|

市场调查报告书

商品编码

1403757

海上钻油平臺:市场占有率分析、产业趋势与统计、2024-2029 年成长预测Offshore Drilling Rigs - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

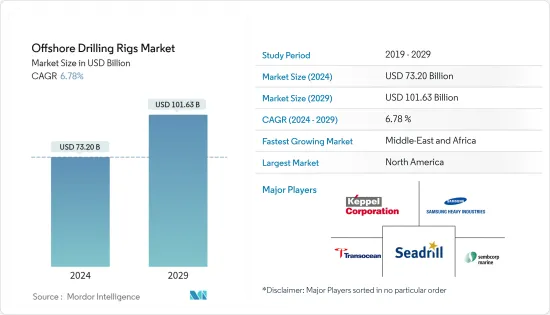

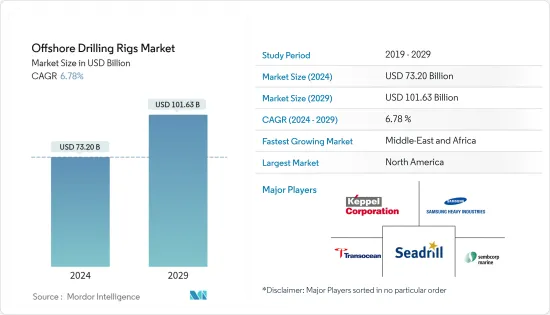

2024年海上钻油平臺市场规模预估为732亿美元,预计2029年将达到1,016.3亿美元,预测期间(2024-2029年)复合年增长率为6.78%。

主要亮点

- 从长远来看,全球能源需求增加和开拓地区的探勘活动等因素预计将在预测期内推动市场发展。

- 另一方面,对海上钻探及其对水生环境影响的日益关注预计将阻碍市场成长。

- 然而,深海和超深海探勘和生产活动的增加预计将在未来创造一些市场机会。

- 北美预计将成为一个主要市场,因为它拥有最新的海上活动技术和基础设施。

海上钻油平臺市场趋势

深水和超深水领域将经历显着成长

- 深海和超深海地区蕴藏大量未开发的石油和天然气蕴藏量。随着陆上和浅海蕴藏量的枯竭,石油和天然气公司越来越注重从这些深海和超深海地区探勘和提取碳氢化合物资源。因此,对能够在如此恶劣环境下运作的钻孔机的需求不断增加。

- 钻井技术、设备和海底系统的进步显着提高了深水和超深水区域钻井作业的可行性和效率。动态定位系统、先进钻井技术和远端操作船 (ROV) 等挑战使得在这些恶劣的海洋环境中进行更安全、更有效率的钻井成为可能。先进技术的出现开拓了以前无法开采的深海蕴藏量,这正在推动该领域的成长。

- 此外,众所周知,深海和超深海区域蕴藏大量石油和天然气蕴藏量。这些蕴藏量通常比陆上或浅水油田具有更高的生产潜力。这些海上地区的高蕴藏量为石油和天然气公司提供了有吸引力的投资机会,增加了对可在这些环境中运作的海上钻油平臺的需求。

- 此外,政府和能源公司正在投资海上探勘和生产活动,以确保未来的能源供应。世界各地正积极进行深海和超深海地区的探勘开发,包括墨西哥湾、巴西盐下蕴藏量、西非、亚太地区。这些投资有助于扩大对深水和超深水钻机的需求。

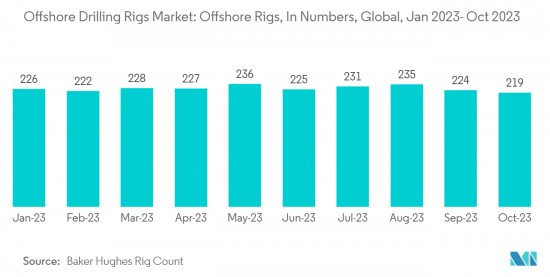

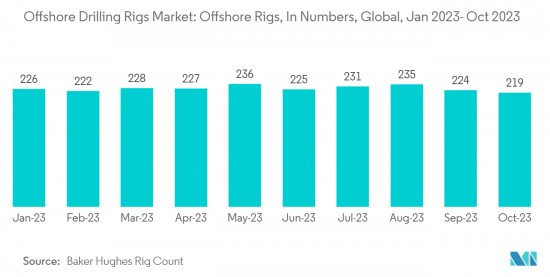

- 根据贝克休斯钻机统计,2023年10月至2022年5月,海上钻井平台数量大幅增加。 2022年5月,只有193个钻井平台,但2023年10月有219个钻井平台,这意味着海上活动在一年内增加了。

- 2022 年 7 月,Jindal Drilling & Industries 宣布已获得石油和天然气公司 (ONGC) 部署 Discovery I 自升式钻井平台的合约。如上所述,Rig Discovery I 是根据 ONGC 授予 Jindal Drilling &Industries 的现有合约运作的。

- 因此,如上所述,深水和超深水领域预计在预测期内将大幅成长。

中东和非洲正在经历显着的成长

- 中东和非洲地区以其丰富的碳氢化合物蕴藏量而闻名,尤其是近海。沙乌地阿拉伯、阿拉伯联合大公国、卡达、奈及利亚、安哥拉和埃及等国家拥有大量海上石油和天然气蕴藏量。这些地区的探勘和生产活动正在推动对海上钻油平臺的需求。

- 中东和非洲许多国家正在积极探勘和开发新的海上油田,以提高油气生产能力。例如,中东波斯湾和红海正在进行的计划。安哥拉、奈及利亚和莫三比克等国正在非洲投资海上油田。这些新发展为海上钻油平臺营运商和服务供应商带来了机会。

- 此外,中东和非洲各国政府也实施了吸引海上石油投资的优惠政策和政策。这些政策包括税收优惠、简化许可流程以及与国际石油公司的合作。此类政府支持措施正在促进该地区海上钻油平臺市场的成长。

- 例如,2022 年 11 月,总部位于阿联酋的 ADNOC 钻井公司从总公司吉宝岸外与海事公司接受了三座新建升降式钻井平台中的第一座。这三座钻井平台是吉宝远东为 BorrDrilling 建造的五座大型钻井平台的一部分。

- 中东和非洲地区也正在投资海事基础设施开发,包括港口、管道和仓储设施。这些基础设施的发展支持海上钻探活动的成长,并实现开采资源的高效物流和运输。发达的基础设施吸引了海上钻油平臺营运商来到该地区。

- 因此,鑑于上述几点,中东和非洲地区预计在预测期内将大幅成长。

海上钻油平臺产业概况

海上钻油平臺市场正在变得半固体。主要参与企业(排名不分先后)包括吉宝企业有限公司、三星重工、胜科海事有限公司、Transocean 有限公司和 Seadrill 有限公司。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 至2028年市场规模及需求预测(单位:十亿美元)

- 2022 年之前浮式钻井平台和自升式钻井的历史平均运作天数

- 主要海上上游计划

- 最新趋势和发展

- 市场动态

- 促进因素

- 全球能源需求增加

- 未开发海上蕴藏量探勘

- 抑制因素

- 环境问题和法规

- 促进因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

第五章市场区隔

- 类型

- 抬高

- 半潜船

- 钻孔船

- 其他类型

- 水深

- 浅海

- 深海/超深海

- 区域市场分析(到 2028 年的市场规模和需求预测(仅按区域)):日本

- 北美洲

- 美国

- 加拿大

- 其他北美地区

- 欧洲

- 英国

- 俄罗斯

- 挪威

- 荷兰

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 澳洲

- 马来西亚

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 委内瑞拉

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 埃及

- 奈及利亚

- 中东和非洲其他地区

- 北美洲

第六章竞争形势

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Offshore Rig Manufacturers

- Keppel Corporation Limited

- Samsung Heavy Industries Co. Ltd

- Sembcorp Marine Ltd

- Daewoo Shipbuilding & Marine Engineering Co. Ltd

- Hyundai Heavy Industries Co. Ltd

- Friede & Goldman Ltd

- Damen Shipyards Group

- Irving Shipbuilding Inc.

- Offshore Drilling Contractors

- Transocean Ltd

- Seadrill Ltd

- ENSCO PLC

- Noble Drilling PLC

- Diamond Offshore Drilling Inc.

- Offshore Rig Manufacturers

第七章 市场机会及未来趋势

- 深海发现的需求不断增长

简介目录

Product Code: 50319

The Offshore Drilling Rigs Market size is estimated at USD 73.20 billion in 2024, and is expected to reach USD 101.63 billion by 2029, growing at a CAGR of 6.78% during the forecast period (2024-2029).

Key Highlights

- Over the long term, factors such as increased global energy demand and exploration activities for untapped regions are expected to drive the market during the forecasted period.

- On the other hand, the rising environmental concerns over offshore drilling and its impact on the aquatic environment are expected to hinder the market's growth.

- Nevertheless, increasing deepwater and ultra-deepwater activities for exploration and production are expected to create several future market opportunities.

- North America is expected to be a major market due to the latest technology and infrastructure for offshore activities.

Offshore Drilling Rigs Market Trends

Deepwater and Ultra-deepwater Segment to Witness Significant Growth

- Deepwater and ultra-deepwater regions hold vast untapped oil and gas reserves. As onshore and shallow-water reserves deplete, oil and gas companies increasingly focus on exploring and extracting hydrocarbon resources from these deepwater and ultra-deepwater locations. It drives the demand for drilling rigs capable of operating in such challenging environments.

- Advances in drilling technologies, equipment, and subsea systems significantly improved the feasibility and efficiency of drilling operations in deepwater and ultra-deepwater areas. Innovations such as dynamic positioning systems, advanced drilling techniques, and remotely operated vehicles (ROVs) enable safer and more efficient drilling in these challenging offshore environments. The availability of advanced technology opened up previously inaccessible deepwater reserves, thereby driving the segment's growth.

- Moreover, deepwater and ultra-deepwater regions are known to host sizable oil and gas reserves. These reserves often include higher production potential compared to onshore and shallow-water fields. The large reserves in these offshore areas make them attractive investment opportunities for oil and gas companies, driving the demand for offshore drilling rigs capable of operating in these environments.

- Furthermore, governments and energy companies invest in offshore exploration and production activities to secure future energy supplies. Deepwater and ultra-deepwater regions are actively explored and developed in various parts of the world, including the Gulf of Mexico, Brazil's pre-salt reserves, West Africa, and the Asia-Pacific region. These investments contribute to the growing demand for deepwater and ultra-deepwater drilling rigs.

- According to Baker Hughes Rig Count, the offshore rig counts increased significantly between Oct 2023 and May 2022. In May 2022, there were only 193 rigs, while in October 2023, there were 219, signifying increased offshore activities in one year.

- In July 2022, Jindal Drilling & Industries revealed that it had secured a contract from Oil & Natural Gas Corporation (ONGC) to deploy the Jack-up Rig Discovery I. It is on a three-year charter hire basis, with an Estimated Daily Rate (EDR) of USD 46,907.57. The Jack-up, as mentioned above, Rig Discovery I, is engaged in operations under an existing contract awarded by ONGC to Jindal Drilling & Industries.

- Therefore, as per the above points, deepwater and ultra-deepwater segments are expected to grow significantly during the forecasted period.

Middle-East and Africa to Witness Significant Growth

- The Middle East and Africa region are known for their rich hydrocarbon reserves, particularly in offshore locations. Countries such as Saudi Arabia, United Arab Emirates, Qatar, Nigeria, Angola, and Egypt include substantial offshore oil and gas reserves. These regions' exploration and production activities drive the demand for offshore drilling rigs.

- Many countries in the Middle East and Africa are actively exploring and developing new offshore fields to enhance their oil and gas production capacities. For example, ongoing projects in the Persian Gulf and the Red Sea in the Middle East exist. Countries like Angola, Nigeria, and Mozambique invest in offshore fields in Africa. These new developments create opportunities for offshore drilling rig operators and service providers.

- Moreover, governments in the Middle East and Africa implemented favorable policies and regulations to attract offshore oil and gas investments. These policies include tax incentives, streamlined permitting processes, and partnerships with international oil companies. Such supportive government initiatives contribute to the growth of the offshore drilling rigs market in the region.

- For instance, in November 2022, ADNOC Drilling, based in the UAE, received the initial unit of a trio of newly constructed jack-up drilling rigs from Keppel Offshore & Marine, headquartered in Singapore. These three rigs were part of a larger batch of five rigs constructed by Keppel FELS for BorrDrilling.

- The Middle East and Africa regions also invest in developing offshore infrastructure, including ports, pipelines, and storage facilities. This infrastructure development supports offshore drilling activities' growth, enabling efficient logistics and transportation of extracted resources. The presence of well-developed infrastructure attracts offshore drilling rig operators to the region.

- Therefore, per the above points, the Middle East and Africa region are expected to grow significantly during the forecasted period.

Offshore Drilling Rigs Industry Overview

The offshore drilling rig market is semi-consolidated. Some major players (in no particular order) include Keppel Corporation Limited, Samsung Heavy Industries Co. Ltd, Sembcorp Marine Ltd, Transocean Ltd, and Seadrill Ltd., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Historical Average Day Rates of Floaters and Jackup Rigs, till 2022

- 4.4 Major Offshore Upstream Projects

- 4.5 Recent Trends and Developments

- 4.6 Market Dynamics

- 4.6.1 Drivers

- 4.6.1.1 Increasing Global Energy Demand

- 4.6.1.2 Exploration of Untapped Offshore Reserves

- 4.6.2 Restraints

- 4.6.2.1 Environmental Concerns and Regulations

- 4.6.1 Drivers

- 4.7 Supply Chain Analysis

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes Products and Services

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Jackups

- 5.1.2 Semisubmersibles

- 5.1.3 Drill Ships

- 5.1.4 Other Types

- 5.2 Water Depth

- 5.2.1 Shallow Water

- 5.2.2 Deepwater and Ultra-deepwater

- 5.3 Geography Regional Market Analysis {Market Size and Demand Forecast till 2028 (for regions only)}

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Russia

- 5.3.2.3 Norway

- 5.3.2.4 Netherlands

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Australia

- 5.3.3.4 Malaysia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Venezuela

- 5.3.4.4 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 Egypt

- 5.3.5.4 Nigeria

- 5.3.5.5 Rest of Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Offshore Rig Manufacturers

- 6.3.1.1 Keppel Corporation Limited

- 6.3.1.2 Samsung Heavy Industries Co. Ltd

- 6.3.1.3 Sembcorp Marine Ltd

- 6.3.1.4 Daewoo Shipbuilding & Marine Engineering Co. Ltd

- 6.3.1.5 Hyundai Heavy Industries Co. Ltd

- 6.3.1.6 Friede & Goldman Ltd

- 6.3.1.7 Damen Shipyards Group

- 6.3.1.8 Irving Shipbuilding Inc.

- 6.3.2 Offshore Drilling Contractors

- 6.3.2.1 Transocean Ltd

- 6.3.2.2 Seadrill Ltd

- 6.3.2.3 ENSCO PLC

- 6.3.2.4 Noble Drilling PLC

- 6.3.2.5 Diamond Offshore Drilling Inc.

- 6.3.1 Offshore Rig Manufacturers

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Demand for Deepwater Discoveries

02-2729-4219

+886-2-2729-4219