|

市场调查报告书

商品编码

1403814

PH 感测器:市场占有率分析、行业趋势和统计、2024 年至 2029 年成长预测PH Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

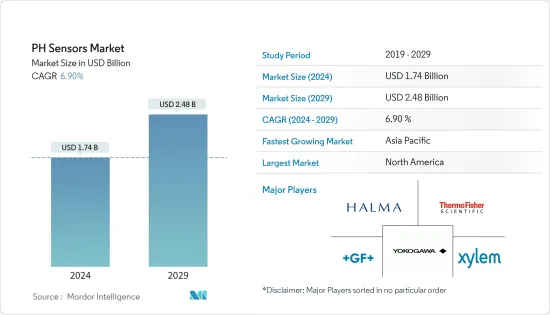

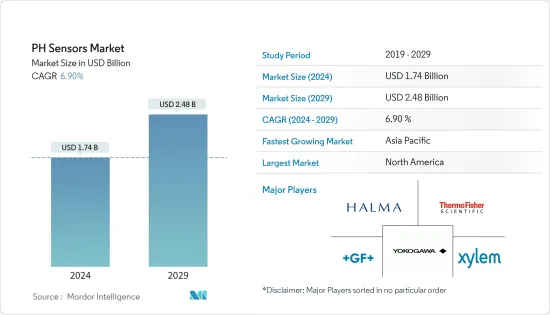

PH感测器市场规模预计到2024年为17.4亿美元,预计到2029年将达到24.8亿美元,在预测期内(2024-2029年)复合年增长率为6.90%。

水、污水、铬和水产养殖处理厂中 pH 感测器和分析仪的使用迅速增加,以准确读取氧化还原电位和 pH 水平,推动了市场成长。 pH 感测器可监测药物效率并为药品生产提供最佳 pH 水平,进一步推动市场发展。

主要亮点

- 此外,全球工业自动化需求不断成长也是推动pH感测器市场开拓的重要因素。此外,印度政府还批准了 16 家关键原料 (KSM)/医药中间体和功能性药物成分 (API) 工厂的 PLI 计划。这16座工厂的建设将投资4,701万美元。这些工厂的商业开发预计将于 2023 年 4 月开始。此外,政府最近还拨款 3.6232 亿美元用于电子和 IT 硬体製造升级,并拨款 1.0425 亿美元用于印度混合和电动车的快速采用和製造 (FAME-India)。

- ZVEI(德国电气电子工业协会)指出,这种情况为测量和製程自动化产业创造了有利的商业环境,同时增加了对pH感测器和分析仪等製程分析设备的需求。

- 此外,有关工业和城市污水污水的严格政府法规正在推动回收和再利用系统中水处理技术的发展,这可能会进一步推动预测期内的调查市场。

- 此外,印度城市的市政当局广泛使用污水技术进行城市污水处理。据NITI Aayog称,由于全国各地市政和污水处理厂的需求不断增长,印度污水处理厂市场预计到2025年将增长至43亿美元。

- 此外,世界各国正在对水基础设施和海水淡化计划进行大量投资。例如,智利中央政府计划在未来几年内斥资2.8亿美元用于水利基础设施。各国也推出了激励措施,在全球范围内促进水处理和污水处理,预计这将推动 pH 感测器和分析仪市场的发展。

- 然而,成本限制和对既定标准的需求正在限制市场成长。许多 pH 感测器已被使用并表现出较高的商业性接受度,包括组合 pH 感测器、差分 pH 感测器、实验室 pH 感测器和製程 pH 感测器。然而,其操作标准有限。这些技术彼此不同且不相容。这些感测器提供的认知度低、接受度低以及不合理的品质标准也可能阻碍市场成长。

pH感测器市场趋势

用水和污水应用记录显着成长

- 由于环保机构和环境状况意识的不断增强,用水和污水产业构成了单一市场中最大的垂直细分市场。铬污水处理和水产养殖等标准应用在很大程度上依赖准确的 pH 和 ORP 测量来提供必要的安全标准,从而创造持续的市场需求。

- 永续能源计划在北美、欧洲和亚太地区等地区强劲成长。水处理和海水淡化活动等水处理倡议对 pH 感测器产生了巨大需求,并在市政和工业部门中迅速普及。

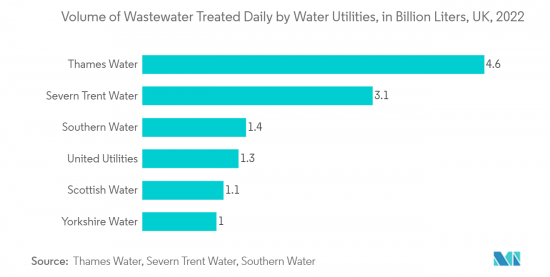

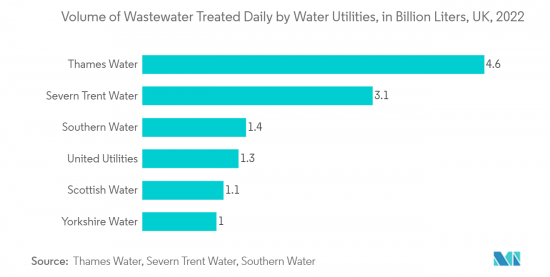

- 泰晤士水务公司表示,截至 2022 年 3 月,该公司每天处理的污水量为 46 亿公升。泰晤士水务公司总部位于伯克郡雷丁,拥有 353 个废水处理厂。它还每天为伦敦和泰晤士河谷地区超过 1500 万客户提供 25 亿公升饮用水。

- 在全球范围内,水处理厂数量的增加和水资源短缺的情况加剧了海水淡化产业对 pH 感测器的需求。水的pH值是控制海水淡化系统处理系统的重要资料。例如,2022年11月,水处理解决方案提供商Daiki Axis Japan计划在印度哈里亚纳邦设立第二家工厂,投资金额为20亿印度卢比。

- 此外,化学、水和污水行业的投资也有望增加。例如,2022 年 7 月,美国农业部(USDA) 宣布了一项计划,旨在发展农村供水基础设施,并改善在殖民地、农村和部落社区生活和工作的人们的经济机会。我们投资了1300 万美元,这 。该投资包括 900 万美元,将为生活在弱势社区的近 14,000 人提供支持。

- 此外,2022 年 8 月,拜登-哈里斯政府宣布建立 EPA-USDA 合作伙伴关係,为服务不足的美国农村地区提供废水卫生设施。

亚太地区将经历显着的市场成长

- 由于新兴经济体、对技术进步的认识不断增强、製药和生物技术行业的进步、製造业意识的提高以及政府措施资金筹措倡议的增加,亚太地区将在未来几年受到 PH 感测器市场的青睐。预期的。

- 据IBEF称,印度政府将在Jal Jeevan项目上花费35万印度卢比(465亿美元),该项目将在2024年之前在沿海地区安装各种处理和海水淡化厂,以加强现有的水源,这是前景。该代表团还希望现有的供水和工作连接、保持水质并实现永续农业。

- 此外,根据能源研究所 (TERI) 报告的资料,到 2022 年 2 月,到 2050 年,该国的用水需求预计将扩大到 1,180 BCM。污水处理用水的这种扩展可能会进一步推动未来所研究市场的成长。

- 此外,随着中国基础设施计划的增加,许多水资源再利用和污水处理政策都需要pH感测器和分析仪。例如,根据国际水协会的统计,中华人民共和国首都北京四分之一的生活废水得到回用,工业污水的强化处理率达85%。

- 此外,石油和天然气计划投资的增加进一步推动了该地区对 pH 测量的需求。据 IBEF 称,2022 年 5 月,ONGC 宣布计划在 22-25 财年投资 40 亿美元,扩大在印度的探勘活动。

- 此外,2022年3月,印度石油公司董事会核准对Numaligarh石化计划投资655.5亿印度卢比(8.3949亿美元)。此外,石油业炼油暂定装置容量为24,921万吨,使IOC成为全国最大的炼油厂,容量为7,005万吨。

pH感测器产业概况

pH 感测器市场适度集中,有多家主要参与者。目前,几家主要企业在市场市场占有率方面占据主导地位,包括豪迈集团(Halma PLC)、赛默飞世尔科技公司(Thermo Fisher Scientific Inc.)、赛莱默公司(Xylem Inc.)、横河电机公司(Yokoyama Electric Corporation)和乔治费歇尔管道系统有限公司(George Fischer Piping Systems Ltd.)。这些拥有重要市场占有率的领先公司正致力于扩大在基本客群。这些公司利用策略合作计划来增加市场占有率和盈利。此外,市场上表现良好的公司正在收购从事 pH 感测器研究的新兴企业,以增强其产品能力。

- 2023 年 2 月 - Rajguru Electronics 发布 ADIY pH 感测器模组,该感测器可计算任何液体中的氢势 (pH)。一种低成本感测器,可以精确测量水溶液中的氢离子活性。它也比 pH 指示剂溶液或石蕊测试更准确。这些感测器可以轻鬆与 Raspberry Pi 或 Arduino 整合。

- 2022 年 6 月 - ABB AWT420 变送器最近获得了 MCERTS 产品一致性。 AWT420 传送器可与类比或数位 EZLink 感测器结合使用,适用于各种应用,包括饮用水、污水、工业用水和电力。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场动态

- 市场驱动因素

- 加强政府监管

- 人们对工业设备安全的兴趣日益浓厚

- 市场抑制因素

- pH 感测器设备的成本和缺乏标准化

第六章市场区隔

- 按类型

- 桌上型分析仪

- 便携式分析仪

- 过程分析仪

- 按用途

- 用水和污水

- 医疗保健

- 油和气

- 食品和饮料

- 工业的

- 其他用途

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章竞争形势

- 公司简介

- Halma Plc.

- Thermo Fisher Scientific Inc.

- Xylem Inc.

- Yokogawa Electric Corporation

- Georg Fischer Piping Systems Ltd

- Honeywell International Inc.

- KOBOLD Messring GmbH

- Emerson Electric Co.

- Schneider Electric SE(Foxboro)

- ABB Ltd

- Hach Company Inc.(Danaher Corporation)

- Endress+Hauser AG

- Mettler-Toledo International Inc.

第八章投资分析

第9章 市场的未来

The PH Sensors Market size is estimated at USD 1.74 billion in 2024, and is expected to reach USD 2.48 billion by 2029, growing at a CAGR of 6.90% during the forecast period (2024-2029).

The market growth is driven by the surge in the usage of pH sensors and analyzers in water, wastewater, chromium, and aquaculture treatment plants for formulating precise readings of the oxidation-reduction potential and pH levels. pH sensors monitor drug efficiency and provide optimal pH levels for pharmaceutical manufacturing, further driving the market.

Key Highlights

- Further, the growth in the need for industrial automation around the globe is one of the essential elements driving the development of the pH sensors market. Additionally, the government of India sanctioned a PLI scheme for 16 plants for critical starting materials (KSM)/drug intermediates and functional pharmaceutical ingredients (APIs). Installing these 16 plants would result in a total investment of USD 47.01 million. The commercial development of these plants is anticipated to begin by April 2023. Furthermore, the government lately allocated USD 362.32 million to upgrade electronics and IT hardware manufacturing and USD 104.25 million for the Faster Adoption & Manufacturing of Hybrid and Electric automobiles in India (FAME - India).

- ZVEI (German Electrical and Electronic Manufacturers' Association) specified that these circumstances created a favorable business environment for the measurement and process automation industry while raising the need for process analytics instruments, such as pH sensors and analyzers.

- In addition, Stringent government rules over industrial and municipal wastewater disposal are driving the water treatment technology need evolution in recycling and reuse systems which may provide further momentum to create the market studied during the forecast period.

- Furthermore, Municipal authorities widely use wastewater technology in different cities across India for municipal wastewater treatment. According to NITI Aayog, India's market for wastewater treatment plants is expected to rise to USD 4.3 billion by 2025 due to growing demand for municipal and sewage water therapy facilities nationwide.

- Further, countries worldwide have made considerable investments in water infrastructure and desalination projects. For instance, the central government in Chile plans to fund USD 280 million in water infrastructure over the coming years. Countries have also developed to present incentives to promote water and wastewater treatment around the globe, which is anticipated to push the market for pH sensors & analyzers market.

- However, cost constraints and a need for established standards restrain market growth. Many pH sensors, like combination, differential, laboratory, and process pH sensors, are utilized and notice high commercial acceptance. However, there are only so many specified standards for their operation. These technologies are different from each other and lack compatibility. Lack of awareness, less acceptability, and the unjust quality standard these sensors offer could also hinder the market growth.

pH Sensors Market Trends

Water and Wastewater Application to Register Significant Growth

- The water and Wastewater Industry" accounts for the biggest vertical segment in the individual market due to environmental agencies' growth in awareness and environmental situation. Standard applications, like chromium wastewater treatment and aquaculture, largely dependent on precise pH and ORP measurements to provide needed safety standards, are providing constant demand in the market.

- Regions like North America, Europe, and Asia-Pacific, have noticed a significant growth in sustainable energy projects. Water treatment initiatives, like water treatment and desalination activities, are rapidly gaining popularity among municipalities and industrial sectors, developing a substantial need for pH sensors.

- According to Thames Water, the company treated 4.6 billion liters of wastewater daily for the year ending March 2022. Thames Water is established in Reading, Berkshire, with 353 sewage treatment works. It also delivers 2.5 billion liters of drinking water daily to more than 15 million customers in London and the Thames Valley region.

- Globally, growing water treatment plants and situations regarding water scarcity fuel the need for pH sensors from the desalination sector. Water pH gives crucial data for controlling the treatment system for desalination systems. For instance, in November 2022, Daiki Axis Japan, a Water treatment solutions provider, intended to set up its second plant in Haryana, India, with an investment of INR 200 crore, with the plant capacity to produce 1,000 sewage treatment units with Japanese "Johkasou" technology.

- Furthermore, investments from the chemical, water, and wastewater industries are anticipated to increase. For instance, in July 2022, The U.S. Department of Agriculture (USDA) invested USD 13 million to develop access to rural water infrastructure and assemble economic opportunities for people who live and work in colonies or rural and Tribal communities. The investments contain over USD 9 million to help nearly 14,000 people in socially vulnerable communities.

- Further, in August 2022, Biden-Harris Administration introduced EPA-USDA Partnership to deliver Wastewater Sanitation to Underserved Rural America, as such developments will further drive market growth.

Asia Pacific to Experience Significant Market Growth

- Asia-Pacific is anticipated to experience lucrative growth in the ph sensors market over the coming years due to the emerging economy, rising awareness of technological advancements, advances in the pharmaceutical and biotechnology industries, growing awareness in the manufacturing sector, and an increase in government initiatives for funding.

- According to IBEF, the Indian government is expected to spend INR 3.50 lakh crore (USD 46.5 billion) for the "Jal Jeevan" program, which strives to reinforce the current water sources to set up different treatment plants and desalination plants in the coastal regions by 2024. The mission also desires that the existing water supply and connections are functional, water quality is maintained, and sustainable agriculture is achieved.

- Further, in February 2022, According to the data reported by The Energy and Resources Institute (TERI), the country's water demand is anticipated to grow to 1180 BCM by 2050. Such expansion in water in wastewater treatment may further drive the studied market growth in the future.

- In addition, with growing infrastructure projects in China, many water reuse and wastewater treatment policies are demanding pH sensors and analyzers in the country. For example, the statistics from the International Water Association indicate that Beijing, the capital of the People's Republic of China, recycled a quarter of its domestic wastewater and enhanced the treatment of up to 85 percent of industrial wastewater discharge.

- Moreover, growing investments in oil and gas projects further drive the demand for pH measurements in the region. According to IBEF, in May 2022, ONGC announced plans to invest USD 4 billion from FY22-25 to expand its exploration efforts in India.

- Furthermore, in March 2022, the Board of Oil India approved an investment of INR 6,555 crore (USD 839.49 million) for the Numaligarh petrochemical project. In addition, the oil sector's aggregate installed provisional refinery capacity stood at 249.21 MMT, and IOC appeared as the largest domestic refiner with a capacity of 70.05 MMT.

pH Sensors Industry Overview

The pH sensors market is moderately concentrated with the presence of several major players. A few significant players such as Halma PLC, Thermo Fisher Scientific Inc., Xylem Inc., Yokogawa Electric Corporation, and George Fischer Piping Systems Ltd. currently dominate the market in terms of market share. With a prominent market share, these major players focus on expanding their customer bases in various foreign countries. These companies leverage strategic collaborative initiatives to improve their market shares and profitability. The players performing in the market are also acquiring startups working on pH sensors to intensify their product capabilities.

- February 2023 - Rajguru Electronics released the ADIY pH sensor module, a sensor for calculating the potential of hydrogen (pH) in any liquid. It is a low-cost sensor that can precisely measure the hydrogen-ion activity in water-based solutions. Also, it provides better accuracy than pH Indicator solutions and litmus tests. These sensors can easily be integrated with Raspberry Pi and Arduino.

- June 2022 - ABB AWT420 Transmitter has recently acquired MCERTS product conformity and an associated range of new ABB pH sensors. The AWT420 transmitter can be used with analog or digital EZLink sensors for various applications, including drinking water, wastewater, industrial water, and power.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness- Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Government Regulations

- 5.1.2 Rising Safety Concerns in Industrial Setups

- 5.2 Market Restraints

- 5.2.1 Cost and Absence of Standardization of pH Sensor Devices

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Benchtop Analyzers

- 6.1.2 Portable Analyzers

- 6.1.3 Process Analyzers

- 6.2 By Application

- 6.2.1 Water and Wastewater

- 6.2.2 Medical

- 6.2.3 Oil and Gas

- 6.2.4 Food and Beverages

- 6.2.5 Industrial

- 6.2.6 Other Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Halma Plc.

- 7.1.2 Thermo Fisher Scientific Inc.

- 7.1.3 Xylem Inc.

- 7.1.4 Yokogawa Electric Corporation

- 7.1.5 Georg Fischer Piping Systems Ltd

- 7.1.6 Honeywell International Inc.

- 7.1.7 KOBOLD Messring GmbH

- 7.1.8 Emerson Electric Co.

- 7.1.9 Schneider Electric SE (Foxboro)

- 7.1.10 ABB Ltd

- 7.1.11 Hach Company Inc. (Danaher Corporation)

- 7.1.12 Endress+Hauser AG

- 7.1.13 Mettler-Toledo International Inc.