|

市场调查报告书

商品编码

1403869

兆赫技术:市场占有率分析、产业趋势与统计、2024年至2029年成长预测Terahertz Technologies - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

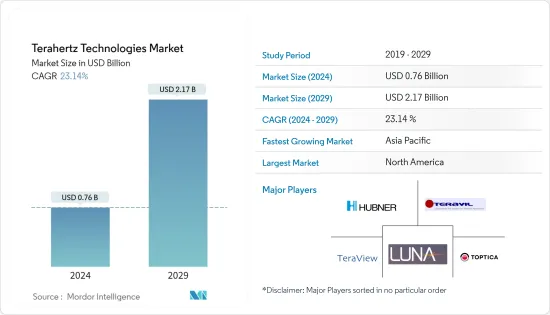

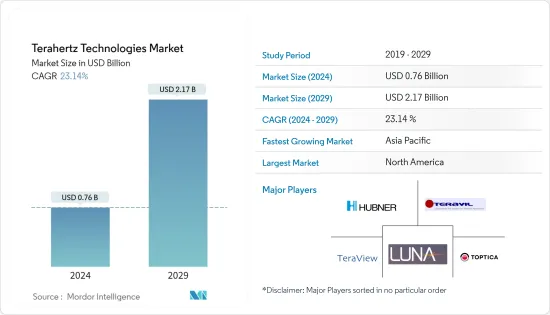

兆赫技术市场规模预计到2024年将达到7.6亿美元,预计到2029年将达到21.7亿美元,在预测期内(2024-2029年)复合年增长率为23.14%。

主要亮点

- 兆赫技术是一个不断发展的新兴领域,具有应用开发的潜力,从机场乘客扫描到大规模数位资料传输。兆赫技术也取得了重大的科学进展。

- 由于兆赫技术的各种重要特性,兆赫辐射有望在未来几年成为一项重要技术。该技术通常用于检测隐藏的爆炸物和麻醉品,以及从塑胶管道洩漏的物质。兆赫技术可以透过非破坏性地可视化陶瓷和塑胶中的材料缺陷来监测层厚度。

- 兆赫(THz)光谱,特别是太赫兹成像,在无损、非接触检测领域具有巨大潜力。由于其精度和准确性,兆赫技术在即时去除所有癌组织、最大限度地减少手术次数以及实现更快、更准确的诊断方面发挥关键作用。兆赫辐射的电磁波频谱范围从微波波段的高端到远红外线范围的低端。兆赫技术可望应用于通讯、安检、生物医学等各领域。特别是,兆赫技术在神经科学中用于区分良性和恶性脑肿瘤。

- 此外,使用兆赫辐射产生高品质的光谱影像极大地促进了许多慢性及相关疾病的诊断。医疗保健领域技术进步的阶段是用兆赫光取代传统的 X 光和红外线,这将推动预测期内的市场扩张。太赫兹成像还可以对锭剂等进行 3D 分析。这使得它可用于测量涂层完整性和厚度、检测和识别局部内的局部化学或物理结构等。它也可用于检查裂缝、化学团聚、分层和埋层的完整性。

- 将兆赫技术推向市场的一个关键挑战是缺乏对该技术的了解。此外,需要提高对兆赫技术的认识,特别是在新兴市场,这是市场成长的主要阻碍因素。

- 由于 COVID-19大流行,兆赫技术市场在医疗保健、生物医学和安全应用方面经历了显着增长。 COVID-19大流行引发了医疗保健领域的大量研究和开发,以寻找合适的技术来检测病毒,从而促进市场成长。

兆赫技术市场趋势

国防和安全领域占据大部分市场占有率

- 在安全环境中,识别隐藏武器和随身爆炸物等威胁是一项关键的营运需求。近年来,人们越来越重视隐藏爆炸物的影像,对兆赫技术的兴趣也随之增加。兆赫技术有助于检测和识别隐藏的物体。兆赫光束现在可以检测机场和其他安全敏感场所的危险非金属材料,例如陶瓷刀和塑胶炸药。

- 此外,金属探测和 X 光袋扫描是耗时的过程。对于人流量大的大众交通工具枢纽来说,这就更加困难。因此,需要一种即使远离潜在源头也能执行安全检查的技术解决方案。兆赫技术可以在不停止安全检查的情况下对大量人员进行扫描,从而为这些挑战提供了解决方案。

- 兆赫感测器可能的军事应用范围很广。因此,它可广泛用于资讯、监视和侦察(ISR),例如侦测敌后孤立人员、确定目标和引导精确武器。此外,在非战斗环境中,太赫兹可用于探测目前或先前战场上的塑胶或最小金属地雷。大多数杀伤人员地雷都是金属和塑胶的组合(其製造目的是为了避免被金属探测探测到)。

- 目前的地雷探测技术需要分析土壤温度。土壤温度是在3D上测量的,并输入到繁琐的软体演算法中,这些演算法会做出不可靠的粗略估计。此检测技术主要采用现场可程式闸阵列(FPGA)技术。兆赫光谱成像是 FPGA 的合理替代方案,在适当的条件下可以相对可靠地检测几乎任何物质。

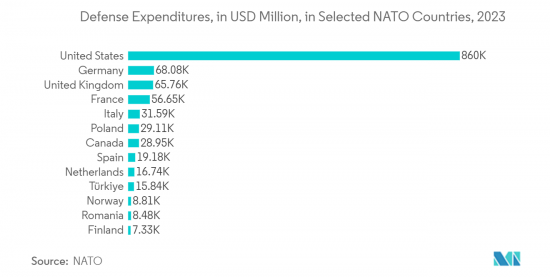

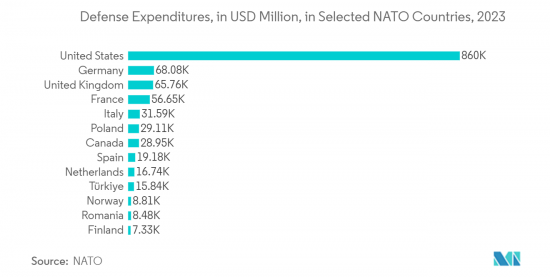

- 据北约称,2023年美国将在国防支出上花费约8,600亿美元。这是北约成员国中最大的国防预算。德国的国防支出排名第二,约 680 亿美元,其次是英国,排名第三。由于涉及如此大量的国防支出,预计将在整个预测期内创造充足的成长机会。

北美占据主要市场占有率

- 美国是兆赫技术的重要市场,这主要是由于国防安全保障问题、国防投资以及研发过程的不断增加。此外,美国政府对航太技术生产和安全的严格监管,以及汽车和航太工业的不断发展,也推动了该地区兆赫技术市场的发展。

- 根据美国航空公司 (A4A) 的数据,商业航空约占美国GDP 总量的 5%,到 2022 年将达到约 1.25 兆美元。美国航空公司每天营运约 25,000 个航班,运送 230 万名乘客往返约 80 个国家,并运送超过 65,000 吨货物往返于 220 个国家。随着航空业强劲復苏并趋于稳定,美国航空公司不断创新、投资和发展。飞机工业不断增长的需求是基于兆赫技术的检测系统成长的主要推动力。此外,美国直升机和商用飞机的产量正在增加,预计将显着推动市场。

- 此外,加拿大创新者专注于为国内和竞争激烈的全球市场生产整合的、技术复杂的高价值产品,进一步塑造兆赫技术市场的未来。我就是。随着越来越多的公共场所需要安全筛检,加拿大对安全筛检设备的需求预计将会增加。例如,加拿大航空公司在乘客登机前往该国之前对其进行筛选。加拿大航空公司的工会-加拿大公共僱员工会(CUPE)宣布将增加飞行前筛检,让空服人员承担更多责任。

- 此外,重要的公司也在投资、与其他公司合併、投资新计画,以扩大消费群并更好地满足各种应用的需求。例如,2022 年 11 月,麻省理工学院的工程师生产了一款低成本的兆赫相机。该设备主要提供比以前版本更高的灵敏度和速度,可用于工业检查、机场通讯和安全目的。

- 同样在 2023 年 6 月,全球唯一致力于加速半导体解决方案的培养箱Silicon Catalyst 宣布四家公司加入半导体产业备受推崇的计画。新成员包括 Cambridge 兆赫 ,该组织致力于透过 CMOS 相控阵技术实现兆赫频谱的民主化。

兆赫技术产业概况

兆赫技术市场较为分散,主要公司包括 Luna Innovations、Teravil Ltd、TeraView Limited、Toptica Photonics AG 和 HUBNER GmbH &Co.KG。市场竞争正在利用联盟、创新、业务扩张和收购等各种策略来增加产品系列获得永续的竞争优势。

- 2023 年 6 月,是德科技发布了 PathWave ADS 2024,以加速 5G 毫米波设计的发展并引领 6G。 PathWave 先进设计系统 (ADS) 2024 主要是一个电子设计自动化 (EDA) 软体套件,使晶片设计人员能够增强其 5G 毫米波产品设计,特别是可以预测 6G 无线通讯开发核心需求的新毫米波设计。亚太兆赫(sub-THz) 频率能力。

- 2022 年 9 月,Toptica 宣布将建造一座新工厂,并为其不断成长的员工队伍提高产能。新设施的占地面积将增加一倍以上,并可扩大实验室和生产空间,这对于未来十年的预期成长至关重要。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 产业价值链分析

- 宏观经济走势对市场的影响

第五章市场动态

- 市场驱动因素

- 医疗领域和无损检测应用的需求不断增长

- 使用兆赫技术的整体安全方法

- 市场抑制因素

- 市场对兆赫技术缺乏认识

- 缺乏支援兆赫技术采用的设备基础设施

第六章市场区隔

- 依技术类型

- 兆赫成像系统

- 主动系统

- 被动系统

- 兆赫光谱系统

- 时域

- 频域

- 通讯系统

- 兆赫成像系统

- 按最终用户

- 卫生保健

- 国防/安全

- 通讯

- 产业

- 食品/农业

- 研究机构

- 其他最终用户

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区

- 拉丁美洲

- 中东/非洲

- 北美洲

第七章竞争形势

- 公司简介

- Luna Innovations

- Teravil Ltd

- TeraView Limited

- Toptica Photonics AG

- HUBNER GmbH & Co. KG

- Advantest Corporation

- BATOP GmbH

- Terasense GP Inc.

- Microtech Instrument Inc.

- Menlo Systems GmbH

- Gentec Electro-optics Inc.

- Bakman Technologies LLC

第八章投资分析

第九章 市场机会及未来趋势

The Terahertz Technologies Market size is estimated at USD 0.76 billion in 2024, and is expected to reach USD 2.17 billion by 2029, growing at a CAGR of 23.14% during the forecast period (2024-2029).

Key Highlights

- Terahertz technology is a growing as well as an emerging field with the potential for developing applications ranging from passenger scanning at an airport to large digital data transfers. It has been reflecting significant advancements on the scientific front.

- Due to the various crucial properties of terahertz technology, terahertz radiation is expected to be adopted as an important technology in the coming years. This technology is commonly used to detect concealed explosives or narcotics or to detect substances leaking from plastic pipes. Terahertz technology can monitor layer thickness by visualizing non-destructive material defects in ceramics and plastics.

- The field of non-destructive, non-contact testing holds great potential for terahertz (THz) spectroscopy, especially THz imaging. Due to its accuracy and precision, terahertz technology plays an important role in the removal of all cancerous tissue in real-time, minimizing the number of surgeries and enabling earlier and more accurate diagnosis. Terahertz radiations range from the microwave band's high-end to the far-IR's lower end in the electromagnetic spectrum. THz technology has shown promising potential for applications in various fields, including communication, security inspection, and biomedicine. More particularly, THz technology has been used in neuroscience to distinguish between benign and malignant brain tumors.

- In addition, terahertz radiation can be used to produce high-quality spectroscopic images, greatly facilitating the diagnosis of many chronic and related diseases. The initial stage towards the advancement of technology establishment in the healthcare field is the replacement of conventional X-rays and infrared rays with terahertz rays, which drives the market expansion during the forecast period. THz imaging also enables 3D analysis to be performed on tablets and more. It thus helps in the measurement of coating integrity and thickness, detection and identification of local chemical or physical structures within the core, etc. It also helps in the inspection of cracks or chemical cohesion, as well as delamination and integrity of embedded layers.

- A significant challenge to adopting terahertz technology in the market has been a sheer lack of knowledge of the technology. Also, the need for more awareness of the topic, especially in developing regions, has been a significant restraining factor for the market's growth.

- With the COVID-19 outbreak, the terahertz technology market witnessed significant growth, with its major healthcare, biomedical, and security applications. The outbreak resulted in many research and development activities in the healthcare space to find appropriate technology to detect the virus, augmenting market growth.

Terahertz Technology Market Trends

Defense and Security Segment Holds Major Market Share

- In security environments, identifying threats such as hidden weapons and body-worn explosives is a robust operational need. In recent years, terahertz technology has seen an increase in interest due to the growing emphasis on imaging concealed explosives. THz technology helps to detect and identify hidden objects. At airports or other security-critical places, dangerous non-metallic substances like ceramic knives or plastic explosives can now be detected with terahertz beams.

- Additionally, metal detection and X-ray bag scanning are time-consuming processes. It becomes more difficult in the case of public transportation hubs, wherein there is a lot of movement. Hence, there is a need for technological solutions that can perform security checks even at a distance from the potential source. Terahertz technology allows the scanning of many people without needing them to stop for a security check, thereby offering a solution to these challenges.

- THz sensors' conceivable military applications are broad. They thus can be widely used for intelligence, surveillance, and reconnaissance (ISR), including detecting isolated personnel behind enemy lines, fixing targets, and terminal guidance of precision weapons. Also, in a non-combat environment, THz could help detect plastic or minimal metal land mines on current or former battlefields. Most anti-personnel mines combine metal and plastic (and are manufactured to avoid detection by metal detectors).

- The current technology for land-mine detection requires analysis of soil temperature. It is measured in three dimensions and then injected into cumbersome software algorithms that make rough estimates with limited confidence. This detection technique primarily uses field programmable gate array (FPGA) technology. THz spectroscopic imaging is one of the logical alternatives to FPGA, as it can detect almost any material under the right conditions with relatively high confidence.

- According to NATO, in 2023, the United States spent a sum of around USD 860 billion on defense. This makes their defense budget the largest out of all the NATO members. Germany had the second-greatest defense expenditure at around USD 68 billion, with the UK in third place. This involvement of a high amount of expenditure on defense is expected to create ample growth opportunities throughout the forecast period.

North America Holds Major Market Share

- The United States is a crucial market for terahertz technologies, primarily owing to the growing homeland security issues, investments in defense, and the R&D processes. In addition, the stringent government regulations regarding the production and safety of aerospace technologies in the U.S. and the growing automotive and aerospace industries are driving the market for THz technologies in the regional market.

- According to Airlines for America (A4A), the total commercial aviation drives around 5 percent of the total U.S. GDP, which is the equivalent of around USD 1.25 trillion in 2022. On a daily basis, U.S. airlines operate around 25,000 flights carrying 2.3 million passengers to and from about 80 countries and over 65,000 tons of cargo to and from over 220 countries. As the aviation industry mounts and stabilizes a robust recovery, U.S. airlines are innovating, investing, and growing. Such heightened demand from the aircraft industry is a significant driver for the inspection systems' growth based on the terahertz technology. Furthermore, the increase in helicopters and commercial aircraft production in the United States is expected to drive the market significantly.

- Moreover, Canadian innovators are focusing on producing a comprehensive range of technologically complex, increased-value products for domestic and competitive global markets, further shaping the future of the terahertz technologies market. In Canada, security screening equipment is expected to be in high demand due to the increased number of public places requiring security screening. For instance, Canadian airlines screen passengers before they board flights bound for the country. Air Canada's union, the Canadian Union of Public Employees (CUPE), announced additional pre-flight screening by making flight attendants responsible.

- Moreover, to increase their consumer base and better meet their demands across various applications, significant companies are also investing, merging with other businesses, and investing in new projects. For instance, in November 2022, MIT engineers built a low-cost terahertz camera. The device mainly delivers greater sensitivity and speed than the previous versions and could be utilized for industrial inspection, airport communications, and security purposes.

- Also, in June 2023, Silicon Catalyst, the only global incubator focused exclusively on accelerating semiconductor solutions, declared the admission of four companies into the semiconductor industry's highly acclaimed program. The newly admitted companies include Cambridge Terahertz, which is focused on democratizing the Terahertz spectrum through CMOS phased array technology.

Terahertz Technology Industry Overview

The terahertz technologies market is fragmented, with the presence of major players like Luna Innovations, Teravil Ltd, TeraView Limited, Toptica Photonics AG, and HUBNER GmbH & Co. KG. Market players are utilizing a variety of strategies to increase their product portfolio and gain sustainable competitive advantages, such as partnerships, innovation, expansion, and acquisitions.

- In June 2023, Keysight introduced PathWave ADS 2024 to speed up the growth of 5G mmWave Design and Lead 6G. The PathWave Advanced Design System (ADS) 2024 is primarily an electronic design automation (EDA) software suite that provides chip designers new millimeter wave and subterahertz (sub-THz) frequency capabilities that can enhance 5G mmWave product design and anticipate the core requirements, especially for 6G wireless communications development.

- In September 2022, Toptica announced an increase in its capacity by building new facilities for a growing workforce. The new facility more than doubles the footprint and allows the company to increase its lab and production spaces, which are critical for anticipated growth over the next decade.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Degree of Competition

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of Macro Economic trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Demand in the Medical Sector and Non-destructive Testing Applications

- 5.1.2 Holistic Approach to Security Through the Usage of Terahertz Technology

- 5.2 Market Restraints

- 5.2.1 Lack of Awareness of the Technology in the Market

- 5.2.2 Lacking the Device Infrastructure to Support the Adoption of Terahertz Technology

6 MARKET SEGMENTATION

- 6.1 By Type of Technology

- 6.1.1 Terahertz Imaging Systems

- 6.1.1.1 Active System

- 6.1.1.2 Passive System

- 6.1.2 Terahertz Spectroscopy Systems

- 6.1.2.1 Time Domain

- 6.1.2.2 Frequency Domain

- 6.1.3 Communication Systems

- 6.1.1 Terahertz Imaging Systems

- 6.2 By End User

- 6.2.1 Healthcare

- 6.2.2 Defense and Security

- 6.2.3 Telecommunications

- 6.2.4 Industrial

- 6.2.5 Food and Agriculture

- 6.2.6 Laboratories

- 6.2.7 Other End Users

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Spain

- 6.3.2.5 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 South Korea

- 6.3.3.5 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Luna Innovations

- 7.1.2 Teravil Ltd

- 7.1.3 TeraView Limited

- 7.1.4 Toptica Photonics AG

- 7.1.5 HUBNER GmbH & Co. KG

- 7.1.6 Advantest Corporation

- 7.1.7 BATOP GmbH

- 7.1.8 Terasense GP Inc.

- 7.1.9 Microtech Instrument Inc.

- 7.1.10 Menlo Systems GmbH

- 7.1.11 Gentec Electro-optics Inc.

- 7.1.12 Bakman Technologies LLC