|

市场调查报告书

商品编码

1404079

PVC 稳定剂:市场占有率分析、产业趋势与统计、2024-2029 年成长预测PVC Stabilizers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

预计2024年全球PVC稳定剂市场规模为148万吨。

预计到 2029 年将达到 179 万吨,预测期内复合年增长率超过 3.9%。

COVID-19 的爆发对 PVC 稳定剂产业产生了负面影响。全球封锁和政府实施的严格规定摧毁了大多数生产基地。儘管如此,业务自 2021 年以来已经復苏,预计未来几年将大幅成长。

主要亮点

- PVC 管道、管材和附件提供的经济效益以及 PVC 在汽车行业的使用正在推动全球市场的成长。

- 关于铅基稳定剂的健康危害和严格的政府法规正在阻碍市场成长。

- 然而,越来越多地使用有机锡稳定剂作为环保选择,可能在不久的将来为全球市场创造利润丰厚的成长机会。

PVC稳定剂市场趋势

建筑和施工主导市场

- 聚氯乙烯 (PVC) 是建设产业中使用最广泛的塑胶。其坚固、轻质的结构能够抵抗风化、化学腐蚀和磨损。由这种塑胶製成的产品包括管道、电缆、窗框、地板材料和屋顶。

- 据欧洲乙烯基工业理事会称,欧洲 70% 的 PVC 用于窗户、管道、地板材料、屋顶薄膜和其他建筑产品。 PVC 是欧洲建筑市场的主导塑胶。

- PVC管材广泛应用于用水和污水系统。具有光滑的表面和无摩擦的流动,不存在堆积、结垢或腐蚀问题。 PVC 管路是输送饮用水的安全选择。地下管道的使用寿命超过100年,性价比高,可回收率高8至10倍。

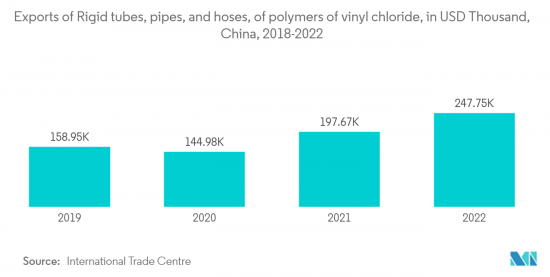

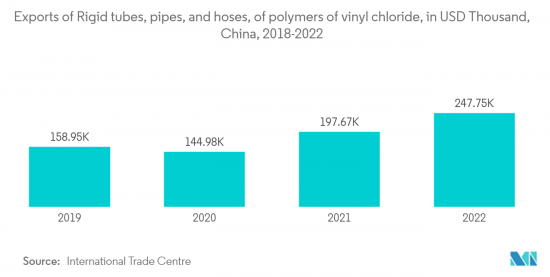

- 根据美国人口普查局统计,到2024年,美国塑胶管道及管附件製造业预计将达到113.3亿美元。根据国际贸易中心统计,2022年该国出口的氯乙烯聚合物硬管、管道和软管总价值为21万美元,而2021年为16万美元。

- PVC窗框和屋顶材料由于其优异的隔热性能,大大提高了建筑物的能源效率。这些特性使 PVC 成为建设产业中其他材料的首选。

- 在建设产业,PVC 用于管道、窗框和屋顶膜。建设产业中使用的住宅和商业塑胶管道和附件以 PVC 为主。

- 根据联合国统计,全球约有50%的人口居住在都市区,预计2030年将达到60%。经济成长和人口成长的速度必须与居住活动的需求相符。到 2030 年,世界上大约 40% 的人口可能需要住宅,每天超过 96,150 户。

- 据印度投资局称,到 2030 年,超过 40% 的人口将居住在都市区,从而需要额外 2,500 万套中檔和经济适用住宅。据住宅和城市事务部称,2022年,AMRUT计划提供了约134,000个水龙头连接和102,000个污水/污水处理连接。

- 因此,全球建筑业将主导市场。因此,PVC稳定剂的需求在预测期内可能会有所改善。

亚太地区主导市场

- 亚太地区是关键地区,由于中国和印度等国家建筑、汽车和其他行业的需求快速增长,预计在预测期内将主导 PVC 稳定剂市场。

- PVC管材和地板材料具有一定的优点,如耐用性、美观效果自由、易于施工、易于清洁和可回收。 PVC 也用作建设产业的屋顶材料。原因是它几乎不需要维护并且使用寿命长(超过30年)。

- 香港住宅委员会推出多项措施鼓励兴建经济适用住宅。当局的目标是在截至 2030 年的 10 年内提供 301,000 套公共住宅。

- 韩国2022年3月建筑业产出较去年同月下降7.3%,上月下降4.6%。建筑业产出下降是由于建筑活动收缩,其中土木工程产出下降14.5%,建设活动产出下降4.2%。

- 中国是全球最大的汽车生产和销售市场。儘管面临COVID-19大流行、结构性晶片短缺和区域地缘政治衝突等负面因素,中国汽车市场在2022年仍实现了成长。根据中国工业协会统计,2022年汽车产量2,702.1万辆,汽车销售2,686.4万辆,与前一年同期比较增加3.4%及2.1%。

- 2023年第一季韩国国内汽车销量从去年同期的300,281辆成长22%至366,157辆。包括现代汽车和起亚汽车在海外生产的汽车在内,五家主要汽车製造商的全球销量从去年同期的609,557辆增长20%至730,181辆,累计销量从1,707,436辆增长14%至1,939,048辆。成为。

- 因此,上述因素和政府支持正在推动预测期内亚太地区PVC稳定剂市场的需求不断增加。

PVC稳定剂产业概况

PVC稳定剂市场本质上是部分一体化的。主要企业(排名不分先后)包括Akdeniz Chemson、Baerlocher GmbH、昆山麦吉森复合材料、SONGWON、山东金昌树新材料科技有限公司。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- PVC管材及附件的经济效益

- PVC在汽车工业的应用

- 抑制因素

- 关于使用铅基稳定剂的健康危害和严格的政府法规

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(市场规模)

- 按类型

- 钙基

- 铅基

- 锡基

- 钡型

- 其他类型

- 按最终用户产业

- 建筑/施工

- 车

- 电力/电子

- 包装

- 鞋类

- 其他最终用户产业

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东/非洲

- 亚太地区

第六章竞争形势

- 併购、合资、联盟、协议

- 市场排名分析

- 主要企业策略

- 公司简介

- ADEKA Corporation

- Akdeniz Chemson

- Baerlocher Gmbh

- Clariant

- Galata Chemicals

- Goldstab Organics Pvt. Ltd

- Jiangsu Uniwel Chemistry Co. Ltd

- KD Chem Co. Ltd

- Kunshan Maijisen Composite Materials Co. Ltd

- PAU Tai Industrial Corporation

- PMC Group Inc.

- RA Chemicals

- Reagens SPA

- Shandong Jinchangshu New Material Technology Co. Ltd

- Songwon

- TIMAH

- Valtris Specialty Chemicals

- Vikas Ecotech Ltd

第七章 市场机会及未来趋势

- 增加使用有机锡稳定剂作为环保选择

The global PVC stabilizers market is estimated at 1.48 million tons in 2024. It is projected to reach 1.79 million tons by 2029, registering a CAGR of over 3.9% during the forecast period.

The COVID-19 pandemic adversely affected the PVC stabilizers sector. Global lockdowns and severe rules enforced by governments resulted in a catastrophic setback as most production hubs were shut down. Nonetheless, the business has been recovering since 2021 and is expected to rise significantly in the coming years.

Key Highlights

- The economic benefits provided by PVC pipes, tubing, and fittings and the use of PVC in the automotive industry fuel the growth of the global market.

- Health hazards and stringent government regulations regarding lead-based stabilizers hinder the market's growth.

- Nevertheless, the rising usage of organo-tin stabilizers as an environmentally friendly option may soon create lucrative growth opportunities for the global market.

PVC Stabilizers Market Trends

Buildings and Constructions to Dominate the Market

- Polyvinyl Chloride (PVC) is the most used plastic in the building and construction industry. Its strong, lightweight structure is durable against weathering, chemical corrosion, and abrasion. The products manufactured from this plastic include pipes, cables, window profiles, flooring, and roofing.

- According to the European Council of Vinyl Manufacturers, windows, pipes, flooring, roofing membranes, and other building products use 70% of all European PVC. It is the leading plastic in the European building and construction market.

- PVC pipes are widely used for water, waste, and sewage systems. They suffer no build-up, scaling, or corrosion and provide smooth surfaces with a friction-free flow. PVC pipes are a safe choice for the transportation of drinking water. They provide more than 100 years of service life for underground pipes and are cost-efficient and 8-10 times recyclable.

- According to the US Census Bureau, by 2024, plastic pipe and pipe fitting manufacturing in the United States is estimated to reach USD 11.33 billion. According to the International Trade Centre, in 2022, the total value of rigid tubes, pipes, and hoses of polymers of vinyl chloride exported from the country accounted for USD 0.21 million, while in the year 2021, it was USD 0.16 million.

- PVC window cladding and roofing significantly increase the energy efficiency of buildings due to excellent thermal insulation properties. Hence, such properties make PVC a preferred option over others in the building and construction industry.

- The construction industry uses PVC in pipes, window frames, and roofing membranes. The plastic pipes and fittings used in the building and construction industry for residential and commercial applications are dominated by PVC.

- According to the United Nations (UN), around 50% of the global population resides in urban cities, projected to reach 60% by 2030. The pace of economic and demographic growth must be in harmony with the demand for residential activities. By 2030, around 40% of the global population may need housing, at over 96,150 houses per day.

- According to Invest India, by 2030, more than 40% of the population is expected to live in urban areas, creating a demand for 25 million additional mid-end and affordable units. According to the Ministry of Housing & Urban Affairs, around 134 lakh water tap connections and 102 lakh sewer/septage connections were provided under the AMRUT scheme in 2022.

- Hence, the construction sector worldwide will dominate the market. Thus, the demand for PVC stabilizers may improve in the forecast period.

Asia-Pacific to Dominate the Market

- Asia-Pacific is the leading region and is expected to dominate the PVC stabilizer market during the forecast period due to the rapid increase in demand from countries like China and India in construction, automotive, and other sectors.

- PVC pipes and flooring have certain benefits, such as durability, freedom of aesthetic effects, ease of installation, cleaning, and recyclability. PVC is also used in roofing in the building and construction industries. It is used for its low maintenance requirements and long-lasting nature (over 30 years).

- The housing authorities of Hong Kong launched several measures to push the construction of low-cost housing. The officials aim to provide 301,000 public housing units in 10 years till 2030.

- In March 2022, the South Korean construction output sank by 7.3% Y-o-Y, following a slump of 4.6% the month before. The factors contributing to the declining construction output include the dwindling construction activity, with civil engineering production contracting by 14.5% and building activity dropping by 4.2%.

- China is the world's biggest automobile market in production and sales. China's auto market experienced growth in 2022 despite several negative factors, including the COVID-19 pandemic, a structural chip shortage, and local geopolitical conflicts. According to the Chinese Association of Automobile Manufacturers, automobile production and sales reached 27.021 million and 26.864 million in 2022, up 3.4% and 2.1% from the previous year.

- In the first quarter of 2023, the overall South Korean domestic vehicle sales increased by 22% to 366,157 units from 300,281 units in the same period last year. Global sales by the five big automakers, including vehicles produced overseas by Hyundai and Kia, increased 20% to 730,181 units in March from 609,557 units a year earlier, while cumulative sales were 14% higher at 1,939,048 from 1,707,436 units.

- Therefore, the abovementioned factors and government support contribute to the increasing demand for the PVC stabilizer market in Asia-Pacific during the forecast period.

PVC Stabilizers Industry Overview

The PVC stabilizers market is partially consolidated by nature. The major players (not in any particular order) include Akdeniz Chemson, Baerlocher GmbH, Kunshan Maijisen Composite Materials Co. Ltd, SONGWON, and Shandong Jinchangshu New Material Technology Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Economic Benefits Provided by PVC Pipes, Tubing, and Fittings

- 4.1.2 Use of PVC in the Automotive Industry

- 4.2 Restraints

- 4.2.1 Health Hazards and Stringent Government Regulations Regarding the Use of Lead-based Stabilizers

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 By Type

- 5.1.1 Calcium-based

- 5.1.2 Lead-based

- 5.1.3 Tin-based

- 5.1.4 Barium-based

- 5.1.5 Other Types

- 5.2 By End-user Industry

- 5.2.1 Building and Construction

- 5.2.2 Automotive

- 5.2.3 Electrical and Electronics

- 5.2.4 Packaging

- 5.2.5 Footwear

- 5.2.6 Other End-user Industries

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ADEKA Corporation

- 6.4.2 Akdeniz Chemson

- 6.4.3 Baerlocher Gmbh

- 6.4.4 Clariant

- 6.4.5 Galata Chemicals

- 6.4.6 Goldstab Organics Pvt. Ltd

- 6.4.7 Jiangsu Uniwel Chemistry Co. Ltd

- 6.4.8 KD Chem Co. Ltd

- 6.4.9 Kunshan Maijisen Composite Materials Co. Ltd

- 6.4.10 PAU Tai Industrial Corporation

- 6.4.11 PMC Group Inc.

- 6.4.12 RA Chemicals

- 6.4.13 Reagens SPA

- 6.4.14 Shandong Jinchangshu New Material Technology Co. Ltd

- 6.4.15 Songwon

- 6.4.16 TIMAH

- 6.4.17 Valtris Specialty Chemicals

- 6.4.18 Vikas Ecotech Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Usage of Organo-tin Stabilizers as an Environment Friendly Option