|

市场调查报告书

商品编码

1404323

海底光缆:市场占有率分析、产业趋势与统计、2024-2029 年成长预测Submarine Optical Fiber Cable - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

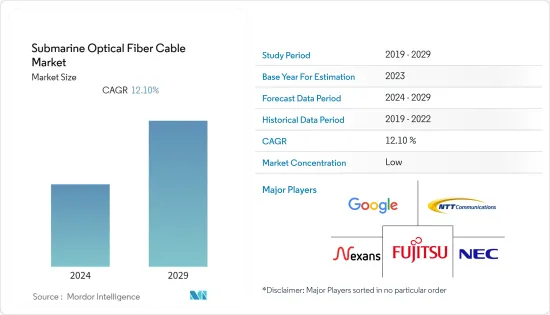

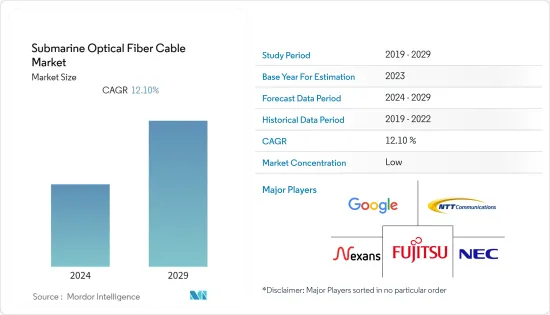

预计2024年海底光缆市场规模为41.6亿美元,预计2029年将达72亿美元,在预测期内(2024-2029年)复合年增长率为12.10%。

主要亮点

- 对高速网路基础设施的投资不断增加正在推动海底光缆市场的成长。全球海量资料的产生和传输持续增加是市场的关键驱动因素之一。因此,许多网路骨干业者可能会在预测期内投资海底光缆市场。

- 海底电缆系统承载超过 99% 的洲际通讯流量,是全球互联互通的无形推动者。在中国和印度等国家的推动下,区域通讯业在全球范围内高速发展。然而,网路基础设施仍然是世界许多地区的关键问题。

- 世界新兴市场的许多人已经可以连接到互联网,这可能是加强有线网路的下一步。因此,包括政府机构在内的许多公司都将海底光缆市场视为机会。

- 行动宽频的快速普及对市场成长做出了重大贡献。有几个因素正在增加全球对智慧型手机的需求,包括可支配收入的增加、5G 的出现以及通讯基础设施的改善。例如,根据 GSMA 的数据,全球智慧型手机订阅量预计将从 2022 年占总连线数的 76% 增加到 2030 年的 92%。

- 海底电缆涂有硅胶,并包裹有多层陡电线、塑胶、铜鞘套、尼龙线和聚乙烯绝缘层,以保护这些光纤免受损坏,但仍确保安全性和寿命。为了确保这一点,定期维护是需要,这是昂贵的。高安装成本和维护成本预计将成为市场成长的挑战。

- 此外,卫星通讯投资的增加也是限制研究市场成长的主要因素。电缆仅适用于短程途径,尤其是在交通拥挤时。然而,随着距离的增加和密度的降低,卫星在经济上变得有吸引力。此外,与任何其他无线部署一样,拥有卫星通讯链路比部署海底电缆要快得多,这是卫星通讯相对于海底光缆的另一个关键优势。

海底光缆市场趋势

智慧型手机普及与网路频宽需求增加推动市场

- 近年来,智慧型手机产业经历了前所未有的成长。除了数位科技的接受度和普及不断提高之外,企业的行动优先方法也是推动智慧型手机普及的主要因素。爱立信预计,全球智慧型手机用户数量预计将从 2022 年的 64.2 亿增加到 2028 年的 77.4 亿。

- 在电子商务这样的商业环境中,随着您的业务成长,尝试同时造访您网站的流量和人数也会增加,容纳这种负载所需的频宽也会增加。预计这些综合因素将在预测期内推动市场成长。

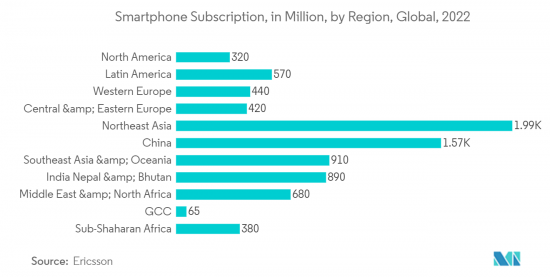

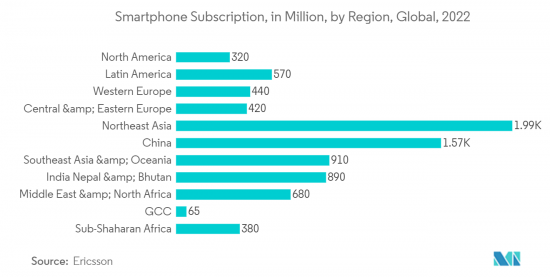

- 儘管已开发国家的智慧型手机产业日益成熟,但新兴国家仍存在巨大的成长机会。例如,根据爱立信的数据,东北亚(2022年为19.9亿)将在智慧型手机用户方面领先,其次是中国(15.7亿)和东南亚和大洋洲(9.1亿)。

- 所有这些因素都对所研究的市场做出了贡献,因为智慧型手机订阅数量的增加对互联网消费和资料生成产生积极影响,推动了对资料中心和其他数位基础设施的需求,其中高频宽连接是关键要求。对生长发育产生正面影响

- 扩展的频宽、超低延迟和高速连接将扩展文明、彻底改变产业并从根本上改善日常体验。电子医疗、连网车辆和运输系统以及先进的行动云端游戏曾经被认为是未来主义。

- 频宽需求通常每年都会显着增加。这种成长趋势在依赖串流视讯服务等高负载服务的网路中尤其明显。随着串流影音服务越来越多地提供 4K 视讯内容,游戏平台正朝着首先提供新游戏下载的方向发展。像 Google Stadia 这样的服务现在已经准备好以串流媒体服务的形式分发游戏。因此,始终存在更高频宽服务的趋势。

跨太平洋地区预计将引领市场

- 海底电缆承载着全球 97% 以上的网路流量,几乎每个人都使用网路进行日常业务。由于网路能够连接世界各地的人们,国际流量每天都在增加。跨太平洋占全球网路总流量的很大一部分,推动了对海底通讯电缆的需求。然而,一些国家没有海底通讯电缆系统,因此世界银行和亚洲开发银行正在资助新的电缆系统。

- 人力资源在网路上花费的时间不断增加也为所研究市场的成长创造了良好的前景。例如,根据日本内务部,日本每个工作日在行动装置上使用网路的时间已从 2016 年的 61.3 分钟增加到 2022 年的 113.3 分钟。

- 此外,数位服务的日益普及和对更快网路连线的需求也推动了该地区的支持措施。例如,2022 年 2 月,根据 Team Telecom 的建议,FCC核准了太平洋光缆网路 (PLCN) 系统的海底电缆登陆授权。从美国到台湾和菲律宾的 PLCN 连接现已投入商业性服务。 Team Telecom 是 Google LLC 及其子公司 GU Holdings Inc.、Meta Platforms Inc.(前身为 Facebook Inc.)和子公司 Edge Cable Holdings USA LLC 保护太平洋光缆网路 (PLCN) 系统上的资料。此海底光缆系统将连接美国、台湾和菲律宾。由此,Team Telecom 获得了 FCC 授予的 PLCN 系统的 Google 和 Meta 电缆登陆授权。

- 同样,2022 年 7 月,NTT Ltd Japan Corporation、Mitsui &、PC Landing Corp. 和 JA Mitsui Leasing Ltd 成立,负责建造和营运连接日本和美国的新型、最大的跨太平洋海底电缆系统 JUNO。宣布成立新公司Seren Juno Network (Seren)。

- 在不断增长的需求和政府支持前景的推动下,供应商正在合作开发全部区域的海底电缆网络,这也支持了所研究市场的成长。例如,2022年8月,NEC公司宣布Seren Juno Network已选择该公司建造JUNO电缆系统,这是一条连接美国加州与美国千叶县和三重县的跨太平洋海底光缆。该电缆全长超过10,000公里,预计2024年终完工。

海底光缆产业概况

海底光缆市场较为分散,主要参与者包括 Google LLC (Alphabet Inc.)、NEC Corporation、Nexans SA、Fujitsu Ltd 和 NTT Communications。市场上的供应商正在采取联盟、合併、创新和收购等策略来增强其产品阵容并获得永续的竞争优势。

- 2023 年 4 月——包括中国电信集团公司、中国移动有限公司和中国联通在内的中国国有电信业者在亚洲、欧洲和中东之间推出价值 5 亿美元的海底光纤互联网连接,以与美国支持的类似网路竞争计划。我们正在开发有线网路。该电缆名为「EMA」(欧洲-中东-亚洲),计划连接香港和中国海南省,然后连接新加坡、巴基斯坦、沙乌地阿拉伯、埃及和法国等国家。

- 2022 年 11 月 - 普睿司曼与三星 C&T 签署了一项 2.2 亿欧元(2 亿欧元)的协议,作为与 Jan De Nul 的 EPC 财团的一部分,该计划据称是第一个高电压直流(HVDC -VSC) 海底联盟。该公司正在建造一个由四个 XLPE 绝缘 HVDC 320kV 单芯电缆和一个光纤电缆系统组成的对称整体系统,以连接阿布扎比海岸附近阿拉伯湾的 Al Garan 人工岛与 Al Mirfa 陆上换流站。设计、供应、组装和测试桿系统。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 产业价值链分析

- 宏观趋势对产业的影响

第五章市场动态

- 市场驱动因素

- 智慧型手机的普及和对网路频宽的需求增加

- 新兴地区光纤连接的增加

- 市场挑战

- 维护成本上升,卫星通讯投资增加

第六章市场区隔

- 按地区

- 跨太平洋

- 跨大西洋横渡

- 美国-拉丁美洲

- 亚洲境内

- 欧洲-亚洲

- 欧洲-撒哈拉以南非洲

第七章竞争形势

- 公司简介

- Google LLC(Alphabet inc.)

- NEC Corporation

- Nexans SA

- Fujitsu Ltd

- NTT Communications Corporations

- Huwaei Marine Networks Co.

- PT Communication Cable System Indonesia TBK

- LS Cable & System Ltd

- Alcatel Submarine Networks Ltd

- SubCom LLC

- Sumitomo Electric Industries Ltd

- Prysmian SpA

- JDR Cable Systems(Holdings)Ltd

第八章投资分析

第9章市场的未来

The Submarine Optical Fiber Cable Market size is estimated at USD 4.16 billion in 2024 and is expected to reach USD 7.2 billion by 2029, growing at a CAGR of 12.10% during the forecast period (2024-2029).

Key Highlights

- Growing investment in high-speed internet infrastructure is driving the growth of the submarine optical fiber cable market. The continuous increase in the generation and transfer of vast amounts of data worldwide is one of the primary drivers of the market. Hence, many internet backbone operators may invest in the submarine optical fiber cable market over the forecast period.

- Submarine cable systems carry over 99% of intercontinental communication traffic, making them the invisible enabler of global connectivity. The regional telecom industry is advancing at a higher rate worldwide, led by countries like China and India. However, internet infrastructure is still a significant issue in many parts of the world.

- As more and more people in developing areas of the world already have access to the internet, the next step in strengthening the cable network may be in emerging markets worldwide. Hence, many companies, including government agencies, see the submarine optical fiber cable market as an opportunity.

- The rapid increase in mobile broadband penetration significantly contributes to the market's growth. The global demand for smartphones has been increasing due to several factors, like increasing disposable income, the advent of 5G, and the development of telecom infrastructure. For instance, according to GSMA, smartphone subscriptions worldwide is anticipated to grow from 76 percent of total connections in 2022 to 92 percent by 2030.

- Although submarine cables are covered in silicon gel and wrapped in multiple layers of steep wires, plastic, copper sheathing, nylon yarn, and polyethylene insulator to protect these optical fibers from damage, periodic maintenance is still necessary to ensure their safety and longevity, which is expensive. The high installation and maintenance costs are expected to challenge the market's growth.

- Furthermore, the growing investment in satellite communications is another major factor challenging the studied market's growth, as cables only have an advantage over short paths, especially if traffic is heavy. However, satellites become economically more attractive as distance increases and density decreases. Additionally, having a satellite communication link is much faster, as with the other wireless deployments, than deploying submarine cables, which is another significant advantage of satellite communications over submarine optical fiber cables.

Submarine Optical Fiber Cable Market Trends

Growing Smartphone Penetration and Increasing Demand for Internet Bandwidth Drive the Market

- The smartphone industry has witnessed unprecedented growth in recent years. The growing acceptance and prevalence of digital technologies, along with the mobile-first approach of companies, are among the major factors driving smartphone adoption. According to Ericsson, the global number of smartphone subscribers is expected to reach 7,740 million in 2028, from 6,420 million in 2022.

- In a business environment such as e-commerce, as the business grows, the traffic or number of people trying to access the website at once increases as well, driving the amount of bandwidth required to accommodate this load. All these combined factors are expected to drive the market's growth during the forecast period.

- Although the smartphone industry is approaching maturity in developed countries, emerging regions still offer huge growth opportunities. For instance, according to Ericsson, Northeast Asia was the leading region in terms of the number of smartphone subscribers (1,990 million in 2022), followed by China (1,570 million) and Southeast Asia & Oceania (910 million).

- All these factors positively contribute to the growth of the market studied, as a higher smartphone subscription positively impacts internet consumption and the amount of data being generated, driving the demand for data centers and other digital infrastructures wherein high bandwidth connectivity is a crucial requirement.

- Increased bandwidth, ultra-low latency, and faster connectivity are expanding civilizations, revolutionizing industries, and radically improving day-to-day experiences. E-health, networked vehicles and traffic systems, and advanced mobile cloud gaming were formerly considered futuristic.

- Bandwidth demands typically grow significantly every year. These growth trends are more likely for networks that rely on services involving heavy workloads, such as streaming video services. As streaming video services have a growing number of 4K video content, gaming platforms are moving toward delivering new games first by download. Now, services such as Google Stadia are poised to deliver games as a streaming service. Hence, there is a constant trend toward higher bandwidth services.

Trans-Pacific Region is Expected to Lead the Market

- Submarine cables carry over 97% of all internet traffic worldwide, and nearly everyone uses the internet for daily tasks. Due to the internet's ability to connect people worldwide, international traffic is growing daily. Trans-Pacific accounts for a significant portion of all internet traffic worldwide, which is increasing the demand for submarine communication cables. However, some countries' lack of submarine communication cable systems has prompted the World Bank and the Asia Development Bank to fund new cable systems.

- The increasing time people spend on the internet also creates a favorable outlook for the growth of the studied market. For instance, according to the Japanese Ministry of Internal Affairs and Communications, the average time spent by people using the internet via mobile devices per weekday in Japan had increased to 113.3 minutes in 2022, compared to 61.3 in 2016.

- Furthermore, the growing penetration of digital services and demand for faster internet connectivity are also driving supportive initiatives in the region. For instance, in February 2022, as per the recommendations of Team Telecom, the FCC approved a Submarine Cable Landing License for the Pacific Light Cable Network (PLCN) system. PLCN connections from the United States to Taiwan and the Philippines are now in service commercially. Team Telecom entered the National Security Agreements with Google LLC and its subsidiary G.U. Holdings Inc. Meta Platforms Inc. (formerly Facebook Inc.) and subsidiary Edge Cable Holdings USA LLC protect data on the Pacific Light Cable Network (PLCN) system. This undersea fiber optic cable system will connect the United States, Taiwan, and the Philippines. Consequently, Team Telecom has FCC grant Google and Meta cable landing licenses for the PLCN system.

- Similarly, in July 2022, NTT Ltd Japan Corporation, Mitsui & Co. Ltd., PC Landing Corp., and JA Mitsui Leasing Ltd announced the launch of a new company, Seren Juno Network Co. Ltd (Seren), which was founded to construct and operate JUNO, the new and largest Trans-Pacific submarine cable system that will run between Japan and the United States.

- Driven by the growing demand and a supportive government outlook, vendors are collaborating to develop submarine cable networks across the region which is also supporting the studied market's growth. For instance, in August 2022, N.E.C. Corporation announced that Seren Juno Network had selected the company to build a Trans-Pacific subsea fiber-optic cable, JUNO Cable System, connecting California in the United States. with Chiba prefecture and Mie prefecture in Japan. The cable will span over 10,000 km and is expected to complete by the end of 2024.

Submarine Optical Fiber Cable Industry Overview

The submarine optical fiber cable market is fragmented, with the presence of major players like Google LLC (Alphabet Inc.), NEC Corporation, Nexans SA, Fujitsu Ltd, and NTT Communications and Corporation; the growing demand is also attracting new players to the market. Vendors in the market are adopting strategies such as partnerships, mergers, innovations, and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- April 2023 - Chinese state-owned telecom firms, including China Telecommunications Corporation, China Mobile Limited, and China Unicom, are developing a USD 500 million undersea fiber-optic internet cable network that would link Asia, Europe, and the Middle East to rival a similar project backed by the United States. Named "EMA" (Europe-Middle East-Asia), the proposed cable is planned to link Hong Kong to China's island province of Hainan before making its way to countries such as Singapore, Pakistan, Saudi Arabia, Egypt, and France.

- November 2022 - Prysmian signed a EUR 220 million (USD 234.50 million) limited notice to proceed with Samsung C&T as part of its EPC consortium with Jan De Nul for the project, which is said to be the Middle East's first-of-its-kind high-voltage, direct current (HVDC-VSC) subsea power transmission system. The company will design, supply, assemble, and test a symmetrical monopole system made up of four HVDC 320 kV single-core cables with XLPE insulation, as well as fiber optic cable systems, to connect the Al Mirfaonshore converter station to the Al Ghallanartificial island in the Arabian Gulf off the coast of Abu Dhabi.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of Macro Trends on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Smartphone Penetration and Increasing Demand for Internet Bandwidth

- 5.1.2 Increasing Fiber Connectivity in Emerging Regions

- 5.2 Market Challenges

- 5.2.1 Higher Maintenance Costs and Growing Investment in Satellite Communication

6 MARKET SEGMENTATION

- 6.1 By Geography

- 6.1.1 Trans-Pacific

- 6.1.2 Trans-Atlantic

- 6.1.3 US-Latin America

- 6.1.4 Intra-Asia

- 6.1.5 Europe-Asia

- 6.1.6 Europe-Sub-Saharan Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Google LLC (Alphabet inc.)

- 7.1.2 NEC Corporation

- 7.1.3 Nexans SA

- 7.1.4 Fujitsu Ltd

- 7.1.5 NTT Communications Corporations

- 7.1.6 Huwaei Marine Networks Co.

- 7.1.7 PT Communication Cable System Indonesia TBK

- 7.1.8 LS Cable & System Ltd

- 7.1.9 Alcatel Submarine Networks Ltd

- 7.1.10 SubCom LLC

- 7.1.11 Sumitomo Electric Industries Ltd

- 7.1.12 Prysmian SpA

- 7.1.13 JDR Cable Systems (Holdings) Ltd