|

市场调查报告书

商品编码

1403904

对苯二甲酸二甲酯(DMT):2024年至2029年市场占有率分析、产业趋势与统计、成长预测Dimethyl Terephthalate (DMT) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

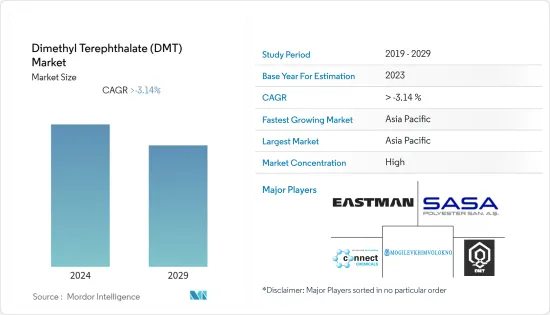

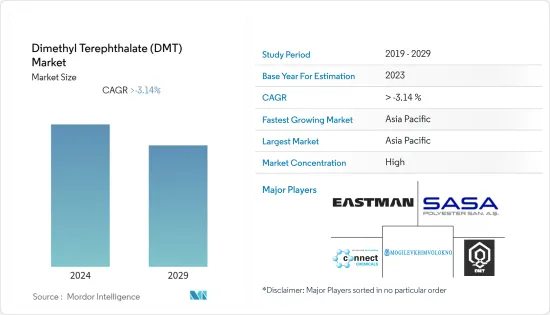

对苯二甲酸二甲酯市场规模预计将从2024年的764.16千吨减少到2029年的651.62千吨,预测期内复合年增长率为-3.14%。

COVID-19 大流行对市场产生了负面影响。世界多个国家已实施封锁措施以遏制病毒传播。许多公司和工厂停止运营,扰乱了全球供应链,损害了全球生产、交货时间和产品销售。

主要亮点

- 短期来看,聚对苯二甲酸Terephthalate(PET)、聚对苯二甲酸Terephthalate(PBT)需求的增加以及纺织业对聚酯纤维需求的增加是市场成长的主要驱动力。

- 另一方面,PTA(高纯度对苯二甲酸)等经济替代品的可用性可能会抑制市场成长。

- 亚太地区占据了最高的市场占有率,该地区很可能在预测期内主导市场。

对苯二甲酸二甲酯(DMT)市场趋势

聚酯纤维主导市场

- 聚酯纤维是以对苯二甲酸二甲酯为原料製成的合成纤维。聚酯纤维表现出优异的机械强度,并且可以收缩和膨胀而不损失强度。

- 这些纤维越来越多地用于製造工业应用,如纱线、绳索、输送机织物、安全带和塑胶增强材料。它也用于纺织工业中的服饰、地毯和家具的生产,以及作为机械加固的辅助剂。此外,这种材料也以其高强度和耐用性而闻名。因此,它也被用于运动服和製服。

- 聚酯纤维是用合成材料製造的,比天然纤维便宜。它的吸水性较低,不适合製造需要吸湿的产品,如运动服、毛巾和床上用品。

- 根据ITC Trademap,2022年全球整体聚酯短纤维(未精纺、精纺或纺纱加工)出口国为中国(包括台北)(12,21,267吨)、韩国(624,362吨)、泰国(318,081吨)、印度(254,531吨)、印尼(212,413吨)和土耳其(157,542吨)。

- 2022年,全球整体聚酯短纤维主要进口国包括斯里兰卡(2,593,370吨)、美国(326,289吨)、土耳其(210,014吨)、德国(175,604吨)。

- 儘管聚酯纤维薄膜的成长趋势良好,但由于新建工厂普遍倾向于使用TPA製程(DMT的替代方案),该领域对DMT的需求正在下降。

- 因此,未来聚酯纤维对DMT的需求可能会下降。

亚太地区主导市场

- 亚太地区对苯二甲酸Terephthalate(DMT)的全球市场占有率最高。由于聚酯和PET树脂的持续生产,亚太地区是市场研究中最大的地区。

- PET、聚酯薄膜及纤维、PBT是我国对苯二甲酸二甲酯的主要消费领域。然而,由于聚酯树脂生产中PTA的使用量增加,预计DMT的需求将下降。

- 华彩、东亚纺织科技有限公司、中国石化和常熟阿苏是中国主要的聚酯生产商/供应商。

- 2022年,中国新增聚酯产能5075万吨/年。产能成长率为8.7%,由于部分旧装置退役,产能成长率已修正为7.3%。聚酯产能仍在上升,到2022年终将突破7,000万吨/年。

- 由于纺织和包装行业的快速成长,印度对聚酯树脂、薄膜、纤维和PET的需求激增,推动了过去几年市场的成长。然而,印度高纯度对苯二甲酸(PTA)产能的扩大导致PTA的使用量超过DMT。

- 纺织业对聚酯的需求正在迅速增加。根据纺织部统计,22财年印度纺织品服装出口(包括手工艺品)为444亿美元,比上年度增长41%。印度在全球纺织品服装贸易中的份额为4.0%。

- 因此,由于上述因素,亚太地区很可能在研究市场中占据主导地位。

对苯二甲酸二甲酯(DMT)产业概况

全球对苯二甲酸二甲酯(DMT)市场具有一体化性质。该市场的主要企业包括伊士曼化学公司、Connect Chemicals、SASA Polyester Sanayi AS、OAO Mogilevkhimvolokno 和纤维中间产品公司。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 聚对苯二甲酸Terephthalate(PET)和聚对苯二甲酸Terephthalate(PBT)需求增加

- 纺织业对聚酯纤维的需求增加

- 抑制因素

- PTA(高纯度对苯二甲酸)等经济替代品的可得性

- 其他阻碍因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 按型态

- 片状(固体)DMT

- 液体DMT

- 按用途

- 聚酯薄膜

- 聚酯纤维

- 聚酯树脂

- 其他用途(包括PBT)

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 东南亚国协

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲

- 亚太地区

第六章竞争形势

- 併购、合资、联盟、协议

- 市场占有率(%)/排名分析

- 主要企业策略

- 公司简介

- Connect Chemicals

- Eastman Chemical Company

- Fiber Intermediate Products Company

- OAO Mogilevkhimvolokno

- Sarna Chemicals

- SASA Polyester Sanayi AS

- SK chemicals

- Yangzhou Juhechang Technology Co. Ltd

第七章 市场机会及未来趋势

The dimethyl terephthalate market size is expected to decline from 764.16 kilotons in 2024 to 651.62 kilotons by 2029, at a CAGR of -3.14% over the forecast period.

The COVID-19 pandemic negatively impacted the market. Several countries worldwide applied lockdowns to curb the spread of the virus. The shutdown of numerous companies and factories disrupted worldwide supply networks and harmed global production, delivery schedules, and product sales.

Key Highlights

- In the short term, major factors driving the market's growth are the rising demand for polyethylene terephthalate (PET), polybutylene terephthalate (PBT), and the rising demand for polyester fiber in the textile industry.

- On the flip side, the availability of economical substitutes like PTA (Purified Terephthalic Acid) may likely restrain the market's growth.

- Asia-Pacific accounted for the highest market share, and the region may likely dominate the market during the forecast period.

Dimethyl Terephthalate (DMT) Market Trends

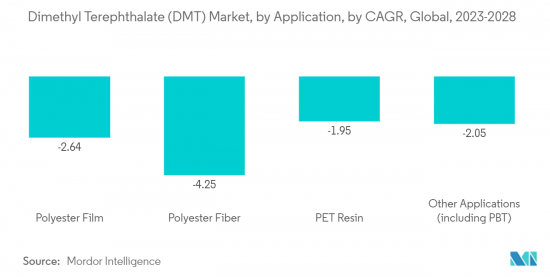

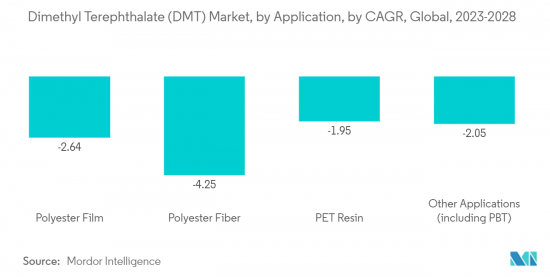

Polyester Fiber to Dominate the Market

- Polyester fibers are synthetic fibers which are produced from dimethyl terephthalate. Polyester fibers exhibit superior mechanical resistance and can shrink and stretch without losing strength.

- These fibers are increasingly used in manufacturing yarns, ropes, conveyor belt fabrics, seatbelts, plastic reinforcements, and others for industrial purposes. It is also used in the textile industry to manufacture clothing, carpets, and home furnishing, and as a mechanical reinforcement aid. In addition, the material is known for its superior strength and durability. Hence, it is used in sportswear and uniforms.

- Polyester fibers are manufactured using synthetic materials and are less expensive than natural fibers. They have low absorbency and are not ideal for manufacturing products that need to soak moisture, including activewear, towels, or bedding.

- According to ITC Trademap, the exporters of polyester staple fiber (not carded, combed, or otherwise processed for spinning) across the globe in 2022 are China (including Taipei, China) (12,21,267 tons), South Korea (624,362 tons), Thailand (318,081 tons), India (254,531 tons), Indonesia (212,413 tons), and Turkey (157,542), among others.

- The key importers of polyester staple fiber across the globe in 2022 are Sri Lanka (2,593,370 tons), the United States (455,384 tons), Vietnam (326,289 tons), Turkey (210,014 tons), and Germany (175,604 tons), among others.

- Although the growth of polyester fiber film is following a positive trend, the demand for DMT in this segment is declining since the newer plants generally tend to use the TPA process (an alternative for DMT).

- Hence, the demand for DMT in polyester fiber may decline in the future.

Asia-Pacific to Dominate the Market

- Asia-Pacific accounts for the highest global Dimethyl Terephthalate (DMT) market share. Continuous polyester and PET resin production make the Asia-Pacific region the largest in the market studied.

- PET, polyester film and fiber, and PBT are China's major consumers of dimethyl terephthalate. However, the demand for DMT is projected to decline due to the rising applications of PTA for polyester resin production.

- HUACAI, EAST ASIA TEXTILE TECHNOLOGY LTD, Sinopec Inc., and Changshu Azue Co. Ltd are the major manufacturers/suppliers of polyesters in China.

- In 2022, China's new polyester capacity was 5,075 kilotons per year. The capacity growth rate was 8.7%, but it was revised to 7.3% after some old units were eliminated. Polyester capacity still edged and was above 70 million tons/year by the end of 2022.

- In India, the demand for polyester resins, film, fiber, and PET is increasing rapidly due to the surging textile and packaging sectors, which have driven the market's growth in past years. However, the expanding production facility for purified terephthalic acid (PTA) in India is increasing the usage of PTA rather than DMT.

- The demand for polyester is increasing rapidly in the textile industry. According to the Ministry of Textiles, India's textile and apparel exports (including handicrafts) stood at USD 44.4 billion in FY22, a 41% increase YoY. India has a 4.0% share of the global trade in textiles and apparel.

- Therefore, due to the above factors, Asia-Pacific may dominate the market studied.

Dimethyl Terephthalate (DMT) Industry Overview

The global Dimethyl Terephthalate (DMT) market is consolidated in nature. Some major companies in the market include Eastman Chemical Company, Connect Chemicals, SASA Polyester Sanayi AS, OAO Mogilevkhimvolokno, and Fiber Intermediate Products Company.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rising Demand for Polyethylene Terephthalate (PET) and Polybutylene Terephthalate (PBT)

- 4.1.2 Rising Demand for Polyester Fiber in the Textile Industry

- 4.2 Restraints

- 4.2.1 Availability of Economical Substitutes Like PTA (Purified Terephthalic Acid)

- 4.2.2 Other Restraints

- 4.3 Industry Value-chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 By Form

- 5.1.1 Flake (Solid) DMT

- 5.1.2 Liquid DMT

- 5.2 By Application

- 5.2.1 Polyester Film

- 5.2.2 Polyester Fiber

- 5.2.3 PET Resin

- 5.2.4 Other Applications (Including PBT)

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)/Ranking Analysis**

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Connect Chemicals

- 6.4.2 Eastman Chemical Company

- 6.4.3 Fiber Intermediate Products Company

- 6.4.4 OAO Mogilevkhimvolokno

- 6.4.5 Sarna Chemicals

- 6.4.6 SASA Polyester Sanayi AS

- 6.4.7 SK chemicals

- 6.4.8 Yangzhou Juhechang Technology Co. Ltd