy and integrate apps across several clouds. Said, it helps the owner and customer save time by looking for services from various vendors and giving clients information on how to use cloud computing to further corporate objectives.

- Moreover, the market is expected to have substantial growth over the forecast period due to the surge in the need for hybrid IT solutions among major companies, along with the rising demand for storage and efficient administration of significant volumes of company data.

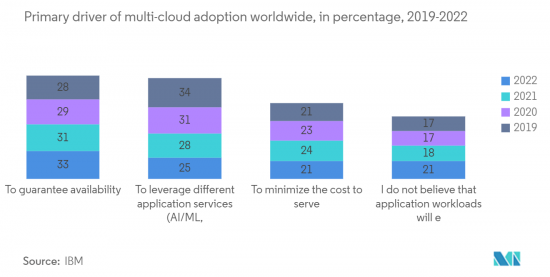

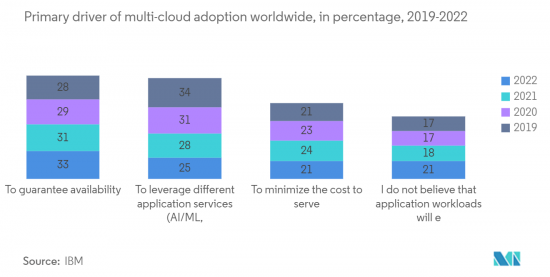

- Businesses also have the option of offering their partners and clients a range of cloud services from one single point of access, such as administration, billing, or support. The high growth in the adoption of multi-cloud platforms, which meet the needs of various clients, service providers, and technical partners, is projected to continue to be a key driver for increasing the global market for cloud services brokerage over the forecast period.

- The lack of knowledge about the advantages of cloud service brokerage solutions, along with growing consumer anxiety over cybersecurity, could, however, impede expansion during the anticipated timeframe. There needs to be more knowledge about the various benefits of cloud computing and storage services and solutions. Also, there is a widening distance between customers and vendors as a result of the need for more understanding.

- Furthermore, the concept of allowing employees to work from home has been embraced by many businesses throughout the world in order to protect employee well-being and maintain operational effectiveness during the pandemic, which has increased demand for cloud-based solutions. The need for cloud service brokerage solutions will increase in the near future as more businesses consider advancing their IT infrastructure with the aid of cloud-based solutions.

Cloud Services Brokerage Market Trends

Internal Cloud Services Brokerage is Expected to Hold the Major Share

- An internal cloud services brokerage refers to a centralized platform within an organization that helps manage and distribute cloud services from different providers to various departments or teams. It acts as an intermediary, allowing teams to select and consume the appropriate cloud service while maintaining control, governance, and cost optimization.

- A cloud services brokerage can bundle all the cloud services into a single bill, where the customers can manage cloud service provider bills for various infrastructure-as-a-service (IaaS), platform-as-a-service (PaaS), and software-as-a-service (SaaS) platforms by using cloud-services brokerage. This approach streamlines the process of provisioning, managing, and optimizing cloud resources, making it more efficient for different parts of the organization to access and use cloud services as needed.

- Internal cloud services brokerage provides a unified multi-cloud/SaaS governance, security, compliance, license management, support, spend management, and overall user experience to employees. It provides centralized resources to both public and private cloud services users.

- In April 2022, cloud service provider OVHcloud decided to make a free cloud service package that will be available to innovative start-ups that merge with ESA Φ-lab, the ESA InCubed commercial program, ESA Business Incubation Centres (ESA BICs) and ESA Technology Brokers.

- For optimal results, cloud services brokerage must be part of the company's cloud equation. Otherwise, the benefits of moving services outside the organization may very well be hampered by the internal mess. It caters to the installed cloud workload, thereby across different cloud services among IaaS, PaaS, and SaaS.

Asia-Pacific is Expected to Have the Fastest Growth Rate

- The Asia-Pacific market is anticipated to expand at the fastest rate over the next several years as a result of the extensive adoption of cloud services brokerage in China, India, Singapore, Australia, and New Zealand.

- The region is growing as a result of a number of factors, including increasing urbanization, technological advancements, and government support for the digital economy. As a result of the quick advancements in telecommunications, cloud computing, and IoT, several firms in the area have embraced cloud-based techniques.

- The drivers of the cloud services brokerage market include the growing adoption of multi-cloud strategies by businesses, the need for expertise in managing diverse cloud environments, the demand for seamless integration of cloud services, and the desire to optimize costs and improve overall efficiency in cloud usage. Additionally, as the cloud computing landscape evolves, businesses seek assistance in navigating complex cloud ecosystems, which further fuels the demand for cloud services brokerage.

- For instance, in November 2022, Palo Alto Networks, the global cybersecurity provider, acquired Cider Security (Cider), the application security (AppSec) and software supply chain security provider. The acquisition would be in support of Palo Alto Networks Prisma Cloud's Platform Approach for Ensuring a comprehensive application security lifecycle from code to cloud. Combined with Software Composition Analysis capabilities, Prisma Cloud will offer a comprehensive supply chain security solution as part of its code-to-cloud security platform.

- The data center market in this region is the fastest-growing in the entire world. As a result, it is projected that this area will grow quickly throughout the course of the projection period. Therefore considerably assisting in the expansion of the global industry.

Cloud Services Brokerage Industry Overview

The cloud services brokerage market features a moderate level of competition and is home to several prominent players. Currently, a few key market leaders hold substantial market share. However, due to ongoing innovations in the cloud sector, most companies are actively expanding their market presence, thus broadening their reach into new markets.

In August 2022, 11:11 Systems, a provider of managed infrastructure solutions, made an important acquisition by purchasing the Cloud Managed Services business of Sungard Availability Services (Sungard AS). The cloud-managed services sector represents a well-established and mature area of cloud management. It caters to blue-chip enterprise customers who rely on hybrid and multi-cloud environments to support their operations, offering them transparency, control, and compliance.

In March 2022, Persistent Systems announced an agreement to acquire MediaAgility, a Princeton, New Jersey-based company. MediaAgility, operating as a Google Cloud Partner, specializes in providing comprehensive cloud transformation services and boasts extensive experience in the development of scalable, cloud-based systems. The company serves more than 35 enterprise service clients worldwide, offering services such as cloud-native application development and modernization, analytics and AI solutions, cloud engineering, migration services, and managed services.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Increasing Adoption of Hybrid and Multi-cloud Environment

- 4.3.2 Increasing Adoption of Cloud Computing Services

- 4.4 Market Restraints

- 4.4.1 Lack of Awareness and Security Concerns

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Platform

- 5.1.1 Internal Cloud Services Brokerage

- 5.1.2 External Cloud Services Brokerage

- 5.2 By Deployment Model

- 5.2.1 Public

- 5.2.2 Private

- 5.2.3 Hybrid

- 5.3 By Enterprise

- 5.3.1 Small and Medium Enterprise (SME)

- 5.3.2 Large Enterprise

- 5.4 By End-user Industry

- 5.4.1 IT and Telecom

- 5.4.2 BFSI

- 5.4.3 Retail

- 5.4.4 Healthcare

- 5.4.5 Government

- 5.4.6 Manufacturing

- 5.4.7 Other End-user Industries

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Rest of Asia-Pacific

- 5.5.4 Latin America

- 5.5.4.1 Mexico

- 5.5.4.2 Brazil

- 5.5.4.3 Argentina

- 5.5.4.4 Rest of Latin America

- 5.5.5 Middle East & Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 Rest of Middle East & Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Accenture PLC

- 6.1.2 Capgemini SE

- 6.1.3 NEC Corporation

- 6.1.4 DXC Technology Company

- 6.1.5 Rightscale Inc.

- 6.1.6 Wipro Limited

- 6.1.7 IBM Corporation

- 6.1.8 NTT Data Inc.

- 6.1.9 Cognizant Technology Solutions Corp.