|

市场调查报告书

商品编码

1403918

纤维增强混凝土(FRC) -市场占有率分析、产业趋势与统计、2024-2029 年成长预测Fiber Reinforced Concrete (FRC) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

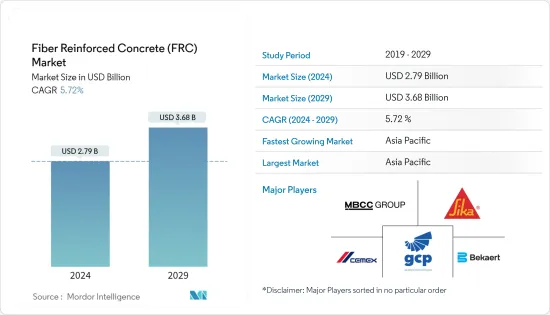

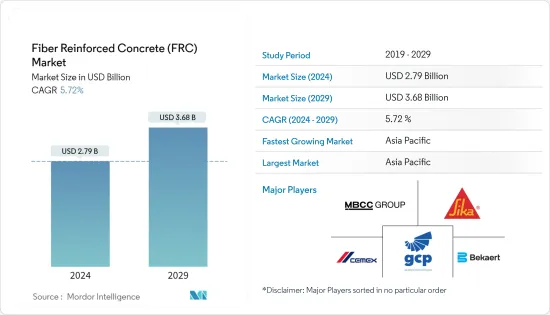

预计2024年纤维增强混凝土市场规模为27.9亿美元,预计到2029年将达到36.8亿美元,在预测期内(2024-2029年)复合年增长率为5.72%。

COVID-19的爆发对2020年的市场产生了负面影响。新大流行(COVID-19) 大流行的爆发已导致全球建筑工程暂停,特别是在中国和印度等主要建筑中心。然而,由于全球建筑业的成长,预计市场在预测期内将稳定成长。

主要亮点

- 短期内,建筑业需求的增加和交通基础设施计划需求的增加预计将推动市场成长。

- 另一方面,即用型混凝土绞线的供应可能会阻碍纤维增强混凝土市场的成长。

- 此外,即将到来的全球基础设施计划可能会在预测期内为受访市场提供机会。

- 在预测期内,由于建设活动的快速增加,预计亚太地区将主导全球市场。

纤维增强混凝土市场趋势

建筑和施工领域主导市场

- 纤维增强混凝土用于各种住宅和商业应用。纤维增强混凝土用于住宅和商业建筑中梁、基础、墙壁和凸起板的结构加固。也用于商业建筑、购物中心等的地板、楼板、停车场、钢骨甲板、高架框架等。

- 根据牛津经济研究院预测,在中国、美国、印度等超级大国建筑市场的推动下,2022年全球建筑业价值将达到9.7兆美元,预计2037年将达到13.9兆美元。

- 此外,未来15年,全球前10个建筑市场国家的建筑工程总量预计将占全球建筑市场总量的70%。

- 人口增长趋势、从家乡向服务业集群的迁移以及核心家庭的日益增长趋势是推动世界各地住宅建设的因素。

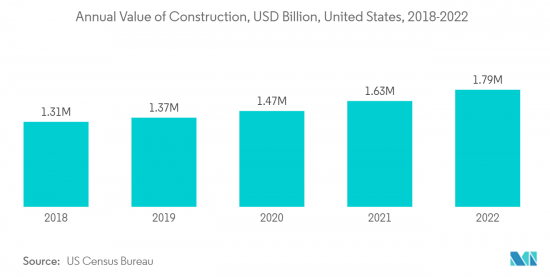

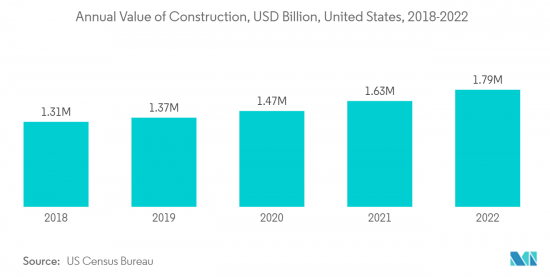

- 美国建筑业是北美最大的。根据美国人口普查局的数据,2022年美国年度建筑业价值达17,920亿美元,而2021年为16,264亿美元,成长率为10.2%。

- 此外,2022 年美国住宅建筑年产值为 9,080 亿美元,而 2021 年为 8,020 亿美元。 2022 年,该国非住宅建筑价值为 8,840 亿美元,而 2021 年为 8,230 亿美元。

- 德国政府在德国黑森州法兰克福-费兴海姆开始兴建占地10.7公顷的费兴海姆数位公园,总占地面积10万平方公尺,投资11.79亿美元。预计2021年第三季度动工,2028年季度完工。

- 因此,对全球建设活动的需求不断增加,预计将在预测期内推动纤维增强混凝土市场的发展。

亚太地区在预测期内主导市场

- 由于交通、建筑和施工行业需求的增加,中国、印度和印尼等亚太国家的纤维混凝土消费水准预计将稳定上升。

- 亚太地区是道路和高速公路建设计划成长最快的地区。中国正在增加道路建设和维护方面的支出。此外,该国还有许多正在进行和即将进行的道路和高速公路建设计划。

- 亚太地区的建筑业是世界上最大的。由于人口增长、中等收入阶层的壮大和都市化,它正在以健康的速度增长。在中国和印度不断扩大的住宅建筑市场的推动下,亚太地区预计将出现最高的成长。

- 根据中国国家统计局的数据,建筑业产值将从2021年的29.3兆元(4.2兆美元)增加至2022年的31.2兆元(4.5兆美元)。预计到 2030 年,中国将在建筑上花费近 13 兆美元,这使得纤维增强混凝土材料的前景乐观。

- 中国「十四五」规划重点在于能源、运输、水利系统、新型都市化等新型基础建设计划。据计算,「十四五」期间(2021-2025年)新基建投资总额将达到约27兆元(4.2兆美元)。

- 此外,该国可支配收入的增加正在推动购物中心、酒店和办公室等豪华商业空间的成长。中国是购物中心建设领先的国家之一。

- 中国约有4,000家购物中心,预计到2025年还将开幕7,000家。此外,武汉佛山外滩中心T1等办公室的建设也有望促进市场研究。该计划的建设工作预计将于2021年第三季度开始,并于2025年季度完工。

- 印度目前拥有世界第五大地铁网络,很快就会超越日本、韩国等已开发国家,成为第三大地铁网络。截至2022年9月,地铁网路达到810公里,在印度20个城市营运。

- 此外,2022 年 9 月,印度政府核准在古瓦哈提现有的 Saraighat 大桥附近建造一座横跨雅鲁藏布江的铁路兼公路大桥,耗资 99.675 亿印度卢比(1.2227 亿美元),NHAI 和铁路部决定分担负担。因此,新基建计划的实施将带动国内纤维混凝土市场。

- 因此,随着此类投资以及基础设施和建设计划的增加,预计该地区对纤维增强混凝土的需求在预测期内将稳定成长。

纤维混凝土产业概况

纤维混凝土市场是一个综合市场,少数企业占据了市场需求的较大份额。市场主要企业(排名不分先后)包括 CEMEX、SAB de CV、Sika AG、Bekaert、GCP Applied Technologies Inc. 和 MBCC Group。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 建筑业的需求增加

- 交通基础建设计划增加

- 抑制因素

- 可得性即用型混凝土绞线

- 其他阻碍因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(以金额为准的市场规模)

- 类型

- 天然纤维

- 合成纤维

- 玻璃纤维

- 钢纤维

- 其他类型

- 最终用户产业

- 基础设施

- 建筑/施工

- 采矿/隧道

- 工业地板

- 其他最终用户产业

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东/非洲

- 亚太地区

第六章竞争形势

- 合併、收购、合资、合伙和协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- AWI Licensing LLC

- Bekaert

- Cemex SAB De CV

- Formglas Products Ltd.

- GCP Applied Technologies Inc.(Saint-gobain)

- Krampeharex Gmbh & Co. Kg

- MBCC Group

- Nycon

- Sika AG

- The Euclid Chemical Company

第七章 市场机会及未来趋势

- 未来的全球基础建设计划

- 其他机会

The Fiber Reinforced Concrete Market size is estimated at USD 2.79 billion in 2024, and is expected to reach USD 3.68 billion by 2029, growing at a CAGR of 5.72% during the forecast period (2024-2029).

The COVID-19 outbreak negatively impacted the market in 2020. With the COVID-19 pandemic's beginning, construction work stopped worldwide, especially in major construction hubs like China and India. However, the market was projected to grow steadily in the forecast period due to global construction sector growth.

Key Highlights

- Over the short term, the increasing demand from the construction sector and rising demand for transport infrastructure projects are expected to drive the market's growth.

- On the flip side, the availability of ready-to-use concrete strands will likely hinder the growth of the fiber-reinforced concrete market.

- Moreover, upcoming global infrastructure projects are likely to provide opportunities for the studied market during the forecast period.

- During the forecast period, the Asia-Pacific region is expected to dominate the global market due to the exponentially increasing construction activities in the region.

Fiber Reinforced Concrete Market Trends

Building & Construction Segment to Dominate the Market

- Fiber-reinforced concrete is used in various residential and commercial applications. The fiber-reinforced concrete is used in the structural reinforcement of beams, foundations, walls, and elevated slabs of residential and commercial buildings. It is also used for floors, slabs, parking areas, steel decks, elevated frameworks in commercial buildings, and shopping centers.

- According to Oxford Economics, the global construction industry was valued at USD 9.7 trillion in 2022 and is estimated to reach USD 13.9 trillion by 2037, driven by superpower construction markets, such as China, the United States, and India.

- Furthermore, all construction work done over the next 15 years by the world's top 10 construction markets is expected to account for 70% of the total global construction market.

- Growth in population growth, migration from hometowns to service sector clusters, and the growing trend of nuclear families are some factors driving residential construction worldwide.

- The construction industry in the United States is the largest in North America. According to the US Census Bureau, the annual construction in the United States accounted for USD 1,792 billion in 2022, compared to USD 1,626.4 billion in 2021, at a growth rate of 10.2%.

- Moreover, the annual value of residential construction output in the United States was valued at USD 908 billion in 2022, compared to USD 802 billion in 2021. The annual non-residential construction in the country was valued at USD 884 billion in 2022, compared to USD 823 billion in 2021.

- The German government initiated the construction of the Digital Park Fechenheim on an area of 10.7 hectares, with a gross floor area of 100,000 square meters in Frankfurt-Fechenheim, Hesse, Germany, with an investment of USD 1,179 million. The construction work started in Q3 2021 and is expected to be completed in Q4 2028.

- Therefore, the growing demand from building and construction activities around the globe is estimated to drive the market for fiber-reinforced concrete during the forecast period.

Asia-Pacific Region to Dominate the Market in the forecast period

- The consumption levels of fiber-reinforced concrete in Asia-Pacific countries, such as China, India, and Indonesia, are expected to rise robustly, owing to the increasing demand from the transportation, building, and construction industries.

- Asia-Pacific is the fastest-growing region for road and highway construction projects. China has increased its road construction and maintenance spending. Further, the country has many ongoing and upcoming road and highway construction projects.

- The construction sector in the Asia-Pacific region is the largest in the world. It is increasing at a healthy rate, owing to the rising population, increase in middle-class income and urbanization. The highest growth for housing is expected to be registered in the Asia-Pacific region, owing to the expanding housing construction markets in China and India.

- According to the National Bureau of Statistics of China, the value of construction output accounted for CNY 31.2 trillion (USD 4.5 trillion) in 2022, up from CNY 29.3 trillion (USD 4.2 trillion) in 2021. China is expected to spend nearly USD 13 trillion on buildings by 2030, creating a positive outlook for fiber-reinforced concrete materials.

- China's 14th Five-Year Plan focuses on new infrastructure projects in energy, transportation, water systems, and new urbanization. According to estimates, overall investment in new infrastructure during the 14th Five-Year Plan period (2021-2025) will reach roughly CNY 27 trillion (USD 4.2 trillion).

- Further, the increasing disposable income in the country has triggered the growth of lavish commercial spaces like malls, hotels, offices, and others. China is one of the leading countries in shopping center construction.

- China has almost 4,000 shopping centers, while 7,000 more are estimated to be open by 2025. Moreover, the construction of office spaces such as Wuhan Fosun Bund Center T1 in China is expected to boost the market studied. Construction work for the project started in Q3 2021 and is forecast to be completed in Q4 2025.

- India currently has the fifth-largest metro network in the world and will soon overtake advanced economies such as Japan and South Korea to become the third-largest network. As of September 2022, the Metro rail network reached 810 km and is operational in 20 cities in India.

- Furthermore, in September 2022, the Indian government approved rail-cum-road bridge across the Brahmaputra river near the existing Saraighat bridge at Guwahati at a cost of INR 9,967.5 million (USD 122.27 million), which NHAI & Ministry of Railways will share. Thus, the implementation of new infrastructural projects will drive the market for fiber-reinforced concrete in the country.

- Therefore, with all such investments and an increasing number of infrastructure and construction projects, the demand for fiber-reinforced concrete will likely increase at a robust rate in the region during the forecast period.

Fiber Reinforced Concrete Industry Overview

The fiber reinforced concrete market is consolidated in nature, with few players accounting for a significant share of the market demand. Some of the major players (not in any particular order) in the market include CEMEX, S.A.B. de C.V., Sika AG, Bekaert, GCP Applied Technologies Inc., and MBCC Group, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand From the Construction Sector

- 4.1.2 Increasing Transport Infrastructure Projects

- 4.2 Restraints

- 4.2.1 Availability of Ready-to-use Concrete Strands

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Natural Fiber

- 5.1.2 Synthetic Fiber

- 5.1.3 Glass Fiber

- 5.1.4 Steel Fiber

- 5.1.5 Other Types

- 5.2 End-user Industry

- 5.2.1 Infrastructure

- 5.2.2 Building and Construction

- 5.2.3 Mining and Tunnel

- 5.2.4 Industrial Flooring

- 5.2.5 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AWI Licensing LLC

- 6.4.2 Bekaert

- 6.4.3 Cemex S.A.B. De C.V.

- 6.4.4 Formglas Products Ltd.

- 6.4.5 GCP Applied Technologies Inc. (Saint-gobain)

- 6.4.6 Krampeharex Gmbh & Co. Kg

- 6.4.7 MBCC Group

- 6.4.8 Nycon

- 6.4.9 Sika AG

- 6.4.10 The Euclid Chemical Company

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Upcoming Global Infrastructure Projects

- 7.2 Other Opportunities