|

市场调查报告书

商品编码

1404073

军用智慧纺织品 -市场占有率分析、产业趋势/统计、2024-2029 年成长预测Smart Textiles For Military - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

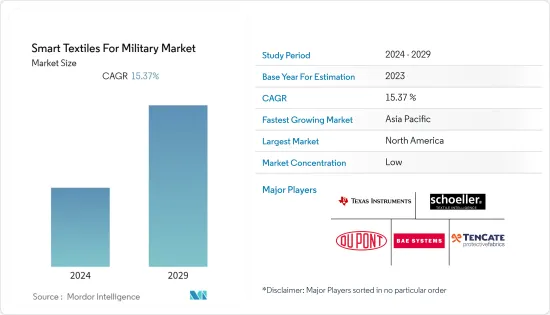

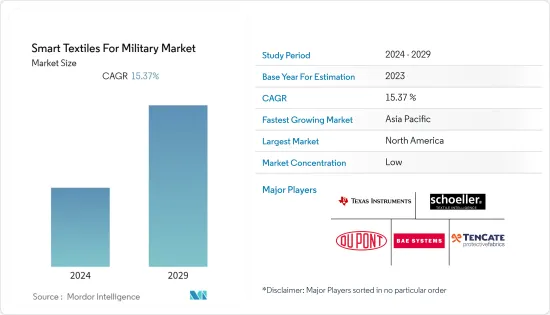

军用智慧纺织品市场2024年市场规模为7.6亿美元,预计2029年将达15.6亿美元,预测期内复合年增长率为15.37%。

由于材料科学、奈米技术、穿戴式电子产品的进步以及对提高士兵性能和安全性的需求不断增加,军用智慧纺织品市场正在经历显着的成长和创新。现代军队寻求为士兵配备先进的系统,以提高他们的情境察觉、生存能力和战场上的整体效能。穿戴式感测器和健康监测系统的整合可以即时追踪生命体征并及早发现潜在的健康问题。感测器小型化、能源采集、资料分析和通讯技术的快速技术进步推动了市场的发展。

主要企业都积极参与将穿戴式电子设备和感测器整合到军事装备中的计划,并专注于先进的士兵系统。公司开发用于军事应用的高性能材料和织物,例如防护衣和智慧制服。该公司还投资于研发,重点是将通讯系统、生物识别感测器和能源采集技术整合到士兵的装备中。

军用智慧纺织品市场趋势

健康监测诊断领域占市场主导地位

健康监测和诊断领域预计将在预测期内引领市场。国防支出的增加和对改善士兵安全的日益关注正在推动市场成长。军事人员长期在恶劣的地形中作战,需要保护免受自然因素和战斗危险的影响。生物和化学製剂因其整体防御和进攻潜力而继续构成严重威胁。由于担心恐怖分子和民兵组织等非国家武装团体可能使用生技药品攻击空气和水源、粮食供应和其他关键基础设施,生物恐怖主义的威胁最近有所增加。我就是。

此外,透过将物联网感测器整合到智慧服装中来确定环境中有害气体的存在和水平,军方可以有效减少有害气体造成的损害。美国公司 Acellent Technologies Inc. 与美国合作开发了 SmartArmor 系统,用于监测防护衣结构在运作中的健康状况。该系统由智慧型层和软体组成,旨在监控个人防护衣并提高战区士兵的安全。

此外,截至 2022 年 5 月,美国研究人员正在致力于开发可整合到製服中的可穿戴气体感测器。用于军事应用的灵活、多孔且灵敏的二氧化氮感测器可监测战场上以及危险气体爆发期间士兵的健康和安全。

2022 年 12 月,美国选择了 24 家小公司开发先进的可穿戴技术,以满足当前和未来的战斗需求。这些公司将在第一阶段小型企业创新研究合约中获得 15 万美元。这是为了开发能够感知和监测即时生理资料的设备,以评估作战人员的健康状况和战备情况。预计多种技术先进产品的研发将在预测期内推动该细分市场显着成长。

预计亚太地区在预测期内将显着成长。

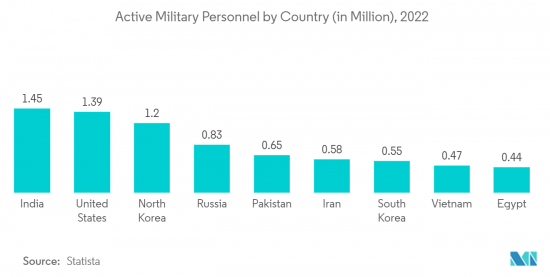

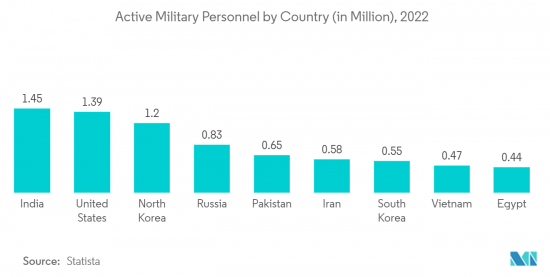

由于国防预算不断增加、地缘政治紧张局势以及对士兵安全和表现的日益关注,亚太地区有望引领市场。该地区快速的技术进步、绳索纺织品製造基地和协作努力也有助于其在采用和开发军事应用创新智慧纺织品解决方案方面的优势。此外,该地区的一些国家正在强调关键国防技术的国内生产和自给自足,并正在促进本土智慧纺织品解决方案的研究、开发和采用。

2022 年 5 月,Soliyarn, Inc. 与韩国领先的纺织品製造公司 Huvis Global 以及马萨诸塞州 M2I2 製造补贴计划签署协议,完成了 770 万美元的资金筹措。这将为大规模生产智慧纺织品的研发和生产设施奠定基础。

例如,2022年9月,印度理工学院(IIT)宣布与印度政府公司Troop Comforts Limited(TCL)签署谅解备忘录,为印度安全部队开发智慧防护衣。

2022年5月,澳洲国防部开始推出澳洲皇家海军的新海服。该制服是与墨尔本工作服集团和布鲁克纺织集团合作开发的,其面料具有固有的阻燃性。然而,为印度、日本和其他国家的军队开发智慧纺织品的研究活动的成长预计将在预测期内推动市场成长。

军用智慧纺织产业概况

军用智慧纺织品市场被许多企业瓜分。市场上一些知名的公司包括 BAE Systems plc、德州仪器公司、TenCate Protective Fabrics、Dupont de Nemours Inc. 和 Schoeller Textil AG。

该市场的公司正在与欧洲和北美的多所大学和研究机构合作,为世界军队开发先进的智慧纺织品。此外,该公司还与政府和军方合作,为军事人员生产客製化产品。市场正在兴起,技术进步空间巨大。随着多个国家认识到智慧纺织品在战场上的重要性,预计许多国家将进行大量研发投资,这可能会在预测期内为当地企业提供新的机会。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 市场抑制因素

- 波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 按用途

- 伪装

- 能量收穫

- 温度监控与控制

- 保护和机动性

- 健康监测和诊断

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 法国

- 德国

- 俄罗斯

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 拉丁美洲

- 巴西

- 墨西哥

- 其他拉丁美洲

- 中东/非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 土耳其

- 南非

- 其他中东/非洲

- 北美洲

第六章竞争形势

- 公司简介

- BAE Systems plc

- TenCate Protective Fabrics

- WL Gore & Associates Inc.

- Milliken & Company

- Schoeller Textil AG

- Dupont de Nemours Inc.

- Bebop Sensors

- Noble Biomaterials Inc.

- Mide Technology Corporation

- Advanced Fabric Technology LLC

- Seyntex

- MMI Textiles.

- Outlast Technologies LLC

- Texas Instruments(TI)

第七章 市场机会及未来趋势

The Smart Textiles for Military market was valued at USD 0.76 billion in 2024 and is projected to reach USD 1.56 billion by 2029, registering a CAGR of 15.37% during the forecast period.

The smart textiles for the military market are experiencing significant growth and innovation, driven by advancements in material science, nanotechnology, wearable electronics, and increasing demand for enhanced soldier performance and safety. Modern militaries are looking to equip their soldiers with advanced systems to enhance their situational awareness, survivability, and overall effectiveness on the battlefield. The integration of wearable sensors and health monitoring systems enables real-time tracking of vital signs and early detection of potential health issues. Rapid technological advancements in sensor miniaturization, energy harvesting, data analytics, and communication technologies drove the market.

Key players are actively involved in projects focusing on advanced soldier systems, integrating wearable electronics and sensors into military gear. Companies are developing high-performance materials and fabrics used in military applications, including protective gear and smart uniforms. Companies are also investing in R&D to focus on integrating communication systems, biometric sensors, and energy harvesting technologies into soldier equipment.

Military Smart Textiles Market Trends

Health Monitoring and Diagnostics Segment to Dominate the Market

The health monitoring and diagnostics segment is projected to lead the market during the forecast period. An increase in defense expenditure and a rising focus on improving soldiers' security drive the growth of the market. The operation of military personnel in harsh terrains for extended tenure necessitates protection from elements and battle hazards. Biological and chemical agents continue to pose severe threats because of their overall defensive and offensive potential. Recently, the threat of bioterrorism increased due to concerns that non-state armed actors, such as terrorists and militia groups, could use biological agents to target air and water sources, food supplies, and other vital infrastructures.

Additionally, integrating IoT sensors in smart clothes to determine the presence and level of hazardous gas in the environment allows the military to efficiently mitigate the harm caused by dangerous gases. Acellent Technologies Inc., a US company, in collaboration with the US Army, developed the SmartArmor system for the in-service monitoring of the health of body armor structures. The system was designed to monitor personal body armor comprising an intelligent layer and software to increase the safety of soldiers in a combat zone.

Furthermore, as of May 2022, researchers in the US worked on wearable gas sensors integrated with uniforms. The flexible, porous, and susceptible nitrogen dioxide sensors for military applications monitor the soldier's health and safety on the battleground or in case of hazardous gases.

In December 2022, the US Army selected 24 small companies to develop advanced wearable technologies to address current and future warfighting needs. These companies each will receive USD 150,000 as Phase I Small Business Innovation Research contracts. It is for developing a device capable of sensing and monitoring real-time physiological data to assess warfighter's health and readiness. Several technologically advanced product research and developments are expected to drive this market segment at significant growth rates during the forecast period.

The Asia-Pacific Region is Expected to Witness Significant Growth During the Forecast Period.

The Asia-Pacific region is poised to lead the market due to increasing defense budgets, geopolitical tensions, and a growing focus on soldier safety and performance. The region's rapid technological advancements, string textile manufacturing base, and collaborative efforts also contribute to its dominance in adopting and developing innovative smart textile solutions for military applications. Moreover, some countries in the region are emphasizing domestic production and self-sufficiency in critical defense technologies, driving local research, development, and adoption of homegrown smart textile solutions.

In May 2022, Soliyarn, Inc. signed a deal with Huvis Global, a South Korean fiber manufacturing giant, and the Commonwealth of Massachusetts, M2I2 Manufacturing Grant program to close a round of funding for USD 7.7 million. It will lay the groundwork for a research & development and production facility to manufacture smart textiles at scale.

For instance, in September 2022, the Indian Institute of Technology (IIT) announced they signed a memorandum of understanding with Troop Comforts Limited (TCL), an enterprise of India's government for developing Smart Protective Clothing for the Indian security forces.

In May 2022, the Australian Department of Defense started the rollout of the Royal Australian Navy's new maritime uniform. This uniform was developed by partnering with Workwear Group, Melbourne, and Bruck Textiles Group and is incorporated with inherent fire-retardant properties within the fabric. Nevertheless, the growth in research activities to develop smart textiles for the militaries of countries like India, Japan, and others is expected to drive market growth during the forecast period.

Military Smart Textiles Industry Overview

The smart textile for the military market is fragmented due to many players. Some prominent players in the market are BAE Systems plc, Texas Instruments Incorporated, TenCate Protective Fabrics, Dupont de Nemours Inc., and Schoeller Textil AG.

Players in the market collaborated with several universities and research organizations in Europe and North America to develop advanced smart textiles for global militaries. Moreover, companies are partnering with governments and armed forces to build customized products for their military personnel. The market is emerging, with a lot of scope for technological advancements. Since several countries realize the importance of smart textiles on the battlefield, significant R&D investments are anticipated from many countries, which may provide new opportunities for local players during the forecast period.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Application

- 5.1.1 Camouflage

- 5.1.2 Energy Harvest

- 5.1.3 Temperature Monitoring and Control

- 5.1.4 Protection and Mobility

- 5.1.5 Health Monitoring and Diagnostics

- 5.2 By Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.2 Europe

- 5.2.2.1 United Kingdom

- 5.2.2.2 France

- 5.2.2.3 Germany

- 5.2.2.4 Russia

- 5.2.2.5 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 India

- 5.2.3.3 Japan

- 5.2.3.4 South Korea

- 5.2.3.5 Rest of Asia-Pacific

- 5.2.4 Latin America

- 5.2.4.1 Brazil

- 5.2.4.2 Mexico

- 5.2.4.3 Rest of Latin America

- 5.2.5 Middle East and Africa

- 5.2.5.1 United Arab Emirates

- 5.2.5.2 Saudi Arabia

- 5.2.5.3 Turkey

- 5.2.5.4 South Africa

- 5.2.5.5 Rest of Middle East and Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles*

- 6.1.1 BAE Systems plc

- 6.1.2 TenCate Protective Fabrics

- 6.1.3 W.L. Gore & Associates Inc.

- 6.1.4 Milliken & Company

- 6.1.5 Schoeller Textil AG

- 6.1.6 Dupont de Nemours Inc.

- 6.1.7 Bebop Sensors

- 6.1.8 Noble Biomaterials Inc.

- 6.1.9 Mide Technology Corporation

- 6.1.10 Advanced Fabric Technology LLC

- 6.1.11 Seyntex

- 6.1.12 MMI Textiles.

- 6.1.13 Outlast Technologies LLC

- 6.1.14 Texas Instruments (TI)