|

市场调查报告书

商品编码

1403937

FPSO:市场占有率分析、产业趋势与统计、2024年至2029年成长预测FPSO - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

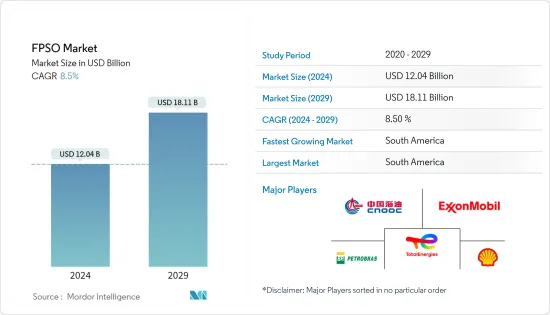

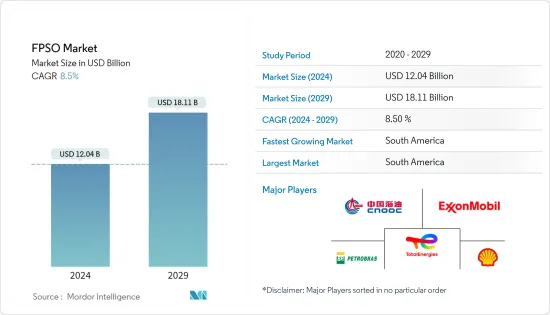

FPSO市场规模预计到2024年为120.4亿美元,预计到2029年将达到181.1亿美元,在预测期内(2024-2029年)复合年增长率为8.5%。

预计到年终FPSO市场规模将达111亿美元,预计未来五年将达到166.9亿美元,预测期内复合年增长率超过8.5%。

主要亮点

- 从中期来看,预计在预测期内,深水和超深水探勘和生产活动的增加将推动 FPSO 市场的发展。

- 另一方面,高昂的初期成本预计将阻碍预测期内的市场成长。

- 然而,FPSO系统的技术进步和创新预计将为FPSO市场带来重大机会。

- 由于该地区海上活动的增加,南美洲预计将成为 FPSO 市场的主导地区。

FPSO市场趋势

承包商拥有的 FPSO 预计将主导市场

- FPSO采购方式主要有三种:新建、现有船舶改造、现有装置搬迁。在这些选项中,重新部署带来了一些挑战,因为 FPSO 是针对特定领域进行高度客製化的。因此,营运商在很大程度上青睐新建和改造方法,并且在过去二十年中往往依赖具有专业知识的第三方承包来提供这些服务。

- 承包商拥有的 FPSO 比营运商拥有的 FPSO 和固定平台具有成本优势。专门从事 FPSO 设计、建造和营运的承包可以实现规模经济并优化船队运转率,从而降低营运商的成本。这使得承包拥有的 FPSO 对于寻求经济高效解决方案的营运商来说成为一个有吸引力的选择。

- 承包商拥有的 FPSO 通常是可租赁的,为营运商提供了油田开发的弹性。租赁允许营运商以最少的领先资本投资获得和部署FPSO,有利于规模较小的营运商和生产情况不确定的计划。

- 随着海上活动的增加,勘探和生产活动的成本以及将FPSO相关业务外包给承包的成本不断增加。这使得营运商能够将 FPSO 营运委託给专业承包商,并将资源和注意力集中到可以创造最大价值的领域。

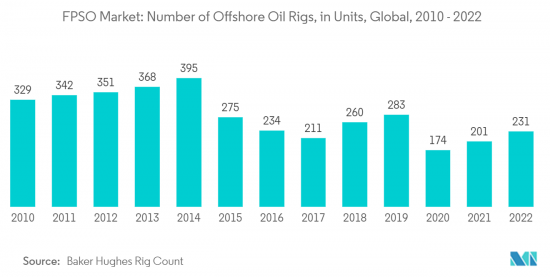

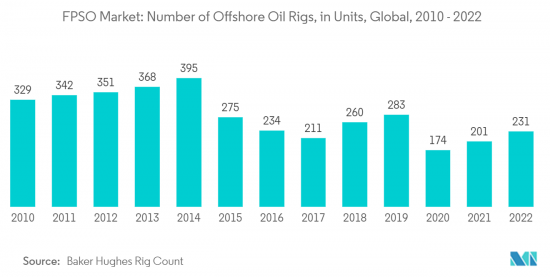

- 例如,根据贝克休斯钻井平台统计, 年终海上钻井平台数量约231座,与前一年同期比较增加约14.9%,海上探勘和生产活动增加,FPSO需求增加。

- 2023年5月,日本FPSO供应商MODEC订单Equinor的一份FPSO订单,为巴西海岸坎波斯盆地的BM-C-33区块提供FPSO。除了交付预计于2027年完工的FPSO外,MODEC还将在其原油生产的第一年为Equinor提供FPSO的营运和维护服务。 Equinor 随后将接手 FPSO 的营运责任。

- 因此,鑑于上述情况,承包商拥有的 FPSO 预计将在预测期内主导市场。

南美洲预计主导市场

- 预计南美洲地区对全球FPSO市场影响最大。特别是近年来,FPSO 的需求大幅成长,巴西和圭亚那成为该市场的主要企业。

- 南美洲拥有大量石油和天然气蕴藏量,特别是巴西和圭亚那。这些蕴藏量位于深海或超深海,需要FPSO进行高效率生产、储存和装运。这些地区大规模发现和生产的潜力正在推动对 FPSO 的需求。

- 例如,2022年11月,Diamond Offshore赢得了巴西国家石油公司Ocean College超深水半潜式钻井平台的钻井专案合约。合约为期四年,并可选择再延长四年。合约期限为四年,合约总价值预计约为4.29亿美元,其中包括外包费用和服务费用。

- 此外,南美洲盐下蕴藏量丰富,特别是巴西的桑托斯盆地和坎波斯盆地。这些蕴藏量位于厚厚的盐层之下,为探勘和生产带来了技术挑战。 FPSO 非常适合这些恶劣环境,因为它们可以在深水中安全运作并满足盐下油田复杂的加工要求。

- 因此,鑑于上述几点,南美地区预计将在预测期内主导FPSO市场。

FPSO产业概况

FPSO 市场是半静态的。市场上的主要企业(排名不分先后)包括巴西石油公司(Petrobras)、中海油、TotalEnergies SE、埃克森美孚公司和壳牌公司。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第二章调查方法

第三章执行摘要

第四章市场概况

- 介绍

- 2028年之前的市场规模与需求预测(单位:美元)

- FPSO运作状况(按地区/操作员)(2022年)

- 最新趋势和发展

- 政府法规政策

- 市场动态

- 促进因素

- 海上石油和天然气探勘和生产活动增加

- 能源需求增加

- 抑制因素

- 初期成本高

- 促进因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 所有权

- 企业拥有

- 供应商拥有

- 水深

- 浅水

- 深海

- 超深海

- 按地区分類的市场分析{2028 年之前的市场规模和需求预测(仅按地区)}:日本

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 挪威

- 英国

- 俄罗斯

- 荷兰

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 澳洲

- 印尼

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 委内瑞拉

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 奈及利亚

- 阿尔及利亚

- 其他中东/非洲

- 北美洲

第六章竞争形势

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- FPSO Contractors

- Modec Inc.

- SBM Offshore NV

- BW Offshore Limited

- Teekay Offshore Partners LP

- Bluewater Holding BV

- Saipem SpA

- Petrofac Limited

- FPSO Operators

- Petroleo Brasileiro SA(Petrobras)

- CNOOC Ltd

- TotalEnergies SE

- ExxonMobil Corp.

- Chevron Corporation

- Shell PLC

- BP PLC

- FPSO Contractors

第七章 市场机会及未来趋势

- 技术进步与创新

The FPSO Market size is estimated at USD 12.04 billion in 2024, and is expected to reach USD 18.11 billion by 2029, growing at a CAGR of 8.5% during the forecast period (2024-2029).

The FPSO market is estimated to be at USD 11.10 billion by the end of this year and is projected to reach USD 16.69 billion in the next five years, registering a CAGR of over 8.5% during the forecast period.

Key Highlights

- Over the medium term, the increasing exploration and production activities in deep and ultradeep water depths are expected to drive the FPSO market during the forecasted period.

- On the other hand, the high upfront cost is expected to hinder the market's growth during the forecasted period.

- Nevertheless, the technological advancements and innovation in FPSO systems are expected to create huge opportunities for the FPSO market.

- South America is expected to be a dominant region for the FPSO market due to the increasing offshore activities in the region.

FPSO Market Trends

Contractor-owned FPSO Expected to Dominate the Market

- There are three primary methods for procuring FPSOs: new build, conversion of an existing vessel, and redeployment of an existing unit. Among these options, redeployment poses several challenges due to the highly customized nature of the FPSO for a specific field. As a result, operators have predominantly favored the new build and conversion approaches, often relying on third-party contractors with specialized expertise for these services over the past two decades.

- Contractor-owned FPSOs offer cost advantages over operator-owned FPSOs or fixed platforms. Contractors, who specialize in designing, constructing, and operating FPSOs, can achieve economies of scale and optimize their fleet utilization, resulting in reduced operator costs. This makes contractor-owned FPSOs an attractive option for operators seeking cost-effective solutions.

- Contractor-owned FPSOs are typically available for lease, providing operators greater flexibility in field development. Leasing allows operators to access and deploy FPSOs with minimal upfront capital investments, benefiting smaller operators or projects with uncertain production profiles.

- With the increasing offshore activities, the cost of exploration and production activities and outsourcing the FPSO-related activities to contractors. This allows operators to allocate their resources and attention to areas where they can create the most value, leaving the FPSO operations to specialized contractors.

- For instance, according to Baker Hughes Rig Count, at the end of 2022, there were around 231 offshore rigs, the offshore rigs witnessed about 14.9% campared to previous year, signifying an increase in offshore exploration and production activities, consequently driving the demand for FPSOs.

- In May 2023, MODEC, a Japanese FPSO supplier, secured a contract from Equinor to supply an FPSO vessel for the BM-C-33 block in the Campos Basin offshore Brazil. In addition to delivering the FPSO, expected to be completed by 2027, MODEC will provide Equinor with operations and maintenance services for the first year of the FPSO's oil production. Subsequently, Equinor plans to take over the operational responsibilities of the FPSO.

- Therefore as per the points mentioned above, the Contractor-owned FPSO is expected to dominate the market during the forecasted period.

South America Expected to Dominate Market

- The South American region is anticipated to exert the highest influence on the global FPSO market. Particularly, Brazil and Guyana have emerged as key players in this market, experiencing a significant surge in demand for FPSOs in recent years.

- South America has significant offshore oil and gas reserves, particularly in Brazil and Guyana. These reserves are located in deepwater and ultra-deepwater areas, requiring FPSOs for efficient production, storage, and offloading. The potential for large-scale discoveries and production in these regions drives the demand for FPSOs.

- For instance, in November 2022, Diamond Offshore secured a drilling program contract from Petrobras in Brazil for its ultra-deepwater semi-submersible rig, Ocean Courage. The contract spans four years, with an unpriced option to extend for another four years. The firm term of the contract is estimated to be valued at around USD 429 million, which includes a mobilization fee and provision of services.

- Moreover, South America has extensive pre-salt reserves, especially in Brazil's Santos and Campos Basins. These reserves are located beneath thick layers of salt, presenting technical challenges for exploration and production. FPSOs are well-suited for these challenging environments, as they can safely operate in deepwater and handle the complex processing requirements of pre-salt fields.

- Therefore, as per the above points, the South American region is expected to dominate the FPSO market during the forecasted period.

FPSO Industry Overview

The FPSO market is semi consolidated. Some of the major players in the market (in no particular order) include Petroleo Brasileiro SA (Petrobras), CNOOC Ltd, TotalEnergies SE, Exxon Mobil Corp., and Shell PLC.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2028

- 4.3 FPSOs in Operation, by Region and Operator, 2022

- 4.4 Recent Trends and Developments

- 4.5 Government Policies and Regulations

- 4.6 Market Dynamics

- 4.6.1 Drivers

- 4.6.1.1 Increasing Offshore Oil and Gas Exploration and Production Activities

- 4.6.1.2 Growing Demand for Energy

- 4.6.2 Restraints

- 4.6.2.1 High Upfront Costs

- 4.6.1 Drivers

- 4.7 Supply Chain Analysis

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitute Products and Services

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Ownership

- 5.1.1 Operator-owned

- 5.1.2 Contractor-owned

- 5.2 Water Depth

- 5.2.1 Shallow Water

- 5.2.2 Deep Water

- 5.2.3 Ultra-deep Water

- 5.3 Geography Regional Market Analysis {Market Size and Demand Forecast till 2028 (for regions only)}

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Norway

- 5.3.2.2 United Kingdom

- 5.3.2.3 Russia

- 5.3.2.4 Netherland

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Australia

- 5.3.3.4 Indonesia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Venezuela

- 5.3.4.4 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 Nigeria

- 5.3.5.4 Algeria

- 5.3.5.5 Rest of Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 FPSO Contractors

- 6.3.1.1 Modec Inc.

- 6.3.1.2 SBM Offshore NV

- 6.3.1.3 BW Offshore Limited

- 6.3.1.4 Teekay Offshore Partners LP

- 6.3.1.5 Bluewater Holding BV

- 6.3.1.6 Saipem SpA

- 6.3.1.7 Petrofac Limited

- 6.3.2 FPSO Operators

- 6.3.2.1 Petroleo Brasileiro SA (Petrobras)

- 6.3.2.2 CNOOC Ltd

- 6.3.2.3 TotalEnergies SE

- 6.3.2.4 ExxonMobil Corp.

- 6.3.2.5 Chevron Corporation

- 6.3.2.6 Shell PLC

- 6.3.2.7 BP PLC

- 6.3.1 FPSO Contractors

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Advancements and Innovation