|

市场调查报告书

商品编码

1403745

汽车抬头显示器-市场占有率分析、产业趋势与统计、2024年至2029年成长预测Automotive Head-up Display - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

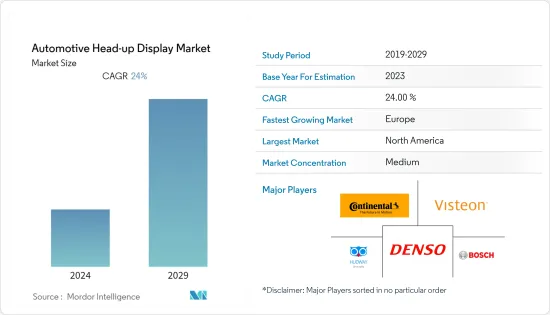

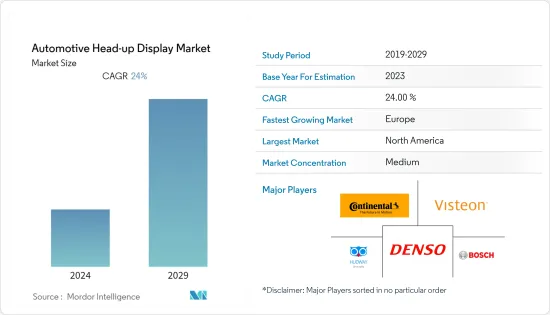

2024年汽车抬头显示器市场价值约14.5亿美元,预计2029年将达到49.9亿美元以上,预测期内复合年增长率约为24%。

主要亮点

- 由于世界各国政府的限制措施导致製造活动停止并扰乱供应链,2020 年 COVID-19 大流行对市场产生了负面影响。但随着疫情后经济活动的復苏,美国、中国、印度等主要国家汽车产销量大幅成长,需求开始回升。

- 具有先进安全功能(包括抬头显示器)的高阶豪华车和中型车的需求,加上智慧型手机和导航系统使用的显着成长,预计将推动市场需求。此外,政府在安全方面推出严格法规、抬头显示器价格持续走低、技术进步以及汽车生产的内部成长可能会进一步推动预测期内的市场成长。

- 汽车製造商抬头显示器市场参与企业正在努力改进目前的抬头显示器系统。现今的抬头显示器GPS(地理定位系统),可在挡风玻璃上显示警告和错误讯息。加上各国政府实施严格的安全法规以及豪华车销量的不断增加,豪华车抬头显示器的采用正在成为驾驶员和乘客安全系统的一部分,为市场参与企业提供了有利的机会。整体呈上升趋势。

- 在预测期内,北美地区预计将主导市场,其次是欧洲和亚太地区。消费者对豪华车的支出增加以及对安全性的日益重视预计将支持这些地区汽车抬头显示器的成长。

汽车抬头显示器市场趋势

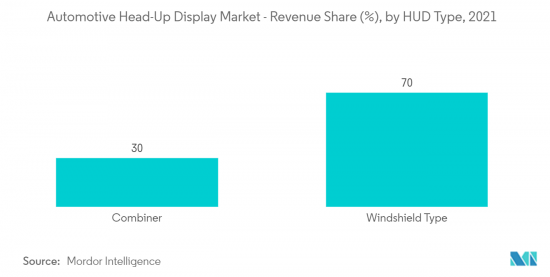

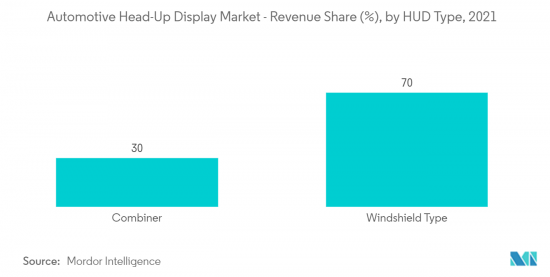

挡风玻璃抬头显示器的采用率正在增加,占了很大的市场份额。

- 汽车製造商抬头显示器供应商不断致力于开发更好的汽车系统。这些抬头显示器是几年前笨重导航的演变。这些系统现在可以在挡风玻璃上显示指南针方向、警告讯息、无线电资讯等。

- 利用液晶显示器 (LCD) 和发光二极体(LED) 等先进技术,可以在挡风玻璃上显示明亮、生动的图像。持续的技术进步也降低了生产成本。例如

- 2022 年 7 月,原东北先锋公司米泽工厂(山形县米泽市)的 SOAR 将开拓有机发光二极体 (电致发光)显示器的新需求。我们将加强对汽车抬头显示器、紧凑型行动出行和智慧型手錶等新领域的探索。

- 新的投影技术,包括基于电子机械系统的微镜设备,正在进入市场,以帮助创造更明亮、更色彩的显示器。预计推动显示系统市场成长的因素是低成本和创新的显示技术。

- 抬头显示器以前主要安装在豪华车上,但现在OEM製造商提出了这个想法,并将其作为经济型轿车的标准配备。 2022 年,日本製造商马鲁蒂铃木 (Maruti Suzuki) 宣布在印度市场上更新配备大型挡风玻璃抬头显示器的 Baleno。

- 大陆集团提供主动式车距维持定速系统,它使用基于 AR 的抬头显示器来显示和监控前方的速度和距离。领先车辆距离太近时,显示器上的新月形图示会改变颜色,提供持续的回馈。显示面板在汽车驾驶辅助系统的日益普及中发挥关键作用。

预计美国将在预测期内主导市场

- 美国在汽车安全方面的突出地位使北美成为继欧洲之后汽车抬头显示器市场的主要地区之一。该国的汽车产业正在经历稳步转型,安全系统获得市场渗透和大规模采用,特别是在小客车领域。皮卡车等商用车也开始采用这些系统,以提高驾驶者的能见度并减少夜间事故。例如

- 2021年8月,加拿大黑莓有限公司(Blackberry)宣布Nobo Auto已开始生产基于黑莓QNX Neutrino即时作业系统(RTOS)和QNX虚拟机器管理程式的智慧驾驶座域控制器。此网域控制器将搭载于长城汽车SUV哈弗H6S。哈弗H6S将搭载Nobo Auto的DCC(数位驾驶座控制器)平台。

- 根据 NHTSA 的一项研究,美国大约 80% 的事故是由于驾驶员分心造成的。随着汽车产业技术的快速发展,抬头显示器不仅可以帮助驾驶者看到车辆资讯,还可以看到周围环境资讯。驾驶员可以收到各种通知,包括来电、行驶速度、导航以及领先车辆煞车时的碰撞风险。

- 福特和通用汽车等汽车製造商越来越多地将资讯娱乐系统整合到其车辆中,为消费者提供更丰富的驾驶体验。对先进系统不断增长的需求预计将导致对与车上娱乐系统和车辆资讯系统复杂整合的抬头显示器系统的需求增加。

- 汽车的连接趋势,例如智慧型手机和平板电脑与车上娱乐系统和资讯系统的日益集成,正在推动对高级驾驶员辅助系统的需求不断增长。製造商目前正致力于开发能够侦测行人的抬头显示器。

- 2021 年 12 月,Karma Automotive 和 WayRay 宣布合作,将创新型态扩增实境 (AR)抬头显示器技术整合到未来的 Karma 车辆中。 WayRay的真扩增实境(True AR)和深度实境(Deep Reality)显示技术能够在任意距离和多个深度平面上产生虚拟影像。透过影像生成单元 (PGU) 将红绿蓝 (RGB) 雷射光束投射到全像光学元件 (HOE) 上来产生影像。

- 此类驾驶辅助系统市场驱动因素的成长预计将增加对抬头显示器系统的需求并促进所提供资讯的监控过程。

汽车抬头显示器产业概况

汽车抬头显示器市场由全球参与企业和一些区域参与企业适度整合。这些公司透过管理产品系列、开发新产品以及扩大在世界多个国家的业务来获得优势。知名製造商正在投资开发先进抬头显示器系统的研发活动,以实现收益最大化并为中型汽车提供经济的抬头显示器。

2021 年 1 月,松下汽车推出了最新的扩增实境抬头显示器,可以显示车道边缘、道路上的物体以及对驾驶员重要的其他资讯。抬头显示器与人工智慧配合,与驾驶员共用资讯。这种新型抬头显示器可以自行确定障碍物是车辆、行人还是垃圾桶。

2020 年 9 月,DigiLens 推出了一款超小巧的 CrystalClear(TM) AR抬头显示器,适合任何车辆仪表板。 CrystalClear(TM) AR抬头显示器的视野约为 15° x 5°,预计将为每辆车打开全像辅助导航的大门。

除此之外,几家主要的OEM公司正在积极进入市场,这种发展预计将对市场产生强烈的正面影响。例如

2021 年 6 月,现代汽车推出了抬头显示器,其光学玻璃与驾驶员成一定角度,因此很难看清。

2021年,奥迪宣布将为电动车车奥迪Q4 e-tron推出最新的现实(AR)抬头显示器。生成的虚拟影像似乎漂浮在驾驶员前方约 10 公尺的空间中。该公司表示,重迭图像有助于快速传达资讯而不会造成混乱。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场驱动因素

- 市场抑制因素

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔(市场规模(单位:美元))

- 抬头显示器类型

- 挡风玻璃

- 组合器

- 汽车模型

- 小客车

- 商用车

- 地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 俄罗斯

- 欧洲其他地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区

- 世界其他地区 中东/非洲

- 南美洲

- 中东/非洲

- 北美洲

第六章竞争形势

- 供应商市场占有率

- 公司简介

- Nippon Seiki Co. Ltd

- Continental AG

- Yazaki Corporation

- DENSO Corporation

- Robert Bosch GmbH

- Visteon Corporation

- Panasonic Corporation

- Pioneer Corporation

- 抬头显示器WAY LLC

第七章 市场机会及未来趋势

The automotive head-up display (HUD) market registered about USD 1.45 billion in 2024 and is expected to reach over USD 4.99 billion by 2029, registering a CAGR of around 24% during the forecast period.

Key Highlights

- The COVID-19 pandemic had a negative impact on the market in 2020 due to a halt in manufacturing activities and supply chain disruptions due to restrictions imposed by governments worldwide. However, post-pandemic, as economic activities restored, the demand started gaining momentum owing to notable growth in production and sales of vehicles across major countries like the United States, China, India, and others.

- The demand for high-end luxury and mid-size cars with advanced safety features, including head-up displays, coupled with significant growth in the use of smartphones and navigation systems, is anticipated to enhance demand in the market. Further, the introduction of stringent government regulations regarding safety, continuous reduction in the price of head-up displays, advancement in technology, and organic growth in automobile production will further boost the growth of the market during the forecast period.

- Automobile manufacturers and HUD market players are working towards improving the present head-up display system. Present HUDs are equipped with a geological positioning system (GPS) that can display warning and error messages on the windshield. Implementation of strict safety regulations by the government coupled with increasing sales of luxury cars, the adoption of HUD in luxury vehicles is on the rise as a part of the driver and passenger safety systems to offer lucrative opportunities for players in the market.

- North American region is expected to dominate the market studied during the forecast period, followed by Europe and Asia-Pacific region. Increased consumer spending on luxury cars and a growing emphasis on safety are expected to support the growth of automotive HUDs in these regions.

Automotive Head-up Display (HUD) Market Trends

Increased Adoption Rate of Windshield HUD to Occupy Significant Share in the Market

- Automobile manufacturers and HUD suppliers have been continually working on developing better systems for cars. These HUDs have evolved beyond the bulky navigation that was available a few years ago. These systems are now capable of displaying compass directions, warning messages, radio information, etc., on the windshield.

- Utilizing advanced technologies, like liquid crystal display (LCD) and light-emitting diodes (LED), delivers the advantage of displaying bright, vibrant images on the windshield. The consistent technological advancements have evolved them to be less expensive to manufacture. For instance,

- In July 2022, SOAR, formerly Tohoku Pioneer Corporation Yonezawa Plant (Yonezawa City, Yamagata Prefecture), will cultivate a new demand for organic electroluminescent displays (ELDs). The company will strengthen its approach to automotive head-up displays (HUDs), compact mobility vehicles, and new fields such as smartwatches.

- New projection technologies, including micro mirror-based devices based on electromechanical systems, are coming into the market, which will aid in creating brighter displays with the usage of more colors. The factors that are expected to drive the growth of the display systems market are the low cost and innovative display technologies.

- Head-up displays were earlier available majorly in luxury cars, but now, OEMs have been thinking and making them standard even in economy cars. In 2022, Japanese manufacturer Maruti Suzuki launched an updated Baleno with the large windshield HUD in the Indian market.

- Continental AG offers Adaptive Cruise Control, which uses AR-based HUD to display and monitor the speed and distance ahead of the cars. A crescent-shaped icon on the display changes its color to provide uninterrupted feedback when the vehicle ahead gets too close. The display panel plays a critical role in the augmented usage of the driver assistant systems in the vehicle.

United States is Expected to Dominate the Market During the Forecast Period

- The prominence of the United States in automotive safety makes North America one of the leading geographies in the automotive HUD market scenario after Europe. With a steady transformation in the country's automotive industry, there is considerable market penetration and mass adoption of safety systems, especially in the passenger vehicle segment. Commercial vehicles, like pick-up trucks, have also started adopting these systems to improve the driver's visibility and reduce accidents at night. For instance,

- In August 2021, Blackberry Limited (BlackBerry) of Canada announced that Nobo Auto has begun production of a smart cockpit domain controller based on the BlackBerry QNX Neutrino real-time operating system (RTOS) and QNX Hypervisor. The domain controller will be installed on Great Wall Motor's Haval H6S SUV. The Haval H6S will use Nobo Auto's DCC (Digital Cockpit Controller) platform.

- According to a study conducted by the NHTSA, about 80% of the accidents happening in the United States are caused due to driver distraction. With the rapid technological developments happening in the automotive industry, HUDs have helped drivers view not only vehicle information but also the nearby environment information. Drivers can be alerted with several notifications, such as a phone call, driving speed, navigation, and imminent collision when the vehicle ahead is braking, etc.

- Automobile manufacturers, such as Ford and GM, are increasingly equipping their vehicles with built-in infotainment systems to provide consumers with enhanced driving experiences. The increasing demand for these advanced systems is expected to result in an increased demand for HUD systems, which are intricately integrated with in-vehicle entertainment and vehicle information systems.

- The growing trend of connectivity in vehicles, with the increased integration of smartphones and tablets with in-vehicle entertainment and information systems, helps drive increased demand for advanced driving-assisted systems. Currently, manufacturers are focusing on developing HUDs that can detect pedestrians. For instance,

- In December 2021, Karma Automotive and WayRay announced a collaboration to integrate an innovative, new form of Augmented Reality (AR) Head-Up Display (HUD) technology in a fleet of future Karma vehicles. The WayRay True Augmented Reality (True AR) and Deep Reality Display technology enable the generation of virtual images at any distance and on multiple depth planes. Images are generated by projecting a red-green-blue (RGB) laser beam through a Picture Generating Unit (PGU) onto a Holographic Optical Element (HOE).

- The growth of the market for these driver-assisted systems is expected to increase the demand for HUD systems, thus easing the process for monitoring the information provided.

Automotive Head-up Display (HUD) Industry Overview

The automotive HUD market is moderately consolidated as the market accommodates global players and several regional players. These companies have managed to gain an advantage by managing their product portfolio, developing new products, and expanding their footprint across several countries across the world. Prominent manufacturers are investing in research and development activities for the development of advanced HUD systems to maximize revenue and provide the HUD in economic and midsize vehicles.

In January 2021, Panasonic Automotive launched its latest augmented-reality HUD capable of displaying lane edges, objects on the road, and other information important to drivers. The HUD runs in AI and shares information with the driver. The new HUD can determine by itself whether the barrier is a vehicle, pedestrian, or trash can.

In September 2020, DigiLens unveiled its Ultra-Compact CrystalClear™ AR HUD, compatible with any auto dashboard. The CrystalClear™ AR HUD has around 15° x 5° field-of-view and is expected to open the gateway for holographic-assisted navigation to any vehicle.

Besides these, several key OEMS are also participating actively in the market, and such developments are likely to have a strong positive impact on the market. For instance,

In June 2021, Hyundai Motor Company introduced a less head-up display (HUD) that features optical glass installed in the dashboard and angled toward the driver, which ensures better vision.

In 2021, Audi announced the introduction of its latest reality (AR) heads-up-display (HUD) in the Audi Q4 e-tron electric vehicle. The generated virtual image will appear to float in space about ten meters ahead of the driver. The company claims that the overlaid image will assist in conveying information at a rapid pace and without confusion.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value USD)

- 5.1 HUD Type

- 5.1.1 Windshield

- 5.1.2 Combiner

- 5.2 Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Commercial Vehicles

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Spain

- 5.3.2.5 Russia

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 South America

- 5.3.4.2 Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Nippon Seiki Co. Ltd

- 6.2.2 Continental AG

- 6.2.3 Yazaki Corporation

- 6.2.4 DENSO Corporation

- 6.2.5 Robert Bosch GmbH

- 6.2.6 Visteon Corporation

- 6.2.7 Panasonic Corporation

- 6.2.8 Pioneer Corporation

- 6.2.9 HUDWAY LLC