|

市场调查报告书

商品编码

1404096

自动储存与搜寻系统-市场占有率分析、产业趋势与统计、2024年至2029年成长预测Automated Storage and Retrieval System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

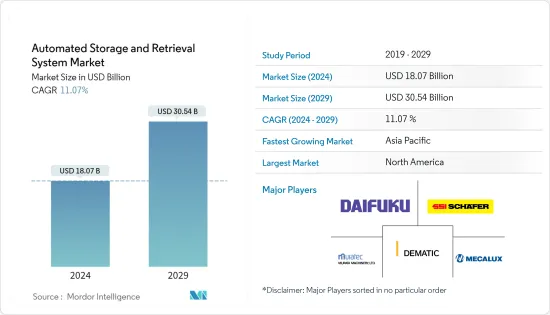

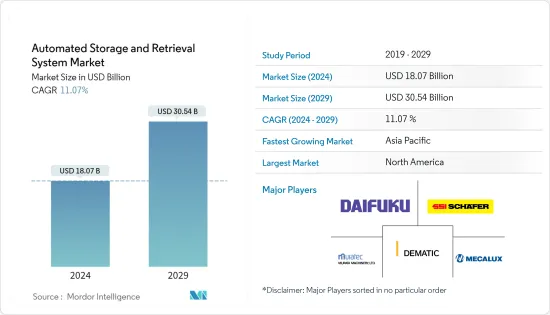

预计2024年自动化储存和搜寻系统市场规模为180.7亿美元,预计到2029年将达到305.4亿美元,预测期内(2024-2029年)复合年增长率为11.07%,预计还会增长。

电子商务的普及、不断变化的消费者需求以及全球劳动力短缺正在推动对灵活的自动化解决方案的需求,以更快、更有效率地处理和交付订单。 ASRS技术应用于製造设备、仓库和配送中心,用于物料运输和库存管理。这些系统通常用于冷藏、汽车、製药、食品和饮料以及电子商务等应用。

主要亮点

- ASRS 在仓库应用中最有利。这些系统可以节省大量的占地面积,这是仓储业务的重要因素。随着技术的发展,物料流动和控制得到了改善。该设备提供更好的可视化以及以更高的速度处理可变性、多样性和体积的能力,从而产生更高的价值。

- 机场为先进技术而进行的扩建活动促进了所研究市场的成长。例如,2022年7月,美国运输部联邦航空管理局(FAA)宣布将向全国85个机场拨款约10亿美元,用于改善各种规模的航站楼。开发机场航站大楼将确保更好的客户体验、更有效地在经济中运输货物、最大限度地降低价格并增强美国的竞争。

- 此外,对管理仓储、运输、物流等的高效解决方案的需求不断增长,这也增加了对 ASRS 的需求。随着对自动储存和搜寻系统的需求增加,公司正在采取各种措施来巩固其市场地位。例如,2023年1月,OPEX Corporation透过其子公司OPEX GmbH与Transition建立策略合作伙伴关係,为其法国客户带来尖端的仓库自动化技术。透过一整套技术解决方案,包括 Perfect Pick、货到人 (AS/RS) 和 Sure Sort、机器人分类系统,OPEX 帮助世界各地的客户降低成本、改善工作流程,从而使之成为可能改善基础设施,提高基础设施效率。市场参与者的这些努力预计将在预测期内重振自动储存和搜寻系统市场。

- 此外,2022年2月,Addverb Technologies宣布在美国设立子公司办事处,为北美和南美的客户提供服务。 Addverbis 专注于建造全自动仓库和製造设施。我们与多个行业合作,包括电子商务、零售和杂货。该公司提供六种类型的机器人:移动机器人、托盘机器人、穿梭机器人、分类机器人和紫外线消毒机器人。我们还提供基于穿梭机的 ASRS 系统和软体,用于建造高速机器人履行中心。

- 然而,需要熟练的操作员来实现自动化物料搬运系统的正常运作和维护可能是新兴国家的主要障碍。然而,自动化物料搬运供应商试图透过提供定期维护来解决这个问题。除了高昂的初始成本外,在车辆的整个保质期内需要熟练人员执行各种任务也被广泛认为是所研究市场的关键问题。

- 相反,预计在大流行后时期,人们对数位和自动化技术的认识将显着提高,这预计将支持所研究市场在预测期内的成长。例如,2023 年 1 月,仓库自动化领域的主要企业之一 AutoStore 推出了 Pio,这是其为中小型企业 (SMB) 定制的、广受好评的 AutoStore 立方体存储技术的即插即用版本。」产品输入/输出」)已宣布。

自动储存和搜寻系统(ASRS)市场趋势

新兴市场的电子商务成长推动市场

- 随着越来越多的公司采用自动化来提高效率、降低成本并保持竞争,工作场所对职场来说也将变得更加安全。 ASRS 市场的主要驱动力之一是工作和安全条件的改善。

- 电子商务公司形成配送网路。 Flipkart 的物流在印度被称为「eKart」就是一个例子。同时,快递物流等物流公司向零售商和经销商运送大量货物。这些发展预计将支持 AS/RS 系统的普及。此外,根据 Ascential's Edge 的数据,线上零售商阿里巴巴的营收预计将在 2022 年达到 7,807 亿美元,并在 2027 年达到 11,375 亿美元。

- 电子商务产业的巨大成长是所研究市场的关键成长动力。 IBEF预计,2022年印度电子商务产业规模将达748亿美元,2025年将增加至1,880亿美元,2030年将进一步增至3,500亿美元。此外,2022年6月,456万名註册卖家和服务供应商透过政府电子市场(GeM)平台向买家下达了1,035万笔订单,总价值330.7亿美元。

- 亚马逊和沃尔玛等零售和电子商务巨头的存在极大地促进了该地区对仓储和仓储服务的需求。据沃尔玛称,截至 2022 年,该公司使用 31 个专用的电子商务履行中心和 4,700 家商店(位于 90% 的美国人口 10 英里范围内)来履行线上订单。根据Google和淡马锡控股的研究,新加坡电商市场的GMV预计将达到50亿美元。同时,到2025年,马来西亚和印尼市场预计将分别超过70亿美元和530亿美元。

- 此外,根据国际贸易局的数据,澳洲被认为是全球第 11 大电子商务市场,预计到 2024 年销售额将达到 323 亿美元。销售活动、市场和创新的 BNPL(先买后付)支付方式的流行是电子商务活动成长的主要因素。此外,报告预测三年内电子商务将占零售支出的 12%。

- 此外,根据国际贸易局的数据,菲律宾电子商务市场销售额近期达到170亿美元,主要得益于7,300万在线活跃消费者。预计到2025年将成长17%,达到240亿美元。

亚太市场成长显着

- 在亚太地区,仓库公司对自动化的日益关注预计将推动自动储存和搜寻系统(ASRS)市场的发展。 IBEF表示,近年来,由于电子商务市场的成长,A级仓储市场一直在稳步成长。预计到 2025 年将成长 15%。

- 中国是工业4.0的主要采用者,拥有世界上最先进的製造设施,领先欧盟、美国和日本。例如,根据世界经济论坛的数据,目前全球有69家工厂被认为是使用工业4.0技术的领先者,其中中国目前有20家,其次是欧盟19家、美国7家和日本。5个工厂。除了作为全工厂自动化的基础之外,自动储存和搜寻系统也是工业 4.0 的基础。

- 包装食品、零嘴零食、肉类和调味饮料的消费量显着增加。例如,根据加拿大农业和农业食品部的数据,到2025年,中国的包装食品零售额预计将达到3,667.5亿美元。此外,根据日本统计局的数据,2023 年食品製造业销售额预计将达到 2,066 亿美元。预计到 2027 年将达到 2,396 亿美元。

- 此外,预计汽车行业的成长将推动所研究的市场。根据 JADA 的数据,2022 年,日本领先的汽车製造商丰田汽车在该国的销量约为 125 万辆。儘管与前一年同期比较减12.1%,丰田汽车的销量却是第二名的两倍多。位居第二的SUZUKI2022 年销量略高于 60 万辆。

- 加大力度实现机场现代化并引进最新技术,使其高效、安全和具有成本效益,预计也将推动所研究市场的成长。此外,到 2025 年,德里、海德拉巴和班加罗尔这三个官民合作关係(PPP) 机场可能会投资 39 亿美元(3,000 亿印度卢比)进行扩大开发。这些旨在实现机场现代化并引入最新技术以提高机场效率、安全性和成本效益的努力预计将推动所研究市场的成长。

- 印度民航部长表示,印度计划在未来 10 至 15 年内投资 600 亿美元建造 100 个新机场,让航班更便宜。这些因素预计将增加该国对 AMH 设备的需求。该国的汽车最终用户产业需要处理大量物料并具有高吞吐率,预计将选择 AMH 系统。

- 根据 DataReportal 的数据,2022 年 1 月印尼有 2.047 亿网路用户。截至 2022 年初,印尼的网路普及为总人口的 73.7%。预计工作活动自动化的可能性将在预测期内推动对 ASRS 的需求。

自动储存和搜寻系统 (ASRS) 产业概述

所研究的市场似乎与采用产品创新和併购等策略的大公司相比具有良好的竞争力。在预测期内,自动储存和搜寻领域领先製造商的不断增长预计将加剧竞争对手之间的敌对行动。 DAIFUKU CO. LTD.和 Schaefer Systems International Pvt Ltd. 等市场老牌企业对整个市场有重大影响。此外,此类系统的日益普及,特别是在仓库自动化领域,也对主要参与企业之间的竞争产生了重大影响。

2023年7月,卡夫亨氏宣布将投资超过4亿美元建造北美最大的自动化CPG物流中心之一。该设施的设计包括一个 24/7 的自动储存和搜寻系统,能够为卡夫亨氏的客户提供两倍的运输量,并包括该公司 60% 的食品服务业务和约 30% 的所有干产品。

ABB Robotics 于2023 年4 月推出Robotic Item Picker,引领产业发展,这是一种基于人工智慧和视觉的新型解决方案,可在仓库和履行中心的非结构化环境中准确检测和拣选物品。ABB Robotics宣布将加强其物流自动化产品组合。 Item Picker 可轻鬆整合到现有的自动化储存和搜寻解决方案中,包括穿梭式、立方体和 3D 储存解决方案,从而减少工程工作量并加快上市时间。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 产业价值链分析

- 评估宏观经济趋势对市场的影响

第五章市场动态

- 市场驱动因素

- 日益重视职业安全

- 新兴国家电子商务的成长

- 市场抑制因素

- 对熟练劳动力的需求以及对人工替代的担忧

第六章市场区隔

- 依产品类型

- 固定通道型

- 堆垛机机

- 单位负荷

- 迷你路

- 穿梭系统

- 托盘负载

- 手提袋、木箱等

- 垂直升降模组

- 固定通道型

- 按最终用户产业

- 製造环境

- 车

- 食品和饮料

- 生命科学

- 其他製造业

- 非製造业

- 通用产品

- 物流/仓储

- 飞机场

- 其他非製造环境

- 製造环境

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 欧洲其他地区

- 亚太地区

- 中国

- 日本

- 印度

- 其他亚太地区

- 拉丁美洲

- 巴西

- 墨西哥

- 其他拉丁美洲

- 中东/非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 中东和非洲其他地区

- 北美洲

第七章竞争形势

- 公司简介

- Daifuku Co. Ltd

- Schaefer Systems International Pvt. Ltd.

- Dematic(Kion Group AG)

- Murata Machinery Ltd

- Mecalux SA

- Honeywell Intelligrated Inc.

- KUKA AG

- Knapp AG

- Kardex AG

- Toyota Industries Corporation

- Viastore Systems GmbH

第八章投资分析

第9章市场的未来

The Automated Storage and Retrieval System Market size is estimated at USD 18.07 billion in 2024, and is expected to reach USD 30.54 billion by 2029, growing at a CAGR of 11.07% during the forecast period (2024-2029).

The explosion of e-commerce, changing consumer demands, and global labor shortages are driving the need for flexible automated solutions that make order fulfillment and distribution faster and more efficient. ASRS technology is finding application in manufacturing units, warehouses, and distribution centers for materials transport and inventory management purposes. These systems are commonly utilized in cold storage, automotive, pharmaceutical manufacturing, food and beverage, and e-commerce applications.

Key Highlights

- ASRS is most beneficial in warehouse applications. These systems save ample floor space, which is a crucial factor in warehouse operations. With the evolution of technology, the flow and control of materials have improved. The equipment offers better visualization and the ability to handle variability, variety, and volume at higher speeds, thus generating increased value.

- The expansion activities carried out by the airports for advanced technologies will boost the studied market growth. For instance, in July 2022, The U.S. Department of Transportation's Federal Aviation Administration (FAA) announced the award of nearly USD 1 billion to 85 airports across the country for improving terminals of all sizes. Building airport terminals will ensure better customer experiences, move goods through the economy with more efficiency, minimize prices, and increase U.S. competitiveness.

- Furthermore, increasing need for efficient and effective solutions for managing warehouses, traffic, logistics, and others, the need for ASRS has been growing. With the growing demand for automated storage and retrieval systems, various companies have been undertaking various initiatives to strengthen their position in the market. For instance, in January 2023, OPEX Corporation, through its subsidiary, OPEX GmbH, entered into a strategic partnership with Transition to launch its leading-edge warehouse automation technology to customers in France. Through its comprehensive suite of technology solutions (including Perfect Pick, a goods-to-person (AS/RS), and Sure Sort, a robotic sorting system), OPEX enables its clients to reduce costs, improve workflow, and drive efficiencies in infrastructure around the world. Such initiatives by the companies in the market are expected to fuel the automated storage and retrieval system market during the forecast period.

- In addition, in February 2022, AddverbTechnologies announced the establishment of a subsidiary office in the United States to serve its North and South American customers. Addverbis focuses on creating fully automated warehouses and manufacturing facilities. It is collaborating with several industries, including e-commerce, retail, and grocery. The company offers six robots comprising a mobile robot, a pallet robot, a shuttle robot, a sorting robot, and a U.V. disinfection robot. It also provides a shuttle-based ASRS system and software to create high-speed robotic fulfillment centers.

- However, the need for skilled operators to enable the adequate functioning and maintenance of automated material-handling systems could be a significant impediment in emerging countries. However, automated material-handling vendors have been trying to offset this issue by offering periodic maintenance. In addition to high initial costs, the need for skilled workers to perform various activities throughout the vehicles' shelf life is widely considered a significant concern in the market studied.

- On the contrary, during the post-pandemic, the significantly increased awareness of digital and automated technologies is expected to support the studied market's growth in the forecast period. For instance, in January 2023, AutoStore, one of the significant warehouse automation companies, launched Pio ("Product In/Out"), which is a plug-and-play version of acclaimed AutoStore cube storage technology tailored for small and medium-sized businesses (SMBs).

Automated Storage & Retrieval System (ASRS) Market Trends

Growth of E-commerce in Developing Countries to Drive the Market

- As more companies turn to automation to boost efficiency, lower costs, and remain competitive, they also make the workplace safer for workers. One of the main causes for the ASRS market is improving working and safety conditions.

- E-commerce businesses are forming their delivery networks. Flipkart's logistics, which India calls "eKart," is one instance. On the other hand, logistics companies such as Express Logistics deliver bulk shipments to retailers and distributors. Such developments are anticipated to boost the penetration of AS/RS systems. In addition, according to Edge by Ascential, the sale of online retailer Alibaba acquired USD 780.70 billion in 2022 and is believed to reach USD 1,137.5 billion in 2027.

- The immense growth in the e-commerce industry is a significant growth driver for the Market studied. According to IBEF, the Indian e-commerce sector reached USD 74.8 billion in 2022 and is predicted to increase to USD 188 billion by 2025, further to USD 350 billion by 2030. Furthermore, in June 2022, 10.35 million orders totaling USD 33.07 billion were fulfilled by 4.56 million registered sellers and service providers through the Government e-Marketplace (GeM) platform for 60,632 purchasers.

- The existence of retail and e-commerce giants, such as Amazon and Walmart, contributes immensely to the region's demand for warehouse and storage services. According to Walmart, as of 2022, the organization uses 31 dedicated e-commerce fulfillment hubs and 4,700 stores within 10 miles of 90 percent of the United States population to fulfill online orders. According to Google and Temasek Holdings' studies, the GMV for the Singaporean e-commerce market is predicted to reach USD 5 billion. In contrast, the Malaysian and Indonesian markets will surpass USD 7 billion and USD 53 billion, respectively, by 2025.

- Moreover, according to the International Trade Administration, Australia is considered the eleventh-largest e-commerce market in the world, and revenue is predicted to reach USD 32.3 billion by 2024. The popularity of sales events, marketplaces, and innovative buy now, pay later (BNPL) payment options contribute significantly to the increase in e-commerce activities. Furthermore, the same report predicted that e-commerce would account for 12 percent of retail spending within three years.

- Additionally, according to the International Trade Administration, the Philippines' eCommerce market sales reached USD 17 billion recently, due mainly to 73 million online active consumers. This is expected to reach USD 24 billion by 2025, with a 17 percent increase.

Asia-Pacific to Experience Significant Market Growth

- The Asia-Pacific is witnessing an increasing focus on automation by warehousing companies, which is expected to drive the automated storage and retrieval systems (ASRS) market. According to IBEF, the grade-A warehousing market has grown steadily in the recent past due to the growth of e-commerce in the country. It is expected to grow at a rate of 15 percent by 2025.

- China is a significant adopter of Industry 4.0, and the country is home to some of the most advanced manufacturing facilities in the world, ahead of the European Union, the United States, and Japan. For instance, according to the World Economic Forum, of the 69 factories worldwide now considered leaders using Industry 4.0 technologies, China is currently home to 20, followed by 19 in the European Union, 7 in the United States, and 5 in Japan. Besides being the foundation for plant-wide automation, the automated storage and retrieval system also serves as a foundation for Industry 4.0.

- There has been a significant increase in packaged food, snacks, meat, and flavored drinks consumption. For instance, according to Agriculture and Agri-Food Canada, packaged food retail sales in China are forecasted to reach USD 366.75 billion by 2025. In addition, according to Statistics Bureau Japan, the revenue in the manufacture of Food Products is projected to amount to USD 206.60 billion in 2023. Also, it is further anticipated to reach 239.60 billion in 2027.

- Further, the growth of the automotive industry is expected to drive the studied Market. According to JADA, in 2022, Toyota, the leading car manufacturer in Japan, sold around 1.25 million vehicles domestically. Despite a decrease of 12.1 percent compared to the prior year, Toyota reported more than twice as many unit sales as the runner-up. Suzuki, which came in second, sold slightly over 600 thousand vehicles in 2022.

- The increasing initiatives to modernize airports and equip them with the latest technology to make them efficient, safe, and cost-effective are also expected to drive the growth of the studied Market. In addition, by 2025, the three public-private partnership (PPP) airports in Delhi, Hyderabad, and Bengaluru will likely invest USD 3.9 billion (INR 300 billion) in expansion development. Such initiatives to modernize airports and equip them with the latest technology to make them efficient, safe, and cost-effective are expected to drive the growth of the studied Market.

- According to the Civil Aviation Minister, India plans to build 100 new airports with an investment of USD 60 billion in the next 10-15 years to make air travel more affordable. These factors are expected to boost the demand for AMH equipment in the country. The automotive end-user industry in the country, which handles a large volume of materials and has a high throughput ratio, is expected to opt for AMH systems.

- According to DataReportal, in January 2022, Indonesia had 204.7 million internet users. At the start of 2022, Indonesia's internet penetration rate was 73.7 percent of the overall population. The possibility of the automation of work activities is expected to drive the demand for ASRS during the forecast period.

Automated Storage & Retrieval System (ASRS) Industry Overview

The studied market appears favorably competitive, with significant players adopting strategies like product innovation and mergers and acquisitions. The growing presence of major manufacturers in the automated storage and retrieval sector is expected to intensify competitive rivalry during the forecast period. Market incumbents, such as Daifuku and Schaefer Systems International Pvt Ltd., considerably influence the overall market. Moreover, the growing deployment of such systems, especially in warehouse automation, is also having a significant impact on the competitiveness of the major players.

In July 2023, the Kraft Heinz Company announced an investment of more than USD 400 million to build one of the largest automated CPG distribution centers in North America. The facility's design includes a 24/7 automated storage and retrieval system with the ability to drive twice the volume for Kraft Heinz customers, distributing more than 60 percent of the Company's food service business and approximately 30 percent of all dry goods.

In April 2023, ABB Robotics announced the enhancement of its industry-leading logistics automation portfolio with the launch of the Robotic Item Picker, which is a new AI and vision-based solution that can accurately detect and pick items in unstructured environments in warehouses and fulfillment centers. The Item Picker reduces engineering effort and accelerates time-to-market by easily integrating into existing automated storage and retrieval solutions, such as shuttle, cubic, and 3D storage solutions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of Macroeconomic Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Emphasis on Workplace Safety

- 5.1.2 Growth of E-commerce in Developing Countries

- 5.2 Market Restraints

- 5.2.1 Need for Skilled Workforce and Concerns over Replacement of Manual Labor

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Fixed Aisle System

- 6.1.1.1 Stacker Crane

- 6.1.1.1.1 Unit Load

- 6.1.1.1.2 Mini Load

- 6.1.1.2 Shuttle Systems

- 6.1.1.2.1 Pallet Loads

- 6.1.1.2.2 Totes, Crates, and Others

- 6.1.2 Vertical Lift Module

- 6.1.1 Fixed Aisle System

- 6.2 By End-user Industry

- 6.2.1 Manufacturing Environments

- 6.2.1.1 Automotive

- 6.2.1.2 Food and Beverages

- 6.2.1.3 Life Sciences

- 6.2.1.4 Other Manufacturing Environments

- 6.2.2 Non-manufacturing Environments

- 6.2.2.1 General Merchandise

- 6.2.2.2 Logistics and Warehousing

- 6.2.2.3 Airport

- 6.2.2.4 Other Non-manufacturing Environments

- 6.2.1 Manufacturing Environments

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Italy

- 6.3.2.5 Spain

- 6.3.2.6 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 Rest of the Asia-Pacific

- 6.3.4 Latin America

- 6.3.4.1 Brazil

- 6.3.4.2 Mexico

- 6.3.4.3 Rest of Latin America

- 6.3.5 Middle East and Africa

- 6.3.5.1 United Arab Emirates

- 6.3.5.2 Saudi Arabia

- 6.3.5.3 South Africa

- 6.3.5.4 Rest of Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Daifuku Co. Ltd

- 7.1.2 Schaefer Systems International Pvt. Ltd.

- 7.1.3 Dematic (Kion Group AG)

- 7.1.4 Murata Machinery Ltd

- 7.1.5 Mecalux SA

- 7.1.6 Honeywell Intelligrated Inc.

- 7.1.7 KUKA AG

- 7.1.8 Knapp AG

- 7.1.9 Kardex AG

- 7.1.10 Toyota Industries Corporation

- 7.1.11 Viastore Systems GmbH