|

市场调查报告书

商品编码

1403834

通讯塔:市场占有率分析、产业趋势与统计、2024年至2029年成长预测Telecom Towers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

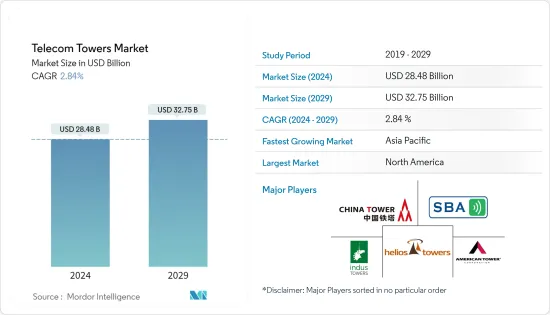

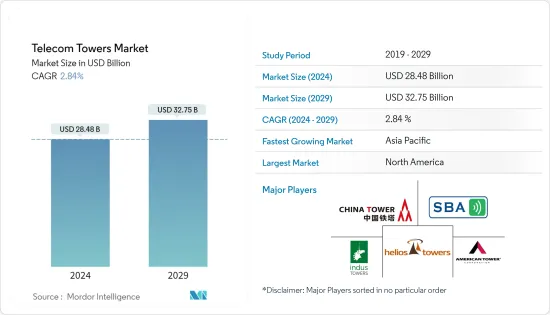

通讯塔市场规模预计到 2024 年为 284.8 亿美元,预计到 2029 年将达到 327.5 亿美元,在预测期内(2024-2029 年)复合年增长率为 2.84%。

铁塔共享已成为通讯业的关键驱动力之一,因为它带来了节省成本和更快的资料部署等好处。通讯塔产业作为独立公司正在获得大量关注,主要是在印度和美国。

主要亮点

- 5G技术的引进是通讯塔市场的主要推动要素。 5G 网路需要更密集的基础设施,包括更多的基地台和小型基地台,以提供增强的覆盖范围和更快的资料通讯速度。根据代表全球行动网路营运商利益的非营利组织GSMA协会统计,截至去年终,全球86个国家已有252个商用5G网络,支援超过10亿个5G连线。 。此外,预计到预测期内,全球 5G 连线数将超过 50 亿,带来超过 1 兆美元的国内生产总值(GDP) 成长。同时,预计到预测期内,5G将在北美、欧洲、中国和海湾合作委员会国家达到成熟。许多低收入和中等收入国家(LMIC)可能会继续成长。

- 随着地理机会的减少,多样化机会的扩大在很大程度上是由先进通讯基础设施的出现所推动的。由于5G技术需要合适的地形,预计许多无线电塔将很快集中在重大建设项目中。然而,由于这些塔可能继续拥有大量 5G 天线,组织可能能够透过收购或租赁垂直房地产来开拓新路线。

- 去年,印度领先的通讯业者之一 Bharti Airtel 计划与高通合作开发其 5G 网路技术堆迭。通讯业者计划利用高通的5G无线接取网路技术在印度部署商用5G网路并建立虚拟5G网路和开放5G网路。

- 此外,对LTE(长期演进)先进技术的投资也正在增加。对 LTE-A 网路连接的需求激增是由多种因素推动的,包括价格实惠的智慧型手机的普及、对高速互联网接入的需求不断增长、对智慧城市计划的投资不断增加以及对物联网设备的需求不断增长。因素。因此,网路营运商正在积极投资LTE-A基础设施的部署,LTE和LTE-A基地台的数量不断增加。这些基地台将连接到通讯塔,并将能够为最终用户提供基本的无线电存取网路服务。由于 LTE-A 需求的增加,通讯塔市场正在经历显着成长。

- 据思科称,在预测期内连接到网际网路协定(IP)网路的设备数量预计将达到 293 亿。 M2M(机器对机器)连线的份额已从近年来的33%增加到明年的50%,今年M2M连线数可能达到147亿。

- 通讯塔对环境的影响一直是一个主要问题。移动塔的辐射是一个重要问题,被认为是一种微妙的看不见的污染物,以多种方式影响生物体。

- 随着 COVID-19 大流行的爆发,由于远距工作条件和很大一部分人留在家里,电讯业对网路服务的需求大幅增加。在家工作的人数增加,透过视讯会议、线上视讯观看、下载以及增加的网路流量和资料使用增加了通讯需求。

通讯塔市场趋势

营运商自有塔预计将录得显着成长

- 信号塔的建造、运作和维护由多个行动通讯业者(MNO) 负责。这些服务越来越多地委託给新兴国家的第三方公司。

- 再加上行动网路营运商分离和保留营运商主导的铁塔公司的趋势不断增强,铁塔公司正在超越其建设、购买和租赁垂直房地产的核心业务,以创造新的资产,并被迫考虑服务。事实上,正如许多铁塔公司领导者所言,超过 50% 的内部成长来自传统大型塔楼和屋顶之外的解决方案,包括街道照明和建筑解决方案。

- 通讯业者拥有超过 200 万座通讯塔,其余由第三方建造。此外,随着Bharti Infratel(印度)等营运商所有公司的出现,营运商自有通讯塔领域的商机正在扩大,这些公司作为客户向其他行动通讯业者提供通讯塔。

- 塔的型态因地区而异。亚太地区的通讯业者更愿意将铁塔视为关键的差异化因素。相比之下,美国铁塔市场经历了转型,大多数铁塔行动通讯业者(MNO)转向独立公司。

- 在印度等国家,行动通讯业者经常利用联合伙伴关係或专属式铁塔公司来拥有铁塔。在多个营运商共用所有权方面,营运商拥有的铁塔业务模式已被证明比行动通讯业者拥有铁塔子公司更有效。

北美预计将占据很大份额

- 美国形势竞争非常激烈,许多大型供应商都在争夺霸主地位。这种激烈的竞争是由5G通讯服务的巨大需求推动的,许多公司都在集中精力拓展业务,以抓住这一机会。美国政府有几家主要供应商致力于合作、收购、合併、推广和联盟。

- SBA Communications 是美国着名的无线电塔供应商,持有约 10,000 个无线电塔,专门从事无线通讯。这项战略合作伙伴关係持有DISH 能够使用 SBA 在美国各地的广泛通讯陆地产品组合。

- 此外,去年,PG&E 也宣布与 SBA Communications Corporation 达成协议,出售其无线通讯业者许可协议。这项战略倡议将使 SBA 能够保持其在市场上的地位,并允许更多无线提供者透过分许可进入其塔楼和建筑物。

- 行动无线服务是加拿大近年来最重要、成长最快的通讯业。随着第五代5G网路等先进技术的引入以及物联网(IoT)等创新应用的融合,预计这一上升趋势将持续下去。

- Bell Mobility、TCI 和 RCCI(国家无线通讯业者)在整个北美地区运营,包括西北地区、育空地区和努纳武特地区,但萨斯喀彻尔除外(萨斯喀彻温省在那里行使唯一的市场支配力)。它在提供行动服务方面行使市场支配力该州的无线零售服务。

- 此外,安大略省和东安大略区域网络去年宣布与加拿大政府建立合作关係。此外,这项措施将为东安大略省99%的居民和企业提供可靠的无线连接,有效缩小行动电话差距,显着提高区域安全、生产力和整体生活质量,我们的目标就是做到这一点。这项措施反映了罗杰对服务扩展的持续承诺,从而改善了服务不足地区(包括偏远和农村地区)的连结性。

通讯塔产业概况

通讯塔市场竞争适度,有几个主要参与者进入该市场。目前,只有少数大公司在市场占有率方面占据主导地位。这些通讯塔市场主要企业正在透过策略联盟和收购通讯塔新兴企业来扩大基本客群。因此,市场集中度较高,少数主导企业受益于较大的市场占有率和盈利。

2022年10月,美国铁塔公司(American Tower)非洲业务(ATC Africa)和Airtel Africa PLC(Airtel Africa)联合宣布计划扩大在肯亚和尼日尔的业务,以支援Airtel Africa的网路部署。产品协议将利用ATC Africa 在尼日利亚和乌干达的庞大通讯土地组合来实现产品开发能力。两家公司计划透过合作,大幅改善非洲大陆的连通性,为边缘化人群提供数位包容性,并实现通用的温室气体(GHG)排放目标。

2022 年 1 月,T-Mobile US 与 Crown Castle International Corporation 宣布建立新的 12 年合作伙伴关係,T-Mobile 可使用 Crown Castle 的信号塔和小型基地台基地台。此交易将使UnCarrier进一步扩大和扩大其5G网路的覆盖范围,并创造合併后的财务协同效应,为美国各地的客户提供服务。此外,此次交易还将支持 Crown Castle 透过小型基地台和塔实现长期收益发展。

2022 年 1 月,美国铁塔公司宣布,将其一家全资子公司与 Coresight 合併,正式收购 Coresight Realty Corporation。此次收购预计将利用 Core Site 的网路资料中心功能和云端入口,透过未来的电脑将推动成长,并增加当前塔楼房地产的价值。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 连结/改善与农村地区的连结性

- 改进和回应不断增长的资料需求

- 市场挑战

- 有关塔楼供电系统的环境问题

- 电信业者之间共享铁塔

第 6 章 技术概览

- 电讯业的主要趋势 - 基础设施共用(主动和被动)

第七章市场区隔

- 按燃料类型

- 可再生

- 不可可再生

- 依塔型分类

- 格子塔

- 引导塔

- 单极塔

- 隐形塔

- 透过安装

- 屋顶

- 地上

- 按所有权

- 企业拥有

- 合资企业

- 个人拥有

- 行动网路业者 (MNO)专属式

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 荷兰

- 瑞典

- 瑞士

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 印尼

- 越南

- 马来西亚

- 菲律宾

- 澳洲/纽西兰

- 其他亚太地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中美洲

- 哥伦比亚

- 其他拉丁美洲

- 中东/非洲

- 沙乌地阿拉伯

- 埃及

- 阿尔及利亚

- 奈及利亚

- 南非

- 坦尚尼亚

- 摩洛哥

- 其他中东和非洲

- 北美洲

第八章竞争形势

- 公司简介

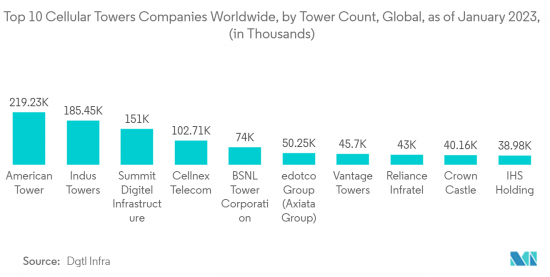

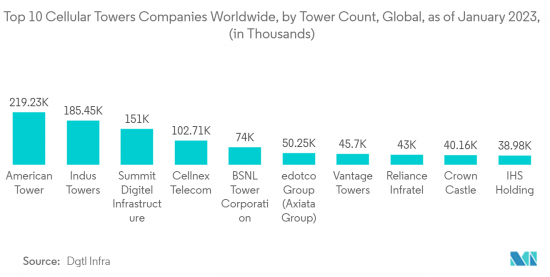

- American Tower Corporation

- Helios Towers Africa

- Indus Towers Limited(Bharti Infratel)

- China Tower Corporation

- SBA Communications Corporation

- AT&T Inc.

- Crown Castle International Corporation

- T-Mobile USA Inc.

- GTL Infrastructure Limited

- IHS Towers(IHS Holding Limited)

- Tawal Com SA

- CellnexTelecom

- Deutsche Funkturm

- First Tower Company

- Orange

- Telenor ASA

- Zong Pakistan

- Telkom Indonesia

- Telxius Telecom SA

- Telesites SAB de CV

- Grup TorreSur

第九章投资分析

第十章投资分析市场的未来

The Telecom Towers Market size is estimated at USD 28.48 billion in 2024, and is expected to reach USD 32.75 billion by 2029, growing at a CAGR of 2.84% during the forecast period (2024-2029).

Tower-sharing is one of the significant growth drivers for the telecom industry, as it presents benefits, such as cost reduction and faster data rollout. The telecom tower industry has obtained high prominence as an independent, mainly in India and the United States.

Key Highlights

- Implementing 5G technology has been a major driving factor for the telecom tower market. 5G networks require denser infrastructure, including more cell towers and small cells, to deliver enhanced coverage and higher data speeds. According to the GSMA Association, a non-profit organization representing the interests of mobile network operators worldwide, there were already 252 commercial 5G networks in 86 countries worldwide at the end of the previous year, serving more than 1 billion 5G connections. Further, more than 5 billion 5G connections are expected globally by the forecast period, producing over USD 1 trillion in Gross Domestic Product (GDP) growth. At the same time, 5G is expected to reach maturity in North America, Europe, China, and the GCC countries by the forecast period. It will continue to grow in many low-and middle-income countries (LMICs).

- With the decline in geographical opportunities, the expansion of diversification opportunities has been significantly propelled by the emergence of advanced communication infrastructure. 5G technology demands appropriate terrain; therefore, many towers are expected to focus on their primary building business soon. However, firms and organizations may be able to explore additional routes by acquiring or leasing vertical real estate, as these towers may continue to see a significant number of 5G antennas installed on them.

- In the previous year, Bharti Airtel, one of India's major telecom operators, planned to develop its 5G network technology stack in partnership with Qualcomm. The telco plans to utilize Qualcomm 5G Radio Access Network Technologies to roll out its commercial 5G network, enabling the establishment of virtual and open 5G networks across India.

- Moreover, the increasing investment in Long Term Evolution (LTE) - Advanced technology. This surge in demand for LTE-A network connectivity results from several factors, including wider availability of affordable smartphones, a growing need for high-speed internet access, expanding investments in smart city initiatives, and a rising demand for IoT devices. Consequently, network operators are proactively investing in the deployment of LTE-A infrastructure, leading to more LTE and LTE-A base stations. These stations are connected to telecom towers, enabling them to offer essential radio access network services to end-users. As a result of the escalating demand for LTE-A, the telecom tower market is experiencing substantial growth.

- According to Cisco, the number of devices connected to the Internet Protocol (IP) network in the forecast period is expected to be 29.3 billion networked devices. The share of Machine-To-Machine (M2M) connections may grow from 33% in recent years to 50% by the following year, with 14.7 billion M2M connections by the current year.

- The environmental impacts of telecom towers have consistently been a major concern. Radiation from mobile towers has been an important issue, recognized as an unseen and subtle pollutant affecting life forms in multiple ways.

- With the outbreak of the COVID-19 pandemic, the telecom industry witnessed a significant increase in demand for internet services due to remote working conditions and a significant chunk of the population staying at home. The increase in people working from home has increased the demand for communication through video conferencing, online video viewing, downloading, and increased network traffic and data usage.

Telecom Towers Market Trends

Operator-owned Tower is Expected to Register a Significant Growth

- In the operator-owned telecom tower segment of the market studied, multiple mobile network operators (MNOs) are responsible for towers' construction, functioning, and maintenance. These services are being increasingly outsourced to third-party companies in emerging economies.

- Between TowerCos nearing saturation of addressable markets and investible portfolios globally, combined with the growing tendency of MNOs to carve out and keep operator-led TowerCo, TowerCos are compelled to look beyond their core business of building, purchasing, and leasing vertical real estate to consider new assets and new services. Indeed, as per numerous TowerCo leaders, more than 50% of organic growth now originates from solutions beyond traditional macro towers and rooftops, encompassing lamp posts and building solutions.

- Operators own over two million telecom towers, while third parties have constructed the rest. Furthermore, the emergence of operator-owned companies like Bharti Infratel (India), which offer telecom towers to other mobile network operators as their clients, has expanded the opportunities within the operator-owned telecom tower segment.

- Tower ownership patterns vary from region to region. The operators in the Asia Pacific region prefer to value their towers as a key differentiator. In contrast, the United States tower market has witnessed a transformation in which most towers moved from mobile network operators (MNOs) to independent enterprises.

- Mobile operators in countries like India frequently use joint partnerships or captive tower companies to own their towers. Regarding shared ownership among several operators, the operator-owned tower business model proved more effective than the mobile provider owning their tower subsidiary.

North America is Expected to Hold Major Share

- The United States landscape is highly competitive, with numerous significant vendors vying for dominance. This intense competition is driven by the country's substantial demand for 5G telecommunications services, leading many companies to focus on expanding their operations to capitalize on this opportunity. The United States government has multiple major vendors engaging in partnerships, acquisitions, mergers, rollouts, and coalitions.

- SBA Communications, a prominent tower provider in the United States, possesses approximately 10,000 towers and specializes in wireless communications. Additionally, the company has recently announced a significant long-term master lease agreement with DISH-this strategic partnership grants DISH access to SBA's extensive portfolio of wireless communications sites nationwide.

- Moreover, the previous year, PG&E made a significant announcement concerning its agreement with SBA Communications Corporation to divest its license agreements with wireless providers. This strategic move allows SBA to retain its market presence and further grant access to the towers and structures to more wireless providers through sub-licensing.

- Mobile wireless services are Canada's most significant and fastest-growing telecommunications industry in recent years. The upward trajectory is anticipated to persist as it witnesses the implementation of advanced technologies like the fifth-generation 5G network and the integration of innovative applications like the Internet of Things(IoT).

- Bell Mobility, TCI, and RCCI (collectively, the national wireless carriers) exercise market power to offer retail mobile wireless services in all provinces of North America, such as Northwest Territories, Yukon, and Nunavut, except Saskatchewan, where SaskTel exercises individual market power.

- Furthermore, the Province of Ontario and the Eastern Ontario Regional Network announced a partnership with the Government of Canada the previous year. Further, the initiatives aim to provide dependable wireless connectivity to 99% of residents and businesses in Eastern Ontario, effectively closing the cellular gap and significantly enhancing the region's safety, productivity, and overall quality of life. This effort reflects Roger's ongoing commitment to expanding its services and has resulted in improved connectivity for underserved communities, including remote and rural areas.

Telecom Towers Industry Overview

The telecom tower market's intensity of competition is moderately high and consists of several major players. Only some significant players currently dominate the market in terms of market share. These major players in the telecom tower market are expanding their customer base internationally through strategic collaborations and acquisitions of telecom tower startups. This has led to a moderately high market concentration, with a few dominant players benefiting from significant market share and profitability.

In October 2022, the American Tower Corporation's (American Tower) African operations (ATC Africa) and Airtel Africa PLC (Airtel Africa) together announced a multi-year, multi-product agreement in support of Airtel Africa's network rollout for leveraging ATC Africa's vast portfolio of communication sites across its footprint in Kenya, Niger, Nigeria, and Uganda for product development capabilities. The companies plan to significantly increase connectivity on the continent, provide digital inclusion to marginalized populations, and achieve their shared greenhouse gas (GHG) emission reduction goals through collaborative efforts.

In January 2022, The announcement of a new 12-year collaboration between T-Mobile US, Inc. and Crown Castle International Corp. would allow T-Mobile more access to Crown Castle's towers and small cell sites as the company expands its national 5G network. With the help of the deal, the Un-carrier may serve customers across the United States by further extending and broadening the coverage of the company's 5G network and generating financial synergies after its merger. Additionally, the deal assists Crown Castle in developing long-term income development from small cells and towers.

In January 2022, American Tower Corporation announced that it had officially acquired CoreSite Realty Corporation by merging one of its wholly-owned subsidiaries with CoreSite. In facilitating growth and raising the value of current tower real estate through upcoming computing opportunities, this acquisition is anticipated to use CoreSite's networked data center capabilities and cloud on-ramps.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Connecting/Improving Connectivity to Rural Areas

- 5.1.2 Improving and Catering to Increasing Data Needs

- 5.2 Market Challenges

- 5.2.1 Environmental Concerns about Power Supply Systems to Towers

- 5.2.2 Tower-sharing between Telecom Companies

6 TECHNOLOGY SNAPSHOT

- 6.1 Discussed Key Trends In Telecom Industry - Infrastructure Sharing (Active And Passive)

7 MARKET SEGMENTATION

- 7.1 By Fuel Type

- 7.1.1 Renewable

- 7.1.2 Non-renewable

- 7.2 By Type of Tower

- 7.2.1 Lattice Tower

- 7.2.2 Guyed Tower

- 7.2.3 Monopole Towers

- 7.2.4 Stealth Towers

- 7.3 By Installation

- 7.3.1 Rooftop

- 7.3.2 Ground-based

- 7.4 By Ownership

- 7.4.1 Operator-owned

- 7.4.2 Joint Venture

- 7.4.3 Private-owned

- 7.4.4 MNO Captive

- 7.5 By Geography

- 7.5.1 North America

- 7.5.1.1 United States

- 7.5.1.2 Canada

- 7.5.2 Europe

- 7.5.2.1 United Kingdom

- 7.5.2.2 Germany

- 7.5.2.3 France

- 7.5.2.4 Italy

- 7.5.2.5 Spain

- 7.5.2.6 Netherlands

- 7.5.2.7 Sweden

- 7.5.2.8 Switzerland

- 7.5.2.9 Rest of Europe

- 7.5.3 Asia-Pacific

- 7.5.3.1 China

- 7.5.3.2 India

- 7.5.3.3 Japan

- 7.5.3.4 South Korea

- 7.5.3.5 Indonesia

- 7.5.3.6 Vietnam

- 7.5.3.7 Malaysia

- 7.5.3.8 Philippines

- 7.5.3.9 Australia & New Zealand

- 7.5.3.10 Rest of Asia-Pacific

- 7.5.4 Latin America

- 7.5.4.1 Brazil

- 7.5.4.2 Mexico

- 7.5.4.3 Argentina

- 7.5.4.4 Central America

- 7.5.4.5 Columbia

- 7.5.4.6 Rest of Latin America

- 7.5.5 Middle East and Africa

- 7.5.5.1 Saudi Arabia

- 7.5.5.2 Egypt

- 7.5.5.3 Algeria

- 7.5.5.4 Nigeria

- 7.5.5.5 South Africa

- 7.5.5.6 Tanzania

- 7.5.5.7 Morocco

- 7.5.5.8 Rest of Middle East and Africa

- 7.5.1 North America

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 American Tower Corporation

- 8.1.2 Helios Towers Africa

- 8.1.3 Indus Towers Limited (Bharti Infratel)

- 8.1.4 China Tower Corporation

- 8.1.5 SBA Communications Corporation

- 8.1.6 AT&T Inc.

- 8.1.7 Crown Castle International Corporation

- 8.1.8 T-Mobile USA Inc.

- 8.1.9 GTL Infrastructure Limited

- 8.1.10 IHS Towers (IHS Holding Limited)

- 8.1.11 Tawal Com SA

- 8.1.12 CellnexTelecom

- 8.1.13 Deutsche Funkturm

- 8.1.14 First Tower Company

- 8.1.15 Orange

- 8.1.16 Telenor ASA

- 8.1.17 Zong Pakistan

- 8.1.18 Telkom Indonesia

- 8.1.19 Telxius Telecom SA

- 8.1.20 Telesites SAB de CV

- 8.1.21 Grup TorreSur