|

市场调查报告书

商品编码

1403754

设施管理:市场占有率分析、产业趋势与统计、2024-2029 年成长预测Facility Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

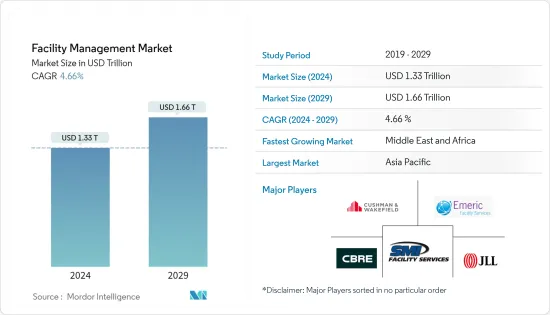

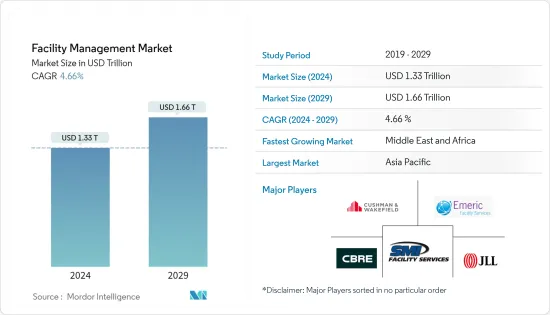

设施管理市场规模预计到 2024 年为 1.33 兆美元,预计到 2029 年将达到 1.66 兆美元,在预测期内(2024-2029 年)复合年增长率为 4.66%。

主要亮点

- 设施管理由影响组织生产力和效率的多个要素组成。新的管理体系标准与业界最佳实务一致,构成了在全球范围内制定和推广有效的策略、战术性和营运设施管理原则的基准。

- 设施管理业的服务已经商品化。此外,最终用户行业对价格高度敏感,这导致了短期合约。由于商业房地产供应过剩给租金收益率带来压力,客户正在削减设施管理服务的成本。

- 然而,设施管理承包商延迟参与施工週期(即以施工后维护主导的参与)正在减少。提供资产管理的设施管理公司从基础设施开发的早期阶段就参与其中,并提供预防性维护、延长资产寿命和长期合约的设施管理咨询。为了支援中东的智慧设施管理,Enova 正在透过数位化无所不在和卓越的客户服务不断发展和现代化。

- 随着医疗基础设施投资和医疗设施建设的增加,对设施管理服务的需求不断增加。近年来,基础设施已成为向民众提供医疗保健的关键要素。因此,世界各地对医疗基础设施发展的投资不断增加。医疗机构积极投资设备以提供先进的医疗服务。

- 然而,随着资料外洩和安全威胁案例不断增加,对足够技能的需求已成为一项挑战。根据Honeywell的一项调查,27% 的受访建筑设施经理在过去一年中经历过 OT 系统遭受网路攻击,66% 的受访者表示他们没有维护操作技术(OT) 网路安全。受访者表示这是他们的问题之一最难维持的业务。

- COVID-19 的爆发对设施管理公司产生了多种业务影响。对人员流动的限制导致许多客户地点的计划工作减少和活动水准降低。受访的市场中的主要企业,例如 Mitie 和 CBRE Group,都受到了疫情关闭的负面影响。

设施管理市场趋势

日益关注核心能力推动市场成长

- 对于组织来说,将资源、时间和专业知识集中在核心能力上的重要性变得越来越明显。核心能力是使公司能够在其专业行业中竞争的特定能力。公司可以透过与外部服务供应商签订合约来专注于核心业务运营,以实现产品开发、销售、行销和创新等设施管理职能。这一策略重点使组织能够有效地分配资源并实现更高水准的效率和生产力。

- 此外,设施管理提供者正在将其服务范围扩展到传统业务之外,以提供直接支援组织核心能力的附加价值服务。这包括策略设施规划、空间优化、工作场所设计咨询、永续性倡议、能源管理计划等。透过提供这些附加价值服务,公司预计将支持其组织的整体业务目标、实现显着的成本节约并改善用户体验。

- 此外,设施管理提供者认识到员工体验的重要性及其对生产力、敬业度和人才保留的影响。随着组织专注于核心能力,设施管理提供者将调整其服务,以创造有利于员工社会福利、协作和创新的环境。这包括实施人体工学设计原则、整合技术以实现无缝职场体验、提供便利设施和健康计划以及确保安全舒适的职场环境。

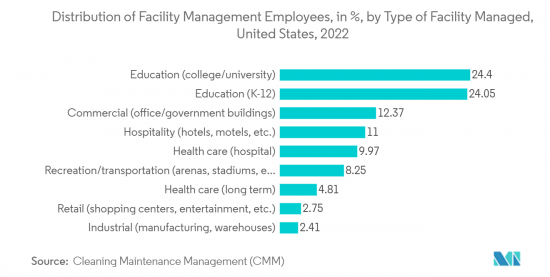

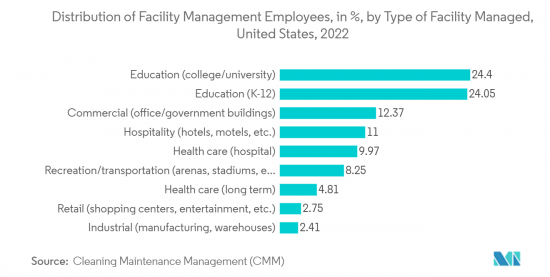

- 根据清洁与维护管理 (CMM) 的一项研究,到 2022 年,美国约 24% 的设施负责人将管理大学或学院建筑。另一方面,製造和仓库等工业环境被记录为管理最少的设施。这项研究的结果表明,美国的许多设施负责人都参与大学和学院建筑的管理。这些机构与设施管理提供者合作,利用专业技能、经济实惠的解决方案和最新的行业标准,确保最佳设施运作并创造有利的研究和学习环境。预计您将从中受益。

- 此外,随着公司努力简化业务、整合技术、提供附加价值服务和创建永续环境,设施管理服务供应商正在调整其产品以反映这些变化。透过专注于其核心优势和策略联盟,组织有望获得专业知识、客製化解决方案和创新技术,以支持其整体成功。Masu。

预计中东和非洲将显着成长

- 卡达和沙乌地阿拉伯的设施管理市场正在经历显着成长,公司需要对其提供的服务进行创新,以继续成长并保持获利。然而,住宅、商业、工业和公共基础设施领域是预计推动调查市场的关键领域。

- 此外,据卡达财政部称,基础设施计划已获得740亿卡达里亚尔(203.3亿美元)的国家利益,约36.0%。这笔金额是为了确保按时完成主要开发计划,特别是与 2022 年在卡达举行的 FIFA 世界杯相关的项目。此外,该部强调,它特别关注两个新兴领域:教育和医疗保健,预计这两个领域的教育计划和计划以及卫生计画和计画将会成长。卫生部门收到近 200 亿卡达里亚尔(54.9 亿美元),教育部门收到近 178 亿卡达里亚尔(48.9 亿美元)。

- 此外,随着预计到 2022 年完成的建筑许可数量的增加,区域设施管理供应商的经营范围预计也会扩大。经济活动、消费者支出和旅游活动活性化等因素正在推高大型住宅布局/计划、酒店和商业空间的运转率。因此,对更好的设施管理的需求日益增长。

- 近年来,日本的医疗设施数量大幅增加,为设施管理公司创造了庞大的商机。此外,政府主导的多项措施正在改变设施管理市场的动态,重塑沙乌地阿拉伯的医疗保健格局,并创造更强大的机构设置和有效的法规结构。

- 此外,随着 COVID-19 病例的增加,设施管理对錶面和空间进行消毒的需求也越来越大。在沙乌地阿拉伯市场,许多公司正在采用此类技术和服务来应对这种情况。

- 此外,由于非洲良好的市场环境和大型设施管理服务供应商的存在,南非正在发展成为一个新兴市场。透过积极参与当地的南非设施管理协会(SA Facilities Management A),产业成员倡导正规培训和技能发展,以提高当地终端客户的服务品质和设施管理水平,我们正在推动管理外包。

设施管理业概况

设施管理市场高度分散,国内外参与企业都拥有数十年的产业经验。设施管理供应商已采取强有力的竞争策略来利用他们的专业知识。我们也花费大量资金进行广告宣传。设施管理提供者正在将技术融入其服务中,以增强其服务组合。市场上营运的知名公司包括戴德梁行 (Cushman & Wakefield PLC)、仲量联行 (Jones Lang LaSalle Inc.)、Emeric Facility Services 和 SMI Facility Services。

2023 年 5 月,Planon 和 SAP 将建立策略合作伙伴关係,为企业提供整合的房地产和设施管理解决方案。因此,企业实体和商业房地产公司将受益于增强的永续建筑性能和优化的投资组合管理。此次合作将透过将 Planon 丰富的房地产和智慧建筑管理解决方案与 SAP 卓越的 ERP 功能相结合,加强程序和技术整合。

2023 年 4 月,BT 集团扩大了与 CBRE 的协议,为其英国投资组合推出设施和计划管理服务,其中包括为超过 80,000 名 BT Group 和 Openreach 员工提供支援的 7,500 多个设施。此次合约延期将目前的合作期限延长至 2026 年,预计将产生进一步的协同效应和服务。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 评估 COVID-19 对设施管理产业的影响

第五章市场动态

- 市场驱动因素

- 加大卫生基础建设投入及卫生设施建设

- 商业建筑中的建筑资讯模型 (BIM) 需求与日俱增

- 更加重视核心能力

- 市场抑制因素

- 资料外洩和安全威胁增加

- 标准化和管理意识不够

第六章市场区隔

- 设施管理:依类型

- 内部设施管理

- 外包设施管理

- 单一设施管理

- 捆绑设施管理

- 综合设施管理

- 按服务

- 硬设施管理

- 软设施管理

- 按最终用户

- 商业的

- 设施

- 公共/基础设施

- 工业的

- 其他最终用户

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 欧洲其他地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区

- 拉丁美洲

- 巴西

- 墨西哥

- 其他拉丁美洲

- 中东/非洲

- 卡达

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 埃及

- 中东和非洲其他地区

- 北美洲

第七章竞争形势

- 公司简介

- CBRE Group, Inc.

- Jones Lang LaSalle Incorporated

- Cushman & Wakefield PLC

- Emeric Facility Services

- SMI Facility Services

- Sodexo, Inc.

- AHI Facility Services, Inc.

- ISS Facility Services, Inc.

- Shine Management & Facility Services

- Guardian Service Industries, Inc.

第八章投资分析

第9章 未来趋势

The Facility Management Market size is estimated at USD 1.33 trillion in 2024, and is expected to reach USD 1.66 trillion by 2029, growing at a CAGR of 4.66% during the forecast period (2024-2029).

Key Highlights

- Facility management consists of multiple factors that influence the productivity and efficiency of organizations. The new management system standard, conforming with the best industry practices, constitutes a benchmark for developing and driving effective strategic, tactical, and operational FM principles across the globe.

- Services in the FM industry have been commoditized to a huge extent. Also, end-user industries are very price-sensitive, and contracts are thus aimed at shorter terms. Commercial real estate over-supply has been creating pressure on rent yields, thus leading the customers to cut costs on FM services.

- However, a late involvement of FM providers in the construction cycle, that is, post-construction led maintenance, was observed to reduce. FM players offering asset management have been involved in the early stages of infrastructure development and provide FM consultancy for preventive maintenance, longer asset life, and longer-term contracts. Enova seeks a digital omnipresence and customer service prominence for growth and modernization to support smart FM in the Middle East.

- With the increasing investments in healthcare infrastructure and the construction of healthcare facilities, the demand for FM services is rising. In recent times, infrastructure has become a crucial element in providing healthcare to the public. Hence, there has been an increased investment in the development of healthcare infrastructure across the world. Healthcare organizations are significantly investing in facilities to deliver advanced healthcare services.

- However, due to increased instances of data breaches and security threats requiring adequate skills is challenging. According to a Honeywell survey, 27% of building facilities managers surveyed had suffered a cyberattack on their OT systems in the past year, and 66% of respondents say maintaining Operation technology (OT) cybersecurity is one of their most challenging duties.

- The outbreak of COVID-19 has had a mixed business impact on facilities management firms. The restrictions on the movement of people resulted in a decline in project work and a decreased level of activity across many customer sites. Significant players in the market studied, such as Mitie, CBRE Group, and others, were adversely affected due to the pandemic lockdown.

Facility Management Market Trends

Increasing Focus on Core Competencies to Drive the Market Growth

- The significance of focusing resources, time, and expertise on core competencies is becoming increasingly evident to organizations. Core competencies are specific abilities that offer businesses a competitive edge in their specialized industries. Organizations may concentrate on their core business operations by contracting with outside service providers for facility management functions, including product development, sales, marketing, and innovation. This strategic focus allows organizations to allocate their resources effectively and achieve higher levels of efficiency and productivity.

- In addition, facility management providers are expanding their service offerings beyond traditional tasks to provide value-added services that directly support the organization's core competencies. This may include strategic facility planning, space optimization, workplace design consulting, sustainability initiatives, and energy management programs. Companies are expected to support the organization's overall business goals, providing significant cost savings, and improve the user experience by providing these value-added services.

- Further, facility management providers are recognizing the importance of employee experience and its impact on productivity, engagement, and talent retention. As organizations focus on their core competencies, facility management providers would adapt their services to create environments promoting employee well-being, collaboration, and innovation. This may involve implementing ergonomic design principles, integrating technology for seamless workplace experiences, providing amenities and wellness programs, and ensuring a safe and comfortable work environment.

- According to a Cleaning & Maintenance Management (CMM) survey, in 2022, around 24 percent of facility management personnel in the United States replied to the question by claiming that they manage college or university buildings. While industrial environments, such as manufacturing and warehousing, were recorded to be the least managed facilities. The survey findings indicate that many facility management personnel in the United States are involved in managing college or university buildings. Such institutions are expected to benefit from specialized skills, affordable solutions and current standards in the industry by collaborating with facility management providers to ensure optimal facility operations and foster an environment that is favorable to study and research.

- Additionally, facility management service providers are adapting their products to reflect these changes as firms work to streamline their operations, integrate technology, supply value-added services, and build sustainable environments. Organizations are anticipated to get specialized knowledge, tailored solutions, and innovative techniques that support their overall success by concentrating on their core strengths and strategic alliances.

Middle East and Africa is Expected to Witness Significant Growth Rates

- Qatar and Saudi Arabia's facility management markets are witnessing significant growth, and companies need to innovate their offerings to keep growing and remain profitable. However, residential, commercial, industrial, and public infrastructure sectors are the primary sectors likely to drive the studied market.

- Moreover, according to the Ministry of Finance of Qatar, infrastructure projects are given QAR 74 billion (USD 20.33 billion), or around 36.0% of the state's interest. This amount is awarded to complete key development projects on schedule, particularly those associated with hosting the FIFA World Cup in Qatar in 2022. In addition, the ministry highlighted a specific focus on two emerging fields, education, and healthcare, which are anticipated to witness the growth of educational projects and initiatives as well as healthcare projects and programs. The health sector has received nearly QAR 20 billion (USD 5.49 billion) in funding, while education has received close to QAR 17.8 billion (USD 4.89 billion).

- Moreover, with the increasing number of building permits expected to be completed by 2022, the regional FM vendors' scope is expected to be high. Factors such as increased economic activity, consumer spending, and tourism activities have increased the occupancy of large residential layouts/projects, hotels, and commercial spaces. This has, in turn, increased the need for better management of the facilities.

- In recent years, healthcare facilities have increased in the country at a significant pace, creating substantial opportunities for facility management companies. Furthermore, several government-driven initiatives are changing the dynamics of the FM market, reshaping the healthcare landscape in Saudi Arabia, and creating a more robust institutional setup and effective regulatory frameworks to promote private sector investment in healthcare.

- Additionally, with increasing cases of COVID-19, the need for facility management to disinfect the surfaces and spaces increased. Many players in the Saudi Arabian market have adopted such technologies and services to combat the situation.

- Furthermore, South Africa is also one of the more developed markets in Africa because of its more favorable market environment and the presence of significant FM service providers. By actively participating in the local South African Facilities Management Association (SAFMA), industry members advocate for formal training and skill development, improve quality-of-service delivery, and promote FM outsourcing among local end customers.

Facility Management Industry Overview

The Facility Management Market is highly fragmented, with local and international players having decades of industry experience. The FM vendors are incorporating a powerful competitive strategy by leveraging their expertise. Also, they are spending a large chunk of the amount on advertising. The FM companies are incorporating technologies into their services, strengthening their service portfolio. A few prominent companies operating in the market include Cushman & Wakefield PLC, Jones Lang LaSalle Inc., Emeric Facility Services, SMI Facility Services, etc.

In May 2023, Planon and SAP established a strategic alliance to provide businesses with an integrated real estate and facilities management solution. Consequently, corporate entities and commercial real estate firms will gain from enhanced and more sustainable building performance as well as optimized portfolio management. The partnership provides enhanced integration of procedures and technology by combining Planon's substantial real estate and smart building management solution with SAP's superior ERP capabilities.

In April 2023, the BT Group expanded its arrangement with CBRE to include facilities and project management services for its UK portfolio, which includes more than 7,500 premises to assist more than 80,000 BT Group and Openreach employees. The contract extension extends the current cooperation until 2026 to provide an additional level of synergy and service delivery.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness-Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of Impact of COVID-19 on the Facility Management Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Investments in Healthcare Infrastructure and the Construction of Healthcare Facilities

- 5.1.2 Requirement of Building Information Modeling (BIM) in Commercial Buildings Addresses the Growth

- 5.1.3 Increasing Focus on Core Competencies

- 5.2 Market Restraints

- 5.2.1 Increased instances of Data Breaches and Security Threats

- 5.2.2 Inadequate Standardization and Managerial Awareness

6 MARKET SEGMENTATION

- 6.1 By Type of Facility Management Type

- 6.1.1 In-house Facility Management

- 6.1.2 Outsourced Facility Mangement

- 6.1.2.1 Single FM

- 6.1.2.2 Bundled FM

- 6.1.2.3 Integrated FM

- 6.2 By Offerings

- 6.2.1 Hard FM

- 6.2.2 Soft FM

- 6.3 By End-Users

- 6.3.1 Commercial

- 6.3.2 Institutional

- 6.3.3 Public/Infrastructure

- 6.3.4 Industrial

- 6.3.5 Other End-Users

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Rest of Europe

- 6.4.3 Asia Pacific

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.3.4 South Korea

- 6.4.3.5 Rest of Asia Pacific

- 6.4.4 Latin America

- 6.4.4.1 Brazil

- 6.4.4.2 Mexico

- 6.4.4.3 Rest of Latin America

- 6.4.5 Middle East and Africa

- 6.4.5.1 Qatar

- 6.4.5.2 Saudi Arabia

- 6.4.5.3 United Arab Emirated

- 6.4.5.4 South Africa

- 6.4.5.5 Egypt

- 6.4.5.6 Rest of Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 CBRE Group, Inc.

- 7.1.2 Jones Lang LaSalle Incorporated

- 7.1.3 Cushman & Wakefield PLC

- 7.1.4 Emeric Facility Services

- 7.1.5 SMI Facility Services

- 7.1.6 Sodexo, Inc.

- 7.1.7 AHI Facility Services, Inc.

- 7.1.8 ISS Facility Services, Inc.

- 7.1.9 Shine Management & Facility Services

- 7.1.10 Guardian Service Industries, Inc.