|

市场调查报告书

商品编码

1403842

工业无线发射器:市场占有率分析、产业趋势与统计、2024年至2029年成长预测Industrial Wireless Transmitter - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

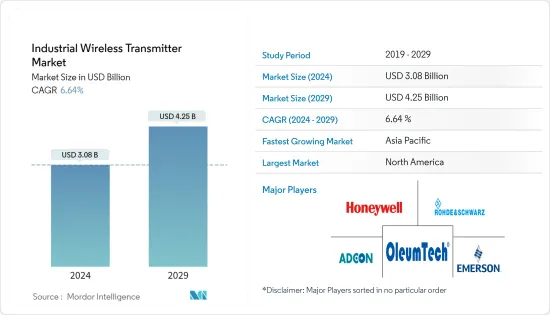

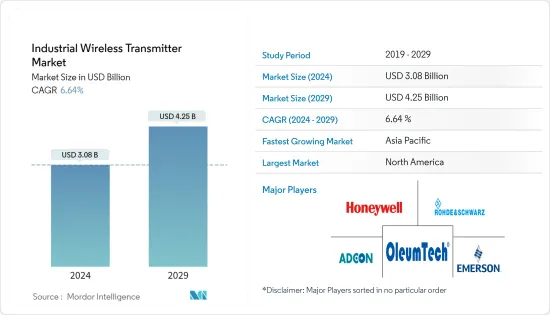

工业无线发射器市场规模预计到2024年为30.8亿美元,预计到2029年将达到42.5亿美元,在预测期内(2024-2029年)复合年增长率为6.64%。

主要亮点

- 随着全球对抗 COVID-19 大流行的技术创新加速,工业无线发射器网路经历了显着增长。电子技术的进步是由对更小型设备的需求推动的,从更快的热感成像和现场护理测试到基于微流控的聚合酶链反应(PCR) 工具和SARS-CoV-2 检测技术,有许多不同的技术。

- 工业无线温度变送器和感测器市场已采用物联网 (IoT) 连接来加快 COVID-19筛检速度。多家公司合作开发了一系列用于人体温度监测的穿戴式装置。这款穿戴式装置的发送器向第一线医护人员提供即时资料,使他们能够快速筛检体温过高的人,体温过高是 COVID-19 最常见的症状之一。此外,上海公共卫生临床中心 (SPHCC) 正在使用加州互联连线健诊新兴企业VivaLNK 的连续无线温度发射器和感测器网路来监测 COVID-19 患者和看护者暴露于病毒的风险。

- 自动化和机器人产业的成长,资产监控、安全和运输领域对无线发射器网路的需求不断增加,以及通讯技术进步带来的可靠性提高,是推动工业无线发射器市场的主导因素。

- 这些发射器主要在工厂中用于生产流程的资料监控。它也应用于其他行业,如国防、楼宇自动化、物料搬运以及食品和饮料。

- 随着政府对发射机安全使用的法规不断加强,对无线发射机的需求也不断增加。例如,这是一个具有极高压力和温度等恶劣环境条件的领域。工业无线发射器可以轻鬆地在安全距离内连续控制和监控您的设施。它对于从难以存取的位置检索资料也很有用。

- 此外,智慧家庭、智慧建筑、智慧城市和智慧工厂的发展利用小尺寸、低功耗、高精度和无线技术来控制智慧家庭中的环境参数(湿度、压力、空气品质等) . - 需要使用工业无线发射器,因为它们能够被监控。

- 随着汽车产业努力遵守全球环境法规,提高效率并更好地控制引擎系统比以往任何时候都更加重要。此类应用需要高效的发送器网络,透过蓝牙技术准确监控状况,而无电池射频识别 (RFID) 技术则透过专注于车内的非关键系统来提高效率。

- 2022 年 11 月,OleumTech 宣布推出两款新型硫化氢 (H2S) 气体侦测发射器。一个用于 OTC 无线感测器网路平台,另一个用于 H 系列硬连线仪器产品线。新型 H2S 发射器旨在持续监测空气质量,并在 H2S 水平超过用户配置的设定值时发出警报。

- 此外,2022年6月,Optex推出了采用LTE-Cat M1*1作为通讯标准的多转换器OWU-300M系列物联网无线单元。 Optex 的物联网无线单元只需连接现有的发射器、感测器和交换器即可实现物联网,从而可以轻鬆地从远端位置监控感测器资料和运作状态。

工业无线发射器市场趋势

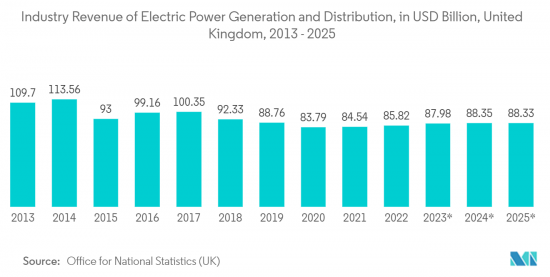

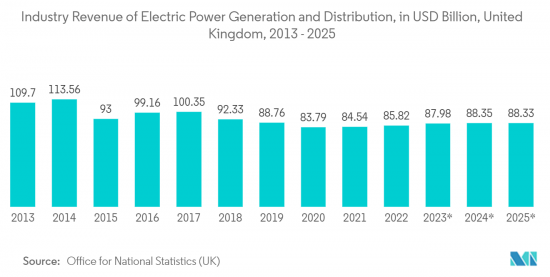

能源和电力预计将占据很大份额

- 工业无线发射器的主要最终用户群体是能源和电力部门。由于无线发射器网路等无线解决方案的采用率很高,并且即使在困难的地点也易于安装,无线发射器在业界已广泛应用。

- 与有线发射器不同,有线发射器不需要将讯号布线回相应的无线网关。近年来,电池供电的发射器模组不再需要电源接线。由于其弹性,现代无线发射器可以放置在任何地方来监控几乎任何东西。

- 在电力和能源领域,无线发射器现在可以安装在祛水器、热交换器、泵浦、压缩机、洩压阀以及许多其他以前使用有线技术难以监控且维护成本昂贵的设备上。

- 全球发电活动的增加预计将推动所研究市场的成长。例如,根据电力工程师有限责任公司的数据,经过几年的稳定成长,巴西的发电量在 2022 年达到了 677兆瓦时以上。水力发电是巴西最重要的发电来源,预计到2022年将占全国发电量的60%以上。 2021年巴西发电量为656.11兆瓦时。

- 供应商正在扩大其在市场上的製造设施,为所研究的细分市场创造更多商机。根据巴西电力监管局的数据,巴西发电装置容量从2021年的181.61吉瓦增加到2022年的189.13吉瓦。

北美占据主要市场占有率

- 无线发射器的需求主要是由北美的高製造业活动所推动的,占该地区国内生产总值(GDP) 的 23% 以上。该地区为几乎所有最终用户垂直市场提供了清晰的前景。预计该地区工业无线发射器的主要需求来源是能源、电力和工业自动化。

- 拜登政府为重振遭受疫情打击的美国经济而推出的投资,使基础设施和电子产业以及小型企业的成长成为主要受益者。基础设施和电子产业是包括无线发送器在内的工业控制系统硬体产品的大量用户,预计将产生直接的正面影响。

- 由于自动化、机器人、物联网和其他连网型解决方案在工业领域的使用,预计该地区将在整个预测期内占据重要的市场占有率。

- 页岩气探勘和精製活动的激增预计将对无线发送器市场产生重大影响。无线发射器在页岩气产业中用于追踪石油和天然气流量、油轮液位和石油钻井过程中的压力。因此,无线电发送器对于控制资源的移动和储存至关重要。随着北美页岩气开采的发展,预计该行业将更频繁地使用无线发射器。

- 由于这些工具能够让经理和监督从任何地方评估工人和设备的性能,製造设施中使用的智慧设备的数量在全部区域不断增加。由于这些改进,系统需要整合无线电发送器。

- 随着智慧型手机在美国越来越普及,对工业无线发射器的需求预计也会同时增加。根据美国人口普查局和消费者技术协会的数据,美国智慧型手机销售额预计将从 2021 年的 730 亿美元增加到 2022 年的 747 亿美元。随着智慧型手机在市场中的普及不断提高,对无线发射器的需求预计也会以同样的速度成长。

工业无线发射器产业概况

工业无线发射器市场呈现分散化、竞争激烈的特点,许多主要企业争夺市场占有率。其中许多公司正在透过赢得合约和推出创新产品和服务来扩大其市场足迹。此外,该领域的公司正在积极与专门从事工业无线发射器技术的新兴企业合作,以增强其产品能力。

2023 年 3 月,Honeywell国际公司推出了 Versatilis 变送器,专为对泵浦、马达、压缩机、风扇、鼓风机和变速箱等旋转设备进行状态监控而设计。HoneywellVersatilis 变送器旨在提供旋转设备的精确测量,提供宝贵的见解,从而提高各行业的安全性、可用性和可靠性。

2022 年 5 月,Monnit 推出本质安全型 ALTA-ISX远距无线发射器。这项进步体现了 Monnit 在充满挑战的工业环境中促进安全的承诺。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 技术概述

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 评估主要宏观经济趋势的市场影响

第五章市场动态

- 市场驱动因素

- 扩大物联网在工业领域的应用

- 工业控制系统的普及

- 市场抑制因素

- 无线通讯安全问题

第六章市场区隔

- 类型

- 一般用途

- 液位传送器

- 压力变送器

- 温度变送器

- 流量传送器

- 其他类型

- 最终用户

- 能源和电力

- 食品和农业

- 工业自动化

- 水和污水处理

- 其他最终用户

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章竞争资讯

- 公司简介

- Emerson Electric Company

- Honeywell International Inc.

- Rohde & Schwarz GmbH & Co. KG

- Adcon Telemetry GmbH

- OleumTech Corporation

- Inovonics Corporation

- Cooper Industries Inc.(Eaton Corporation PLC)

- Phoenix Contact

- Ascom Wireless Solutions AG

- Siemens Corporation

- Schneider Electric Corporation

- Keri Systems Inc.

第八章投资分析

第九章 市场机会及未来趋势

The Industrial Wireless Transmitter Market size is estimated at USD 3.08 billion in 2024, and is expected to reach USD 4.25 billion by 2029, growing at a CAGR of 6.64% during the forecast period (2024-2029).

Key Highlights

- Industrial wireless transmitters network has viewed immense growth as technology companies globally accelerated innovation in the fight against the COVID-19 pandemic. The need for tiny devices is behind advances in electronics, thus, ranging from thermal imaging and faster point-of-care testing to microfluidics-based polymerase chain reaction (PCR) tools and techniques to detect SARS-CoV-2.

- Industrial wireless temperature transmitters and sensors in the market employed Internet of Things (IoT) connectivity to speed up COVID-19 screening. Multiple companies joined forces to develop a series of human body temperature monitoring wearable devices. The wearable devices' transmitters offered real-time data to frontline healthcare workers and let them quickly screen individuals with a high temperature, one of the most common symptoms of COVID-19. Moreover, Shanghai Public Health Clinical Center (SPHCC) used California-based connected health startup VivaLNK's continuous wireless temperature transmitters and sensors network to monitor COVID-19 patients, which decreased the risks of caregivers being exposed to the virus.

- The growing automation and robotics industry, growing demand for a wireless transmitter network in asset monitoring, security, and transportation, and improved reliability with communication technology advancements are the influential factors driving the industrial wireless transmitter market.

- These transmitters are primarily used in factory settings for data monitoring of production flow. These also find applications in defense, building automation, and other industries, like materials handling and food and beverage.

- Due to the increased government regulation for the increased use of transmitters for safety, the demand for wireless transmitters is growing. For example, the areas with challenging environmental conditions, such as extreme high pressure, high temperature, etc. With the help of industrial wireless transmitters, it becomes easy to control and monitor the facility from a safe distance continually. They help to acquire the data from locations that are difficult to access.

- Further, transforming the growth of smart homes and buildings, smart cities, and smart factories demand the use of industrial wireless transmitters, owing to the small form factor, low power consumption, high precision, and ability to control and monitor ambient parameters (such as humidity, pressure, and air quality) in smart homes with the help of wireless technologies.

- As the automotive industry strives to comply with worldwide environmental regulations, the efforts to boost efficiency and achieve better control of engine systems are more crucial than ever. These applications demand efficient wireless transmitter networks to accurately monitor conditions through Bluetooth technology, and battery-free radio frequency identification (RFID) technology enhances efficiency by concentrating on non-critical systems inside vehicles.

- In November 2022, OleumTech introduced two new Hydrogen Sulfide (H2S) Gas Detection Transmitters: one to its OTC Wireless Sensor Network platform and the other to its H Series hardwired process instrumentation product line. The new H2S Transmitters were designed to continuously monitor air quality and generate alarms when H2S levels exceed user-configured setpoints.

- Further, in June 2022, Optex Co., Ltd. launched the Multi-Converter OWU-300M Series IoT wireless units, which use LTE-Cat M1*1 as their communication standard. Optex's IoT wireless units make IoT possible by simply connecting existing transmitters, sensors, and switches, allowing for simple monitoring of sensor data and operational status from remote locations.

Industrial Wireless Transmitter Market Trends

Energy and Power is Expected to Hold a Significant Share

- The energy and electricity sector is the primary end-user group for industrial wireless transmitters. Due to the high deployment rate of wireless solutions, such as wireless transmitters networks, etc., and their ease of installation even in difficult-to-reach locations, wireless transmitters are widely used in the industry.

- Unlike wired transmitters, wired transmitters do not require any signal wiring to return to a corresponding wireless gateway. The use of battery-powered transmitter modules eliminated the requirement for power wiring in recent years. Modern wireless transmitters can be deployed anywhere to monitor almost anything because of their flexibility.

- In the case of the power and energy sector, numerous pieces of equipment, including steam traps, heat exchangers, pumps, compressors, and pressure relief valves, which were previously difficult to monitor and frequently expensive to maintain using wired technology, can now be equipped with wireless transmitters.

- The increasing power generation activities globally are anticipated to rev the studied market's growth. For instance, according to Electric Power Engineers, LLC, the electricity generation in Brazil amounted to more than 677 terawatt-hours in 2022 after growing steadily for a few years. Hydropower is observed to be the most crucial electricity generation source in Brazil, accounting for more than 60 percent of the country's output in 2022. In 2021, the electricity generation in Brazil amounted to 656.11 terawatt-hours.

- Vendors are expanding their manufacturing facility in the market, further creating opportunities for the studied segment. According to the Brazilian Electricity Regulatory Agency, the installed capacity for electricity generation in Brazil increased from 181.61 gigawatts in 2021 to 189.13 gigawatts in 2022.

North America Holds a Significant Market Share

- Demand for wireless transmitters is mainly driven by North America's high manufacturing activity, which contributes more than 23 percent of the region's gross domestic product (GDP). Almost all end-user verticals contain a clear prognosis for the area. The region's primary sources of demand for industrial-grade wireless transmitters are expected to be energy, power, and industrial automation.

- With investment roll-outs by the Biden government to revive the pandemic-hit US economy, infrastructure, and the electronics industry are marked as the primary beneficiaries alongside the growth of small and medium-sized enterprises. The infrastructure and electronics industry are heavy users of industrial control systems' hardware products, including wireless transmitters, and are expected to have a direct positive effect.

- Due to the use of automation, robots, the Internet of Things, and other connected solutions in the industrial sector, the region is anticipated to include a significant market share throughout the projected period.

- A surge in shale gas exploration and refining activities is predicted to impact the wireless transmitter market significantly. Wireless transmitters are used in the shale gas industry to track oil and gas flow, oil tanker levels, and pressure during oil extraction. As a result, they are essential in controlling resource movement and storage. As shale gas extraction in North America receives more attention, this industry is projected to use wireless transmitters more frequently.

- The number of smart devices used in manufacturing facilities expanded across the region due to these tools' ability to let managers and supervisors assess the performance of workers and equipment from any location. As a result of these modifications, the system now requires the integration of wireless transmitters.

- With the increasing adoption of smartphone devices in the US, the demand for industrial wireless transmitters is expected to increase simultaneously in the market. As per the US Census Bureau and Consumer Technology Association, smartphone sales in the US are expected to rise to USD 74.7 billion in 2022 compared to USD 73 billion in 2021. With the rising adoption of smartphones in the market, the demand for wireless transmitters is also expected to grow at the same speed.

Industrial Wireless Transmitter Industry Overview

The industrial wireless transmitter market is marked by fragmentation and intense competition, featuring numerous prominent players vying for market share. Many of these companies are expanding their market footprint through the acquisition of contracts and the introduction of innovative products and services. Moreover, businesses operating within this sector are proactively engaging with startups specializing in industrial wireless transmitter technology to enhance their product capabilities.

In March 2023, Honeywell International Inc. introduced its Versatilis Transmitters, designed for the condition-based monitoring of rotating equipment such as pumps, motors, compressors, fans, blowers, and gearboxes. Honeywell's Versatilis Transmitters are engineered to provide precise measurements for rotating equipment, delivering valuable insights that can enhance safety, availability, and reliability across various industries.

In May 2022, Monnit unveiled its intrinsically safe ALTA-ISX Long-Range Wireless transmitters, specifically tailored to safeguard workers and facilities operating in industrial environments with explosive atmospheres. This advancement demonstrates Monnit's commitment to promoting safety in challenging industrial settings.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Technology Overview

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of Impact of Key Macroeconomic Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Adoption of IoT in Industrial Space

- 5.1.2 Proliferation of Industrial Control Systems

- 5.2 Market Restraints

- 5.2.1 Security Challenges of Wireless Communication

6 MARKET SEGMENTATION

- 6.1 Type

- 6.1.1 General Purpose

- 6.1.2 Level Transmitters

- 6.1.3 Pressure Transmitters

- 6.1.4 Temperature Transmitters

- 6.1.5 Flow Transmitters

- 6.1.6 Other Types

- 6.2 End User

- 6.2.1 Energy and Power

- 6.2.2 Food and Agriculture

- 6.2.3 Industrial Automation

- 6.2.4 Water and waste water Treatment

- 6.2.5 Other End-users

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE INTELLIGENCE

- 7.1 Company Profiles

- 7.1.1 Emerson Electric Company

- 7.1.2 Honeywell International Inc.

- 7.1.3 Rohde & Schwarz GmbH & Co. KG

- 7.1.4 Adcon Telemetry GmbH

- 7.1.5 OleumTech Corporation

- 7.1.6 Inovonics Corporation

- 7.1.7 Cooper Industries Inc. (Eaton Corporation PLC)

- 7.1.8 Phoenix Contact

- 7.1.9 Ascom Wireless Solutions AG

- 7.1.10 Siemens Corporation

- 7.1.11 Schneider Electric Corporation

- 7.1.12 Keri Systems Inc.