|

市场调查报告书

商品编码

1404076

汽车继电器市场占有率分析、产业趋势及统计、2024年至2029年成长预测Automotive Relay - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

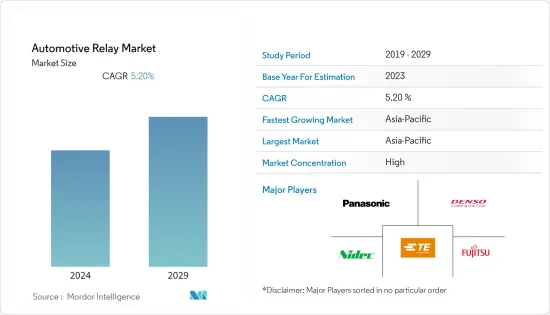

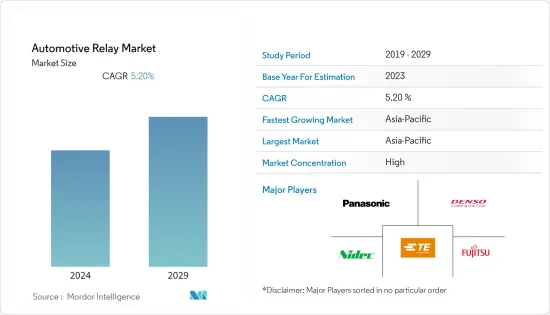

汽车继电器市场规模预计将从2024年的102.3亿美元成长到2029年的131.8亿美元,预测期间(2024-2029年)复合年增长率为5.2%。

随着混合汽车和电动车等汽车电动的进展,对控制和管理各种电气系统的继电器的需求不断增加。此外,主动式车距维持定速系统和车道偏离警告系统等 ADAS 功能的发展依赖继电器来控制感测器和致动器。

对具有轻量化和高性能特性的先进继电器的需求正迫使製造商投资生产比传统重型电子机械继电器更多的固态继电器。这是由于该地区对混合和电动车的需求不断增长。

按地区划分,亚太地区预计将主导汽车继电器市场。亚太继电器市场主要受到汽车产量和销售增加、汽车快速电动、更严格的排放法规以及消费者可支配收入增加的推动。因此,随着人们越来越追求安全和舒适,对汽车的需求也增加。

汽车继电器市场趋势

自动化系统的普及正在推动电子设备的采用。

汽车产业正在从硬体车辆转向软体车辆,每辆车的软体和电子产品的平均数量正在迅速增加。电子产品通常允许将新功能和特性整合到汽车中。因此,电子产品日益渗透到动力传动系统、安全管理、车身、便利性和资讯娱乐等关键应用领域。

政府的参与和消费者对系统自动控制的需求导致汽车中电子产品的使用增加。电子产品为提高能源效率和减少排放气体提供了新的机会。汽车电子在所有车型中的高普及受到三个主要方面的影响:生产力、品质和创新。

汽车产业正在製定措施来改变消费者的驾驶体验。汽车变得越来越聪明并且能够进行自我诊断。未来几年,汽车将能够高效连接。

此外,乘客安全也是推动自动驾驶系统在汽车上采用的因素之一。过去几十年来,汽车中安全功能和系统的安装极大地减少了道路事故和死亡人数。

随着确保消费者安全和便利的自动驾驶汽车和智慧汽车(能够透过车对车(V2V)和车对车基础设施(V2I)通讯进行连接)越来越受到关注,智慧汽车正在安装在新车。对电子系统的需求正在迅速增加。

驱动因素 改善体验的新一代汽车电子产品正在中檔和入门级汽车领域大量采用,并且可以透过售后市场轻鬆获得。

目前和即将推出的车辆中电气元件的使用正在迅速增加,并且对製造可靠、标准化元件以高效、安全和可靠地切换电气负载的需求持续增长。我就是。这些因素正在推动当前市场的成长。

亚太地区主导汽车继电器市场

亚太地区是全球最大的汽车生产中心,也是中国、日本、韩国、印度等主要汽车製造商的所在地。收入水准的提高、都市化和生活水准的提高也推动了亚太地区汽车持有的成长。汽车持有的快速成长直接影响了各种车辆系统中使用的汽车继电器的需求。

亚太地区许多国家实施了严格的排放法规,以减少污染和温室气体排放。这些法规正在推动先进引擎管理和排放控制系统的采用,这些系统使用继电器来实现高效运作。

向电动车和混合的转变是汽车产业的重要趋势。电动车和混合比传统内燃机汽车使用更多的继电器,有助于市场成长。继电器的整合度越来越紧凑,占用的空间越来越小,车内的重量也越来越轻。这一趋势符合汽车产业对减重和空间优化的关注。

亚太地区由于其作为汽车生产主要中心的地位、汽车持有的增加、汽车电动、严格的法规以及先进汽车技术的采用,在汽车继电器市场上处于领先地位。

汽车继电器产业概况

汽车继电器市场由Denso、Panasonic Corporation、TE Connectivity 和 Nidec Corporation 等公司主导。

汽车继电器市场竞争激烈,该地区既有国际、国内的继电器製造商。本公司大力投资研发计划并推出新产品。例如

- 2022 年 4 月,LG Magna e- 动力传动系统在墨西哥拉莫斯阿里斯佩揭幕了最新的製造工厂。新工厂将专门生产逆变器、马达和汽车充电器,主要目的是加强通用汽车的电动车(EV)製造业务。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场驱动因素

- 汽车电动进展

- 市场抑制因素

- 精确的测试和检验

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔(市场金额单位:美元)

- 按类型

- 印刷电路板继电器

- 插入式继电器

- 按使用类型

- 锁系统

- 引擎管理模组

- 灯/灯

- 其他应用类型(电动车窗、天窗、ABS 控制等)

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 欧洲其他地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区

- 世界其他地区

- 巴西

- 南非

- 其他国家

- 北美洲

第六章竞争形势

- 供应商市场占有率

- 公司简介

- Robert Bosch GmbH

- DENSO Corporation

- Fujitsu Ltd

- Panasonic Corporation

- MITSUBA Corporation

- TE Connectivity

- Omron Corporation

- Hella KGaA Hueck & Co.

- Nidec Corporation

第七章 市场机会及未来趋势

The Automotive Relay Market size is expected to grow from USD 10.23 billion in 2024 to USD 13.18 billion by 2029, registering a CAGR of 5.2% during the forecast period (2024-2029).

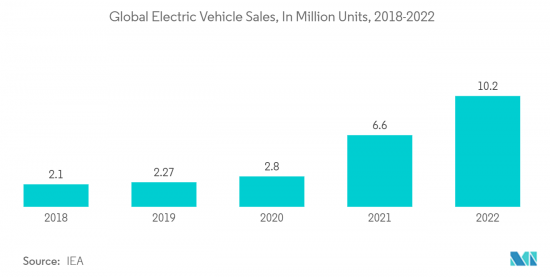

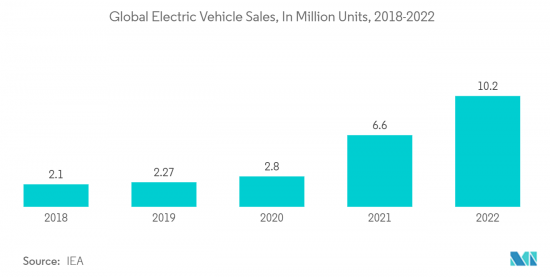

The increasing electrification of vehicles, including hybrid and electric vehicles, drives the demand for relays to control and manage various electrical systems. Also, the growth of ADAS features such as adaptive cruise control and lane departure warning systems relies on relays to control sensors and actuators.

The demand for advanced relays with lightweight and high-performance characteristics is compelling manufacturers to invest in producing more solid-state relays compared to traditional heavy electromechanical relays. It is owing to the growing demand for hybrid and electric vehicles in the region.

Among regions, Asia-Pacific is anticipated to dominate the automotive relay market. The Asia-Pacific relay market is primarily driven by growing vehicle production and sales, rapid electrification of vehicles, rising stringency of emission norms, and increasing disposable income of consumers. It, in turn, is increasing the demand for vehicles, owing to the growing preference for safety and comfort.

Automotive Relay Market Trends

Increasing Penetration of Automated Systems Driving the Adoption of Electronics.

The automotive industry is transitioning from hardware to software-enabled vehicles, and the average software and electronics content per vehicle is increasing rapidly. Electronics often enable the integration of new functions and features into the car. Thus, there is increasing penetration of electronics into major application fields, including powertrain, safety management, body, and convenience or infotainment.

Both government involvement and consumers' demand for greater automatic control of systems resulted in the increased usage of electronics in vehicles. Electronics are offering new opportunities to improve energy efficiency and emission reduction as several functions can be consolidated into fewer and smaller electronic control super units, thereby reducing the weight. The high penetration rate of automobile electronics across all vehicle classes is being influenced by three major aspects, namely, productivity, quality, and innovation.

Efforts are being deployed in the automobile industry to transform consumers driving experience. Cars are becoming smarter and capable of conducting self-diagnostics. In the coming years, cars can connect effectively.

In addition, passenger safety is another factor driving the adoption of automated systems in automobiles. The installation of safety features and systems in vehicles greatly aided in reducing the number of accidents and fatalities on the road over the past few decades.

With the increasing focus on autonomous vehicles and smart cars (with the ability to connect with vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communications) that can ensure safety and convenience to consumers, the demand for electronic systems in new cars is increasing rapidly.

Newer generation automotive electronics that enhance the driver experience are witnessing mass adoption in mid-range and entry-level car segments and ease of availability through the aftermarket.

The rapidly growing use of electric components in current and upcoming vehicles is consistently propelling the need for manufacturing reliable and standardized components for efficient, safe, and secure switching of electric loads. These factors are currently driving the market growth.

Asia-Pacific Dominating The Automotive Relay Market

Asia-Pacific is the world's largest automotive production hub, with several countries in the region, including China, Japan, South Korea, and India being major automobile manufacturers. Also, rising income levels, urbanization, and improved living standards led to an increase in vehicle ownership across Asia-Pacific. This surge in vehicle ownership directly impacts the demand for automotive relays used in various vehicle systems.

Many countries in Asia-Pacific implemented strict emission regulations to reduce pollution and greenhouse gas emissions. These regulations drive the adoption of advanced engine management and emission control systems that use relays for efficient operation.

The shift towards EVs and hybrid vehicles is a significant trend in the automotive industry. EVs and hybrids use more relays compared to traditional internal combustion engine vehicles, contributing to the market growth. Relays are becoming more compact and integrated, saving space in vehicles and reducing weight. This trend aligns with the automotive industry's focus on lightweighting and space optimization.

Asia-Pacific region leads in the automotive relay market due to its position as a major automotive production hub, growing vehicle ownership, the electrification of vehicles, stringent regulations, and the adoption of advanced automotive technologies.

Automotive Relay Industry Overview

The automotive relay market is dominated by companies such as DENSO Corporation (ANDEN Co. Ltd), Panasonic Corporation, TE Connectivity, and Nidec Corporation.

The market for automotive relays is highly competitive due to the presence of both international and domestic relay suppliers in the region. The companies are investing heavily in R&D projects and launching new products. For instance,

- In April 2022, LG Magna e-Powertrain announced its latest manufacturing facility located in Ramos Arizpe, Mexico. This newly established plant is dedicated to the production of inverters, motors, and onboard chargers with the primary objective of bolstering General Motors Electric Vehicle (EV) manufacturing operations.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increasing Electrification of Vehicles

- 4.2 Market Restraints

- 4.2.1 Precise Testing and Validation

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market value in (USD))

- 5.1 By Type

- 5.1.1 PCB Relay

- 5.1.2 Plug-in Relay

- 5.2 By Application Type

- 5.2.1 Locking System

- 5.2.2 Engine Management Module

- 5.2.3 Lamps/Lights

- 5.2.4 Other Application Types (Power Window, Sunroof, ABS Control, etc.)

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 US

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 UK

- 5.3.2.3 France

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 Brazil

- 5.3.4.2 South Africa

- 5.3.4.3 Other Countries

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Robert Bosch GmbH

- 6.2.2 DENSO Corporation

- 6.2.3 Fujitsu Ltd

- 6.2.4 Panasonic Corporation

- 6.2.5 MITSUBA Corporation

- 6.2.6 TE Connectivity

- 6.2.7 Omron Corporation

- 6.2.8 Hella KGaA Hueck & Co.

- 6.2.9 Nidec Corporation