|

市场调查报告书

商品编码

1639441

下一代搜寻引擎:市场占有率分析、产业趋势/统计、成长预测(2025-2030)Next Generation Search Engines - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

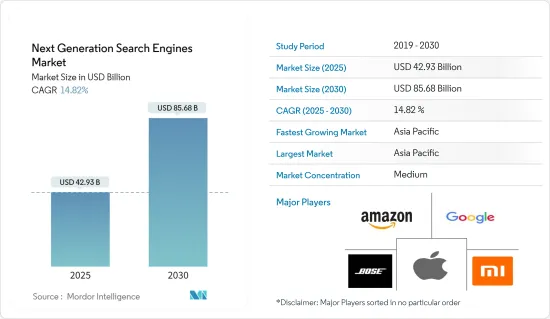

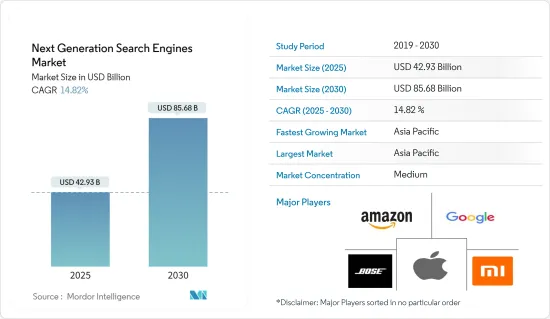

下一代搜寻引擎市场规模预计到 2025 年为 429.3 亿美元,预计到 2030 年将达到 856.8 亿美元,预测期内(2025-2030 年)复合年增长率为 14.82%。

主要亮点

- 下一代搜寻引擎为想要获得搜寻工作知识以评估可用解决方案并与软体和资料提供者互动的决策者和科学家描述了高级资讯搜寻模型。近年来,语音搜寻的数量呈指数级增长。此外,语音搜寻不再是新鲜事物,而是正在成为新标准。因此,下一代搜寻引擎面向基于语音的搜寻引擎。

- 由于深度神经网路和机器学习等人工智慧技术的进步,下一代搜寻引擎也正在崛起。智慧扬声器等虚拟助理被用于多个终端用户行业的各种应用,包括零售、BFSI 和医疗保健。消费者的主要应用之一是个人助理。这可以帮助消费者完成多项任务。例如,Apple 的 Siri 为连网家庭和汽车提供了直觉的介面。

- 对自助服务选项不断增长的需求反映了消费者对更快速度和便利性的快速增长的需求。根据 NICE 的 2022 年数位第一客户体验报告,81% 的消费者表示他们想要更多的自助服务选择。然而,只有 15% 的消费者对所提供的工具非常满意。这一趋势正在推动下一代搜寻引擎市场的需求。

- 对改善专业服务客户体验的日益关注正在推动市场发展。改善客户体验带来丰厚回报。无论哪个行业,满意的客户都会花更多的钱并随着时间的推移保持忠诚度。透过同情客户并帮助他们解决问题,这些公司可以释放巨大的价值来源,发现新的商机,并从长远来看改变他们的商业模式。

- 对真人互动的日益偏好可能会抑制市场。根据 Liveperson Inc. 进行的一项研究,全球 87% 的消费者更喜欢那些能够透过语音和通讯与他们进行灵活互动的公司。这些偏好会根据情况和一天中的时间而变化,这表明允许消费者在他们想要的时间、地点、条件下使用服务的重要性。

下一代搜寻引擎的市场趋势

自助服务和个人细分市场将经历最高的成长

- 面向个人最终用户的智慧音箱预计将占据大部分市场份额。现在人们期望智慧音箱具备的一些功能包括播放音乐和控制智慧家庭设备,这些设备包括可以回答您所有问题的语音助理。

- 消费者应用开发中的技术进步导致了智慧或连网家庭的整合。智慧家庭的发展促使最终用户将行动互联网和高速宽频连接带入市场上的每个家庭。

- 声控音箱已经成为人们日常生活的一部分。语音扬声器描述了在多任务处理时使用技术的能力。个人化答案是语音搜寻的着名使用案例之一,Google在很大程度上已经达到了这一点,因为它知道并可以猜测用户接下来会问什么问题。另一方面,Alexa 无法像 Google 一样理解上下文。虽然 Alexa 依赖自订的技能和通讯协定,但 Google Assistant 可以理解特定的使用者请求并提供更个人化的回应。

- 语音使用者依靠助理来完成购买过程中的许多任务,包括产品研究、价格比较和添加到购物车。 Adobe 研究表明,消费者在整个购物过程中都使用语音。前三名的活动是产品研究/研究(47%)、建立购物清单(43%)和价格比较(32%)。

- 最着名的智慧音箱是 Amazon Echo 和 Google Nest 系列,但也有一些第三方音箱,例如 Sonos One,内建了 Alexa 和 Google Assistant。

- 美国仍然是消费领域的重要市场,特别是在语音助理的采用方面。根据 eMarketer 的数据,过去 5 年来,语音助理的数量已从 1.03 亿增加到 1.23 亿。根据 NPR 最新的智慧音讯报告,18 岁以上的美国人中有 24% 拥有至少一台智慧音箱。平均业主拥有不只一个。超过一半的美国人拥有 Alexa。自从亚马逊首次推出 Echo 以来,它在美国广受欢迎,并继续挑战顶级竞争对手。

亚太地区占最大市场占有率

- 目前,亚太地区在所研究的市场中占据最大的市场占有率。该地区,特别是新兴国家的产品需求预计将保持在较高水准。预计主要企业将主要关注该地区并瞄准年轻人。

- 中国、印度、日本、韩国和新加坡等具有消费产品需求的人口大国预计将继续成为目标市场,因为这些国家的产品需求将继续推动市场。

- 此外,电子商务在中国和印度等国家不断发展,预计将推动线上分销管道销售智慧设备。例如,根据 IBEF 预测,到 2026 年,印度的电子商务市场预计将成长至 2,000 亿美元。该行业的发展受到互联网和智慧型手机日益普及的推动。

- 最新的行销趋势是企业实施语音搜寻引擎优化以吸引潜在的入境流量。例如,中国的科大讯飞拥有准确率高达98%的语音辨识系统。该系统准确地将英语翻译成普通话,普通话翻译成英语、韩语、日语和22种不同的中国方言。该公司团队预计三年内准确率将达到 99%。

- 预计该地区的主要供应商还将透过提供不同价位的产品来瞄准对价格敏感的消费群组。这为低价提供产品的供应商创造了机会。拥有高价值产品的供应商可能会透过提供与其他电子产品(例如笔记型电脑或平板电脑)整合的包装来瞄准不同的客户群。

下一代搜寻引擎产业概述

市场竞争激烈,主要以技术创新为关键成长要素。它保持适度的集中度,以亚马逊、谷歌和苹果等行业领导者为中心。最近的事态发展值得注意:

2023 年 5 月,Google宣布计划推出人工智慧整合搜寻引擎结果页面。这个创新的搜寻引擎目前正在测试中,其特点是人工智慧生成的主题摘要显示在传统搜寻结果上方。它还包括突出显示的背景部分,其颜色根据用户的搜寻意图动态调整。

2022年9月,Z世代与TikTok建立策略伙伴关係,并推出新的搜寻引擎。此次合作利用 TikTok 强大的演算法,有效契合年轻用户的偏好。值得注意的是,该搜寻引擎的与众不同之处在于,它提供的内容是由平台上的真实个人而不是匿名网站合成和分发的。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 对下一代搜寻引擎市场的影响

第五章市场动态

- 采用市场动态

- 市场驱动因素

- 更加重视改善专业服务的客户体验

- 自助服务和个人细分市场将经历最高的成长

- 市场限制因素

- 越来越偏好与真人对话

第六章 市场细分

- 按分销管道

- 在线的

- 离线

- 按最终用户

- 个人

- 商务用

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲/纽西兰

- 拉丁美洲

- 中东/非洲

第七章 竞争格局

- 公司简介

- Amazon.com Inc.

- Google LLC(Alphabet Inc.)

- Alibaba Group

- Sonos Inc.

- Harman-Kardon Inc./JBL

- Apple Inc.

- Bose Corporation

- Xiaomi Inc.

- Baidu Inc.

第八章投资分析

第九章 市场机会及未来趋势

The Next Generation Search Engines Market size is estimated at USD 42.93 billion in 2025, and is expected to reach USD 85.68 billion by 2030, at a CAGR of 14.82% during the forecast period (2025-2030).

Key Highlights

- The next-generation search engine provides an advanced information retrieval model for decision-makers and scientists who wish to gain working knowledge about the search to evaluate available solutions and dialogue with software and data providers. Over the last few years, the number of voice searches has increased exponentially. Also, it is becoming less of a novelty and more like a new standard. Therefore, the next-generation search engines are more oriented toward voice-based search engines.

- Next-generation search engines are also increasing because of deep neural networks, machine learning, and other advancements in AI technologies. Virtual assistants, such as smart speakers, are used for various applications across several end-user industries, such as retail, BFSI, and healthcare. One primary consumer-facing application is a personal assistant. It helps consumers accomplish multiple tasks. For instance, Apple's Siri offers an intuitive interface for connected homes or cars.

- Growing demand for Self-service options indicates rapid growth in consumer demand for more incredible speed and convenience. According to NICE's 2022 Digital First Customer Experience Report, 81% of consumers say they want more self-service options. Yet, only 15% of consumers expressed high satisfaction with the tools provided to them. This trend drives the demand for Next next-generation search engine market.

- Increasing focus on improving Customer Experience across professional services drives the market. Enhancing the customer experience can bring rich rewards. Across industries, satisfied customers spend more and stay more loyal over time. By showing empathy with customers and helping to fix their problems, companies like these can tap into a source of tremendous value, find new business opportunities, and shift their operating model over time.

- Increasing Preference for Live Person Interaction could restrain the market. According to a survey conducted by Liveperson Inc., 87% of consumers worldwide prefer that the companies provide the flexibility to connect interactions across voice and messaging. Such preferences also shift based on different situations and times of the day, demonstrating the importance of allowing consumers to engage on their terms, when, and where they want.

Next Generation Search Engines Market Trends

Self Service and Personal Segment to Witness the Highest Growth

- Smart speakers in personal end-user verticals are expected to hold the majority share. The characteristics expected from a smart speaker nowadays include playing music and controlling smart home devices consisting of voice assistants ready to answer every question.

- The technological enhancements in the development of consumer applications resulted in the integration of smart homes or connected homes. Smart homes' development pushed end users to adopt mobile internet and fast broadband connections across households in the market.

- Voice-activated speakers have become part of people's routines. They provide the ability to use the technology while multi-tasking, as people speak more quickly than they can type (speed), and the increasingly "human" interfaces. Personalized responses are one of the famous use cases of voice search, which Google has attained to a large extent, as Google can know and guess the next question the users will most likely ask. On the other hand, Alexa cannot understand the context to the same extent as Google. Alexa relies on custom-built skills and protocols, whereas Google Assistant can understand specific user requests and further personalize the response.

- Voice users turn to their assistants to accomplish many tasks along their buying journeys, such as product research, price comparison, and adding to cart. A study from Adobe announced the consumer's usage of voice throughout their shopping journeys. The top three activities included product search/research (47%), creating shopping lists (43%), and price comparison (32%).

- The most well-known smart speakers are the Amazon Echo and Google Nest range of products, but there are plenty of third-party speakers, like the Sonos One, which comes with both Alexa and Google Assistant built-in.

- The United States remains a key market for the personal segment, especially voice assistant adoption. According to eMarketer, The number of voice assistants has risen from 103 million to 123 million over the last five years. According to the latest Smart Audio Report from NPR, 24% of Americans aged 18 years or above own at least one smart speaker. The average owner has more than one. A majority of Americans own Alexa. Since Amazon first introduced the Echo, it has become popular in the United States, and it continues to challenge top competitors.

Asia-Pacific Occupies the Largest Market Share

- The Asia-Pacific region currently holds the largest market share for the market studied. The demand for the products in the region, which is primarily from emerging economies, is expected to remain high. The major players are expected to focus chiefly on this region, with the youth as the target audience.

- China, India, Japan, South Korea, Singapore, and other populous nations with consumer product-based demand are expected to remain the target market as product demand in these countries continues to drive the market.

- Moreover, the growth of e-commerce across the world in countries like China and India is anticipated to drive the online distribution channels for selling smart devices. For instance, according to IBEF, the Indian e-commerce market is expected to grow to USD 200 billion by 2026. The development of the industry is driven by increasing internet and smartphone penetration.

- The latest marketing trend is companies implementing voice SEO to attract possible inbound traffic. For instance, China's iFlytek has a speech recognition system with an accuracy rate of 98%. The system accurately translates English to Mandarin and Mandarin to English, Korean, Japanese, and 22 different Chinese dialects. Its team predicts that it will achieve 99% accuracy within three years.

- Also, the major vendors in this region are expected to target the price-sensitive consumer group by offering products in different price segments. Therefore, they create an opportunity for vendors who offer products at a low price. Vendors with expensive products may target a different customer segment by offering products as a package in collaboration with other electronic products, such as notebooks and tablets.

Next Generation Search Engines Industry Overview

The market faces intense competition, primarily driven by technological innovation as a pivotal growth factor. It maintains a moderate level of concentration, featuring industry leaders such as Amazon, Google, and Apple. Several noteworthy developments have recently taken place:

In May 2023, Google Inc. unveiled plans for an AI-integrated search engine results page. This innovative search engine is currently in its testing phase and promises AI-generated topic summaries that will appear above the conventional search results. Additionally, it will include a highlighted background section, with its color dynamically adjusting according to the user's search intent.

In September 2022, Gen Z entered into a strategic partnership with TikTok to introduce a new search engine. This collaboration leverages TikTok's powerful algorithm, effectively tailored to the preferences of younger users. Notably, this search engine differentiates itself by offering content synthesized and delivered by real individuals on the platform rather than anonymous websites.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Next Generation Search Engine Market

5 MARKET DYNAMICS

- 5.1 Introduction to Market Dynamics

- 5.2 Market Drivers

- 5.2.1 Increasing Focus to Improve Customer Experience Across Professional Services

- 5.2.2 Self Service and Personal Segment to Witness the Highest Growth

- 5.3 Market Restraints

- 5.3.1 Increasing Preference for Live Person Interaction

6 MARKET SEGMENTATION

- 6.1 By Distribution Channel

- 6.1.1 Online

- 6.1.2 Offline

- 6.2 By End-user

- 6.2.1 Personal

- 6.2.2 Commercial

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amazon.com Inc.

- 7.1.2 Google LLC (Alphabet Inc.)

- 7.1.3 Alibaba Group

- 7.1.4 Sonos Inc.

- 7.1.5 Harman-Kardon Inc. /JBL

- 7.1.6 Apple Inc.

- 7.1.7 Bose Corporation

- 7.1.8 Xiaomi Inc.

- 7.1.9 Baidu Inc.