|

市场调查报告书

商品编码

1640498

製造业物联网 (IoT) -市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Internet-of-Things (IoT) In Manufacturing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

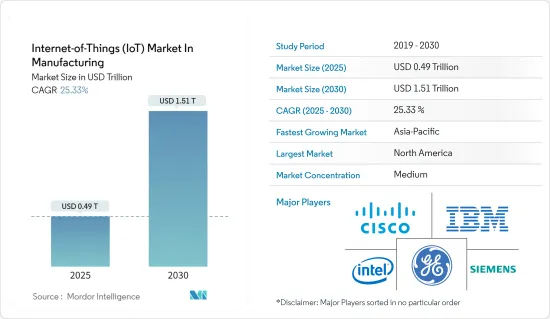

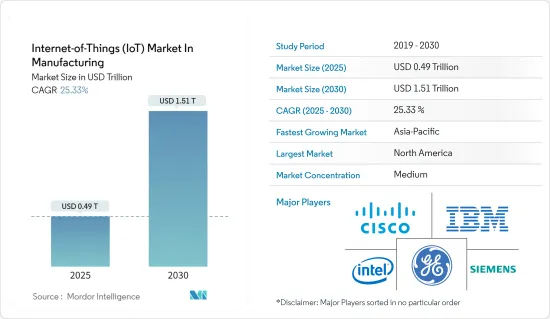

製造业物联网 (IoT) 市场规模预计将从 2025 年的 4,900 亿美元成长到 2030 年的 1.51 兆美元,预测期内(2025-2030 年)的复合年增长率为 25.33%。

在过去二十年中,对可追溯性和透明度的需求日益增长,使得公司对其产品生产过程的透明度更高。物联网设备的资料收集和分析使製造商的整个流程变得无缝。

关键亮点

- 促进物联网发展的因素包括更重视预防性维护、提高生产效率以及简化製造基础设施的管理。物联网为製造商提供了前所未有的可视性、洞察力和控制力。透过简化生产程序、减少停机时间、提高工作场所安全性和实现预测性维护,这项技术有可能彻底改变工业领域。

- 随着生产车间、供应链和产品中联网感测器数量的增加,製造商正在转向新一代系统,其中机器、系统、资产和事物可以自动、即时地相互通讯。连网型设备的普及正在整个价值链的多个製造和供应链环节中得到应用。

- 製造业的物联网可以帮助工厂的生产流程,因为物联网设备可以自动追踪开发週期并追踪仓库和库存。这就是过去几十年来物联网设备投资激增的原因之一。製造业、物流业和运输业中的物联网预计将会成长。

- 物联网被广泛认为是一项将显着改善製造业的先进技术。可整合所有工业领域的组件,包括感测器、处理单元、通讯和执行器。这种完全整合的智慧资讯物理系统将创造新的製造市场和商业性前景,为第四次工业革命铺路。这给行业带来了巨大可能性。

製造业物联网 (IoT) 市场趋势

供应炼和物流管理应用推动市场成长

- RFID 和 GPS 等行动装置和感测器的引入正在推动供应链在追踪库存和仓库资产方面的重大转变。

- 行动技术使企业能够监控设备、库存和业务。透过提供整个供应链的即时资料,资产智慧使公司能够扩展其专业知识和能力。这些解决方案推动了运输物流行业的发展,但当与物联网 (IoT) 等实行技术相结合时,它们可以提供更多的资产智慧并帮助用户做出更明智的决策。

- 物流中心、仓库和货场是供应链生态系统中最关键的部分。如果公司能够提高这些组件的效能,它就能更有效率地业务。物流业将越来越依赖物联网,仓库将使用云端来追踪库存、车辆和设备。大量透过 RFID 标籤连接起来的机器使这成为可能。包裹和托盘在本地层面进行交互,而公司伺服器则在全球范围内持续监控它们的移动和进展。

- 使用RFID标籤等追踪设备收集有关生产、有效期、製造日期、售后服务状态和保固期的信息,可以更有效地监控生产过程中的供应链。

- 根据SAS研究所的数据,英国从製造业获益的潜力最大,物联网为经济带来的收益约为40.32亿英镑。同样,预计其他经济体也将大力投资供应链自动化,加速整个製造业对物联网的采用。

北美是最大的市场

- 製造业的物联网市场主要由北美主导。该地区是美国和加拿大等新兴经济体的所在地,这些经济体正在大力投资与市场相关的研发活动,从而帮助开拓新技术。作为行动性、巨量资料和物联网等技术趋势的早期采用者,製造商渴望将物联网技术融入他们的流程中。

- 连网型设备和资料流已经应用于製造业。这有望降低基础设施成本并缩短交货时间。为了保持竞争力,製造商正在转向物联网和分析来营运和改善他们的业务。在美国,大约 35% 的製造商正在收集和使用智慧感测器产生的资料来增强其生产流程。

- 根据一项调查显示,约有 34% 的製造商认为美国製造商应该在业务中实施物联网。对于製造商来说,物联网是一个结合软体、云端运算和分析工具的生态系统,将来自各种来源的原始资料转化为有意义的预测,并以易于使用的介面显示出来。未来五年,自动化领域的连网设备数量预计将增加50台。

- 北美凭藉其技术力、强大的基础设施、多样化的产业和支援生态系统,成为全球物联网 (IoT) 製造领域最大的市场。随着该地区在技术创新和数位转型方面保持主导地位,物联网在製造业的应用预计将继续成长,进一步巩固其作为全球最大物联网市场的地位。

製造业物联网 (IoT) 概述

製造业的物联网 (IoT) 市场具有凝聚力和连贯性。随着企业选择物联网作为其製造设备的推动者,工业 4.0 及更高层级的市场开始变得更具吸引力。此外,市场正趋向细分化。市场的主要企业包括思科系统公司、通用电气、英特尔公司、IBM 公司、AT&T 公司、高通和西门子股份公司。

- 2022 年 6 月 - 领先的 LabOps Intelligence 技术平台 Elemental Machines 和下一代製造执行系统 (MES) 开发商 MasterControl 宣布建立战略伙伴关係,利用两项最尖端科技消除手动资料收集的需要。製造商实现自动化、加强资料完整性、确保合规性并加速细胞和基因疗法等先进生技药品的生产。

- 2022 年 5 月 - 全球最大的 RFID 和数位 ID 解决方案供应商艾利丹尼森公司与物联网先驱 WilIoT 达成战略合作伙伴关係,将物联网提升到新水平,并推进造福人类的全新物联网解决方案和环境。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业相关人员分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场动态

- 市场驱动因素

- 资料分析的快速发展和技术进步

- 改善供应链管理和物流,降低营运成本

- 市场限制

- 缺乏标准化接口,限制集成和可扩展性

- 安全和隐私问题

- 机会

- 物联网与巨量资料的结合对于智慧製造的未来至关重要

- COVID-19 对资料中心服务市场的影响

第六章 重大技术投入

- 云端技术

- 人工智慧

- 网路安全

- 数位服务

- 产业政策

第七章 市场区隔

- 按软体

- 应用程式安全

- 资料管理与分析

- 监控

- 网管

- 其他软体

- 连结性别(定性分析)

- 卫星网路

- 蜂巢式网路

- RFID

- NFC

- Wi-Fi

- 其他连接

- 按服务

- 专业的

- 系统整合与部署

- 託管

- 其他的

- 按用途(定性分析)

- 流程优化

- 预测性维护

- 资产管理

- 劳动力管理

- 紧急和事故管理

- 物流与供应链管理

- 库存管理

- 按行业

- 车

- 食品和农业设备

- 工业设备

- 电子和通讯设备

- 化工及材料设备

- 其他最终用户产业

- ***按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 亚洲

- 中国

- 日本

- 印度

- 澳洲和纽西兰

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 北美洲

第八章 竞争格局

- 公司简介

- Cisco Systems Inc.

- General Electric

- Intel Corporation

- IBM Corporation

- Verizon Communication Inc.

- AT&T Inc.

- Qualcomm

- Siemens AG

- Microsoft Corporation

- SAP SE

第九章投资分析

第十章 市场机会与未来趋势

The Internet-of-Things Market In Manufacturing Industry is expected to grow from USD 0.49 trillion in 2025 to USD 1.51 trillion by 2030, at a CAGR of 25.33% during the forecast period (2025-2030).

With the increasing demand in the last two decades for traceability and transparency, companies have started making the processes involved in the production of their products transparent. Data collection and analysis through IoT devices make the whole process seamless for manufacturers.

Key Highlights

- Some of the drivers that have fueled the IoT's growth include a greater emphasis on preventative maintenance, increased production effectiveness, and streamlining the management of manufacturing infrastructure. Manufacturers have unprecedented visibility, insight, and control thanks to the IoT. By streamlining production procedures, cutting downtime, enhancing workplace safety, and enabling predictive maintenance, this technology has the potential to transform the industrial sector completely.

- As the number of networked sensors in production, the supply chain, and products grows, manufacturers are moving into a new generation of systems that let machines, systems, assets, and things talk to each other automatically and in real time.The pervasiveness of connected devices is finding applicability across multiple manufacturing and supply chain segments throughout the value chain.

- IoT in manufacturing can help the flow of production in a plant because IoT devices automatically track development cycles and keep track of warehouses and stock. It is one of the reasons that investments in IoT devices have skyrocketed over the past few decades. IoT in manufacturing, logistics, and transportation will grow.

- IoT is widely recognized as a advanced technology that significantly improves the manufacturing sector. It can integrate every industrial sector's components, including sensors, processing units, communication, and actuation devices. This fully integrated smart cyber-physical system creates new manufacturing markets and commercial prospects and sets the path for the fourth industrial revolution. It creates significant potential for the industrial industry.

Internet of Things (IoT) in Manufacturing Market Trends

Supply Chain and Logistics Management Application to Spur Growth in the Market Studied

- There has been a substantial change in the supply chain with the adoption of mobile devices and sensors, including RFID and GPS, to track inventory and warehouse assets.

- Mobile technologies allow businesses to monitor equipment, inventory, and business operations. By giving them real-time data across their entire supply chain, asset intelligence enables enterprises to boost their expertise and capacity. Although these solutions have helped the transportation and logistics industries advance over time, combining them with enabling technologies like the Internet of Things (IoT) can provide even more asset intelligence and help users make more educated decisions.

- Distribution centers, warehouses, and yards are the most important ecosystem parts of the supply chain.If a business is able to improve the performance of these components, the effectiveness of its operations will also improve. The logistics industry would increasingly rely on IoT, and warehouses would use the cloud to track their inventory, cars, and equipment. Numerous machines connected via RFID tags make this possible. The packages and pallets would interact with one another on a local level, while a company-based server would continuously monitor their movements and travel progress on a global level.

- Improved inventory management is a major outcome of IoT adoption in the manufacturing industries, made possible by the availability of real-time object visibility and the capability to track and maintain inventories.Using tracking devices, like RFID tags, to collect information about production, expiration dates, manufacture dates, after-sales status, and warranty periods could make supply chain monitoring during manufacturing more effective.

- According to the SAS Institute, the United Kingdom may benefit the most from the manufacturing sector, with IoT accounting for approximately GBP 4,032 million of the total economy. Similarly, other economies are expected to invest heavily in the automation of the supply chain, thereby driving IoT adoption in the overall manufacturing sector.

North America to be the Largest Market

- North America mainly dominates the market for IoT in manufacturing. This region has developed economies, like the United States and Canada, which heavily invest in R&D activities related to the market, thus contributing to the development of new technologies. With the early adoption of trending technologies like mobility, big data, and IoT, manufacturers are eager to integrate IoT technologies into their processes.

- Connected devices and data flow are already finding applications in manufacturing. Therefore, accelerated deliveries can now be expected as the infrastructure cost is reduced. In order to stay competitive, manufacturers are leveraging IoT and analytics to run and improve businesses. In the United States, about 35% of manufacturers collect and use data generated from smart sensors to enhance manufacturing processes.

- According to a study, around 34% of the manufacturers believe that US manufacturers must adopt IoT in their operations. For manufacturers, IoT has become an ecosystem where software, cloud computing, and analytics tools are combined to turn raw data from different sources into meaningful predictions and present them in easy-to-use interfaces. By next five years, the number of connected devices in the automation sector is expected to increase by 50.

- North America's technological prowess, solid infrastructure, variety of industries and supportive ecosystem have helped it take the lead as the world's largest market for the manufacturing sector of Internet of Things (IoT). The use of IoT in manufacturing is anticipated to continue to grow as the region maintains its dominance in technical innovation and digital transformation, further strengthening its position as the world's largest IoT market,

Internet of Things (IoT) in Manufacturing Industry Overview

The Internet-of-Things (IoT) market in manufacturing is cohesive and coherent. The market after Industry 4.0 has started to be more attractive, as companies are opting for IoT as enablers in their manufacturing units. Moreover, the market is inclined toward fragmentation. Some of the key players in the market are Cisco Systems Inc., General Electric, Intel Corporation, IBM Corporation, AT&T Inc., Qualcomm, and Siemens AG, among others.

- June 2022 - Elemental Machines, a leading LabOps Intelligence technology platform, and MasterControl, a developer of a next-generation manufacturing execution system (MES), announced a strategic partnership utilizing two cutting-edge technologies to assist bio manufacturers in automating manual data collection, enhancing data integrity, guaranteeing compliance, and accelerating production for advanced biologics like cell and gene therapies.

- May 2022- The world's largest supplier of RFID and digital ID solutions, Avery Dennison Corporation, and the Internet of Things pioneer, Wiliot, announced a strategic alliance to expand the IoT to the next level and usher in a new era of IoT that benefits people and the environment.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Stakeholder Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rapid Growth and Technological Advancements in Data Analytics

- 5.1.2 Improved Supply Chain Management and Logistics at Lower Operational Costs

- 5.2 Market Restraints

- 5.2.1 Lack of Standardized Interfaces and Limited Integration and Scalability

- 5.2.2 Security and Privacy Issues

- 5.3 Opportunities

- 5.3.1 Intersection of IoT and Big Data Essential to the Future of Smart Manufacturing

- 5.4 Impact of COVID-19 on Data Center Services Market

6 KEY TECHNOLOGY INVESTMENTS

- 6.1 Cloud Technology

- 6.2 Artificial Intelligence

- 6.3 Cyber Security

- 6.4 Digital Services

- 6.5 Industry Policies

7 MARKET SEGMENTATION

- 7.1 By Software

- 7.1.1 Application Security

- 7.1.2 Data Management and Analytics

- 7.1.3 Monitoring

- 7.1.4 Network Management

- 7.1.5 Other Software

- 7.2 By Connectivity (Qualitative Analysis)

- 7.2.1 Satellite Network

- 7.2.2 Cellular Network

- 7.2.3 RFID

- 7.2.4 NFC

- 7.2.5 Wi-Fi

- 7.2.6 Other Connectivities

- 7.3 By Services

- 7.3.1 Professional

- 7.3.2 System Integration and Deployment

- 7.3.3 Managed

- 7.3.4 Other Services

- 7.4 By Application (Qualitative Analysis)

- 7.4.1 Process Optimization

- 7.4.2 Predictive Maintenance

- 7.4.3 Asset Management

- 7.4.4 Workforce Management

- 7.4.5 Emergency and Incident Management

- 7.4.6 Logistics and Supply Chain Management

- 7.4.7 Inventory Management

- 7.5 By End-user Vertical

- 7.5.1 Automotive

- 7.5.2 Food and Agriculture Equipment

- 7.5.3 Industrial Equipment

- 7.5.4 Electronics and Communication Equipment

- 7.5.5 Chemicals and Materials Equipment

- 7.5.6 Other End-user Verticals

- 7.6 ***By Geography

- 7.6.1 North America

- 7.6.1.1 United States

- 7.6.1.2 Canada

- 7.6.2 Europe

- 7.6.2.1 Germany

- 7.6.2.2 United Kingdom

- 7.6.2.3 France

- 7.6.2.4 Spain

- 7.6.3 Asia

- 7.6.3.1 China

- 7.6.3.2 Japan

- 7.6.3.3 India

- 7.6.3.4 Australia and New Zealand

- 7.6.4 Latin America

- 7.6.4.1 Brazil

- 7.6.4.2 Mexico

- 7.6.4.3 Argentina

- 7.6.5 Middle East and Africa

- 7.6.5.1 United Arab Emirates

- 7.6.5.2 Saudi Arabia

- 7.6.5.3 South Africa

- 7.6.1 North America

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Cisco Systems Inc.

- 8.1.2 General Electric

- 8.1.3 Intel Corporation

- 8.1.4 IBM Corporation

- 8.1.5 Verizon Communication Inc.

- 8.1.6 AT&T Inc.

- 8.1.7 Qualcomm

- 8.1.8 Siemens AG

- 8.1.9 Microsoft Corporation

- 8.1.10 SAP SE