|

市场调查报告书

商品编码

1403850

能源管理系统-市场占有率分析、产业趋势与统计、2024年至2029年成长预测Energy Management Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

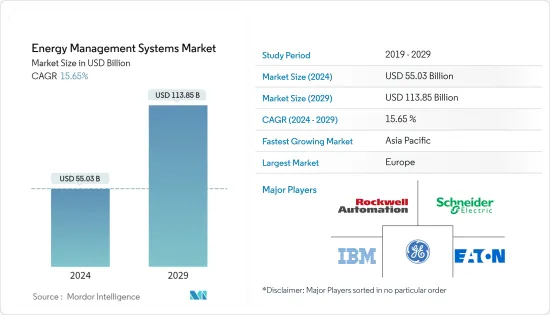

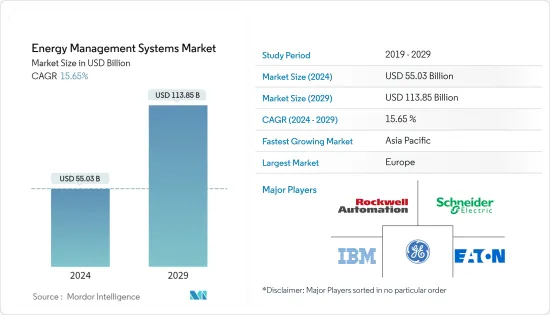

能源管理系统市场规模预计到2024年为550.3亿美元,到2029年达到1138.5亿美元,在市场估计和预测期间(2024-2029年)复合年增长率为15.65%。

由于最终用户对多种智慧电錶应用的需求不断增长以及对智慧型电气和建筑技术的投资,该市场正在不断扩大。 2022年9月,美国(DOE)投资105亿美元,透过智慧电网和其他升级来加强国家能源网路。这笔资金被纳入电网韧性创新合作伙伴计划,分为25亿美元用于电网韧性、30亿美元用于智慧电网和50亿美元用于电网创新。

主要亮点

- 网路通讯等科技发展日新月异。双向通讯媒体、智慧电网、资讯基础设施、节能技术、各种策略和家庭区域网路正在电力消耗领域的多个领域经历革命性的变化,例如用电模式和消费设施的节能。 2023 年 2 月,全球能源技术公司、全球最大的微型逆变器太阳能电池阵列和电池製造商 Enphase Energy, Inc. 向奥地利客户宣布 IQ 宣布他们已开始供应电池,以扩大在整个欧洲的可用性。

- 据埃克森美孚称,到 2040 年,整个工业部门的能源需求预计将增加至 123 兆英热单位,这增加了对 EMS 解决方案的需求。能源效率日益成为世界各地私人公司和政府机构的焦点。经济活动的活性化增加了能源消费量,将国际电网推向极限。

- 政府法规、成本降低和能源消耗优化正在推动家庭、工业和企业越来越多地采用能源管理解决方案。 EMS 的关键组件降低了成本:测量、通讯和软体应用程式。根据麻省理工学院 (MIT) 的研究,建筑物浪费了至少 30% 的能源,而 EMS 可以帮助避免这种情况。此外,2023年1月,法国政府启动了自己的支援系统,专注于先进的5G、6G和下一代网路的研发计划。具体来说,它专注于与虚拟、存取网路开放介面、安全、边缘运算以及人工智慧和机器学习整合相关的解决方案。这些措施进一步扩大了市场范围。

- 施耐德电机、霍尼韦尔国际公司、松下公司和绿色能源选项有限公司等重要供应商正持续投资于所研究市场的成长。例如,2022年11月,施耐德电机确认,除了其全系列家庭能源管理产品外,其Wiser网关和智慧插头是最早获得Matter认证的产品之一。

- 能源管理系统透过整合智慧电錶、智慧感测器和其他设备,随着技术的发展而进步。安装整个系统的成本很高,因为它整合了各种技术来保持能源效率。这对市场成长来说是一个挑战。

- 此外,新冠肺炎 (COVID-19) 疫情、俄罗斯和乌克兰战争造成的资源匮乏以及能源价格急剧上升促使德国采取永续行动。俄罗斯通往欧洲的最大天然气管道北溪1号被发现有多处天然气洩漏,其平行管道北溪2号已无限期关闭。欧洲,尤其是德国,越来越依赖俄罗斯天然气来满足其能源需求。过去一年,俄罗斯已将向欧盟国家的天然气供应削减了88%。这些因素可能会进一步阻碍所研究市场的成长。

能源管理系统市场趋势

能源效率投资的增加推动市场

- 各国政府正在投资各种倡议,包括可再生能源、采用提高电网效率的解决方案以及对使用低效技术的製裁。能源效率局(BEE)也估计,到2030年,德国对再生能源来源和石化燃料发电的需求将从600太瓦时增加到700太瓦时以上,这主要是由于电动车的扩张。

- 此外,有许多供应商在能源效率领域运营,使政府能够采用这些解决方案,而这些公司的投资也在成长。在拜登政府的领导下,预计透过联邦投资,美国将在 2050 年实现碳中和。

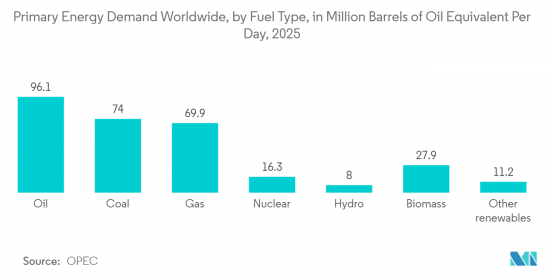

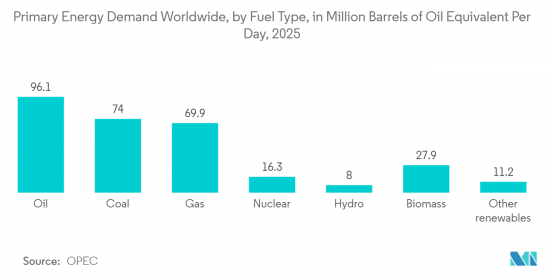

- 据欧佩克称,到 2025 年,初级能源消费量预计将达到每天约 3.034 亿桶石油当量。 OPEC预计石油和天然气仍将是最重要的能源来源,产量分别为9,610万桶和6,990万桶。

- 能源效率领域的几家供应商正在帮助政府采用此类解决方案,而此类企业的投资也在增加。例如,义大利天然气发行公司 Italgas 计划到 2028 年投资 86 亿欧元(88 亿美元)用于智慧燃气表和其他技术和活动。第二个支柱是能源效率,旨在将义大利天然气公司定位为该领域的主要企业,预计该领域的市场规模将从今年的 60 亿欧元增长到 2028 年的约 80 亿欧元。

- 据土耳其自然资源和能源部称,未来10年计划在能源效率领域投入超过100亿美元的公共和私人投资。这项投资预计到 2033 年将节省 300 亿美元。这些发展进一步增加了该领域对 EMS 的需求。

- 随着能源效率投资的成长,欧洲在这些投资方面处于世界领先地位。此外,大多数英国公民在冬季使用燃气中央暖气系统取暖。英国商业、能源和工业战略部 (BEIS) 2022 年的一项调查显示,78% 的受访者使用这种供暖方式。随着该地区法规的变化,参与企业正在市场上开发创新的新产品。例如,2022 年 2 月,法国公司 Cedric Francois 开发了新型热泵系统的独特核心。

- 这是一种工业 4.0 解决方案,可让您查看透过更好的压缩空气控制来减少能耗所需的资讯。为了减少洩漏、提高营运效率并降低成本,具有监控应用程式的 SICK FTMg 可让生产和维护团队持续监控压缩空气。

欧洲占主要市场占有率

- 英国在采用这种方法方面处于领先地位,并得到有利的能源政策和立法的支持,透过引入智慧电錶、节能建筑或此类系统来减少国家的碳排放。此外,英国社区能源计划也推动了国内能源管理市场。据英格兰社区能源 (CEE) 称,该国已经拥有 200 多个社区主导的能源组织,营运的综合能源发电量超过 180 兆瓦。此外,随着政府主导的能源价格上涨,消费者开始转向这些能源管理解决方案。

- 此外,英国政府要求能源供应商在 2,600 万家庭安装智慧电錶。智慧电錶普及的加速和能源危机意识的增强,再加上到2050年将二氧化碳排放减少80%的欧洲指令,预计将成为影响该国家庭能源管理系统成长的关键因素。

- 此外,该国还投资了智慧建筑解决方案,以减少碳排放和能源消费量,主要是在建筑领域。我国拥有大量智慧城市。此外,英国政府透过其创新机构 Innovate UK 制定了一项向投资智慧倡议的地方当局提供直接资助的计划。根据欧洲议会的报告,英国是拥有超过 31 个城市至少一项智慧倡议的三个欧洲国家之一。

- 德国政府旨在透过国家行动计画能源效率计画成为世界上最节能、最环保的国家之一,该计画管理能源效率标准和审核。据经济部称,政府计划在2030年将初级能源消费量减少30%。

- 此外,该国目前面临能源价格上涨的问题,正在寻求替代能源生产方法。欧盟委员会已允许根据欧盟国家援助规则修改德国的可再生能源生产支持系统。此外,该计划还考虑了德国可再生能源法的最新修正案。 EEG 2023 支持计画的总预算为 280 亿欧元(296.9 亿美元),目标是到 2030 年 80% 的电力由可再生能源生产,到 2045 年实现气候中和。

- 由于经济不确定性和投资回收期短,许多公司不愿投资能源效率,预计将阻碍该国的市场成长。 2022年12月,数位製造解决方案专家Cimlogic宣布推出新的能源管理解决方案,作为其综合MES(製造执行系统)解决方案的额外模组。 Simlogic 的能源解决方案可即时监控能源使用情况(水、空气、燃气、电力、蒸汽),帮助全球製造商提高业务效率、减少废弃物、加强企业社会责任,并协助我们实现永续製造。

- 此外,生态协议和能源企业义务(ECO)旨在减少英国的能源消耗。预计这将鼓励电力公司积极考虑透过智慧EMS解决方案的工业实施来降低能源消耗。 2022 年 12 月,英国宣布计画加速 5G 和 6G 技术研究,作为 1.1 亿英镑通讯研发计画的一部分。作为该计划的一部分,英国三所顶尖大学——约克大学、布里斯託大学和萨里大学——将获得2800万英镑的份额,并将与爱立信、诺基亚等主要通讯公司合作和三星为支持6G等未来网路而设计和製造。先进无线技术的持续采用预计将进一步加速工业 4.0 的采用,并提供积极的市场成长前景。

能源管理系统产业概况

市场竞争十分激烈。市场上的一些主要参与企业包括 IBM 公司、罗克韦尔自动化公司、通用电气、施耐德电机、伊顿、ABB 和甲骨文公司。预计公司将透过建立多个合作伙伴关係并投资引入新解决方案来扩大市场占有率,从而在预测期内获得竞争。

2022 年 9 月,IBM 发布了下一代 LinuxONE 伺服器。 LinuxONE Server 是一个基于 Linux 和 Kubernetes 的可扩展平台,旨在提供可扩充性,透过单一策略维持数千个工作负载。 IBM LinuxONE Empire 4 采用计划中的横向扩展方法,让客户可以透过打开未使用的核心来扩展工作负载,而不会增加能耗和相关的温室气体排放。这使他们能够以更高的密度运行并提高其性能。能力。

2022 年 7 月,伊顿与欧盟 (EU) 支持的 Flow 联盟共同开发并宣布了整合电动车充电基础设施。伊顿在联盟中的作用将建立在将建筑物开发为网格方法所获得的经验基础上,将建筑物和电动汽车电力需求与现场可再生能源发电相结合,并进一步开发电动汽车充电技术和电动车充电解决方案。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 宏观经济走势对市场的影响

第五章市场动态

- 市场驱动因素

- 增加智慧电网和智慧电錶的使用

- 增加能源效率投资

- 市场挑战

- 初始安装和维护成本高

第六章市场区隔

- 按 EMS 类型

- BEMS

- IEMS

- HEMS

- 按最终用户

- 製造业

- 电力/能源

- 资讯科技/通讯

- 医疗保健

- 住宅/商业

- 其他最终用户

- 按用途

- 能源生产

- 能量传输

- 能源监控

- 按成分

- 硬体

- 软体

- 服务

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 其他拉丁美洲

- 中东/非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 中东和非洲其他地区

- 北美洲

第七章竞争形势

- 公司简介

- IBM Corporation

- Rockwell Automation Inc.

- General Electric

- Schneider Electric

- Eaton

- Enel X

- SAP SE

- Siemens AG

- ABB

- Oracle Corporation

- Honeywell International Inc.

第八章投资分析

第9章 市场的未来

The Energy Management Systems Market size is estimated at USD 55.03 billion in 2024, and is expected to reach USD 113.85 billion by 2029, growing at a CAGR of 15.65% during the forecast period (2024-2029).

Due to the growing demand for multiple Smart Meter applications by end users, as well as investments in intelligent electric and building technologies, the market is expanding. In September 2022, the US (DOE) invested USD 10.5 billion to strengthen the country's energy grid through smart grids and other upgrades. The financing was consolidated into the Grid Resilience and Innovation Partnership program, divided into USD 2.5 billion for grid resilience, USD 3 billion for smart grids, and USD 5 billion for grid innovation.

Key Highlights

- Technological developments, like network communications, are rapidly improving. Bidirectional communication mediums, smart grids, information infrastructures, power conservation methodologies, and various strategies, home area networks are experiencing a revolutionary change in multiple areas of power consumption domains, like electricity usage patterns and energy conservation at consumption premises. In February 2023, Enphase Energy, Inc., a global energy technology company and the world's largest manufacturer of microinverter solar arrays and batteries, announced that it began supplying IQ Batteries to Austrian customers in order to extend their availability throughout Europe.

- According to Exxon Mobile, energy demand is anticipated to increase across the industrial sector by 2040, accounting for 123 quadrillion British thermal units, pushing the need for EMS solutions. Energy efficiency has increasingly evolved as the primary focus of private companies and government authorities worldwide. The increasing economic activities have led to high energy consumption rates and have pushed the international electricity grids to their limits.

- Due to government regulations, cost savings, and energy consumption optimization, homes, industries, and enterprises have increasingly adopted energy management solutions. Costs are reduced by the primary component of EMS measurement, communication, and software applications. Building wastes at least 30% of their energy, according to a study done by MIT, which could be avoided through EMS. Further, in January 2023, the French government launched a unique support scheme for R&D projects centered on advanced 5G, 6G, and future generations of networks. Specifically, it is focused on solutions linked to virtualization, open interfaces on access networks, security, edge computing, and the integration of AI and ML. Such initiatives further expand the scope of the market.

- Significant vendors continuously invest in the studied market growth, including Schneider Electric, Honeywell International Inc., Panasonic Corporation, and Green Energy Options Limited. For instance, in November 2022, Schneider Electric company also confirmed that, in addition to its complete range of energy management products for the home, Wiser Gateways and Smart Plugs are some of the earliest products that have been certified by Matter.

- Energy management systems have advanced with technological developments by incorporating smart meters, smart sensors, and other devices. Installing the entire system is expensive, as it integrates various technologies to maintain energy efficiency. This poses a challenge to the market's growth.

- Moreover, COVID-19 and scarcity owing to the Russia and Ukraine war and high energy prices propelled Germany to take sustainable action. Nord Stream 1, Russia's largest gas pipeline to Europe, was closed indefinitely after discovering several leaks and a parallel pipeline, Nord Stream 2. Europe, particularly Germany, has increasingly relied on Russian gas to meet its energy needs. Over the past year, Russia has cut its gas supplies to EU states by 88%. Such factors may further hamper the growth of the studied market.

Energy Management System Market Trends

Rising Investments in Energy Efficiency to Drive the Market

- Global investments toward having a more energy-efficient infrastructure have been growing steadily, with governments investing in various initiatives, such as renewable energy, adopting solutions that enhance the power grid's efficiency, and sanctions on the use of technologies that are not efficient. In addition, the Bureau of Energy Efficiency (BEE) estimated that the demand for energy generation from renewable sources and fossil fuels would rise from 600 TWh to over 700 TWh by 2030 in Germany, primarily driven by the expansion of electric mobility.

- Furthermore, various vendors have been operating in the energy efficiency space that enables governments to adopt such solutions, and such enterprises have been seeing growth in their investments. Under the Biden administration, the United States is expected to be carbon neutral by 2050 with investments from the federal government.

- According to OPEC, primary energy consumption is forecast to reach roughly 303.4 million barrels of oil equivalent per day by 2025. The source expects oil and gas to continue being the most significant contributing energy sources, at 96.1 and 69.9 million barrels, respectively.

- Several vendors in the energy efficiency space help governments adopt such solutions, and such businesses are seeing an increase in investment. For example, Italgas, the Italian gas DSO, plans to invest EUR 8.6 billion (USD 8.8 billion) in smart gas meters and other technologies and activities by 2028. The second pillar of energy efficiency aims to position Italgasamong as the major player in the sector, which is expected to have a market value of approximately EUR 8.0 billion by 2028, up from EUR 6.0 billion this year, according to the company.

- The Turkish Ministry of Natural Resources and Energy says that over 10 billion USD worth of investments in the area of energy efficiency are planned within the next decade by both public and private sectors. The investment is expected to generate USD 30 billion in savings until 2033; such developments have further augmented the demand for EMS in this space.

- With the growing investments in energy efficiency, Europe has been leading the global numbers in such investments. Further, most UK citizens keep warm using gas central heating during winter. A 2022 survey by the UK Department for Business Energy & Industrial Strategy (BEIS) found that 78% of respondents used this heating method. In line with the changing regulations in the region, the players have been establishing new and innovative products in the Market. For instance, in February 2022, a unique core for a heat pumps new system was developed by Cedric Francois in France.

- Further, in June 2022, SICK, the FTMg system with a monitoring app, was launched, which is an Industry 4.0 solution to enable them to see the information that they need in order to decrease their energy consumption as a consequence of Bettercompressed Air Control. In order to reduce leaks, enhance operational efficiency, and lower costs, SICK FTMg with Monitoring App allows continuous monitoring of compressed air by the production and maintenance teams.

Europe to Hold Significant Market Share

- The UK, supported by favorable energy policy and legislation to reduce the country's carbon footprint through the deployment of Smart Meters, Energy Efficient Buildings, or systems such as that, continues to be one of the leaders in adopting this approach. In addition, the UK's community energy projects have driven the domestic energy management market. According to Community Energy England (CEE), the country already has over 200 community-led energy organizations, which operate over 180 MW of energy-generating capacity together. Further, consumers are turning towards these energy management solutions with rising energy prices due to government initiatives.

- Furthermore, the UK government mandates that energy suppliers install smart meters in 26 million homes. The accelerating smart meter rollout and increasing awareness of the energy crisis, coupled with the European directive to reduce 80% of carbon emissions by 2050, have been recognized as the significant factors influencing the nation's home energy management system's growth.

- Additionally, the country has invested in smart building solutions, primarily to reduce the building sector's carbon footprint and energy consumption. The country is home to a large number of smart cities. Moreover, through Innovate UK, an innovation agency, the UK government has implemented programs that directly fund municipalities for investing in smart initiatives. As per a report by the European Parliament, the United Kingdom is one of only three European countries with more than 31 cities with at least one smart initiative.

- The German government is on course to become one of the world's most energy-efficient and environmentally friendly countries through the National Action Plan Energy Efficiency Plan, which manages funding schemes for energy efficiency standards and audits. According to the Ministry for Economic Affairs, the government plans to reduce primary energy consumption by 30% by 2030.

- Also, the country is facing increasing energy prices currently and is looking for alternative ways to produce energy. The European Commission has given the green light under EU State Aid rules to revise Germany's support scheme for renewable energy production. Further, the program considers recent amendments to Germany's Renewable Energy Act. With a total budget of EUR 28 billion (USD 29.69 billion), the EEG 2023 assistance program seeks to achieve climate neutrality by 2045 by producing 80% of power from renewable sources by 2030.

- Various companies are reluctant to invest in energy efficiency owing to economic uncertainty and seeking short payback times., which are expected to hinder market growth in this country. In December 2022, Cimlogic, specialists in digital manufacturing solutions, announced the launch of a new energy management solution, an additional module to their comprehensive MES (Manufacturing Execution System) solutions. Cimlogic's energy solution monitors energy usage (water, air, gas, electricity, and steam) in real-time to help global manufacturers improve operational efficiency, reduce waste, strengthen corporate social responsibility status, and achieve sustainable manufacturing.

- Furthermore, the Green Deal and Energy Companies Obligation (ECO) aimed to reduce UK energy consumption. This is expected to make utilities actively consider lowering energy consumption via the industrial adoption of smart EMS solutions. In December 2022, the UK announced plans to accelerate study on 5G and 6G technology as part of a GBP 110 million telecoms R&D package. As a part of the package, three top UK universities, the University of York, the University of Bristol, and the University of Surrey, would receive a share of GBP 28 million to team up with major telecoms companies, including Ericsson, Nokia, and Samsung to design and make networks of the future such as 6G. The increasing deployment of advanced wireless technologies is expected to further aid the adoption of Industry 4.0, creating a positive growth outlook for the market.

Energy Management System Industry Overview

The market studied is very competitive. Some significant players in the market are IBM Corporation, Rockwell Automation Inc., General Electric, Schneider Electric, Eaton, ABB, Oracle Corporation, and many more. The companies are expected to increase the market share by forming multiple partnerships and investing in introducing new solutions to earn a competitive edge during the forecast period.

In September 2022, IBM announced the next generation of its LinuxONE server, a favorably scalable Linux and Kubernetes-based platform designed to provide scalability to sustain thousands of workloads in the footprint of a single strategy. IBM LinuxONE Emperor 4 was a planned scale-out-on-scale-up approach that allowed clients to run workloads at increased density and increased capability by turning on unused cores without raising their energy consumption and associated greenhouse gas emissions.

In July 2022, an integrated electric vehicle charging infrastructure was developed and presented by Eaton with the Flow consortium, which received support from the European Union. Based on the experience gained in the development of its buildings as a grid approach, merging the power needs of buildings and EVs with on-site renewable power generation, Eaton's role in the consortium was to apply further developing EV charging technologies and establishing electric vehicle charging solutions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of Macroeconomic Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Usage of Smart Grids and Smart Meters

- 5.1.2 Rising Investments in Energy Efficiency

- 5.2 Market Challenges

- 5.2.1 High Initial Installation Costs Coupled with Maintenance Costs

6 MARKET SEGMENTATION

- 6.1 By Type of EMS

- 6.1.1 BEMS

- 6.1.2 IEMS

- 6.1.3 HEMS

- 6.2 By End User

- 6.2.1 Manufacturing

- 6.2.2 Power and Energy

- 6.2.3 IT and Telecommunication

- 6.2.4 Healthcare

- 6.2.5 Residential and Commercial

- 6.2.6 Other End Users

- 6.3 By Application

- 6.3.1 Energy Generation

- 6.3.2 Energy Transmission

- 6.3.3 Energy Monitoring

- 6.4 By Component

- 6.4.1 Hardware

- 6.4.2 Software

- 6.4.3 Services

- 6.5 By Geography

- 6.5.1 North America

- 6.5.1.1 United States

- 6.5.1.2 Canada

- 6.5.2 Europe

- 6.5.2.1 United Kingdom

- 6.5.2.2 Germany

- 6.5.2.3 France

- 6.5.2.4 Spain

- 6.5.2.5 Rest of Europe

- 6.5.3 Asia-Pacific

- 6.5.3.1 China

- 6.5.3.2 India

- 6.5.3.3 Japan

- 6.5.3.4 South Korea

- 6.5.3.5 Rest of the Asia-Pacific

- 6.5.4 Latin America

- 6.5.4.1 Brazil

- 6.5.4.2 Argentina

- 6.5.4.3 Mexico

- 6.5.4.4 Rest of Latin America

- 6.5.5 Middle East and Africa

- 6.5.5.1 United Arab Emirates

- 6.5.5.2 Saudi Arabia

- 6.5.5.3 South Africa

- 6.5.5.4 Rest of Middle East and Africa

- 6.5.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 Rockwell Automation Inc.

- 7.1.3 General Electric

- 7.1.4 Schneider Electric

- 7.1.5 Eaton

- 7.1.6 Enel X

- 7.1.7 SAP SE

- 7.1.8 Siemens AG

- 7.1.9 ABB

- 7.1.10 Oracle Corporation

- 7.1.11 Honeywell International Inc.