|

市场调查报告书

商品编码

1403867

电动液压转向系统-市场占有率分析、产业趋势与统计、2024年至2029年的成长预测Electrically Powered Hydraulic Steering - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

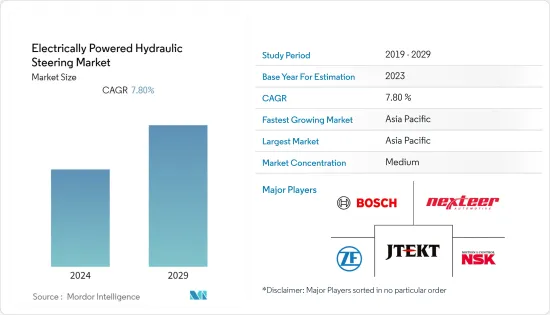

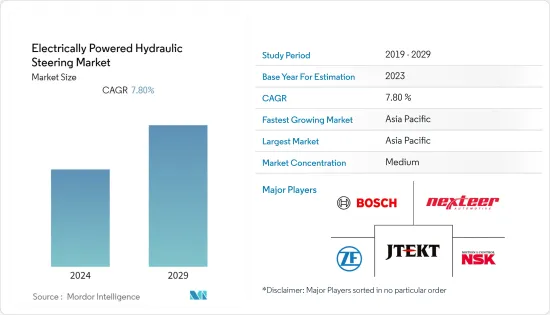

目前电动液压转向器市场规模为16亿美元。

预计未来五年将成长至 25.1 亿美元,预测期内收益复合年增率为 7.8%。

从中期来看,随着客户对新安全系统和技术的了解越来越多,他们将越来越多地选择具有改进安全功能的汽车。对乘客安全的日益担忧迫使汽车製造商为其车辆配备驾驶员辅助系统,尤其是转向辅助系统。这些因素将推动未来几年的需求。

现在,透过使用电动液压油压混合动力系统,可以在不使用引擎驱动的液压泵的情况下操作传统的液压转向。相反,不由引擎提供动力的电动帮浦单元提供液压。该技术在使用传统液压转向作为主要技术的车辆中最有用,但也可用于混合动力电动车模型。

电动液转向的优点是操控轻便,转向时舒适度高。另一方面,高速时转向强劲。功率摄取量根据需求而变化,从而提高整体燃油经济性。预计亚太地区的销售额在预测期内将大幅成长。

电动液压转向帮浦 (EHPS) 为中型和重型商用车的油压辅助转向系统精确供应适量的油。在恆定供给速率下,EHPS 与传统转向帮浦相比可节省高达 70% 的能源,且能源使用适应驾驶环境。

按地区划分,亚太地区在汽车 EPS 市场占据主导地位。亚太地区EPS市场的推动因素包括汽车产量和销售的增加、车辆的快速电动、更严格的排放气体法规以及消费者可支配收入的增加。因此,人们对安全性和舒适性的偏好日益增强,从而增加了汽车销售的需求。

电动液压转向器市场趋势

电动转向技术的进步推动成长

事故数量的大幅增加也促使最终用户采用更好的安全系统。道路和车辆设计的改进稳步降低了所有第一世界国家的伤害和死亡率。然而,由于一些开发中国家的事故率仍然很高,各国政府正在专注于实施严格的安全标准并支持在汽车中采用各种安全增强子系统。

在这些因素的推动下,汽车製造商正在将多种安全增强系统整合到他们的车辆中。先进的安全和安全功能不再仅限于豪华车。消费者现在更关心安全系统和技术。因此,他们有兴趣选择一辆安全系统更好的汽车。

世界上多个国家针对车辆污染和燃油效率制定了严格的法规。美国NHTSA(运输部交通安全管理局)和欧洲ICCT(国际清洁交通理事会)等监管机构均已采用车队等级的要求。这些标准规定了汽车製造商必须遵守的平均排放气体量。

在过去的十年中,汽车行业越来越倾向于在世界各地的小客车和商用车中使用电动转向系统,以配合日益严格的法规。该系统消除了转向泵浦、软管、液压油和其他随着时间的推移而劣化并需要频繁更换的汽车零件的需要。因此,在最近的新车中,已经更换为电动转向系统。随着 EPS 组件数量的减少,以及全球更严格的排放法规增加了对轻型车辆的需求,对 EPS 系统以及扩展马达的需求正在显着增加。

这些需求迫使汽车製造商增加对电动转向等节能转向技术的投资。为了满足这些需求,各公司正在共同开发先进的转向系统。例如

- 2022 年 3 月,蒂森克虏伯与日本精工株式会社 (NSK) 达成协议,探讨蒂森克虏伯汽车与 NSK 转向部门于 2022 年 3 月成立合资企业。该谅解备忘录寻求蒂森克虏伯汽车公司的汽车业务与 NSK 的转向部门之间建立技术和战略合作伙伴关係。

由于上述全球市场的开拓,预计该市场在预测期内将显着增长。

亚太地区可望成为市场领导者

中国在亚太汽车市场占据主导地位。随着汽车安全措施和先进安全技术如ESC(电子电子稳定控制)、ADAS(先进驾驶辅助系统)等的接受度不断提高,市场在预测期内可能会大幅成长。

在中国,随着小客车需求的增加,感测器在汽车中的使用迅速增加。中国推出了安全法规并实施了新车评估计画(C-NCAP),制定了与欧洲同等的标准。这些规定实施后,中国立即发生了重大的法律和社会变化。

汽车电动的不断增长趋势是推动汽车转向感测器市场的关键因素。因此,汽车製造商越来越多地与感测器製造商合作,以满足消费者的需求。此外,较低的系统价格也将支援最新感测器和半导体产品在中国的快速普及,对目标市场的成长产生正面影响。

- 2022年4月,中国爆发的COVID-19疫情日益频繁,给市场相关人员带来了挑战,也给中国经济带来了负面压力。在此期间,汽车产业和供应链面临终极挑战。此外,一些主要汽车製造商已经停产,并面临巨大的物流挑战,导致交付能力崩坏。

此外,COVID-19 的爆发削弱了整体购买力和消费者信心。儘管市场逐渐復苏,仍面临疫情带来的挑战。

参与转向感测器供应和销售的公司期待在其他机会区域进行大规模部署。多家OEM正在与汽车製造商合作,将增强型产品推向市场。例如

- 2021年7月,中国领先的转向零件和系统供应商中国汽车系统股份有限公司表示,为阿尔法罗密欧开发新型方向盘已进入OTOP(Off Tool Off Process)阶段。

由于上述国家的发展,未来几年对电动液压转向系统的需求可能会增加。

电动液压转向器产业概况

电动液压转向器市场由 JTEKT Corporation、Nexteer Automotive Group Ltd、ZF Friedrichshafen AG、NSK Ltd 等主要企业主导。汽车零件製造商正在全球迅速扩张,市场可能在预测期内显着成长。

- 2023 年 5 月,NSK Ltd. 扩大了在中国的研发设施。透过此次扩张,该公司扩大了在产品系列。

- 2022年1月,博世与大众集团子公司Cariad同意建立广泛的合作关係,共同努力实现这一目标。两家公司希望使部分和高度自动驾驶适合大规模生产,从而为广大消费者提供服务。此次合作旨在为大众汽车集团品牌销售的车辆提供一项功能,让驾驶者可以暂时将手从方向盘上移开。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场驱动因素

- 政府措施和对安全的日益重视推动市场发展

- 市场抑制因素

- 线控转向系统的采用阻碍了市场成长

- 波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔(市场规模(美元))

- 依组件类型

- 方向盘/转向柱

- 感应器

- 方向盘马达

- 其他的

- 按车型

- 小客车

- 商用车

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 世界其他地区 中东/非洲

- 南美洲

- 中东/非洲

- 北美洲

第六章竞争形势

- 供应商市场占有率

- 公司简介

- NSK Ltd.

- ZF Friedrichshafen AG

- Showa Corporation

- Robert Bosch GmbH

- Continental AG

- JTEKT Corporation

- Mando Corporation

- Mitsubishi Electric Corporation

- Nexteer Automotive

- Danfoss

- ThyssenKrupp AG

第七章 市场机会及未来趋势

The Electrically Powered Hydraulic Steering market is valued at USD 1.60 billion in the current year. It is anticipated to grow to USD 2.51 billion by the next five years, registering a CAGR of 7.8% in terms of revenue during the forecast period.

Over the medium term, as customers are becoming more aware of new safety systems and technology, they are increasingly selecting vehicles with improved safety features. Automotive manufacturers are forced to equip their vehicles with driver assistance systems, particularly steering assistance systems, as passenger safety concerns grow. Such factors are pushing the demand in the coming years.

Traditional hydraulic steering can now be operated without the use of an engine-driven hydraulic pump owing to the usage of electro-hydraulic hybrid systems. Instead, an electric motor pump unit that does not take power from the engine provides hydraulic pressure. This technique is most useful in vehicles that use traditional hydraulic steering as their primary technology, but it is also available in hybrid-electric vehicle types.

The advantage of electro-hydraulic power steering is greater comfort: steering is light to handle when maneuvering. The steering, on the other hand, is strong at high speeds. As the power uptake changes as needed, this improves overall fuel economy. Sales in Asia-Pacific are expected to hold a significant rise throughout the forecast period.

The electro-hydraulic power steering pump (EHPS) delivers precisely the proper amount of oil for hydraulic steering systems in medium and heavy commercial vehicles. EHPS provides up to 70% energy savings over traditional power steering pumps with a constant supply volume, and energy usage adapts to the driving environment.

Among regions, Asia-Pacific dominated the automotive EPS market. The Asia-Pacific EPS market is primarily driven by growing vehicle production and sales, rapid electrification of vehicles, rising stringency of emission norms, and increasing disposable income of consumers. It, in turn, is increasing the demand for vehicle sales, owing to the growing preference for safety and comfort.

Electrically Powered Hydraulic Steering Market Trends

Advancements in Electric Power Steering Technology is Driving Growth

A significant increase in the number of accidents also encouraged end users to adopt better safety systems. Improvements in roadway and motor vehicle designs steadily reduced injury and death rates in all first-world countries. However, the accident rates are still higher in some developing countries, and governments are focusing on implementing stringent safety norms and supporting the adoption of various subsystems in vehicles that enhance the aspects of safety.

Driven by these factors, automobile manufacturers are incorporating several systems in the vehicles that enhance safety. Advanced safety and security features are no longer restricted to premium vehicles. Consumers are now more concerned about safety systems and technologies. They are therefore interested in opting for vehicles that are equipped with better safety systems.

Several countries throughout the world enacted strict vehicle pollution and fuel economy rules. Fleet-level requirements are adopted by regulatory authorities such as the National Highway Traffic and Safety Administration (NHTSA) in the United States, the International Council on Clean Transportation (ICCT) in Europe, and other organizations. These standards establish an average emission level that carmakers must adhere to.

An increasing preference for electric power steering systems is witnessed for the past decade across the automotive industry with respect to both passenger cars and commercial vehicles around the world to complement the growing regulations. This system eliminates the need for a power steering pump, hoses, hydraulic fluids, and several other such automotive components that are prone to wear over time and require replacement very often. It can make the cost of maintenance for the vehicle high and is therefore replaced by electrically powered steering systems in the newer vehicles today. With a lesser number of components for EPS and an increasing need for lightweight vehicles due to the stringent emission norms across the world, the need for EPS systems and, consequently, the motor is immense.

These requirements forced automakers to invest more in fuel-efficient steering technology like electric power steering. To cater to these requirements, players are collaborating and co-developing advanced steering systems. For instance,

- In March 2022, Thyssenkrupp and NSK Ltd. (NSK) agreed to explore a joint venture between Thyssenkrupp Automotive and NSK's steering division. The MoU calls for a technological and strategic alignment between ThyssenKrupp's automotive business with NSK's steering division.

With the development mentioned above across the globe, it is likely to witness major growth for the market during the forecast period.

Asia-Pacific is Expected to Be Market Leader

China is dominating the vehicle market in the Asia-Pacific region. Increased acceptance of car safety measures, as well as a rise in advanced technology for safety such as ESC, Advanced Driver Assistance Systems (ADAS), etc., are likely to witness major growth for the market during the forecast period.

The use of sensors in vehicles rapidly increased with the increase in demand for passenger vehicles in China. The country introduced safety regulations to run a New Car Assessment Program, C-NCAP, with standards that will match those of Europe. There are significant legal and social changes in China soon after the implementation of these regulations.

The growing trend of vehicle electrification is a significant factor driving the automotive steering sensors market. As a result, automotive manufacturers are increasingly collaborating with sensor manufacturers to suit the needs of their consumers. Additionally, lower system prices also aided in the rapid adoption of modern sensors and semiconductor products in China, which will positively impact the target market's growth.

- In April 2022, the increased frequency of COVID-19 incidences in China created challenges for market players and put negative pressure on the Chinese economy. During this time, the automobile industry and supply chain were pushed to the ultimate challenge. Furthermore, some of the major automakers shut down production and faced enormous logistical challenges, resulting in a collapse in delivery capacity.

Furthermore, the COVID-19 epidemic weakened total buying power and consumer confidence. Although the market recovered over time, it is still facing hurdles as a result of the pandemic.

Companies operating in the supply and distribution of steering sensors are looking forward to their mass expansion in other opportunity regions. Several OEMs are partnering with carmakers to bring enhanced products to market. For instance,

- In July 2021, China Automotive Systems Inc., a major provider of power steering components and systems in China, stated that it reached the OTOP (Off Tool Off Process) phase of new steering development for Alfa Romeo.

With the development mentioned above across the country, the demand for electro-hydraulic power steering in the coming years will increase.

Electrically Powered Hydraulic Steering Industry Overview

Electrically-Powered Hydraulic Steering Market is dominated by several key players such as JTEKT Corporation, Nexteer Automotive Group Ltd, ZF Friedrichshafen AG, NSK Ltd, and Others. The rapid expansion of automotive component manufacturers across the globe is likely to witness major growth for the market during the forecast period. For instance,

- In May 2023, NSK Ltd. expanded its research and development facility in China. Through this expansion, the company expanded its product portfolio across the country.

- In January 2022, Bosch and the Volkswagen Group subsidiary Cariad are now collaborating to achieve this objective and agreed to form an extensive partnership. The companies want to make partially and highly automated driving suitable for volume production and thus available to the broad mass of consumers. For the vehicles sold under the Volkswagen Group brands, the alliance aims to make functions available that will allow drivers to temporarily take their hands off the steering wheel.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Government Initiatives and the Growing Emphasis on Safety is Driving the Market

- 4.2 Market Restraints

- 4.2.1 Adoption of Steer-By-Wire System Hindering the Market Growth

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value (USD))

- 5.1 By Component Type

- 5.1.1 Steering Wheel/Column

- 5.1.2 Sensors

- 5.1.3 Steering Motor

- 5.1.4 Others

- 5.2 By Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Commercial Vehicle

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 South America

- 5.3.4.2 Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 NSK Ltd.

- 6.2.2 ZF Friedrichshafen AG

- 6.2.3 Showa Corporation

- 6.2.4 Robert Bosch GmbH

- 6.2.5 Continental AG

- 6.2.6 JTEKT Corporation

- 6.2.7 Mando Corporation

- 6.2.8 Mitsubishi Electric Corporation

- 6.2.9 Nexteer Automotive

- 6.2.10 Danfoss

- 6.2.11 ThyssenKrupp AG