|

市场调查报告书

商品编码

1404107

润滑油添加剂:市场占有率分析、产业趋势与统计、2024年至2029年成长预测Lubricant Additives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

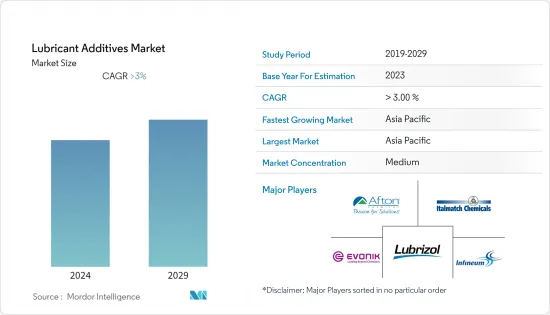

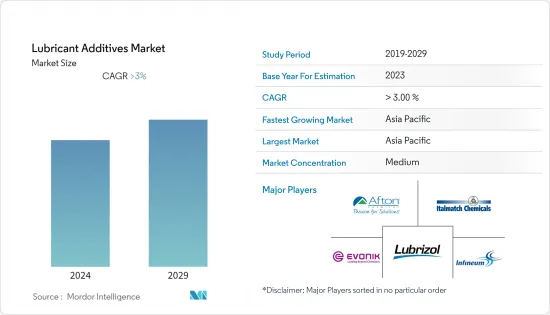

预计润滑油添加剂市场在预测期内复合年增长率将超过 3%。

COVID-19 的爆发对市场产生了负面影响。 COVID-19 相关法规减少了多个行业的维护需求。主要影响出现在汽车和建筑业,但从 2021 年起,由于汽车和建设活动的增加,市场开始稳定成长。

主要亮点

- 短期来看,中东和非洲有关排放气体和工业成长的严格环境法规是市场成长的主要驱动力。

- 然而,机械和汽车换油週期的延长预计是预测期内抑制目标行业成长的主要因素。

- 然而,高性能润滑油在亚太地区的日益普及可能会在不久的将来为全球市场提供利润丰厚的成长机会。

- 由于其理想的特性,预计亚太地区的润滑油添加剂市场将在评估期间实现健康成长,从而导致润滑油在汽车和建筑等最终用途领域中广泛使用。

润滑油添加剂市场趋势

汽车和其他运输业的需求增加。

- 汽车和飞机、船舶等其他运输媒介是润滑油的最大市场。

- 引擎设计不断改进,以提高性能、提高效率并满足环境排放气体法规。

- 机油、齿轮油、变速箱油、润滑脂和压缩机油是各类汽车中使用最广泛的润滑油。润滑油在售后市场和OEM中拥有很高的市场份额。

- 中负荷和高性能润滑油广泛用于承受高负载和快速摩擦的汽车零件,例如齿轮、传动系统和引擎。

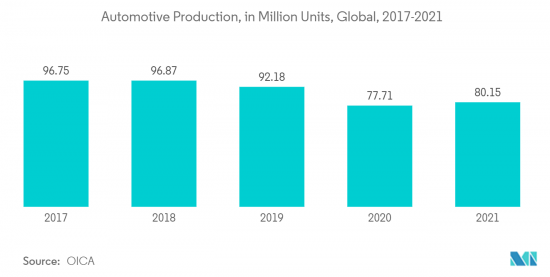

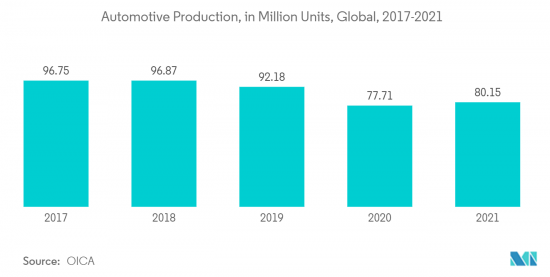

- 根据OICA的数据,2021年汽车(所有类型)总产量为80,145,988辆,比2020年的77,711,725辆成长3%。

- 在北美,美国也拥有世界上最大的汽车工业之一。根据OICA的数据,2021年汽车产量为9,167,214辆,比2020年的8,822,399辆成长4%。

- 复合材料在航太工业中的强劲成长,特别是在商业航空运输中,有望导致腐蚀抑制剂和去除液的变化。

- 此外,根据国际航空运输协会(IATA)的数据,2020年全球商业航空公司收益为3730亿美元,预计与前一年同期比较增长26.7%。做过。此外,预计到2022年将达到6,580亿美元。

- 最近,飞机製造商一直在寻找加快生产的方法,以填补积压的订单。例如,波音公司《2022-2041 年商业展望》预计,到 2041 年,全球新飞机交付总量将达到 41,170 架。截至 2019 年,全球持有数量约为 25,900 架,到 2041 年可能达到 47,080 架。

- 所有上述因素预计将在未来几年推动润滑油添加剂市场的发展。

中国主导亚太地区

- 在亚太地区,中国在区域市场占有率占据主导地位。食品和汽车工业正在成长。

- 根据OICA统计,2021年中国汽车产量为26,082,220辆,较去年同期成长3%。

- 食品加工业正趋于成熟并经历适度增长。加工和包装的冷冻食品越来越受欢迎。在饮料业,健康、天然、方便的即饮冰沙、果汁和优格的消费趋势正在兴起。

- 中国是金属加工液的主要消费国。该地区建设活动的强劲增长以及造船和飞机订单的增加预计将推动金属製造的成长。

- 近年来,中国的飞机和太空船产业经历了显着成长。根据波音《2022-2041年商业展望》,到2041年,中国将交付约8,485架新飞机,市场服务价值将达到5,450亿美元。

- 鑑于上述情况,预计中国将在预测期内主导亚太地区。

润滑油添加剂产业概况

全球润滑油添加剂市场已部分整合,主要参与者包括Evonik Industries AG、Italmatch Chemicals SpA(The Elco Corporation)、Infineum International Limited、The Lubrizol Corporation、Afton Chemical Corporation等(排名不分先后)。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 严格的排放环境法规

- 中东和非洲的工业成长

- 抑制因素

- 延长机械和汽车的换油週期

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(以金额为准的市场规模)

- 产品类别

- 分散剂和乳化剂

- 黏度指数增进剂

- 清洗皂

- 缓蚀剂

- 抗氧化剂

- 极压添加剂

- 摩擦调节剂

- 其他特性

- 润滑油类型

- 工艺油

- 其他润滑剂

- 最终用户产业

- 机动车辆及其他运输

- 发电

- 重型机械

- 冶金和金属加工

- 食品和饮料

- 其他最终用户产业

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 东南亚国协

- 其他亚太地区

- 北美洲

- 美国

- 墨西哥

- 加拿大

- 欧洲

- 德国

- 英国

- 俄罗斯

- 义大利

- 法国

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲

- 亚太地区

第六章竞争形势

- 合併、收购、合资、合伙和协议

- 市场排名分析

- 主要企业策略

- 公司简介

- Afton Chemical

- BASF SE

- BRB International

- Chevron Corporation

- Croda International PLC

- DOG Deutsche Oelfabrik Gesellschaft fur chemische Erzeugnisse mbH & Co. KG

- Dorfketal Chemicals(I)Pvt Ltd

- DOVER CHEMICAL CORPORATION

- Evonik Industries AG

- Infineum International Limited

- Jinzhou Kangtai Lubricant Additives Co. Ltd

- King Industries Inc.

- LANXESS

- Multisol

- RT Vanderbilt Holding Company Inc.

- Shepherd Chemical

- Italmatch Chemicals SpA(The Elco Corporation)

- The Lubrizol Corporation

- Wuxi South Petroleum Additives Co. Ltd

第七章 市场机会及未来趋势

- 高性能润滑油在亚太地区越来越受欢迎

The lubricant additives market is projected to register a CAGR of over 3% during the forecast period.

The Covid pandemic had a negative impact on the market. COVID-19-related restrictions led to decreased maintenance requirements from several industries. The major impact was observed in the automotive and construction industry, However, the market started growing steadily, owing to increased automotive and construction activities, since 2021.

Key Highlights

- Over the short term, the stringent environmental regulations regarding emissions, and industrial growth in the Middle East and Africa are major factors driving the growth of the market studied.

- However, extended oil change intervals in machinery and automobiles are a key factor anticipated to restrain the growth of the target industry over the forecast period.

- Nevertheless, the growing popularity of high-performance lubricants in Asia-Pacific is likely to create lucrative growth opportunities for the global market soon.

- Asia-Pacific is estimated to witness healthy growth over the assessment period in the lubricant additives market due to the wide usage of lubricants in end-use application segments, such as automotive, and construction due to their desirable properties.

Lubricant Additives Market Trends

Increasing Demand from Automotive and Other Transportation Industry.

- Automotive and other transportation media, such as aircraft and marine, are the largest markets for lubricants.

- Engine designs have been continually improved to enhance performance, increase efficiency, and meet environmental emission regulations.

- Engine oils, gear oils, transmission oils, greases, and compressor oils are the most widely used lubricants in all kinds of automobiles. Lubricants have a good share in the aftermarket and among OEMs.

- Medium-duty and high-performance lubricants are used extensively in vehicle components, such as gears, transmission systems, and engines, which are subjected to high loads and rapid rubbing.

- The automotive industry has been growing rapidly increasing the usage of lubricants and additives, over the past few years, according to OICA, the total production of vehicles (all types) in the year 2021 was 80,145,988 units and registered a growth of 3% when compared to 77,711,725 units in 2020.

- In North America, the United States also has one of the largest automotive industries globally. According to OICA, the automotive production in 2021 accounted for 91,67,214 units, an increase of 4% in comparison to the production in 2020, which was reported to be 88,22,399 units.

- The strong growth of composites in the aerospace industry, particularly in commercial air transport, is poised to lead to changes in corrosion inhibitors and removal fluids.

- Furthermore, according to the International Air Transport Association (IATA), the global revenue for commercial airlines was valued at USD 373 billion in 2020 and was estimated at USD 472 billion in 2021, registering a growth rate of 26.7% Y-o-Y. Furthermore, the revenue is expected to reach USD 658 billion by 2022.

- Recently, aircraft manufacturers are looking for ways to accelerate production to fill order backlogs. For instance, according to the Boeing Commercial Outlook 2022-2041, the total global deliveries of new airplanes are estimated to be 41,170 by 2041. The global airplane fleet amounted to around 25,900 units as of the year 2019 and the fleet number is likely to reach 47,080 units by 2041.

- All the above factors are expected to drive the market for lubricant additives in the coming years.

China to Dominate the Asia-Pacific Region

- In the Asia-Pacific region, China dominated the regional market share. With growing food, and automotive industrial activities.

- China is the leading manufacturer of the automotive industry, According to, OICA, the country has also produced 26,082,220 units of vehicles in 2021, a 3% growth in comparison to the same period last year.

- The food processing industry is moving toward maturity in the country, witnessing moderate growth. Processed and packaged frozen foods are increasingly becoming popular. While in the beverage industry, the trend for the consumption of healthy, natural, and convenient ready-to-drink smoothies, juices, and yogurts has been emerging.

- China is the leading consumer of metalworking fluids. The growth for metalworking is expected to be driven by the robust growth in construction activities and increasing shipbuilding and aircraft orders in the region.

- The Chinese aircraft and spacecraft industry has depicted significant growth over the years. In China, according to the Boeing Commercial Outlook 2022-2041, around 8,485 new deliveries will be made by 2041 with a market service value of USD 545 billion.

- Based on the aforementioned aspects, China is expected to dominate the Asia-Pacific region in the forecast period.

Lubricant Additives Industry Overview

The global lubricant additives market is partially consolidated in nature, The major players include Evonik Industries AG, Italmatch Chemicals S.p.A (The Elco Corporation), Infineum International Limited, The Lubrizol Corporation, and Afton Chemical Corporation, among others (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Stringent Environmental Regulations Regarding Emissions

- 4.1.2 Industrial Growth in Middle-East and Africa

- 4.2 Restraints

- 4.2.1 Extended Oil Change Intervals in Machinery and Automobiles

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Product Type

- 5.1.1 Dispersants and Emulsifiers

- 5.1.2 Viscosity Index Improvers

- 5.1.3 Detergents

- 5.1.4 Corrosion Inhibitors

- 5.1.5 Oxidation Inhibitors

- 5.1.6 Extreme-pressure Additives

- 5.1.7 Friction Modifiers

- 5.1.8 Other Functions

- 5.2 Lubricant Type

- 5.2.1 Engine Oil

- 5.2.2 Transmission and Hydraulic Fluid

- 5.2.3 Metalworking Fluid

- 5.2.4 General Industrial Oil

- 5.2.5 Gear Oil

- 5.2.6 Grease

- 5.2.7 Process Oil

- 5.2.8 Other Lubricant Types

- 5.3 End-user Industry

- 5.3.1 Automotive and Other Transportation

- 5.3.2 Power Generation

- 5.3.3 Heavy Equipment

- 5.3.4 Metallurgy and Metal Working

- 5.3.5 Food and Beverage

- 5.3.6 Other End-users Industries

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN Countries

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Mexico

- 5.4.2.3 Canada

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Russia

- 5.4.3.4 Italy

- 5.4.3.5 France

- 5.4.3.6 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Afton Chemical

- 6.4.2 BASF SE

- 6.4.3 BRB International

- 6.4.4 Chevron Corporation

- 6.4.5 Croda International PLC

- 6.4.6 DOG Deutsche Oelfabrik Gesellschaft fur chemische Erzeugnisse mbH & Co. KG

- 6.4.7 Dorfketal Chemicals (I) Pvt Ltd

- 6.4.8 DOVER CHEMICAL CORPORATION

- 6.4.9 Evonik Industries AG

- 6.4.10 Infineum International Limited

- 6.4.11 Jinzhou Kangtai Lubricant Additives Co. Ltd

- 6.4.12 King Industries Inc.

- 6.4.13 LANXESS

- 6.4.14 Multisol

- 6.4.15 RT Vanderbilt Holding Company Inc.

- 6.4.16 Shepherd Chemical

- 6.4.17 Italmatch Chemicals SpA (The Elco Corporation)

- 6.4.18 The Lubrizol Corporation

- 6.4.19 Wuxi South Petroleum Additives Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Popularity of High-performance Lubricants in Asia-Pacific