|

市场调查报告书

商品编码

1403976

农业接种剂:市场占有率分析、产业趋势与统计、2024-2029 年成长预测Agricultural Inoculants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

农业接种剂市场规模预计到2024年为101.5亿美元,预计到2029年将达到167.6亿美元,预测期内复合年增长率为10.5%。

主要亮点

- 目前的农业方法严重依赖化学肥料、农药和除草剂等化学投入,这对农产品的营养价值以及农民和消费者的健康产生负面影响。过度和滥用这些化学物质导致了食品污染、杂草和抗病性以及对环境的负面影响,对人类健康产生了重大影响。这些化学输入促进有毒化合物在土壤中的累积。

- 有些合成肥料含有酸根,如盐酸根和硫酸根,会增加土壤的酸度,对土壤和植物的健康产生不利影响。此外,一些植物可能会吸收高度持久的化合物。持续食用此类作物会导致人类全身性疾病。

- 因此,随着人们越来越认识到消费劣质作物带来的健康挑战,需要新的和改进的技术来提高农产品的数量和品质而不损害人类健康。

- 化学投入的可靠替代品是微生物接种剂,可用作生物肥料、生物除草剂、生物杀虫剂和生物防治剂。它们是有益的微生物,应用于土壤和植物以提高生产力和作物健康。它也广泛用于控制害虫和改善地面和作物的品质。

- 此外,政府促进有机农业采用的倡议预计将在研究期间推动市场成长。例如,根据绿色交易的「从农场到餐桌」策略,欧盟委员会制定了到2030年将欧盟至少25%的农业用地纳入有机农业的目标,并大幅增加有机水产养殖。

农业接种剂市场趋势

采用有机农业和环保耕作方法

- 耕作方式有从传统耕作到有机耕作的趋势。这种转变是由于人们越来越认识到传统耕作方法对人类健康和环境安全的负面影响。

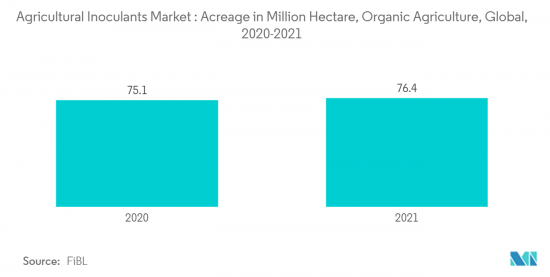

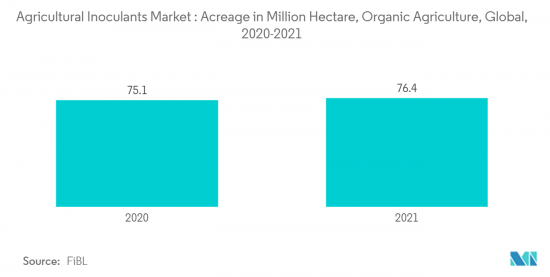

- 根据有机农业研究所(德语:Forschungsinstitut Fur biologischen Landbau (FiBL))预测,有机种植面积将从2018年的7090万公顷增加到2021年的7640万公顷,有187个国家实行有机农业。我是。这导致对接种剂等有机解决方案的需求增加,并增加了对社区研究的公共和私人投资。

- 微生物接种剂可以改善土壤健康、增加养分利用率并预防疾病,为合成投入提供天然且永续的替代品。此外,微生物接种剂可以帮助减少合成投入物对环境的影响,并促进更永续的农业实践。

- 因此,寻求减少环境足迹并生产更健康、更永续作物的农民对微生物接种剂的需求不断增加。此外,在预测期内,农业用地面积的增加和消费者对有机产品需求的增加可能会对农业接种剂市场产生正面影响。

北美是最大市场

- 北美是农业接种剂最大的市场,其中美国占大部分市场。美国农业部门高度发达,最近采用了自然和有机耕作方法。化学投入成本的增加、对土壤和环境的负面影响以及平衡植物营养意识的提高是推动该国市场的主要因素。

- 此外,某些公司和研究机构强调推出新产品以获得竞争优势。例如,由温尼伯生物研究公司 XiteBio Technologies 开发的 XiteBio OptiPlus 是一种革命性的液体大豆接种剂,采用了经过市场验证的 AGPT(先进促进生长技术)。

- 它结合了固氮细菌日本慢生根瘤菌(Bradyrhizobium japonicum)与2021年2月在加拿大註册的取得专利的解磷植物促生根瘤菌(PGPR),专用大豆设计。预计此类新兴市场的开拓将创造该地区对农业接种剂的需求,并在研究期间影响全球市场。

农业接种剂产业概况

农业接种剂市场分散,国际企业占据主要市场占有率。主要企业专注于研发活动、广泛的产品系列、地理扩张、收购和积极的促销策略,以维持其市场地位。领先公司包括 Novozymes、Lesaffre、BioceresCrop Solutions、Premier Tech 和BASF SE。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 采用有机农业和环保耕作方法

- 耕地面积减少,粮食安全担忧加剧

- 市场抑制因素

- 对传统产品和合成产品的高需求

- 缺乏认识和其他限制农业接种剂采用的因素

- 波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 功能

- 作物营养

- 作物保护

- 微生物

- 细菌

- 根瘤菌

- 固氮菌

- 磷细菌

- 其他细菌

- 菌类

- 木霉属

- 菌根真菌

- 其他真菌

- 其他微生物

- 细菌

- 申请方法

- 种子接种

- 土壤接种

- 作物类型

- 粮食

- 豆类和油籽

- 经济作物

- 水果和蔬菜

- 其他用途

- 地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 其他北美地区

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 俄罗斯

- 义大利

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 非洲

- 南非

- 其他非洲

- 北美洲

第六章竞争形势

- 最采用的策略

- 市场占有率分析

- 公司简介

- BASF SE

- Premier Tech

- Lallemond Inc.

- Novozymes

- Mapleton Agri Biotec Pty Ltd

- New Edge Microbials Pty Ltd

- T.Stanes & Company Limited

- AEA Investors(Verdesian Life Sciences LLC)

- Lesaffre

- Bioceres Crop Solutions

第七章 市场机会及未来趋势

The agricultural inoculants market size is estimated at USD 10.15 billion in 2024 and is expected to reach USD 16.76 billion by 2029, growing at a CAGR of 10.5% during the forecast period.

Key Highlights

- Current agricultural practices depend heavily on chemical inputs, such as fertilizers, pesticides, and herbicides, which cause a deleterious effect on the nutritional value of farm products and the health of farm workers and consumers. Excessive and indiscriminate use of these chemicals has resulted in food contamination, weed and disease resistance, and adverse environmental outcomes, significantly impacting human health. Applying these chemical inputs promotes the accumulation of toxic compounds in soils.

- Several synthetic fertilizers contain acid radicals, such as hydrochloride and sulfuric radicals, increasing soil acidity and adversely affecting soil and plant health. Highly recalcitrant compounds can also be absorbed by some plants. Continuous consumption of such crops can lead to systematic disorders in humans.

- Therefore, the increasing awareness of health challenges due to the consumption of poor-quality crops has led to a quest for new and improved technologies to improve the quantity and quality of produce without jeopardizing human health.

- A reliable alternative to chemical inputs is microbial inoculants that can act as biofertilizers, bioherbicides, biopesticides, and biocontrol agents. They are beneficiary microorganisms applied to the soil or the plant to improve productivity and crop health. They are also widely used to control pests and improve the quality of the ground and crops.

- Moreover, government initiatives to promote the adoption of organic farming are anticipated to fuel the market growth during the study period. For instance, under the Green Deal's Farm to Fork strategy, the European Commission set a target of at least 25% of the EU's agricultural land under organic farming and a significant increase in organic aquaculture by 2030.

Agricultural Inoculants Market Trends

Adoption of Organic and Eco-friendly Farming Practices

- Agricultural practices are witnessing a trend shift from conventional to organic farming. This shift can be attributed to growing awareness about the adverse impact of traditional farming methods on human health and environmental safety.

- According to the Research Institute of Organic Agriculture (German: Forschungsinstitut fur biologischen Landbau (FiBL)), the area under organic cultivation increased from 70.9 million ha in 2018 to 76.4 million ha in 2021, with 187 countries practicing organic agriculture. This increases the demand for organic solutions such as inoculants and investments in localized research by private and public sectors.

- Microbial inoculants offer a natural and sustainable alternative to synthetic inputs, as they can improve soil health, increase nutrient availability, and protect against diseases. Additionally, microbial inoculants help reduce the environmental impact of synthetic inputs and promote more sustainable farming practices.

- As a result, the demand for microbial inoculants is increasing among farmers looking for ways to reduce their environmental footprint and produce healthier, more sustainable crops. Moreover, rising acreage and growing consumer demand for organic products will positively influence the agricultural inoculants market during the forecast period.

North America is the Largest Market

- North America is the largest market for agricultural inoculants, with the United States holding the majority of the share. The United States, with its highly evolved agricultural sector, has been adopting the natural and organic way of farming lately. The increasing cost of chemical inputs, their adverse effect on soil mass and the environment, and increasing awareness regarding balanced plant nutrition are the major factors driving the market in the country.

- Moreover, certain companies and research institutions emphasize introducing new products to gain a competitive advantage. For instance, developed by the Winnipeg bioresearch company XiteBio Technologies, XiteBio OptiPlus is a revolutionary proprietary liquid inoculant for soybeans powered by market-proven AGPT (Advanced Growth Promoting Technology).

- It combines the nitrogen-fixing bacteria Bradyrhizobium japonicum with patented phosphate-solubilizing plant growth-promoting rhizobacteria (PGPR), registered in Canada in February 2021, designed explicitly for soybeans. Such developments are anticipated to create demand for agricultural inoculants in the region and influence the global market during the study period.

Agricultural Inoculants Industry Overview

The agricultural inoculants market is fragmented, with international players occupying a major market share. The major players focus on R&D activities, extensive product portfolios, geographical expansions, acquisitions, and aggressive promotional strategies to uphold their position in the market. Some of the leading players are Novozymes, Lesaffre, BioceresCrop Solutions, Premier Tech, and BASF SE.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Adoption of Organic and Eco-friendly Farming Practices

- 4.2.2 Declining Area of Arable Land and Rising Food Security Concerns

- 4.3 Market Restraints

- 4.3.1 High Demand for Conventional and Synthetic Products

- 4.3.2 Lack of Awareness and Other Factors Limiting the Adoption of Agricultural Inoculants

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Function

- 5.1.1 Crop Nutrition

- 5.1.2 Crop Protection

- 5.2 Microorganism

- 5.2.1 Bacteria

- 5.2.1.1 Rhizobacteria

- 5.2.1.2 Azotobacter

- 5.2.1.3 Phosphobacteria

- 5.2.1.4 Other Bacteria

- 5.2.2 Fungi

- 5.2.2.1 Trichoderma

- 5.2.2.2 Mycorrhiza

- 5.2.2.3 Other Fungi

- 5.2.3 Other Microorganisms

- 5.2.1 Bacteria

- 5.3 Mode of Application

- 5.3.1 Seed Inoculation

- 5.3.2 Soil Inoculation

- 5.4 Crop Type

- 5.4.1 Grains and Cereals

- 5.4.2 Pulses and Oilseeds

- 5.4.3 Commercial Crops

- 5.4.4 Fruits and Vegetables

- 5.4.5 Other Applications

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Spain

- 5.5.2.5 Russia

- 5.5.2.6 Italy

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 BASF SE

- 6.3.2 Premier Tech

- 6.3.3 Lallemond Inc.

- 6.3.4 Novozymes

- 6.3.5 Mapleton Agri Biotec Pty Ltd

- 6.3.6 New Edge Microbials Pty Ltd

- 6.3.7 T.Stanes & Company Limited

- 6.3.8 AEA Investors (Verdesian Life Sciences LLC)

- 6.3.9 Lesaffre

- 6.3.10 Bioceres Crop Solutions