|

市场调查报告书

商品编码

1403968

气雾罐:市场占有率分析、产业趋势与统计、2024年至2029年成长预测Aerosol Cans - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

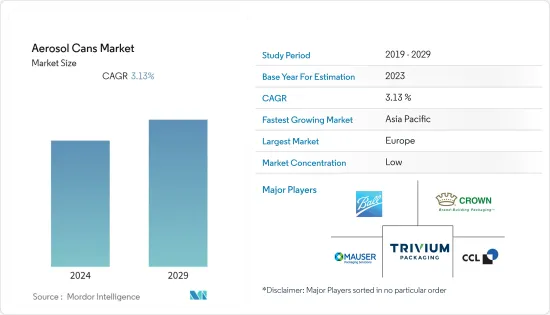

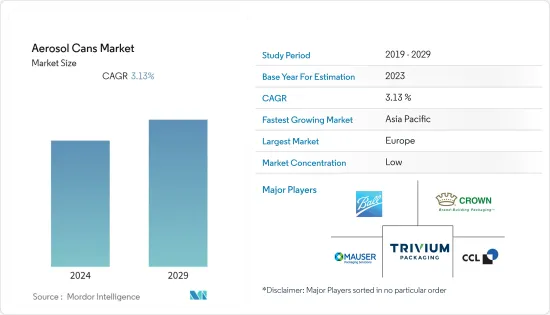

气雾罐市场规模预计将从2024年的191.2亿个扩大到2029年的223.1亿个,在预测期内(2024-2029年)复合年增长率为3.13%。

主要亮点

- 气雾罐具有防漏性,可保护其内容物免受污染和蒸发,并促进许多工业流程,例如喷漆、抛光和润滑。此外,气雾罐也用于除臭剂、髮胶、清洁剂家用包装产品。气溶胶喷雾剂用于空气净化和害虫防治技术。

- 气雾罐的可重复使用性和可回收性是推动市场成长的主要因素。气雾罐可以无限期回收,因为它们由金属製成,并且是按照环境法规製造的。用户可以受益于包装的成本优势,同时消除浪费问题。供应商可以透过他们的产品为永续性目标做出贡献。

- 此外,化妆品和个人护理行业的成长也是推动市场成长的主要因素。由于可支配收入的增加、消费者生活方式的改变、产品展示和差异化以及对除臭剂和髮胶等产品的需求不断增加,气雾罐可能会被消费。由于需求量大,铝製气雾罐正迅速获得市场认可。

- 铝气雾罐具有高度弹性,已成为该行业的重要方面。此外,可回收材料的可用性也有助于提高易用性,从而推动需求。透过创新设计,公司可以节省材料并用有限的材料生产更多的铝製气雾罐。

- 在化妆品和个人护理品产业,消费者俱有很高的议价能力。这是由于竞争加剧以及来自不同製造商的化妆品的可用性。购买竞争产品的消费者可以迫使製造商降低产品价格,这是气雾罐市场的主要限制。此外,由于人们越来越担心气雾罐对环境的影响,有关气雾罐处置的法规可能继续对市场构成挑战。

- 各种药品的开发激增,对气雾罐的需求增加,但供应链陷入困境,导致通货膨胀。除此之外,俄罗斯和乌克兰战争因能源危机对市场产生了负面影响。新冠疫情过后,化妆品和个人护理等终端用户行业开始全面高效运营,以满足不断增长的需求,最终对市场产生积极影响。

气雾罐市场趋势

个人护理和化妆品行业需求的增加推动市场

- 由于技术和产品的突破、知名公司的併购、虚拟试妆的出现以及线上市场的出现,美容和个人护理领域正在发生巨大的变化,对化妆品和护肤品的需求增加。 我是。

- 随着西方风格的巨大影响力和气雾罐製造商的崛起,国内外许多製造商正在逐渐增加他们的存在。在美容和零售行业,每年都会开发许多产品。

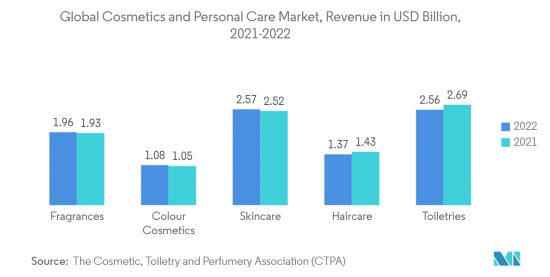

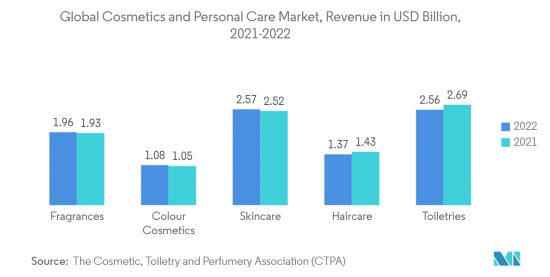

- 提高客户对外观的敏感度是推动气雾罐市场扩张的关键因素之一。彩妆品、护肤和护髮是千禧世代日常使用的美容和个人护理产品。含有天然、无毒、有机成分的化妆品的出现也推动了市场的扩张。香水、彩妆、护肤、护髮等各类化妆品及个人护理领域在2021-2022年都呈现正成长。

- 已开发地区和新兴地区个人护理和化妆品行业的成长正在推动市场成长。人口的增加、人们对外表的关注度的改变以及消费者购买力的提高是推动市场成长的因素。

欧洲可望成为重要市场

- 气雾罐在除臭剂和香水产业的使用不断增加,是法国等欧洲国家市场的关键成长要素。法国香水产业是全球化妆品产业最受欢迎的领域之一。近年来,法国香水市场经历了显着成长。根据化妆品、洗护用品和香水协会(CTPA)预测,2022年法国将成为全球第二大化妆品和个人护理国内市场。

- 至2022年,香水产业约占欧洲化妆品和个人护理市场的16%。这一增长得益于新产品发布方面的持续创新。世界领先香水製造商之间的广泛研究、开发和合作正在推动香水行业的发展,并推动对气雾剂包装(包括气雾剂罐)的需求。

- 德国的汽车工业不断发展,对气雾罐的需求也不断增加。根据德国贸易投资署(GTAI)的数据,德国是欧洲最大的汽车生产和销售市场,约占小客车製造量的25%。

- 钢製气雾罐被广泛认为是油漆和被覆剂的优秀包装解决方案。此外,它还具有特殊高溶剂涂料所需的高扩散阻隔性能。此外,随着通用机械、电子马达、汽车和精密设备等机械产业的扩大,市场预计将会成长。

- 义大利化妆品市场提供了许多商机,国际公司正在投资在该国促销其产品和品牌。它还使公司能够有效地推广自有品牌并迎合意大利偏好和时尚偏好。主要进口为彩妆和护肤品,义大利几乎进口所有化妆品原料,原料需求预计将持续成长。所有这些因素都在推动该国气雾罐市场的发展。

- 在英国,由于收入增加、生活便利,对气雾罐的需求不断增加。由于人们对环境问题的日益关注,最终用户行业寻求气雾罐,因为其对环境的影响较小。气雾罐的高可回收性是研究市场的关键驱动因素之一。

气雾罐产业概况

气雾罐市场竞争对手之间的竞争非常激烈,并且由于现有参与者的存在,预计在预测期内将保持不变。市场上的知名企业有 Ball Corporation、Crown Holdings Inc.、Nampak Ltd.、CCL Containers、Trivium Packaging BV 等。每个参与者都专注于开拓创新产品和扩大设备,以回应市场并在竞争激烈的市场中获得份额。

- 2022 年 8 月,波尔公司推出了轻质 ReAl 合金,同时加入了使用再生能源来源的铝和 50% 的回收成分,将包装的碳排放减少了一半。推出了一种新型铝气雾罐。

- 2022年8月,Colep Packaging收购了西班牙铝气雾剂製造商ALM Envases 40%的股权。此次收购是为了扩大公司的包装解决方案。这是公司策略实施的另一个倡议,为市场提供更有效的答案,并加强与客户的合作关係。此次收购也将使 Challenge 能够利用 ALM 的技术和专业知识来应对更具挑战性的气雾罐市场。

- 2022年2月,Trivium Packaging在美国和巴西的工厂投资4,000万美元,扩大铝气雾罐和饮料瓶的生产。此次扩张可能有助于该公司满足快速成长的气雾剂包装需求。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 乌克兰和俄罗斯衝突对市场的影响

第五章市场动态

- 市场驱动因素

- 气雾罐的可回收性

- 个人护理和化妆品行业需求不断增长

- 市场抑制因素

- 关于气雾罐的使用和处置的规定

第六章市场区隔

- 依材料类型

- 钢

- 铝

- 其他材料

- 按最终用户产业

- 个人护理

- 家庭用品

- 车

- 卫生保健

- 其他最终用户产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 法国

- 德国

- 义大利

- 西班牙

- 英国

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 其他亚太地区

- 拉丁美洲

- 阿根廷

- 巴西

- 其他拉丁美洲

- 中东/非洲

- 北美洲

第七章竞争形势

- 公司简介

- Ball Corporation

- Crown Holdings, Inc.

- Trivium Packaging

- Mauser Packaging Solutions

- Toyo Seikan Co. Ltd.

- CCL Container

- Colep Packaging

- CPMC Holdings Limited

- TUBEX Holding GmbH

第八章投资分析

第9章市场的未来

The Aerosol Cans Market size is expected to grow from 19.12 billion units in 2024 to 22.31 billion units by 2029, growing at a CAGR of 3.13% during the forecast period (2024-2029).

Key Highlights

- Aerosol cans are leakeproof which helps in protecting the content from contamination & evoporation and make many industrial processes, such as painting, polishing, and lubricating, easier. Additionally, aerosol cans are used for domestic packaging products, including deodorants, hairsprays, and detergents. Aerosol sprays are used in air purification and pest control techniques.

- The reusability and recyclability of aerosol cans are key factors driving the growth of the market. The aerosol cans can be recycled indefinitely as they are made of metal manufactured as per environmental regulations; users benefit from the cost advantages of packaging while eliminating disposal concerns. It helps the vendors contribute to sustainability goals through the products.

- Further, the growing cosmetics and personal care industries are significant factors behind the market's growth. Aerosol cans will likely be consumed by rising disposable incomes, changing consumer lifestyles, product presentation and differentiation, and increased demand for products such as deodorants, hairsprays, and more. Due to high demand, aluminum aerosol can is rapidly gaining acceptance in the market studied.

- Aluminium aerosol cans offer high flexibility, a crucial industry aspect. Additionally, the eased recyclable material availability adds to its usability, thus driving the demand. With companies innovating in design, material savings enable companies to produce more aluminum aerosol cans with limited material.

- Consumers have high bargaining leverage in the cosmetics and personal care industry. This is owing to increased competition and the availability of cosmetics from different manufacturers. The consumers buying competitors' products can force manufacturers to lower their product prices which is a significant limitation for the aerosol cans market. Also, the regulation over the dispose of aerosol cans may remain the challegene for the market due to the increased focus on environmental effects.

- The surge in development of different pharmaceutical products resulted in increased demand for aerosol cans during the pandmeic but the supply chain struggled which led to inflation. Besides this, Russia-Ukraine war had adverse impact on the market due to the energy crisis. Post-COVID the end-user industries such as cosmetics & personal care started to operate at full efficiencies to cater the growing demand which ultimately has positive impact on the market.

Aerosol Cans Market Trends

Growing Demand from the Personal Care and Cosmetic Industry to Drive the Market

- The beauty and personal care sector is changing dramatically due to increased demand for cosmetics and skin care products because of technology and product breakthroughs, high-profile mergers and acquisitions, the advent of virtual try-on, and the emergence of online marketplaces.

- With the significant influence of western styles and the rise of aerosol cans providers, many domestic and international manufacturers have progressively increased their presence. The beauty and retail industry has seen more items developed over the years.

- The increased sensitivity of customers about their appearance is one of the critical elements driving aerosol cans market expansion. Color cosmetics, Skincare, and hair care are among the beauty and personal care goods millennials use daily. The emergence of cosmetics, including natural, non-toxic, and organic components, has also aided market expansion. The different cosmetics & personal care segment such as fragrances, color cosmetics, skincare, haircare, and others have showcased positive growth during 2021-2022.

- The growing personal care and cosmetic industry in developed and developing regions contribute to market growth. The rising population, shifting concern of people toward appearance, and rising consumer purchasing power is some factors driving the market growth.

Europe is Expected to Emerge as a Significant Market

- The increasing use of aerosol cans in the deodorants and perfume industry is a significant factor of growth for the market in European countries such as France. The French fragrance industry is one of the most popular segments in the global cosmetics industry. The fragrance market in France has witnessed substantial growth over recent years. France was the second largest national market in 2022 for cosmetics & personal care in the world, according to the Cosmetic, Toiletry and Perfumery Association (CTPA).

- The fragrance segment accounted for around 16% of the European cosmetic & personal care market in 2022. The increase results from ongoing innovation in terms of new product launches. Extensive research, development, and collaboration by the world's leading perfume producers drive the fragrance industry, which bolsters the demand for aerosol packaging, including aerosol cans.

- With the growing automotive industry in Germany, the country's demand for aerosol cans is increasing. According to the German Trade and Invest (GTAI), Germany is the Europe's biggest automotive market in terms of production as well as sales, accounting for around 25 percent of all the passenger cars manufactured.

- Steel aerosol cans are widely recognized as an excellent packaging solution for paint and coatings, being robust and able to offer the kind of protection a chemical product, such as paint, needs. In addition, it has a high diffusion barrier required for special high-solvent paints. The market is also expected to grow with the expansion of the machinery industry in a broad sense, including general machinery, electronic motors, vehicles, precision appliances, etc.

- The Italian cosmetics market offers many opportunities, and international businesses invest in promoting their products and brands in the country. Also, companies can effectively promote their brand and appeal to Italian tastes and fashion preferences. The main imports are make-up and skin care products, Italy imports almost all cosmetic ingredients, and demand for raw materials will continue to grow. All such factors leverage the market for aerosol cans in the country.

- The United Kingdom is undergoing demand for aerosol cans with rising income, ease, and convenience. The end-user industries demand aerosol cans, owing to their low environmental impact due to the increasing environmental concerns. The high recyclability of aerosol cans is one of the significant driver for the market studied.

Aerosol Cans Industry Overview

The intensity of competitive rivalry in the aerosol cans market is high and expected to remain the same throughout the forecast period due to the presence of established players. Prominent players in the market include Ball Corporation, Crown Holdings Inc., Nampak Ltd., CCL Containers, Trivium Packaging B.V., etc. The players are focusing on developing innovative product and expanding facilities to cater the market and gain the market share in the competitive market.

- In August 2022, Ball Corporation introduced a new aluminum aerosol can made with its lightweight ReAl alloy while incorporating 50% recycled content and aluminum smelted using renewable energy sources in a bid to half the pack's carbon footprint.

- In August 2022, Colep Packaging acquired a 40% stake in ALM Envases, an aluminum aerosols provider from Spain. The acquisition was to enlarge the packaging solutions of the company. This is one more step in the strategic implementation that gives the company a more effective answer to the market and a strengthened partnership with its customers. Also, the acquisition will allow Colep to use ALM's technology and expertise to cater to the more challenging market in aerosol cans.

- In February 2022, Trivium Packaging invested USD 40 million in United States and Brazil facilities to expand the production of aluminum aerosol cans and beverage bottles. The expansion will help the company meet the fastest growing demand for aerosol packaging.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of Ukraine-Russia Standoff on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Recyclability of Aerosol Cans

- 5.1.2 Growing Demand from the Personal Care & Cosmetics Industry

- 5.2 Market Restraints

- 5.2.1 Regulations over the Usage and Dispose of Aerosol Cans

6 MARKET SEGMENTATION

- 6.1 By Material Type

- 6.1.1 Steel

- 6.1.2 Aluminium

- 6.1.3 Other Materials

- 6.2 By End-user Industry

- 6.2.1 Personal Care

- 6.2.2 Household Care

- 6.2.3 Automotive

- 6.2.4 Healthcare

- 6.2.5 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 France

- 6.3.2.2 Germany

- 6.3.2.3 Italy

- 6.3.2.4 Spain

- 6.3.2.5 United Kingdom

- 6.3.2.6 Rest of Europe

- 6.3.3 Asia Pacific

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.3.4 Rest of Asia Pacific

- 6.3.4 Latin America

- 6.3.4.1 Argentina

- 6.3.4.2 Brazil

- 6.3.4.3 Rest of Latin America

- 6.3.5 Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Ball Corporation

- 7.1.2 Crown Holdings, Inc.

- 7.1.3 Trivium Packaging

- 7.1.4 Mauser Packaging Solutions

- 7.1.5 Toyo Seikan Co. Ltd.

- 7.1.6 CCL Container

- 7.1.7 Colep Packaging

- 7.1.8 CPMC Holdings Limited

- 7.1.9 TUBEX Holding GmbH