|

市场调查报告书

商品编码

1404065

聚丙烯酰胺:市场占有率分析、产业趋势与统计、2024-2029 年成长预测Polyacrylamide - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

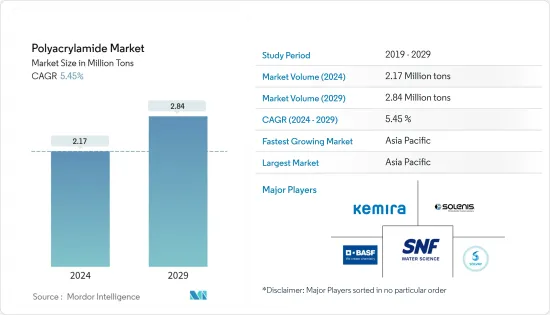

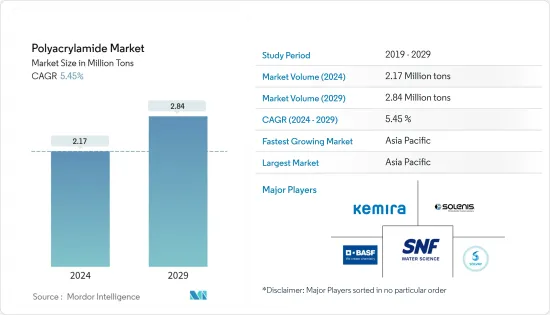

预计2024年聚丙烯酰胺市场规模为217万吨,预计2029年将达到284万吨,在预测期间(2024-2029年)复合年增长率为5.45%。

2022 年,全球 COVID-19 大流行迫使水处理、纸浆和造纸、石油和天然气以及采矿作业关闭,减少了对聚丙烯酰胺的需求。这次疫情几乎影响了这些产业的方面,从产品需求到劳动力发展,再到疫情爆发时已经出现的加速和放缓趋势。客户及其临时停产降低了生产水平,需求的减少对生产过程产生了重大影响。然而,这种情况预计将在预测期下半年恢復并恢復市场的成长轨迹。

主要亮点

- 从中期来看,预计需求将受到石油和天然气行业中聚丙烯酰胺用于提高采收率以及水处理行业中对聚丙烯酰胺作为凝聚剂的需求不断增长的推动。

- 由于接触丙烯酰胺单体而引起的健康问题预计将阻碍市场成长。

- 聚丙烯酰胺在生物医学产业的新兴应用和生物基聚丙烯酰胺的市场开拓预计将为市场提供利润丰厚的机会。

- 亚太地区占据了最高的市场占有率,该地区很可能在预测期内主导市场。

聚丙烯酰胺市场趋势

水处理产业主导市场

- 聚丙烯酰胺是由丙烯酰胺聚合而成的水溶性凝聚剂。这种聚合物能够增加黏度并促进颗粒团聚,使其成为水和污水处理的理想选择。因此,此聚合物可作为凝聚剂用于工业水净化、废水净化、生活污水处理、污水处理等领域。

- 它还可用于饮用水产业,原水中由于胶体颗粒而存在钠,使其无法饮用,必须在使用前溶解和过滤。在这种情况下,聚丙烯酰胺可作为低分子量凝聚剂,从水中去除额外的钠,使其适合饮用。

- 聚丙烯酰胺在用水和污水行业中的使用最大限度地减少了其他常规凝聚剂的使用,以去除细菌、病毒、藻类和其他不必要的杂质,从而导致污泥体积显着减少,使其成为一种经济且具有成本效益的製程。

- 全球水消费量每 20 年增加 100%。饮用水日益短缺,加上人口成长和用水需求增加,是推动全球薄膜污水处理市场需求的主要问题。目前,中国和美国是全球最大的两个水回收和再利用市场。

- 2022年6月,专注于水环境治理的环保公司中国光大水务拿下山东省博市张店东部工业园区工业污水处理扩建及提昇计划。本计划将以BOT(建设-运营-移交)模式运营,每日处理工业污水规模约5000立方公尺。

- 美国环保署 (EPA) 宣布将向 2023 年 9 月可用的水基础设施融资和创新法案 (WIFIA) 资金投资 75 亿美元。这项创新的低利率融资计画帮助社区投资饮用水、污水和雨水基础设施,同时节省数百万美元并创造高薪当地就业机会。迄今为止,EPA 的 WIFIA 计画已宣布拨款 190 亿美元,资助全美 109 个计划。

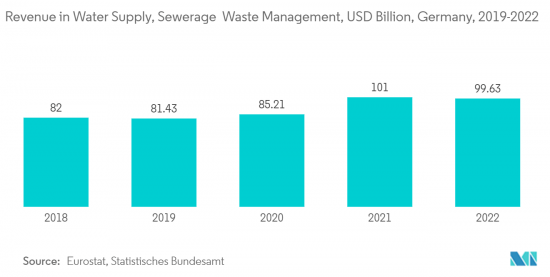

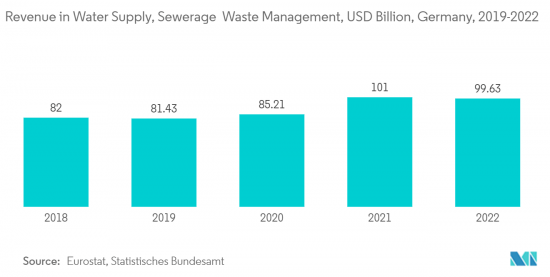

- 德国的水处理技术市场是欧洲最大的,并且正在显着成长。水处理活动的活性化(主要是在该国北部地区)正在推动对水处理化学品的需求。据联邦环境与自然保护部称,该国供水和污水处理行业每年的产值约为220亿欧元(233.3亿美元)。

- 根据欧盟统计局和德国联邦统计局的数据,2022 年德国水、废水和废弃物管理产业创造了 996.3 亿美元的收益。

- 考虑到世界不同地区的成长趋势和各种水处理计划,水处理行业可能会主导市场,预计将在预测期内增加对聚丙烯酰胺的需求。

亚太地区主导市场

- 亚太地区在 2022 年占据聚丙烯酰胺市场的主导地位,拥有巨大的销售份额,预计在预测期内将保持其主导地位。

- 近年来,中国增加了处理水的使用,以减少对淡水的依赖。随着中国五年计画 (FYP) 中严格的法律规范以及中水回用的重要性日益提高,中国正在迅速加强水处理产业,以实现永续的未来。

- 2023年9月,苏伊士集团订单了水处理计划新合同,该项目将为中国实现2060年碳中和目标做出贡献。该公司将与重庆水务集团(CWG)一起投资约1.68亿美元,在中国重庆兴建和营运一座水处理厂。

- 在油气产业,中国最大的油气生产商中国石油天然气集团公司管理的塔里木油田2022年油气产量创历史新高,达3,310万吨。预计2022年该油田原油产量为736万吨,天然气产量为323亿立方公尺。

- 2023 年 7 月,IDE Technologies 在印度订单CleanEdge Water 的订单,为采矿应用建造一座最先进的污水处理厂 (WWTP)。该计划预计将于 2024 年由 IDE Technologies 向该公司供货,预计每天处理 400 万公升盐水。

- 到2025年,印度的纸张需求预计将达到每年23.5吨。一些造纸厂已经存在了几十年,需要升级和投资新机器。印度的人均纸张消费量刚超过13公斤,远远落后于57公斤的世界平均值。到2024年,印度的纸张和纸製品市场预计将达到134亿美元。

- 在采矿方面,截至 2022 年 1 月,国有的印度煤炭有限公司 (CIL) 已核准了32 个采矿计划,投资额为 4,730 亿印度卢比。

- 这些因素可能会推动亚太地区聚丙烯酰胺市场在预测期内的成长。

聚丙烯酰胺产业概况

聚丙烯酰胺市场高度整合,龙头企业占重要市场占有率。市场上的主要企业(排名不分先后)包括 SNF Group、 BASF SE、Kemira、Solenis 和 Solvay。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场驱动因素

- 扩大在石油和天然气产业提高石油提高采收率的用途

- 水处理产业对聚丙烯酰胺作为凝聚剂的需求不断增加

- 市场抑制因素

- 接触丙烯酰胺单体引起的健康问题

- 价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔(市场规模:基于数量)

- 按物理形状

- 粉末

- 液体

- 乳化/分散体

- 按用途

- 提高采收率

- 水处理凝聚剂

- 土壤改良剂

- 化妆品粘合剂和稳定剂

- 其他用途

- 按最终用户产业

- 水处理

- 油和气

- 纸浆/造纸製造

- 矿业

- 其他最终用户产业

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 俄罗斯

- 荷兰

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东/非洲

- 亚太地区

第六章竞争形势

- 併购、合资、联盟、协议

- 市场排名分析

- 主要企业策略

- 公司简介

- AnHui JuCheng Fine Chemicals Co. Ltd

- Anhui Tianrun Chemical Industry Co. Ltd

- Ashland

- BASF SE

- Beijing Hengju Chemical Group Corporation

- Beijing Xitao Technology Development Co. Ltd

- CHINAFLOC

- Envitech Chemical Specialities Pvt.Ltd

- Kemira

- Liaocheng Yongxing Environmental Protection Science&Technology Co. Ltd

- Qingdao Oubo Chemical Co. Ltd

- Shandong Tongli Chemical Co. Ltd

- SNF Group

- Solenis

- Solvay

- Yixing Cleanwater Chemicals Co. Ltd

第七章 市场机会及未来趋势

- 聚丙烯酰胺的新应用领域,例如用作生物材料

- 生物基聚丙烯酰胺的开发

The Polyacrylamide Market size is estimated at 2.17 Million tons in 2024, and is expected to reach 2.84 Million tons by 2029, growing at a CAGR of 5.45% during the forecast period (2024-2029).

In 2022, the COVID-19 pandemic, on a global scale, forced water treatment, pulp and paper, oil and gas, and mining industries to shut down their operations, lowering the demand for polyacrylamide. The pandemic impacted almost every aspect of these industries, from product demand to workforce development to accelerating or decelerating trends already underway when it struck. Customers and their temporary production stops reduced production levels, and demand reductions significantly impacted production processes. However, the condition is expected to recover, restoring the growth trajectory of the market during the latter half of the forecast period.

Key Highlights

- In the medium term, the growing utilization in the oil and gas industry for enhanced oil recovery and the increasing need for polyacrylamide as a flocculant in the water treatment industry are expected to drive demand.

- Health concerns caused by exposure to acrylamide monomer is expected to hinder the market's growth.

- The emerging application of polyacrylamide in the biomedical industry and the development of bio-based polyacrylamide are expected to offer lucrative opportunities to the market.

- Asia-Pacific accounted for the highest market share, and the region will likely dominate the market during the forecast period.

Polyacrylamide Market Trends

Water Treatment Industry to Dominate the Market

- Polyacrylamide is a kind of polymer flocculant that is soluble in water and is produced using acrylamide polymerization. The polymer is deemed ideal for water and wastewater treatment because of its ability to increase viscosity and promote the flocculation of particles. Therefore, this polymer, as a flocculant, can be used for the purification of industrial water, drainage purification, sewage treatment, and wastewater treatment.

- It can also be utilized in the drinking water industry as well, where the presence of sodium in raw water due to colloidal particles makes it unfit for drinking, thereby needing to be dissolved and filtered before usage. Polyacrylamide, in this case, acts as a low molecular weight flocculant and removes the additional sodium from water, making it suitable for drinking purposes.

- The use of polyacrylamide in the water and wastewater industry minimizes the usage of other conventional flocculants for the removal of bacteria, viruses, algae, and other unwanted impurities, resulting in significantly less sludge and making the process more economical and cost-effective.

- The global water consumption rate is increasing by 100% every twenty years. The rising scarcity of potable water, coupled with the growing population and increasing water demand, is the major concern that is driving the demand for the membrane wastewater treatment market across the world. Currently, China and the United States represent the two largest water reclamation and reuse markets across the world.

- In June 2022, an environmental protection company that focuses on water environment management, named China Everbright Water, secured the expansion and upgrading project of the Zhangdian East Chemical Industry Park Industrial Wastewater Treatment in Zibo City, Shandong Province. This project will be operated on a BOT (Build-Operate-Transfer) model, with a designed daily industrial wastewater treatment capacity of around 5,000 m3.

- The United States Environmental Protection Agency (EPA) announced an investment of USD 7.5 billion in September 2023 in available Water Infrastructure Finance and Innovation Act (WIFIA) funding. This innovative low-interest loan program helps communities invest in drinking water, wastewater, and stormwater infrastructure while saving millions of dollars and creating good-paying local jobs. To date, EPA's WIFIA program has announced USD 19 billion to help finance 109 projects across the country.

- The German water treatment technology market is the largest in Europe and is growing considerably. The increasing water treatment activities, primarily in the country's Northern region, are boosting the demand for water treatment chemicals. The country's water supply and wastewater treatment sectors account for about EUR 22 billion (USD 23.33 billion) annually, as per the Federal Ministry for the Environment and Nature Conservation.

- According to the Eurostat and Statistisches Bundesamt, the revenue of Germany's water supply, sewerage, and waste management industry generated USD 99.63 billion in 2022.

- Considering the growth trends and various water treatment projects in different regions worldwide, the water treatment industry is likely to dominate the market, which, in turn, is expected to enhance the demand for polyacrylamide during the forecast period.

Asia-Pacific to Dominate the Market

- The Asia-Pacific region dominated the polyacrylamide market in 2022 with a considerable volume share, and it is expected to maintain its dominance during the forecast period.

- In recent years, China has increased the use of treated water to reduce its dependency on fresh water. With a tough regulatory framework and the increasing importance of water reuse in China's five-year plans (FYPs), the country is rapidly moving toward enhancing its water treatment industry for a sustainable future.

- Suez Group bagged a new contract for a water treatment project in China in September 2023 to contribute to the country's 2060 carbon neutrality ambition. The company, in collaboration with Chongqing Water Group (CWG), is investing around USD 168 million for the construction and operation of a water treatment plant in Chongqing, China.

- In the oil and gas industry, The Tarim Oilfield, controlled by China National Petroleum Corporation (CNPC), China's largest oil and gas producer, saw its annual oil and gas production reach a record high of 33.1 million tons in 2022. The oilfield is estimated to have generated 7.36 million tons of crude oil and 32.3 billion cubic meters of natural gas in 2022.

- In India, in July 2023, IDE Technologies received a contract from CleanEdge Water Pte Ltd for the construction of a state-of-the-art wastewater treatment plant (WWTP) for mining industry applications. This project is expected to be supplied to the company by IDE Technologies in 2024 and is estimated to treat 4.0 million liters of challenging brine per day.

- The paper demand in India is expected to reach 23.5 metric tons per year by 2025. Some paper mills have existed for several decades, making upgrades and investments into newer machinery necessary. The per capita paper consumption in India, at a little over 13 kg, is way behind the global average of 57 kg. The market for paper and paper products in India is estimated to reach USD 13.4 billion by 2024.

- In the mining industry, state-run Coal India Ltd (CIL) has approved 32 mining projects till January 2022, with an investment of around INR 47,300 crore as the company seeks to replace imports and move toward its 1 billion tons of coal production target by 2023-2034.

- Factors like these are likely to fuel the growth of the polyacrylamide market in Asia-Pacific over the forecast period.

Polyacrylamide Industry Overview

The polyacrylamide market is highly consolidated, with the major players accounting for a major market share. Some of the major players in the market (not in any particular order) include SNF Group, BASF SE, Kemira, Solenis, and Solvay, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Growing Utilization in the Oil and Gas Industry for Enhanced Oil Recovery

- 4.1.2 Increasing Demand for Polyacrylamide as a Flocculant in Water Treatment Industry

- 4.2 Market Restraints

- 4.2.1 Health Concerns Caused by Exposure to Acrylamide Monomer

- 4.3 Industry Value Chain Analysis

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 By Physical Form

- 5.1.1 Powder

- 5.1.2 Liquid

- 5.1.3 Emulsion/Dispersions

- 5.2 By Application

- 5.2.1 Enhanced Oil Recovery

- 5.2.2 Flocculants for Water Treatment

- 5.2.3 Soil Conditioner

- 5.2.4 Binders and Stabilizers in Cosmetics

- 5.2.5 Other Applications

- 5.3 By End-user Industry

- 5.3.1 Water Treatment

- 5.3.2 Oil and Gas

- 5.3.3 Pulp and Paper

- 5.3.4 Mining

- 5.3.5 Other End-user Industries

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Russia

- 5.4.3.5 Netherlands

- 5.4.3.6 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AnHui JuCheng Fine Chemicals Co. Ltd

- 6.4.2 Anhui Tianrun Chemical Industry Co. Ltd

- 6.4.3 Ashland

- 6.4.4 BASF SE

- 6.4.5 Beijing Hengju Chemical Group Corporation

- 6.4.6 Beijing Xitao Technology Development Co. Ltd

- 6.4.7 CHINAFLOC

- 6.4.8 Envitech Chemical Specialities Pvt.Ltd

- 6.4.9 Kemira

- 6.4.10 Liaocheng Yongxing Environmental Protection Science&Technology Co. Ltd

- 6.4.11 Qingdao Oubo Chemical Co. Ltd

- 6.4.12 Shandong Tongli Chemical Co. Ltd

- 6.4.13 SNF Group

- 6.4.14 Solenis

- 6.4.15 Solvay

- 6.4.16 Yixing Cleanwater Chemicals Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Emerging Applications of Polyacrylamide, such as its Use as a Biomaterial

- 7.2 Development of Bio-based Polyacrylamide