|

市场调查报告书

商品编码

1404093

无尘室技术:市场占有率分析、产业趋势与统计、2024-2029 年成长预测Cleanroom Technology - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

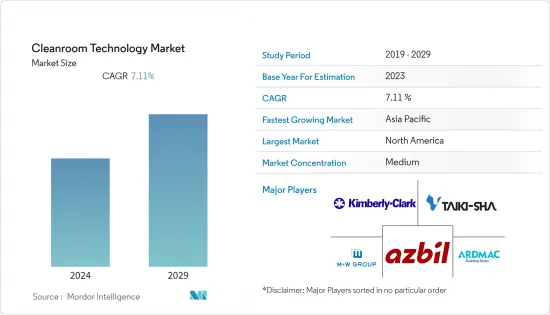

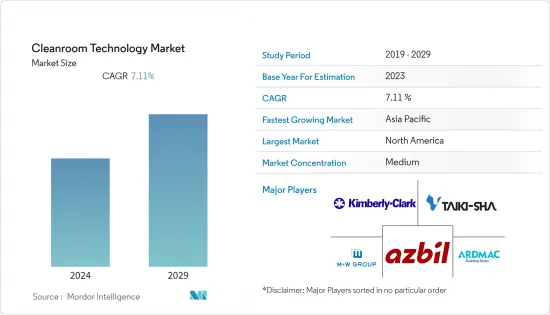

去年无尘室技术市场规模为81.7亿美元,预计未来五年将达121.1亿美元,复合年增长率为7.11%。

主要亮点

- 各行业对先进无尘室技术的需求日益增加,严格的污染控制对于确保产品和工艺的安全性和有效性至关重要,从而有效地监管和最大程度地减少污染,目标是将污染控制在最低限度。这包括精确控制每立方公尺的灰尘、空气微生物、气溶胶和蒸发颗粒的水平。

- 现代无尘室的发展始于第二次世界大战期间,旨在提高枪支、坦克和飞机生产中使用的仪器的品质和可靠性。在此期间,还开发了 HEPA 过滤器来容纳核分裂实验以及化学和生物战研究产生的危险放射性物质、微生物和化学污染物。由于 NASA 在 20 世纪 50 年代和 1960 年代的太空旅行计划,无尘室的发展势头强劲。这段时期「层流」概念的提出,标誌着无尘室技术的转捩点。

- 值得注意的是,这一概念在 COVID-19 期间的广泛普及导致了电子製造业的大幅增长,以及製药业用于疫苗生产的巨额投资。 mRNA 疫苗技术的引入以及 COVID-19 疫苗的核准和生产速度是一项惊人的创新。目前,几种基于 mRNA 的疫苗正在开发中,但有一个通用是它们都需要无菌处理。此外,疫情增加了对个人防护套件和手套的需求,导致个人防护套件产量增加,并支持了市场成长。

- 随着电子产品需求的不断成长,无尘室技术供应商的业务正在不断扩张。因此,已开发国家和开发中国家的政府正在做出重大努力,以确保拥有足够的无尘室来处理所有罕见的国内情况。例如,2022年,美国政府正式通过了2022 CHIPS法案。根据这项法律,美国政府希望美国公司在美国建造用于半导体製造的无尘室,而不是外包给外国无尘室。该法出台后,外国半导体製造商也计划在美国新建无尘室,以获得美国政府资助。

- 无尘室在各种最终用户市场中越来越受欢迎,因为需要受控环境来维持高品质的产品。然而,无尘室的建造成本不仅投资非常集中,而且运作成本还取决于所需的空气交换次数和过滤效率。运作成本非常高,因为无尘室必须始终运作以保持适当的空气品质。不用说,节能运作和持续遵守无尘室标准使无尘室成为製造技术和实验室最重要的基础设施之一。预计这将决定市场的成长。

- 无尘室已成为製造过程中不可或缺的一部分,特别是在半导体和电子产品製造中,因为它们避免了有害细菌和污染物污染的可能性,并确保在规定的无菌条件下保持清洁。 COVID-19大流行使得对无数消耗品和配置条件的需求变得如此迫切,因此需要将无尘室技术带到製造业发展的最前沿,使其成为遏制病毒行动的基石。

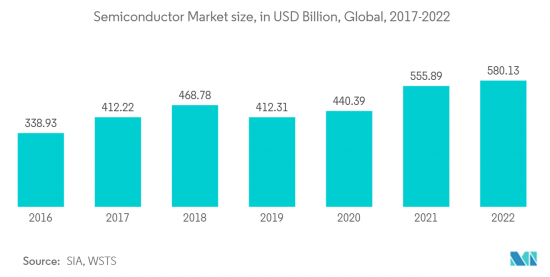

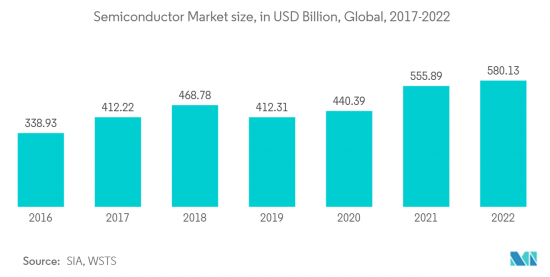

- 因此,半导体产业在去年的疫情封锁令期间强劲成长,原因是远距工作、远距学习、游戏、娱乐和网路购物的增加改变了消费者的习惯,对家用电子电器。这是因为对半导体的需求大大超过了生产。随着数位化扩展到日常生活的各个方面,对半导体的需求持续飙升,远远超过了全球的供给能力。许多全球最大的製造商,例如英特尔和台积电 (TSMC),正在透过增加新的製造商来扩大产能,以满足这一需求。

无尘室技术市场趋势

最大的最终用户是半导体製造

- 无尘室是半导体製造的重要组成部分,因为该行业严重依赖无尘室环境来製造精密的微电子产品。半导体晶片用于各种电脑化设备,从行动电话等家用物品到汽车、国防技术和太空船等复杂机器。半导体晶片采用极为精密的材料製造,形成必须小心操作的精密层。因此,半导体晶片製造、测试和封装等操作必须在受控的无尘室环境中进行。

- 半导体无尘室是要求最高的无尘室之一。由于光刻线宽为 0.1 微米或更小,因此这些无尘室通常具有 10 级或 100 级无尘室分类(ISO-4 或 ISO-5)。此外,半导体无尘室有严格的温度和湿度要求。此类无尘室的面积从 500 平方英尺到 500,000 平方英尺不等。通常,ULPA 过滤器用于取代半导体无尘室中的 HEPA 过滤器,以防止最小的亚微米颗粒进入无尘室。 HEPA过滤器可以捕捉99.97%的0.3u的粒状物,而ULPA过滤器可以捕捉99.999%的0.12u的粒状物。

- 由于线宽极细,半导体无尘室製造流程对温度和湿度的变化极为敏感。半导体无尘室通常需要 +1 华氏度和 +5% 或 10% 相对湿度。这需要为每个房间配备一个带有加热和冷却元件的专用空气处理器。大多数半导体无尘室都有专用的冷冻和锅炉来支援 HVAC 系统。此外,在半导体无尘室工作的人员通常穿着兔女郎服、靴子、头罩、口罩和手套,以防止颗粒进入无尘室。它通过无尘室空气浴尘室,过滤HEPA过滤的空气,去除无尘室中附着在衣服外部的颗粒。

- 此外,全球半导体产业投资的增加也是市场的主要成长要素。例如,2022年8月,美国政府通过了《晶片与科学法案》,旨在提振国内半导体晶片製造。该法案授权为美国半导体製造和研究提供约 520 亿美元的政府补贴,并为半导体晶片製造商提供约 240 亿美元的投资税额扣抵。

- 因此,随着对奈米技术和半导体的需求增加,引入更先进的无尘室变得有必要。伦斯勒理工学院 (RPI) 在材料、装置和整合系统中心 (CMDIS) 内提供微奈米製造无尘室(MNCR) 设施,帮助您为该领域的职业生涯奠定坚实的基础。我们提供 BYOND 计划适合希望获得知识和培训的本科生。

- 随着半导体产业大幅扩张并在亚太地区占据主导地位,预计该地区将为研究市场提供巨大的成长潜力。世界上第一批现代化无尘室设施可以追溯到 20 世纪 60 年代,无尘室设施于 1920 世纪 80 年代引入亚洲发展中国家,包括马来西亚。

- 无尘室从美国转移到亚洲是由于 20 世纪 90 年代半导体和微电子製造业的发展。英特尔、戴尔、摩托罗拉等美国公司在此期间在亚洲设立製造工厂,刺激了亚洲无尘室产业的发展。

预计北美将占据较大市场占有率

- 预计北美在预测期内将出现显着增长,这主要是由于该地区售后市场销售的增加以及向改进的定长切割伐木技术的转变。

- 这一成长主要归功于生物技术产业的成长,尤其是与汽车、化学和钢铁产业相比,该产业仍然年轻。生物技术产业的发展是一个独特的故事,但它与美国其他工业部门建立在通用的基础上。

- 政府和私人资助的多年研究不断建立一个不同于世界上任何其他地方的知识库。透过生物製造,美国各地的永续物质被转化为新产品,为基于石油的化学品、药品、燃料、材料等生产提供替代品。

- 例如,2022 年 9 月,拜登总统签署了一项关于「推动生物技术和生物製造创新,实现永续、安全和有保障的美国生物经济」的行政命令 (EO)。在行政命令中,总统概述了基础和应用研究与开发需求,这些需求将带来健康、气候变迁、能源、粮食安全、农业、供应链弹性以及国家和经济安全方面的创新解决方案。透过制定研究议程,我们制定了政府整体推动生物技术和生物製造的愿景。

- 随着生物技术产业的发展,无尘室技术正在获得区域参与企业的大量投资。例如,2022 年 11 月,Charles River Laboratoires International, Inc. 宣布扩建其位于田纳西州孟菲斯的细胞治疗合约开发和製造 (CDMO) 设施。扩建后的空间适用于临床和商业细胞治疗製造,另外还有 9 间最先进的加工套件和 16 间无尘室。

- 此外,区域国家对加强晶片製造并透过人工智慧、5G和量子运算等未来战略技术支持美国寄予厚望,这些技术将决定未来几十年的全球经济和军事领导地位。根据半导体产业协会的一份新报告,美国政府将扭转美国晶片製造业长达数十年的下滑轨迹,加强国家安全,使供应链更具弹性,并使美国成为全球领先的半导体製造商。使其成为最具吸引力的地点之一的战略机会。随着各公司宣布计划在未来几年扩大北美无尘室技术市场的规模,这种成长预计将为北美无尘室技术市场带来广泛的吸引力。

无尘室技术产业概况

在无尘室技术市场,无尘室设备产业的分散化导致竞争企业之间竞争激烈,许多厂商争夺市场占有率。在这些供应商中,特别是在消耗品领域,为了占领很大一部分市场,竞争非常激烈。该领域的主要企业包括M+W Group GmbH、Azbil Corporation、Taikisha Global Limited、Kimberly Clark Corporation、Ardmac Ltd等。

2023年5月,专注于高科技设施的知名EPC(工程、采购和施工)公司ExyteSingapore荣获久负盛名的SBR国际商业奖工业建筑类别奖项。该奖项表彰了该公司在为新加坡半导体公司 WorldFoundries (GF) 设计和建造新工厂方面的杰出表现。该最先进的设施包括 23,000平方公尺的无尘室空间、中央公共产业大楼 (CUB) 和行政办公室。具备年产45万片晶圆(300mm)的生产能力。完工后,格芯新加坡工厂的年产能将达到约 150 万件(300 毫米)。

同月,位于泰国春武里府的生产子公司阿自倍尔生产(泰国)宣布建设计画一座新工厂大楼。主要目的是加强AZBIL的全球生产体系并支持海外企业发展。随着阿自倍尔集团扩大海外业务,预计需求将增加,新工厂将提高产能,并能够生产更广泛的产品。它还将满足阿自倍尔集团海外客户的各种产品的先进生产需求。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- COVID-19 对市场的影响

第五章市场动态

- 市场驱动因素

- 主要市场生物技术和医疗保健支出的整体成长

- 严格的政府法规和对优质产品的需求

- 市场挑战

- 安装成本、维修成本高且缺乏技术纯熟劳工

第六章市场区隔

- 按成分

- 设备类型

- 无尘室空气浴尘室室

- 暖通空调系统

- 层流系统

- 高效过滤器

- 干燥柜

- 风扇过滤单元

- 消耗品种类

- 服装类

- 手套

- 擦拭巾

- 真空系统

- 消毒剂

- 其他消耗品

- 设备类型

- 按最终用户

- 製药

- 生物技术

- 医疗设备

- 医院

- 半导体製造

- 其他最终用户

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 其他地区(拉丁美洲和中东非洲)

第七章竞争形势

- 公司简介

- M+W Group

- Azbil Corporation

- Taikisha Global Limited

- Kimberly Clark Corporation

- Ardmac Ltd

- Ansell Limited

- Clean Air Products

- Labconco Corporation

第八章投资分析

第九章 市场机会及未来趋势

The cleanroom technology market was valued at USD 8.17 billion the previous year and is expected to register a CAGR of 7.11%, reaching USD 12.11 billion by the next five years.

Key Highlights

- Due to the increasing demand for advanced cleanroom technology across various industries where stringent contamination control is vital for ensuring product and process safety and effectiveness, the objective is to effectively regulate and minimize contamination. This involves maintaining precise control over the levels of dust, airborne microorganisms, aerosols, and vaporized particles on a per-cubic-meter basis.

- Development of the modern, clean room began during the Second World War to improve the quality and reliability of instrumentation used in manufacturing guns, tanks, and aircraft. During this time, HEPA filters were also developed to contain the dangerous radioactive, microbial, or chemical contaminants that resulted from experiments into nuclear fission, as well as research into chemical and biological warfare. The evolution of clean rooms gained momentum as a result of NASA's space travel program in the 1950s and 1960s. It was during this time that the concept of 'laminar flow' was introduced, which marked a turning point in clean room technology.

- Notably, this concept gained wide popularity during COVID-19 owing to the significant rise in electronics manufacturing along with huge investment in the pharmaceutical industry for vaccine production. The introduction of mRNA vaccine technology and the speed with which the COVID-19 vaccines were approved and manufactured stand out as amazing innovations. Right now, there are several mRNA-based vaccines in the pipeline, and one thing that all of them have in common is the need for sterile processing. Moreover, the pandemic increased demand for PPE kits and gloves, which has led to increased production of PPE kits, thereby assisting the market growth.

- With the growing demand for electronics, cleanroom technology providers are witnessing increased business. As a result of this, governments from developed and developing nations are significantly working towards securing ample cleanrooms to handle any scarce situation domestically. For instance, the 2022 CHIPS Act was officially passed by the US government in 2022. Under this act, the US Government wants US companies to build cleanrooms in the USA for semiconductor manufacturing instead of outsourcing to cleanrooms in foreign countries. After introducing this act, foreign semiconductor manufacturers have also been planning new US-based cleanrooms to get US government funding.

- Cleanrooms are gaining popularity in various end-user markets as a controlled environment has become a necessity for maintaining high-quality products. However, the cost of a cleanroom is not only extremely investment-intensive to build, but operational costs can also depend on the number of required air exchanges and filtration efficiency. The operation can be extremely costly, as maintaining the appropriate air quality means the room has to be in constant operation. Not to mention, energy-efficient operation and continuous adherence to cleanroom standards make a cleanroom one of the most important infrastructures for manufacturing technology and laboratories. This is expected to challenge the market's growth.

- Cleanrooms have been deeply established as an integral part of manufacturing processes, especially in semiconductor and electronics manufacturing, as cleanliness can be ensured in their regulated and sterile conditions, avoiding possible contamination by harmful bacteria and pollutants. The COVID-19 pandemic rendered the need for a myriad of supplies and set conditions so severe that cleanroom technology had to be brought to the forefront of manufacturing development, serving as a foundation for action in keeping the virus at bay.

- Thus, the significant boost in the semiconductor industry boosted by last year's pandemic lockdown orders as changing consumer habits, driven by the rise in remote work, distance learning, gaming, entertainment, and internet shopping - significantly increased demand for consumer electronic devices to the point that demand for semiconductors far outpaced production. Demand for semiconductors continues to surge far beyond the global capacity for supply as digitization expands into every facet of daily life. Many of the world's largest fabricators, like Intel and the Taiwan Semiconductor Manufacturing Company (TSMC), are expanding capacity with new fabrication facilities to satisfy that demand, which has positively impacted the market studied.

Cleanroom Technology Market Trends

Semiconductor Manufacturing to be the Largest End User

- Cleanrooms are a necessary part of semiconductor manufacturing as this industry relies heavily on cleanroom environments to manufacture sensitive microelectronics. Semiconductor chips are utilized in every computerized device - from household objects like cell phones to complex machines such as vehicles, defense technology, or spacecraft. They are produced using highly sensitive materials to create delicate layers that must be worked on carefully. Thus, tasks like semiconductor chip manufacturing, testing, and packaging must be carried out in a controlled cleanroom environment.

- Semiconductor cleanrooms are amongst the most demanding cleanrooms. As photolithography linewidths go below 0.1 microns, these cleanrooms are usually class 10 or 100 cleanroom classification (ISO-4 or ISO-5). Additionally, semiconductor cleanrooms have tight temperature and humidity requirements. Such cleanrooms can vary in size from 500 SF to 500,000 SF; usually, semiconductor cleanrooms use ULPA filters instead of HEPA filters to prevent even the smallest submicron particles from entering the cleanroom. While HEPA filters can catch 99.97% of particles at 0.3u, ULPA filters can catch 99.999% at 0.12u.

- Owing to extremely fine linewidths, the manufacturing processes in semiconductor cleanrooms are highly sensitive to temperature and humidity variations. Typically, semiconductor cleanrooms need +1 degrees Fahrenheit and +5% or 10% relative humidity. This requires dedicated air handlers for each room with hot and cold elements. Most semiconductor cleanrooms have dedicated chillers and boilers to support the HVAC system. Furthermore, personnel working in semiconductor cleanrooms usually wear bunny suits, booties, hoods, masks, and gloves to prevent particles from entering the cleanroom. After garbing up, the personnel often pass through a cleanroom air shower, which blows them off with HEPA-filtered air to remove any particles on the outside of their cleanroom garments.

- Furthermore, the growing investments in the semiconductor industry around the world are a key growth driver for the market. For instance, in August 2022, the United States government passed the CHIPS and Science Act aimed at boosting semiconductor chip manufacturing in the country. It authorized around USD 52 billion in government subsidies for semiconductor manufacturing and research in the US and an estimated USD 24 billion in investment tax credits for semiconductor chip manufacturers.

- Due to this, the growing demand for nanotechnology and semiconductors necessitates implementing more sophisticated cleanroom procedures. Rensselaer Polytechnic Institute (RPI) provides the Micro and Nanofabrication Clean Room (MNCR) facility, housed within the Center for Materials, Devices, and Integrated Systems (CMDIS), which offers the BYOND program to undergraduate students seeking to establish a solid foundation and acquire training for a career in this field.

- With the semiconductor industry expanding significantly and its dominance in the APAC region, the region is expected to provide significant potential growth to the studied market. The first modern cleanroom facility globally can be dated back to the 1960s, and the cleanroom facility was introduced to developing Asia, including Malaysia, in the 1980s.

- Cleanroom shifted from the US to Asia in the 1990s due to the growth of semiconductor and microelectronics manufacturing industries. US companies such as Intel, Dell, Motorola, etc. established their manufacturing facilities in Asia during that period, which has driven the growth of the cleanroom industry in Asia.

North America is Expected to Hold Significant Market Share

- It is anticipated that North America will experience significant growth during the projected period, primarily due to the rising aftermarket sales and the shift towards modified cut-to-length logging techniques in the region.

- This growth is largely attributed to the growing biotechnology industry, which is still young, especially compared with the automotive, chemical, and steel industries. The growth of the biotechnology industry is a unique story, and yet it rests on foundations common to other segments of American industry.

- Years of research, both government-funded and privately funded, continue to provide a knowledge base unequaled in the world. Through biomanufacturing, sustainable biomass across the United States has been converted into new products and provides an alternative to petroleum-based production for chemicals, medicines, fuels, materials, and more.

- For instance, in September 2022, President Biden signed an Executive Order (EO) on 'Advancing Biotechnology and Biomanufacturing Innovation for a Sustainable, Safe, and Secure American Bioeconomy.' In the EO, the President laid out his vision for a whole-of-government approach to advance biotechnology and biomanufacturing by creating a research agenda that outlines the foundational and use-inspired R&D needs that will lead to innovative solutions in health, climate change, energy, food security, agriculture, supply chain resilience, and national and economic security.

- With the growing biotechnology sector, cleanroom technology has seen significant investment from the regional players. For instance, in November 2022, Charles River Laboratoires International, Inc. announced the expansion of its cell therapy contract development and manufacturing (CDMO) facility in Memphis, Tenn. The expanded space is suitable for clinical and commercial cell therapy manufacturing, with an additional nine (9) state-of-the-art processing suites, adding to 16 cleanrooms.

- Furthermore, the regional countries are largely looking forward to strengthening chip manufacturing, which is expected to help America with the strategic technologies of the future, including AI, 5G, quantum computing, and more, that will determine global economic and military leadership for decades to come. According to a new report by the Semiconductor Industry Association, the US government has a strategic opportunity to reverse the decades-long trajectory of declining chip manufacturing in America, strengthen national security, make supply chains more resilient, and make the country one of the most attractive places in the world to produce semiconductors. This growth is expected to provide a wide share of traction to the North American cleanroom technology market as the companies have announced their plans to majorize the region in the upcoming few years.

Cleanroom Technology Industry Overview

In the cleanroom technology market, intense competitive rivalry prevails due to the fragmentation of the cleanroom equipment industry, with numerous vendors vying for market share. Among these vendors, especially in the consumable segments, fierce competition is evident as they seek to capture a larger portion of the market. Key players in this sector include M+W Group GmbH, Azbil Corporation, Taikisha Global Limited, Kimberly Clark Corporation, Ardmac Ltd, and more.

In May 2023, ExyteSingapore, a renowned Engineering, Procurement, and Construction (EPC) firm specializing in high-tech facilities, received the prestigious SBR International Business Award in the Industrial Construction category. This accolade recognizes the company's exceptional execution in designing and constructing a new facility for GlobalFoundries (GF), a semiconductor company in Singapore. The state-of-the-art facility spans 23,000 sqm of cleanroom space and includes a Central Utility Building (CUB) and administrative offices. It will have the capacity to produce 450,000 wafers (300mm) annually. Upon completion, GF's Singapore site will boast a total capacity of around 1.5 million wafers (300mm) per year.

In the same month, Azbil Production (Thailand) Co. Ltd., a production subsidiary located in Chonburi, Thailand, announced plans to construct a new factory building. The primary aim of this expansion is to fortify the company's global production system, supporting overseas business development. The new facility will enhance production capacity and enable the manufacture of a broader range of items in anticipation of rising demand as Azbil Group's overseas business continues to grow. Additionally, it will cater to the needs of the Group's overseas customers for advanced production of various products.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Degree of Competition

- 4.3 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Overall Growth in Biotechnology and Healthcare Spending in Major Markets

- 5.1.2 Stringent Government Regulations and Demand for Quality Products

- 5.2 Market Challenges

- 5.2.1 High Installation, Maintenance Costs, and Lack of Skilled Workforce

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Type of Equipment

- 6.1.1.1 Cleanroom Air Showers

- 6.1.1.2 HVAC Systems

- 6.1.1.3 Laminar Air Flow Systems

- 6.1.1.4 High Efficiency Filters

- 6.1.1.5 Desiccator Cabinets

- 6.1.1.6 Fan Filter Units

- 6.1.2 Type of Consumable

- 6.1.2.1 Apparels

- 6.1.2.2 Gloves

- 6.1.2.3 Wipes

- 6.1.2.4 Vacuum Systems

- 6.1.2.5 Disinfectants

- 6.1.2.6 Other Types of Consumables

- 6.1.1 Type of Equipment

- 6.2 By End-User

- 6.2.1 Pharmaceutical

- 6.2.2 Biotechnology

- 6.2.3 Medical Devices

- 6.2.4 Hospitals

- 6.2.5 Semiconductor Manufacturing

- 6.2.6 Other End-Users

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Rest of the World (Latin America and Middle East and Africa)

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 M+W Group

- 7.1.2 Azbil Corporation

- 7.1.3 Taikisha Global Limited

- 7.1.4 Kimberly Clark Corporation

- 7.1.5 Ardmac Ltd

- 7.1.6 Ansell Limited

- 7.1.7 Clean Air Products

- 7.1.8 Labconco Corporation