|

市场调查报告书

商品编码

1686631

再生 PET:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Recyclate PET - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

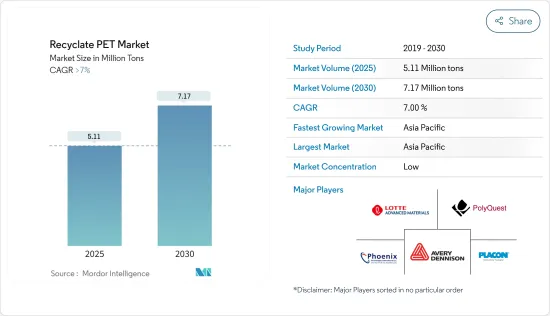

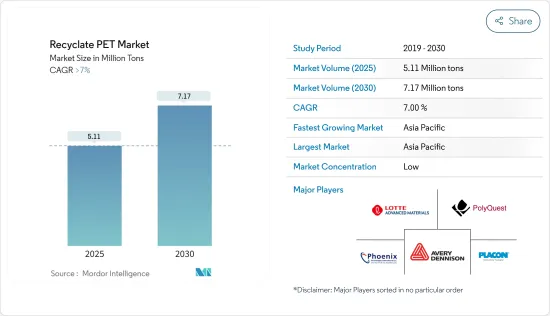

2025年再生PET市场规模预计为511万吨,预计2030年将达到717万吨,预测期内(2025-2030年)的复合年增长率将超过7%。

2020 年,COVID-19 疫情对市场产生了负面影响。这是因为製造设施和工厂因封锁和限製而关闭。供应链和运输中断进一步扰乱了市场。但2021年,产业復苏,市场需求回归。

主要亮点

- 从中期来看,消费者和包装产品对永续性关注以及纺织业不断增长的需求正在推动市场成长。

- 另一方面,行业利润率下降预计将阻碍市场成长。

- 然而,回收技术的创新以及塑胶自动加工和分类的新材料来源的发现可能会在预测期内为研究市场提供机会。

- 由于中国、印度和日本等国家的需求大幅成长,亚太地区在全球市场占据主导地位。

再生 PET 的市场趋势

工业丝领域主导市场需求

- 再生PET工业丝是一种由回收的宝特瓶所生产的环保合成材料。 宝特瓶收集、分类后,可以切成薄片,熔化,然后纺成纱线。由宝特瓶成的聚酯纤维、莱卡纤维和尼龙纤维可用于製作服饰和鞋子。

- 各种政府倡议、为实现零废弃物和循环经济目标而进行的工业投资、环境因素以及全球对聚酯纱的需求不断增长正在推动市场需求。

- 对此,欧盟为纺织业设定了若干目标。根据报告,到2030年,所有纺织产品必须耐用、可修復、可回收、主要由再生纤维製成且不含有害物质,这表明预测期内再生 PET 市场将会成长。

- 此外,H&M 和 Inditex 等零售时尚品牌已设定目标,到 2025-2030 年在其成衣 (RMG) 领域使用 100% 再生纤维。根据德国联邦统计局的数据,德国纺织业的收益预计到 2022 年将达到约 140 亿美元,高于 2021 年的约 129 亿美元。同样,服饰的收益从去年的 62.3 亿美元成长至近 75 亿美元。

- 此外,2022 年 8 月,信实工业有限公司宣布计划将其瓶子回收能力提高一倍至每年 50 亿瓶,以保持在 PET 回收领域的领先地位。该公司正在投资提高其时尚业务部门的纱线和纤维产量。预计这将在不久的将来推动再生 PET 市场的成长。

- 因此,这些趋势可能会在预测期内影响产业对再生 PET 的需求。

亚太地区占市场主导地位

- 在亚太地区,中国是GDP最大的经济体。即使与美国的贸易战导致贸易中断,该国的 GDP 在 2022 年仍成长了 3% 左右。

- 2020 年中国实际 GDP 成长 2.2%,2021 年成长 8.4%,这在很大程度上得益于疫情后消费支出的復苏。此外,国际货币基金组织预测,2023年GDP成长率为5.2%,2024年放缓至4.5%。

- 由于包装、纺织和汽车行业的不断发展,中国成为该地区最大的再生PET(rPET)消费国。预计预测期内这些产业的生产将推动该国对聚对苯二甲酸乙二醇酯树脂的需求。

- 该国的 rPET 製造商包括威立雅华飞和玛氏。威立雅华飞是日本最大的再生PET生产商之一。 2021年,公司将rPET瓶片产能从3万吨扩大至10万吨。在越南和马来西亚等邻国,中国投资者对再生 PET 托盘的待开发区投资正在增加。

- 2023年2月,全球糖果零食製造商玛氏箭牌中国分公司推出了首款完全由消费后回收PET(rPET)製成的包装。该公司已向本土巧克力品牌璀璨米(CXM)引入了再生 PET 包装。

- 此外,印度是全球新兴经济体之一,人口、生活水准和人均收入不断增加,几乎几乎所有终端用户产业成长。

- 国内已有多家公司参与rPET的生产。例如,印度 PET 回收先驱 Ganesha Ecosphere Ltd 的子公司 Ganesha Ecopet Private Limited 已在瓦朗加尔开设了一家新工厂,品牌名为 Go Rewise,生产用于长丝、纤维和食品包装的 rPET。该公司在位于 Telangana 省 Warangal 的工厂安装了两条 Sterling PET 回收生产线。

- 此外,由于塑胶不可降解,人们对其对环境的有害影响的日益关注和日益严格的监管预计将在未来几年为亚太地区再生 PET 市场提供巨大的机会。

再生 PET 行业概况

再生 PET 市场较为分散。该市场的知名企业包括 Phoenix Technologies、Placon(EcoStar)、PolyQuest、乐天化学株式会社和艾利丹尼森株式会社(不分先后顺序)。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 越来越重视消费品和包装商品的永续性

- 纺织业需求不断增长

- 限制因素

- 没有塑胶收集和分类框架

- 环境问题和健康危害

- 没有塑胶收集和分类框架

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场区隔

- 依产品类型

- 聚酯短纤维

- PET打包带

- PET 片材或薄膜

- 按应用

- 包装

- 工业丝

- 单丝

- 带子

- 建材

- 其他用途

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作、协议

- 市场占有率分析

- 主要企业策略

- 公司简介

- Alpla Group

- Avery Dennison Corporation

- Ds Smith

- Far Eastern New Century Corporation

- Indorama Ventures Public Company Limited

- Jiangsu Zhongyuan Industrial Group Co. Ltd

- Kaptan Group Holdings AS

- Krones AG

- Libolon

- Lotte Chemical Corporation

- Placon

- Phoenix Technologies

- Polyquest Inc.

- Reliance Industries Ltd

- Repro-PET

- Veolia

- Verdeco Recycling Inc.

第七章 市场机会与未来趋势

- 塑胶自动加工和分类回收技术的创新

- 增加循环经济倡议

The Recyclate PET Market size is estimated at 5.11 million tons in 2025, and is expected to reach 7.17 million tons by 2030, at a CAGR of greater than 7% during the forecast period (2025-2030).

The COVID-19 pandemic negatively impacted the market in 2020. This was because of the shutdown of the manufacturing facilities and plants due to the lockdown and restrictions. Supply chain and transportation disruptions further created hindrances for the market. However, the industry witnessed a recovery in 2021, thus rebounding the demand for the market studied.

Key Highlights

- Over the medium term, factors such as the growing emphasis on sustainability among consumers and packaging products and the increasing demand from the textile industry are driving the market growth.

- On the flip side, lower profit margins in the industry are expected to hamper the market's growth.

- Nevertheless, the innovations in recycling technologies for automatic processing and sorting of plastics and the discovery of new material sources are likely to provide opportunities for the market studied during the forecast period.

- Asia-Pacific dominated the global market due to the significant growth in demand coming from countries such as China, India, and Japan.

Recyclate PET Market Trends

The Industrial Yarn Segment to Dominate the Market Demand

- Recycled PET industrial yarn is an environmentally friendly synthetic material manufactured from recycled PET bottles. After collecting and sorting PET plastic bottles, they can be turned into flakes, melted down, and spun into yarn. Polyester, lycra, and nylon fibers spun from PET plastic can create clothing and shoes.

- Various government initiatives, industrial investments to reach zero waste and circularity targets, environmental factors, and the rising demand for polyester yarns worldwide are driving the market demand.

- In this regard, the European Union has set several goals for the textile industry. As per reports, by 2030, all textile products must be durable, repairable, and recyclable, primarily made from recycled fibers and free from hazardous substances, indicating an increase in the recyclate PET market in the forecast period.

- Additionally, retailer fashion brands like H&M and Inditex have set targets to use 100% recycled fibers by 2025-2030 in the ready-made garments (RMG) sector. In Germany, as per the Federal Statistical Office of Germany, the textile industry's revenue in 2022 was nearly USD 14 billion, an increase from roughly USD 12.9 billion in 2021. Similarly, the revenue from the clothing industry was nearly USD 7.5 billion, an increase from USD 6.23 billion in the previous year.

- Furthermore, in August 2022, Reliance Industries Ltd. announced its plan to maintain its leadership position in PET recycling by doubling its bottle recycling capacity to 5 billion bottles per year. The company invests in boosting its yarn and fiber production for its fashion business segment. It is expected to enhance growth in the recyclate PET market in the near future.

- Therefore, these trends are likely to influence the industry's demand for recycled PET during the forecast period.

Asia-Pacific Region to Dominate the Market

- In the Asia-Pacific region, China is the largest economy in terms of GDP. The country witnessed about 3% growth in its GDP in 2022, even after the trade disturbance caused due to its trade war with the United States.

- China's real GDP grew by 2.2% in 2020 and by 8.4% in 2021, largely driven by the consumer spending rebound post-pandemic. Furthermore, in 2023, as per IMF forecasts, the country's GDP grew by 5.2% and is expected to decline to 4.5% in 2024.

- China is the largest consumer of recyclate PET (rPET) in the region, owing to its growing packaging, textile, and automotive industries. The production in these industries is expected to drive the demand for polyethylene terephthalate resin in the country during the forecast period.

- Some of the manufacturers of rPET in the country include Veolia Huafei and Mars. Veolia Huafei is one of the largest manufacturers of recycled PET in the country. In 2021, the company scaled up its rPET bottle flakes capacity from 30,000 metric tons to 100,000 metric tons. There is an increase in greenfield investment for recycled PET pallets by Chinese investors in neighboring countries, such as Vietnam and Malaysia.

- In February 2023, the Chinese branch of the global confectionery company Mars Wrigley launched its first package made entirely from post-consumer recycled PET (rPET). The company adopted this recycled PET packaging for its local chocolate brand, Cui Xiang Mi (CXM).

- Furthermore, India is one of the emerging economies globally, and almost all the end-user industries have been growing, owing to the rising population, living standards, and per capita income.

- There are many companies that have been involved in the production of rPET in the country. For instance, Ganesha Ecopet Private Limited, a subsidiary of Indian PET recycling pioneer Ganesha Ecosphere Ltd, opened its new Warangal facility under the brand name Go Rewise, where it produces rPET for filament yarns and fibers, as well as for food-grade packaging. The company has installed two Starlinger PET recycling lines in its facility in Warangal, Telangana.

- Besides, the increased concerns related to harmful environmental impact due to the no-degradability of plastic and the growing regulations are expected to provide enormous opportunities for the recyclate PET market in Asia-Pacific in the coming years.

Recyclate PET Industry Overview

The recyclate PET market is fragmented in nature. Some of the noticeable players in the market include (in no particular order) Phoenix Technologies, Placon (EcoStar), PolyQuest, Lotte Chemical Corporation, and Avery Dennison Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Emphasis on Sustainability among the Consumer and Packaging Products

- 4.1.2 Increasing Demand from the Textile Industry

- 4.2 Restraints

- 4.2.1 Absence of the Required Framework for Plastic Collection and Segregation

- 4.2.1.1 Environmental Concerns and Health Hazards

- 4.2.1 Absence of the Required Framework for Plastic Collection and Segregation

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 By Product Type

- 5.1.1 PET Staple Fiber

- 5.1.2 PET Straps

- 5.1.3 PET Sheets or Films

- 5.2 By Application

- 5.2.1 Packaging

- 5.2.2 Industrial Yarn

- 5.2.3 Mono Filaments

- 5.2.4 Strapping

- 5.2.5 Building Materials

- 5.2.6 Other Applications

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East & Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East & Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Alpla Group

- 6.4.2 Avery Dennison Corporation

- 6.4.3 Ds Smith

- 6.4.4 Far Eastern New Century Corporation

- 6.4.5 Indorama Ventures Public Company Limited

- 6.4.6 Jiangsu Zhongyuan Industrial Group Co. Ltd

- 6.4.7 Kaptan Group Holdings AS

- 6.4.8 Krones AG

- 6.4.9 Libolon

- 6.4.10 Lotte Chemical Corporation

- 6.4.11 Placon

- 6.4.12 Phoenix Technologies

- 6.4.13 Polyquest Inc.

- 6.4.14 Reliance Industries Ltd

- 6.4.15 Repro-PET

- 6.4.16 Veolia

- 6.4.17 Verdeco Recycling Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Innovations in Recycling Technologies for Automatic Processing and Sorting of Plastics

- 7.2 Increasing Circular Economy Initiatives