|

市场调查报告书

商品编码

1403829

震动监测 -市场占有率分析、行业趋势和统计、2024-2029 年成长预测Vibration Monitoring - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

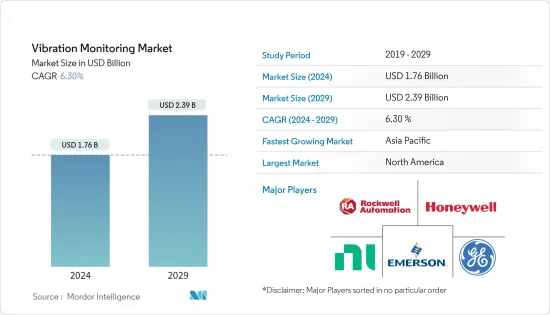

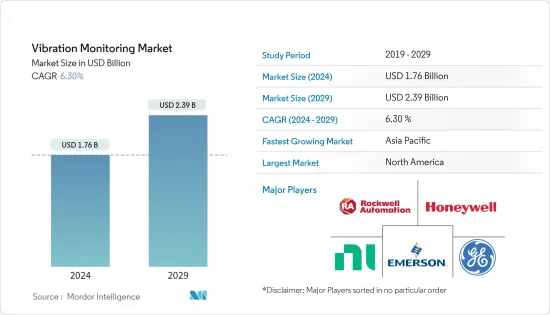

震动监测市场规模预计到 2024 年为 17.6 亿美元,预计到 2029 年将达到 23.9 亿美元,在预测期内(2024-2029 年)复合年增长率为 6.30%。

由于比生产流程更简化的维护流程具有最佳化潜力,机械维护产业正在不断成长。

主要亮点

- 震动监测是预测性维护的一个重要方面,主要用于旋转设备,如蒸气涡轮和燃气涡轮机机、马达、泵浦、压缩机、造纸机、轧延、工具机和工具机。用于评估设备的运作状况和机械状况。震动分析可以在问题变得严重并导致意外停机之前发现问题。这可以透过连续或以指定间隔监测机器震动来实现。

- 震动状态监测设备测量旋转和往復机械的震动程度。感测器收集频率和振幅资讯来测量机器震动模式。震动监测对于追踪和分析齿轮和轴承等机械部件的状况变化以及预测设备和零件故障至关重要。

- 与物联网 (IoT) 相关的先进技术和服务的引入正在改变大多数工业应用。新参与企业和传统进入者提供改变商业模式的创新解决方案的机会越来越多,旨在实现工厂自动化和工业智慧维护,创造更多创新的工作环境,这是透过努力产生的。由于使用状态监测进行预防性维护,震动监测市场预计将出现强劲成长。

- 化学、石油和天然气、电力和石化、水泥和製药等行业必须遵守严格的国际政策,管理流程效率、人体工学和员工安全。製造过程会产生许多有毒气体和化学物质,包括多环芳烃、乙烯、苯、丙烯、硫化氢、丁二烯、丁烷和硫,取决于产品。因此,员工安全已成为重中之重,震动监测正在蓬勃发展。

- 这种重要性促使各行业做出特别努力来保护其机械。使用状态监测进行故障识别的主要好处是,负责人可以采取补救措施,以避免或降低维修成本,提高机器安全性,从而提高人身安全。市场成长受到各种关键因素的推动,包括机器状态监测中无线系统的接受度不断提高、自动化状态监测技术的普及和智慧工厂的普及,以及用于状态监测的安全云端运算平台的出现。

- 技术专长的存在可以改善整体市场成长。此外,由于管理机构施加的道德考虑以及需要熟练的技术资源来进行可操作的资料分析,市场面临限制。此外,由于偏远地区缺乏专业知识以及震动监测系统与其他维护方法整合的趋势不断增加,预计市场在整个预测期内将面临挑战。

- 由于COVID-19的爆发,远端操作的需求大幅增加。 2020年第一季,全球多家工业通讯企业收益成长大幅下滑。随着经济持续復苏和远端控制需求的增加,市场变得越来越活跃,导致不需要人工监督的高度自动化系统的引入。

震动监测市场趋势

石油和天然气占据主要市场占有率份额

- 石油和天然气业务在恶劣的操作环境下运营,包括海上钻井和石化精製。机械故障会造成严重的经济和环境后果。因此,在世界许多地区,检测和预防不可预测的石油和天然气机械及零件问题是强制性的。因为预测性维护技术透过优化维护计划和提高生产力来帮助降低营运成本。

- 石油和天然气产业处于采用创新技术的最前沿,以在快速发展的(物联网)形势中优化营运、提高效率并确保安全。该行业受到严格的监管标准,以确保营运安全和环境保护。震动监测是帮助企业遵守这些法规的主动措施。透过利用震动感测器并采取主动维护方法,石油和天然气产业可以优化资产性能、提高安全性并显着节省成本。

- 石油和天然气产业预计将主导不断扩大的市场。能源电力产业包括煤炭、核能、矿产、无污染燃料领域。已开发国家和开发中国家政府和私营部门在替代能源和电力源的支出不断增加,导致安装更多额外的能源和发电厂,加剧了对震动监测程序的需求。例如,2022年3月,印度石油公司董事会核准对Numaligarh石化计划投资655亿印度卢比(8.3949亿美元)。此类计划可能会增加震动监测系统的应用机会。

- 此外,2022 年 1 月,印度石油公司 (IOCL) 宣布了城市燃气发行(CGD) 行业的扩张计划,并正在考虑投资 700 亿印度卢比(9.186 亿美元)。此外,2022 年 5 月,ONGC 宣布计划在 22-25 财年投资 40 亿美元,扩大在印度的勘探活动。这些努力可能会进一步加速所研究市场的成长。

- 震动监测解决方案在石油和天然气行业非常重要,因为它们可确保生产机械的运作并最大限度地减少停机时间、降低营运成本并提高生产力和财务回报。震动监测系统透过减少非计划性运作和优化机器性能来降低维护和维修成本。

- 预计未来几年对地下震动监测和控制系统的需求将大幅增加,以提高盈利并减少上游业务的停机时间。据日本经济产业省称,2022年日本从阿联酋进口的原油将超过6,030千万公升。其中大部分(约 3,000 万千公升)来自穆尔班油田,其次是达斯岛(Das Island)约 1,770 万千公升。美国、沙乌地阿拉伯、阿联酋等国未来的勘探和钻探计划预计将进一步扩大地下震动监测和控制系统的使用。

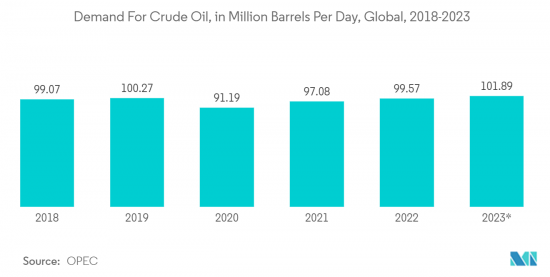

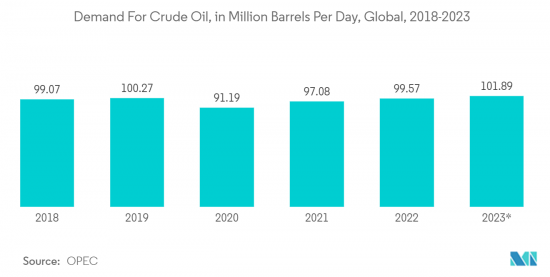

- 此外,根据OPEC的数据,2022年国际原油消费量预计将达到9,957万桶/日,若算上生质燃料,2023年国际原油消费量将增加至1,0189万桶/日。此外,震动监测在石油和天然气行业的采用率很高。这用于预测分析,帮助製造商提高生产力并最大限度地提高营运效率。在石油和天然气领域,需要进行状态监测以对关键机械震动分析,以管理和防止因意外机器故障而导致的意外停机。

亚太地区市场将实现显着成长

- 中国是全球重要的製造中心,也是世界上人口最多的国家,正在增加对电力和基础设施领域的投资。中国政府先前宣布投资780亿美元兴建110座核能发电厂,预计2030年运作。这些进步预计将增加采用新兴技术的潜力,以促进基于状态的监测,例如震动监测解决方案。

- 电力、石油和天然气、水泥、化学和石化以及汽车公司对预测性维护和震动监测技术的采用和认识不断提高,再加上「中国製造 2025」等政府雄心勃勃的目标,可能会维持对震动监测的需求预测期内亚太地区。

- 儘管碳氢化合物能源价格下降,中国石油天然气集团公司(中石油)等中国国家石油公司仍继续专注于石油和天然气探勘活动,以实现能源独立。预计此类活动将推动对震动监测解决方案的强劲需求,以监测和促进石油和天然气设备和基础设施的维护。中国拥有世界上最大的页岩油气蕴藏量,并致力于透过与石油和天然气公司成立合资企业来开发这些蕴藏量。

- 震动监测是预测性维护计画的重要组成部分。定期检查和监控油气泵的状况可以让您在潜在问题导致故障之前识别并解决它们,避免计划外停机和不必要的维修,可以节省您的时间和金钱。增加对所研究市场中各种应用的投资可能会进一步推动成长。 IBEF预计,2023年1月印度液化天然气进口量预计为22.66亿立方公尺(MMSCM)。 IEA预计,到2024年,印度天然气消费量预计将成长25 BCM,年均成长率为9%。

- 印度拥有世界上最大的汽车市场之一。据 SIAM 称,2023 财年印度汽车销量约为 2,120 万辆。印度汽车工业商协会(SIAM)的报告显示,2022年6月国内小客车批发量成长2.2%至327万辆,摩托车销量成长1.7%至1,330万辆。此外,政府的目标是到2030年将公车的电动车普及提高到40%,私家车的电动车普及率达到30%,商用车的电动车普及率达到70%。因此,随着汽车产业的崛起和销售能力的增强,该领域对震动监测的需求预计将会增加。

- 预防性保养是食品和饮料行业的关键要求。此外,震动监测可以有效避免停机,从根本上识别机器健康状况,预测即将发生的设备故障,并透过主动纠正来最大限度地降低能源成本。我可以。食品业投资的增加预计将为市场和供应商创造丰富的前景,以满足需求。

- 例如,根据(MFDS)的数据,2022年韩国食品工业总产值约占该国GDP的3.15%,较前一年的2.91%略有上升。此外,韩国还计划增强当地食品工业五个关键部门的活力,作为 2030 年食品工业价值翻倍目标的一部分。同样,根据韩国食品和药物管理局的数据,韩国食品工业近年来经历了显着增长,年增长率约为 8.1%。这些能力可能有助于市场需求。

震动监测产业概况

震动监测市场竞争激烈。该市场的重要参与企业包括罗克韦尔自动化公司、美国国家仪器公司、通用电气公司、艾默生电气公司、霍尼韦尔国际公司、Bruel &Kjaer 声音与振动测量公司等。公司建立多种合作伙伴关係,透过推出新产品来竞争并扩大市场占有率。

2022年8月,专注于电池生产、汽车和能源储存技术的脱碳领域创新解决方案供应商罗克韦尔自动化宣布将与Bravo汽车公司合作。汽车製造商依靠噪音震动监测和声振粗糙度测试来优化车辆性能并维持其车辆目录的舒适度标准。

2022 年 2 月,倍加福开始提供一系列震动感测器,以对低频或高频范围内的震动速度和加速度进行可靠的测量。倍加福的震动感测器已获得 SIL 2 许可,测量能力高达每分钟 128 毫米,与竞争产品相比,还可自动侦测滚珠轴承的状态。由于其坚固的外壳封装了电子装置,该感测器以其免维护操作和长使用寿命而令人印象深刻。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 宏观经济走势对市场的影响

第五章市场动态

- 市场驱动因素

- 提高预测性维护和分析强化的意识

- 无线系统在震动监测中的使用增加

- 市场挑战

- 缺乏客製化且初始投资较高

第六章市场区隔

- 按类型

- 硬体

- 加速计

- 车速表

- 位移计

- 其他硬体

- 软体

- 服务

- 硬体

- 按最终用户产业

- 车

- 油和气

- 能源/电力

- 矿业

- 食品和饮料

- 化学

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章竞争形势

- 公司简介

- Rockwell Automation Inc.

- National Instruments Corporation

- General Electric Corporation

- Emerson Electric Company

- Honeywell International Inc.

- Bruel & Kjaer Sound & Vibration Measurement

- Meggit PLC

- Analog Devices Inc.

- SPM Instrument AB

- Schaeffler AG

- STMicroelectronics

- PCB Piezotronics Inc.

- Banner Engineering

- SKF

- Azima DLI Corporation

- Data Physics Corporation

第八章投资分析

第9章市场的未来

The Vibration Monitoring Market size is estimated at USD 1.76 billion in 2024, and is expected to reach USD 2.39 billion by 2029, growing at a CAGR of 6.30% during the forecast period (2024-2029).

The machine maintenance industry has experienced growth due to the optimization potential of maintenance processes, which have become more streamlined than production processes.

Key Highlights

- Vibration monitoring is a critical aspect of predictive maintenance, and it is primarily used in rotating equipment such as steam and gas turbines, motors, pumps, compressors, paper machines, rolling mills, machine tools, and gearboxes. It is used to evaluate the operational and mechanical condition of equipment. Vibration analysis can detect developing problems before they become too severe and cause unscheduled downtime, which can be achieved by continuously monitoring machine vibrations or at predetermined intervals.

- Vibration condition monitoring equipment measures the vibration levels of rotating and reciprocating machinery. Sensors collect information on frequency and amplitude to measure the vibration patterns of machinery. Vibration monitoring is essential for tracking and analyzing changes in the condition of machinery parts, such as gears and bearings, and predicting equipment or part failure.

- The introduction of advanced technologies and services associated with the Internet of Things (IoT) is transforming most industrial applications. The opportunities for new entrants and traditional players to offer innovative solutions that change the business models are created by initiatives aimed at the automation of factories and implementing industrial smart maintenance, as well as efforts towards creating more innovative working environments. The vibration monitoring market is expected to grow strongly, thanks to the use of condition monitoring for preventive maintenance.

- Industries such as chemical, oil and gas, power and petrochemical, cement, and pharmaceuticals must abide by the stringent international policies that dictate process efficiency, ergonomics, and employee safety. Many toxic gasses and chemicals, such as polyaromatic hydrocarbons, ethylene, benzene, propylene, hydrogen sulfide, butadiene, butane, and sulfur, are generated as byproducts during the manufacturing processes. Therefore, vibration monitoring is gaining momentum as employee safety has gained paramount prominence.

- This significance has pushed various verticals to make extra efforts to protect their machinery. The main benefit of fault identification using condition monitoring is to allow personnel to take remedial action to avoid or reduce repair costs and increase machinery safety, thus improving human safety. The growth of the market is anticipated to be driven by various key factors, such as the rising acceptance of wireless systems in machine condition monitoring, the rising popularity of automated condition monitoring technologies and smart factory penetration, and the emergence of secure cloud computing platforms utilized in condition monitoring.

- The market's overall growth could be improved by the presence of technical expertise. Additionally, the market faces limitations due to ethical considerations imposed by governing bodies and a need for proficient technological resources for practical data analysis. Moreover, the market is expected to encounter challenges throughout the projected period, including the unavailability of expertise in remote areas and the increasing trend of integrating vibration monitoring systems with other maintenance practices.

- There has been a significant increase in the demand for remote operations due to the COVID-19 outbreak. A major decline in revenue growth for a number of industry communication companies worldwide took place during the 1st quarter of 2020. With the continued recovery of the economy and the growing need for remote operations, the market is becoming more and more active, leading to the adoption of highly automated systems that do not require any human oversight.

Vibration Monitoring Market Trends

Oil and Gas to Hold Significant Market Share

- Oil and gas operations operate in extreme operating environments, such as offshore drills and petrochemical refineries. There are severe financial and environmental consequences for any mechanical defeat. Thus, the detection and prevention of unpredictable oil and gas machinery and component issues are mandated in many parts of the world. The flammable oil price environment expands the adoption of predictive maintenance technologies, as these help organizations cut operational expenses by optimizing maintenance scheduling and driving productivity.

- The oil and gas industry is at the forefront of adopting innovative technologies to optimize operations, enhance efficiency, and ensure safety in the rapidly evolving landscape of the (IoT). This industry is subject to strict regulatory standards to ensure operational safety and environmental protection. Vibration monitoring is a proactive measure that helps companies comply with these regulations. By leveraging vibration sensors and adopting a proactive approach to maintenance, the oil and gas industry can optimize asset performance, enhance safety, and achieve substantial cost savings.

- The oil and gas industry is anticipated to dominate the expanding Market. The energy and power industry includes several segments, such as coal, nuclear power, minerals, and clean fuels. The raised spending from the government and the private sector on alternative energy and power sources in developed and developing nations is resulting in the installation of more additional energy and power plants, thus fueling the need for vibration monitoring procedures. For instance, in March 2022, the Board of Oil India approved an investment of INR 6,555 crore (USD 839.49 million) for the Numaligarh petrochemical project. Such projects will enhance the application opportunities for vibration monitoring systems.

- In addition, in January 2022, Indian Oil Corp. Ltd. (IOCL) announced plans to extend its city gas distribution (CGD) industry, looking to invest INR 7,000 crore (USD 918.6 million). Further, in May 2022, ONGC announced plans to invest USD 4 billion from FY22-25 to increase its exploration efforts in India. Such initiatives may further propel the studied market growth.

- Vibration monitoring solutions are critical in the oil and gas industry as they ensure that the production machinery is operational and downtime is minimized, lowering operating costs and increasing productivity and monetary gains. A vibration monitoring system aids in the reduction of unplanned outages and the optimization of machine performance, thus reducing maintenance and repair costs.

- The demand for downhole vibration monitoring and control systems is expected to increase significantly in the coming years to increase profitability and reduce downtime in upstream operations. According to METI (Japan), in 2022, the import volume of crude oil from the United Arab Emirates to Japan reached more than 60.3 million kiloliters. The majority of nearly 30 million kiloliters comprised oil from the Murban oil field, followed by oil from Das Island at around 17.7 million. The applications of the downhole vibration monitoring control system have been expected to grow further with upcoming exploration and drilling projects in countries such as the United States, Saudi Arabia, and the United Arab Emirates.

- In addition, according to OPEC, the international Crude oil consumption reached 99.57 million barrels a day in 2022, which included biofuels is projected to grow to 101.89 million barrels per day in 2023. Furthermore, the adoption of vibration monitoring is high in the oil and gas sectors. It is used for predictive analysis, which helps manufacturers increase their productivity and maximize operational efficiency. Condition monitoring is required for vibration analysis on vital machines to manage and prevent unexpected shutdowns due to unforeseen machinery failure within the oil and gas sector.

Asia-Pacific to Witness Significant Market Growth

- China is a prominent global manufacturing center with the largest population globally, and it is increasing investments in the power and infrastructure sectors. The Chinese government has previously declared investments worth USD 78 billion to construct 110 nuclear power plants, which are scheduled to become operational by 2030. These advancements are anticipated to expand the potential for adopting contemporary technologies, such as vibration monitoring solutions, to facilitate condition-based monitoring.

- Increasing adoption and awareness of predictive maintenance and vibration monitoring technologies in the power, oil and gas, cement, chemical and petrochemical, and automotive firms, coupled with government ambitions, such as 'Made in China 2025', may design sustained demand for vibration monitoring in Asia-Pacific during the forecast period.

- Despite the falling hydrocarbon energy prices, there is a continued focus on oil and gas exploration activities to achieve energy self-sufficiency by NOCs, such as CNPC in China. These activities are anticipated to create a robust demand for vibration-monitoring solutions to monitor and facilitate the maintenance of oil and gas equipment and infrastructures. China has the most significant shale oil and gas reserve worldwide and focuses on tapping the same through joint ventures with oil and gas companies.

- Vibration monitoring is an integral part of a predictive maintenance program. Regularly inspecting and monitoring the condition of oil and gas pumps can help identify and address potential problems before they cause failure, thus saving time and money by avoiding unplanned outages and unnecessary repairs. Increasing investment in various applications in the studied market may further propel growth. According to IBEF, India's LNG import was predicted at 2,266 million metric standard cubic meters (MMSCM) in January 2023. According to IEA, natural gas consumption in India is expected to grow by 25 BCM, recording an average annual boost of 9 percent until 2024.

- India boasts one of the largest automotive markets globally. As per SIAM, approximately 21.2 million vehicles were sold in India during FY 2023. In June 2022, domestic passenger vehicle wholesales witnessed a 2.2 percent surge, reaching 3.27 lakh units, while two-wheeler sales experienced a 1.7 percentage increase, totaling 13.30 lakh units, as reported by the Society of Indian Automobile Manufacturers (SIAM). Additionally, the government aims to achieve a 40 percent electric vehicle sales penetration for buses, 30 percentage for private cars, and 70 percent for commercial vehicles by 2030. Therefore, with the rising automotive industry and growing sales capabilities, the need for vibration monitoring in the sector is expected to increase.

- Preventive maintenance has emerged as a crucial requirement in the Food and Beverage Industry. Furthermore, vibration monitoring can effectively avert downtime, identify fundamental machine health, and minimize energy expenses by anticipating impending equipment malfunctions and rectifying them proactively. The escalating investments in the food sector are expected to generate abundant prospects for the market and vendors to cater to the demand.

- For instance, According to the (MFDS), the food industry's total production value in South Korea accounted for approximately 3.15 percent of the country's GDP in 2022, a slight increase from 2.91 percent in the previous year. Additionally, South Korea aims to enhance the vitality of five significant sectors within the local food industry as part of its 2030 objective to double the sector's value. Similarly, according to the Korea Food and Drug Administration, the Korean food industry has experienced significant growth in recent years, with an annual increase of approximately 8.1 percent. These capabilities will contribute to the market's demand.

Vibration Monitoring Industry Overview

The vibration monitoring market is significantly competitive. Some significant players in the Market are Rockwell Automation Inc., National Instruments Corporation, General Electric Corporation, Emerson Electric Company, Honeywell International Inc., and Bruel & Kjaer Sound & Vibration Measurement. The companies are increasing their market share by forming multiple partnerships and introducing new products to earn a competitive edge.

In August 2022, Rockwell Automation Inc., a company providing innovative solutions in the area of decarbonization focused on battery production, vehicles, and energy storage technologies, teamed up with Bravo Motor Company, a California firm that offers an array of services to businesses. Automotive manufacturers rely on noise vibration monitoring and harshness testing to optimize vehicle performance and keep a standard of comfort across their automobile catalog.

In February 2022, Pepperl+Fuchs started offering a range of vibration sensors to perform reliable measures of vibration velocity and acceleration in lower or high-frequency fields. Pepperl+Fuchs vibration sensors are licensed to SIL 2, and they have a large measurement capacity of up to 128 mm per minute, as well as an automated state detecting for ball bearings compared with competing products. The sensors impress with a maintenance-free operation and long service life due to their robust housing encased in electronics.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of Macroeconomic Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Awareness About Predictive Maintenance and Augmenting it with Analytics

- 5.1.2 Increasing Use of Wireless Systems for Vibration Monitoring

- 5.2 Market Challenges

- 5.2.1 Lack of Customization and High Initial Investment

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Hardware

- 6.1.1.1 Accelerometer

- 6.1.1.2 Velocity

- 6.1.1.3 Displacement

- 6.1.1.4 Other Hardware

- 6.1.2 Software

- 6.1.3 Services

- 6.1.1 Hardware

- 6.2 By End-user Industry

- 6.2.1 Automotive

- 6.2.2 Oil and Gas

- 6.2.3 Energy and Power

- 6.2.4 Mining

- 6.2.5 Food and Beverage

- 6.2.6 Chemicals

- 6.2.7 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle-East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Rockwell Automation Inc.

- 7.1.2 National Instruments Corporation

- 7.1.3 General Electric Corporation

- 7.1.4 Emerson Electric Company

- 7.1.5 Honeywell International Inc.

- 7.1.6 Bruel & Kjaer Sound & Vibration Measurement

- 7.1.7 Meggit PLC

- 7.1.8 Analog Devices Inc.

- 7.1.9 SPM Instrument AB

- 7.1.10 Schaeffler AG

- 7.1.11 STMicroelectronics

- 7.1.12 PCB Piezotronics Inc.

- 7.1.13 Banner Engineering

- 7.1.14 SKF

- 7.1.15 Azima DLI Corporation

- 7.1.16 Data Physics Corporation