|

市场调查报告书

商品编码

1403810

3D列印-市场占有率分析、产业趋势与统计、2024年至2029年成长预测3D Printing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

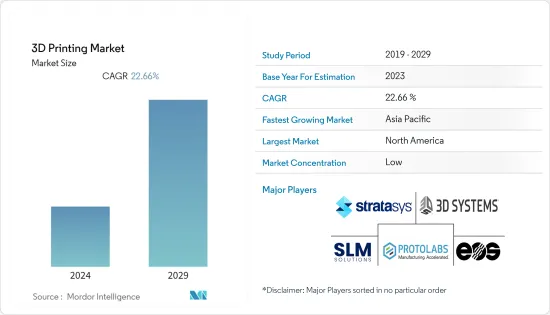

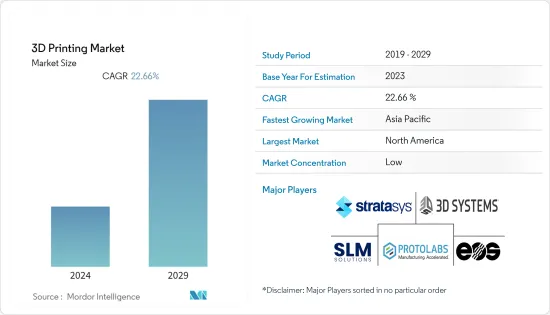

3D列印市场规模预计本财年为202.4亿美元,五年后为562.1亿美元,预测期内复合年增长率为22.66%。

3D列印市场的成长归因于主要製造商越来越倾向于使用该技术进行大规模生产。

主要亮点

- 随着材料成分的快速进步,包括聚合物和金属的新使用案例,积层製造正在从原型设计工具发展成为製造的功能部分。新材料、缩短的交货时间和创新的表面处理使该技术能够融入製造流程,同时符合标准(FDA、ASTM、ISO)。

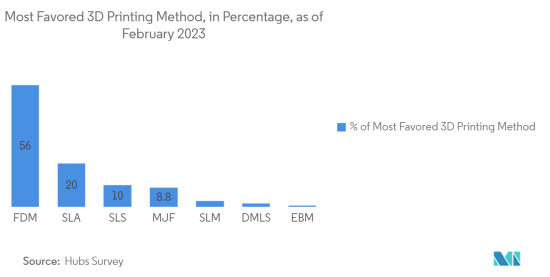

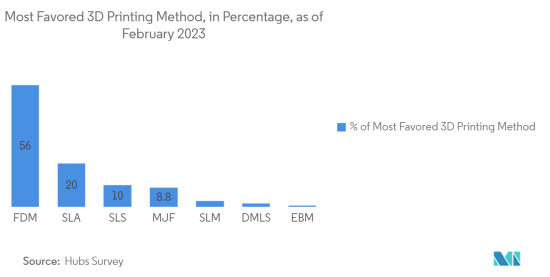

- 此外,由于积层製造机器的价格下降、专业知识的增加和意识的提高,3D 製造的采用正在增加。更新、更先进的熔融沉积建模方法可以使用多种材料,这使得它们近年来在各个行业中被广泛采用。

- 世界各国政府已经开始投资 3D 列印研发,对该技术的普及和采用产生了积极影响。例如,印度政府的目标是到 2022 年 2 月全球市场占有率5% 的份额,在未来两到三年内为 GDP 增加约 2-30 亿美元。政府计划在材料、机械、工艺和软体方面创造 50 项本土技术,使印度成为 3D 列印设计和製造的中心。

- 然而,随着技术的进步,积层製造对传统的智慧财产权(IP)保护提出了挑战。预计这将大大增加印刷武器和毒品的非法使用并阻碍市场成长。该市场也受到实现大规模规模经济所需的高资本成本的抑制因素。此外,缺乏规范製造商的国际标准化机构限制了市场的标准化结构。

- COVID-19大流行增加了对 3D 列印的需求。 3D 列印系统正迅速被用来製造医疗设备、个人防护设备(PPE)、测试设备,甚至用于隔离病人的紧急住房。人工智慧和机器学习等各种技术的进步进一步支持了 3D 列印设备的采用。

- 疫情对金属和聚合物 3D 列印市场造成了沉重打击。儘管金属和聚合物的成长速度低于疫情前的预期,但随着最终用户产业需求的增加,这些市场正在迅速復苏。

3D列印市场趋势

印刷技术和材料的快速进步推动市场

- 生产技术和材料的快速开拓正在推动3D列印市场的需求。世界各地的 3D 列印技术和材料正在快速发展,为 3D 列印和创造复杂的自订设计产品开闢了新的可能性。

- 例如,选择性雷射烧结(SLS)和直接金属雷射烧结(DMLS)等新型列印技术使得製造高精度的复杂金属零件成为可能。这为汽车、航太和国防工业的 3D 列印带来了新的机会。随着太空探勘经历范式转变,更多国家准备发射人造卫星,SLS列印的需求预计将增加。

- 碳纤维和石墨烯等新材料也正在开发用于 3D 列印。这些材料坚固且重量轻,适合各种应用。例如,碳纤维用于製造 3D 列印赛车零件,石墨烯用于製造 3D 列印医疗植入。例如,2022 年 11 月,马萨诸塞州增材製造公司 Inkbit 在 Formnext 上宣布推出其最新的增材製造材料 Titan Tough Epoxy 85合成橡胶。这种材料可提高需要高精度和生产级机械性能的应用的性能。

- 列印技术和材料的快速进步是促进3D列印市场成长的主要趋势之一。随着这些技术的不断发展,製造商将能够将 3D 列印用于各种最终用途。

北美市场占最大份额

- 北美地区预计将主导 3D 列印市场,因为它是该技术的早期采用者。一系列新产品的推出和创新预计将推动市场成长。全球多家3D列印解决方案供应商正在扩大在北美市场的业务,以提高其在市场的占有率。

- 在美国市场,多家公司正加大对3D列印研发的关注。 2023年5月,西门子宣布更加重视其在美国的3D列印工作,透过系列积层製造製造加速美国积层製造的转型。透过这些倡议,该公司致力于从根本上改变从产品到机器再到製造的端到端事物。

- 该地区还出现了北美医疗、航太和国防、工业和消费品产业的投资浪潮,预计这些产业将大幅成长。 2022 年 11 月,医疗科技新兴企业Axial3D 获得 1,500 万美元融资,由 Stratasys 领投的 1,000 万美元策略投资。两家公司之间的合作预计将使医院和医疗设备製造商更容易获得针对患者的 3D 列印解决方案,并使其成为主流医疗解决方案。

- 此外,美国国家航空暨太空总署 (NASA) 等多个政府机构已经认识到,对 3D 列印技术的大量投资可以极大地促进太空应用和零重力技术的发展,从而推动市场成长。

- 在美国,健身追踪器和智慧服装也有望成为 3D 列印技术的驱动力。此外,不断变化的消费者偏好和日益增长的客製化需求正在推动开发由 3D 列印技术支援的柔性錶带和电子系统的需求,从而推动市场成长。

3D列印行业概况

3D列印市场分为全球参与企业和区域参与企业。 Stratasys Ltd、3D Systems Corporation、EOS GmbH、通用电气公司 (GE Additive) 和 Sisma SPA 等市场主要企业正在透过联盟、合併、收购和投资来维持其市场地位。

2023 年 4 月,聚合物 3D 列印解决方案的领导者之一 Stratasys Ltd. 收购了 Covestro AG 的积层製造材料业务。此次收购包括位于欧洲、美国和亚洲的研发设施和活动,以及全球开发和销售团队。

2022年10月,AML3D澳洲金属3D列印扩大了与波音飞机製造商的合作关係。今年早些时候,波音公司委託 AML3D 进行 3D 列印铝製原型飞机零件,作为密集测试程序的一部分。这是根据「飞行」部件的 AS9100D 品质保证要求进行测试的。根据这份合同,决定扩大计划范围,将 3D 列印零件纳入。

2022 年 6 月,总公司以色列的 Stratasys 计划扩大其在印度的 3D 列印空间。公司客户包括Ashok Leyland、Hero MotoCorp、AIIMS、Symbiosis、IITs等,在设计原型、製造工具和生产零件方面拥有丰富的经验。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场概况

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 产业价值链分析

- COVID-19 对市场的影响

第五章市场动态

- 市场驱动因素

- 政府措施和支出

- 易于开发客製化产品

- 市场挑战

- 初始成本高且缺乏技能

第六章市场区隔

- 依技术

- 立体光刻技术(SLA)

- 熔融沉积建模(FDM)

- 电子束熔炼

- 数位光处理

- 选择性雷射烧结(SLS)

- 其他技术

- 依材料类型

- 金属

- 塑胶

- 陶瓷

- 其他材料类型

- 按最终用户产业

- 车

- 航太/国防

- 医疗保健

- 建筑/施工

- 活力

- 食品

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 世界其他地区 中东/非洲

第七章竞争形势

- 公司简介

- Stratasys Ltd

- 3D Systems Corporation

- EOS GmbH

- General Electric Company(GE Additive)

- Sisma SPA

- ExOne Co.

- SLM Solutions Group AG

- Proto Labs Inc.

- Hewlett Packard Inc.

- Nano Dimernsion Ltd

- Ultimaker BV

第八章投资分析

第九章 市场机会及未来趋势

The 3D Printing Market size was estimated at USD 20.24 billion in the current year to USD 56.21 billion in five years, registering a CAGR of 22.66% during the forecast period. This growth of the 3D printing market is pinned to the trend that large manufacturers are increasingly using the technology for mass production.

Key Highlights

- With rapid advancements in material composition, such as the emerging use cases of polymers and metals, additive manufacturing is evolving from a prototyping tool to a functional part of fabrication. New materials, shorter lead times, and innovative finishes while adhering to standards (FDA, ASTM, and ISO) enable the technology to be integrated into manufacturing processes.

- Further, the decreased prices of additive manufacturing-based machines, growing expertise, and awareness have increased 3D manufacturing adoption. Newer and advanced fused deposition modeling methods have enabled the use of diverse materials, thereby boosting widespread adoption across various industries over recent years.

- Governments worldwide have already started investing in R&D on 3D printing, which has positively impacted technology propagation and adoption. For instance, in February 2022, the government of India aims to capture 5% of the global market share in 3D printing by adding nearly USD 2-3 billion to the GDP in the coming 2-3 years. The government plans to create 50 India-specific technologies for material, machine, process, and software to make India a 3D-printed design and manufacturing hub.

- However, as technology advances, additive manufacturing challenges the traditional forms of Intellectual Property (IP) protection. It significantly boosts the illegal usage of printed weapons and drugs, which is expected to hinder the market's growth. Also, the market is constrained by the high equipment costs needed to achieve substantial economies of scale. Furthermore, the lack of an international standards body regulating manufacturers limits the market's standardization structure.

- COVID-19 pandemic increased the demand for 3D printing. 3D printing systems are rapidly being utilized to create medical devices, personal protective equipment (PPE), testing devices, and even emergency dwellings to isolate persons suffering from the disease. The various technological advancements, such as AI and ML, further augment the adoption of 3D Printing devices.

- The pandemic hit the metal and polymer 3D printing markets hard. Whereas growth has been slower for metals and polymers than pre-pandemic expectations, these markets are returning rapidly with growing demand from end-user industries.

3D Printing Market Trends

Rapid Advancement in Printing Technologies and Materials to Drive Market

- Rapid developments in production technologies and materials are helping to drive demand for the 3D printing market. The rapid growth of 3D printing techniques and materials is taking place worldwide, opening up new possibilities in 3D printing and creating complex and custom design products.

- For example, new printing technologies like selective laser sintering (SLS) and direct metal laser sintering (DMLS) make it possible to create complex metal parts with high precision. This is opening up new opportunities for 3D printing in the automotive, aerospace, and defense industries. With space exploration witnessing a paradigm shift, the demand for SLS printing is expected to mount, with an increasing number of countries gearing up to launch satellites.

- New materials like carbon fiber and graphene are also being developed for 3D printing. These materials are solid and lightweight, making them ideal for various applications. For example, carbon fiber is used to create 3D-printed racing car parts, and graphene is used to create 3D-printed medical implants. For instance, in November 2022, Inkbit, a Massachusetts-based additive manufacturing company, introduced its latest additive manufacturing material, the Titan Tough Epoxy 85 elastomer, at Formnext. This material improves performance for applications requiring high accuracy and production-grade mechanical properties.

- The rapid advancement in printing technologies and materials is one of the key trends contributing to the growth of the 3D printing market. As these technologies continue to develop, manufacturers can use 3D printing in various end-use applications.

North America Holds the Largest Share in the Market

- The North American region is expected to dominate the 3D printing market as the region is an early adopter of technology. A series of new product launches and innovations are expected to augment market growth. Several 3D printing solution providers worldwide are expanding their presence in the North American market for an enhanced market presence.

- Several players in the United States market are expanding their focus on 3D printing research and development. In May 2023, Siemens announced its increasing emphasis on 3D printing initiatives in the United States to accelerate the transformation of the US additive manufacturing industry through serial additive manufacturing. With these initiatives, the company is working on bringing fundamental changes to the landscape, end-to-end, from product to machine to manufacturing.

- The region is also witnessing a series of investments in North America's healthcare, aerospace and defense, industrial, and consumer products industries, which are expected to grow significantly. In November 2022, Med-tech start-up Axial3D received an investment round of USD 15 million led by a strategic investment of 10 million USD from Stratasys. The collaboration between the two companies would provide a combined offering to make 3D printing solutions that are patient-specific for hospitals and medical device manufacturers more accessible, pushing for its adoption as a mainstream healthcare solution.

- In addition, various government organizations, such as NASA, have identified that substantial investments in 3D printing technologies can contribute considerably to space applications and develop zero-G technologies, driving the market's growth.

- Fitness trackers and smart apparel are also expected to drive factors for 3D printing technology in the United States. Also, changing consumer preferences and a rising need for customization have brought about a need to create flexible bands and electronics systems that could be realized using 3D printing technology, thereby driving its growth.

3D Printing Industry Overview

The 3D printing market is fragmented with global and regional players. The key players in the market, like Stratasys Ltd, 3D Systems Corporation, EOS GmbH, General Electric Company (GE Additive), and Sisma SPA, among others, are making partnerships, mergers, acquisitions, and investments in the market to retain their market position.

In April 2023, Stratasys Ltd., one of the leaders in polymer 3D printing solutions, acquired Covestro AG's additive manufacturing materials business. The acquisition includes R&D facilities and activities, global development, and sales teams in Europe, the United States, and Asia.

In October 2022, AML3D Australian metal 3D printing expanded its partnership with Boing aircraft manufacturer. Boeing tasked AML3D earlier this year with 3D printing aluminum prototype airplane components as part of an intensive testing procedure. They were tested against the requirements of AS9100D quality assurance for 'fly' parts. Building on this contract, it has now been decided to broaden the scope of the project to include additional 3D-printed components, increasing the agreement's value by 150%.

In June 2022, Israel-based Stratasys planned the expansion of its 3D printing sector in India. Ashok Leyland, Hero MotoCorp, AIIMS, Symbiosis, and IITs are among the company's clientele, with extensive experience in design prototyping, manufacturing tools, and production parts.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGTHS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Initiatives and Spending by the Government

- 5.1.2 Ease in Development of Customized Products

- 5.2 Market Challenges

- 5.2.1 High Initial Cost and Skill Shortage

6 MARKET SEGMENTATION

- 6.1 By Technology

- 6.1.1 Stereo Lithography (SLA)

- 6.1.2 Fused Deposition Modeling (FDM)

- 6.1.3 Electron Beam Melting

- 6.1.4 Digital Light Processing

- 6.1.5 Selective Laser Sintering (SLS)

- 6.1.6 Other Technologies

- 6.2 By Material Type

- 6.2.1 Metal

- 6.2.2 Plastic

- 6.2.3 Ceramics

- 6.2.4 Other Material Types

- 6.3 By End-user Industry

- 6.3.1 Automotive

- 6.3.2 Aerospace and Defense

- 6.3.3 Healthcare

- 6.3.4 Construction and Architecture

- 6.3.5 Energy

- 6.3.6 Food

- 6.3.7 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Stratasys Ltd

- 7.1.2 3D Systems Corporation

- 7.1.3 EOS GmbH

- 7.1.4 General Electric Company (GE Additive)

- 7.1.5 Sisma SPA

- 7.1.6 ExOne Co.

- 7.1.7 SLM Solutions Group AG

- 7.1.8 Proto Labs Inc.

- 7.1.9 Hewlett Packard Inc.

- 7.1.10 Nano Dimernsion Ltd

- 7.1.11 Ultimaker BV